UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

|

|

|

|

þ

|

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

|

|

For

the quarterly period ended September 30, 2008

|

|

|

|

OR

|

|

|

|

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the transition period from ___________________ to _______________

CHINA

DASHENG BIOTECHNOLOGY COMPANY

(Exact

name of registrant as specified in its charter)

|

Nevada

|

333-141327

|

26-0162321

|

|

(State

or other jurisdiction

of

incorporation or organization)

|

Commission

File Number

|

(I.R.S.

Employer

Identification

No.)

|

Building

B 17th Floor

Century

Plaza

Qingyang

Road

Lanzhou,

Gansu

People's

Republic of China

Telephone

number:

(

86

)

931

8441248

(Address

and telephone number of principal executive offices)

c/o

American Union Securities

100

Wall Street 15th Floor

New

York, NY 10005

Telephone

number:

(

212)

232-0058

(Address

and telephone number of United States agent offices)

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

þ

No

o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large

accelerated filer

o

|

|

|

Accelerated

filer

o

|

|

|

|

|

|

|

Non-accelerated

filer

o

|

(Do

not check if a smaller reporting company)

|

|

Smaller

reporting company

þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes

o

No

þ

As of

November 14, 2008, 30,000,000 shares of common stock, par value $.001

per share, were outstanding.

|

TABLE OF

CONTENTS

|

Page

|

|

PART I. FINANCIAL

INFORMATION

|

|

|

Item 1. Financial Statements

|

1

|

|

|

|

|

Consolidated Balance

Sheets as of September 30, 2008 (Unaudited) and June 30, 2008

|

1

|

|

|

|

|

Consolidated Statements

of Operations for three months ended September 30, 2008 and 2007

(Unaudited)

|

2

|

|

|

|

|

Consolidated

Statements of Cash Flows for the three months ended September 30,

2008 and 2007 (Unaudited)

|

3

|

|

|

|

|

Notes to

Consolidated Financial Statements

|

4-11

|

|

|

|

|

Item 2. Management's

Discussion and Analysis of Financial Condition and Results of

Operation

|

12

|

|

|

|

|

Item 3. Quantitative

and Qualitative Disclosures About Market Risk

|

13

|

|

|

|

|

Item 4. Controls and

Procedures

|

13

|

|

|

|

|

PART

II. OTHER INFORMATION

|

|

|

|

|

|

Item 1. Legal

Proceedings

|

14

|

|

|

|

|

Item 2. Unregistered

Sales of Equity Securities and Use of Proceeds

|

14

|

|

|

|

|

Item 3. Defaults

Upon Senior Securities

|

14

|

|

|

|

|

Item 4. Submission

of Matters to a Vote of Security Holders

|

14

|

|

|

|

|

Item 5. Other

Information

|

14

|

|

|

|

|

Item 6.

Exhibitions

|

14

|

|

|

|

|

Signatures

|

15

|

PART I. FINANCIAL

INFORMATION

ITEM I. FINANCIAL

STATEMENTS

|

CHINA

DASHENG BIOTECHNOLOGY COMPANY

|

|

|

(FORMERLY

NAMED AS MAX NUTRITION INC.)

|

|

|

CONSOLIDATED

BALANCE SHEETS

|

|

|

AS

OF SEPTEMBER 30, 2008 and JUNE 30, 2008

|

|

|

(in

US DOLLARS)

|

|

|

|

|

|

|

|

|

|

|

|

|

30-Sep-08

|

|

|

30-Jun-08

|

|

|

|

|

(UNAUDITED)

|

|

|

|

|

|

ASSETS

|

|

|

Current

assets:

|

|

|

|

|

|

|

|

Cash

& cash equivalents

|

|

$

|

2,381,735

|

|

|

$

|

1,561,403

|

|

|

Accounts

receivable, net of allowance for doubtful

|

|

|

5,113,965

|

|

|

|

3,244,476

|

|

|

accounts

of $16,470 and $16,303, respectively

|

|

|

|

|

|

|

|

|

|

Inventory

|

|

|

435,538

|

|

|

|

561,883

|

|

|

Advances

to suppliers

|

|

|

859,784

|

|

|

|

1,486,379

|

|

|

Due

from related parties

|

|

|

1,596,931

|

|

|

|

1,580,820

|

|

|

Prepayments

and other current assets

|

|

|

22,153

|

|

|

|

35,675

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

current assets

|

|

|

10,410,106

|

|

|

|

8,470,636

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment

in Real Estate Ventures

|

|

|

6,549,514

|

|

|

|

6,483,437

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and

equipmen

t, net of accumulated depreciation

|

|

|

1,551,703

|

|

|

|

1,618,829

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

Assets

|

|

|

|

|

|

|

|

|

|

Land

use right, net of accumulated amortization

|

|

|

1,519,575

|

|

|

|

1,531,555

|

|

|

Notes

receivable

|

|

|

1,030,225

|

|

|

|

998,502

|

|

|

Long-term

prepayments

|

|

|

1,508,146

|

|

|

|

1,150,082

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

other assets

|

|

|

4,057,946

|

|

|

|

3,680,139

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Assets

|

|

$

|

22,569,269

|

|

|

$

|

20,253,041

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

AND STOCKHOLDERS' EQUITY

|

|

|

Current

liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts

payable

|

|

$

|

854,144

|

|

|

$

|

725,680

|

|

|

Accrued

expenses and other payables

|

|

|

806,155

|

|

|

|

809,463

|

|

|

Payable

to related parties

|

|

|

321,088

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

current liabilities

|

|

|

1,981,387

|

|

|

|

1,535,143

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term

payable - land use right

|

|

|

1,474,008

|

|

|

|

1,459,137

|

|

|

|

|

|

|

|

|

|

|

|

|

Minority

Interest

|

|

|

1,986,483

|

|

|

|

1,564,957

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders'

