Table of Contents

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

x

|

QUARTERLY

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the quarterly period ended

August 31, 2010

|

o

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934

|

For the transition period from

to

Commission file number 000-23425

Burzynski

Research Institute, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

76-0136810

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(IRS Employer Identification No.)

|

9432 Old Katy Road, Suite 200, Houston,

Texas 77055

(Address of principal executive offices)

(713) 335-5697

(Registrant’s telephone number)

(Former name, former address, and former fiscal year, if changed since

last report)

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes

x

No

o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of

this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files). Yes

o

No

o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definition of “large

accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

|

|

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

x

|

|

(Do not check if a smaller reporting company)

|

|

|

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

Yes

o

No

x

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate

the number of shares outstanding of each of the issuers classes of common

stock, as of the latest practicable date:

As of August 31, 2010, 131,448,444 shares of the Registrant’s

Common Stock were outstanding.

Table of

Contents

Item 1. Financial

Statements

BURZYNSKI RESEARCH INSTITUTE, INC.

BALANCE SHEETS

|

|

|

August 31,

|

|

February 28,

|

|

|

|

|

2010

|

|

2010

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

16,456

|

|

$

|

18,122

|

|

|

TOTAL CURRENT ASSETS

|

|

16,456

|

|

18,122

|

|

|

|

|

|

|

|

|

|

Property and equipment, net of accumulated

depreciation of $17,931 and $17,559 at August 31, 2010 and February 28,

2010, respectively

|

|

4,484

|

|

4,856

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

20,940

|

|

$

|

22,978

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND

STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

96,552

|

|

$

|

41,771

|

|

|

Accrued liabilities

|

|

30,269

|

|

29,685

|

|

|

CURRENT AND TOTAL LIABILITIES

|

|

126,821

|

|

71,456

|

|

|

|

|

|

|

|

|

|

Commitments and

contingencies

|

|

—

|

|

—

|

|

|

|

|

|

|

|

|

|

Stockholders’ deficit

|

|

|

|

|

|

|

Common stock, $.001 par value; 200,000,000 shares authorized,

131,448,444 and 131,388,444 issued and outstanding

|

|

131,449

|

|

131,389

|

|

|

Additional paid-in capital

|

|

91,754,712

|

|

89,232,302

|

|

|

Retained deficit

|

|

(91,992,042

|

)

|

(89,412,169

|

)

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS’ DEFICIT

|

|

(105,881

|

)

|

(48,478

|

)

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

$

|

20,940

|

|

$

|

22,978

|

|

See accompanying notes to financial statements.

1

Table of Contents

BURZYNSKI RESEARCH INSTITUTE, INC.

STATEMENTS OF OPERATIONS

(UNAUDITED)

|

|

|

Three Months Ended

|

|

|

|

|

August 31,

|

|

|

|

|

2010

|

|

2009

|

|

|

Operating expenses

|

|

|

|

|

|

|

Research and development

|

|

$

|

1,122,339

|

|

$

|

1,075,784

|

|

|

General and administrative

|

|

82,022

|

|

118,666

|

|

|

Depreciation

|

|

189

|

|

249

|

|

|

Total operating expenses

|

|

1,204,550

|

|

1,194,699

|

|

|

|

|

|

|

|

|

|

Net loss before provision for income tax

|

|

(1,204,550

|

)

|

(1,194,699

|

)

|

|

|

|

|

|

|

|

|

Provision for income tax

|

|

—

|

|

(474

|

)

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

$

|

(1,204,550

|

)

|

$

|

(1,194,225

|

)

|

|

|

|

|

|

|

|

|

Loss per share information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per common share

|

|

$

|

(0.01

|

)

|

$

|

(0.01

|

)

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding

|

|

131,448,444

|

|

131,388,444

|

|

|

|

|

Six Months Ended

|

|

|

|

|

August 31,

|

|

|

|

|

2010

|

|

2009

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

Research and development

|

|

$

|

2,420,725

|

|

$

|

2,067,807

|

|

|

General and administrative

|

|

158,776

|

|

245,220

|

|

|

Depreciation

|

|

372

|

|

475

|

|

|

Total operating expenses

|

|

2,579,873

|

|

2,313,502

|

|

|

|

|

|

|

|

|

|

Net loss before provision for income tax

|

|

(2,579,873

|

)

|

(2,313,502

|

)

|

|

|

|

|

|

|

|

|

Provision for income tax

|

|

—

|

|

—

|

|

|

NET LOSS

|

|

$

|

(2,579,873

|

)

|

$

|

(2,313,502

|

)

|

|

|

|

|

|

|

|

|

Loss per share information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per common share

|

|

$

|

(0.02

|

)

|

$

|

(0.02

|

)

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding

|

|

131,448,444

|

|

131,388,444

|

|

See accompanying notes to financial statements.

