New York, New York (NetworkNewsWire) – While developments in

U.S. marijuana markets have no trouble attracting headlines, many

seasoned investors have discovered a more predictable method of

capitalizing on the cannabis boom by turning their attention to the

north. Data from Health Canada suggest that almost 130,000

Canadians had signed up with the country’s 38 licensed cannabis

producers by the end of 2016, more than tripling in number from the

previous year. One of these licensed producers is ABcann

Global Corp. (OTCQB: ABCCF) (TSX.V: ABCN) (ABCCF

Profile), which has remained focused

on changing the face of medical cannabis since its launch in 2014.

With fellow licensed producers Canopy Growth Corp. (OTC:

TWMJF) (TSX: WEED), Aurora Cannabis, Inc. (OTCQX:

ACBFF) (TSX: ACB) and Aphria, Inc. (OTCQB: APHQF)

(TSX: APH) all recording huge PPS

spikes approaching or exceeding 1,000 percent following their

respective IPOs, ABcann’s comparatively low market cap, combined

with its strong balance sheet reflecting investment from cannabis

streaming company Cannabis Wheaton Income Corp. (OTC:

KWFLF) (TSX.V: CBW), makes it an intriguing investment

opportunity as Canada prepares to legalize recreational use of

marijuana at the federal level in 2018.

The impending legalization of marijuana for recreational use in

Canada could offer licensed producers a chance to record tremendous

growth in the coming months. According to a 2016 report by

Deloitte, the legal Canadian marijuana market could soon be worth

$18 billion annually. As for volume, Deloitte forecast annual

demand for the plant at about 1.32 million pounds per year. Therein

lies the opportunity. As of the 2016 report, Canada’s network of

licensed growers produced about 20,000 pound of dried marijuana per

year. Just last week, investors were given an early glimpse into

the possibilities presented by this supply bottleneck.

As reported by Vice News,

New Brunswick’s financial minister last Friday announced two

historic supply deals with Organigram and Canopy Growth Corp. with

a combined value of more than $80 million. Both companies saw a

jump in share prices following the announcement, but the scale of

these agreements demonstrates the nearly insatiable demand for

volume in the Canadian cannabis market ahead of next year’s

legalization measures. The Financial

Post notes that Organigram’s supply agreement with New

Brunswick accounts for about 25 percent of its anticipated annual

production. With Quebec and Ontario having recently floated details

of their individual plans for July’s complete marijuana

legalization goal and the other seven Canadian provinces now on the

clock, the market is ripe for expansion.

“These are the first agreements that any province has signed for

supply from licensed producers in Canada,” Organigram CEO Greg

Engel told the Financial Post. “Part of the initiative to get this

supply agreement in place was they understand that there will be a

supply deficiency for the first couple years of the adult

recreational market, and they wanted to make sure that they were in

a position to get a significant supply going forward and be the

first to do so.”

ABcann

Global Corp. (OTCQB: ABCCF) (TSX.V: ABCN) with its

fully operational Vanluven production facility, is well-positioned

to capitalize on this expansion. The company’s computer-controlled

growing platform helps it produce in excess of 250 grams of

cannabis per square foot each year, placing it among the highest

yields within the Canadian sector, according to data from PI Financial.

Likewise, these reliable growing systems have proven extremely

adept at producing a consistent chemical compound from plant to

plant and batch to batch, allowing ABcann to achieve a long-term

cannabinoid profile with deviations of less than 10 percent. This

is particularly noteworthy as some competitors within the Canadian

cannabis market have faced product recalls resulting from

substandard consistency and other production issues.

Canada’s largest cannabis producer, Cannabis Growth

Corp., through its recently-acquired Mettrum Health Corp.

subsidiary, is one company that has faced product

recalls in recent months. Health Canada classified the product

deficiency as a Type III recall, defined as “a situation in which

the use of, or exposure to, a product is not likely to cause any

adverse health consequences.” Aurora Cannabis,

Inc. announced a Type II

recall of its products in January 2017, with some of its

marketed offerings containing “residual levels of myclobutanil

and/or bifenazate that exceed any of the levels permitted in food

production for these two pesticides.” Aphria, Inc.

initiated a Type III

recall of its own in March 2017 due to mislabeling of the

delta-9-tetrahydrocannabidiol (THC) content of some of its

products.

In the face of these quality concerns in the burgeoning

industry, ABcann has not had any product recalls. The company’s

management team notes that ABcann’s reputation for the consistent

production of pharmaceutical-grade cannabis will be vital to both

its expansion within Canada and its entry into additional global

markets.

Leaning on this reputation for quality, ABcann has already

outlined some aggressive expansion plans designed to help it widen

its presence in the fertile Canadian cannabis market. The company’s

Vanluven facility in Napanee, Ontario, boasts 15,000 square feet of

production space, and management expects completion of an

additional 15,000-square-foot expansion at the site sometime in

2017. Looking ahead, ABcann also owns a 2,649-hectare parcel of

land near its Vanluven facility, known as its Kimmett facility,

upon which it plans to construct a 150,000-square-foot

facility offering annual cannabis production capacity of 20,000

kilograms. In late July, the company provided an update on these

construction efforts, noting that its plans to commence

construction at the Kimmett facility remain on track for the third

quarter of 2017, with first cultivation from the facility expected

in the fourth quarter of 2018. These plans are supported by

ABcann’s strong cash position.

