Preliminary

Offering Circular dated July 25, 2024

An

Offering Statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission.

Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor

may offers to buy be accepted before the Offering Statement filed with the Commission is qualified. This Preliminary Offering Circular

shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state

in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We

may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion

of our sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular

was filed may be obtained.

BioQuest

Corp.

$10,000,000

$1.00

per Unit

5,000,000

Units

Each

Unit consists of 1 Share of Common Stock, 1 warrant (“Warrant”) and 1 share of Common Stock that is issuable upon the

exercise of the Warrant at an exercise price of $1.00 (the “Units”).

5,000,000

Shares of Common Stock to be issued upon Exercise of Warrants

This

is the public offering of securities of BioQuest Corp., a Nevada corporation. We are offering 5,000,000 units each unit consisting of

one Share of Common Stock, one Warrant and one share of Common Stock that is issuable upon the exercise of the warrant, par value $0.001 (“Units”), at an offering price

of $1.00 per Unit (the “Offered Units”) by the Company. See “Description of Securities” beginning on page 41

and “Securities Offered” on page 44. The total number of shares included in the Units is 5,000,000 and the total underlying

shares after the exercise of all warrants is 10,000,000 shares. Each Class A Warrant is exercisable at $1.00 per warrant and will entitle

the holder to purchase one share of common stock. The Offering will terminate on the earlier of (i) the date on which the Maximum Offering

is sold, (ii) the third anniversary of the date of qualification of this offering statement; or (iii) when the Company elects to terminate

the offering for any reason (in each such case, the “Termination Date”). At least every 12 months after this offering has

been qualified by the United States Securities and Exchange Commission (the “Commission”), the Company will file a post-qualification

amendment to include the Company’s recent financial statements. (such earlier date, the “Termination Date”) over a

maximum period of 3 years, starting from the date of qualification of this Offering Statement. The minimum purchase requirement per investor

is 500 Offered Units ($500); however, we can waive the minimum purchase requirement on a case-by-case basis in our sole discretion.

These

securities are speculative securities. Investment in the Company’s stock involves significant risk. You should purchase these

securities only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 4 of

this Offering Circular.

No

Escrow

The

proceeds of this offering will not be placed into an escrow account. We will offer our Units on a best efforts’ basis. As there

is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds

into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Subscriptions

are irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. The Company, by determination

of the Board of Directors, in its sole discretion, may issue the Securities under this Offering for cash, promissory notes, and services

without notice to subscribers. All proceeds received by the Company from subscribers for this Offering will be available for use by the

Company upon acceptance of subscriptions for Securities by the Company.

Sales

of these Units will commence within two calendar days of the qualification date, and it will be a continuous Offering pursuant to Rule

251(d)(3)(i)(F).

This

Offering will be conducted on a “best-efforts” basis, which means our Officers will use their commercially reasonable best

efforts in an attempt to offer and sell the Units. Our Officers will not receive any commission or any other remuneration for these sales.

In offering the securities on our behalf, the Officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1

under the Securities Exchange Act of 1934, as amended.

This

Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these

securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful, prior to registration or qualification

under the laws of any such state.

The

Company is using the Offering Circular format in its disclosure in this Offering Circular. The Company’s address is 4570 Campus

Drive, Newport Beach, CA 92660. The Company’s phone number is (714) 978-4425.

Our

Common Stock is quoted on the OTC Markets Pink Open Market under the stock symbol “BQST.”

Investing

in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 4 for a discussion of certain

risks that you should consider in connection with an investment in our Common Stock.

| | |

Number of Units | | |

Per

Unit (1)(2)(3) | | |

Total Maximum (4) | |

| Public Offering Price | |

| 5,000,000 | | |

$ | 1.00 | | |

$ | 5,000,000.00 | |

| Underwriting Discounts and Commissions | |

| | | |

$ | 0.000 | | |

$ | 0 | |

| Proceeds to Company | |

| | | |

$ | 1.00 | | |

$ | 5,000,000.00 | |

| Warrants | |

| | |

Exercise Price per Warrant | | |

| |

| Public Offering Price – Shares Underlying Warrants | |

| 5,000,000 | | |

$ | 1.00 | | |

$ | 5,000,000.00 | |

| Proceeds to Company – From the Exercise of Shares Underlying Warrants | |

| | | |

| | | |

$ | 5,000,000.00 | |

| | |

| | | |

| | | |

| | |

| (1) |

We are offering Units on

a continuous basis. See “Distribution – Continuous Offering. The number of Units being sold is 5,000,000 Units which

consist of One (1) share of common stock and One (1) warrant per Unit. The total underlying shares of all warrants is 5,000,000 shares. |

| |

|

| (2) |

This is a “best efforts”

offering. The proceeds of this offering will not be placed into an escrow account. We will offer our Units on a best efforts’

basis. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately

deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

See “How to Subscribe.” |

| |

|

| (3) |

We are offering these securities

without an underwriter. |

| |

|

| (4) |

Excludes

estimated total offering expenses, including underwriting discount and commissions, will be approximately $10,000 assuming the maximum

offering amount is sold. |

Our

Board of Directors used its business judgment in setting a value of $1.00 per Unit to the Company as consideration for the Units to be

issued under the Offering. The sales price per Unit bears no relationship to our book value or any other measure of our current value

or worth.

THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE

TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE

SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT

DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

TABLE

OF CONTENTS

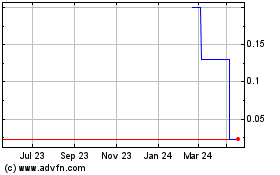

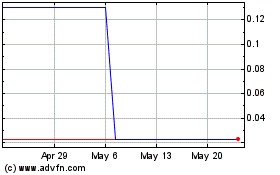

The

following table sets forth the high and low bid prices for our Common Stock per quarter for the past two years as reported by the OTC

Markets, based on our fiscal year ending April 30. These prices represent quotations between dealers without adjustment for retail markup,

markdown or commission and may not represent actual transactions.

| Fiscal Year Ended | |

| |

Bid Prices | |

| April 30, | |

Period | |

High $ | | |

Low $ | |

| 2025 | |

First Quarter | |

| 0.13 | | |

| 0.023 | |

| | |

| |

| | | |

| | |

| 2024 | |

First Quarter | |

| 1.94 | | |

| 1.94 | |

| | |

Second Quarter | |

| 1.94 | | |

| 1.94 | |

| | |

Third Quarter | |

| 1.94 | | |

| 1.94 | |

| | |

Fourth Quarter | |

| 1.94 | | |

| 0.13 | |

| | |

| |

| | | |

| | |

| 2023 | |

First Quarter | |

| 0.94 | | |

| 0.05 | |

| | |

Second Quarter | |

| 0.95 | | |

| 0.10 | |

| | |

Third Quarter | |

| 1.94 | | |

| 0.11 | |

| | |

Fourth Quarter | |

| 1.94 | | |

| 0.22 | |

We

are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You

should rely only on the information contained in this Offering Circular. The Company has not authorized anyone to provide you with any

information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate

only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this

Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our

affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent

required by the federal securities laws.

In

this Offering Circular, unless the context indicates otherwise, references to “BioQuest Corp.,” “we,”

the “Company,” “our” and “us” refer to the activities of and the assets and liabilities of

the business and operations of BioQuest Corp.

Continuous

Offering

Under

Rule 251(d)(3) to Regulation A, the following types of continuous or delayed Offerings are permitted, among others: (1) securities offered

or sold by or on behalf of a person other than the issuer or its subsidiary or a person of which the issuer is a subsidiary; (2) securities

issued upon conversion of other outstanding securities; or (3) securities that are part of an Offering which commences within two calendar

days after the qualification date. These may be offered on a continuous basis and may continue to be offered for a period in excess of

30 days from the date of initial qualification. They may be offered in an amount that, at the time the Offering statement is qualified,

is reasonably expected to be offered and sold within one year from the initial qualification date. No securities will be offered or sold

“at the market.”

Sale

of these Units will commence within two calendar days of the qualification date, and it will be a continuous Offering pursuant to Rule

251(d)(3)(i)(F).

Subscriptions

are irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. The Company, by determination

of the Board of Directors, in its sole discretion, may issue the Securities under this Offering for cash, promissory notes, services,

and/or other consideration without notice to subscribers. All proceeds received by the Company from subscribers for this Offering will

be available for use by the Company upon acceptance of subscriptions for the Securities by the Company.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The

information contained in this offering circular includes some statements that are not historical and that are considered “forward-looking

statements.” Such forward-looking statements include, but are not limited to, statements regarding our development plans for our

business; our strategies and business outlook; anticipated development of our Company, our Officers and Directors; and various other

matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). These forward-looking

statements express our Officers and Directors expectations, hopes, beliefs, and intentions regarding the future. In addition, without

limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking statements. The words “anticipates”, “believes”, “continue”,

“could”, “estimates”, “expects”, “intends”, “may”, “might”, “plans”,

“possible”, “potential”, “predicts”, “projects”, “seeks”, “should”,

“will”, “would” and similar expressions and variations, or comparable terminology, or the negatives of any of

the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The

forward-looking statements contained in this offering circular are based on current expectations and beliefs concerning future developments

that are difficult to predict. Neither we nor our Officers or Directors can guarantee future performance, or that future developments

affecting our Company, our Officers or Directors will be as currently anticipated. These forward-looking statements involve a number

of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be

materially different from those expressed or implied by these forward-looking statements.

All

forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks

and uncertainties, along with others, are also described below under the heading “Risk Factors.” Should one or more

of these risks or uncertainties materialize, or should any of the parties’ assumptions prove incorrect, actual results may vary

in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking

statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to

update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be

required under applicable securities laws.

SUMMARY

This

summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain

all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire

Offering Circular, including the risks associated with an investment in the company discussed in the “Risk Factors” section

of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking

statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Company

Overview

BioQuest

Corp.(the “Company”) was originally incorporated in the State of Nevada on May 17, 2011, as Renaissance Films Inc. On September

26, 2011, the Company changed its name to Sedition Films Inc. and on May 1, 2014, the Company changed its name to Select-TV Solutions,

Inc. The Company was organized for the purpose of producing documentary films. On October 10, 2019, there was a change in control of

the Company with the purchase of 270,000,000 of the Company’s Common stock and on that date the Company changed its name to BioQuest

Corp. On October 12, 2019, the Company elected a new Board of Directors and approved a 2,000 to 1 Reverse Stock Split resulting in the

reduction of the outstanding shares of the Company’s Common Stock from 454,254,585 shares to 237,233 shares of Common Stock. All

common shares and per common share data in these financial statements and related notes hereto have been retroactively adjusted to account

for the effect of the reverse stock split for all periods presented. The total number of authorized common shares and the par value thereof

were not changed by the reverse stock split. The Company had previously intended to market, package, and distribute Hemp-CBD based products.

Our mission was to create high end, unique content and aggregate all relevant CBD content in the Nutraceutical and Pharmaceutical markets.

In 2022, after the effects of Covid, the Company decided to change direction and to pursue an acquisition partner.

As

of this Offering the Company is an early-stage enterprise and has not commenced principal operations.

On

March 21, 2024, AI Callers, Inc., a yet to be formed corporation in the AI industry (“BotMakers”) with a yet to be formed,

planned conversational AI subsidiary BotMakers, Inc., both to be operated by Ms. Sella Hall, entered into a letter of intent with

the Company; wherein, the Company agreed to issue approximately 105,000,000 shares of Common and Preferred Stock, and to

the raising of $10,000,000 through the sale of equity, $250,000 of which will be used to reduce the BioQuest’s outstanding

debts and the rest will be used as working capital for BotMakers, in return for 100% of BotMakers shares (“BotMakers Agreement”).