2

Table of Contents

BURZYNSKI RESEARCH INSTITUTE, INC.

STATEMENT OF STOCKHOLDERS’ DEFICIT

For the six months ended August 31, 2010

(UNAUDITED)

|

|

|

Common Stock

|

|

Additional

|

|

|

|

Total

Stockholders’

|

|

|

|

|

Shares

|

|

Amount

|

|

Paid-in Capital

|

|

Retained Deficit

|

|

Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance February 28, 2010

|

|

131,388,444

|

|

$

|

131,389

|

|

$

|

89,232,302

|

|

$

|

(89,412,169

|

)

|

$

|

(48,478

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash contributed by S.R. Burzynski, M.D., Ph.D.

|

|

—

|

|

—

|

|

226,598

|

|

—

|

|

226,598

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FDA clinical trial expenses paid directly by S.R.

Burzynski, M.D., Ph.D.

|

|

—

|

|

—

|

|

2,295,872

|

|

—

|

|

2,295,872

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issue 60,000 shares of stock for services rendered

|

|

60,000

|

|

60

|

|

(60

|

)

|

—

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

—

|

|

—

|

|

—

|

|

(2,579,873

|

)

|

(2,579,873

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance August 31, 2010

|

|

131,448,444

|

|

$

|

131,449

|

|

$

|

91,754,712

|

|

$

|

(91,992,042

|

)

|

$

|

(105,881

|

)

|

See accompanying notes to financial statements.

3

Table of Contents

BURZYNSKI

RESEARCH INSTITUTE, INC.

STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

|

|

Six months Ended August 31,

|

|

|

|

|

2010

|

|

2009

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

Net loss

|

|

$

|

(2,579,873

|

)

|

$

|

(2,313,502

|

)

|

|

Adjustments to reconcile net loss to net cash used

by operating activities:

|

|

|

|

|

|

|

Depreciation

|

|

372

|

|

475

|

|

|

FDA clinical trial expenses paid directly by S.R.

Burzynski, M.D., Ph.D.

|

|

2,295,872

|

|

1,951,248

|

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

Accounts payable

|

|

54,781

|

|

99,104

|

|

|

Accrued liabilities

|

|

584

|

|

(123

|

)

|

|

|

|

|

|

|

|

|

NET CASH USED BY OPERATING ACTIVITIES

|

|

(228,264

|

)

|

(262,798

|

)

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contribution of capital

|

|

226,598

|

|

265,599

|

|

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY FINANCING ACTIVTIES

|

|

226,598

|

|

265,599

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH

|

|

(1,666

|

)

|

2,801

|

|

|

|

|

|

|

|

|

|

CASH AT BEGINNING OF PERIOD

|

|

18,122

|

|

10,695

|

|

|

|

|

|

|

|

|

|

CASH AT END OF PERIOD

|

|

$

|

16,456

|

|

$

|

13,496

|

|

See accompanying notes to financial statements

4

Table of

Contents

BURZYNSKI

RESEARCH INSTITUTE, INC.

NOTES

TO FINANCIAL STATEMENTS

NOTE A.

BASIS OF PRESENTATION

The financial statements of Burzynski Research

Institute, Inc., a Delaware corporation (the “Company”), include expenses

incurred directly by S.R. Burzynski, M.D., Ph.D. (“Dr. Burzynski”) within

his medical practice, related to the conduct of U.S. Food and Drug

Administration (“FDA”) approved clinical trials for Antineoplaston drugs used

in the treatment of cancer. These

expenses have been reported as research and development costs and as additional

paid-in capital. Cash contributions received

from Dr. Burzynski have also been reported as additional paid-in capital,

which are used to fund general operating expenses. Expenses related to Dr. Burzynski’s

medical practice (unrelated to the clinical trials) have not been included in

these financial statements. Dr. Burzynski

is the President, Chairman of the Board and owner of over 80% of the

outstanding stock of the Company, and also is the inventor and original patent

holder of certain drug products known as “Antineoplastons,” which he has

licensed to the Company.

