Rising Demand for Delivery Is Shifting China's Grocery Landscape -- Update

June 24 2019 - 10:55AM

Dow Jones News

By Julie Wernau

BEIJING -- Carrefour SA, one of Europe's largest grocery

retailers, is unloading most of its operations in China, where

big-box retailers are struggling to keep pace in a market whose

shoppers are turning toward nimble delivery providers.

France's Carrefour, once a dominant force in many Chinese

cities, is the latest Western company to pull back from China as

upstart domestic rivals have been better able to respond to demand.

That trend is compounded in sectors that rely on delivery, where

local competitors have ramped up logistics networks to meet Chinese

expectations for speedy service.

Carrefour is selling an 80% stake in its China business to

Nanjing-based Suning.com Co. for about $700 million.

Delivery is emerging as one of the biggest puzzles facing the

food business globally, with high consumer demand for convenience.

Logistics are tricky, and finding a profitable business model has

been complicated because of the large upfront costs associated with

ubiquitous, convenient locations.

In China, local rivals have snatched market share, complicating

the process for newcomers in the delivery market. To compete,

brands such as Walmart Inc. have either partnered with one of the

domestic titans that largely control the e-commerce space or sold

to their competitors. Earlier this year, Amazon.com Inc. sold its

third-party online marketplace in China to a competitor after years

of declining market share.

Hypermarkets -- stores such as Carrefour whose outlets are

larger than 6,000 square meters -- have been losing market share,

according to Bain & Co., dropping to 20.2% in 2018 from 23.6%

in 2014.

"Vegetables and meat and dairy delivered to your door, that's

the tipping point we're at right now," said Michael Norris,

research and strategy manager at AgencyChina. "The hypermarkets

haven't quite adjusted to these changing dynamics -- that it isn't

necessarily shoppers finding products but products finding

shoppers." Carrefour operates 210 hypermarkets and 24 convenience

stores in 51 Chinese cities.

China has by far the largest online food-delivery market, with

45% of global market share, according to Sanford C. Bernstein. To

compete in the fast-delivery market, the products should be within

3 kilometers, or roughly 2 miles, of the consumer to arrive within

a half-hour of ordering. Hypermarkets' locations on the edges of

cities make that difficult.

Carrefour didn't respond to requests for comment. The stock rose

nearly 1% in late-day trading in Paris.

The deal follows moves by Carrefour in recent years to shore up

its China business, including a partnership last year with Tencent

Holdings Ltd. to benefit from the tech giant's digital expertise.

Carrefour's sales in China fell 5.9% last year to EUR4.1

billion.

Carrefour helped change the retail landscape in China. When the

company entered the country in 1995, it was one of a handful of

Western grocery chains here.

"They've been around for so long, so to invest in e-commerce and

e-commerce logistics and warehouses would be a totally new endeavor

in what is already a very low-margin business," said Ker Zheng, an

e-commerce consultant with Azoya.

Suning shares rose 3.3% Monday to 11.62 yuan a share as the deal

is seen enabling the Chinese retailer to diversify beyond consumer

electronics and appliances. Suning said the partnership would

combine its delivery network and digital strategy with Carrefour's

global supply chain and supermarket-management experience.

In the past few years, direct delivery has become a way of life

for Chinese consumers. Big data and a build-out of logistical

operations have extended this trend to groceries, allowing stores

to plan better and get fresher food items to customers faster.

Retail giants such as JD.com Inc., Alibaba Group Holding Ltd.'s

Tmall and Walmart are experimenting with combining in-store

shopping with e-commerce, while going head-to-head with newer

online-only fresh-grocery providers such as Miss Fresh and Dingdong

Maicai.

At Alibaba's Hema stores, shoppers browse in the same space

where employees fill bags with online orders that are placed on

conveyor belts. At JD.com-backed 7FRESH supermarkets, customers can

inspect produce and peruse other items in person, then use a mobile

app to place their orders for delivery.

By year-end, Walmart said, its more than 400 stores in China

would offer one-hour delivery through its partnership with JD.com.

E-commerce platforms such as Pinduoduo and Taobao, as well as

WeChat, feature farmers live-streaming and selling their goods

directly to consumers.

The grocery race even has retailers snatching up suppliers for

popular products. In April, Tencent-backed JD.com signed a deal

that grants it access to nearly a quarter of Thailand's supply of

durian in a three-year agreement valued at five billion yuan ($728

million). Durian, a tropical fruit famous for its gym-sock stench,

has recently become wildly popular in China.

--Xiao Xiao contributed to this article.

Write to Julie Wernau at Julie.Wernau@wsj.com

(END) Dow Jones Newswires

June 24, 2019 11:40 ET (15:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

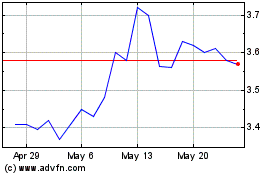

Carrefour (PK) (USOTC:CRRFY)

Historical Stock Chart

From Oct 2024 to Nov 2024

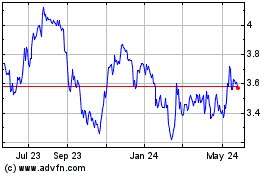

Carrefour (PK) (USOTC:CRRFY)

Historical Stock Chart

From Nov 2023 to Nov 2024