Issuer

Free Writing Prospectus

Filed

Pursuant to Rule 433

Registration

Statement No. 333-162677

November

14, 2010

The

Company has filed a registration statement, including a prospectus,

(Registration No. 333-162677), with the SEC for the offering to which this

communication relates. Before you invest, you should read the

prospectus in that registration statement, together with the prospectus

supplement to be prepared and filed with the SEC in connection with the offering

to which this communication relates, and other documents the Company has filed

with the SEC for more complete information about the Company and this offering.

You may get these documents, when available, for free by visiting EDGAR on the

SEC website at www.sec.gov. Alternatively, the Company will arrange to send you

the base prospectus, the prospectus supplement (when available), and any other

offering documents if you request them by calling (604) 638-5050.

CANADIAN

FEDERAL INCOME TAX CONSIDERATIONS

The

following summary describes the principal Canadian federal income tax

considerations generally applicable to a purchaser who acquires, as a beneficial

owner, Units pursuant to this Offering and who, at all relevant

times, for the purposes of the application of the

Income

Tax Act

(Canada) and the Income Tax Regulations (collectively, the “

Tax

Act

”), deals at arm’s length with the Company; is not affiliated with the

Company, the Underwriters or a subsequent holder of the Shares and Warrants; and

holds the Shares and Warrants as capital property (a “

Holder

”). Generally,

the Shares and Warrants will be capital property to a Holder provided the Holder

does not acquire or hold those Shares or Warrants in the course of carrying on a

business or as part of an adventure or concern in the nature of

trade.

This

summary is

based on the current provisions of the Tax Act and the current published

administrative policies and assessing practices of the Canada Revenue Agency

(“

CRA

”) published in

writing prior to the date hereof. This summary also takes into account all

specific proposals to amend the Tax Act and Regulations publicly announced by

the Minister of Finance (Canada) prior to the date hereof (collectively, the

“

Tax Proposals

”) and

assumes all Tax Proposals will be enacted in the form proposed. There is no

certainty that the Tax Proposals will be enacted in the form proposed, if at

all. This summary does not otherwise take into account or anticipate any changes

in laws or administrative policy or assessing practice whether by judicial,

regulatory, administrative or legislative decision or action nor does it take

into account provincial, territorial or foreign income tax legislation or

considerations.

This

summary is of a general nature only and is not, and is not intended to be, nor

should it be construed to be, legal or tax advice to any particular purchaser of

Units. This summary is not exhaustive of all Canadian federal income

tax considerations. Accordingly, purchasers should consult their own

tax advisors regarding the income tax consequences of purchasing Units based on

their particular circumstances.

Holders

Resident in Canada

This

portion of the summary is generally applicable to a Holder who, at all relevant

times, for the purposes of the Tax Act is, or is deemed to be, resident in

Canada (a “

Resident

Holder

”). Certain Resident Holders may be entitled to make, or may have

already made, the irrevocable election permitted by subsection 39(4) of the Tax

Act the effect of which may be to deem to be capital property any Shares and all

other “Canadian securities” (as defined in the Tax Act) owned by such Resident

Holder in the taxation year in which the election is made and in all subsequent

taxation years. Resident Holders should consult their own tax

advisors for advice as to whether an election under subsection 39(4) is

available and/or advisable in their particular circumstances.

This

portion of the summary is not applicable to a Holder that is a “specified

financial institution”; a Holder an interest in which is a “tax shelter

investment”; a Holder that is a “financial institution” for purposes of the

mark-to-market rules contained in the Tax Act; or a Holder that has made a

“functional currency” reporting election, each as defined in the Tax Act. Such

Holders should consult their own tax advisors.

Acquisition

of Shares and Warrants

A

Resident Holder must allocate the total purchase price of Cdn.$0.28 for a Unit

on a reasonable basis between the Share and the Warrant to determine the cost of

each for its purposes under the Tax Act. For its own purposes, the Company

intends to allocate Cdn.$0.08 to the Warrant and Cdn.$0.20 to the Share of the

$0.28 issue price of each Unit for its purposes under the Tax Act. Although the

Company believes its allocation is reasonable, it is not binding on the Resident

Holder or the CRA. The Resident Holder’s adjusted cost base of the Share

comprising a part of each Unit will be determined by averaging the cost

allocated to the Share with the adjusted cost base to the Resident Holder of all

other Shares owned by the Resident Holder (other than certain Shares acquired

under the Company’s employee stock option plan, if any) immediately prior to

such acquisition.

Exercise

of Warrants

Where a

Resident Holder exercises a Warrant to acquire a Share, no gain or loss will

arise for purposes of the Tax Act. The Resident Holder’s cost of the Share

acquired on the exercise of the Warrant will be equal to the adjusted cost base

of the Warrant and the exercise price paid for the Share. The Resident Holder’s

adjusted cost base of the Share acquired on the exercise of the Warrant will be

determined by averaging the cost allocated to the Share with the adjusted cost

base to the Resident Holder of all other Shares owned by the Resident Holder

(other than certain Shares acquired under the Company’s employee stock option

plan, if any) immediately prior to such acquisition.

