Tenneco Earnings Beat Estimates - Analyst Blog

April 30 2013 - 12:12PM

Zacks

Tenneco Inc. (TEN) reported a 9.1% increase in

adjusted earnings per share to 72 cents in the first quarter of

2013 from 66 cents a year ago, surpassing the Zacks Consensus

Estimate by 7 cents. Net income augmented 7.3% to $44.0 million

from $41.0 million a year ago. On a reported basis, the company’s

profit was $54.0 million or 88 cents per share compared with $30.0

million or 49 cents in the first quarter of 2012.

Revenues increased marginally to $1.90 billion, beating the Zacks

Consensus Estimate of $1.84 billion. The year-over-year increase in

revenues was attributable to higher revenues from Clean Air

division, partially offset by decline in revenues from Ride

Performance.

Adjusted EBIT (earnings before interest, taxes and non-controlling

interests) remained flat year over year at $97.0 million. Adjusted

EBIT benefited from higher Clean Air EBIT offset by declining Ride

Performance EBIT.

Segment Results

Revenues from Clean Air Division improved

marginally to $1.29 billion from $1.28 billion a year ago. The

improvement was due to higher revenues from Asia Pacific, mainly

driven by increase in light vehicle production in China. Adjusted

EBIT augmented to $78.0 million from $76.0 million due to higher

Asia Pacific volumes and effective operational cost management.

Revenues from Ride Performance Division fell 3.2%

to $607.0 million due to lower light and commercial vehicle

revenues in Europe and lower commercial vehicle revenues in North

America. Adjusted EBIT declined to $40.0 million from $44.0 million

due to lower volumes in Europe and North America and related

manufacturing absorption costs.

Financial Position

Tenneco had cash and cash equivalents of $242.0 million as of Mar

31, 2013, up from $223.0 million as of Dec 31, 2012. Net debt was

$1.38 billion as of Mar 31, 2013 compared with $1.18 billion as of

Dec 31, 2012.

For the first three months of 2013, the company had cash outflow

from operating activities of $123.0 million, up from $85.0 million

in the year-ago period. Capital expenditures for the period were

$70.0 million compared with $65.0 million in the corresponding

period year ago.

Outlook

Based on IHS forecasts, the company expects that total light

vehicle production will increase 3% in the second quarter of 2013,

with a 4% rise in North America, 8% hike in China, 9% increase in

South America and 3% boost in India. However, it will decline 3% in

Europe due to the economic uncertainty.

Our Take

Tenneco is a leading manufacturer and supplier of emission control,

ride control systems, and systems for the automotive original

equipment manufacturers (OEMs) and the aftermarket. Currently, the

company retains a Zacks Rank #3 (Hold).

Some other stocks that are performing well in the industry where

Tenneco operates include Gentherm Inc. (THRM),

Visteon Corp. (VC) and Denso

Corp. (DNZOY). All these companies carry a Zacks Rank #1

(Strong Buy).

DENSO CORP (DNZOY): Get Free Report

TENNECO INC (TEN): Free Stock Analysis Report

GENTHERM INC (THRM): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

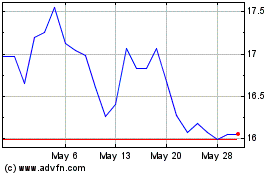

Denso (PK) (USOTC:DNZOY)

Historical Stock Chart

From Oct 2024 to Nov 2024

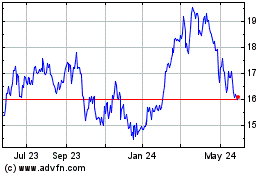

Denso (PK) (USOTC:DNZOY)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Denso Corp Ltd (PK) (OTCMarkets): 0 recent articles

More Denso Corp. (PC) News Articles