SCHEDULE

14C

(RULE

14C-101)

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of

1934

Check the

appropriate box:

x

Preliminary

Information Statement

o

Definitive

Information Statement

o

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

Cyberlux

Corporation

(Name of

Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the Appropriate Box):

x

No

fee required

o

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

(1) Title

of each class of securities to which transaction applies:

(2) Aggregate

number of securities to which the transaction applies:

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is

calculated and state how it was

determined):

|

(4) Proposed

maximum aggregate value of transaction:

(5) Total

fee paid:

o

Fee

paid previously with preliminary materials

o

check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

(1) Amount

previously paid:

(2) Form,

Schedule or Registration Statement No.:

(3) Filing

Party:

(4) Date

Filed:

CYBERLUX

CORPORATION

4625

Creekstone Drive, Suite 130

Research

Triangle Park

Durham,

North Carolina 27703

INFORMATION

STATEMENT

PURSUANT

TO SECTION 14

OF

THE SECURITIES EXCHANGE ACT OF 1934

AND

REGULATION 14C AND SCHEDULE 14C THEREUNDER

WE

ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE NOT REQUESTED TO SEND US A PROXY.

Durham,

North Carolina

*,

2009

This

information statement has been mailed on or about *, 2009 to the stockholders of

record on *, 2009 (the “Record Date”) of Cyberlux Corporation, a Nevada

corporation (the "Company") in connection with certain actions to be taken by

the written consent by the majority stockholders of the Company, dated as of

April 3, 2009. The actions to be taken pursuant to the written

consent shall be taken on or about *, 2009, 20 days after the mailing of this

information statement.

THIS

IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING

WILL BE HELD TO CONSIDER ANY MATTER WHICH WILL BE DESCRIBED HEREIN.

|

|

By Order of the Board of

Directors,

|

|

|

|

|

|

|

|

|

|

/s/ John

W. Ringo

|

|

|

|

|

Chairman of

the Board

|

|

|

|

|

|

|

|

|

|

|

|

NOTICE

OF

ACTION TO BE TAKEN

PURSUANT TO THE WRITTEN CONSENT OF MAJORITY STOCKHOLDERS IN LIEU OF A SPECIAL

MEETING OF THE STOCKHOLDERS, DATED APRIL 3, 2009

To Our

Stockholders:

NOTICE IS

HEREBY GIVEN that the following action will be taken pursuant to a written

consent of a majority of stockholders dated April 3, 2009, in lieu of a special

meeting of the stockholders. Such action will be taken on or about *,

2009:

1. To

Amend the Company's Articles of Incorporation, as amended, to increase the

number of authorized shares of common stock, par value $.001 per share (the

“Common Stock”), of the Company from 950,000,000 shares to 1,450,000,000 shares

and to increase the number of authorized shares of preferred stock, par value

$.001(the “Preferred Stock”) from 5,000,000 shares to 10,000,000

shares.

OUTSTANDING

SHARES AND VOTING RIGHTS

As of the

Record Date, the Company's authorized capitalization consisted

of 950,000,000 shares of Common Stock, of which 944,955,532 shares

were issued and outstanding as of the Record Date. Holders of Common Stock of

the Company have no preemptive rights to acquire or subscribe to any of the

additional shares of Common Stock. As of the Record Date, the Company also had

4,650,000 shares of Series B preferred stock issued and outstanding. Each share

of Series B preferred stock is entitled to voting rights equal to ten times the

number of shares of Common Stock such holder of Series B Preferred Stock would

receive upon conversion of such holder's shares of Series B Preferred Stock. The

conversion price is $0.10 per share.

Each

share of Common Stock entitles its holder to one vote on each matter submitted

to the stockholders. However, as a result of the voting rights of the Series B

preferred stockholders who hold forty nine percent of the voting rights of all

outstanding shares of capital stock as of April 3, 2009, will have voted in

favor of the foregoing proposals by resolution dated April 3, 2009; and, along

with certain employees and shareholders, having sufficient voting power to

approve such proposals through their ownership of capital stock, no stockholder

consents other than those listed below will be solicited in connection with this

Information Statement., Alan H. Ninneman holds 1,007,547 shares of Series B

preferred stock, John W. Ringo holds 1,283,019 shares of Series B preferred

stock , Mark D. Schmidt holds 1,627,359 shares of Series B preferred stock and

David D. Downing holds 732,075 shares of Series B preferred stock. Combined,

they hold 465,000,000 votes out of a total of 950,000,000 possible

votes on each matter submitted to the stockholders., Alan H. Ninneman, John W.