As part of the BotMakers Agreement the Company will be authorizing and designating a class of Preferred Stock that

will be issued to BotMakers, Inc.

The

foregoing description of the BotMakers, Inc. Agreement does not purport to be complete and is qualified in its entirety by reference

to the complete text of such agreement, which is filed as Exhibit 6.5 to this Regulation A Offering and is incorporated herein by reference.

On April 18, 2024, AI Callers, Inc., and BotMakers AI, Inc., were formed as sole proprietorships, by Ms. Sella Hall,

in Texas, in order to enter to reserve the names with the intent on becoming conversational AI companies that develop solutions for business

and organizations to utilize conversational AI technology. On May 9, 2024, Ms. Hall decided to formally incorporate the name AI Callers,

Inc. in Texas. Upon entering into negotiations with BQST the BotMakers name was preferred and presented as a part of AI Callers, Inc.

On June 24, 2024, AI Callers, Inc., officially changed its name in Texas to BotMakers, Inc. As of this Offering the final transaction

agreement has not been finalized or executed.

On

April 1, 2024, BotMakers paid the Company $35,000 as a first payment towards the total of $250,000 purchase price. The current outstanding debt amounts to approximately $250,000. The Company plans to allocate 50% of the first $500,000

raised to the retirement of the debt and the other 50% to the other principal uses of proceeds (See – Use of Proceeds).

The

vision of BioQuest is to acquire BotMakers and its Conversational Artificial Intelligence (“AI”). BotMakers, currently

provides its customers with an AI platform that utilizes voice calling AI, text messaging and chatbots. At this time, there are no products of BotMakers that will utilize MaxTrades AI technology that are aspirational

or still in development. All BotMakers products and services are fully functional and are currently selling to retail customers. Any future

updates to the MaxTrades technology will be based on future data gathered through customer usage and feedback. BotMakers has no current

plans to enhance the MaxTrades technology used in conversational Al products or chatbots. The MaxTrades technology is a series of automated

workflows that can plug in to a any Customer Relationship Management system that allows webhooks to send data to and from those systems.

The scope of the current capabilities

of the BotMakers conversational AI tech platform that supports or will support BotMakers’ products and/or services are fully functional

and provide the following:

1. The ability for BotMakers’ customers to develop written “prompts”

that will give instructions to the AI agent logic to allow it to communicate in natural language with end-users.

2. The ability for chatbots developed by BotMakers to use logic and to reference client supplied data to interact

with customers.

In

order to finalize the purchase of BotMakers, the Company will need to raise approximately $500,000 in funding.

The Company cannot guarantee that it will be able to raise adequate funding in order to acquire BotMakers and then operate

BotMakers thereafter in order to execute its current business plan.

BotMakers

is currently delivering AI products to its clients to support their business communication with customers.

To

distinguish BotMakers from competitors, BotMakers plans to work with celebrities and influencers in an effort to establish

the BotMakers brand as a solution for AI powered business communications.

The

Company also intends to aggressively pursue the acquisition of new products and product lines that fit within its model; although

as of this Offering, there are no acquisitions, other than BotMakers, in progress or planned.

Our

fiscal year ends April 30.

The Company

is in the early development stage and has generated no revenues.

Our

mailing address is 4750 Campus Drive, Newport Beach, CA 92660. Our telephone number is (714) 978-4425. Our website is www.bioquestcorp.com,

and our email address is business@bioquestcorp.com, BotMakers websites are www.BotMakers.ai and www.aicallers.us.

We

do not incorporate the information on or accessible through our websites into this Offering Circular, and you should not consider any

information on, or that can be accessed through, our websites a part of this Offering Circular.

Section

15(g) of the Securities Exchange Act of 1934

Our

shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements

on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions

with assets in excess of $10,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000

jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for

the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may

affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section

15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page

summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing;

terms important to in understanding of the function of the penny stock market, such as bid and offer quotes, a dealers spread and broker/dealer

compensation; the broker/dealer compensation, the broker/dealers’ duties to its customers, including the disclosures required by

any other penny stock disclosure rules; the customers’ rights and remedies in cases of fraud in penny stock transactions; and,

the FINRA’s toll free telephone number and the central number of the North American Securities Administrators Association, for

information on the disciplinary history of broker/dealers and their associated persons.

Dividends

The

Company has not declared or paid a cash dividend to stockholders since it was organized and does not intend to pay dividends in the foreseeable

future. The board of directors presently intends to retain any earnings to finance our operations and does not expect to authorize cash

dividends in the foreseeable future. Any payment of cash dividends in the future will depend upon the Company’s earnings, capital

requirements and other factors.

Trading

Market

Our

Common Stock is quoted on the OTC Markets Pink Open Market Sheets under the symbol BQST.

THE

OFFERING

______

| Issuer: |

|

BioQuest

Corp. |

| |

|

|

| Securities offered by the Company: |

|

A

maximum of 5,000,000 Units, par value $0.001 (“Units”) at an offering price of $1.00 per Unit (the “Offered Units”).

Each Unit contains 1 share of our common stock 1 warrant and 1 share of Common Stock that is issuable upon the exercise of the Warrant. The total number of shares included in the Units is 10,000,000

and the total underlying shares of all warrants is 5,000,000. (See “Distribution.”) |

| |

|

|

| Number of shares of Common Stock outstanding before

the offering |

|

11,485,230

issued and outstanding as of July 25, 2024 |

| |

|

|

| Number of shares of

Common Stock to be outstanding after the offering |

|

21,485,230

shares, if the maximum amount of Offered Units are sold. The total number of shares of our common stock outstanding assumes that

the maximum number of units containing shares of our common stock and warrants is sold in this offering. |

| |

|

|

| Number of Warrants to

be outstanding after the offering |

|

A

maximum of 5,000,000 Warrants, par value $0.001. |

| |

|

|

| Price per Unit: |

|

$1.00

per Unit. |

| |

|

|

| Maximum offering amount: |

|

5,000,000

Units at $1.00 per Unit, or $5,000,000 and an additional $5,000,000 from the exercise of Warrants (See “Distribution.”).