Disposition

and Expiry of Warrants

On a

disposition or deemed disposition of a Warrant (other than on the exercise

thereof), a Resident Holder will realize a capital gain (or capital loss) equal

to the amount, if any, by which the proceeds of disposition, net of any

reasonable costs of disposition, exceed (or are less than) the adjusted cost

base to the Resident Holder of the Warrant immediately before the disposition or

the deemed disposition. If an unexercised Warrant expires, the Resident Holder

will realize a capital loss equal to the Resident Holder’s adjusted cost base of

the unexercised, expired Warrant. The tax treatment of capital gains and capital

losses is discussed in greater detail under the heading “Dispositions of

Shares”.

Dividends

A

Resident Holder will be required to include in computing its income for a

taxation year any dividends received or deemed to be received on the Shares. In

the case of a Resident Holder that is an individual (other than certain trusts),

such dividends will be subject to the gross-up and dividend tax credit rules

applicable to taxable dividends received or deemed to be received from taxable

Canadian corporations, including the enhanced gross-up and dividend tax credit

applicable to any dividends designated by us as “eligible dividends” in

accordance with the provisions of the Tax Act. Although the Company

currently anticipates that all dividends to Resident Holders will be designated

as “eligible dividends”, it is possible that such dividends may not be so

designated. A dividend received by a Resident Holder that is a corporation must

be included in computing its income but generally will be deductible in

computing the corporation’s taxable income.

A

Resident Holder that is a “private corporation”, as defined in the Tax Act, or

any other corporation controlled, whether because of a beneficial interest in

one or more trusts or otherwise, by or for the benefit of an individual (other

than a trust) or a related group of individuals (other than trusts) will

generally be liable to pay a refundable tax of 331⁄3% under Part IV of the Tax

Act on dividends received on the Shares to the extent such dividends are

deductible in computing the Resident Holder’s taxable income for the

year.

Dispositions

Generally,

on a disposition or deemed disposition of a Share, a Resident Holder will

realize a capital gain (or capital loss) equal to the amount, if any, by which

the proceeds of disposition, net of any reasonable costs of disposition, exceed

(or are less than) the adjusted cost base to the Resident Holder of the Share

immediately before the disposition or the deemed disposition.

Generally,

a Resident Holder is required to include in computing its income for a taxation

year one-half of the amount of any capital gain (a “

taxable

capital gain

”) realized in the year. Subject to and in accordance with

the provisions of the Tax Act, a Resident Holder is required to deduct one-half

of the amount of any capital loss (an “

allowable

capital loss

”) realized in a taxation year from taxable capital gains

realized by the Resident Holder in the year. Allowable capital losses in excess

of taxable capital gains may be carried back and deducted in any of the three

preceding taxation years or carried forward and deducted in any subsequent

taxation year against net taxable capital gains realized in such years, to the

extent and under the circumstances described in the Tax Act.

The

amount of any capital loss realized by a Resident Holder that is a corporation

on the disposition or deemed disposition of a Share may be reduced by the amount

of dividends received or deemed to have been received by it on such share, to

the extent and in the circumstances prescribed by the Tax Act. Similar rules may

apply where a Share is owned by a partnership or trust of which a corporation,

trust or partnership is a member or beneficiary. Resident Holders to whom these

rules may be relevant should consult their own tax advisors.

A Holder

that is throughout the year a “Canadian-controlled private corporation”, as

defined in the Tax Act, is liable for tax, a portion of which may be refundable,

on investment income, including taxable capital gains realized and dividends

received in respect of the Shares (but not dividends that are deductible in

computing taxable income).

Alternative

Minimum Tax

Capital

gains realized on the disposition of Shares or Warrants by a Resident Holder who

is an individual or a trust may give rise to a liability to pay alternative

minimum tax.

Eligibility

for Investment

The

Shares would, if issued on the date hereof and listed on a “designated stock

exchange”, as defined in the Tax Act, (which includes the TSX) be qualified

investments under the Tax Act for a trust governed by a registered retirement

savings plan, registered retirement income fund, registered education savings

plan, deferred profit sharing plan, registered disability savings plan

(collectively, the “

Deferred

Plans

”) and a tax-free savings account (“

TFSA

”).

If the

Shares are qualified investments for Deferred Plans and a TFSA, generally the

Warrants should also be qualified investments for Deferred Plans and a

TFSA.

Notwithstanding

that the Shares or Warrants may be a qualified investment for a trust governed

by a TFSA, the holder of a TFSA will be subject to a penalty tax on the Shares

or Warrants held in the TFSA if such Shares or Warrants are a “prohibited

investment” for that TFSA. The Shares and Warrants will generally be

a “prohibited investment” if the holder of the TFSA does not deal at arm’s

length with the Company for the purposes of the Tax Act or the holder of the

TFSA has a “significant interest” (within the meaning of the Tax Act) in the

Company or a corporation, partnership or trust with which the Company does not

deal at arm’s length for the purposes of the Tax Act.

