Current Report Filing (8-k)

September 26 2019 - 1:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

Form

8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (Date

of earliest event reported): September 19, 2019

FOOTHILLS

EXPLORATION, INC.

(Exact name of registrant

as specified in its charter)

|

Delaware

|

|

000-55872

|

|

27-3439423

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

10940 Wilshire Blvd., 23rd Floor

Los Angeles, CA 90024

(Address of principal executive offices)

(Zip Code)

(424) 901-6655

(Registrant’s

telephone number, including area code)

N/A

(Former name or

former address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

[ ]

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 1.01. Entry into a Material Definitive

Agreement

On September 19, 2019, Foothills Exploration,

Inc. (the “Company”), closed on a convertible redeemable loan transaction with an unaffiliated lending entity (“Holder”)

in the principal amount of $115,000 (the “Note”), before giving effect to certain transactional costs including legal

fees yielding a net of $115,000.

The Holder is entitled, at its option, at any

time after the 180th daily anniversary of the Note, to convert all or any amount of the principal face amount of this Note then

outstanding into shares of the Company’s common stock (the “Common Stock”) at a price (“Conversion Price”)

for each share of Common Stock equal to 55% of the lowest trading price of the Common Stock as reported on the National Quotations

Bureau OTC Marketplace exchange which the Company’s shares are traded or any exchange upon which the Common Stock may be

traded in the future (“Exchange”), for the twenty (20) prior trading days including the day upon which a Notice of

Conversion is received by the Company or its transfer agent (provided such Notice of Conversion is delivered by fax or other electronic

method of communication to the Company or its transfer agent after 4 P.M. Eastern Standard or Daylight Savings Time if the Holder

wishes to include the same day closing price).

Interest on any unpaid principal balance of

this Note shall be paid at the rate of 12% per annum. Interest shall be paid by the Company in Common Stock (“Interest Shares”).

Holder may, at any time, after the 180th daily anniversary of the Note, send in a Notice of Conversion to the Company for Interest

Shares based on the formula described above. The dollar amount converted into Interest Shares shall be all or a portion of the

accrued interest calculated on the unpaid principal balance of this Note to the date of such notice.

The maturity date for this Note is September

19, 2020 (“Maturity Date”), and is the date upon which the principal sum, as well as any accrued and unpaid interest,

shall be due and payable. This Note may be prepaid or assigned with the following penalties/premiums: (i) during the initial 60

calendar day period after the issuance of the Note, by making a payment to the Holder of an amount in cash equal to 125% multiplied

by the principal, plus accrued interest; (ii) during the 61st through 120th calendar day period after the issuance of the Note,

by making a payment to the Holder of an amount in cash equal to 135% multiplied by principal, plus accrued interest; (iii) during

the 121st through 180th calendar day period after the issuance of the Note, by making a payment to the Holder of an amount in cash

equal to 145% multiplied by principal, plus accrued interest.

The Company may not prepay any amount outstanding

under this Note after the 180th calendar day after the issuance of the Note. Any amount of principal or interest due pursuant to

this Note, which is not paid by the Maturity Date, shall bear interest at the rate of the lesser of (i) twenty-four percent (24%)

per annum or (ii) the maximum amount permitted by law from the due date thereof until the same is paid (“Default Interest”).

If this Note is not paid by the Maturity Date, the outstanding principal due under this Note shall increase by 10%. Interest shall

commence accruing on the date the Note is fully paid and shall be computed on the basis of a 360-day year and the actual number

of days elapsed. Net proceeds obtained in this transaction will be used to retire two convertible notes with existing lenders and

for general corporate and working capital purposes. No broker-dealer or placement agent was retained or involved in this transaction.

The transaction documents contain additional

terms and provisions, representations and warranties, including further provisions covering conversions of debt, remedies on default,

venue, and governing law. The summary of the transactions described in this Form 8-K is qualified in its entirety by reference

to the Securities Purchase Agreement, and the 12% Convertible Redeemable Note, which are filed as Exhibits 10.1 and 10.2, to this

report.

Item 3.02 Unregistered Sales of Equity Securities.

Disclosures made in Item 1.01 of this Form

8-K are incorporated by reference into this Item 3.02. The offer and sale of the securities were made in reliance on the exemption

from registration under Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D under the Securities Act. The offering

and sale were not conducted in connection with a public offering, and no public solicitation or advertisement was made or relied

upon by the Holder in connection with the offering. This current report on Form 8-K shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall such securities be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements and certificates evidencing such shares contain a legend stating the same.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date: September 25, 2019

|

|

|

|

|

|

FOOTHILLS EXPLORATION, INC.

|

|

|

|

|

|

By:

|

/s/ B. P. Allaire

|

|

|

|

B. P. Allaire

|

|

|

|

Chief Executive Officer

|

|

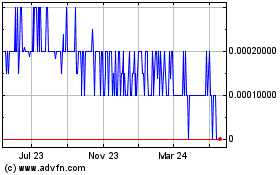

Foothills Exploration (CE) (USOTC:FTXP)

Historical Stock Chart

From Dec 2024 to Jan 2025

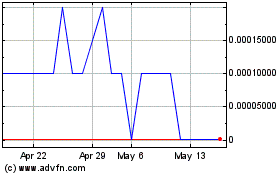

Foothills Exploration (CE) (USOTC:FTXP)

Historical Stock Chart

From Jan 2024 to Jan 2025