Equity:

|

|

|

|

|

|

|

|

|

|

Preferred

stock, $0.001 par value, 1,000,000 shares authorized,

|

|

|

|

|

|

|

|

|

|

-

0 - shares issued and outstanding at September 30, 2008 and June 30,

2008

|

|

|

-

|

|

|

|

-

|

|

|

Common

stock, $0.001 and $0.1208 par value, 74,000,000 and 74,000,000

shares

|

|

|

|

|

|

|

|

|

|

authorized,

30,000,000 and 30,000,000 shares issued and outstanding at

|

|

|

|

|

|

|

September

30, 2008 and June 30, 2008, respectively

|

|

|

30,000

|

|

|

|

30,000

|

|

|

Additional

paid-in-capital

|

|

|

3,846,035

|

|

|

|

3,846,035

|

|

|

Statutory

surplus reserve and common welfare fund

|

|

|

1,837,187

|

|

|

|

1,837,187

|

|

|

Retained

earnings

|

|

|

9,338,072

|

|

|

|

8,009,800

|

|

|

Accumulated

other comprehensive income

|

|

|

2,076,097

|

|

|

|

1,970,782

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

stockholders' equity

|

|

|

17,127,391

|

|

|

|

15,693,804

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Liabilities and Stockholders' Equity

|

|

$

|

22,569,269

|

|

|

$

|

20,253,041

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See

accompanying notes to the Consolidated Financial

Statements

|

|

|

|

|

|

|

|

|

|

CHINA

DASHENG BIOTECHNOLOGY COMPANY

|

|

|

(FORMERLY

NAMED AS MAX NUTRITION INC.)

|

|

|

CONSOLIDATED

STATEMENTS OF OPERATION

|

|

|

FOR

THE THREE MONTHS ENDED SEPTEMBER 30, 2008 AND 2007

|

|

|

(in

US DOLLARS)

|

|

|

|

|

|

|

|

|

|

|

|

|

For

the three months ended September 30,

|

|

|

|

|

2008

|

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Net

Sales

|

|

$

|

5,107,515

|

|

|

$

|

3,006,437

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost

of Sales

|

|

|

(2,666,604

|

)

|

|

|

(1,811,755

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Gross

profit

|

|

|

2,440,911

|

|

|

|

1,194,682

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Expenses:

|

|

|

|

|

|

|

|

|

|

Selling

expenses

|

|

|

350,927

|

|

|

|

150,077

|

|

|

Genernal

and administration expense

|

|

|

454,915

|

|

|

|

199,670

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

operating expenses

|

|

|

805,842

|

|

|

|

349,747

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

from Operations

|

|

|

1,635,069

|

|

|

|

844,935

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

Income and Expenses:

|

|

|

|

|

|

|

|

|

|

Interest

income (expenses)

|

|

|

26,237

|

|

|

|

(22,383

|

)

|

|

Other

income

|

|

|

2,925

|

|

|

|

4,546

|

|

|

Other

expenses

|

|

|

(4,923

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

other income and (expense)

|

|

|

24,239

|

|

|

|

(17,837

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Income

before income taxes and minority interest

|

|

|

1,659,308

|

|

|

|

827,098

|

|

|

|

|

|

|

|

|

|

|

|

|

Minority

Interest

|

|

|

(331,036

|

)

|

|

|

(171,243

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net

income

|

|

$

|

1,328,272

|

|

|

$

|

655,855

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

Comprehensive Income:

|

|

|

|

|

|

|

|

|

|

Foreign

currency translation adjustment

|

|

|

97,236

|

|

|

|

175,384

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive

income

|

|

$

|

1,425,508

|

|

|

$

|

831,239

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

and Diluted Income per common share

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.04

|

|

|

$

|

0.02

|

|

|

Diluted

|

|

$

|

0.04

|

|

|

$

|

0.02

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

average common share outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

30,000,000

|

|

|

|

32,080,000

|

|

|

Diluted

|

|

|

30,000,000

|

|

|

|

32,080,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See

accompanying notes to the Consolidated Financial

Statements

|

|

|

|

|

|

|

CHINA

DASHENG BIOTECHNOLOGY COMPANY

|

|

|

(FORMERLY

NAMED AS MAX NUTRITION INC.)

|

|

|

CONSOLIDATED

STATEMENTS OF CASH FLOWS

|

|

|

FOR

THE THREE MONTHS ENDED SEPTEMBER 30, 2008 AND 2007

|

|

|

(

in US DOLLARS)

|

|

|

|

|

|

|

|

|

|

|

|

|

For

the three months ended September 30,

|

|

|

|

|

2008

|

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Cash

Flows From Operating Activities:

|

|

|

|

|

|

|

|

Net

income

|

|

$

|

1,328,272

|

|

|

$

|

655,855

|

|

|

Adjustments

to reconcile net income to net cash

|

|

|

|

|

|

|

|

|

|

provided

by operating activities:

|

|

|

|

|

|

|

|

|

|

Minority

interest in net income of consoldiated subsidiaries

|

|

|

331,036

|

|

|

|

171,243

|

|

|

Interest

income from real estate project

|

|

|

(21,396

|

)

|

|

|

-

|

|

|

Bad

debt expense

|

|

|

(167

|

)

|

|

|

-

|

|

|

Depreciation

expense

|

|

|

67,126

|

|

|

|

74,897

|

|

|

Amortization

expense

|

|

|

11,980

|

|

|

|

36,600

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes

in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts

receivable

|

|

|

(1,869,320

|

)

|

|

|

(1,200,754

|

)

|

|

Inventory

|

|

|

(43,794

|

)

|

|

|

228,764

|

|

|

Advance

to suppliers

|

|

|

626,595

|

|

|

|

|

|

|

Prepayments

and other current assets

|

|

|

(344,543

|

)

|

|

|

(103,480

|

)

|

|

Accounts

payable

|

|

|

298,603

|

|

|

|

695,756

|

|

|

Accrued

expenses and other current liabilities

|

|

|

(3,308

|

)

|

|

|

(1,217,448

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash

provided (used) by operating activities

|

|

|

381,084

|

|

|

|

(658,567

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash

Flows From Investing Activities:

|

|

|

|

|

|

|

|

|

|

Purchases

of property, plant and equipment

|

|

|

-

|

|

|

|

(21,198

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash

used in investing activities

|

|

|

-

|

|

|

|

(21,198

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash

Flows From Financing Activities:

