UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended November 30, 2012

Commission file number: 000-52759

DIMI TELEMATICS INTERNATIONAL, INC.

(Name of registrant as specified in its charter)

|

Nevada

|

20-4743354

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

290 Lenox Avenue, New York, NY 10027

|

|

(Address of principal executive offices)(Zip Code)

|

(855) 633 - 3738

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

x

No

o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes

o

No

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

o

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if smaller reporting company)

|

Smaller reporting company

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes

o

No

x

As of January 8, 2013, there were 327,716,928 shares of common stock outstanding.

TABLE OF CONTENTS

|

|

|

|

Page No.

|

|

|

PART I. - FINANCIAL INFORMATION

|

|

|

|

|

|

|

F-1 - F-9

|

|

|

|

|

|

|

3

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

6

|

|

|

PART II - OTHER INFORMATION

|

|

|

|

|

|

|

|

|

|

7

|

|

|

Item 1A.

|

Risk Factors.

|

|

|

7

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

7

|

|

|

Signatures

|

|

|

|

8

|

|

PART I - FINANCIAL INFORMATION

These unaudited financial statements have been prepared by the registrant, pursuant to the rules and regulations of the Securities and Exchange Commission. These financial statements and the notes attached hereto should be read in conjunction with the financial statements and notes included in the registrant’s Form 10-K for its fiscal year ended August 31, 2012 as filed with the SEC on November 29, 2012. In the opinion of the registrant, all adjustments, including normal recurring adjustments necessary to present fairly the financial position of the Company, as of November 30, 2012 and November 30, 2011 and the results of its operations and cash flows for the three month periods then ended have been included. The results of operations for the interim period are not necessarily indicative of the results for the full year.

|

ITEM 1.

|

FINANCIAL STATEMENTS

|

DiMi Telematics International, Inc.

(Formerly First Quantum Ventures, Inc.)

(A Development Stage Company)

Condensed Consolidated Balance Sheet

|

|

|

|

|

|

|

|

|

|

|

November 30

|

|

|

|

|

|

|

|

2012

|

|

|

August 31

|

|

|

Assets

|

|

(unaudited)

|

|

|

2012

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

571,490

|

|

|

$

|

733,123

|

|

|

Prepaid expense

|

|

|

9,000

|

|

|

|

9,000

|

|

|

Total current assets

|

|

|

580,490

|

|

|

|

742,123

|

|

|

|

|

|

|

|

|

|

|

|

|

iPhone applications, net

|

|

|

10,083

|

|

|

|

11,000

|

|

|

DiMi Platform

|

|

|

62,500

|

|

|

|

-

|

|

|

Intellectual property, net

|

|

|

1,807

|

|

|

|

1,840

|

|

|

Total assets

|

|

|

654,880

|

|

|

$

|

754,963

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

14,370

|

|

|

$

|

16,532

|

|

|

Total current liabilities

|

|

|

14,370

|

|

|

|

16,532

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Series A Convertible Prefered Stock, $0.001 par value, 50,000,000

|

|

|

|

|

|

|

|

|

|

authorized shares. 1,000 and 0 shares issued and outstanding November 30, 2012

|

|

|

|

|

|

|

and August 31, 2012, respectively

|

|

|

1

|

|

|

|

1

|

|

|

Common stock, $.001 par value: 500,000,000 authorized;

|

|

|

|

|

|

|

|

|

|

327,716,928 and 327,716,928 shares issued and

|

|

|

|

|

|

|

|

|

|

outstanding on November 30, 2012 and August 31, 2012, respectively

|

|

|

327,717

|

|

|

|

327,717

|

|

|

Additional paid in capital

|

|

|

1,026,481

|

|

|

|

1,026,481

|

|

|

Accumulated deficit

|

|

|

(713,689

|

)

|

|

|

(615,768

|

)

|

|

Total stockholders' equity

|

|

|

640,510

|

|

|

|

738,431

|

|

|

Total liability and stockholders' equity

|

|

$

|

654,880

|

|

|

$

|

754,963

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements

DiMi Telematics International, Inc.

(Formerly First Quantim Ventures, Inc.)

(A Development Stage Company)

Condensed Consolidated Statements of Operations

(unaudited)

|

|

|

|

|

|

|

|

|

From

|

|

|

|

|

|

|

|

|

|

|

Inception

|

|

|

|

|

For the

|

|

|

For the

|

|

|

January 28,

|

|

|

|

|

three months

|

|

|

three months

|

|

|

2011

|

|

|

|

|

ended

|

|

|

ended

|

|

|

through

|

|

|

|

|

November 30,

|

|

|

November 30,

|

|

|

November 30,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

96,971

|

|

|

|

57,977

|

|

|

|

712,608

|

|

|

Amortization expense

|

|

|

950

|

|

|

|

33

|

|

|

|

1,081

|

|

|

Total operating expenses

|

|

|

97,921

|

|

|

|

58,010

|

|

|

|

713,689

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income tax

|

|

|

(97,921

|

)

|

|

|

(58,010

|

)

|

|

|

(713,689

|

)

|

|

Provision for income tax

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Net Loss

|

|

$

|

(97,921

|

)

|

|

$

|

(58,010

|

)

|

|

$

|

(713,689

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share: basic and diluted

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average share outstanding

|

|

|

327,716,928

|

|

|

|

90,411,496

|

|

|

|

|

|

|

Basic and diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements

DiMi Telematics International, Inc.