Holders

Not Resident in Canada

This

portion of the summary is generally applicable to a Holder who, at all relevant

times, for purposes of the application of the Tax Act, is not, and is not deemed

to be, resident in Canada and does not use or hold, and is not deemed to use or

hold, the Shares in a business carried on in Canada (a “

Non-Resident

Holder

”). Special rules, which are not discussed in this

summary, may apply to a Non-Resident Holder that is an insurer that carries on

an insurance business in Canada and elsewhere.

Dividends

Dividends

paid or credited or deemed to be paid or credited to a Non-Resident Holder by

the Company will be subject to Canadian withholding tax at the rate of 25%,

subject to any reduction in the rate of withholding to which the Non-Resident

Holder is entitled under any applicable income tax convention between Canada and

the country in which the Non-Resident Holder is resident. For example, where the

Non-Resident Holder is a resident of the United States and is entitled to

benefits under the Canada-United States Income Tax Convention (1980) and is the

beneficial owner of the dividends, the applicable rate of Canadian withholding

tax is generally reduced to 15%.

Dispositions

A

Non-Resident Holder will not be subject to tax under the Tax Act on any capital

gain realized on a disposition of a Share or Warrant, unless the Share or

Warrant is or is deemed to be “taxable Canadian property” to the Non-Resident

Holder for the purposes of the Tax Act and the Non-Resident Holder is not

entitled to relief under an applicable income tax convention between Canada and

the country in which the Non-Resident Holder is resident.

Generally,

provided the Shares are listed on a “designated stock exchange” as defined in

the Tax Act (which includes the TSX) at the time of disposition, the Shares will

not constitute taxable Canadian property of a Non-Resident Holder, unless at any

time during the 60-month period immediately preceding the disposition, the

Non-Resident Holder, persons with whom the Non-Resident Holder did not deal at

arm’s length, or the Non-Resident Holder together with all such persons, owned

25% or more of the issued Shares or any other class of our shares and more than

50% of the fair market value of the Shares was derived directly or indirectly

from any one or combination of (i) real or immovable property situated in

Canada,(ii) Canadian resource properties, (iii) timber resource properties, and

(iv) options in respect of, or interests in, or for civil rights law rights in,

property described in any of (i) to (iii), whether or not that property

exists.

If the

Shares constitute taxable Canadian property of a particular Non-Resident Holder,

the Warrants will also constitute taxable Canadian property of that Non-Resident

Holder.

Notwithstanding

the foregoing, in certain circumstances set out in the Tax Act, the Shares may

be deemed to be taxable Canadian property. Non-Resident Holders whose Shares

constitute taxable Canadian property should consult with their own tax

advisors.

CERTAIN

U.S. FEDERAL INCOME TAX CONSIDERATIONS

The

following is a general summary of certain U.S. federal income tax considerations

applicable to a U.S. Holder (as defined below) arising from and relating to the

acquisition, ownership and disposition of Units acquired pursuant to this

document, the acquisition, ownership, and disposition of Common

Shares acquired as part of the Units, the exercise, disposition, and lapse of

Warrants acquired as part of the Units, and the acquisition, ownership, and

disposition of Warrant Shares received on exercise of the

Warrants.

If an

entity that is classified as a partnership for U.S. federal income tax purposes

holds Units, Common Shares, Warrants or Warrant Shares, the U.S. federal income

tax consequences to such partnership and the partners of such partnership

generally will depend on the activities of the partnership and the status of

such partners. Partners of entities that are classified as

partnerships for U.S. federal income tax purposes should consult their own tax

advisor regarding the U.S. federal income tax consequences arising from and

relating to the acquisition, ownership, and disposition of Units, Common Shares,

Warrants and Warrant Shares.

This

summary is for general information purposes only and does not purport to be a

complete analysis or listing of all potential U.S. federal income tax

considerations that may apply to a U.S. Holder as a result of the acquisition of

Units pursuant to this document. In addition, this summary does not

take into account the individual facts and circumstances of any particular U.S.

Holder that may affect the U.S. federal income tax consequences to such U.S.

Holder, including specific tax consequences to a U.S. Holder under an applicable

tax treaty. Accordingly, this summary is not intended to be, and

should not be construed as, legal or U.S. federal income tax advice with respect

to any U.S. Holder. This summary does not address the U.S. federal

alternative minimum, U.S. federal estate and gift, U.S. state and local, or

foreign tax consequences to U.S. Holders of the acquisition, ownership, and

disposition of Units, Common Shares, Warrants and Warrant

Shares. Each U.S. Holder should consult its own tax advisor regarding

the U.S. federal, U.S. federal alternative minimum, U.S. federal estate and

gift, U.S. state and local, and foreign tax consequences relating to the

acquisition, ownership and disposition of Units, Common Shares, Warrants and

Warrant Shares.