Ringo, Mark D. Schmidt, David D. Downing Richard Brownand Larson J. Isely are

the shareholders who will have voted in favor of the foregoing proposals by

resolution dated April 3, 2009.

Pursuant

to Rule 14c-2 under the Securities Exchange Act of 1934, as amended, the

proposal will not be adopted until a date at least 20 days after the date on

which this Information Statement has been mailed to the

stockholders. The Company anticipates that the actions contemplated

herein will be effected on or about the close of business on *,

2009.

The

Company has asked brokers and other custodians, nominees and fiduciaries to

forward this Information Statement to the beneficial owners of the Common Stock

held of record by such persons and will reimburse such persons for out-of-pocket

expenses incurred in forwarding such material.

This

Information Statement will serve as written notice to stockholders pursuant to

Section 78.370 of the Nevada General Corporation Law.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The

following tables sets forth, as of April 3, 2009, the number of and

percent of the Company's common stock beneficially owned by

o all

directors and nominees, naming them,

o our

executive officers,

o our

directors and executive officers as a group, without naming them,

and

o persons

or groups known by us to own beneficially 5% or more of our common

stock:

The

Company believes that all persons named in the table have sole voting and

investment power with respect to all shares of common stock

beneficially owned by them.

A person

is deemed to be the beneficial owner of securities that can be acquired by him

within 60 days from April 3, 2009 upon the exercise of options, warrants or

convertible securities. Each beneficial owner's percentage ownership is

determined by assuming that options, warrants or convertible securities that are

held by him, but not those held by any other person, and which are exercisable

within 60 days of April 3, 2009 have been exercised and converted.

|

NAME

AND ADDRESS OF OWNER

|

TITLE

OF CLASS

|

NUMBER

OF SHARES BENEFICIALLY OWNED (1)

|

PERCENTAGE

OF CLASS

|

TOTAL

VOTES ENTITLED TO BE CAST ON SHAREHOLDER MATTERS (3)

|

PERCENTAGE

OF TOTAL VOTES ON SHAREHOLDER MATTERS (4)

|

|

|

|

|

|

|

|

|

Mark

D. Schmidt

|

Common

Stock

|

16,128,280(5)

|

1.71%

|

178,894,180(5)

|

18.93%

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alan

H. Ninneman

|

Common

Stock

|

9,892,986(6)

|

1.05%

|

110,647,686(6)

|

11.71%

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John

W. Ringo

|

Common

Stock

|

9,752,986(7)

|

1.03%

|

138,054,886(7)

|

14.61%

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David

D. Downing

|

Common

Stock

|

8,500,000(8)

|

0.90%

|

81,707,500(8)

|

8.65

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard

P. Brown

|

Common

Stock

|

11,628,980

|

1.23%

|

11,628,980

|

1.23%

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Larson

J. Isely

|

Common

Stock

|

8,250,000

|

0.87%

|

8,250,000

|

0.87%

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marietta,

OH 45750

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All

Officers,Directors, and

|

Common

Stock

|

64,153,232

|

8.48%

|

(9)529,153,232

|

56.00

%

|

|

Employees

and Shareholders

|

|

|

|

|

|

|

As

a Group (6 persons)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark

D. Schmidt

|

Preferred

B

|

1,627,359(5)

|

44.59%

|

|

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alan

H. Ninneman

|

Preferred

B

|

1,007,547(6)

|

27.60%

|

|

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John

W. Ringo

|

Preferred

B

|

1,283,019(7)

|

35.15%

|

|

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David

D. Downing

|

Preferred

B

|

732,075(8)

|

20.06%

|

|

|

|

4625

Creekstone Drive, Suite 130

|

|

|

|

|

|

|

Research

Triangle Park

|

|

|

|

|

|

|

Durham,

NC 27703

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

Beneficial Ownership is determined in accordance with the rules of the

Securities and Exchange Commission and generally includes voting or investment

power with respect to securities. Shares of common stock subject to options or

warrants currently exercisable or convertible, or exercisable or convertible

within 60 days of April 3, 2009 are deemed outstanding for computing the

percentage of the person holding such option or warrant but are not deemed

outstanding for computing the percentage of any other person.

