false

0001568385

0001568385

2024-12-26

2024-12-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 26, 2024

Bright

Mountain Media, Inc.

(Exact

name of registrant as specified in its charter)

Florida

(State

or other jurisdiction of incorporation)

| 000-54887 |

|

27-2977890 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

6400

Congress Avenue, Suite 2050

Boca

Raton, Florida 33487

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code (760) 707-5959

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Bright

Mountain Media, Inc. (the “Company”) and its subsidiaries are parties to an Amended and Restated Senior Secured Credit Agreement

between itself, the lenders party thereto (the “Lenders”), and Centre Lane Partners Master Credit Fund II, L.P., as Administrative

Agent and Collateral Agent (“Centre Lane Partners”), dated June 5, 2020, as amended (the “Credit Agreement”).

Effective

as of December 26, 2024, the Company and its subsidiaries, CL Media Holdings LLC, Bright Mountain LLC, MediaHouse, Inc., Deep Focus Agency

LLC, and BV Insights LLC, Centre Lane Partners, and the Lenders entered into the Twenty-First Amendment to Amended and Restated Senior

Secured Credit Agreement (the “Twenty-First Amendment”) to amend certain terms of the Credit Agreement.

The

Twenty-First Amendment was entered into in for the purpose of securing a bond (the “Bond”) to stay execution of a judgment

in the amount of approximately $1.7 million (the “Judgment”) that was entered into against the Company as a result of certain

previously disclosed litigation (the “Ladenburg Litigation”), as the Company intends to appeal the Judgment.

On

December 26, 2024, pursuant to the Twenty-First

Amendment, the Company borrowed an additional approximately $1.9 million from the Lenders, which funds were

used to secure the Bond. Amounts drawn pursuant to the Twenty-First Amendment (the “Twenty-First Amendment Loan Amounts”),

including all accrued but unpaid principal and interest thereon, will mature and become payable on the earlier of (i) the date upon which

the Ladenburg Litigation is resolved and results in the Company being obligated to pay less than the Judgment and (ii) April 20, 2026.

Interest

incurred on the Twenty-First Amendment Loan Amounts will be payable in a combination of cash and payments in kind. Interest to be paid

in cash (the “Twenty-First Amendment Cash Pay Rate”) will accrue at (i) a rate of 0% per annum from the date the Twenty-First

Amendment Loan Amounts are funded until June 30, 2025 and (ii) a rate of 5% per annum thereafter; provided, however, if prior to June

30, 2025, the Company informs Centre Lane Partners that it will pay the PIK Fee (as defined below) to the Lenders, then the interest

rate will remain 0% per annum. Interest to be paid in kind (the “Twenty-First Amendment PIK Pay Rate”) will accrue at (x)

a rate of 15% per annum from the date the Twenty-First Amendment Loan Amounts are funded until June 30, 2025 and (y) a rate of 10% per

annum thereafter; provided, however, if prior to June 30, 2025, the Company informs Centre Lane Partners that it will pay the PIK Fee

to the Lenders, then the interest rate will remain 15% per annum. For purposes of the foregoing, the “PIK Fee” shall mean

an amount equal to 2% of the Twenty-First Amendment Loan Amounts outstanding payable in kind.

If

the Twenty-First Amendment Loan Amounts are prepaid prior to April 20, 2026, then an amount equal to the minimum amount of all additional

interest that would have accrued from the date of such prepayment through April 20, 2026, calculated at the Twenty-First Amendment Cash

Pay Rate or the Twenty-First Amendment PIK Pay Rate, as applicable, will be paid in addition to the prepayment amount. Further, any amounts

released under the Bond or under a related indemnity agreement entered into in connection with the Bond shall be used to prepay the Twenty-First

Amendment Loan Amounts. The Twenty-First Amendment Loan Amounts are secured by a perfected, first priority security interests in all

assets and capital stock held in or by the Company and all existing and future subsidiaries of the Company.

In

connection with the Twenty-First Amendment and as consideration therefor, the Company agreed to issue a number of shares of the common

stock of the Company, par value $0.01 per share (the “Common Stock”), equal to 2.5% of the fully-diluted pro forma ownership

of the Company, or 5,001,991 shares of Common Stock, to an affiliate of the Lenders. Following such issuance, Centre Lane Partners and

its affiliates collectively beneficially own approximately 23.6% of the Company’s common stock.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

Bright

Mountain Media, Inc. |

| |

|

|

| Date:

January 2, 2025 |

By: |

/s/

Matt Drinkwater |

| |

|

Matt

Drinkwater |

| |

|

Chief

Executive Officer |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

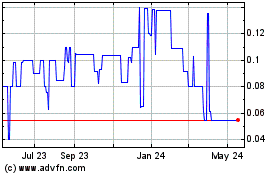

Bright Mountain Media (QB) (USOTC:BMTM)

Historical Stock Chart

From Dec 2024 to Jan 2025

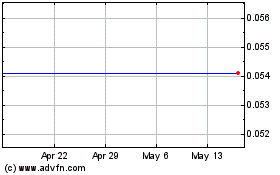

Bright Mountain Media (QB) (USOTC:BMTM)

Historical Stock Chart

From Jan 2024 to Jan 2025