No legal

opinion from U.S. legal counsel or ruling from the Internal Revenue Service (the

“IRS”) has been requested, or will be obtained, regarding the US. federal income

tax considerations applicable to U.S. Holders as discussed in this

summary. This summary is not binding on the IRS, and the IRS is not

precluded from taking a position that is different from, and contrary to, the

positions taken in this summary. In addition, because the authorities

on which this summary is based are subject to various interpretations, the IRS

and the U.S. courts could disagree with one or more of the positions taken in

this summary.

NOTICE

PURSUANT TO IRS CIRCULAR 230: NOTHING CONTAINED IN THIS SUMMARY CONCERNING ANY

U.S. FEDERAL TAX ISSUE IS INTENDED OR WRITTEN TO BE USED, AND IT CANNOT BE USED,

BY A U.S. HOLDER (AS DEFINED BELOW), FOR THE PURPOSE OF AVOIDING U.S. FEDERAL

TAX PENALTIES UNDER THE U.S. CODE (AS DEFINED BELOW). THIS SUMMARY WAS WRITTEN

TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTIONS OR MATTERS ADDRESSED

BY THIS DOCUMENT. EACH U.S. HOLDER SHOULD SEEK U.S. FEDERAL TAX ADVICE, BASED ON

SUCH U.S. HOLDER’S PARTICULAR CIRCUMSTANCES, FROM AN INDEPENDENT TAX

ADVISOR.

Scope

of this Summary

Authorities

This

summary is based on the Internal Revenue Code of 1986, as amended (the “Code”),

Treasury Regulations (whether final, temporary, or

proposed), published rulings of the IRS, published administrative

positions of the IRS, U.S. court decisions and the Convention Between Canada and

the United States of America with Respect to Taxes on Income and on Capital,

signed September 26, 1980, as amended (the “Canada-U.S. Tax Convention”), that

are applicable and, in each case, as in effect and available, as of the date of

this document. Any of the authorities on which this summary is based

could be changed in a material and adverse manner at any time, and any such

change could be applied on a retroactive basis or prospective basis which could

affect the U.S. federal income tax considerations described in this

summary. This summary does not discuss the potential effects, whether

adverse or beneficial, of any proposed legislation that, if enacted, could be

applied on a retroactive or prospective basis.

U.S.

Holders

For

purposes of this summary, the term "U.S. Holder" means a beneficial owner of

Units, Common Shares, Warrants or Warrant Shares acquired pursuant to this

document that is for U.S. federal income tax purposes:

|

|

·

|

an

individual who is a citizen or resident of the

U.S.;

|

|

|

·

|

a

corporation (or other entity taxable as a corporation for U.S. federal

income tax purposes) organized under the laws of the U.S., any state

thereof or the District of

Columbia;

|

|

|

·

|

an

estate whose income is subject to U.S. federal income taxation regardless

of its source; or

|

|

|

·

|

a

trust that (1) is subject to the primary supervision of a court within the

U.S. and the control of one or more U.S. persons for all substantial

decisions or (2) has a valid election in effect under applicable Treasury

regulations to be treated as a U.S.

person.

|

Non-U.S.

Holders

For

purposes of this summary, a “non-U.S. Holder” is a beneficial owner of Units,

Common Shares, Warrants or Warrant Shares that is not a U.S.

Holder. This summary does not address the U.S. federal income tax

consequences to non-U.S. Holders arising from and relating to the acquisition,

ownership, and disposition of Units, Common Shares, Warrants and Warrant

Shares. Accordingly, a non-U.S. Holder should consult its own tax

advisor regarding the U.S. federal, U.S. federal alternative minimum, U.S.

federal estate and gift, U.S. state and local, and foreign tax consequences

(including the potential application of and operation of any income tax

treaties) relating to the acquisition, ownership, and disposition of Units,

Common Shares, Warrants and Warrant Shares.

U.S. Holders Subject to

Special U.S. Federal Income Tax Rules Not Addressed

This

summary does not address the U.S. federal income tax considerations applicable

to U.S. Holders that are subject to special provisions under the Code, including

the following: (a) U.S. Holders that are tax-exempt organizations,

qualified retirement plans, individual retirement accounts, or other

tax-deferred accounts; (b) U.S. Holders that are financial institutions,

underwriters, insurance companies, real estate investment trusts, or regulated

investment companies; (c) U.S. Holders that are dealers in securities or

currencies or U.S. Holders that are traders in securities that elect to apply a

mark-to-market accounting method; (d) U.S. Holders that have a “functional

currency” other than the U.S. dollar; (e) U.S. Holders that own Units, Common

Shares, Warrants or Warrant Shares as part of a straddle, hedging transaction,

conversion transaction, constructive sale, or other arrangement involving more

than one position; (f) U.S. Holders that acquired Units, Common Shares, Warrants

or Warrant Shares in connection with the exercise of employee stock options or

otherwise as compensation for services; (g) U.S. Holders that hold Units, Common

Shares, Warrants or Warrant Shares other than as a capital asset within the

meaning of Section 1221 of the Code (generally, property held for investment

purposes); (h) partnerships and other pass-through entities (and investors in

such partnerships and entities); or (i) U.S. Holders that own or have

owned (directly, indirectly, or by attribution) 10% or more of the

total combined voting power of the outstanding shares of the

Company. This summary also does not address the U.S. federal income

tax considerations applicable to U.S. Holders who are (a) U.S. expatriates or

former long-term residents of the U.S., (b) persons that have been, are, or will

be a resident or deemed to be a resident in Canada for purposes of the Tax Act;