The Company and Dr. Burzynski have

entered into various agreements which provide the Company the exclusive right

in the United States, Canada and Mexico to use, manufacture, develop, sell,

distribute, sublicense and otherwise exploit all the rights, titles and

interest in Antineoplaston drugs used in the treatment of cancer, once an

Antineoplaston drug is approved for sale by the FDA.

The Company is primarily engaged as a research

and development facility for Antineoplaston drugs being tested for the use in

the treatment of cancer. The Company is

currently conducting clinical trials on various Antineoplastons in accordance

with FDA regulations. At this time, however, none of the Antineoplaston drugs

have received FDA approval; further, there can be no assurance that FDA

approval will be granted. In September 2004, the Company announced that

the FDA awarded orphan drug status to Antineoplastons A10 and AS2-1 for the

treatment of brainstem glioma. During

2008, the FDA awarded orphan drug status to Antineoplastons A10 and AS2-1 for

the treatment of all glioma.

The accompanying unaudited financial

statements have been prepared in accordance with accounting principles

generally accepted in the United States of America for interim financial

information. Certain disclosures and information normally included in financial

statements have been condensed or omitted. In the opinion of management of the

Company, these financial statements contain all adjustments necessary for a

fair presentation of financial position as of August 31, 2010 and February 28,

2010, results of operations for the three and six months ended August 31,

2010 and 2009, and cash flows for the six months ended August 31, 2010 and

2009. All adjustments are of a normal

recurring nature. The results of

operations for interim periods are not necessarily indicative of the results to

be expected for a full year. These

statements should be read in conjunction with the financial statements and

footnotes thereto included in the Company’s Annual Report on Form 10-K for

the year ended February 28, 2010.

5

Table of Contents

BURZYNSKI

RESEARCH INSTITUTE, INC.

NOTES

TO FINANCIAL STATEMENTS - continued

NOTE B.

ECONOMIC DEPENDENCY

The Company has not generated significant

revenues since its inception and has suffered losses from operations, has a

working capital deficit and has an accumulated deficit. Dr. Burzynski has funded the capital and

operational needs of the Company through his medical practice since inception,

and has entered into various agreements to continue such funding.

The Company is economically dependent on its

funding through Dr. Burzynski’s medical practice. A portion of Dr. Burzynski’s patients

are admitted and treated as part of the clinical trial programs, which are

regulated by the FDA. The FDA imposes

numerous regulations and requirements regarding these patients and the Company

is subject to inspection at any time by the FDA. These regulations are complex and subject to

interpretation and though it is management’s intention to comply fully with all

such regulations, there is the risk that the Company is not in compliance and

is thus subject to sanctions imposed by the FDA.

In addition, as with any medical practice, Dr. Burzynski

is subject to potential claims by patients and other potential claimants

commonly arising out of the operation of a medical practice. The risks associated with Dr. Burzynski’s

medical practice directly affect his ability to fund the operations of the

Company.

It is also the intention of the directors and

management to seek additional capital through the sale of securities. The proceeds from such sales will be used to

fund the Company’s operating deficit until it achieves positive operating cash

flow. There can be no assurance that the

Company will be able to raise such additional capital.

NOTE C.

STOCK OPTIONS

At August 31, 2010, the Company had one

stock-based employee compensation plan, which is described below.

On September 14,

1996, the Company granted 600,000 stock options, with an exercise price of

$0.35 per share, to an officer who is no longer with the Company. The options vested as follows:

|

400,000 options

|

September 14,

1996

|

|

|

100,000 options

|

June 1,

1997

|

|

|

100,000 options

|

June 1,

1998

|

|

The options are

valid in perpetuity. In addition, for a

period of 10 years from the grant date, they increase in the same percentage of

any new shares of stock issued; however, no additional shares have been issued since

September 14, 1996. None of the

options have been exercised as of August 31, 2010.

The

Company follows the fair value recognition provisions of FASB ASC 505; 718

“Compensation — Stock Compensation.”

Under this method,

compensation cost for all share-based payments is based on the grant-date fair

value amortized to expense over the requisite service period, generally the

vesting period.

6

Table of Contents

BURZYNSKI RESEARCH INSTITUTE, INC.

