General Motors Rises Above IPO Price - Analyst Blog

May 20 2013 - 8:50AM

Zacks

Shares of General Motors Company (GM) hit new

52-week high of $33.77 on May 17, which is above its previous level

of $32.44 as well as the Initial Public Offering (IPO) price of

$33.00 (held in Nov 2010) for the first time since May 4, 2011.

GM’s last closing price was $33.42, which represented a solid

one-year return of 54.7% and year-to-date return of 14.7%. The

world’s second largest automaker (by sales volume) has a market cap

of $45.7 billion. Average volume of shares traded over the last

three months stood at approximately 11,419.4K.

Shares of the company started escalating following its announcement

of revival plan in Europe and U.S. Treasury department’s

announcement of selling a significant stake in the company as well

as improvements in the U.S. and Chinese markets.

Last month, Chairman and CEO of GM, Dan Akerson, promised to invest

€4 billion ($5.2 billion) in its European operation Opel without

revealing any plan to close down plants or other specific measures

in order to boost earnings. Opel plans to launch 23 new models and

13 new engines within 2016 and develop a small car platform with

French partner PSA Peugeot Citroen (PEUGY).

In the same month, the U.S. Treasury Department revealed that it

sold $621 million worth of GM common stock in March, recovering

$30.4 billion of the $49.5 billion bailout fund received by GM. The

U.S. Treasury intends to sell the remaining 16% stake in GM early

2014. The rising stock price would definitely help the government

recovering its bailout fund as much as possible.

GM reported a 28.0% fall in earnings to 67 cents per share in the

first quarter of the year from 93 cents in the same quarter of 2012

(all excluding special items) due to lower earnings generated from

the company’s all geographic operations except Europe. Despite

this, the automaker’s earnings exceeded the Zacks Consensus

Estimate by 11 cents per share.

Revenues in the quarter slid 2.4% to $36.9 billion, despite a 3.6%

rise in retail unit sales to 2.4 million vehicles globally.

Nevertheless, it was higher than the Zacks Consensus Estimate of

$36.4 billion.

General Motors is gearing up for more than 40 major vehicle

launches in 2013 across the globe in order to drive sales and

revenues. In addition, the company expects its European results

will improve further based on its cost reduction measures.

Last month, GM’s sales increased 11.4% to 237,646 vehicles, driven

by strong sales of its all four brands and especially Chevrolet

Silverado pickup truck. Sales increased 11% for Chevrolet, 34% for

Cadillac, 11% for Buick and 7% for GMC. Silverado sales escalated

28% to 39,395 units.

GM’s sales were helped by the recovering auto market in the U.S. as

well as by the unpopularity of the Japanese brands in China due to

a political conflict between China and Japan.

Auto sales in the U.S. rose 3.5% to 14.92 million vehicles in

April. Total vehicle sales went up 8.5% to 1.29 million vehicles in

the month. In China, General Motors and its Chinese joint venture

partners sold 261,870 vehicles in the month, up 15.3% from Apr

2012.

Currently, shares of GM retain a Zacks Rank #3 (Hold). While we

remain on the sidelines about General Motors, stocks that are

currently performing well in the broader auto industry include

Visteon Corp. (VC) and Denso

Corp. (DNZOY) with a Zacks Rank #1 (Strong Buy).

DENSO CORP (DNZOY): Get Free Report

GENERAL MOTORS (GM): Free Stock Analysis Report

PEUGEOT CIT-ADR (PEUGY): Get Free Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

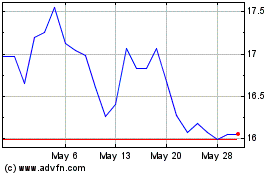

Denso (PK) (USOTC:DNZOY)

Historical Stock Chart

From Oct 2024 to Nov 2024

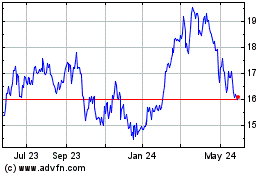

Denso (PK) (USOTC:DNZOY)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Denso Corp Ltd (PK) (OTCMarkets): 0 recent articles

More Denso Corp. (PC) News Articles