(c) persons that use or hold, will use or hold, or that are or will be deemed to

use or hold Units, Common Shares, Warrants or Warrant Shares in connection with

carrying on a business in Canada; (d) persons whose Units, Common Shares,

Warrants or Warrant Shares constitute “taxable Canadian property” under the Tax

Act; or (e) persons that have a permanent establishment in Canada for the

purposes of the Canada-U.S. Tax Convention. U.S. Holders that are

subject to special provisions under the Code, including U.S. Holders described

immediately above, should consult their own tax advisor regarding the U.S.

federal, U.S. federal alternative minimum, U.S. federal estate and gift, U.S.

state and local, and foreign tax consequences relating to the acquisition,

ownership and disposition of Units, Common Shares, Warrants or Warrant

Shares.

U.S.

Federal Income Tax Consequences of the Acquisition of Units

For U.S.

federal income tax purposes, the acquisition by a U.S. Holder of a Unit will be

treated as the acquisition of an “investment unit” consisting of two

components: a component consisting of one Common Share and a

component consisting of one Common Share and 0.65 of a Common Share purchase

warrant. The purchase price for each Unit will be allocated between

these two components in proportion to their relative fair market values at the

time the Unit is purchased by the U.S. Holder. This allocation of the

purchase price for each Unit will establish a U.S. Holder’s initial tax basis

for U.S. federal income tax purposes in the one Common Share and 0.65 of a

Common Share purchase warrant that comprise each Unit.

For this

purpose, the Company will allocate Cdn.$0.20 of the purchase price for the Unit

to the Common Share and Cdn$0.08 of the purchase price for each Unit to the 0.65

of a Common Share purchase warrant. However, the IRS will not be

bound by the Company’s allocation of the purchase price for the Units, and

therefore, the IRS or a U.S. court may not respect the allocation set forth

above. Each U.S. Holder should consult its own tax advisor regarding

the allocation of the purchase price for the Units.

U.S.

Federal Income Tax Consequences of the Exercise and Disposition of

Warrants

Exercise of

Warrants

A U.S.

Holder should not recognize gain or loss on the exercise of a Warrant and

related receipt of a Warrant Share (unless cash is received in lieu of the

issuance of a fractional Warrant Share). A U.S. Holder’s initial tax

basis in the Warrant Share received on the exercise of a Warrant should be equal

to the sum of (a) such U.S. Holder’s tax basis in such Warrant plus (b) the

exercise price paid by such U.S. Holder on the exercise of such

Warrant. Subject to the “passive foreign investment company” (or

“PFIC”, as defined below) rules discussed below, a U.S. Holder’s holding period

for the Warrant Share received on the exercise of a Warrant should begin on the

date that such Warrant is exercised by such U.S. Holder.

Disposition of

Warrants

A U.S.

Holder will recognize gain or loss on the sale or other taxable disposition of a

Warrant in an amount equal to the difference, if any, between (a) the amount of

cash plus the fair market value of any property received and (b) such U.S.

Holder’s tax basis in the Warrant sold or otherwise disposed

of. Subject to the PFIC rules discussed below, any such gain or loss

generally will be a capital gain or loss (provided that the Warrant Share to be

issued on the exercise of such Warrant would have been a capital asset within

the meaning of Section 1221 of the Code if acquired by the U.S. Holder), which

will be long-term capital gain or loss if the Warrant is held for more than one

year.

Expiration of Warrants

Without Exercise

Subject

to the PFIC rules discussed below, upon the lapse or expiration of a Warrant, a

U.S. Holder will recognize a loss in an amount equal to such U.S. Holder’s tax

basis in the Warrant. Any such loss generally will be a capital loss

and will be long-term capital loss if the Warrants are held for more than one

year. Deductions for capital losses are subject to complex

limitations under the Code.

Certain Adjustments to the

Warrants

Under

Section 305 of the Code, an adjustment to the number of Warrant Shares that will

be issued on the exercise of the Warrants, or an adjustment to the exercise

price of the Warrants, may be treated as a constructive distribution to a U.S.

Holder of the Warrants if, and to the extent that, such adjustment has the

effect of increasing such U.S. Holder’s proportionate interest in the “earnings

and profits” or assets of the Company, depending on the circumstances of such

adjustment (for example, if such adjustment is to compensate for a distribution

of cash or other property to shareholders of the Company). (See more

detailed discussion of the rules applicable to distributions made by the Company

at “U.S. Federal Income Tax Consequences of the Acquisition, Ownership, and

Disposition of Common Shares and Warrant Shares – Distributions on Common Shares

and Warrant Shares” below).