(2) For

purposes of calculating the percentage beneficially

owned, the number of

shares of each class of stock deemed

outstanding include

944,955,532 common shares and 4,650,000 Preferred "B" Shares outstanding as

of April 3, 2009.

(3) This

column represents the total number of votes each named shareholder is entitled

to vote upon matters presented to the shareholders for a

vote.

(4) For

purposes of calculating the percentage of total votes on shareholder matters,

the total number of votes entitled to vote on matters submitted to shareholders

is 1,234,955,412, which includes: one vote for each share of common stock

currently outstanding (944,955,532 ); and 100 votes for each share of Series B

preferred stock outstanding (4,650,000 shares of Series B stock * 100

=.465,000,000).

(5)

Includes 1,627,359 shares of Series B convertible preferred stock convertible

into 16,275,590 shares of common stock and the right to cast 162,765,900

votes.

(6)

Includes 1,007,547shares of Series B convertible preferred stock convertible

into 10,075,470 shares of common stock and the right to cast

100,754,700 votes.

(7)

Includes 1,283,019 shares of Series B convertible preferred stock convertible

into 12,830,190 shares of common stock and the right to cast 128,301,900

votes.

(8)

Includes 732,075 shares of Series B convertible preferred stock convertible into

7,320,750 shares of common stock and the right to cast 73,207,500

votes.

(9)

Includes 4,650,000 shares of Series B convertible preferred stock convertible

into 46,500,000 shares of common stock and the right to cast 465,000,000

votes.

AMENDMENT

TO THE ARTICLES OF INCORPORATION

On April 3, 2009, the majority

stockholders of the Company approved an amendment to the Company’s Articles of

Incorporation, as amended, to increase the number of authorized shares of Common

Stock from 950,000,000 to 1,450,000,000 and to increase the number of authorized

shares of Preferred Stock from 5,000,000 to 10,000,000. The Company

currently has authorized capital stock of 950,000,000 shares and approximately

944,955,532 shares of Common Stock are outstanding and has authorized preferred

stock of 5,000,000 and approximately 4,800,29.9806 shares of Preferred Stock are

outstanding as of April 3, 2009. The Board believes that the increase

in authorized common and preferred shares would provide the Company greater

flexibility with respect to the Company’s capital structure for such purposes as

additional equity financing, and stock based acquisitions.

INCREASE

IN AUTHORIZED COMMON STOCK

The terms

of the additional shares of Common Stock will be identical to those of the

currently outstanding shares of Common Stock. However, because

holders of Common Stock have no preemptive rights to purchase or subscribe for

any un-issued stock of the Company, the issuance of additional shares of Common

Stock will reduce the current stockholders' percentage ownership interest in the

total outstanding shares of Common Stock. This amendment and the creation of

additional shares of authorized common stock will not alter the current number

of issued shares. The relative rights and limitations of the shares

of Common Stock will remain unchanged under this amendment.

As of the

Record Date, a total of 944,955,532 shares of the Company's currently authorized

950,000,000 shares of Common Stock are issued and

outstanding. The increase in the number of authorized but un-issued

shares of Common Stock would enable the Company, without further stockholder

approval, to issue shares from time to time as may be required for proper

business purposes, such as raising additional capital for ongoing operations,

business and asset acquisitions, stock splits and dividends, present and future

employee benefit programs and other corporate purposes.

The

proposed increase in the authorized number of shares of Common Stock could have

a number of effects on the Company's stockholders depending upon the exact

nature and circumstances of any actual issuances of authorized but un-issued

shares. The increase could have an anti-takeover effect, in that

additional shares could be issued (within the limits imposed by applicable law)

in one or more transactions that could make a change in control or takeover of

the Company more difficult. For example, additional shares could be

issued by the Company so as to dilute the stock ownership or voting rights of

persons seeking to obtain control of the Company, even if the persons seeking to

obtain control of the Company offer an above-market premium that is favored by a

majority of the independent shareholders. Similarly, the issuance of

additional shares to certain persons allied with the Company's management could

have the effect of making it more difficult to remove the Company's current

management by diluting the stock ownership or voting rights of persons seeking

to cause such removal. The Company does not have any other provisions

in its articles or incorporation, by-laws, employment agreements, credit

agreements or any other documents that have material anti-takeover

consequences. Additionally, the Company has no plans or proposals to

adopt other provisions or enter into other arrangements, except as disclosed

below, that may have material anti-takeover consequences. The Board

of Directors is not aware of any attempt, or contemplated attempt, to acquire

control of the Company, and this proposal is not being presented with the intent

that it be utilized as a type of anti- takeover device.

