UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31,

2013

Commission File Number: 000-52759

DIMI TELEMATICS INTERNATIONAL,

INC.

(Exact name of registrant as specified

in its charter)

| Nevada |

20-4743354 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| |

|

|

|

| 290 Lenox Avenue, New York, NY 10027 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s Telephone Number,

including area code: (855) 633-3738

Securities registered pursuant to Section 12(b) of the

Exchange Act:None

Securities registered pursuant to

Section 12(g) of the Exchange Act:Common Stock, par value $.001 par value

Indicate by check mark if the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure

of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

| |

|

| Large Accelerated Filer [ ] |

Accelerated Filer [ ] Accelerated Filer [ ] Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] |

Smaller Reporting Company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting

stock held by non-affiliates of the issuer on February 28, 2013, based upon the $0.0122 per share closing price of such stock on

that date, was $221,054.

There were 352,716,928 shares of common

stock outstanding as of November 25, 2013.

Documents incorporated by reference: None

TABLE OF CONTENTS

EXPLANATORY

NOTE

We

are filing this Amendment No. 1 on Form 10-K/A to our Annual Report on Form 10-K for the fiscal year ended August 31, 2013, as

originally filed with the Securities and Exchange Commission (the “SEC”) on November 27, 2013 (the “Original

Filing”). We are filing this Amendment in response to a comment letter received from the SEC (the "Comment Letter")

in connection with its review of the Original Filing. In response to the SEC Comment Letter, changes and revisions

have been made to the following items: Item 1. Business; Item 1A. Risk Factors; Item 7. Management’s Discussion and Analysis

of Financial Condition and Results of Operations; and Item 15. Exhibits and Financial Statement Schedules. These revised items

are filed herewith in this amended report in their entirety.

As

a result of this Amendment No. 1, we are also filing as exhibits the certifications required under Section 302 and Section 906

of the Sarbanes-Oxley Act of 2002.

This

Amendment No. 1 does not change any of the other information contained in the Original Filing. Other than as specifically set

forth herein, this Amendment No. 1 continues to speak as of the date of the Original Filing and we have not updated or amended

the disclosures contained therein to reflect events that have occurred since the date of the Original Filing. Accordingly, this

Amendment No. 1 should be read in conjunction with our filings made with the SEC subsequent to the date of the Original Filing.

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange

Act of 1934. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking

statements by terminology including “anticipates,” “believes,” “expects,” “can,”

“continue,” “could,” “estimates,”“intends,” “may,” “plans,”

“potential,” “predict,” “should” or “will” or the negative of these terms or other

comparable terminology. These statements are only predictions; uncertainties and other factors may cause our actual results, levels

of activity, performance or achievements to be materially different from any future results, levels or activity, performance or

achievements expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Our expectations are as of the date this Form 10-K is filed, and we do not intend to update any of the forward-looking statements

after the date this Annual Report on Form 10-K is filed to confirm these statements to actual results, unless required by law.

PART I

ITEM 1. BUSINESS.

Background

On October 28, 2011, DiMi Telematics

International, Inc. (“DTII”) entered into a Share Exchange Agreement (the “Share Exchange”) with DiMi Telematics,

Inc. (“DTI”) and its stockholders. Pursuant to the agreement, DTII issued 87,450,000 shares of its common stockin exchange

for all outstanding shares and warrants to purchase common shares of DTI. As a result of the Share Exchange Agreement, DTI became

a subsidiary of DTII. DTII assumed operation of DTI and entered the Telematics/M2M industry. On November 10, 2011, the

closing of the Share Exchange occurred. In connection with the Share Exchange, 15,000,000 of DTII’s issued

and outstanding shares of common stock were surrendered for cancellation.

The following discussion includes information

about the business operations, management and financial condition of DTII and DTI. Unless specifically set forth to the contrary,

when used in this report the terms “we,”“us,”“our,” the “Company” and similar

terms refer to DTII, a Nevada corporation, and its wholly owned subsidiary DTI, also a Nevada corporation.

General

The Company designs, develops and distributes

Machine-to-Machine (“M2M”) communications solutions used to remotely track, monitor, manage and protect multiple mobile

and fixed assets in real-time from virtually any web-enabled desktop computer or mobile device. Through our proprietary software

and hosted service offerings, the Company is endeavoring to capitalize on the pervasiveness and data transport capabilities of

wireless networks in order to facilitate communications and process efficiencies between commercial and industrial business owners/managers

and their respective networked control systems, sensors and devices.

Strategically, the Company is focused

on the M2M market segments in which we can provide highly differentiated and value-driven solutions capable of unleashing tangible

productivity gains, material cost reductions and quantifiable risk mitigation across an enterprise.

Our mission is to earn global distinction

as the leading supplier of world class M2M communications solutions that empower our customers to optimize efficiencies and productivity

through remote tracking, monitoring, management and protection of their most valuable assets.

The DiMi Solution Platform

Our flagship M2M solution is “DiMi,”

a proprietary, patent-pending, business intelligence and two-way communications platform that captures and seamlessly integrates

real-time data from networked tracking, monitoring, alarm and alert systems, sensors and devices; and, in turn, centralizes this

data onto an online command and control dashboard that is accessible 24/7 by a designated user or community of designated users

through the secure DiMi Internet portal, found at www.dimispeaks.com.

To date, we have not yet commenced

commercial marketing of DiMi and have not yet generated revenues from operations. DiMi is currently being beta tested

in anticipation of the initial commercial roll-out of version 4.0, which is anticipated will take place in the first

quarter of 2015 . We have also instructed our outsource software developer to begin work on smartphone apps to work in conjunction

with version 4.0. For more information on our agreements with our outsource software developer for the development of version

4.0 and corresponding smartphone apps to work in conjunction with version 4.0, see “MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.”

With adoption of the DiMi M2M

communications platform, users can remotely control, monitor, manage and acquire data from their operational assets, providing

the interface for lighting, temperature, humidity, keycard access, fleet management and many other vital systems that impact the

enterprise. DiMi uses established secure technology standards (i.e. LONet, MODbus, BACnet and ELK) combined with a unique,

proprietary software interface that keeps users connected to their asset management and control systems through any web-enabled

computer or mobile device.

By providing dynamic, real-time access

to critical information from a wide array of new or legacy sensors, GPS tracking tools and/or diagnostic devices – irrespective

of their make, model or manufacturer, DiMi alerts or reports back to its users via familiar communication tools, like instant

messaging, email, HTML and text messaging. Users can even issue global commands to its asset management and control systems through

the DiMi software interface. Moreover, DiMi leverages the collected knowledge of a particular asset or assets

and compares it to historical performance metrics and other critical benchmarks through an integrated data management module, giving

users insight that allows them to rapidly identify and implement proper preventive maintenance measures, efficiency improvements

and other key operational activities.