ABcann earlier this week reported (http://nnw.fm/zQY7o) total proceeds of $11.9 million

from the exercise of warrants since its acquisition of ABcann

Medicinals, Inc. in April, bringing the company’s working capital

to $45 million, to be used to significantly increase production

capacity in 2018.

“ABcann thanks our shareholders for their continued support and

confidence as we work toward expanding our facilities and

increasing production. Our strong financial position, represented

by our current cash position is earmarked for new construction and

will facilitate the timely execution of our business plan. The

Company’s main focus in the coming months will be on the deployment

of capital towards the expansion of our existing Vanluven facility

and development and construction of the new Kimmett facility, as

well as the pursuit of our international expansion plans,” ,”

stated director and CEO Aaron Keay, who as of October 1 will be

replaced by incoming CEO Barry Fishman (http://nnw.fm/WrOQ4).

This strong cash position is anchored to news from early August,

when ABcann announced

the close of a $15 million investment by Cannabis Wheaton

Income Corp., the world’s first cannabis streaming

company, as part of a larger phased investment to fund its

expansion efforts. As noted on its website, Cannabis Wheaton aims to construct a

pan-Canadian network of streaming partners connecting licensed

producers with consumers. This falls in line with ABcann’s current

operations, though, notably, the company has already outlined plans

for growth beyond the Canadian border.

In its August 2017 corporate

presentation, ABcann highlights its active global initiatives

targeting cannabis markets in Europe, Israel and Australia. It is

in this area that the company’s proven track record of quality

production is expected to be most valuable. As a member of ABcann’s

management team told NetworkNewsWire, “With Canadian growers moving

so fast into commercial production, the opportunities will be in

growing international markets. The licensed producer's with the

best domestic reputations for quality consistency and capacity will

be the winners in the new emerging markets ... We expect ABcann to

be successful in the global supply chain.”

Its plans for the construction of a 150,000-square-foot

production facility in the coming months place ABcann in the upper

echelon of growers in Canada’s developing cannabis market. It’s

joined in these ranks by Canopy Growth, the nation’s largest

licensed producer, which operates a diverse collection of brands

supported by over half a million square feet of indoor greenhouse

production capacity. Canopy Growth was first granted a licensed to

legally produce marijuana in January 2014, and its production

facility was the first approved under the Marijuana for Medical

Purposes Regulations in April 2014. This early-mover status

propelled the company to rapid expansion, as it became the first

company in the marijuana industry to achieve a valuation of $1

billion in November 2016. ABcann will look to record similar

growth through its facility expansion projects, as well as its

international growth initiatives.

Despite recent recalls impacting their operations, fellow

licensed producers Aphria and Aurora Cannabis are also competing in

the booming Canadian cannabis space. Marketing a wide variety of

products including capsules, oral solutions and vaporizers, Aphria

has recorded seven

consecutive quarters of positive EBITDA while continuing to

expand its production capacity. Its PPS for its Canada-listed

shares have highlighted the growth potential of this evolving

market, hitting a high of C$7.79 in November 2016 that marked a 967

percent gain from IPO in February 2015. Similarly, Aurora

Cannabis’s Canadian shares rose by 1,419 percent, from June 2015 to

November 2016, to C$3.95 as the company implemented a strategy

combining low-cost production with high customer growth rates in an

effort to maximize market share and compete with low-price

competitors.

With federal legalization of recreational use scheduled for

2018, the Canadian cannabis industry is in the midst of a major

boom. Producers are scrambling to increase production capacity in

the face of a forecast supply dearth, and many are facing the

quality concerns and product recalls that are often associated with

expedited expansion. ABcann Global, on the other hand, is taking a

deliberate approach to the so-called ‘Green Revolution’. In

addition to rapidly increasing its production capacity by

leveraging its strong cash position, ABcann has remained steadfast

in its commitment to consistency and product quality. With no

product recalls in its history, ABcann is well-positioned to both

expand its share of the Canadian cannabis industry and make

strategic entries into promising international markets. These

factors, when combined with a market cap that’s significantly lower

than its competitors in the cannabis space, make ABcann an

intriguing option for investors looking to capitalize on the

impending legalization of marijuana in Canada and beyond.

For more information on ABcann Global Corp. please visit:

ABcann Global

(TSX.V: ABCN) (OTCQB: ABCCF)

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

NetworkNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, NNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. NNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, NNW brings

its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

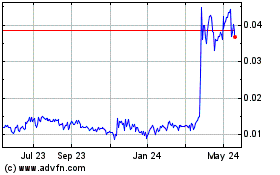

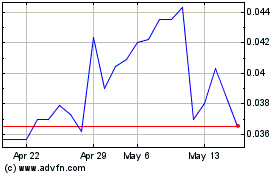

Auxly Cannabis (QB) (USOTC:CBWTF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Auxly Cannabis (QB) (USOTC:CBWTF)

Historical Stock Chart

From Feb 2024 to Feb 2025