(Formerly First Quantum Ventures, Inc.)

(A Development Stage Company)

Condensed Consolidated Statements of Cash Flows

|

|

|

|

|

|

|

|

|

From

|

|

|

|

|

|

|

|

|

|

|

Inception

|

|

|

|

|

For the

|

|

|

For the

|

|

|

January 28,

|

|

|

|

|

Three Months

|

|

|

Three Months

|

|

|

2011

|

|

|

|

|

ended

|

|

|

ended

|

|

|

through

|

|

|

|

|

November 30,

|

|

|

November 30,

|

|

|

November 30,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(97,921

|

)

|

|

$

|

(58,010

|

)

|

|

$

|

(713,689

|

)

|

|

Adjustments to reconcile net loss to net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

cash used in operating activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization expense

|

|

|

950

|

|

|

|

33

|

|

|

|

1,300

|

|

|

Warrant expense

|

|

|

-

|

|

|

|

9

|

|

|

|

9

|

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expense

|

|

|

|

|

|

|

-

|

|

|

|

(9,000

|

)

|

|

Accounts payable

|

|

|

(2,162

|

)

|

|

|

(21,751

|

)

|

|

|

14,370

|

|

|

Net Cash used in operating activities

|

|

|

(99,133

|

)

|

|

|

(79,719

|

)

|

|

|

(707,010

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from invesing activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DiMi platform

|

|

|

(62,500

|

)

|

|

|

-

|

|

|

|

(62,500

|

)

|

|

iPhone applications

|

|

|

-

|

|

|

|

-

|

|

|

|

(11,000

|

)

|

|

Net cash used in investing activities

|

|

|

(62,500

|

)

|

|

|

-

|

|

|

|

(73,500

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from financing activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from common stock sale

|

|

|

-

|

|

|

|

225,000

|

|

|

|

1,352,000

|

|

|

Net cash provided by financing activities

|

|

|

-

|

|

|

|

225,000

|

|

|

|

1,352,000

|

|

|

Net increase(decrease) in cash and cash equivalents

|

|

|

(161,633

|

)

|

|

|

145,281

|

|

|

|

571,490

|

|

|

Cash and cash equivalents at beginning of period

|

|

|

733,123

|

|

|

|

117,382

|

|

|

|

-

|

|

|

Cash and cash equivalents at end of period

|

|

$

|

571,490

|

|

|

$

|

262,663

|

|

|

$

|

571,490

|

|

|

Supplemental disclosure of cash flow information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid during period for

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Cash paid for income taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Stock and warrants issued for intellectual property

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

1,971

|

|

|

Common stock exchanged

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for 1,000 preferred stock

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

100,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements

DiMi Telematics International, Inc.

(Formerly First Quantum Ventures, Inc.)

(A Development Stage Company

NOTES TO CONDENSED FINANCIAL STATEMENTS

1. BASIS OF PRESENTATION AND NATURE OF BUSINESS OPERATIONS

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of DiMi Telematics International Inc. formerly (First Quantum Ventures, Inc.), a Nevada corporation (the "Company"), have been prepared in accordance with the instructions to Form 10-Q and do not include all of the information and footnotes required by accounting principles generally accepted in the United States of America for complete consolidated financial statements. These unaudited condensed consolidated financial statements and related notes should be read in conjunction with the Company's Form 10-K for the fiscal year ended August 31, 2012. In the opinion of management, these unaudited condensed consolidated financial statements reflect all adjustments that are of a normal recurring nature and which are necessary to present fairly the financial position of the Company as of November 30, 2012, and the results of operations and cash flows for the three months ended November 30, 2012 and 2011. The results of operations for the three ended November 30, 2012 are not necessarily indicative of the results that may be expected for the entire fiscal year.

On October 28, 2011 the Company entered into a Share Exchange Agreement (“Share Exchange”) with DiMi Telematics, Inc. shareholders. Pursuant to the agreement, the Companyissued 87,450,000 shares of common stock pre split in exchange for all outstanding shares and warrants to purchase common shares of DiMi Telematics, Inc. (“DTI”), the Companyreceived 145,750,000 shares of common stock and warrants to purchase 21,625,000 shares of common stock. As a result of the Share Exchange Agreement, DTI became a subsidiary of the Company. The Company assumed operation of DiMi Telematics Inc. and entered the Telematics/M2M industry. On November 10, 2011, the closing of the Share Exchange occurred. In connection with the Share Exchange, (a) 15,000,000 shares of the Company’s issued and outstanding common stock were surrendered for cancellation and (b) the Company’s officers and directors resigned and the following individuals assumed their duties as officers and directors:

|

|

|

|

Name

|

Title(s)

|

|

Barry Tenzer

|

President, Chief Executive Officer, Chief Financial Officer, Secretary and Director

|

|

|

|

|

Roberto Fata

|

Executive Vice President – Business Development and Director

|

The Company has accounted for the acquisition under the purchase method of accounting for business combinations. Under the purchase method of accounting in a business combination effected through an exchange of equity interest, the entity that issues the equity interest is generally the acquiring entity. In some business combinations (commonly referred to as reverse acquisitions), however, the acquired entity issues the equity interest. Accounting for business combinations requires consideration of the facts and circumstances surrounding a business combination that generally involves the relative ownership and control of the entity by each of the parties subsequent to the acquisition. Based on a review of these factors, the acquisition will be accounted for as a reverse acquisition, i.e. the Company will be considered the acquired company and DTI will be considered the acquiring company. As a result, the Company’s assets and liabilities will be incorporated into DTI’s balance sheet based on the fair value of the net assets acquired. Further, the Company’s operating results will not include the Company’s results prior to the date of closing. Accordingly the accompanying financial statements are the financial statements of the DTI. In addition, the Company’s fiscal year end changed to DTI’s fiscal year end of August 31 following the closing.