Our proprietary M2M solutions utilize

a cloud-based, two-way communications delivery platform, marketed as “DiMi.” Leveraging the power, scalability

and flexible turnkey advantages of DiMi’s patent-pendingsoftware and hosting platform, users are able to remotely

track, monitor, manage and protect multiple mobile and fixed assets in real-time from virtually any web-enabled desktop computer

or mobile device while located anywhere in the world. DiMi features a robust, customized interface that gives its

users secure command and control functionality of multiple remote, connected sensors, alarms and diagnostic devices. Moreover,

the intuitive DiMi framework readily adapts to and integrates both new and legacy monitoring/sensing equipment – irrespective

of make, model or manufacturer – providing for simplified, economical M2M deployments.

Our DiMi solution is currently

being used to actively monitor property management systems in several high-rise commercial and residential buildings in New York

City – all beta sites which have served to demonstrate the efficacy of the DiMi technology and M2M communications

platform. Moving forward, the Company intends to concentrate its DiMi commercialization efforts on marketing the solution

to property management companies, commercial property developers, government/military installations, industrial facilities, retail

and restaurant chains, colleges and universities, fleet managers, and any business or institutional concern with valuable fixed

and mobile assets requiring remote surveillance, regular maintenance or general oversight.

We expect to deliver DiMi as

a monthly, hosted service that puts critical information into the palm of its user’s hands with no major hardware investments.

Our hosting platform can be tailored for each customer to create secure and reliable end-to-end connectivity between their specific

remote connected equipment and DiMi’s proprietary web interface. Once a new client’s core M2M business needs

have been confirmed, the Company will closely collaborate with the client to design the organizational and process modifications

required to ensure a successful DiMi launch, offering full service project definition, management, user interface customization,

implementation services and ongoing quality assurance and testing.

Uses and Benefits of the DiMi

Solution

Due to the knowledge and experience

of our executive management in real estate operations and management, we have initially targeted the real estate management industry

for initial commercialization of the DiMi Platform solution. Among the uses and benefits of DiMi in the real estate

industry are the following:

“Smart” Facility Management

Today’s buildings – whether

residential, commercial, medical or otherwise – are sustained through operation of various utility systems. Through these

systems, electricity, heat, HVAC, water, lighting, security and other necessities, are provided to the buildings.

Some conventional systems are controlled

by human operators and, thus, require maintenance staff on-site or on-call to control, maintain and otherwise operate them. Others

may be controlled electronically or through a combination of electronic and human control. These systems force building owners

to extend additional resources and incur burdensome costs in order to maintain proper operation of the systems, as well as account

for human errors that may result from improper system operation or management. Moreover, many conventional systems are not capable

of remotely controlling multiple buildings having multiple building functionalities using a single monitor and control device

and be adaptable to various control interfaces that are used by the buildings and facility managers.

OurDiMi solution works as a centralizing

component of a facility or multiple facilities’ management system, acquiring and interpreting data from literally thousands

of networked devices monitoring systems operating in multiple locations.

Whether a facility manager is looking

to save oil and gas, monitor carbon emissions, avert a flood or monitor and control temperatures, lighting or remote keycard access,

DiMi provides a fully integrated, affordable solution. Moreover, DiMi allows our clients to evaluate their building

management practices for strengths, weaknesses and opportunities to be greener, more productive and more efficient. DiMi’s

virtual grid can track and sort building data to enable cost savings, reduce the carbon footprint and set new global standards

of performance for the facility management industry.

Energy Savings

For boilers to run at peak efficiency,

operators must attend to boiler staging, water chemistry, pumping and boiler controls, boiler fuel-air mixtures, burn-to-load ratios

and stack temperatures. DiMi can consolidate all the above efficiency-enhancing metrics and provide monitoring of water

chemistry and temperature to improve equipment efficiency and reduce energy expenditures. DiMi provides these features on

a cost effective platform which empowers users to realize significant cost savings.

DiMi can help maintain consistent

temperature throughout buildings and provide the ability for managers to monitor and control irregularities. Users benefit from

being able to prevent system wear and tear from operating under stress; increase the life of the systems through proper timing

of maintenance; determine peak efficiencies and set pre-defined conditions and alerts. DiMi’s service can also measure

water consumption by unit to ascertain actual usage by tenant and carbon emissions to track actual changes.

Enhanced Security

DiMi can provide remote monitoring,

control and access to restricted areas. Our technology provides an audit trail that enables users to see who accessed a room and

when. The ability to track entries to individual rooms via the audit trail eliminates the cost of replacing locks and lost keys.

DiMi readily interfaces with most alarm panels on the market as well as most existing keycard access systems.

Disaster Management

Water leaks and flooding can be costly

problems for property managers and owners. DiMi can help by providing the ability to monitor strategically placed water

sensors in bathrooms, elevator shafts, rooftop drains or any other problem area. Users will be alerted if there are any irregularities

within a defined scope to avert catastrophes. Hurricane shields can be activated from a remote location to avoid disaster and minimize

costs in protecting an asset.

Routine Maintenance

All forms of routine maintenance that

can be automated can be controlled directly using the DiMi M2M communications solution. From pre-defined schedules, on a

demand basis when equipped with the proper sensors, or from a user’s IM account anywhere the Internet is accessible, maintenance

can be performed at will. As an example, automated service calls can be enabled when the boiler is operating outside of predetermined

optimal ranges. Or, storage tank levels can be preset to enable DiMi to trigger automatic scheduling of oil deliveries.

Building Value

We believe that a building that incorporates

DiMi will have a documented pedigree of asset performance. Energy management and efficiency gains, along with maintenance

and repair history, are mapped through our Master Data Management module. DiMi’s information management capabilities

increase property return on investment and overall property value.

The Marketplace

Although widely heralded as a “transformative”

technology, M2M is not new. The concept was first used during World War II for identifying “friend” or “foe”

to prevent pilots from hitting the wrong targets. Satellites use M2M to fire engines based on guidance and navigation sensors.

Garage door openers respond to the clicker in a car. The difference now is that you can network the sensors in devices and objects,

and use the data for extended purposes, such as recognizing that the garage door was left open and notifying the homeowner or security

company to close it by way of remote command.

M2M – also commonly called “ubiquitous”

or “pervasive” computing – refers to digital microprocessors and sensors embedded in everyday objects and connected

to networks. M2M most often refers to “machine-to-machine,” although mobile-to-machine or man-to-machine is also used

to describe this fast evolving family of technologies. Because M2M communications can exist in practically any machine, environment

and market, it holds the potential to reshuffle entire industry structures, creating an anticipated windfall for technology enablers

in the M2M arena and enabling an array of solutions that deliver new levels of “smart services” and commerce.

According to FocalPoint Consulting Group,

the global M2M market is expected to reach $50 billion in 2011 and will grow five-fold to $250 billion by 2012. Moreover,

GSMA, an industry association representing the interests of over 800 mobile operators worldwide, is forecasting that a connected

universe of up to 50 billion M2M devices will develop over the next 15 years.