The Company will not raise more than $10,000,000 in gross proceeds from this offering. |

| |

|

|

| Trading Market: |

|

Our

Common Stock is quoted on the OTC Markets Pink Open Market Sheets division under the symbol “BQST.” |

| |

|

|

| Use of proceeds: |

|

If

we sell all of the Units being offered, our net proceeds (after our estimated offering expenses) will be $4,990,000. We will use these

net proceeds for working capital and other general corporate purposes. |

| |

|

|

| Risk factors: |

|

Investing

in our Common Stock involves a high degree of risk, including:

Immediate

and substantial dilution.

Limited

market for our stock.

See

“Risk Factors.” |

RISK

FACTORS

______

The

following is only a brief summary of the risks involved in investing in our Company. Investment in our Securities involves risks. You

should carefully consider the following risk factors in addition to other information contained in this Disclosure Document. The occurrence

of any of the following risks might cause you to lose all or part of your investment. Some statements in this Document, including statements

in the following risk factors, constitute “Forward-Looking Statements.”

The

price of our common stock may continue to be volatile.

The

trading price of our common stock has been and is likely to remain highly volatile and could be subject to wide fluctuations in response

to various factors, some of which are beyond our control or unrelated to our operating performance. In addition to the factors discussed

in this “Risk Factors” section and elsewhere, these factors include: the operating performance of similar companies; the

overall performance of the equity markets; the announcements by us or our competitors of acquisitions, business plans, or commercial

relationships; threatened or actual litigation; changes in laws or regulations relating to our businesses; any major change in our board

of directors or management; publication of research reports or news stories about us, our competitors, or our industry or positive or

negative recommendations or withdrawal of research coverage by securities analysts; large volumes of sales of our shares of common stock

by existing stockholders; and general political and economic conditions.

In

addition, the stock market in general, and the market for developmental related companies in particular, has experienced extreme price

and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies’ securities.

This litigation, if instituted against us, could result in very substantial costs; divert our management’s attention and resources;

and harm our business, operating results, and financial condition.

There

are doubts about our ability to continue as a going concern.

The

Company is an early-stage enterprise and has not commenced principal operations. The Company has no revenues and has an accumulated deficit

of $10,928,884 for the year ended April 30, 2024. These factors raise substantial doubt about the Company’s

ability to continue as a going concern.

There

can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that funds

will be available from external sources, such as debt or equity financings or other potential sources. The lack of additional capital

resulting from the inability to generate cash flow from operations, or to raise capital from external sources would force the Company

to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there

can be no assurance that any such required funds, if available, will be available on attractive terms or that they will not have a significant

dilutive effect on the Company’s existing stockholders.

The

Company intends to overcome the circumstances that impact on its ability to remain a going concern through a combination of the growth

of revenues, with interim cash flow deficiencies being addressed through additional equity and debt financing. The Company anticipates

raising additional funds through public or private financing, strategic relationships or other arrangements in the near future to support

its business operations; however, the Company does not have commitments from third parties for a sufficient amount of additional

capital. The Company cannot be certain that any such financing will be available on acceptable terms, or at all, and its failure to raise

capital when needed could limit its ability to continue its operations. The Company’s ability to obtain additional funding will

determine its ability to continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms

would have a material adverse effect on the Company’s financial performance, results of operations and stock price and require

it to curtail or cease operations, sell off its assets, seek protection from its creditors through bankruptcy proceedings, or otherwise.

Furthermore, additional equity financing may be dilutive to the holders of the Company’s common stock, and debt financing, if available,

may involve restrictive covenants, and strategic relationships, if necessary, to raise additional funds, and may require that the Company

relinquish valuable rights. Please see Financial Statements – Note 3. Going Concern for further information.

Risks

Relating to Our Financial Condition

The Company has no operational history in the

emerging Conversational AI industry, making it difficult to accurately predict and forecast business operations.

As

the Company has no operational history and have yet to generate revenue, it is extremely difficult to make accurate predictions and forecasts

on our finances. This is compounded by the fact that we expect to operate in the transforming industries of customer relations management

and related tools that are moving from human based providers to conversational AI programs. There is no guarantee that our potential

of acquisition and use of BotMakers products or services will remain attractive to potential and current users as these industries undergo

rapid change, or that potential customers will utilize BotMakers services.

There

may be deficiencies with our internal controls that require improvements, and if we are unable to adequately evaluate internal controls,

we may be subject to sanctions.

As

a Tier 1 issuer, we do not need to provide a report on the effectiveness of our internal controls over financial reporting, and we are

exempt from the auditor attestation requirements concerning any such report so long as we are a Tier 1 issuer. We are in the process

of evaluating whether our internal control procedures are effective and therefore there is a greater likelihood of undiscovered errors

in our internal controls or reported financial statements as compared to issuers that have conducted such evaluations.

As

a development stage company, the Company has yet to generate any revenues or profit and may not achieve a profit in the near future, if

at all.

The

Company has not yet produced any revenue or profit

and may not in the near future, if at all. While we expect to obtain revenue and grow, the Company has not achieved any revenue or profitability

and cannot be certain that we will be able to sustain growth rate or realize sufficient revenue to achieve profitability. Our ability

to continue as a going concern may be dependent upon raising capital from financing transactions, beginning to receive revenue and keeping

operating expenses within our budget, none of which can be assured.

We

will require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all.

We

intend to continue to make investments to support our business growth and may require additional funds to respond to business challenges,

including the need to update our technology, our website, increase our offered products, and improve our operating infrastructure or

acquire complementary businesses and technologies. Accordingly, we will need to engage in continued equity or debt financings to secure

additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders

could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those

of our common stock. Any debt financing, we secure in the future could involve restrictive covenants relating to our capital raising

activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue

business opportunities. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain

adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth

and to respond to business challenges could be impaired, and our business may be harmed.

We

are highly dependent on the services of our key executives, the loss of whom could materially harm our business and our strategic direction.

