UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): December 1, 2017 (June 29, 2017)

Blue Sphere Corporation

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55127

|

|

98-0550257

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer Identification

No.)

|

301

McCullough Drive, 4th Floor, Charlotte, North Carolina 28262

(Address

of principal executive offices) (Zip Code)

704-909-2806

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if Changed since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☒ Emerging

growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As

used in this Current Report, all references to the terms “we”, “us”, “our”, “Blue Sphere”

or the “Company” refer to Blue Sphere Corporation and its direct and indirect wholly-owned subsidiaries, unless the

context clearly requires otherwise.

Explanatory

Note

As

it relates to the subsection in Item 1.02 titled

Cantu Share Purchase Agreement

, this Current Report on Form 8-K/A is being

filed to amend the Current Report on Form 8-K filed by the Company on July 6, 2017 and the Form 8-K/A filed by the Company on

September 14, 2017. As it relates to the subsection in Item 1.02 titled

Udine GPOMA

, this Current Report on Form 8-K/A

is being filed to amend the Current Report on Form 8-K filed by the Company on September 6, 2017 and the Form 8-K/A filed on November

16, 2017.

Item

1.02

Termination

of a Material Definitive Agreement

Cantu Share Purchase Agreement

As

previously reported, on June 29, 2017, we entered into a Share Purchase Agreement (the “SPA”) with Pronto Verde A.G.

(the “Seller”), relating to the purchase of one hundred percent (100%) of the share capital of Energyeco S.r.l., a

limited liability company organized under the laws of Italy (the “SPV”), which owns and operates a 990 Kw plant for

the production of electricity from vegetal oil located in Cantù, Italy (the “Facility”). We agreed to pay an

aggregate purchase price of €2,200,000 (approximately USD $2,490,000) (the “Purchase Price”) for the SPV, subject

to an adjustment formula to be calculated at the closing. The closing in relation to the SPV was scheduled to take place within

90 days of the date of the SPA, or September 27, 2017, and was subject to specified conditions precedent.

On

November 27, 2017, we notified the Seller that the SPA was terminated because (a) the deadline for consummation of the

closing expired and no agreement to extend the deadline was granted by Blue Sphere, and (b) none of the specified conditions

precedent had materialized. We also demanded the repayment of €150,000 (approximately USD $179,000) paid to escrow under

the SPA, which is reimbursable should the closing not occur due to Seller’s breach or in the event that a condition

precedent to closing does not materialize. We also reserved our right to unspecified damages incurred as a consequence of

documented material representations made in connection with the SPA.

Udine GPOMA

As

previously reported, on September 4, 2017, our indirect wholly-owned Italian subsidiary, Futuris Papia S.p.A. (“Futuris

Papia”), which owns and operates a 995 Kw plant for the production of electricity from vegetal oil located in Udine, Italy,

and the Seller entered into Guarantee Plant Operation Management Agreement (the “Udine GPOMA”). The Udine GPOMA concerned

the performance of services for the operation and maintenance of the facility in Udine, including the supply of vegetal oil

to the facility.

On

November 27, 2017, we notified the Seller that the Udine GPOMA was terminated because, in part, (a) the Seller did not

successfully engage the designated supplier to supply vegetal oil, and Futuris Papia was forced to procure vegetal oil from

another supplier at a higher cost; (b) the Seller and its operator did not diligently perform specified tasks under the Udine

GPOMA, including a proper inspection and review of the facility and preparation of a takeover plan, and Futuris Papia was

forced to procure such services from another operator at a higher cost than contemplated by the Udine GPOMA; and (c) due to a

number of specified breaches by the Seller to perform under the Udine GPOMA. We reserved our right to recover the damages

incurred as a consequence of documented material breaches made in connection with the Udine GPOMA.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

Blue Sphere Corporation

|

|

|

|

|

|

|

|

Dated: December

1, 2017

|

By:

|

/s/

Shlomi Palas

|

|

|

|

|

Shlomi Palas

|

|

|

|

President and Chief Executive Officer

|

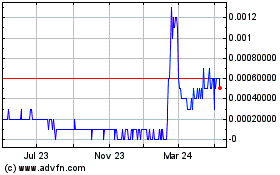

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Dec 2024 to Jan 2025

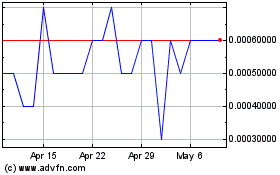

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Jan 2024 to Jan 2025