NOTES TO FINANCIAL STATEMENTS -

continued

NOTE C. STOCK

OPTIONS-Continued

The

Company did not grant any options and no options previously granted vested in

any of the periods presented in these financial statements. Due to this fact, there was no effect on net

loss and loss per share.

NOTE D.

INCOME TAXES

The

Company adopted the provisions of FASB ASC 740-10, “

Accounting

for Uncertainty in Income Taxes,”

on March 1, 2007. As a result

of the implementation of FASB ASC 740-10, the Company had no material change in

the amounts of unrecognized tax benefits as a result of tax positions taken

during a prior period or the current period.

The federal income tax returns of the Company

for 2009, 2008, and 2007 are subject to examination by the IRS, generally for

three years after they are filed.

The Company recognizes interest and penalties

as interest expense when they are accrued or assessed.

The actual provision for income tax for the

three and six months ended August 31, 2009 and 2008, respectively, differ

from the amounts computed by applying the U.S. federal income tax rate of 34%

to the pretax loss as a result of the following:

|

|

|

Three Months Ended August 31,

|

|

|

|

|

2010

|

|

2009

|

|

|

Expected income

tax benefit

|

|

$

|

(409,547

|

)

|

$

|

(406,198

|

)

|

|

Effect of expenses

deducted directly by Dr. Burzynski

|

|

409,543

|

|

406,018

|

|

|

Nondeductible

expenses and other adjustments

|

|

14,764

|

|

26,092

|

|

|

Change in

valuation allowance

|

|

(14,760

|

)

|

(25,912

|

)

|

|

State tax

|

|

—

|

|

(474

|

)

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

$

|

—

|

|

$

|

(474

|

)

|

|

|

|

Six Months Ended August 31,

|

|

|

|

|

2010

|

|

2009

|

|

|

Expected income

tax benefit

|

|

$

|

(877,157

|

)

|

$

|

(786,591

|

)

|

|

Effect of expenses

deducted directly by Dr. Burzynski

|

|

877,153

|

|

786,572

|

|

|

Nondeductible

expenses and other adjustments

|

|

19,515

|

|

32,862

|

|

|

Change in

valuation allowance

|

|

(19,511

|

)

|

(32,843

|

)

|

|

State tax

|

|

—

|

|

—

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

$

|

—

|

|

$

|

—

|

|

7

Table of Contents

BURZYNSKI RESEARCH INSTITUTE, INC.

NOTES TO FINANCIAL STATEMENTS —

continued

NOTE D.

INCOME TAXES-Continued

At August 31, 2010, the Company had a net

deferred tax asset of $0, which includes a valuation allowance of $473,636. The Company’s ability to utilize net

operating loss carryforwards and alternative minimum tax credit carryforwards

will depend on its ability to generate adequate future taxable income. The Company has no historical earnings on

which to base an expectation of future taxable income. Accordingly, a valuation allowance for

deferred tax assets has been provided.

At August 31, 2010, the Company had net operating loss

carryforwards available to offset future income in the amount of $1,255,692,

which may be carried forward and will expire if not used between 2012 and 2031

in varying amounts.

NOTE E. SUBSEQUENT EVENTS

The Company has no subsequent events to

disclose in accordance with FASB ASC 855-10, “Subsequent events.”

8

Table of Contents

Item 2. Management’s

Discussion and Analysis of Financial Condition and Results of Operation

The

following is a discussion of the financial condition of the Company as of

August 31, 2010, and the results of operations comparing the three and six

months ended August 31, 2010 and August 31, 2009. It should be read in conjunction with the

financial statements and the notes thereto included elsewhere in this report

and in conjunction with the Annual Report on Form 10-K for the year ended

February 28, 2010.

Introduction

The

Company was incorporated under the laws of the State of Delaware in 1984 in

order to engage in the research, production, marketing, promotion and sale of

certain medical chemical compounds composed of growth-inhibiting peptides,

amino acid derivatives and organic acids which are known under the trade name “Antineoplastons.” The Company believes Antineoplastons are

useful in the treatment of human cancer and is currently conducting Phase II

clinical trials of Antineoplastons relating to the treatment of cancer. The Company has generated no significant

revenue since its inception, and does not expect to generate any operating revenues

until such time, if any, as Antineoplastons are approved for use and sale by

the FDA. The Company’s sole source of

funding is S.R. Burzynski, M.D., Ph.D. (“Dr. Burzynski”), the Company’s

President and Chief Executive Officer.