Juniper Research reported in May 2011

that M2M connections will be the catalyst for over $35 billion of new service revenues across a diverse range of industry

sectors by the end of 2016. Specific sectors noted as having particularly strong potential include consumer and commercial telematics,

smart metering, point of sale, retail, banking, mobile health monitoring, smart buildings and security.

According to an article published on

GoingM2M.com on July 22, 2011, titled “Verizon and AT&T Realize Greater Future in M2M,” the mobile carriers

managed to add 3.4 million new subscribers in the second quarter of 2011. Of Verizon’s new adds, 40% came from wholesale

and other devices with the majority coming from M2M connections. AT&T reported a similar ratio, noting that 30% of its newly

connected devices came from new M2M connections.

Secondary Target Markets

Distilling customer needs to discrete

services allows us to target and expand high value opportunities and generate critical need niches in vertical market sectors.

Combining these niches into a consolidated service, offering a single point customer interface, is expected to give the Company

key competitive differentiation in the marketplace.

Restaurant and Retail Chains

– DiMi can provide owners and managers of restaurants and retail businesses the ability to monitor and control multiple

locations remotely from any web-enabled computer or mobile device. We can provide the interface that gives users real-time insight

and control of critical systems within their establishments that enable them to reduce costs, manage more efficiently and increase

their return on investment. As long as there is Internet access, users can monitor and manage all of their properties – whether

at home, walking down the street or traveling out of the country.

Specific to restaurants, DiMi provides

the ability to monitor the humidity and temperature of walk-in environments, such as freezers, wine cellars and refrigeration units,

helping to ensure that meats age properly, cellaring of wines is maintained and cheese or other perishables are well stored. When

a power failure or surge occurs, immediate alerts are sent to a manager or owner’s handheld device, enabling quicker response

times and reducing the loss of inventory from food spoilage or wine cellar temperature fluctuation.

Weather extremes may also trigger instability

in a restaurant environment. DiMi helps by providing the ability to remotely monitor temperatures through one or many restaurants

and signal any deviation from normal.

Schools, Colleges and Universities

– With DiMi, educational facilities can experience the peace of mind that comes with being able to monitor points

of entry as well as restricted areas on-site or remotely from any web-enabled computer or mobile device.

Our solution helps to protect sensitive

documents, dormitories and classrooms housing expensive assets, such as computer centers, biotech labs, movie production and digital

publishing facilities. Moreover, through use of DiMi’s auditing capabilities, school building managers can mitigate

losses due to theft and receive immediate, real-time feedback in emergency situations, including security breaches, fire, smoke,

gas leaks, and CO and CO2 alerts, among other potential crises.

Healthcare Facilities –

In addition to benefiting from the same remote monitor and control capabilities afforded all sectors involving the management of

building systems, healthcare facilities can leverage DiMi M2M communications solutions in highly innovative ways to enhance

resident patient care.

For instance, DiMi can provide

care facilities with an ability to prevent scalding due to inconsistencies in tap water temperature. The risk is increased where

the resident population may be elderly and prone to sensory loss and because nerve reaction times are reduced; thus the intuitive

reaction to pull away from the scalding hot water is not sufficient to avoid potentially severe skin burns.

Another potential application is home

monitoring of patients suffering from chronic diseases and conditions, such as congestive heart failure, hypertension, diabetes,

asthma and obesity. Hospitals, clinics and physician practices can utilize DiMi to establish an additional communication

channel with their patients, removing geographic barriers and enhancing the quality of care.

Connecting with Telehealth devices used

in the home and accessed via any web-enabled computer or wireless device, DiMi’s powerful interfacecan give medical

staff the ability to monitor and quickly assess – in real-time – an at-home patient’s oxygen levels, pulse, blood

pressure and other vital statistics, potentially reducing hospitalization rates, improving treatment plans and decreasing emergency

room visits. Moreover, DiMi’s data management module captures important patient data for medical records, which can help

reduce costs related to paperwork and prevent costly mistakes that could lead to malpractice claims.

Industrial Complexes –

DiMi’s cloud-based M2M communications platform supports a vast array of possibilities to employ innovative tracking,

sensing, monitoring, alerting and reporting equipment to remotely monitor and manipulate industrial control systems. Integrating

with existing or new backend systems, DiMi can serve as the command and control interface for a vast number of industrial

M2M applications in sectors that range from oil and gas, water treatment and waste management to manufacturing, green power generation

and utilities.

One possible DiMi application

is managing an industrial complex’s consumption of energy by reducing or shifting electricity use to improve electric grid

reliability, manage electricity costs, and encourage load shifting or load shedding during times when the electric grid is near

capacity. Another would be real-time remote monitoring and control of automated irrigation systems for a commercial farming enterprise

or monitoring and detecting tank leaks at oil refineries.

Because DiMi is hardware-agnostic

and readily customized to address the demands of any industrial sector, we believe that the DiMi interface can be leveraged

and applied to protect a vast array of fixed and mobile assets deemed valuable and mission-critical.

Logistics/Fleet Management -

Powered by DiMi, DiMi Telematicsprovides the commercial transport industry with a cost effective method of monitoring in

real-time all aspects of fleet operations, including driver and vehicle performance, geo-tracking, safety, compliance and efficiency.

The resulting benefits range from the successful streamlining of routes and schedules to save money in fuel consumption and personnel

costs, to mitigating risk and lowering insurance costs.

Certain U.S. legislation (e.g., Food

Safety Act 1990, Quick Frozen Foodstuffs Regs 1995 and the Temperature Control Regs 1995) mandates that mobile transporters

of chilled food products closely monitor the temperature of goods in transit to protect them from spoilage. Working in concert

with automated, wireless temperature monitoring devices, DiMi is able to transmit alerts directly to fleet managers and/or

refrigerated truck drivers when load temperatures approach predefined levels requiring immediate attention.

Competition

Given the positive outlook for the M2M

industry and our targeted market segments, we must contend with the reality that we are selling our solutions in intensely competitive

markets. Some of our competitors have significantly greater financial, technical, sales and marketing resources than we do. As

the markets for our software products and hosting services continue to develop, additional companies, including those with significant

market presence in the wireless industry, could enter the markets in which we compete and further intensify competition. In addition,

we believe price competition may become a more significant competitive factor in the future.

Several businesses that share the M2M

space can be viewed as competitors, such as M2M application service providers, Mobile Virtual Network Operators, system integrators

and wireless operators/carriers that offer a variety of the components and services required for the delivery of complete M2M solutions.

We believe we have a competitive advantage

and are uniquely positioned as an M2M solution-centric business since our M2M communications platform is hardware-agnostic, and

our hosting environment is in the cloud – this gives us the ability to help businesses lower their IT infrastructure costs

and management requirements while improving performance, scalability and flexibility.

We have also taken – and will

continue to take – the necessary steps to secure the proprietary aspects of our applications through patent filings in the

U.S. and in key international markets. Moreover, we intend to remain focused on proactively developing best-of-breed Internet-enabled

M2M solutions that are designed to effectively meet the evolving needs of our primary target market, namely web-based remote asset

tracking, management and control with applications in the commercial, industrial, educational, government and military sectors.