The Company has retroactively reflected the acquisition in DTI’s common stock in a ratio consistent with the Share Exchange.

On March 15, 2012, First Quantum Ventures, Inc., changed its name to DiMi Telematics International, Inc.

Nature of Business Operations

DTI is a development stage company formed on January 28, 2011 as Medepet Inc. as a Nevada corporation. During the first year of operations the Company has redefined its business purpose and operation. On June 20, 2011 the Company changed its name from Medepet Inc. to Precision Loc8. On July 28, 2011 the Company changed its name from Precision Loc8 to Precision Telematics Inc. On August 9, 2011 the Company changed its name to DiMi Telematics Inc.

On July 28, 2011 the Company entered into an asset purchase agreement for the purchase of intellectual property.

DTI designs, develops and distributes Machine-to-Machine (M2M) communications solutions used to remotely track, monitor, manage and protect multiple mobile and fixed assets in real-time from virtually any web-enabled desktop computer or mobile device. Through our proprietary software and hosted service offerings, DTI is endeavoring to capitalize on the pervasiveness and data transport capabilities of wireless networks in order to facilitate communications and process efficiencies between commercial and industrial business owners/managers and their respective networked control systems, sensors and devices.

DTI is focused on the M2M market segments in which we can provide highly differentiated and value-driven solutions capable of unleashing tangible productivity gains, material cost reductions and quantifiable risk mitigation across an enterprise. Aside from the oversight and administration of our corporate, financial and legal affairs by the executive management team, our Company’s operating activities are centralized in three core areas:

|

•

|

Sales and Marketing

, which will employ both direct and indirect sales models utilizing an in-house business development team, partners and resellers and self-service through a service on-demand web interface.

|

|

•

|

Operations

, which will be responsible for managing daily activities related to monitoring and administering our cloud-based server operations; 24/7 client service/help desk; professional services and installation support; and quality assurance and testing of our

DiMi

software and hosting platform, as well as the implementation and ongoing administration of our hosted clients’ M2M communications platforms.

|

|

•

|

Product Development

, which will be charged with enhancing our existing M2M software applications and services and introducing new and complementary hosted products and applications on a timely basis.

|

Going Concern

The accompanying financial statements have been prepared contemplating a continuation of the Company as a going concern. However, the Company has reported a net loss of $97,921 for the three months ended November 30, 2012 and had an accumulated deficit of $713,689 as of November 30, 2012. The Company has net working capital of $566,120 as of November 30, 2012.

DTI’s flagship M2M solution is “

DiMi

,” a proprietary, patent-pending, business intelligence and two-way communications platform that captures and seamlessly integrates real-time data from networked tracking, monitoring, alarm and alert systems, sensors and devices; and, in turn, centralizes this data onto an online command and control dashboard that is accessible 24/7 by a designated user or community of designated users through the secure

DiMi

Internet portal, found at

www.dimispeaks.com

.

With adoption of the

DiMi

M2M communication

s

platform, users can remotely control, monitor, manage and acquire data from their operational assets, providing the interface for lighting, temperature, humidity, keycard access, fleet management and many other vital systems that impact the enterprise.

DiMi

uses established secure technology standards (i.e. LONet, MODbus, BACnet and ELK) combined with a unique, proprietary software interface that keeps users connected to their asset management and control systems through any web-enabled computer or mobile device,

By providing dynamic, real-time access to critical information from a wide array of new or legacy sensors, GPS tracking tools and/or diagnostic devices – irrespective of their make, model or manufacturer,

DiMi

alerts or reports back to its users via familiar communication tools, like IM, email, HTML and text messaging. Users can even issue global commands to its asset management and control systems through the

DiMi

software interface. Moreover,

DiMi

leverages the collected knowledge of a particular asset or assets and compares it to historical performance metrics and other critical benchmarks through an integrated data management module, giving users insight that allow them to rapidly identify and implement proper preventive maintenance measures, efficiency improvements and other key operational activities.

DTI’s

DiMi

solution is currently being used to actively monitor property management systems in several high-rise commercial and residential buildings in New York City – all beta sites which have served to successfully prove out the

DiMi

technology and M2M communications platform. Moving forward, DTI intends to concentrate its

DiMi

commercialization efforts on marketing the solution to property management companies, commercial property developers, government/military installations, industrial facilities, retail and restaurant chains, colleges and universities, fleet managers, and any business or institutional concern with valuable fixed and mobile assets requiring remote surveillance, regular maintenance or general oversight.

Once a new client’s core M2M business needs have been confirmed, DTI will closely collaborate with the client to design the organizational and process modifications required to ensure a successful

DiMi

launch, offering full service project definition, management, user interface customization, implementation services and ongoing quality assurance and testing.

Cash and Cash Equivalents

For purposes of these financial statements, cash and cash equivalents includes highly liquid debt instruments with maturity of less than three months.