There are currently no plans,

arrangements, commitments or understandings for the issuance of the additional

shares of Common Stock which are proposed to be authorized:

ADDITIONAL

INFORMATION

As a reporting company, we are subject

to the informational requirements of the Exchange Act and accordingly file our

annual report on Form 10-KSB, quarterly reports on Form 10-QSB,

current reports on Form 8-K, proxy statements and other information with

the SEC. The Public may read and copy any materials filed with the SEC at the

SEC’s Public Reference Room at

100 F Street, NE

,

Washington

,

DC

20549

. Please call the SEC at

(800) SEC-0330 for further information on the Public Reference Room. As an

electronic filer, our public filings are maintained on the SEC’s Internet site

that contains reports, proxy and information statements, and other information

regarding issuers that file electronically with the SEC. The address of that

website is http://www.sec.gov. In addition, our annual report on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K and

amendments to those reports filed or furnished pursuant to Section 13(a) or

15(d) of the Exchange Act may be accessed free of charge through our website as

soon as reasonably practicable after we have electronically filed such material

with, or furnished it to, the SEC. The address of that website is

http://www.cyberlux.com.

.

|

|

By Order of the Board of

Directors,

|

|

|

|

|

|

|

|

|

By:

|

/s/ John

W. Ringo

|

|

|

|

|

John

W. Ringo

|

|

|

|

|

Chairman

of the Board

|

|

|

|

|

|

|

Durham,

North Carolina

April 3,

2009

EXHIBIT

A

Ross

Miller

Secretary

of State

204 North

Carson Street, Ste 1

Carson

City, Nevada 89701-4299

(775 684

5708

Website:

secretaryofstate.biz

_______________________________

Certificate of

Amendment

(PURSUANT

TO NRS 78.385 AND 78.390

_______________________________

Certificate of Amendment to

Articles of Incorporation

For Nevada Profit

Corporations

(Pursuant

to NRS 78.385 and 78.390 – After Issuance of Stock)

1. Name

of Corporation:

Cyberlux

Corporation

2. The

articles have been amended as follows (provide article numbers, if

available):

Article

four has been amended to state that the total number of shares of stock of each

class which the Corporation shall have authority to issue and the par value of

each share of each class of stock are as follows:

|

Class

|

|

Par

Value

|

|

|

Authorized

Shares

|

|

|

|

|

|

|

|

|

|

|

Common

|

|

$

|

0.001

|

|

|

|

1,450,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred

|

|

$

|

0.001

|

|

|

|

10.000.000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

1,460,000,000

|

|

3. The

vote by which the stockholders holding shares in the corporation entitling them

to exercise at least a majority of the voting power, or such greater proportion

of the voting power as may be required in the case of a vote by classes of

series, or as may by the provisions of the* articles of incorporation have voted

in favor of the amendment is:

56

%

4. Effective

date of filing (optional)

(must

not be later than 90 days after the certificate is filed)

5. Officer

Signature

(Required_: X_____________________________

* If any

proposed amendment would alter or change any preference or any relative or other

right given to any class or series of outstanding shares, the the amendment must

be approved by vote. In addition to the affirmative vote otherwise required, of

the holders of shares representing a majority of the voting power of each class

or series affected by the amendment regardless of limitations or restrictions on

the voting power thereof.

8

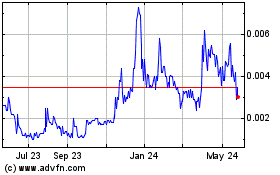

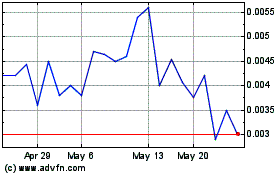

Cyberlux (PK) (USOTC:CYBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cyberlux (PK) (USOTC:CYBL)

Historical Stock Chart

From Jan 2024 to Jan 2025