Postal Savings Bank of China Raises $7 Billion Ahead of IPO

December 08 2015 - 10:20PM

Dow Jones News

BEIJING—Postal Savings Bank of China Co. raised 45.1 billion

yuan ($7 billion) from 10 strategic foreign and domestic investors

ahead of an expected initial public offering next year, the bank

said Wednesday.

The stake taken by strategic investors represents 16.92% of the

state-owned bank's shares, the company said in a statement.

The investors include UBS Group AG, JPMorgan Chase & Co.,

International Finance Corp. and Canada Pension Plan Investment

Board. In addition, Singapore firms DBS Bank Ltd. and

government-run investment company Temasek Holdings invested, as did

Chinese Internet companies Ant Financial Services Group and Tencent

Holdings Ltd. Also, China Life Insurance Co. and China Telecom

Corp. invested.

Postal Savings Bank President Lu Jia said the bank's listing

will be the next step in its plan.

The bank is aiming to raise $10 billion in Hong Kong for its

initial offering, people with knowledge of the matter told The Wall

Street Journal last month.

Pei Li and Chuin-Wei Yap

(END) Dow Jones Newswires

December 08, 2015 23:05 ET (04:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

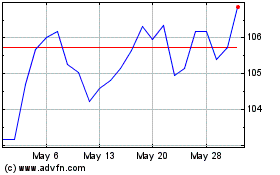

DBS (PK) (USOTC:DBSDY)

Historical Stock Chart

From Nov 2024 to Dec 2024

DBS (PK) (USOTC:DBSDY)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about DBS Group Holdings Ltd (PK) (OTCMarkets): 0 recent articles

More Dbs Group Holdings Ltd. (PC) News Articles