Concentrations of Credit Risk

Financial instruments and related items, which potentially subject the Company to concentrations of credit risk, consist primarily of cash and cash equivalents. The Company places its cash and temporary cash investments with high credit quality institutions. At times, such investments may be in excess of the FDIC insurance limit. Currently our operating account is not above the FDIC limit.

Income Taxes

The Company accounts for income taxes under the asset and liability method, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements. Under this method, deferred tax assets and liabilities are determined based on the differences between the financial statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period that includes the enactment date.

The Company records net deferred tax assets to the extent the Company believes these assets will more likely than not be realized. In making such determination, the Company considers all available positive and negative evidence, including future reversals of existing taxable temporary differences, projected future taxable income, tax planning strategies and recent financial operations. A valuation allowance is established against deferred tax assets that do not meet the criteria for recognition. In the event the Company were to determine that it would be able to realize deferred income tax assets in the future in excess of their net recorded amount, the Company would make an adjustment to the valuation allowance which would reduce the provision for income taxes.

The Company follows the accounting guidance which provides that a tax benefit from an uncertain tax position may be recognized when it is more likely than not that the position will be sustained upon examination, including resolutions of any related appeals or litigation processes, based on the technical merits. Income tax positions must meet a more-likely-than-not recognition threshold at the effective date to be recognized initially and in subsequent periods. Also included is guidance on measurement, recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition.

iPhone Application

The iPhone application is stated at cost. When retired or otherwise disposed, the related carrying value and accumulated amortization are removed from the respective accounts and the net difference less any amount realized from disposition, is reflected in earnings. Minor additions and renewals are expensed in the year incurred. Major additions and renewals are capitalized and depreciated over their estimated useful lives being 3.

DiMi Platform

.

The DiMi Platform is stated at cost. Anticipated completion is December 2013. When retired or otherwise disposed, the related carrying value and accumulated amortization are removed from the respective accounts and the net difference less any amount realized from disposition, is reflected in earnings. Minor additions and renewals are expensed in the year incurred. Major additions and renewals are capitalized and depreciated over their estimated useful lives being 5 years

Intellectual Properly

Intellectual property is stated at cost. When retired or otherwise disposed, the related carrying value and accumulated amortization are removed from the respective accounts and the net difference less any amount realized from disposition, is reflected in earnings. Minor additions and renewals are expensed in the year incurred. Major additions and renewals are capitalized and depreciated over their estimated useful lives being 3 years up to 15 years.

Revenue Recognition

The Company recognizes revenue on four basic criteria which must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded.

Stock Based Compensation

The Company accounts for all compensation related to stock, options or warrants using a fair value based method whereby compensation cost is measured at the grant date based on the value of the award and is recognized over the service period, which is usually the vesting period. The Company uses the Black-Scholes pricing model to calculate the fair value of options and warrants issued to both employees and non-employees. Stock issued for compensation is valued using the market price of the stock on the date of the related agreement.

Recent Accounting Pronouncements

On January 1, 2012, the Company adopted changes issued by the Financial Accounting Standards Board (FASB) to conform existing guidance regarding fair value measurement and disclosure between GAAP and International Financial Reporting Standards. These changes both clarify the FASB’s intent about the application of existing fair value measurement and disclosure requirements and amend certain principles or requirements for measuring fair value or for disclosing information about fair value measurements. The clarifying changes relate to the application of the highest and best use and valuation premise concepts, measuring the fair value of an instrument classified in a reporting entity’s shareholders’ equity, and disclosure of quantitative information about unobservable inputs used for Level 3 fair value measurements. The amendments relate to measuring the fair value of financial instruments that are managed within a portfolio; application of premiums and discounts in a fair value measurement; and additional disclosures concerning the valuation processes used and sensitivity of the fair value measurement to changes in unobservable inputs for those items categorized as Level 3, a reporting entity’s use of a nonfinancial asset in a way that differs from the asset’s highest and best use, and the categorization by level in the fair value hierarchy for items required to be measured at fair value for disclosure purposes only. Other than the additional disclosure requirements, the adoption of these changes had no impact on the Consolidated Financial Statements.

On January 1, 2012, the Company adopted changes issued by the FASB to the presentation of comprehensive income. These changes give an entity the option to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements; the option to present components of other comprehensive income as part of the statement of changes in stockholders’ equity was eliminated. The items that must be reported in other comprehensive income or when an item of other comprehensive income must be reclassified to net income were not changed. Additionally, no changes were made to the calculation and presentation of earnings per share. Management elected to present the two-statement option. Other than the change in presentation, the adoption of these changes had no impact on the Consolidated Financial Statements.

In December 2011, the Financial Accounting Standards Board (“FASB”) released Accounting Standards Update No. 2011-10 (“ASU 2011-10”),

Property, Plant and Equipment (Topic 360): Derecognition of in Substance Real Estate—a Scope Clarification (a consensus of the FASB Emerging Issues Task Force).

ASU 2011-10 clarifies when a parent (reporting entity) ceases to have a controlling financial interest in a subsidiary that is in substance real estate as a result of default on the subsidiary’s nonrecourse debt, the reporting entity should apply the guidance for Real Estate Sale (Subtopic 360-20). The provisions of ASU 2011-10 are effective for public companies for fiscal years and interim periods within those years, beginning on or after June 15, 2012. When adopted, ASU 2011-10 is not expected to materially impact our consolidated financial statements.