|

|

|

|

|

|

|

|

|

|

Repayment

of loans payable

|

|

|

321,088

|

|

|

|

-

|

|

|

Advances

received from related parties

|

|

|

-

|

|

|

|

1,816,110

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

provided by financing activities

|

|

|

321,088

|

|

|

|

1,816,110

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect

of currency exchange rate on cash and cash equivalents

|

|

|

118,160

|

|

|

|

27,884

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase

in cash and cash equivalents

|

|

|

820,332

|

|

|

|

1,164,229

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

and Cash Equivalents - Beginning of the year

|

|

|

1,561,403

|

|

|

|

1,316,569

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

and Cash Equivalents - Ending of the year

|

|

$

|

2,381,735

|

|

|

$

|

2,480,798

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental

disclosures of cash flow information:

|

|

|

|

|

|

|

|

|

|

Interest

paid

|

|

$

|

41,760

|

|

|

$

|

22,383

|

|

|

Income

Taxes paid

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See

accompanying notes to the Consolidated Financial

Statements

|

|

|

|

|

|

CHINA

DASHENG BIOTECHNOLOGY COMPANY AND SUBSIDIARIES

Notes

to the Consolidated Financial Statements

September 30,

2008

(Unaudited)

NOTE

1 – ORGANIZATION AND OPERATIONS

China Dasheng Biotechnology Company (“Dasheng” or the “Company”) was

incorporated in the state of Nevada on January 12, 2007, under the original name

of Max Nutrition Inc, as a holding vehicle for selling the nutritional

supplements.

On January 29, 2008, Pursuant to an Agreement and Plan of Reorganization,

American Spring Pharmaceutical, Inc., a Delaware corporation (“ASPI”) purchased

an aggregate of 7,700,000 shares of the 10,000,000 issued and outstanding shares

of Max Nutrition common stock for $183,000 and ASPI’s transfer of 100% of the

issued and outstanding shares of Gansu Dasheng Biology Science and Technology

Stock Co., Ltd. (“Dasheng”) to Max Nutrition in exchange for 20,000,000 shares

of the common stock of Max Nutrition. Upon completion of the transaction, ASPI

distributed 27,700,000 shares of Max Nutrition common stock it received from Max

Nutrition and the Max Nutrition’ previous principal stockholder to Dasheng’s

shareholders, pro rata. At the effective time of the merger, the total number of

shares of Max Nutrition acquired and number of shares of Max Nutrition Common

Stock issued to the shareholders of Dasheng pursuant to the agreement,

represented approximately 92.33% of the outstanding shares of Max Nutrition’s

common stock after giving effect to Max Nutrition’s acquisition of Dasheng. As a

result of the ownership interests of the former shareholders of Dasheng, for

financial statement reporting purposes, the merger between the Company and

Dasheng has been treated as a reverse acquisition with Dasheng deemed as the

accounting acquirer and the Max Nutrition deemed the accounting acquire in

accordance with Statement of Financial Accounting Standards No. 141 “Business

Combinations” (“SFAS No. 141”). The reverse merger is deemed as a

recapitalization of Dasheng and the net assets of Dasheng (the accounting

acquirer) are carried forward to the Company (the legal acquirer and the

reporting entity) at their historical carrying value before the combination. The

assets and liabilities of Dasheng are recorded at historical cost.

Gansu Dasheng Biology Science and Technology Stock Co., Ltd. was incorporated on

October 16, 2002, in the City of Lanzhou, Gansu Province, People’s Republic of

China (“PRC”). Dasheng operates within the biological products and agents

market. This space includes organic fertilizers, non-chemical agents, and

biological agents based additives.

On March 6, 2008, the Company changed its name to China Dasheng Biotechnology

Company.

The Company derived its revenues from the sale of products in the biological

products and agents market. All revenues generated are from sales to customers

in China. The Company has two majority-owned subsidiaries in China. It has 80%

interest in Hainan Lüshen Biology Technology Co., Ltd. (“Lüshen”) located in

HaiKou, Hainan Province, China. Lüshen engages in developing, manufacturing and

marketing artificial microorganisms (“AM”), high-efficiency microorganism (“HM”)

based biological bacterium blends, and biological preservatives. The Company

also has a 60% interest in

Yangling Elemiss Foods Co., Ltd. (“Elemiss”) located in City of Yangling,

Shaanxi Province, China. Elemiss engages in developing, manufacturing and

marketing artificial microorganism (“AM”) based biological bacterium blends, and

Bulgarian lactobacillus live stock feed additives.

CHINA

DASHENG BIOTECHNOLOGY COMPANY AND SUBSIDIARIES

Notes

to the Consolidated Financial Statements

September 30,

2008 (Continued)

(Unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Interim

Statements

The

accompanying unaudited interim financial statements of China DaSheng

Biotechnology Company have been prepared in accordance with accounting

principles generally accepted in the United States of America and the rules of

the Securities and Exchange Commission, and should be read in conjunction with

the audited consolidated financial statements and notes thereto contained in the

Company’s Amendment No. 1 to Annual Report filed with the SEC on Form 10-K/A. In

the opinion of management, all adjustments, consisting of normal recurring

adjustments, necessary for a fair presentation of financial position and the

results of operations for the interim periods presented have been reflected

herein. The results of operations for the interim periods are not necessarily

indicative of the results to be expected for the full year. Notes to the

consolidated financial statements which would substantially duplicate the

disclosure contained in the audited consolidated financial statements for 2008

as reported in the 10-K/A have been omitted.

Basis

of presentation and consolidation

The

consolidated financial statements include the financial statements of DaSheng,

and its wholly owned subsidiary, and its majority-owned subsidiaries, Lüshen and

Elemiss. All significant inter-company transactions and balances among the

Company and its subsidiary are eliminated upon consolidation.

Certain previously reported amounts have been reclassified to conform to

classifications adopted in the period ended September 30,

2008.

Accounts

receivables consist primarily of receivables resulting from sales of products.

The Company establishes provisions for doubtful accounts receivable based on

management’s estimates of amounts that it believes are unlikely to be

collected. Collectability of receivables is reviewed and the

allowance for doubtful accounts is adjusted at least quarterly, based on aging

of specific accounts and other available information about the associated

customers. The allowance for uncollectible amounts as of September 30, 2008 and

June 30, 2008 was $16,470 and $16,303, respectively.

