1st Colonial Bancorp Reports Increases in Net Income, Assets, Deposits and Loans

January 30 2006 - 10:06PM

Business Wire

1st Colonial Bancorp, Inc. (OTC Bulletin Board: FCOB), the holding

company for 1st Colonial National Bank, today announced that for

the year ended December 31, 2005, it had net income of $708,000,

representing an $83,000 or 13.3% increase over the prior year. It

also reported that its total assets, loans and deposits had

increased by 20.7%, 20.3% and 20.7%, respectively, since December

31, 2004. Gerry Banmiller, the President and Chief Executive

Officer of 1st Colonial, said "Our 20% growth in 2005 speaks

volumes about the continued success of our bank, and we achieved

this growth while maintaining sound loan underwriting that has

limited our non-performing assets to just 0.02% of our total assets

at year end 2004 and 2005. As a leading community bank in our

market area, we will continue to focus our efforts on the banking

needs of our local businesses and residents. Our efforts have been

facilitated by the opening of a full service branch office at 2802

Route 130, Cinnaminson, New Jersey. This office opened on September

6, 2005." During the fourth quarter of 2005, the Company declared a

5% stock dividend to be paid on April 15, 2006 to all shareholders

of record on April 1, 2005. This is the fifth consecutive year that

the Company has paid a stock dividend. At December 31, 2005, 1st

Colonial reported $164.1 million in assets and $93.1 million in

loans. These amounts reflect an increase of $28.1 million in assets

and $15.7 million in loans from December 31, 2004. Deposits were

$134.2 million at December 31, 2005, an increase of $23.0 million

or 20.7% from December 31, 2004. 1st Colonial also reported a 15.2%

increase in net interest income, to $4.6 million for the year ended

December 31, 2005 from $4.0 million for the comparable period ended

December 31, 2004. According to Gerry Banmiller, "strong growth in

our loan portfolio and an increase in interest rates has resulted

in substantial net interest income growth." Although 1st Colonial's

net income increased 13.3% for the year ended December 31, 2005

compared to the comparable period in 2004, its diluted earnings per

share decreased 3.4% to $0.28 compared to $0.29 in the prior

period. This decline was due largely to the increase in the number

of shares outstanding during 2005. During the year, warrants issued

in 2000 and 2002 were exercised resulting in the issuance of

approximately 237,000 shares of 1st Colonial common stock. The

earnings per share numbers for both periods have been adjusted to

reflect the 5% stock dividend paid on April 15, 2005. For the year

ended December 31, 2005, other income increased approximately

$122,000 or 40.5% compared to the comparable prior period. This was

due primarily to increased account fees of $44,000, income of

$75,000 on Bank Owned Life Insurance ("BOLI"), an increase in ATM

fees of $13,000, and the receipt of $5,000 as a tentative

settlement in a class action lawsuit in which the Bank participated

as a member of the Pulse EFT network, as offset by a $14,000

decrease in gains on loans sold. The remaining increase was volume

related. For the year ended December 31, 2005, other expense

increased approximately $632,000 or 20.3% from the comparable prior

period. Most of these increases were growth related. Due to

increased staff for our new Cinnaminson office and normal salary

adjustments, salaries and benefits increased by $353,000, or 26.3%.