The markets for our M2M communications

solutions will remain characterized by rapid technological change and evolving industry standards. Nonetheless, the principal competitive

factors in these markets will continue to be product performance, ease of use, reliability, price, breadth of solution offerings,

sales and distribution capability, technical support and service, customer relations, and general industry and economic conditions.

We believe that our consultative approach

to enabling hosted M2M technologies for our clients – as well as the attention we give to their specific needs, requirements

and circumstances – are critical competitive differentiators that we are dedicated to preserving and nurturing as we grow.

Moreover, prudent and timely integration of new and emerging digital and web technologies into our M2M communications platform

will remain an underpinning mission for us if we are to earn and maintain distinction as a recognized industry leader.

Among the public companies with which

we may compete are: Digi International, Inc. (Nasdaq:DGII); EnerNOC, Inc. (Nasdaq:ENOC);Evolving Systems, Inc. (Nasdaq:EVOL); Gemalto,

NV (OTCQB:GTOFF); Numerex Corp. (Nasdaq:NMRX); RF Monolithics, Inc. (Nasdaq: RFMI);Telular Corporation (Nasdaq:WRLS); and Trimble

Navigation Ltd. (Nasdaq:TRMB). Many of these competitors have greater name recognition as well as financial and other resources

than we have. We may never become a competitive influence in the marketplace.

Plan of Operations

DiMi Telematics, Inc. is headquartered

in New York City and incorporated under the laws of Nevada. Aside from the oversight and administration of our corporate, financial

and legal affairs by the executive management team, once commercial roll-out of DiMi takes place, our company’s operating

activities will be centralized in three core areas:

·

Sales and Marketing, which will employ both direct and indirect

sales models utilizing an in-house business development team, partners and resellers and self-service through a service on-demand

web interface.

Our initial sales and marketing team

will be comprised of our current management staff, and supplemented by the hiring of dedicated sales professionals as the Company

matures. However, we intend to immediately begin building out its global distribution network through reseller and strategic marketing

agreements with qualified third party sources. To support and nurture strong relationships with our future sales and marketing

partners, we expect to provide co-marketing, trade show support, product training and DiMi demo units, while also actively

engaging in industry awareness and lead generation programs.

Once a new client’s core M2M business

needs have been confirmed, our Solutions Team will closely collaborate with the client to design the organizational and process

modifications required to ensure a successful DiMi launch, offering full service project definition, management, user interface

customization, implementation services and ongoing quality assurance and testing.

In order to achieve accelerated market

penetration and sustainable, recurring revenue from a global customer base, the Company expects to ultimately adopt a hybrid sales

and marketing model involving the following: direct sales (Solutions Team); channel sales (via leading Value-Added Resellers (“VARs”)

and distributors dedicated to niche market applications that DiMi is capable of addressing in target domestic and international

markets); and strategic marketing and integration collaborations with industry leading system integrators, Original Equipment Manufacturers

(“OEMs”) and large cellular carriers and dealers.

· Operations,

which will be responsible for managing daily activities related to monitoring and administering our cloud-based server operations;

24/7 client service/help desk; professional services and installation support; and quality assurance and testing of our DiMi

software and hosting platform, as well as the implementation and ongoing administration of our hosted clients’ M2M communications

platforms.

Our DiMi solution is currently

being used to actively monitor property management systems in numerous high-rise commercial and residential buildings in New York

City – all beta sites owned and managed by the FATA Organization. These sites have served to successfully prove out the DiMi

software technology and hosting platform and will provide the Company’s sales and marketing team with the capability to provide

live demonstrations of the DiMi platform.

After our Solutions Team works in close

collaboration with our customers throughout their respective DiMi implementation projects, our Account Service Representatives

will assume responsibility for ongoing technical and administrative support following DiMi’s deployment. In addition,

our customers will have access to a dedicated team of customer service and technical specialists who can be reached after hours

and on weekends through a telephone helpdesk and an online technical support center.

· Product

Development, which will be charged with enhancing our existing M2M software applications and services and introducing new and

complementary hosted products and applications on a timely basis. We anticipate that the creative formulation of enhancements and

new product conceptualization will be performed in-house by our officers and directors. Thereafter, we intend to outsource software

enhancement and product development to outside third parties.

Currently, the Company, in collaboration

with its outsource software development team, is engaged in developing the next generation of its M2M communications platform:

DiMi 4.0.is being designed to provide for a number of technological enhancements and new user benefits being built into

the system, including Voice Over Internet Protocol. Based on current development timelines, DiMi 4.0 should be finalized

and ready for commercial launch on or before the end of the first quarter of 2014.

At that time, the Company intends to

concentrate its DiMi commercialization efforts on marketing the solution to property management companies, commercial property

developers, government/military installations, industrial facilities, retail and restaurant chains, colleges and universities,

fleet managers, and any business or institutional concern with valuable fixed and mobile assets requiring remote surveillance,

regular maintenance or general oversight.

Intellectual Property

Our M2M communications solutions rely

on and benefit from our portfolio of intellectual property, including pending patents, trademarks, trade secrets and domain names.

Patent Applications:

1.

U.S. Patent Application No. 12/798,923

· Filed

April 13, 2010

· Title:

Monitoring and Control Systems and Methods

·

Jurisdiction: U.S. Patent and Trademark Office

2.

International Application Serial No. PCT/US2010/030882

· Title:

Monitoring and Control Systems and Methods

3.

Taiwan Patent Application Serial No. 99111633

· Title:

Monitoring and Control Systems and Methods

U.S. Trademark Applications

1. Greenfreak Serial No.: 77724645

2. Domain Names

| |

|

|

http://www.dimispeaks.com

http://www.greenfreak.com

http://www.controlfreak.org

http://www.theicontrol.us

http://www.icontrol.mobi

http://www.icontrolmultiple.com

http://www.icontrolnow.com

http://www.icontrolonline.com

http://www.greened.biz

http://www.greenfreak.biz

http://www.green-freak.com

http://www.green-freak.info

http://www.green-freak.me

http://www.green-freak.mobi

http://www.green-freak.org

http://www.greened.ws

http://www.greenfreak.info

http://www.greenfreak.me

http://www.greenfreak.mobi

http://www.greenfreak.ws

http://www.greened.net

http://www.askdimi.net

http://www.askdimi.org

http://www.askdimi.info

http://www.askdimi.biz |

http://www.askdimi.us

http://www.cntrlfreaks.biz

http://www.cntrlfreaks.us

http://www.cntrlfreaks.com

http://www.cntrlfreaks.info

http://www.cntrlfreaks.net

http://www.cntrlfreaks.org

http://www.greenfreak.us

http://www.greenfreak.com

http://www.Precisionloc8.com

http://www.Precisionloc8.net

http://www.Precisionlok8.com

http://www.Precisionlok8.net

http://www.Precisionlocate.com

http://www.Precisionlocate.net

http://www.DiMiTelematics.com

http://www.DiMiTelematics.net

http://www.DiMiTM.com

http://www.DiMiTM.net

http://www.DiMi-tm.com

http://www.DiMi-tm.net

http://www.DiMi-m2m.com

http://www. DiMi -m2m.net

http://www. DiMi m2m.com

http://www. DiMi m2m.net |

History

History of DTI

DTI was formed as a Nevada corporation

on January 28, 2011 under the name Medepet, Inc. On or about May 23, 2011, DTI increased the number of shares it was

authorized to issue from 100,000,000 shares, par value $.0001 per share, to 200,000,000 shares of common stock, par value $.0001

per share. On June 30, 2011, Medepet, Inc. changed its name to Precision Loc8, Inc.; on July 28, 2011, Precision Loc8,

Inc. changed its name Precision Telematics, Inc.; and on August 10, 2011, Precision Telematics changed its name to DiMi Telematics,

Inc.