If we lose key management or significant personnel, cannot recruit qualified employees, directors, officers, or other personnel or experience

increases in our compensation costs, our business may materially suffer.

We

are highly dependent on our management, specifically Thomas Hemingway, Michael Krall, Corinda J. Melton and David Noyes. If we lose key

management or employees, our business may suffer. Furthermore, our future success will also depend in part on the continued service of

our management personnel and our ability to identify, hire, and retain additional key personnel. We do not carry “key-man”

life insurance on the lives of any of our executives, employees or advisors. We experience intense competition for qualified personnel

and may be unable to attract and retain the personnel necessary for the development of our business. Because of this competition, our

compensation costs may increase significantly.

The Company plans to operate in a highly competitive

environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash flows

and prospects could be materially adversely affected.

The Company plans to operate in a highly competitive environment.

Our competition includes all other companies that are in the conversational AI services, products or other related items. A highly competitive

environment could materially adversely affect our business, financial condition, results of operations, cash flows and prospects.

We

may not be able to compete successfully with other established companies offering the same or similar products and, as a result, we may

not achieve projected revenue and user targets.

If

we are unable to compete successfully with other businesses in our planned markets, we may not achieve projected revenue and/or customer

targets. We expect to compete with both start-up and established companies. Compared to our business, most of our competitors

may have greater financial and other resources, have been in business longer, have greater name recognition and be better established

in our markets of choice.

Our

lack of adequate D&O insurance may also make it difficult for us to retain and attract talented and skilled directors and officers.

In

the future we may be subject to litigation, including potential class action and stockholder derivative actions. Risks associated with

legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods of

time. To date, the Company has not obtained directors and officers liability (“D&O”) insurance. Without adequate D&O

insurance, the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service

to the Company could have a material adverse effect on our financial condition, results of operations and liquidity. Furthermore, our

lack of adequate D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which

could adversely affect our business.

We

expect to incur substantial expenses to meet our reporting obligations as an OTC Markets company. In addition, failure to maintain

adequate financial and management processes and controls could lead to errors in our financial reporting and could harm our ability to

manage our expenses.

We

estimate that it will cost approximately $60,000 annually to maintain the proper management and financial controls for our filings required

as an OTC Markets company. In addition, if we do not maintain adequate financial and management personnel, processes and controls,

we may not be able to accurately report our financial performance on a timely basis, which could cause a decline in our stock price and

adversely affect our ability to raise capital.

Risks

Relating to our Common Stock and Offering

The

Common Stock is thinly traded, so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise

money or otherwise desire to liquidate your shares.

The

Common Stock has historically been sporadically traded on the OTC Pink Sheets, meaning that the number of persons interested in purchasing

our shares at, or near ask prices at any given time, may be relatively small or non-existent. This situation is attributable to a number

of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional

investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of

such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend

the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days

or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer, which has a large and steady

volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you

any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that current

trading levels will be sustained.

The

market price for the common stock is particularly volatile given our status as a relatively unknown company with a small and thinly traded

public float, no operating history, and no revenues, which could lead to wide fluctuations in our share price. The price at which

you purchase our Units may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common

shares at or above your purchase price, which may result in substantial losses to you.

The

market for our shares of common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect

that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share

price is attributable to a number of factors. First, as noted above, our shares are sporadically traded. As a consequence of this lack

of liquidity, the trading of relatively small quantities of shares may disproportionately influence the price of those shares in either

direction. The price for our shares could, for example, decline precipitously in the event that a large number of our shares is sold

on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact

on its share price. Secondly, we are a speculative investment due to, among other matters, no operating history and no

revenue to date, and the uncertainty of future market acceptance for our potential products. As a consequence of this

enhanced risk, more risk-averse investors may, under the fear of losing all or most of their investment in the event of negative news

or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case

with the securities of a seasoned issuer. The following factors may add to the volatility in the price of our shares: actual or anticipated

variations in our quarterly or annual operating results; acceptance of our inventory of games; government regulations, announcements

of significant acquisitions, strategic partnerships or joint ventures; our capital commitments and additions or departures of our key

personnel. Many of these factors are beyond our control and may decrease the market price of our shares regardless of our operating performance.

We cannot make any predictions or projections as to what the prevailing market price for our shares will be at any time, including as

to whether our shares will sustain their current market prices, or as to what effect the sale of shares or the availability of shares

for sale at any time will have on the prevailing market price.

Shareholders

should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of

fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related

to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press

releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons;

(4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities

by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of

those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny

stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate

in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established

with respect to our securities. The possible occurrence of these patterns or practices could increase the volatility of our share price.

We

do not expect to pay dividends in the foreseeable future; any return on investment may be limited to the value of our common stock.

We

do not currently anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend

on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider

relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing our capital base and development

and marketing efforts. There can be no assurance that the Company will ever have sufficient earnings to declare and pay dividends to

the holders of our common stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our board of

directors. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if its

stock price appreciates.

Our

issuance of additional shares of Common Stock, or options or warrants to purchase those shares, would dilute your proportionate ownership

and voting rights.

We

are entitled under our articles of incorporation to issue up to 500,000,000 shares of common stock. The Company has issued and

outstanding, as of July 25, 2024, 11,485,230 shares of common stock. Our board may generally issue shares of common stock, preferred stock, options, or

warrants to purchase those shares, without further approval by our shareholders based upon such factors as our board of directors may

deem relevant at that time. It is likely that we will be required to issue a large amount of additional securities to raise capital to

further our development. It is also likely that we will issue a large amount of additional securities to directors, officers, employees

and consultants as compensatory grants in connection with their services, both in the form of stand-alone grants or under our stock plans.

We cannot give you any assurance that we will not issue additional shares of common stock, or options or warrants to purchase those shares,

under circumstances we may deem appropriate at the time.

In

order to complete the letter of intent with BotMakers, Inc., we will need to issue approximately 100,000,000 shares of our common stock

and raise approximately $500,000, potentially through the sale of equity in this Offering.