Investment

in real estate ventures

The Company had two joint ventures for real estate projects in China to develop

commercial and residential real estate in China. The Company’s ownership

interests in the two ventures are 17.5% and 16.5%, respectively. As a result,

the Company accounts for these two ventures based on cost method of

accounting.

Land

use rights

Land use rights represent the cost to obtain the right to use land in China.

Land use rights are carried at cost and amortized on a straight-line basis over

the lives of the rights, ranging from 17 to 50 years.

CHINA

DASHENG BIOTECHNOLOGY COMPANY AND SUBSIDIARIES

Notes

to the Consolidated Financial Statements

September 30,

2008 (Continued)

(Unaudited)

NOTE 2 – SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES (Continued)

Patent

and purchased formulae

The Company has adopted the guidelines as set out in Statement of Financial

Accounting Standards No. 142 “Goodwill and Other Intangible Assets” (“SFAS No.

142”) for the patent and purchased formulae. Under the requirements as set out

in SFAS No. 142, the Company amortizes the costs of acquired patent and formulae

over their remaining legal lives or the term of the contract, whichever is

shorter. All internally developed process costs incurred to the point when a

patent application is to be filed are expensed as incurred and classified as

research and development costs. Patent application costs, generally legal costs,

thereafter incurred, are capitalized pending disposition of the individual

patent application, and are subsequently either amortized based on the initial

patent life granted, generally 15 to 20 years for domestic patents and 5 to 20

years for foreign patents, or expensed if the patent application is rejected.

The costs of defending and maintaining patents are expensed as incurred. Upon

becoming fully amortized, the related cost and accumulated amortization are

removed from the accounts.

Impairment

of long-lived assets

Long-lived assets, which include property, plant and equipment and intangible

assets, are reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset may not be

recoverable.

Recoverability of long-lived assets to be held and used is measured by a

comparison of the carrying amount of an asset to the estimated undiscounted

future cash flows expected to be generated by the asset. If the

carrying amount of an asset exceeds its estimated undiscounted future cash

flows, an impairment charge is recognized by the amount by which the carrying

amount of the asset exceeds the fair value of the assets. Fair value

is generally determined using the asset’s expected future discounted cash flows

or market value, if readily determinable. No impairment loss is recorded

for three months ended September 30, 2008 and 2007.

Income

taxes

The Company accounts for income tax under the provisions of SFAS No.109

"Accounting for Income Taxes", which requires recognition of deferred tax assets

and liabilities for the expected future tax consequences of the events that have

been included in the financial statements or tax returns. Deferred

income taxes are recognized for all significant temporary differences between

tax and financial statements bases of assets and

liabilities. Valuation allowances are established against net

deferred tax assets when it is more likely than not that some portion or all of

the deferred tax asset will not be realized. There are no deferred

tax amounts as at September 30, 2008 and June 30, 2008.

Revenue

recognition

The Company utilizes the accrual method of accounting. In accordance

with the provisions of Staff Accounting Bulletin (“SAB”) 104, sales revenue is

recognized when products are shipped and payments of the customers and

collection are reasonably assured. Payments received before all of

the relevant criteria for revenue recognition are satisfied are recorded as

unearned revenue.

The Company follows the guidance of the Securities and Exchange Commission’s

Staff Accounting Bulletin 104 (“SAB No.104”) for revenue recognition. The

Company records revenue when persuasive evidence of an arrangement exists,

product delivery has occurred and the title and risk of loss transfer to the

buyer, the sales price to the customer is fixed or determinable, and

collectability is reasonably assured. For sale of additive for livestock

feed and crop cultivation, the Company derives the majority of its revenue from

sales contracts with customers with revenues being generated upon the shipment

of goods. Persuasive evidence of an arrangement is demonstrated via invoice,

product delivery is evidenced by warehouse shipping log as well as a signed bill

of lading from the trucking or rail company and title transfers upon shipment,

based on either free on board (“FOB”) factory or destination terms; the sales

price to the customer is fixed upon acceptance of the purchase order and there

is no separate sales rebate, discount, or volume incentive. When the Company

recognizes revenue, no provisions are made for returns because, historically,

there have been very few sales returns and adjustments that have impacted the

ultimate collection of revenues.

Earnings

per share

The Company computes earnings per share (“EPS’) in accordance with Statement of

Financial Accounting Standards No. 128, “Earnings per Share” ("FAS No. 128”),

and SEC Staff Accounting Bulletin No. 98 (“SAB 98”). SFAS

No. 128 requires companies with complex capital structures to present basic

and diluted EPS. Basic EPS is measured as net income divided by the

weighted average common shares outstanding for the period. Diluted EPS is

similar to basic EPS but presents the dilutive effect on a per share basis of

potential common shares (e.g., convertible securities, options and warrants) as

if they had been converted at the beginning of the periods presented, or

issuance date, if later. Potential common shares that have an

anti-dilutive effect (i.e., those that increase income per share or decrease

loss per share) are excluded from the calculation of diluted EPS. There are

30,000,000 and 30,000,000 shares of common stock equivalent available in the

computation of dilute earnings per share at September 30, 2008 and June 30, 2008

respectively.

Risks

and uncertainties

The operations of the Company are located in the PRC. Accordingly, the Company's

business, financial condition, and results of operations may be influenced by

the political, economic, and legal environments in the PRC, as well as by the

general state of the PRC economy.

The Company’s operations in the PRC are subject to special considerations and

significant risks not typically associated with companies in North America and

Western Europe. These include risks associated with, among others, the

political, economic and legal environment and foreign currency exchange. The

Company’s results may be adversely affected by changes in the political and

social conditions in the PRC, and by changes in governmental policies with

respect to laws and regulations, anti-inflationary measures, currency

conversion, remittances abroad, and rates and methods of taxation, among other

things.

CHINA

DASHENG BIOTECHNOLOGY COMPANY AND SUBSIDIARIES

Notes

to the Consolidated Financial Statements

September 30,

2008 (Continued)

(Unaudited)

NOTE 2 – SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES (Continued)

Foreign

currency translation

The Company’s functional currency is the Renminbi (“RMB”). For financial

reporting purposes, RMB has been translated into United States dollars ("USD")

as the reporting

currency.