Net Loss per Share

Basic and diluted loss per share amounts are computed based on net loss divided by the weighted average number of common shares outstanding. Outstanding warrants to purchase of 12,675,000 common shares were not included in the computation of diluted loss per share because the assumed conversion and exercise would be anti-dilutive for the three months ended November 30, 2012.

Management Estimates

The presentation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Actual results could differ from those estimates.

2. INTELLECTUAL PROPERTY

Intellectual property of the following:

|

|

|

November 30, 2012

|

|

|

August 31, 2011

|

|

|

Intellectual property

|

|

$

|

2,190

|

|

|

$

|

2,190

|

|

|

Less: amortization

|

|

|

383

|

|

|

|

219

|

|

|

Net intellectual property

|

|

$

|

1,807

|

|

|

$

|

1,971

|

|

The company executed an Asset Purchase Agreement on August 28, 2011 which included various types of intellectual property. Amortization expense for the three months ended November 30, 2012 and 2011amounted to $33 and $33, respectively.

3. I PHONE APPLICATION

The Company’s purchase of an iPhone application was completed in September 2012. The total cost of the applications is $11,000 and will be amortized over a three year period.

|

|

|

November 30, 2012

|

|

|

Intellectual property

|

|

$

|

11,000

|

|

|

Less: amortization

|

|

|

917

|

|

|

Net intellectual property

|

|

$

|

10,083

|

|

Amortization expense for the I phone application for the three months ended November 30, 2012 and 2011 amounted to $917 and $0, respectively.

4. DiMi PLATFORM

The company has contracted for the development of softwareto develop and distributes Machine-to-Machine (M2M) communications solutions used to remotely track, monitor, manage and protect multiple mobile and fixed assets in real-time from virtually any web-enabled desktop computer or mobile device. Completion of the software is anticipated to be implemented by year end 2013. A total of $62,500 has been paid to begin development.

5. EQUITY

Common Stock

The Company formed in the state of Nevada on January 28, 2011. The Company has authorized capital of 500,000,000 shares of common stock with a par value of $0.001, and 50,000,000 shares of Preferred Stock with a par value of $0.001.

On April 16, 2012 the Company issued a 1 for 1 stock dividend to current shareholders of record whereby the Company issued an additional 101,879,232 shares of common stock. On May 16, 2012 the Company issued an additional 1 for 1 stock dividend to current stockholders of record whereby an additional 213,858,464 shares were issued. The dividends include outstanding warrants. The Company has reflected the dividends as splits, which have been retroactively reflected in the financial statements.

During the period ended August 31, 2011 the company issued 296,400,000 shares of common stock through stock purchase agreements in the amount of $312,000.

On July 29, 2011 the company issued 48,000,000 shares of common stock and 48,000,000 warrants for the purchase of common stock pursuant to an Asset Purchase Agreement for the purchase of intellectual property valued at $2,190.

The Company entered into a Securities Purchase Agreement for the sale of 600,000 shares of common stock at $0.042 per share. The Security Purchase Agreement includes 150,000 Class A warrants and 150,000 Class B warrants. On September 12, 2011, the Company received $25,000.

On September 28, 2011 the Company entered into a Securities Purchase Agreement for the sale of 4,800,000 shares of common stock at $0.042 per share in the amount of $200,000. The Security Purchase Agreement includes 1,200,000 Class A warrants and 1,200,000 Class B warrants.

On October 28, 2011 First Quantum Ventures entered into a Share Exchange Agreement (“Share Exchange”) with DiMi Telematics, Inc. shareholders. Pursuant to the agreement, First Quantum Ventures issued 87,450,000 shares of common stock (pre split) in exchange for all outstanding shares and warrants to purchase common shares of DiMi Telematics, Inc (DTI), First Quantum Ventures, Inc received 145,750,000 shares of common stock and warrants to purchase 21,625,000 shares of common stock. In connection with the Share Exchange, (a) 15,000,000 shares of the Company’s issued and outstanding common stock owned by Kesgood Company, Inc. were surrendered for cancellation

During the second quarter the Company sold stocks and warrants in the amount of $815,000. The stocks and warrants were unissued as of February 29, 2012. During April 2012, the Company issued 20,200,000 shares of common stock and 16,300,000warrants for the sale.

On June 14, 2012 the Company entered into an exchange agreement with a major shareholder pursuant to which the Company will issue 1,000 shares of Series A Convertible Preferred Stock in exchange for the surrender and cancellation of 100,000,000 shares of common stock held by the shareholder. All, and not less than all, shares of Preferred Stock shall, provided that the Corporation shall have reported earnings per share of less than $0.01 in its Annual Report for its fiscal year ended August 31, 2013, be convertible, at any time and from time to time after the filing of such Annual Report, at the option of the Holder thereof, into that number of shares of Common Stock determined by dividing the aggregate Stated Value of all shares of Preferred Stock being converted by the Conversion Price of $0.001 per share. Shares of Preferred Stock converted into Common Stock or redeemed in accordance with the terms shall be canceled and shall not be reissued. If the Company shall have reported earnings per share equal to or greater than $0.01 in its Annual Report, then all such shares of Preferred Stock shall immediately be redeemed by the Company without any consideration payable to the shareholder.