U.S.

Federal Income Tax Consequences of the Acquisition, Ownership, and Disposition

of Common Shares and Warrant Shares

The

following discussion is subject to the rules described below under the heading

“Passive Foreign Investment Company Rules.”

Distributions on Common

Shares and Warrant Shares

Subject

to the PFIC rules discussed below, a U.S. Holder that receives a distribution,

including a constructive distribution, with respect to a Common Share or Warrant

Share will be required to include the amount of such distribution in gross

income as a dividend (without reduction for any Canadian income tax withheld

from such distribution) to the extent of the current or accumulated “earnings

and profits” of the Company, as computed for U.S. federal income tax

purposes. A dividend generally will be taxed to a U.S. Holder at

ordinary income tax rates. To the extent that a distribution exceeds

the current and accumulated “earnings and profits” of the Company, such

distribution will be treated first as a tax-free return of capital to the extent

of a U.S. Holder's tax basis in the Common Shares or Warrant Shares and

thereafter as gain from the sale or exchange of such Common Shares or Warrant

Shares. (See “ Sale or Other Taxable Disposition of Common Shares

and/or Warrant Shares” below). However, the Company does not intend

to maintain the calculations of earnings and profits in accordance with U.S.

federal income tax principles, and each U.S. Holder should therefore assume that

any distribution by the Company with respect to the Common Shares or Warrant

Share will constitute ordinary dividend income. Dividends received on

Common Shares or Warrant Shares generally will not be eligible for the

“dividends received deduction”.

For tax

years beginning before January 1, 2011, a dividend paid to a U.S. Holder who is

an individual, estate or trust by the Company generally will be taxed at the

preferential tax rates applicable to long-term capital gains if the Company is a

“qualified foreign corporation” as defined under Section 1(h)(11) of the Code (a

“QFC”) and certain holding period requirements for the Common Shares or Warrant

Shares are met. The Company generally will be a QFC if the Company is

eligible for the benefits of the Canada-U.S. Tax Convention or the Common Shares

or Warrant Shares are readily tradable on an established securities market in

the U.S. However, even if the Company satisfies one or more of these

requirements, the Company will not be treated as a QFC if the Company is a PFIC

for the tax year during which it pays a dividend or for the preceding tax

year. (See the section below under the heading “Passive Foreign

Investment Company Rules”).

If a U.S.

Holder fails to qualify for the preferential tax rates discussed above, a

dividend paid by the Company to a U.S. Holder generally will be taxed at

ordinary income tax rates (and not at the preferential tax rates applicable to

long-term capital gains). The dividend rules are complex, and each

U.S. Holder should consult its own tax advisor regarding the application of such

rules.

Sale or Other Taxable

Disposition of Common Shares and/or Warrant Shares

Subject

to the PFIC rules discussed below, upon the sale or other taxable disposition of

Common Shares or Warrant Shares, a U.S. Holder generally will recognize capital

gain or loss in an amount equal to the difference between (i) the amount of cash

plus the fair market value of any property received and (ii) such U.S. Holder’s

tax basis in such Common Shares or Warrant Shares sold or otherwise disposed

of. Subject to the PFIC rules discussed below, gain or loss

recognized on such sale or other disposition generally will be long-term capital

gain or loss if, at the time of the sale or other disposition, the Common Shares

or Warrant Shares have been held for more than one year.

Preferential

tax rates apply to long-term capital gain of a U.S. Holder that is an

individual, estate, or trust. There are currently no preferential tax

rates for long-term capital gain of a U.S. Holder that is a

corporation. Deductions for capital losses are subject to significant

limitations under the Code.

Passive

Foreign Investment Company Rules

If the

Company were to constitute a PFIC (as defined below) for any year during a U.S.

Holder’s holding period, then certain different and potentially adverse tax

consequences would apply to such U.S. Holder’s acquisition, ownership and

disposition of Units, Common Shares, Warrants, and Warrant Shares.

The

Company generally will be a PFIC under Section 1297 of the Code if, for a

taxable year, (a) 75% or more of the gross income of the Company for such

taxable year is passive income or (b) 50% or more of the assets held by the

Company either produce passive income or are held for the production of passive

income, based on the quarterly average of the fair market value of such

assets. “Gross income” generally means all revenues less the cost of

goods sold, and “passive income” includes, for example, dividends, interest,

certain rents and royalties, certain gains from the sale of stock and

securities, and certain gains from commodities transactions. Active

business gains arising from the sale of commodities generally are excluded from

passive income if substantially all of a foreign corporation’s commodities are

(a) stock in trade of such foreign corporation or other property of a kind which

would properly be included in inventory of such foreign corporation, or property

held by such foreign corporation primarily for sale to customers in the ordinary

course of business, (b) property used in the trade or business of such foreign

corporation that would be subject to the allowance for depreciation under

Section 167 of the Code, or (c) supplies of a type regularly used or consumed by

such foreign corporation in the ordinary course of its trade or

business.