Occupancy and equipment expenses increased by approximately

$92,000, or 23.2%. Of that amount, $41,000 was directly related to

the Cinnaminson office. Advertising expenses increased $104,000, or

by 88.7% for the year ended December 31, 2005 as compared to the

year ended December 31, 2004, due largely to the promotion of our

Cinnaminson office. Data processing increased $36,000 for the year

ended December 31, 2005 compared to the comparable prior period due

to our growth in accounts. With respect to the warrants exercised

during the year ended December 31, 2005, 63,600 shares were issued

upon the exercise of warrants issued in 2000 and 173,000 shares

were issued upon the exercise of warrants issued in 2002. These

exercises resulted in $2,014,000 in additional capital. 38,300

warrants issued in 2000 were not exercised and expired on June 29,

2005. 108,300 warrants issued in 2002 were not exercised and

expired on December 16, 2005. Highlights as of December 31, 2005

and December 31, 2004, and a comparison of the year ended December

31, 2005 to the year ended December 31, 2004, respectively (all

unaudited), include the following (dollars in thousands, except per

share data): -0- *T At At $ % December December increase/ increase/

31, 2005 31, 2004 (decrease) (decrease) --------- ---------

---------- ---------- Total assets $164,107 $135,973 $ 28,134 20.7%

Total loans 93,090 77,390 15,700 20.3% Total deposits 134,201

111,186 23,015 20.7% Shareholders' equity 19,810 17,399 2,411 13.9%

For the year ended ----------------------------------------- $ %

December December increase/ increase/ 31, 2005 31, 2004 (decrease)

(decrease) --------- --------- ---------- ---------- Net interest

income $ 4,646 $ 4,033 $ 613 15.2% Provision for loan losses 228

218 10 4.6% Other income 423 301 122 40.5% Other expense 3,740

3,108 632 20.3% Net income 708 625 83 13.3% Earnings per share,

diluted $ 0.28 $ 0.29 $ (0.01) -3.4% At and for the year ended

------------------------- December 31, December 31, 2005 2004

------------ ------------ Key financial ratios Return on average

assets 0.45% 0.49% Return on average equity 3.91% 3.94% Net

interest margin 3.20% 3.32% Efficiency ratio (1) 73.78% 71.69%

Non-interest income/operating revenue 8.34% 6.95% Non-performing

assets/assets 0.02% 0.02% Net charge offs/average loans 0.05% 0.02%

Allowance for loan losses/loans 1.24% 1.25% (1) Efficiency ratio is

total other expense divided by the sum of net interest income and

total other income. *T 1st Colonial National Bank is a locally

managed community bank headquartered in Collingswood, New Jersey.

Through its three branches, the Bank strives to offer highly

personalized service combined with extended lobby and drive-through

hours, and low fees and charges. The Bank services consumers as

well as small- to mid-sized businesses. Services include free

personal checking, savings, money market and certificates of

deposit accounts. In addition, the bank offers consumer and

commercial loans, lines of credit, home equity loans, ATM cards,

debit cards, free internet banking and free telephone banking. This

Release contains forward-looking statements. These statements are

not historical facts and include statements about management's

strategies and expectations about programs, products, and

opportunities. Such forward-looking statements involve certain

risks and uncertainties. Because of such risks and uncertainties,

actual results and performance may be materially different from

results indicated by these forward-looking statements. Factors that

might cause a difference include, but are not limited to, general

economic conditions; changes in interest rates, deposit flows, loan

demand, real estate values and competition; changes in accounting

principles, policies or guidelines; changes in legislation or

regulation; and other economic, competitive, governmental,

regulatory and technological factors affecting the bank's

operations, pricing, products and services. More detailed

information concerning 1st Colonial's financial condition and

results of operations can be found in the company's 2005 annual

report to shareholders, which should be available shortly. If you

would like a copy when it becomes available, please send a written

request to Robert C. Faix, Corporate Secretary, at 1040 Haddon

Avenue, Collingswood, New Jersey 08108. More information on 1st

Colonial can be found online at www.1stColonial.com or by

telephoning 1st Colonial's main branch at 856-858-1100.

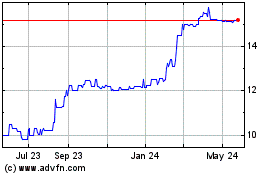

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Jun 2024 to Jul 2024

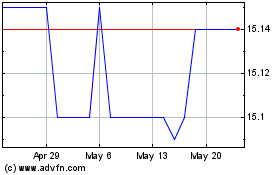

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Jul 2023 to Jul 2024