Dr. Burzynski funds the Company’s operations from his medical

practice pursuant to certain agreements between Dr. Burzynski and the

Company

.

Funds received by the Company from Dr. Burzynski are

reported as additional paid-in capital to the Company.

The

Company is primarily engaged as a research and development facility of drugs

currently being tested for the use in the treatment of cancer, and provides

consulting services. The Company is

currently conducting five FDA-approved clinical trials. The Company holds the exclusive right in the

United States, Canada and Mexico to use, manufacture, develop, sell,

distribute, sublicense and otherwise exploit all the rights, titles and

interest in Antineoplaston drugs used in the treatment and diagnosis of cancer,

once an Antineoplaston drug is approved for sale by the FDA

.

In

September 2004, the Company announced that the FDA awarded orphan drug

status to Antineoplastons A10 and AS2-1 for treating patients with brainstem

gliomas.

On

January 13, 2009, the Company announced that the Company had reached an

agreement with the FDA for the Company to move forward with a pivotal Phase III

clinical trial of combination Antineoplaston therapy plus radiation therapy in

patients with newly diagnosed, diffuse, intrinsic brainstem gliomas (DBSG). The agreement was made under the FDA’s

Special Protocol Assessment procedure, meaning that the design and planned

analysis of the Phase III study is acceptable to support a regulatory

submission seeking new drug approval. On

February 1, 2010, the Company entered into an agreement with Cycle

Solutions, Inc., dba ResearchPoint (“ResearchPoint”) to initiate and

manage a pivotal Phase III clinical trial of combination Antineoplastons A10

and AS2-1 plus radiation therapy (RT) in patients with newly-diagnosed DBSG. ResearchPoint is currently conducting a

feasibility assessment. ResearchPoint

has secured interest and commitment from a number of sites selected. Upon completion of this assessment, a

randomized, international phase III study will commence. The study’s objective is to compare overall

survival of children with newly-diagnosed DBSG who receive combination

Antineoplastons A10 and AS2-1 plus RT versus RT alone.

Results of Operations

Three Months Ended

August 31, 2010 Compared to Three Months Ended August 31, 2009

Research

and development costs were approximately $1,122,000 and $1,076,000 for the

three months ended August 31, 2010 and 2009, respectively. The increase of $46,000 or 4% was due to

increases in personnel cost of $147,000, offset by decreases in material costs

of $77,000, facility and equipment costs of $16,000, consulting and quality

control costs of $1,000 and other research and development costs of $7,000.

General

and administrative expenses were approximately $82,000 and $119,000 for the

three months ended August 31, 2010 and 2009, respectively. The decrease of $37,000 or 31% was due to

decreases in legal and professional fees of $27,000, and other general and

administrative expenses of $10,000.

The

Company had net losses of approximately $1,205,000 and $1,194,000 for the three

months ended August 31, 2010 and 2009, respectively. The increase in the net loss from 2009 to

2010 is primarily due to the increases in research and development costs due to

increases in personnel cost, offset by decreases in material costs, facility

and equipment costs, consulting and quality control costs and other research

and development costs; further offset by decreases in general and

administrative expenses due to decreases in legal and professional fees and

other general and administrative costs.

9

Table of Contents

Six Months Ended August 31,

2010 Compared to Six Months Ended August 31, 2009

Research

and development costs were approximately $2,421,000 and $2,068,000 for the six

months ended August 31, 2010 and 2009, respectively. The increase of $353,000 or 17% was due to

increases in personnel cost of $294,000, material costs of $57,000 and

consulting and quality control costs of $10,000, offset by decreases in

facility and equipment costs of $8,000.

General

and administrative expenses were approximately $159,000 and $245,000 for the

six months ended August 31, 2010 and 2009, respectively. The decrease of $86,000 or 35% was due to

decreases in legal and professional fees of $50,000, and other general and

administrative expenses of $36,000.

The

Company had net losses of approximately $2,580,000 and $2,314,000 for the six

months ended August 31, 2010 and 2009, respectively. The increase in the net loss from 2009 to

2010 is primarily due to the increases in research and development costs due to

increases in personnel costs, material costs, consulting and quality control

costs, and other research and development costs, offset by decreases in

facility and equipment costs; further offset by decreases in general and

administrative expenses due to decreases in legal and professional fees and

other general and administrative costs.