Assets and liabilities are translated at the exchange rate in effect at the

balance sheet date. Revenues and expenses are translated at the average rate of

exchange prevailing during the reporting period. Translation adjustments arising

from the use of different exchange rates from period to period are included as a

component of stockholders' equity as "Accumulated other comprehensive income".

Gains and losses resulting from foreign currency translations are included in

accumulated other comprehensive income. There is no significant

fluctuation in exchange rate for the conversion of RMB to USD after the balance

sheet date.

NOTE

3 – INVENTORY

The inventory consists of the following:

|

|

|

Balance

as of

|

|

|

|

|

September

30,2008

|

|

|

June

30, 2008

|

|

|

Raw

materials

|

|

$

|

9,108

|

|

|

$

|

218,985

|

|

|

Packing

materials

|

|

|

35,209

|

|

|

|

14,461

|

|

|

Work-in-process

|

|

|

347,206

|

|

|

|

246,695

|

|

|

Finished

goods

|

|

|

44,015

|

|

|

|

81,742

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

435,538

|

|

|

$

|

561,883

|

|

|

|

|

|

|

|

|

|

|

|

No allowance for inventory was made for as of September 30, 2008 and June 30,

2008.

NOTE

4 – RELATED PARTY TRANSACTIONS

The detail of related party transactions is as follows:

(i) Office space

On

December 1, 2006, Lüshen entered into a non-cancellable operating lease for its

manufacturing facility in Hainan Province from Dasheng Industries Co., Ltd., an

affiliate of the Company, expiring November 30, 2026. Lüshen prepaid the total

lease obligation of RMB3.0 million (equivalent to $441,833 and $437,375 at

September 30, 2008 and June 30, 2008 respectively) upon signing the lease, which

approximates the present fair market value of the lease.

(ii)

Due from (+) and to (-) related parties

|

|

|

Balance

as of

|

|

|

|

September

30, 2008

|

|

|

June

30, 2008

|

|

|

Receivables

from shareholders/officers

|

|

$

|

1,596,931

|

|

|

$

|

1,580,820

|

|

|

Payable

to shareholder

|

|

|

(321,088

|

)

|

|

|

-

|

|

|

Total

|

|

$

|

1,275,843

|

|

|

$

|

1,580,820

|

|

|

|

|

|

|

|

|

|

|

|

The

advances to shareholders/officers bear no interest and have no formal repayment

terms.

CHINA

DASHENG BIOTECHNOLOGY COMPANY AND SUBSIDIARIES

Notes

to the Consolidated Financial Statements

September 30,

2008 (Continued)

(Unaudited)

NOTE 5 – REAL

ESTATE

i) Dasheng Garden Development Project

On March 19, 2005, the Company signed a joint venture property development

("JV") agreement with an unrelated developer (the "Developer"). Under the

agreement, the Company was required to (1) contribute RMB14 million (equivalent

to $1,924,002 at date of signing) in cash as the investment into the project,

(2) assist the Developer in the project planning and (3) assist the Developer in

applying for and obtaining relevant approvals. The Developer was required

to contribute RMB71million (equivalent to $8,578,505 at date of signing) in cash

into the project.

Upon completion of Phase I, representing approximately 50% of the Company owned

land use rights in the City of Lanzhou, the Company will receive RMB7 million

(equivalent to $845,768 at date of signing) from the JV and will retain the

ownership of all the commercial retail units on the first floor and the basement

which will be sold as a parking lot, and the Developer will obtain all remaining

units.

Upon completion of Phase II, (which concerns the development of the remaining

50% of the land use rights, the Company and the Developer will be entitled to

29% and 71% of the net profits, respectively.

The Company ownership percentage in the real estate venture is

16.5%.

On June 30, 2005 the Company transferred the land use right associated with

Phase I valued at RMB 2,929,686 (equivalent to $353,976 at date of transfer)

less accumulated amortization of RMB459,142 (equivalent to $55,475 at date

of transfer) from the land use right account and reclassified the net amount to

investment in real estate ventures, with no further amortization of the land use

right to be taken.

On

December 31, 2007, the Company received cash from Dasheng Garden Development of

RMB 7,000,000 (equivalent to US$1,020,542), which was accounted for as a

reduction of the investment in real estate investment (return of

capital).

(ii) Changlin Real Estate Development project

On May 31, 2008, the Company contributed RMB35m (equivalent to US$5,102,710) to

set up a joint venture of Changlin Real Estate Development Co., Ltd. The joint

venture intends to develop residential real estate in an old manufacturing site

in Lanzhou within 2 years. The Company's share of the joint venture project is

17.5%.

CHINA

DASHENG BIOTECHNOLOGY COMPANY AND SUBSIDIARIES

Notes

to the Consolidated Financial Statements

September 30,

2008 (Continued)

(Unaudited)

NOTE

6 - PROPERTY, PLANT ADN EQUIPMENT, NET

The detail of property, plant and equipment is as follows:

|

|

|

Balance

as of

|

|

|

|

|

September

30,2008

|

|

|

June

30, 2008

|

|

|

Buildings

and improvements

|

|

$

|

1,610,801

|

|

|

$

|

1,594,550

|

|

|

Machinery

and equipments

|

|

|

1,162,135

|

|

|

|

1,278,136

|

|

|

Transportation

equipments

|

|

|

333,251

|

|

|

|

258,194

|

|

|

Office

equipments

|

|

|

104,731

|

|

|

|

62,729

|

|

|

Sub-total

|

|

|

3,210,918

|

|

|

|

3,193,609

|

|

|

Less:

Accumulated Depreciation

|

|

|

(1,659,215

|

)

|

|

|

(1,574,780

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

1,551,703

|

|

|

$

|

1,618,829

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation expense for the three months ended September 30, 2008 and 2007 was

$67,126 and $74,897, respectively.

CHINA

DASHENG BIOTECHNOLOGY COMPANY AND SUBSIDIARIES

Notes

to the Consolidated Financial Statements

September 30,

2008 (Continued)

(Unaudited)

NOTE

7 - LAND USE RIGHTS

All land in the People’s Republic of China is government owned and cannot be

sold to any individual or company. Instead, the government grants the user a

“Land use right” (the “Right”) to use the land.