In

addition, for purposes of the PFIC income test and asset test described above,

if the Company owns, directly or indirectly, 25% or more of the total value of

the outstanding shares of another corporation, the Company will be treated as if

it (a) held a proportionate share of the assets of such other corporation and

(b) received directly a proportionate share of the income of such other

corporation. In addition, for purposes of the PFIC income test and

asset test described above, “passive income” does not include any interest,

dividends, rents, or royalties that are received or accrued by the Company from

a “related person” (as defined in Section 954(d)(3) of the Code), to the extent

such items are properly allocable to the income of such related person that is

not passive income.

Under

certain attribution rules, if the Company is a PFIC, U.S. Holders will be deemed

to own their proportionate share of any subsidiary of the Company which is also

a PFIC (a ‘‘Subsidiary PFIC’’), and will be subject to U.S. federal income tax

on (i) a distribution on the shares of a Subsidiary PFIC or (ii) a disposition

of shares of a Subsidiary PFIC, both as if the holder directly held the shares

of such Subsidiary PFIC.

The

Company does not believe that it was a PFIC for the tax year ended December 31,

2009, and based on current business plans and financial expectations, the

Company does not expect to be a PFIC for the current tax year. The

determination of whether the Company will be a PFIC for a taxable year depends,

in part, on the application of complex U.S. federal income tax rules, which are

subject to differing interpretations. In addition, whether the

Company will be a PFIC for its current taxable year depends on the assets and

income of the Company over the course of each such taxable year and, as a

result, cannot be predicted with certainty as of the date of this communication.

Consequently, there can be no assurance regarding the Company’s PFIC status for

any taxable year, and there can be no assurance that the IRS will not challenge

the determination made by the Company concerning its PFIC

status.

Under the

default PFIC rules, a U.S. Holder would be required to treat any gain recognized

upon a sale or disposition of our Units, Common Shares, Warrants, or Warrant

Shares as ordinary (rather than capital), and any resulting U.S. federal income

tax may be increased by an interest charge which is not deductible by

non-corporate U.S. Holders. Rules similar to those applicable to

dispositions will generally apply to distributions in respect of our Common

Shares or Warrant Shares which exceed a certain threshold level.

While

there are U.S. federal income tax elections that sometimes can be made to

mitigate these adverse tax consequences (including, without limitation, the “QEF

Election” and the “Mark-to-Market Election”), such elections are available in

limited circumstances and must be made in a timely manner. Under

proposed Treasury Regulations, if a U.S. holder has an option, warrant, or other

right to acquire stock of a PFIC (such as the Units or the Warrants), such

option, warrant or right is considered to be PFIC stock subject to the default

rules of Section 1291 of the Code. However, the holding period for

the Warrant Shares will begin on the date a U.S. Holder acquires the

Units. This will impact the availability of the QEF Election and

Mark-to-Market Election with respect to the Warrant Shares. Thus, a

U.S. Holder will have to account for Warrant Shares and Common Shares under the

PFIC rules and the applicable elections differently. U.S. Holders are

urged to consult their own tax advisers regarding the potential application of

the PFIC rules to the ownership and disposition of Units, Common Shares,

Warrants, and Warrant Shares, and the availability of certain U.S. tax elections

under the PFIC rules.

U.S.

Holders should be aware that, for each taxable year, if any, that the Company or

any Subsidiary PFIC is a PFIC, the Company can provide no assurances that it

will satisfy the record keeping requirements of a PFIC, or that it will make

available to U.S. Holders the information such U.S. Holders require to make a

QEF Election under Section 1295 of the Code with respect of the Company or any

Subsidiary PFIC. Each U.S. Holder should consult its own tax advisor

regarding the availability of, and procedure for making, a QEF Election with

respect to the Company and any Subsidiary PFIC.

Subject

to certain specific rules, foreign income and withholding taxes paid with

respect to any distribution in respect of stock in a PFIC should qualify for the

foreign tax credit. The rules relating to distributions by a PFIC are

complex, and a U.S. Holder should consult with its own tax advisor with respect

to any distribution received from a PFIC.

Additional

Considerations

Receipt of Foreign

Currency

The

amount of any distribution paid to a U.S. Holder in foreign currency or on the

sale, exchange or other taxable disposition of Common Shares, Warrants or

Warrant Shares generally will be equal to the U.S. dollar value of such foreign

currency based on the exchange rate applicable on the date of receipt

(regardless of whether such foreign currency is converted into U.S. dollars at

that time). If the foreign currency received is not converted into

U.S. dollars on the date of receipt, a U.S. Holder will have a basis in the

foreign currency equal to its U.S. dollar value on the date of

receipt. Any U.S. Holder who receives payment in foreign currency and

engages in a subsequent conversion or other disposition of the foreign currency

may have a foreign currency exchange gain or loss that would be treated as

ordinary income or loss, and generally will be U.S. source income or loss for

foreign tax credit purposes. Each U.S. Holder should consult its own

U.S. tax advisor regarding the U.S. federal income tax consequences of

receiving, owning, and disposing of foreign currency.