Liquidity and Capital

Resources

The

Company’s operations have been funded entirely by contributions from

Dr. Burzynski and from funds generated from Dr. Burzynski’s medical

practice. Effective March 1, 1997,

the Company entered into a Research Funding Agreement with Dr. Burzynski

(the “Research Funding Agreement”), pursuant to which the Company agreed to

undertake all scientific research in connection with the development of new or

improved Antineoplastons for the treatment of cancer and Dr. Burzynski

agreed to fund the Company’s Antineoplaston research for that purpose. Under the Research Funding Agreement, the

Company hires such personnel as is required to conduct Antineoplaston research,

and Dr. Burzynski funds the Company’s research expenses, including

expenses to conduct the clinical trials.

Dr. Burzynski also provides the Company laboratory and research

space as needed to conduct the Company’s research activities. The Research Funding Agreement also provides

that Dr. Burzynski may fulfill his funding obligations in part by

providing the Company such administrative support as is necessary for the

Company to manage its business.

Dr. Burzynski pays the full amount of the Company’s monthly and

annual budget of expenses for the operation of the Company, together with other

unanticipated but necessary expenses which the Company incurs. In the event the research results in the

approval of any additional patents for the treatment of cancer,

Dr. Burzynski shall own all such patents, but shall license to the Company

the patents based on the same terms, conditions and limitations as are in the

current license between Dr. Burzynski and the Company.

The

amounts which Dr. Burzynski is obligated to pay under the agreement shall

be reduced dollar for dollar by the following: (1) any income which the

Company receives for services provided to other companies for research and/or

development of other products, less such identifiable marginal or additional

expenses necessary to produce such income, or (2) the net proceeds of any

stock offering or private placement which the Company receives during the term

of the agreement up to a maximum of $1,000,000 in a given Company fiscal year.

The

Research Funding Agreement, as amended, contains an annual automatic renewal

provision providing for an additional one-year term, unless one party notifies

the other party at least thirty days prior to the expiration of the then

current term of the agreement of its intention not to renew the agreement. Subject to the foregoing, the term of the

Research Funding Agreement was renewed and extended until February 28,

2011. It is expected that the Research

Funding Agreement will continue to renew each year prospectively unless

terminated under the provisions of the agreement.

The

Research Funding Agreement automatically terminates in the event that

Dr. Burzynski owns less than fifty percent of the outstanding shares of

the Company, or is removed as President and/or Chairman of the Board of the

Company, unless Dr. Burzynski notifies the Company in writing of his

intention to continue the agreement notwithstanding this automatic termination

provision.

The

Company estimates that it will spend approximately $2,500,000 during the

remaining two quarters of the fiscal year ending February 28, 2011. The Company estimates that ninety-five percent

(95%) of this amount will be spent on research and development and the

continuance of FDA-approved clinical trials.

While the Company anticipates that

Dr. Burzynski will continue to fund the Company’s research and FDA-related

costs, there is no assurance that Dr. Burzynski will be able to continue

to fund the Company’s operations pursuant to the Research Funding Agreement or

otherwise. The Company believes

Dr. Burzynski will be financially able to fund the Company’s operations

for at least the next year. In addition,

Dr. Burzynski’s medical practice has successfully funded the Company’s

research activities over the last 25 years and, in 1997, his medical practice

was expanded to include traditional cancer treatment options such as

chemotherapy, immunotherapy and hormonal therapy in response to FDA

requirements that cancer patients utilize more traditional cancer treatment

options in order to be eligible to participate in the Company’s Antineoplaston

clinical trials. As a result of the

expansion of Dr. Burzynski’s medical practice, the financial condition of

the medical practice has improved Dr. Burzynski’s ability to fund the

Company’s operations.

10

Table of Contents

The

Company may be required to seek additional capital through equity or debt

financing or the sale of assets until the Company’s operating revenues are

sufficient to cover operating costs and provide positive cash flow; however,

there can be no assurance that the Company will be able to raise such

additional capital on acceptable terms to the Company. In addition, there can be no assurance that

the Company will ever achieve positive operating cash flow.