On or about July 31, 2011, DTI

entered into an Asset Purchase Agreement with Roberto Fata pursuant to which Mr. Fata sold, and DTI purchased, the technology

encompassing DiMi, including certain specified assets used in the remote monitoring and control of building management systems

through unique software interface. See “Certain Relationships and Related Transactions.”

History of DTII

DTII was originally formed as Cine-Source

Entertainment, Inc. (“Old Corporation”), a Colorado corporation, on July 29, 1988. Pursuant to a Plan of Merger

dated February 24, 2004, the Old Corporation filed Articles and Certificate of Merger with the Secretary of State of the State

of Colorado merging the Old Corporation into Cine-Source Entertainment, Inc. (the “Surviving Corporation”), a Colorado

corporation. On April 26, 2004, the Surviving Corporation effected a 1-for-200 reverse stock split. Thereafter, on April 27,

2004, the name of the Surviving Corporation was changed to First Quantum Ventures, Inc. On April 13, 2006, the Surviving Corporation

formed a wholly owned subsidiary, a Nevada corporation, under the name First Quantum Ventures, Inc., and on May 5, 2006 merged

the Surviving Corporation into First Quantum Ventures, Inc. On November 10, 2011, DTII acquired DTI in a “reverse merger”

as discussed elsewhere in this Annual Report on Form 10-K.

Fiscal Year End

Following the closing of the Share Exchange

Agreement pursuant to which DTII acquired DTI, DTII changed its fiscal year end to August 31, so as to correspond to the fiscal

year end of DTI.

Employees

As of November 25, 2013, other than

our officers and directors, we had no full time or part time employees.

Properties

We currently lease approximately 500

square feet of general office space at 290 Lenox Avenue, New York, NY 10027 from our Vice President – Operations.

ITEM 1A. RISK FACTORS.

An investment in our common stock involves significant

risks. You should carefully consider the following risks and all other information set forth in this Annual Report before deciding

to invest in our common stock. If any of the events or developments described below occurs, our business, financial condition and

results of operations may suffer. In that case, the value of our common stock may decline and you could lose all or part of your

investment.

You should consider each of the following

risk factors and any other information set forth in this Form 10-K and the other reports filed by the Company with the Securities

and Exchange Commission (the “SEC”), including the Company’s financial statements and related notes, in evaluating

the Company’s business and prospects. The risks and uncertainties described below are not the only ones that impact on the

Company’s operations and business. Additional risks and uncertainties not presently known to the Company, or that the Company

currently considers immaterial, may also impair its business or operations. If any of the following risks actually occurs, the

Company’s business and financial condition, results or prospects could be harmed.

Risks Associated with the Company’s

Prospective Business and Operations

The Company lacks meaningful operating

history and will require substantial capital if it is to be successful. We will require additional funds for our operations.

At August 31, 2013, we had working capital

of approximately $416,470. We will require significant cash during fiscal 2014, in order to grow our business, including to implement

any acquisitions. No assurances can be given that the Company will be able to obtain the necessary funding during this time to

make any acquisitions or for any other purpose. The inability to raise additional funds will have a material adverse affect on

the Company’s business, plan of operation and prospects. Acquisitions may be made with cash or our securities or a combination

of cash and securities. To the extent that we require cash, we may have to borrow the funds or sell equity securities. The issuance

of equity, if available, would result in dilution to our stockholders. We have no commitments from any financing source and we

may not be able to raise any cash necessary to complete an acquisition. If we fail to make any acquisitions, our future growth

may be limited. If we make any acquisitions, they may disrupt or have a negative impact on our business.

The terms on which we may raise additional

capital may result in significant dilution and may impair our stock price. Because of our cash position, our stock price and our

immediate cash requirements, it is difficult for us to raise capital for any acquisition. We cannot assure you that we will be

able to get financing on any terms, and, if we are able to raise funds, it may be necessary for us to sell our securities at a

price that is at a significant discount from the market price and on other terms which may be disadvantageous to us. In connection

with any such financing, we may be required to provide registration rights to the investors and pay damages to the investor in

the event that the registration statement is not filed or declared effective by specified dates. The price and terms of any financing

which would be available to us could result in both the issuance of a significant number of shares and significant downward pressure

on our stock price.

The Company’s officers and

directors may have conflicts of interest and do not devote their full time to the Company’s operations.

The Company’s officers and directors

may have conflicts of interest in that they are and may become affiliated with other companies. In addition, the Company’s

officers do not devote their full time to the Company’s operations. Until such time that the Company can afford executive

compensation commensurate with that being paid in the marketplace, its officers will not devote their full time and attention to

the operations of the Company. No assurances can be given as to when, if ever, the Company will be financially able to engage its

officers on a full time basis.

We have not voluntarily implemented

various corporate governance measures in the absence of which, stockholders may have more limited protections against interested

director transactions, conflicts of interest and similar matters.

Recent federal legislation, including

the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity

of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements.

Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or The

Nasdaq Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the

rules of national securities exchanges are those that address board of directors' independence, audit committee oversight, and

the adoption of a code of ethics. While our board of directors intends to adopt a Code of Ethics, we have not yet done so nor have

we adopted any of these corporate governance measures and, since our securities are not listed on a national securities exchange,

we are not required to do so. It is possible that if we were to adopt some or all of these corporate governance measures, stockholders

would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and

that policies had been implemented to define responsible conduct. For example, in the absence of audit, nominating and compensation

committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages

to our senior officers and recommendations for director nominees may be made by a majority of directors who have an interest in

the outcome of the matters being decided. Prospective investors should bear in mind our current lack of corporate governance measures

in formulating their investment decisions.

Provisions of our Articles of Incorporation

and Bylaws may delay or prevent take-over which may not be in the best interest of our stockholders.