Foreign Tax

Credit

Subject

to the PFIC rules discussed above, a U.S. Holder who pays (whether directly or

through withholding) Canadian income tax with respect to dividends paid on the

Common Shares and Warrant Shares generally will be entitled, at the election of

such U.S. Holder, to receive either a deduction or a credit for such Canadian

income tax paid. Generally, a credit will reduce a U.S. Holder’s U.S.

federal income tax liability on a dollar-for-dollar basis, whereas a deduction

will reduce a U.S. Holder’s income subject to U.S. federal income tax. This

election is made on a year-by-year basis and applies to all foreign taxes paid

(whether directly or through withholding) by a U.S. Holder during a

year.

Complex

limitations apply to the foreign tax credit, including the general limitation

that the credit cannot exceed the proportionate share of a U.S. Holder’s U.S.

federal income tax liability that such U.S. Holder’s “foreign source” taxable

income bears to such U.S. Holder’s worldwide taxable income. In

applying this limitation, a U.S. Holder’s various items of income and deduction

must be classified, under complex rules, as either “foreign source” or “U.S.

source.” Generally, dividends paid by a foreign corporation should be

treated as foreign source for this purpose, and gains recognized on the sale of

stock of a foreign corporation by a U.S. Holder should be treated as U.S. source

for this purpose, except as otherwise provided in an applicable income tax

treaty, and if an election is properly made under the Code. However,

the amount of a distribution with respect to the Common Shares or Warrant Shares

that is treated as a “dividend” may be lower for U.S. federal income tax

purposes than it is for Canadian federal income tax purposes, resulting in a

reduced foreign tax credit allowance to a U.S. Holder. In addition,

this limitation is calculated separately with respect to specific categories of

income. The foreign tax credit rules are complex, and each U.S.

Holder should consult its own U.S. tax advisor regarding the foreign tax credit

rules.

Information Reporting;

Backup Withholding Tax

Under

U.S. federal income tax law and Treasury regulations, certain categories of U.S.

Holders must file information returns with respect to their investment in, or

involvement in, a foreign corporation. For example, recently enacted

legislation generally imposes new U.S. return disclosure obligations (and

related penalties) on U.S. Holders that hold certain specified foreign financial

assets in excess of $50,000. The definition of specified foreign

financial assets includes not only financial accounts maintained in foreign

financial institutions, but also, unless held in accounts maintained by a

financial institution, any stock or security issued by a non-U.S. person, any

financial instrument or contract held for investment that has an issuer or

counterparty other than a U.S. person and any interest in a foreign

entity. U. S. Holders may be subject to these reporting requirements

unless their Units, Common Shares, Warrants, and Warrant Shares are held in an

account at a domestic financial institution. Penalties for failure to

file certain of these information returns are substantial. U.S.

Holders should consult with their own tax advisors regarding the requirements of

filing information returns, and, if applicable, filing obligations relating to a

Mark-to-Market or QEF Election.

Payments

made within the U.S., or by a U.S. payor or U.S. middleman, of dividends on, and

proceeds arising from the sale or other taxable disposition of the Units, Common

Shares, Warrants, and Warrant Shares generally may be subject to information

reporting and backup withholding tax, at the rate of 28% (and increasing to 31%

for payments made after December 31, 2010), if a U.S. Holder (a) fails to

furnish such U.S. Holder’s correct U.S. taxpayer identification number

(generally on Form W-9), (b) furnishes an incorrect U.S. taxpayer identification

number, (c) is notified by the IRS that such U.S. Holder has previously failed

to properly report items subject to backup withholding tax, or (d) fails to

certify, under penalty of perjury, that such U.S. Holder has furnished its

correct U.S. taxpayer identification number and that the IRS has not notified

such U.S. Holder that it is subject to backup withholding

tax. However, certain exempt persons generally are excluded from

these information reporting and backup withholding tax rules. Any

amounts withheld under the U.S. backup withholding tax rules will be allowed as

a credit against a U.S. Holder’s U.S. federal income tax liability, if any, or

will be refunded, if such U.S. Holder furnishes required information to the IRS

in a timely manner. Each U.S. Holder should consult its own tax

advisor regarding the information reporting and backup withholding tax

rules.

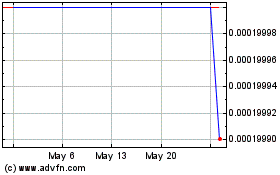

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

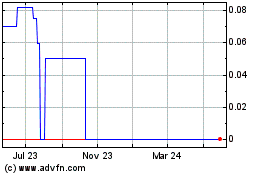

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jul 2023 to Jul 2024