Forward-Looking Statements

Certain

matters discussed in this quarterly report, except for historical information

contained herein, may constitute “forward-looking statements” that are subject

to certain risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements. Forward-looking statements provide current

expectations of future events based on certain assumptions. These statements encompass information that

does not directly relate to any historical or current fact and often may be

identified with words such as “anticipates,” “believes,” “expects,” “estimates,”

“intends,” “plans,” “projects” and other similar expressions. Management’s expectations and assumptions

regarding Company operations and other future results are subject to risks,

uncertainties and other factors that could cause actual results to differ

materially from the anticipated results or other expectations expressed in the

forward-looking statements.

Item

4T. Controls and Procedures

Within

the 90 days prior to the date of this report, the Company carried out an

evaluation, under the supervision and with the participation of the Company’s

management, including the Company’s principal executive officer (who is also

the Company’s principal financial officer), of the effectiveness of the Company’s

disclosure controls and procedures pursuant to Rule 13a-14 under the

Securities Exchange Act of 1934, as amended.

Based on that evaluation, the Company’s principal executive officer (who

is also the Company’s principal financial officer) concluded that the Company’s

disclosure controls and procedures are effective in timely alerting him to

material information required to be included in periodic filings with the

Securities and Exchange Commission. A

controls system cannot provide absolute assurance, however, that the objectives

of the controls system are met, and no evaluation of controls can provide

absolute assurance that all control issues and instances of fraud, if any,

within a company have been detected.

There were no significant changes in the Company’s internal controls or

in other factors that could significantly affect internal controls over

financial reporting that occurred during the fiscal quarter ended

August 31, 2009 that have materially affected or are reasonably likely to

materially affect our internal controls subsequent to that date.

PART II

— OTHER INFORMATION

Item

1. Legal Proceedings

The

Company’s activities are subject to regulation by various governmental

agencies, including the FDA, which regularly monitor the Company’s operations

and often impose requirements on the conduct of its clinical trials and other

aspects of the Company’s business operations.

The Company’s policy is to comply with all such regulatory

requirements. From time to time, the

Company is also subject to potential claims by patients and other potential

claimants commonly arising out of the operation of a medical practice. The Company seeks to minimize its exposure to

claims of this type wherever possible.

Currently,

the Company is not a party to any material pending legal proceedings. Moreover, the Company is not aware of any

such legal proceedings that are contemplated by governmental authorities with

respect to the Company or any of its properties.

Item

6. Exhibits

|

3.1

|

Certificate

of Incorporation of the Company, as amended (incorporated by reference from

Exhibits 3(i) — (iii) to Form 10-SB filed with the Securities

and Exchange Commission on November 25, 1997 (File No. 000-23425)).

|

|

|

|

|

3.2

|

Amended

Bylaws of the Company (incorporated by reference from

Exhibit 3(iv) to Form 10-SB filed with the Securities and

Exchange Commission on November 25, 1997 (File No. 000-23425)).

|

|

|

|

|

31.1

|

Certification

of Chief Executive Officer and Principal Financial Officer pursuant to

Rules 13a-14 and 15d-14 of the Securities Exchange Act of 1934, as

amended, filed herewith.

|

|

|

|

|

32.1

|

Certification

of Chief Executive Officer and Principal Financial Officer pursuant to 18

U.S.C. Section 1350, as adopted pursuant to Section 906 of the

Sarbanes-Oxley Act of 2002, filed herewith.

|

11

Table of Contents

SIGNATURES

In

accordance with the requirements of the Exchange Act, the Company caused this

report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

BURZYNSKI RESEARCH INSTITUTE, INC.

|

|

|

|

|

|

|

By:

|

/s/

Stanislaw R. Burzynski

|

|

|

|

Stanislaw

R. Burzynski,

|

|

|

|

President,

Secretary, Treasurer and

|

|

|

|

Chairman

of the Board of Directors

|

|

|

|

(Chief

Executive Officer and

|

|

|

|

Principal

Financial Officer)

|

Date:

October 15

,

2010

12

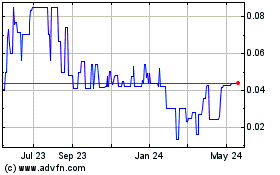

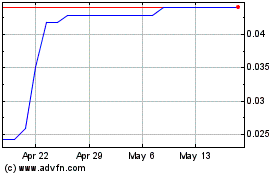

Burzynski Research Insti... (PK) (USOTC:BZYR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Burzynski Research Insti... (PK) (USOTC:BZYR)

Historical Stock Chart

From Feb 2024 to Feb 2025