On

August 17, 2006, Elemiss entered into an agreement with and obtained a

certificate of a land use right from the Chinese government, whereby Elemiss

acquired for RMB 703,200 (equivalent to $88,247 at date of acquisition) the

right to use certain land until August 16, 2056. The purchase price is being

amortized over the term of the right, which is 50

years.

Net land use right at September 30, 2008 and June 30, 2008 were as

follows:

|

|

|

Balance

as of

|

|

|

|

|

September

30,2008

|

|

|

June

30, 2008

|

|

|

Land

use right

|

|

$

|

1,902,492

|

|

|

$

|

1,883,298

|

|

|

Less:

Accumulated amortization

|

|

|

(382,917

|

)

|

|

|

(351,743

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

1,519,575

|

|

|

$

|

1,531,555

|

|

|

|

|

|

|

|

|

|

|

|

Amortization expense for the three months ended September 30, 2008 and 2007 was

$11,980 and $36,600, respectively. Amortization expense for the next five years

is approximately $70,510 per year.

As of September 30, 2008 and June 30, 2008, the Company had notes receivable due

from Weiye Forestry Ecosystem and Development Co., Ltd (“Weiye

Forestry”). On May 24, 2007, the Company sold its forestry

development rights at RMB 10,439,340 (equivalent to US$1,364,174 at

date of signing) to Weiye Forestry for 5 installments from 5/23/2008 to

5/23/2012. According to this agreement, the Company would collect RMB

2,000,000 annually, with the remaining RMB 439,340 collected at the last

year. Weiye Forestry was a related party at the time the transaction

occurred. The CEO of one of the Company’s affiliates was the owner of Weiye.

During the year ended June 30, 2008, this person was no longer the CEO of the

affiliated company. As a result, Weiye is no longer a related

party.

As

this sale of forestry development right payment term is five years and there is

no specified interest rate, the Company used discounted rate of 8.5%, which

approximate five year China bank loan rate, to calculate present value of the

future payments.

NOTE

9. PREPAYMENTS

As of September 30, 2008 and June 30, 2008, long-term prepayments consisted of

the followings:

|

|

|

Balance

as of

|

|

|

|

|

September

30,2008

|

|

|

June

30, 2008

|

|

|

Consulting

Fees

|

|

$

|

987,152

|

|

|

$

|

538,850

|

|

|

Land

Lease Exp.

|

|

|

344,261

|

|

|

|

406,394

|

|

|

Rental

|

|

|

-

|

|

|

|

4,374

|

|

|

Advertisement

|

|

|

176,733

|

|

|

|

200,464

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

1,508,146

|

|

|

$

|

1,150,082

|

|

|

|

|

|

|

|

|

|

|

|

NOTE

10. ACCRUED EXPENSES AND OTHER PAYABLES

As of September 30, 2008 and June 30, 2008, accrued expenses and other payables

consisted of the followings:

|

|

|

Balance

as of

|

|

|

|

|

September

30,2008

|

|

|

June

30, 2008

|

|

|

Accrued

expenses

|

|

$

|

476,351

|

|

|

$

|

477,512

|

|

|

Other

payables and accruals

|

|

|

329,804

|

|

|

|

331,951

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

806,155

|

|

|

$

|

809,463

|

|

|

|

|

|

|

|

|

|

|

|

NOTE

11. LONG-TERM PAYABLE-LAND USE RIGHTS

In April 2001, Lüshen obtained a land use right from the Chinese government, for

RMB 10,008,364 (equivalent to $1,200,381 at the date of acquisition). The term

of the land use right is through May 18, 2031. The purchase price is being

amortized over the term of the right. The payment of the original purchase price

was deferred and due on or before June 24, 2011. The long-term

payable bears no interest.

NOTE

12 – INCOME TAXES

The

Company is governed by the Income Tax Law of the People’s Republic of China

concerning foreign invested companies, which, until January 2008, generally

subject to tax at a statutory rate of 33% (30% state income tax plus 3% local

income tax) on income reported in the statutory financial statements after

appropriate tax adjustments.

Substantially all of the Company’s taxable income and related tax expense are

from PRC sources. Dasheng, Lüshen and Elemiss file separate income tax returns

under the Income Tax Law of the People’s Republic of China concerning Foreign

Investment Enterprises and Foreign Enterprises and local income tax laws (the

“PRC Income Tax Law”). In accordance with the relevant income tax laws, the

profits of the Company derived from agribusiness are fully exempted from income

taxes and the profits of the Company derived from real estate investment are

subject to income taxes. As of September 30, 2008 and 2007, the Company derived

all of its revenues and profits from its agriculture business.

On

March 16, 2007, the National People’s Congress of China approved the Corporate

Income Tax Law of the People’s Republic of China (the “New CIT Law”), which is

effective from January 1, 2008. Under the new law, the corporate income tax rate

applicable to all Companies, including both domestic and foreign-invested

companies, will be 25%, replacing the current applicable tax rate of

33%. However, tax concession granted to eligible companies prior to

the new CIT laws will be grand fathered in.

The

Company has been formally approved by the local tax bureau for the favorable tax

benefit enjoyed by the foreign invested company, which allows two-year tax

exemption from income tax from January 1, 2007 through December 31, 2008, and

three-year 50% tax reduction from January 1, 2009 to December 31, 2011. As a

result of this tax reduction benefit, the Company is still subject to income tax

exemption for the three months ended September 30,

2008.

CHINA

DASHENG BIOTECHNOLOGY COMPANY AND SUBSIDIARIES

Notes

to the Consolidated Financial Statements

September 30,

2008 (Continued)

(Unaudited)

NOTE

13. FOREIGN OPERATION

(i)

Operations

Substantially all of the Company’s operations are carried out and all of its

assets are located in the PRC. Accordingly, the Company’s business, financial

condition and results of operations may be influenced by the political, economic

and legal environments in the PRC. The Company’s business may be influenced by

changes in governmental policies with respect to laws and regulations,

anti-inflationary measures, currency fluctuation and remittances and methods of

taxation, among other things.