Provisions of our articles of incorporation

and bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings of our stockholders may

be called, and may delay, defer or prevent a takeover attempt. In addition, certain provisions of the Nevada Revised Statutes also

may be deemed to have certain anti-takeover effects which include that control of shares acquired in excess of certain specified

thresholds will not possess any voting rights unless these voting rights are approved by a majority of a corporation's disinterested

stockholders. In addition, our articles of incorporation authorize the issuance of up to 50,000,000 shares of preferred stock with

such rights and preferences as may be determined from time to time by our board of directors, of which 1,000 shares of preferred

stock are issued and outstanding as of August 31, 2013. Our board of directors may, without stockholder approval, issue preferred

stock with dividends, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights

of the holders of our common stock. As a result, our board of directors can issue such stock to investors who support our management

and give effective control of our business to our management.

We may be exposed to potential risks

relating to our internal control over financial reporting.

As directed by Section 404 of the Sarbanes-Oxley

Act of 2002 (“SOX 404”), the SEC has adopted rules requiring public companies to include a report of management on

the Company's internal control over financial reporting in its annual reports.

While we expect to expend significant

resources in developing the necessary documentation and testing procedures required by SOX 404, there is a risk that we will not

comply with all of the requirements imposed thereby. At present, there is no precedent available with which to measure compliance

adequately. In the event we identify significant deficiencies or material weaknesses in our internal control over financial reporting

that we cannot remediate in a timely manner, investors and others may lose confidence in the reliability of our financial statements

and our ability to obtain equity or debt financing could suffer.

Our business relies heavily on

outsource software developers, which could harm our business by adversely affecting the availability, delivery, reliability, and

development cost of our platform.

We have limited staffing and are

relying on our outsource software developer to create our DiMi 4.0 platform. If the outsource software developer delays or curtails

progress on our platform, we may not be able to roll out the related platform in desired configurations, or in a timely manner.

In addition, we may not be able to replace the functionality provided by the third-party software that we currently offer if that

software becomes obsolete, defective, or incompatible with future versions of our software (especially if we use different outsource

software developers for different versions of our platform) or if the software is not adequately maintained or updated. Even though

other software developers are available, qualification of the alternative developer and establishment of reliable software code

could result in delays and a possible loss of sales as well as a significant increase in development costs, which could harm our

operating results. In addition, defective or delayed roll out of our platform could harm our reputation and brand recognition .

Risks Related to the Company’s

Common Stock

The Company does not expect to pay

dividends in the foreseeable future.

The Company has never paid cash dividends

on its common stock and has no plans to do so in the foreseeable future. The Company intends to retain earnings, if any, to develop

and expand its business.

“Penny stock” rules may

make buying or selling the common stock difficult and severely limit their market and liquidity.

Trading in the Company’s common

stock is subject to certain regulations adopted by the SEC commonly known as the “Penny Stock” rules. The Company’s

common stock qualifies as penny stock and is covered by Section 15(g) of the Securities and Exchange Act of 1934, as amended (the

“1934 Act”), which imposes additional sales practice requirements on broker/dealers who trade in the Company’s

common stock in the market. The “Penny Stock” rules govern how broker/dealers can deal with their clients and “penny

stock.” For sales of the Company’s common stock, the broker/dealer must make a special suitability determination and

receive from clients a written agreement prior to making a trade. The additional burdens imposed upon broker/dealers by the “penny

stock” rules may discourage broker/dealers from effecting transactions in the Company’s common stock, which could severely

limit its market price and liquidity. This could prevent investors from reselling the Company’s common stock and may cause

the price of the common stock to decline.

Although publicly traded, the Company’s

common stock has substantially less liquidity than the average trading market for a stock listed on a national securities exchange,

and its market price may fluctuate dramatically in the future.

Although the Company’s common

stock is eligible quotation on the OTC QB, the trading market in the common stock has substantially less liquidity than shares

of companies listed on national securities exchanges. A public trading market having the desired characteristics of depth, liquidity

and orderliness depends on the presence in the marketplace of willing buyers and sellers of our common stock at any given time.

This presence depends on the individual decisions of investors and general economic and market conditions over which we have no

control. Due to,among other reasons, limited trading volume, the market price of the Company’s common stock may fluctuate

significantly in the future, and these fluctuations may be unrelated to the Company’s performance. General market price declines

or overall market volatility in the future could adversely affect the price of the Company’s common stock, and the current

market price may not be indicative of future market prices.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

ITEM 2. PROPERTIES.

The Company’s current executive

offices are 290 Lenox Ave, New York City, New York, 10027, the property consist of 500 square feet of finished office space. We

currently have a three-year lease through August 31, 2014. We believe that the current office space is adequate to meet our current

needs.

ITEM 3. LEGAL PROCEEDINGS.

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable

PART II

ITEM 5. MARKET FOR REGISTRANT’S

COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASERS OF EQUITY SECURITIES.

Market Information

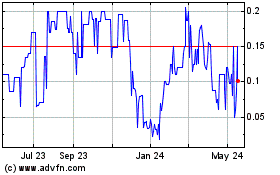

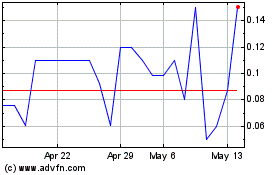

Our shares of common stock are eligible

for quotation on the OTC QB under the symbol “DIMI”. However, our shares do not trade other than on an extremely limited

and sporadic basis. The following table sets forth for the periods indicated the range of high and low bid quotations per share

as reported on the OTC QB since the first period for which figures are available. These quotations represent inter-dealer prices,

without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

| Year 2012 | |

High | |

Low |

| First Quarter | |

$ | 0.2775 | | |

$ | 0.0025 | |

| Second Quarter | |

$ | 0.6875 | | |

$ | 0.2775 | |

| Third Quarter | |

$ | 1.35 | | |

$ | 0.50 | |

| Fourth Quarter | |

$ | 1.92 | | |

$ | 0.032 | |

| | |

| | | |

| | |

| Year 2013 | |

High | |

Low |

| First Quarter | |

$ | 0.048 | | |

$ | 0.013 | |

| Second Quarter | |

$ | 0.0183 | | |

$ | 0.011 | |

| Third Quarter | |

$ | 0.0159 | | |

$ | 0.005 | |

| Fourth Quarter | |

$ | 0.02 | | |

$ | 0.005 | |

On November 21, 2013, the closing price of our common stock

as reported on the OTC QB was $0.0093 per share.

Holders. As of August 31, 2013,

there were approximately 332 holders of record of our common stock, which excludes those stockholders holding stock in street name.

Dividend Policy. We have not

declared or paid cash dividends or made distributions in the past, and we do not anticipate that we will pay cash dividends or

make distributions in the foreseeable future. We currently intend to retain and reinvest future earnings, if any, to finance our

operations.

Equity Compensation Plans. We

have not authorized any compensation plans (including individual compensation arrangements) under which our equity securities have

been authorized for issuance as of the end of the most recently completed fiscal year ended August 31, 2013. We have not authorized

any such plan for the fiscal year ended August 31, 2013.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable because our company is a smaller reporting

company.