Warrants

The Company issued 12,000,000 Common Stock warrants, at an exercise price of $0.17 per share, pursuant to an Asset Purchase Agreement on July 29, 2011 for the purchase of intellectual property. The warrants have an expiration date of four years from the issue date and contain provisions for a cash exercise. The estimated value of the warrants granted in accordance with the Asset Purchase Agreement was determined using the Black-Scholes pricing model and the following assumptions:

During the first quarter the Company issued 337,500 Class A warrants at an exercise price of $0.17 per share and issued 337,500 Class B Warrants at an exercise price of $0.25 per share. The estimated value of the warrants granted in accordance with the Asset Purchase Agreement was determined using the Black-Scholes pricing model and the following assumptions:

|

Risk-free interest rate at grant date

|

|

|

0.39

|

%

|

|

Expected stock price volatility

|

|

|

200

|

%

|

|

Expected dividend payout

|

|

|

--

|

|

|

Expected option in life-years

|

|

|

2

|

|

Transactions involving warrants are summarized as follows:

|

|

|

Number of Warrants

|

|

|

Weighted-Average Price Per Share

|

|

|

|

|

|

|

|

|

|

|

Balance August 31, 2011

|

|

|

12,000,000

|

|

|

$

|

0.17

|

|

|

Granted

|

|

|

675,000

|

|

|

|

0.17

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercised

|

|

|

-

|

|

|

|

-

|

|

|

Cancelled or expired

|

|

|

-

|

|

|

|

-

|

|

|

Ending balance August 31, 2012

|

|

|

12,675,000

|

|

|

|

0.17

|

|

|

Granted

|

|

|

-

|

|

|

|

-

|

|

|

Exercised

|

|

|

-

|

|

|

|

-

|

|

|

Canceled or expired

|

|

|

-

|

|

|

|

-

|

|

|

Outstanding at November 30, 2012

|

|

|

12,675,000

|

|

|

$

|

0.17

|

|

|

Warrants Outstanding

|

|

|

Warrants Exercisable

|

|

|

|

|

|

|

|

Weighted

|

|

|

|

|

|

|

|

Weighted

|

|

|

|

|

|

|

|

Average

|

|

|

Weighted

|

|

|

|

|

Average

|

|

|

|

|

|

|

|

Remaining

|

|

|

Average

|

|

|

|

|

Remaining

|

|

Exercise

|

|

|

Number

|

|

|

Contractual

|

|

|

Exercise

|

|

|

Number

|

|

Contractual

|

|

Prices

|

|

|

Outstanding

|

|

|

Life (years)

|

|

|

Price

|

|

|

Exercisable

|

|

Life (years)

|

|

|

$

|

0.17

|

|

|

|

12,000,000

|

|

|

|

3.0

|

|

|

$

|

0.17

|

|

|

|

12,000,000

|

|

3.0

|

|

|

|

0.17

|

|

|

|

675,000

|

|

|

|

3.25

|

|

|

|

0.17

|

|

|

|

675,000

|

|

3.25

|

|

|

|

|

|

|

|

12,675,000

|

|

|

|

3.01

|

|

|

$

|

0.17

|

|

|

|

12,675,000

|

|

3.01

|

6. RELATED PARTY TRANSACTIONS

None

7. COMMITMENTS AND CONTINGENCIES

As of November 30, 2012 there are no continuing commitments and contingencies.

|

ITEM 2.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND PLAN OF OPERATIONS.

|

Forward-looking Statements

We and our representatives may from time to time make written or oral statements that are “forward-looking,” including statements contained in this quarterly report and other filings with the SEC, reports to our stockholders and news releases. All statements that express expectations, estimates, forecasts or projections are forward-looking statements. In addition, other written or oral statements which constitute forward-looking statements may be made by us or on our behalf. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “project,” “forecast,” “may,” “should,” variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in or suggested by such forward-looking statements. We undertake no obligation to update or revise any of the forward-looking statements after the date of this quarterly report to conform forward-looking statements to actual results. Important factors on which such statements are based are assumptions concerning uncertainties, including but not limited to, uncertainties associated with the following:

|

·

|

Inadequate capital and barriers to raising the additional capital or to obtaining the financing needed to implement our business plans;

|

|

·

|

Our failure to earn revenues or profits;

|

|

·

|

Inadequate capital to continue business;

|

|

·

|

Volatility or decline of our stock price;

|

|

·

|

Potential fluctuation in quarterly results;

|

|

·

|

Rapid and significant changes in markets;

|

|

·

|

Litigation with or legal claims and allegations by outside parties; and

|

|

·

|

Insufficient revenues to cover operating costs.

|

The following discussion should be read in conjunction with the financial statements and the notes thereto which are included in this quarterly report. This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ substantially from those anticipated in any forward-looking statements included in this discussion as a result of various factors.

Overview

Cine-Source Entertainment, Inc. (the “

Old Corporation

”) a Colorado corporation, was formed on July 29, 1988. Pursuant to a Plan of Merger dated February 24, 2004, the Old Corporation filed Articles and Certificate of Merger with the Secretary of State of the State of Colorado merging the Old Corporation into Cine-Source Entertainment, Inc. (the “

Surviving Corporation

”), a Colorado corporation. A previous controlling shareholder group of the Old Corporation arranged the merger for business reasons that did not materialize. On April 26, 2004, the Surviving Corporation effected a 1-for-200 reverse stock split. The name of the Surviving Corporation was changed to First Quantum Ventures, Inc., on April 27, 2004. On April 13, 2006 the Surviving Corporation formed a wholly owned subsidiary, a Nevada corporation named First Quantum Ventures, Inc., and on May 5, 2006 merged the Surviving Corporation with and into this subsidiary, referred to herein as DTII.