In

order to complete the acquisition of BotMakers, Inc., we will need to issue approximately 100,000,000 shares of our common stock and

raise approximately $500,000, potentially through

the sale of equity in this Offering. This issuance of shares will immediately dilute all shareholders of the Company. Our current issued

shares will increase from 11,485,230 to 111,485,230 shares of outstanding stock; thereby causing a substantial dilution to current shareholders

and purchasers in this Offering. The Company will also need to raise approximately $500,000 in funding in order to finalize the purchase

of BotMakers. In order to raise those funds the Company will potentially sell more equity through this Offering which will cause further

dilution to the existing shareholders. Also, the Company does not have any investors currently committed to purchasing those shares and

the Company can give no guarantees that it will be able to raise that funding in order to complete the purchase of BotMakers.

The

elimination of monetary liability against our directors, officers and employees under our Articles of Incorporation and the existence

of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage

lawsuits against our directors, officers and employees.

Our

Articles of Incorporation contain provisions that eliminate the liability of our directors for monetary damages to our company and shareholders.

Our bylaws also require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our

agreements with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring

substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable

to recoup. These provisions and resulting costs may also discourage our company from bringing a lawsuit against directors, officers and

employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders

against our directors, officers and employees even though such actions, if successful, might otherwise benefit our company and shareholders.

We

may become involved in securities class action litigation that could divert management’s attention and harm our business.

The

stock market in general, and the shares of early-stage companies in particular, have experienced extreme price and volume fluctuations.

These fluctuations have often been unrelated or disproportionate to the operating performance of the companies involved. If these fluctuations

occur in the future, the market price of our shares could fall regardless of our operating performance. In the past, following periods

of volatility in the market price of a particular company’s securities, securities class action litigation has often been brought

against that company. If the market price or volume of our shares suffers extreme fluctuations, then we may become involved in this type

of litigation, which would be expensive and divert management’s attention and resources from managing our business.

As

an OTC Markets company, we may also from time to time make forward-looking statements about future operating results and provide

some financial guidance to the markets. Our management has limited experience as a management team in an OTC Market company and

as a result, projections may not be made timely or set at expected performance levels and could materially affect the price of our shares.

Any failure to meet published forward-looking statements that adversely affect the stock price could result in losses to investors, stockholder

lawsuits or other litigation, sanctions or restrictions issued by the SEC.

Our

common stock is currently deemed a “penny stock,” which makes it more difficult for our investors to sell their shares.

The

SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity

security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock,

unless exempt, the rules require that a broker or dealer approve a person’s account for transactions in penny stocks, and the broker

or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock

to be purchased.

In

order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and

investment experience objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable

for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of

transactions in penny stocks.

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to

the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination,

and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally,

brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more

difficult for investors to dispose of our common stock if and when such shares are eligible for sale and may cause a decline in the market

value of its stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading, and about the commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities, and the rights and remedies

available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent

price information for the penny stock held in the account and information on the limited market in penny stock.

As

an issuer of a “penny stock,” the protection provided by the federal securities laws relating to forward-looking statements

does not apply to us.

Although

federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal

securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe

harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement

of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not

misleading. Such an action could hurt our financial condition.

Because

directors and officers currently and for the foreseeable future will continue to control BioQuest Corp., it is not likely that you will

be able to elect directors or have any say in the policies of BioQuest Corp.

Our

shareholders are not entitled to cumulative voting rights. Consequently, the election of directors and all other matters requiring shareholder

approval will be decided by majority vote. The directors, officers and affiliates of BioQuest Corp. beneficially own a majority of our

outstanding common stock voting rights. Due to such significant ownership position held by our insiders, new investors may not be able

to affect a change in our business or management, and therefore, shareholders would have no recourse as a result of decisions made by

management.

In

addition, sales of significant amounts of shares held by our directors, officers or affiliates, or the prospect of these sales, could

adversely affect the market price of our common stock. Management’s stock ownership may discourage a potential acquirer from making

a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders

from realizing a premium over our stock price.

Risks

Relating to Our Company and Industry

The

following risks relate to our business and the effects upon us assuming we obtain financing in a sufficient amount.

Our

business plan is speculative.

Our

planned businesses are speculative and subject to numerous risks and uncertainties. The burden of government regulation on artificial

intelligence, securities markets and related industry participants is uncertain and difficult to quantify. There is no assurance that

we will ever earn any revenue or enough revenue to make a net profit.

If we fail to acquire BotMakers,

we will be unable to enter into the conversational AI industry.

Our success depends on our ability

to acquire BotMakers through the sale of equity in this Offering. If we fail to acquire BotMakers we will be unable to enter into the

conversational AI industry. We will also be unable to use BotMakers AI, which will make proceeding with our current business plan very

unlikely. Consequently, if we fail to acquire BotMakers, our planned business, financial condition, and results of operations will be

materially and adversely affected.

Conflicts of interest may arise

between the Officers, Directors and the Company.

Potential conflicts may exist between

the Directors and the Company. These conflicts are not limited to the following: Our Officers and Directors, of which any or all may

be involved in similar investments or have interests in similar entities, may raise capital for others, may serve on the board of other

companies that may be a conflict of interest to the Company, may hire affiliates, contractors, vendors or suppliers to provide services

to the Company on its behalf.

Further there is a potential for a

conflict of interest between the Company and Mr. Hemingway and Ms. Melton. As Mr. Hemingway is a controlling shareholder and also our

Chief Executive Officer, and Director. Mr. Hemingway also owns and manages the Redwood Investment Group and Pillar Marketing Group, as

such there is the potential for a conflict of interest between the Company and Mr. Hemingway. Ms. Melton is also a Director of BotMakers

and as such there is the potential for a conflict of interest between the Company and Ms. Melton.

We

expect to depend on the stability and availability of our information technology systems.