(ii) Profit Appropriation & Statutory Reserves

Under

the laws of the PRC, net income after taxation can only be distributed as

dividends after appropriation has been made for the following: (i) cumulative

prior years’ losses, if any; (ii) allocations to the "Statutory Surplus Reserve"

of at least 10% of net income after tax, as determined under PRC accounting

rules and regulations, until the fund amounts to 50% of the Company’s registered

capital; (iii) Allocations to any discretionary surplus reserve, if approved by

stockholders.

The

statutory reserves represent restricted retained earnings and is

non-distributable other than during liquidation and can be used to fund previous

years’ losses, if any, and may be utilized for business expansion or converted

into share capital by issuing new shares to existing shareholders in proportion

to their shareholding or by increasing the par value of the shares currently

held by them, provided that the remaining reserve balance after such issue is

not less than 25% of the registered capital.

As of September 30, 2008 and June 30, 2008, the Company established and

segregated in retained earnings an aggregate amount for the Statutory Surplus

Reserve of $1,837,187 and $1,837,187, respectively.

Note

14. CONCENTRATIONS AND CREDIT RISK

Financial instruments that potentially subject the Company to significant

concentration of credit risk consist primarily of cash and cash

equivalents. As of September 30, 2008 and June 30, 2008,

substantially all of the Company’s cash and cash equivalents were held by major

financial institutions located in the PRC, none of which are insured. However,

the Company has not experienced losses on these accounts and management believes

that the Company is not exposed to significant risks on such

accounts.

ITEM

2. MANGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Forward

Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking” statements as such

term is defined in the Private Securities Litigation Reform Act of 1995 and

information relating to the Company that is based on the beliefs of the

Company’s management as well as assumptions made by and information currently

available to the Company’s management. When used in this report, the words

“anticipate,” “believe,” “estimate,” “expect” and “intend” and words or phrases

of similar import, as they relate to the Company or Company management, are

intended to identify forward-looking statements. Such statements reflect the

current risks, uncertainties and assumptions related to certain factors

including, without limitations, competitive factors, general economic

conditions, customer relations, relationships with vendors, the interest rate

environment, governmental regulation and supervision, seasonality, distribution

networks, product introductions and acceptance, technological change, changes in

industry practices, onetime events and other factors described herein and in

other filings made by the company with the Securities and Exchange Commission.

Based upon changing conditions, should any one or more of these risks or

uncertainties materialize, or should any underlying assumptions prove incorrect,

actual results may vary materially from those described herein as anticipated,

believed, estimated, expected or intended. The Company does not intend to update

these forward-looking statements.

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

RESULTS OF OPERATIONS – Th

ree

Months Ended September 30, 2008 compared to Three Months Ended September 30,

2007

Revenues for the three months ended September 30, 2008 were $5,107,515, compared

to $3,006,437 for the same period in 2007. The $2,101,078, or 69.8% increase in

revenues was primarily due to an increase in AM/HM livestock feed additive

products and bacterial based fertilizer sales volume. For the three months ended

September 30, 2008, we sold a total of 1,694.12 and 227.96 tons of AM/HM

livestock feed additives and bacterial based fertilizer respectively in

comparison to 863.14 and 49.90 tons in the same period in 2007. Overall, we saw

a healthy growth in the sales volume of all four of our major product

lines.

The following is a breakdown of revenue by product, by region, and by subsidiary

and as a percentage of total revenue:

|

|

|

Percentage

of Q1 2008

|

|

|

Percentage

of Q1 2009

|

|

|

Product

line

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AM/HM™

Crop additives

|

|

$

|

1,919,328

|

|

|

|

63.84

|

%

|

|

$

|

2,729,170

|

|

|

|

53.43

|

%

|

|

AM/HM™

Livestock feed additives

|

|

$

|

926,669

|

|

|

|

30.82

|

%

|

|

$

|

1,896,619

|

|

|

|

37.13

|

%

|

|

FGW™

Preservatives

|

|

$

|

90,991

|

|

|

|

3.03

|

%

|

|

$

|

151,059

|

|

|

|

2.96

|

%

|

|

Bacterial

based Fertilizer

|

|

$

|

69,449

|

|

|

|

2.31

|

%

|

|

$

|

330,690

|

|

|

|

6.47

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

3,006,437

|

|

|

|

|

|

|

$

|

5,107,515

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

Percentage

of Revenue

|

|

|

Region

|

|

|

|

|

|

|

|

|

Northwest

|

|

$

|

1,751,895

|

|

|

|

34.30

|

%

|

|

Southwest

|

|

$

|

102,252

|

|

|

|

2.00

|

%

|

|

Northern

|

|

$

|

464,367

|

|

|

|

9.09

|

%

|

|

Northeast

|

|

$

|

152,385

|

|

|

|

2.98

|

%

|

|

Central

|

|

$

|

87,690

|

|

|

|

1.72

|

%

|

|

Eastern

|

|

$

|

466,680

|

|

|

|

9.14

|

%

|

|

South

|

|

$

|

2,082,268

|

|

|

|

40.77

|

%

|

|

|

|

Revenue

|

|

|

Percentage

of Revenue

|

|

|

Subsidiaries

|

|

|

|

|

|

|

|

|

Hainan

Lüshen

|

|

$

|

2,082,268

|

|

|

|

40.77

|

%

|

|

Yangling

Elemiss

|

|

$

|

1,263,173

|

|

|

|

24.73

|

%

|

|

Gansu

Dasheng

|

|

$

|

1,762,097

|

|

|

|

34.50

|

%

|

Gross profit for the three months ended September 30, 2008 was $2,440,911, an

increase of $1,246,229 or 104.3% compared to the same period in 2007. The

increase in gross profit is a direct result of our increase in revenues as we

experienced an increase in demand for our products.

|

|

|

Gross

Margin

|

|

|

|

|

for

the quarter ended Sept 30, 2008

|

|

|

Product

line

|

|

|

|

|

AM/HM™

Crop Additives

|

|

|

48.73

|

%

|

|

AM/HM™ Livestock

feed Additives

|

|

|

46.19

|

%

|

|

|

|

|

39.05

|

%

|

|

Bacterial

based Fertilizer

|

|

|

53.21

|

%

|

|

|

|

|

|

|

|

Over

all

|

|

|

47.79

|

%

|

Operating expenses for the three months ended September 30, 2008 were $805,842

compared to $349,747 in the same period for 2007. This increase of $456,095 or

130.4% is primarily due to the significantly increase Selling and General

Administrative expenses. Our selling and general administrative expenses were

increased by $200,850 and $255,245 respectively. The cause for the increase is

primarily because of the increase of advertising and sales promotion

expense and professional fees. The advertising and sales promotion expense

has significantly increased by $130,456 or 330% from the same period of

2007. The professional fee of $212,125 which did not

incurred for the same period of 2007 also materially increased our

current quarter's operation expenses.