As disclosed on a Current Report on Form 8-K filed with the SEC on November 16, 2011, on October 28, 2011, we entered into a Share Exchange Agreement (the “

Exchange Agreement

”) with Andrew Godfrey, our Chief Executive Officer, DiMi Telematics, Inc. (“

DTI

”) and the holders of all of the issued and outstanding capital stock of DiMi Telematics (the “

DiMi Shareholders

”). Under the Exchange Agreement, we exchanged 87,450,000 shares of our common stock (pre split) (the “

First Quantum Shares

”) for 100% of the issued and outstanding shares of DTI (the “

DiMi Shares

”). The exchange of the DiMi Shares for the First Quantum Shares is hereinafter referred to as the “

Share Exchange

.” The First Quantum Shares issued in the Share Exchange represent 85.8% of our issued and outstanding common stock immediately following the Share Exchange. As a result of the Share Exchange, DTI became our wholly-owned subsidiary. In connection with the Share Exchange, (a) 15,000,000 shares of our issued and outstanding common stock owned by Kesgood Company, Inc. were surrendered for cancellation and (b) our officers and directors resigned and the following individuals assumed their duties as officers and directors:

|

Name

|

|

Title(s)

|

|

Barry Tenzer

|

|

President, Chief Executive Officer, Chief Financial Officer, Secretary and Director

|

|

|

|

|

|

Roberto Fata

|

|

Executive Vice President – Business Development and Director

|

The Exchange qualified as a transaction exempt from registration or qualification under the Securities Act of 1933, as amended (the “

Securities Act

”), and under the applicable securities laws of each jurisdiction where any of the stockholders reside.

On March 15, 2012, the Company changed its name to DiMi Telematics, International, Inc.

On April 16, 2012 the Company issued a 1 for 1 stock dividend to current shareholders of record whereby the Company issued an additional 101,879,232 shares of common stock. On May 16, 2012 the Company issued an additional 1 for 1 stock dividend to current stockholders of record whereby an additional 213,858,464 shares were issued. The dividends include outstanding warrants. The Company has reflected the dividends as splits, which have been retroactively reflected in the financial statements.

The Company designs, develops and distributes Machine-to-Machine (M2M) communications solutions used to remotely track, monitor, manage and protect multiple mobile and fixed assets in real-time from virtually any web-enabled desktop computer or mobile device. Through our proprietary software and hosted service offerings, DTI is endeavoring to capitalize on the pervasiveness and data transport capabilities of wireless networks in order to facilitate communications and process efficiencies between commercial and industrial business owners/managers and their respective networked control systems, sensors and devices.

The Company is focused on the M2M market segments in which we can provide highly differentiated and value-driven solutions capable of unleashing tangible productivity gains, material cost reductions and quantifiable risk mitigation across an enterprise. Aside from the oversight and administration of our corporate, financial and legal affairs by the executive management team, our Company’s operating activities are centralized in three core areas:

Sales and Marketing

, which will employ both direct and indirect sales models utilizing an in-house business development team, partners and resellers and self-service through a service on-demand web interface.

Operations

, which will be responsible for managing daily activities related to monitoring and administering our cloud-based server operations; 24/7 client service/help desk; professional services and installation support; and quality assurance and testing of our

DiMi

software and hosting platform, as well as the implementation and ongoing administration of our hosted clients’ M2M communications platforms.

Product Development

, which will be charged with enhancing our existing M2M software applications and services and introducing new and complementary hosted products and applications on a timely basis. We anticipate that the creative formulation of enhancements and new product conceptualization will be performed in-house by our officers and directors. Thereafter, we intend to outsource software enhancement and product development to outside third parties.

PLAN OF OPERATIONS

Product Development Plan

Product Development will be charged with enhancing our existing M2M software applications and services and introducing new and complementary hosted products and applications on a timely basis.

The primary building blocks of machine-to-machine (M2M) technology on which the Company has focused its development activities have been and will remain:

·

Building an expert knowledge base of existing and emerging electronics/technologies that enable geo-location, remote monitoring and control, auto-diagnostics and object identification;

·

Engagement of a cloud computing platform that enables ubiquitous, scalable and on-demand network access;

·

Development of proprietary software that controls two-way communication events, acts on predefined rules and delivers users a customized web interface that is accessible 24/7 from any web-enabled computer or device anywhere on Earth; and

·

Information systems that enable users to process management solutions that allow for exploiting the information gathered for intelligent decision-making purposes and enhanced situational awareness.

The Company’s proprietary M2M solutions utilize a cloud-based, two-way communications delivery platform, marketed as “

DiMi

.” Leveraging the power, scalability and flexible turnkey advantages of

DiMi’s

patent-pending software and hosting platform, users are able to remotely track, monitor, manage and protect multiple mobile and fixed assets in real-time from virtually any web-enabled desktop computer or mobile device while located anywhere in the world.

DiMi

features a robust, customized interface that gives its users secure command and control functionality of multiple remote, connected sensors, alarms and diagnostic devices. Moreover, the intuitive

DiMi

framework readily adapts to and integrates both new and legacy monitoring/sensing equipment – irrespective of make, model or manufacturer – providing for simplified, economical M2M deployments.