We

expect to rely on information technology in all aspects of our business. A significant disruption or failure of our information

technology systems could result in service interruptions, revenue collection disruptions, safety failures, security violations,

regulatory compliance failures and the inability to protect corporate information assets against intruders or other operational

difficulties. Although we anticipate taking steps to mitigate these risks, a significant disruption could adversely affect our

results of our operations, financial condition or liquidity. Additionally, if we are unable to acquire or implement new technology,

we may suffer a competitive disadvantage, which could also have an adverse effect on our results of operations, financial condition

or liquidity.

The

Company may not be able to

successfully compete against companies with substantially greater resources.

The

conversational AI industry in which the Company plans to operate in general is subject to intense and increasing competition. Some of our

potential competitors may have greater capital resources, facilities, and diversity of product lines, which may enable them to compete

more effectively in this market. Our potential competitors may devote their resources to developing technologies and marketing products

that will directly compete with our planned product lines. Due to this competition, there is no assurance that we will not encounter

difficulties in obtaining revenues and market share or in the positioning of our planned products. There are no assurances that competition

in our respective industries will not lead to reduced prices for our proposed products. If we are unable to successfully compete with

existing companies and new entrants to the market this will have a negative impact on our business and financial condition.

Commencement

and development of operations will depend on the acceptance of its proposed business services and platforms. If the Company’s

planned products are not deemed desirable and suitable for purchase and it cannot establish a loyal customer base, it may not be

able to generate revenues, which would result in a failure of the business and a loss of any investment one makes in the

shares.

The

acceptance of BotMakers conversational AI products and services, is critically important to its success. The Company cannot

be certain that the BotMaker products that it plans to acquire and continue offering will be appealing and as a result there may not be any demand

for these products and sales could be limited and it may never realize any revenues.

We

cannot assure that we will earn a profit or that BotMakers products will be accepted by consumers.

The conversational AI business is speculative

and dependent upon acceptance of BotMakers products by consumers. Our future operating performance will be heavily dependent on

whether or not we are able to earn a profit on the sale of BotMakers products. We cannot assure that we will be successful

or earn revenue or make a profit, or that investors will not lose their entire investment.

The

conversational AI software industry is highly competitive.

This

Company expects to compete against a number of large well-established financial companies with greater name recognition, a more comprehensive

offering of AI analysis, tools, and platforms, and with substantially larger resources than the Company’s, including financial

and marketing. In addition to these well-established competitors there are some smaller companies that have developed and are marketing

their AI products. There can be no assurance that it can compete successfully in this market. If it cannot successfully compete

in this highly competitive app development business, it may never be able to generate revenues or become profitable. As a result, you

may never be able to liquidate or sell any shares you purchase in this offering.

If

the Company is unable to attract customers, retain customers, expand BotMakers products and services offerings for our

potential customers, or identify areas of higher growth, our potential revenue growth and profitability will be harmed.

Our

success depends on our ability to acquire customers, expand engagements with those customers and identify areas of higher growth, and

to do so in a cost-effective manner. The Company plans to make significant investments related to customer acquisition and retention, expect

to continue the need to spend significant amounts on these efforts in future periods, and cannot guarantee that any revenue from new

or existing customers, in the future will ultimately exceed the costs of these investments.

Additionally,

if we fail to deliver a quality user experience, or if customers do not perceive the products and services the Company plans to offer to

be of high value and quality, we may be unable to acquire or retain customers. Additionally, if we are unable to acquire or retain customers

to a level where our revenues will exceed our losses from the user side, we may be unable to achieve our operational objectives. Consequently,

we may need to increase prices or may not decrease to competitive levels to maintain customers, and as a result expected revenues may

decrease, margins may decline, and we may not achieve or maintain profitability. Consequently, our business, financial condition, and

results of operations may be materially and adversely affected.

Our

future efforts to purchase BotMakers, expand our service offerings and to develop and integrate our existing services in order

to keep pace with policy, regulatory, political and technological developments may not succeed.

Our

future efforts to purchase BotMakers may not succeed; as a result, we may not

achieve profitability or the revenue growth rate we expect. In addition, the markets for certain of our intended offerings remain

relatively new and it is uncertain whether our efforts, and related investments, will ever result in revenue for us. We may be required

to continuously enhance technology platforms, including artificial intelligence capabilities and algorithms, to maintain

and improve the quality of our proposed products and services in order to remain competitive with alternatives. Further, the introduction

of significant platform changes and upgrades may not succeed, and early-stage interest and adoption of such new services may not result

in long-term success or revenue for us. Additionally, if we fail to anticipate or identify significant technology trends

and developments early enough, or if we do not devote appropriate resources to adapting to such trends and developments, our business

could be harmed.

If

we are unable to develop or acquire enhancements to, and new features for, our planned or new services that keep pace with

rapid technological developments, our business could be harmed. The success of enhancements and new or acquired products and

services depends on several factors, including the timely completion, introduction and market acceptance of the feature, service or

enhancement by customers, administrators and developers, as well as our ability to seamlessly integrate all of our product and

service offerings and develop adequate selling capabilities in new markets. Failure in this regard may significantly impair our potential

revenue as well as negatively impact our operating results if the additional costs are not offset by additional revenues. We may not

be successful in either developing or acquiring these enhancements and new products and services or effectively bringing them to

market.

Furthermore,

uncertainties about the timing and nature of new services or technologies, or modifications to existing services or technologies, or

changes in customer usage patterns thereof, could increase our research and development or service delivery expenses or lead to our increased

reliance on certain vendors. Any failure of our services to operate effectively with future network platforms and technologies could

reduce the demand for our services, result in customer dissatisfaction and harm our business.

If

the Company has overestimated the size of its total addressable market, our future growth rate may be limited.

It

is difficult to accurately estimate the size of the conversational AI services markets and predict with certainty the rate at which the

market for BotMakers services will grow, if at all. While our market size estimate was made in good faith and is based on assumptions

and estimates the Company believes to be reasonable, this estimate may not be accurate. If our estimates of the size of our addressable

market are not accurate, our potential for future growth may be less than we currently anticipate, which could have a material adverse

effect on our business, financial condition, and results of operations.