ITEM 7. MANAGEMENT'S DISCUSSION

AND ANALYSISOF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial

condition and results of operations should be read in conjunction with the audited financial statements and notes thereto for the

fiscal year ended August 31, 2013, found in this Annual Report. In addition to historical information, the following discussion

contains forward-looking statements that involve risks, uncertainties and assumptions. Where possible, we have tried to identify

these forward looking statements by using words such as “anticipate,” “believe,” “intends,”

or similar expressions. Our actual results could differ materially from those anticipated by the forward-looking statements due

to important factors and risks including, but not limited to, those set forth under “Risk Factors” in Part I, Item

1A of this Annual Report.

Forward-looking Statements

We and our representatives may from

time to time make written or oral statements that are “forward-looking,” including statements contained in this annual

report and other filings with the SEC, reports to our stockholders and news releases. All statements that express expectations,

estimates, forecasts or projections are forward-looking statements. In addition, other written or oral statements which constitute

forward-looking statements may be made by us or on our behalf. Words such as “expect,”“anticipate,”“intend,”“plan,”“believe,”“seek,”“estimate,”“project,”“forecast,”“may,”“should,”

variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are

not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Therefore,

actual outcomes and results may differ materially from what is expressed or forecasted in or suggested by such forward-looking

statements. We undertake no obligation to update or revise any of the forward-looking statements after the date of this annual

report to conform forward-looking statements to actual results. Important factors on which such statements are based are assumptions

concerning uncertainties, including but not limited to, uncertainties associated with the following:

| |

• |

Inadequate capital and barriers to raising the additional capital or to obtaining the financing needed to implement our business plans; |

| |

• |

Our failure to earn revenues or profits; |

| |

• |

Inadequate capital to continue business; |

| |

• |

Volatility or decline of our stock price; |

| |

• |

Potential fluctuation in quarterly results; |

| |

• |

Rapid and significant changes in markets; |

| |

• |

Litigation with or legal claims and allegations by outside parties; and |

| |

• |

Insufficient revenues to cover operating costs. |

The following discussion should be

read in conjunction with the financial statements and the notes thereto which are included in this annual report. This

discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results

may differ substantially from those anticipated in any forward-looking statements included in this discussion as a result of various

factors.

Overview

Cine-Source Entertainment, Inc. (the

“Old Corporation”) a Colorado corporation, was formed on July 29, 1988. Pursuant to a Plan of Merger dated February

24, 2004, the Old Corporation filed Articles and Certificate of Merger with the Secretary of State of the State of Colorado merging

the Old Corporation into Cine-Source Entertainment, Inc. (the “Surviving Corporation”), a Colorado corporation.

A previous controlling stockholder group of the Old Corporation arranged the merger for business reasons that did not materialize.

On April 26, 2004, the Surviving Corporation effected a 1-for-200 reverse stock split. The name of the Surviving Corporation was

changed to First Quantum Ventures, Inc., on April 27, 2004. On April 13, 2006 the Surviving Corporation formed a wholly owned subsidiary,

a Nevada corporation named First Quantum Ventures, Inc., and on May 5, 2006 merged the Surviving Corporation with and into this

subsidiary, referred to herein as DTII.

As disclosed on a Current Report

on Form 8-K filed with the SEC on November 16, 2011, on October 28, 2011, we entered into a Share Exchange Agreement (the “Exchange

Agreement”) with Andrew Godfrey, our then Chief Executive Officer, DTI and the holders of all of the issued and outstanding

capital stock of DTI (the “DiMi Stockholders”). Under the Exchange Agreement, we exchanged 87,450,000 shares

of our common stock (the “First Quantum Shares”) for 100% of the issued and outstanding shares of DTI (the

“DiMi Shares”). The exchange of the DiMi Shares for the First Quantum Shares is hereinafter referred to as

the “Share Exchange.” The First Quantum Shares issued in the Share Exchange represented 85.8% of our issued

and outstanding common stock immediately following the Share Exchange. As a result of the Share Exchange, DTI became DTII’s

wholly-owned subsidiary. In connection with the Share Exchange, (a) 15,000,000 shares of our issued and outstanding common stock

owned by Kesgood Company, Inc. were surrendered for cancellation and (b) our officers and directors resigned and the following

individuals assumed their duties as officers and directors:

| Name |

|

Title(s) |

| Barry Tenzer |

|

President, Chief Executive Officer, Chief Financial Officer, Secretary and Director |

| Roberto Fata |

|

Executive Vice President – Business Development and Director |

The Share Exchange qualified as a transaction

exempt from registration or qualification under the Securities Act of 1933, as amended (the “Securities Act”),

and under the applicable securities laws of each jurisdiction where any of the stockholders reside.

On March 15, 2012, the Company changed

its name to DiMi Telematics, International, Inc.

On April 16, 2012 the Company issued

a 1 for 1 stock dividend to current stockholders whereby the Company issued an additional 101,879,232 shares of common stock. On

May 16, 2012 the Company issued an additional 1 for 1 stock dividend to current stockholders whereby an additional 213,858,464

shares were issued. The dividends include outstanding warrants. The Company has reflected the dividends as splits, which

have been retroactively reflected in the financial statements.

The Company designs, develops and distributes

Machine-to-Machine (“M2M”) communications solutions used to remotely track, monitor, manage and protect multiple mobile

and fixed assets in real-time from virtually any web-enabled desktop computer or mobile device. Through our proprietary software

and hosted service offerings, DTI is endeavoring to capitalize on the pervasiveness and data transport capabilities of wireless

networks in order to facilitate communications and process efficiencies between commercial and industrial business owners/managers

and their respective networked control systems, sensors and devices.

The Company is focused on the M2M market

segments in which we can provide highly differentiated and value-driven solutions capable of unleashing tangible productivity gains,

material cost reductions and quantifiable risk mitigation across an enterprise. Aside from the oversight and administration of

our corporate, financial and legal affairs by the executive management team, our Company’s operating activities are centralized

in three core areas:

Sales and Marketing, which will

employ both direct and indirect sales models utilizing an in-house business development team, partners and resellers and self-service

through a service on-demand web interface.

Operations, which will be responsible

for managing daily activities related to monitoring and administering our cloud-based server operations; 24/7 client service/help

desk; professional services and installation support; and quality assurance and testing of our DiMi software and hosting

platform, as well as the implementation and ongoing administration of our hosted clients’ M2M communications platforms.

Product Development, which will

be charged with enhancing our existing M2M software applications and services and introducing new and complementary hosted products

and applications on a timely basis. We anticipate that the creative formulation of enhancements and new product conceptualization

will be performed in-house by our officers and directors. Thereafter, we intend to outsource software enhancement and product development

to outside third parties.

Plan of Operations

Product Development Plan

Product development will be charged

with enhancing our existing M2M software applications and services and introducing new and complementary hosted products and applications

on a timely basis.