DiMi

is delivered as a monthly, hosted service that puts critical information into the palm of its user’s hands with no major hardware investments. Our hosting platform can be tailored for each customer to create secure and reliable end-to-end connectivity between their specific remote connected equipment and

DiMi

’s proprietary web interface

Marketing Plan

Strategically, the Company is focused on the M2M market segments in which we can provide highly differentiated and value-driven solutions capable of unleashing tangible productivity gains, material cost reductions and quantifiable risk mitigation across an enterprise.

We have also taken – and will continue to take – the necessary steps to secure the proprietary aspects of our applications through patent filings in the U.S. and in key international markets. Moreover, we intend to remain focused on proactively developing best-of-breed Internet-enabled M2M solutions that will effectively meet the evolving needs of our primary target market, namely web-based remote asset tracking, management and control with applications in the commercial, industrial, educational, government and military sectors.

At that time, DTI intends to concentrate its

DiMi

commercialization efforts on marketing the solution to property management companies, commercial property developers, government/military installations, industrial facilities, retail and restaurant chains, colleges and universities, fleet managers, and any business or institutional concern with valuable fixed and mobile assets requiring remote surveillance, regular maintenance or general oversight.

In order to achieve accelerated market penetration and sustainable, recurring revenue from a global customer base, The Company expects to ultimately adopt a hybrid sales and marketing model involving direct sales (Solutions Team); channel sales (via leading Value-Added Resellers (VARs) and distributors dedicated to niche market applications that

DiMi

is capable of addressing in target domestic and international markets); and strategic marketing and integration collaborations with industry leading system integrators, Original Equipment Manufacturers (OEMs) and large cellular carriers and dealers.

Competition

We believe we have a competitive advantage and are uniquely positioned as an M2M solution-centric business since our M2M communications platform is hardware-agnostic, and our hosting environment is in the cloud – this gives us the ability to help businesses lower their IT infrastructure costs and management requirements while improving performance, scalability and flexibility.

Our consultative approach to enabling hosted M2M technologies for our clients – as well as the attention we give to their specific needs, requirements and circumstances – are critical competitive differentiators that we are dedicated to preserving and nurturing as we grow. Moreover, prudent and timely integration of new and emerging digital and web technologies into our M2M communications platform will remain an underpinning mission for DTI if we are to earn and maintain distinction as a recognized industry leader.

Employees

As of November 30, 2012, other than its officers and directors, the Company employed no full time and no part time employees.

Subsidiaries

In accordance with the Exchange Agreement dated October 28, 2011, DTI became a subsidiary of the Company.

LIQUIDITY AND CAPITAL RESOURCES

As of November 30, 2012, we had cash of $571,490 and a net working capital of $566,120.

The accompanying financial statements have been prepared contemplating a continuation of the Company as a going concern. The Company has reported a net loss of $97,921 for the three months ended November 30, 2012 and had an accumulated deficit of $713,689.

We have not generated positive cash flows from operating activities. The primary source of capital has been from the sale of equity securities. Our primary use of capital has been for professional fees, and general and administrative costs. Our working capital requirements are expected to increase in line with the growth of our business.

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not applicable

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Each of our principal executive and principal financial officer has evaluated the effectiveness of our disclosure controls and procedures, as defined in Rules 13a - 15(e) and 15d - 15(e) under the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), as of the end of the period covered by this quarterly report. Based on their evaluation, each such person concluded that our disclosure controls and procedures were effective as of November 30, 2012.

Changes in Internal Control over Financial Reporting

.

Our management has evaluated whether any change in our internal control over financial reporting occurred during the last fiscal quarter. Based on that evaluation, management concluded that there has been no change in our internal control over financial reporting during the relevant period that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

None

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None

ITEM 4. MINE SAFETY DISCLOSURES

N/A

ITEM 5. OTHER INFORMATION

None

ITEM 6. EXHIBITS AND 8K

(a) Documents furnished as exhibits hereto:

Exhibit No

.

Description

|

31.1

|

Certification of the Chief Executive Officer and Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

32.1

|

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

1101.INS

|

XBRL Instance Document

|

|

101.SCH

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

XBRL Taxonomy Calculation Linkbase Document

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

XBRL Taxonomy Label Linkbase Document

|

|

101.PRE

|

XBRL Taxonomy Presentation Linkbase Document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

DIMI TELEMATICS INTERNATIONAL, INC.

|

|

|

|

|

|

|

|

January 14, 2013

|

By:

|

/s/

Barry Tenzer

|

|

|

|

|

Barry Tenzer

|

|

|

|

|

President, CEO and CFO

|

|

|

|

|

(Principal Executive Officer and Principal Financial Officer)

|

|

Bespoke Extracts (QB) (USOTC:BSPK)

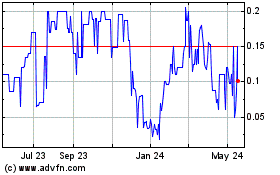

Historical Stock Chart

From Oct 2024 to Nov 2024

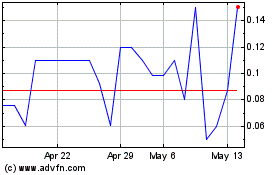

Bespoke Extracts (QB) (USOTC:BSPK)

Historical Stock Chart

From Nov 2023 to Nov 2024