BotMakers

will rely on third parties, including

public sources, for data, information and other products and services, and our relationships with such third parties may not be successful

or may change, which could adversely affect our results of operations.

BotMakers

products and services will rely upon data, information, and services obtained from third-party providers and public sources. Such data,

information, and services are made available to potential customers or are integrated for potential customers’ use through information

and technology solutions provided by BotMakers and third-party service providers. We may have commercial relationships with third-party

providers whose capabilities complement BotMakers, and, in some cases, these providers could also be competitors. The priorities

and objectives of these providers, particularly those that are competitors, may differ from BotMakers, which may make us vulnerable to

unpredicted price increases, unfavorable licensing terms and other adverse circumstances. Agreements with such third-party providers

periodically come up for renewal or renegotiation, and there is a risk that such negotiations may result in different rights and restrictions,

which could impact or eliminate customers’ use of the content. In addition, as the number of products and services in our planned

markets increases and the functionality of these products and services further overlaps with third-party products and services, we may

become increasingly subject to claims by a third party that BotMakers products and services infringe on such party’s IP rights.

Moreover, providers that are not currently competitors may become competitors or be acquired by or merge with a competitor in the future,

any of which could reduce BotMakers access to the information and technology solutions provided by those companies. If we do not maintain,

or obtain the expected benefits from, relationships with third-party providers or if a substantial number of third-party providers or

any key service providers were to withdraw their services, we may be less competitive, our ability to offer products and services to

customers may be negatively affected, and results of operations could be adversely impacted.

BotMakers

ability to introduce new features, integrations, capabilities, and enhancements is dependent on adequate research and development resources.

If we do not adequately fund BotMakers research and development efforts, or if our research and development investments do not translate

into material enhancements to BotMakers products and services, BotMakers may not be able to compete effectively, and our business,

financial condition, results of operations and prospects may be adversely affected.

To

remain competitive, BotMakers in the future, may develop new features, integrations, and capabilities to BotMakers current

line of products and services. Maintaining adequate research and

development resources, such as the appropriate personnel and development technology, to meet the demands of the market is essential.

If BotMakers is unable to develop features, integrations, and capabilities internally due to certain constraints, such as lack of

management ability, or a lack of other research and development resources, our business may be harmed.

Moreover,

research and development projects can be technically challenging and expensive. The nature of these research and development cycles may

cause us and BotMakers to experience delays between the time we incur expenses associated with research and development and the

time we are able to offer compelling features, integrations, capabilities, and enhancements and generate revenue, if any, from such investment.

Anticipated demand for a feature, integration, capability, or enhancement we are developing could decrease after the development cycle

has commenced, and we would nonetheless be unable to avoid substantial costs associated with the development of any such feature, integration,

capability, or enhancement. Additionally, we may experience difficulties with software development, design, or marketing that could affect

the length of these research and development cycles that could further delay or prevent our development, introduction, or implementation

of features, integrations, capabilities, and enhancements. If we expend a significant amount of resources on research and development

and our efforts do not lead to the successful introduction or improvement of features, integrations, and capabilities that are competitive,

our business, results of operations, and financial condition could be adversely affected.

Further,

competitors may expend more on their respective research and development programs or may be acquired by larger companies that would allocate

greater resources to our competitors’ research and development programs or our competitors may be more efficient or effective in

their research and development activities. Failure to maintain adequate research and development resources or to compete effectively

with the research and development programs of potential competitors would give an advantage to such competitors and may harm our

future business, results of operations, and financial condition.

The

Company may not be able to successfully implement its business strategy, which could adversely affect its business, financial condition,

results of operations and cash flows.

Successful

implementation of its business strategy depends on the successful purchase of BotMakers. The state of the conversational AI industry and numerous other factors that may be beyond its control. Adverse changes in the following factors could undermine our business

strategy and have a material adverse effect on its business, its financial condition, and results of operations and cash flow:

| ● | The

competitive environment in the conversational AI sector that may force us to reduce

prices below the optimal pricing level or increase promotional spending; |

| | ● | The

inability of the Company to raise funds in this Offering in order to complete the purchase

of BotMakers; |

| ● | Its

ability to anticipate changes in consumer preferences and to meet customers’ needs

for AI products in a timely cost effective manner; and |

| ● | Its

ability to establish, maintain and eventually grow market share in a competitive environment. |

There

are no substantial barriers to entry into the industry and because the Company does not currently have any copyright protection

for the products it intends to sell, there is no guarantee someone else will not duplicate its ideas and bring them to market before

it does, which could severely limit the Company proposed sales and revenues.

Since

it has no copyright protection, unauthorized persons may attempt to copy aspects of its business, including its product design or functionality,

services or marketing materials. Any encroachment upon the Company corporate information, including the unauthorized use of its brand

name, the use of a similar name by a competing company or a lawsuit initiated against it for infringement upon another company’s

proprietary information or improper use of their copyright, may affect its ability to create brand name recognition, cause customer confusion

and/or have a detrimental effect on its business. Litigation or proceedings before the U.S. or International Patent and Trademark Offices

may be necessary in the future to enforce future company intellectual property rights, to protect its trade secrets and domain

name and/or to determine the validity and scope of the proprietary rights of others. Any such infringement, litigation or adverse proceeding

could result in substantial costs and diversion of resources and could seriously harm its business operations and/or results of operations.

As a result, an investor could lose his or her entire investment.

The

Company may be unable to keep pace

with changes in the industries that the Company plans to serve and advancements in technology as our business and market strategy evolves.

As

changes in the industries the Company plans to serve occur or macroeconomic conditions fluctuate the Company may need to

adjust our business strategies or find it necessary to restructure our operations or businesses, which could lead to changes in our cost

structure, the need to write down the value of assets, or impact our profitability. The Company plans to also make investments

in existing and/or new businesses, including investments in technology and expansion of our business plans. These investments may

have short-term returns that are negative or less than expected and the ultimate business prospects of the business may be uncertain.

As