The primary building blocks of M2M technology

on which the Company has focused its development activities have been and will remain:

·

Building an expert knowledge base of existing and emerging electronics/technologies

that enable geo-location, remote monitoring and control, auto-diagnostics and object identification;

·

Engagement of a cloud computing platform that enables ubiquitous,

scalable and on-demand network access;

·

Development of proprietary software that controls two-way communication

events, acts on predefined rules and delivers users a customized web interface that is accessible 24/7 from any web-enabled computer

or device anywhere on Earth; and

·

Information systems that enable users to process management solutions

that allow for exploiting the information gathered for intelligent decision-making purposes and enhanced situational awareness.

The Company’s proprietary M2M

solutions utilize a cloud-based, two-way communications delivery platform, marketed as “DiMi.” Leveraging the

power, scalability and flexible turnkey advantages of DiMi’s patent-pending software and hosting platform, users are

able to remotely track, monitor, manage and protect multiple mobile and fixed assets in real-time from virtually any web-enabled

desktop computer or mobile device while located anywhere in the world.

DiMi features a robust, customized

interface that gives its users secure command and control functionality of multiple remote, connected sensors, alarms and diagnostic

devices. Moreover, the intuitive DiMi framework readily adapts to and integrates both new and legacy monitoring/sensing

equipment – irrespective of make, model or manufacturer – providing for simplified, economical M2M deployments.

DiMi is delivered as a monthly,

hosted service that puts critical information into the palm of its user’s hands with no major hardware investments. Our hosting

platform can be tailored for each customer to create secure and reliable end-to-end connectivity between their specific remote

connected equipment and DiMi’s proprietary web interface.

The newest version of DiMi

is currently being beta tested in anticipation of the initial commercial roll-out of version 4.0, which it is anticipated will

take place in the first quarter of 2015. Pursuant to an agreement dated September 18, 2014, we agreed to pay our outsource software

developer, Creative Media Farm SL, an aggregate sum of $250,000 for the development of DiMi 4.0. On August 5, 2013, we

agreed to extend and amend our agreement with our outsource software developer to: (i) continue to develop drivers and improvements

to the DiMi version 4.0 platform, the work for which was initially anticipated to be complete by January, 2014 but is now

anticipated to be complete by March, 2015; and (ii) begin work on smartphone apps to allow version 4.0 to be fully accessible

from smartphones, the work for which was completed and delivered to us on February 10, 2014. The extended agreement requires us

to pay our outsource software developer: (i) $14,400 per month for a total of six months in order to complete the development

of the drivers and improvements to the DiMi version 4.0 platform; and (ii) a total of $13,800 for the development of smartphone

apps to work in conjunction with DiMi version 4.0.

Marketing Plan

Strategically, the Company is focused

on the M2M market segments in which we can provide highly differentiated and value-driven solutions capable of unleashing tangible

productivity gains, material cost reductions and quantifiable risk mitigation across an enterprise.

We have also taken – and will

continue to take – the necessary steps to secure the proprietary aspects of our applications through patent filings in the

U.S. and in key international markets. Moreover, we intend to remain focused on proactively developing best-of-breed Internet-enabled

M2M solutions that will effectively meet the evolving needs of our primary target market, namely web-based remote asset tracking,

management and control with applications in the commercial, industrial, educational, government and military sectors.

At soon as practicable, DTI intends

to concentrate its DiMi commercialization efforts on marketing the solution to property management companies, commercial

property developers, government/military installations, industrial facilities, retail and restaurant chains, colleges and universities,

fleet managers, and any business or institutional concern with valuable fixed and mobile assets requiring remote surveillance,

regular maintenance or general oversight.

In order to achieve accelerated market

penetration and sustainable, recurring revenue from a global customer base, The Company expects to ultimately adopt a hybrid sales

and marketing model involving direct sales (Solutions Team); channel sales (via leading Value-Added Resellers (VARs) and distributors

dedicated to niche market applications that DiMi is capable of addressing in target domestic and international markets);

and strategic marketing and integration collaborations with industry leading system integrators, Original Equipment Manufacturers

(OEMs) and large cellular carriers and dealers.

Employees

As of August 31, 2013, other than its

officers and directors, the Company employed no full time and no part time employees.

LIQUIDITY AND CAPITAL RESOURCES

As of August 31, 2013, we had cash and

cash equivalents of $437,970 and a net working capital of $416,470.

The accompanying financial statements

have been prepared contemplating a continuation of the Company as a going concern. The Company has reported a net loss of $321,645

and had an accumulated deficit of $937,413.

We have not generated positive cash

flows from operating activities. The primary source of capital has been from the sale of equity securities. Our primary use of

capital has been for professional fees, and general and administrative costs. Our working capital requirements are expected to

increase in line with the growth of our business.

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet

arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK.

Not applicable because our company is a smaller reporting

company.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The financial statements required by this item are located

following the signature page of this Annual Report.

Report of Independent Registered Public

Accounting Firm

To the Board of Directors and Stockholders

Dimi Telematics International, Inc.

We have audited the accompanying balance

sheets of Dimi Telematics International, Inc. (Formerly First Quantim Ventures, Inc.) (A Development Stage Company) as of August

31, 2013 and 2012, and the related statements of operations, stockholders’ equity, and cash flows for each of

the years ended August 31, 2013 and 2012 and for the periods from January 28, 2011 (Inception) through August 31, 2013. These financial

statements are the responsibility of the entity’s management. Our responsibility is to express an opinion on these financial

statements based on our audits.

We conducted our audits in accordance

with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform

the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes

assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial

statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial

statements referred to above present fairly, in all material respects, the financial position of Dimi Telematics, Inc. as of August

31, 2013 and 2012, and the results of its operations and its cash flows for each of the years ended August 31, 2013 and 2012, and

for the periods from January 28, 2011 (Inception) through August 31, 2013 in conformity with accounting principles generally accepted

in the United States of America.

The accompanying financial statements

have been prepared assuming that the entity will continue as a going concern. As discussed in Note 1 to the financial statements,

the entity has suffered recurring losses from operations and has a net capital deficiency that raises substantial doubt about its

ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The financial

statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ L.L. Bradford & Company, LLC

Las Vegas, Nevada

Dimi

Telematics International, Inc.

(Formerly First Quantum Ventures, Inc.)

(A Development Stage Company)

Consolidated

Balance Sheet

| |

|

August 31 |

|

|

August 31 |

|

| Assets |

|

2013 |

|

|

2012 |

|

| Current assets |

|

|

|

|

|

|

| Cash |

|

$ |

437,970 |

|

|

$ |

733,123 |

|

| Prepaid expense |

|

|

- |

|

|

|

9,000 |

|

| Total current assets |

|

|

437,970 |

|

|

|

742,123 |

|

| |

|

|

|

|

|

|

|

|

| DiMi Platform |

|

|

241,275 |

|

|

|

- |

|

| iPhone applications, net of amortization of $3,667 and $0 |

|

|

7,333 |

|

|

|

11,000 |

|

| Intellectual property, net of amortization of $482 and $350 |

|

|

1,708 |

|

|

|

1,840 |

|

| Total assets |

|

$ |

688,286 |

|

|

$ |

754,963 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|