Net

income for the three months ended September 30, 2008 was $1,328,272, an increase

of $672,417 or 102.5% compared to the same period in 2007. The increase in net

income is due to our higher sales volume which is a result of greater market

demand.

LIQUIDITY AND CAPITAL RESOURCES

At

September 30, 2008, we had $8,428,719 in working capital, an increase of

$1,493,226 since the end of the last fiscal year on June 30,

2008. The increase was primarily a result of our net income for the

quarter. In addition to $2,381,735 in cash and cash equivalents, the

greater portion of our current working capital consists of account receivables

of $5,113,965. We expect that account receivables will be

significantly reduced the end of calendar year 2008. In addition, we are

owed $1,596,931 by Weiye Forestry Ecosystem and Development Co., Ltd (“Weiye

Forestry”). On May 24, 2007, the Company sold its forestry

development rights at RMB10, 439,340 (equivalent to US$ 1,364,174 at

date of signing) to Weiye Forestry for 5 installments from 5/23/2008 to

5/23/2012. According to this agreement, the Company would collect

RMB2,000,000 annually.

Net

cash used in operating activities totaled $381,084 for the three months ended

September 30, 2008, as compared to cash used by operating activities of $658,567

for the three months ended September 30, 2007. The net cash used in

operations was largely due to the increase in account receivable of

$1,869,320.

We had no

investing activities for the three month period ended September 30, 2008 as

compared to the same period in 2007 when we had $21,198 in purchase of plant and

equipment.

Net cash provided by financing activities was $321,088 for the three months

ended September 30, 2008 as compared to $1,816,110 for the same period in 2007.

CRITICAL

ACCOUNTING POLICIES AND USE OF ESTIMATES

The discussion and analysis of our financial condition and results of operations

are based on our unaudited financial statements, which have been prepared

according to U.S. generally accepted accounting principles. In preparing these

financial statements, we are required to make estimates and judgments that

affect the reported amounts of assets, liabilities, revenues and expenses and

related disclosures of contingent assets and liabilities. We evaluate these

estimates on an on-going basis. We base these estimates on historical experience

and on various other assumptions that we believe are reasonable under the

circumstances, the results of which form the basis for making judgments about

the carrying values of assets and liabilities. Actual results may differ from

these estimates under different assumptions or conditions. We consider the

following accounting policies to be the most important to the portrayal of our

financial condition and that require the most subjective judgment.

ITEM 3. QUANTITATIVE AND QUALITATIVE

DISCLOSURES ABOUT MARKET RISK

The Company is

subject to certain market risks, including changes in interest rates and

currency exchange rates. The Company does not undertake any specific actions to

limit those exposures.

ITEM

4. CONTROLS AND PROCEDURES

(a) Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that

information required to be disclosed in our Securities Exchange Act reports is

recorded, processed, summarized and reported within the time periods specified

in the SEC’s rules and forms, and that such information is accumulated and

communicated to our management, including our Principal Executive Officer and

Principal Financial Officer, as appropriate, to allow timely decisions regarding

required disclosure. In designing and evaluating the disclosure controls and

procedures, management recognized that any controls and procedures, no matter

how well designed and operated, can provide only reasonable assurance of

achieving the desired control objectives, as ours are designed to do, and

management necessarily was required to apply its judgment in evaluating the

cost-benefit relationship of possible controls and procedures.

As

of March 31, 2008, we carried out an evaluation, under the supervision and with

the participation of our management, including our Principal Executive Officer

and Principal Financial Officer, of the effectiveness of the design and

operation of our disclosure controls and procedures, as defined in

Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934.

Based upon that evaluation, our Principal Executive Officer and Principal

Financial Officer concluded that our disclosure controls and procedures are

effective in enabling us to record, process, summarize and report information

required to be included in our periodic SEC filings within the required time

period.

(b) Changes in Internal Controls

There

have been no changes in our internal control over financial reporting that

occurred during the period covered by this report that have materially affected,

or are reasonably likely to materially affect, our internal control over

financial reporting.

PART

II

OTHER

INFORMATION

ITEM 1.

LEGAL PROCEEDINGS

The company is not party to any material legal proceeding.

ITEM

2. CHANGES IN SECURITIES

None.

ITEM

3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM

4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

ITEM

5. OTHER INFORMATION

None.

ITEM

6. EXHIBITS

EXHIBIT

31

Certification of the Principal Executive Officer and Principal Financial Officer

pursuant to Rule 13a-14(a) and Rule 15d-14(a) of the Securities Exchange Act of

1934, as amended

EXHIBIT32

Certifications of the Principal Executive Officer and Principal Financial

Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906

of the Sarbanes-Oxley Act of 2002

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

Date: November

14, 2008

|

|

|

|

|

|

China

Dasheng Biotechnology Company

|

|

|

|

|

|

|

By:

|

/s/

JiJun

Qi

|

|

|

|

JiJun

Qi

|

|

|

|

Chief

Executive Officer and President

(Principal

Executive, Financial and Accounting Officer)

|

|

|

|

|

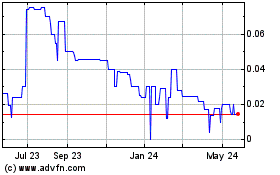

China Dasheng Biotechnol... (PK) (USOTC:CDBT)

Historical Stock Chart

From Feb 2025 to Mar 2025

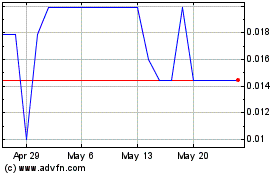

China Dasheng Biotechnol... (PK) (USOTC:CDBT)

Historical Stock Chart

From Mar 2024 to Mar 2025