EUROPE MARKETS: European Banks Continue To Rally After ECB Cut

September 13 2019 - 4:33AM

Dow Jones News

By Steve Goldstein, MarketWatch

European banks advanced on Friday, continuing a rally as the

European Central Bank took steps to improve the domestic economy

while making it less painful to lenders.

The Euro Stoxx banks index rose as the central bank took several

steps favorable to lenders -- cutting interest rate less than

anticipated, making more holdings eligible for refinancing and

introducing an exemption of part of the deposits that have been

slapped with a negative rate (so-called tiering).

Bank of Ireland (BIRG.DB) , CaixaBank (CABK.MC) and AIB Group

(A5G.DB) each rose about 4%.

The bank index has now climbed 12% over the last month, though

it's still down 16% over the last 52 weeks.

The broader market gauges were less active, as the Stoxx Europe

600 gained 0.12% to 390.94.

The German DAX added 0.25% to 12441.44, the French CAC 40

increased 0.31% to 5660.59 and the U.K. FTSE 100 increased 0.06% to

7348.99,

Market focus turned back to the prospect of a U.S.-China trade

deal. President Trump said he would consider an interim deal. "It's

something we would consider, I guess," he told reporters. At a

retreat with Congressional Republicans, Trump added he would

consider a tax cut for "middle-income people," though it's not

clear either what was planned or how that would get through a

Democratic-controlled House of Representatives.

A wave of economic data is set for release, including U.S.

retail sales for August.

Bollore (BOL.FR) , the French holding company with interests

ranging from logistics to media, rose over 4% after reporting a

first-half profit rise of 54% and declaring a dividend of 2 cents a

share.

(END) Dow Jones Newswires

September 13, 2019 05:18 ET (09:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

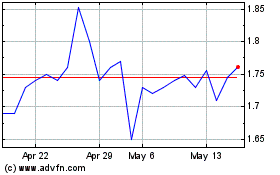

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Feb 2024 to Feb 2025