UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant [ ]

Filed by a Party other than the Registrant

[ ]

Check the appropriate box:

|

|

[X]

|

Preliminary Proxy Statement

|

|

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

Definitive Proxy Statement

|

|

|

|

Definitive Additional Materials

|

|

|

|

Soliciting Material Pursuant to §240.14a-12

|

FORTUNE VALLEY

TREASURES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if

Other Than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

|

|

[ ]

|

No fee required.

|

|

|

|

|

|

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

Amount previously paid:

|

|

|

|

|

|

|

|

|

(2)

|

Form, schedule or registration statement no.:

|

|

|

|

|

|

|

|

|

(3)

|

Filing party:

|

|

|

|

|

|

|

|

|

(4)

|

Date filed:

|

FORTUNE VALLEY TREASURES, INC.

19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan

District,

Shenzhen, 518000, China

Tel: (86) 75586961406

October 13, 2017

Dear Stockholder:

You are cordially invited to attend a Special

Meeting of Stockholders (the “Special Meeting”) of Fortune Valley Treasures, Inc. to be held on November 6, 2017 at

9:30 a.m., at 19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan District, Shenzhen, 518000, China. Only stockholders of record at the

close of business on October 2, 2017 are entitled to the notice of, and to vote at, the Special Meeting, including any postponement

or adjournment thereof.

Details regarding the business

to be conducted are more fully described in the accompanying Notice of Special Meeting and Proxy Statement.

It is important that your

shares be represented at the Special Meeting, and you are encouraged to vote your shares as soon as possible. If you are unable

to attend the meeting in person, I urge you to complete, date and sign the enclosed proxy card and promptly return it in the envelope

provided. Your vote is important.

We look forward to seeing

you at the Special Meeting

Sincerely yours,

|

/s/ Lin Yumin

|

|

|

President, Secretary, Treasurer, Director, Chairman of the Board

|

|

Important Notice Regarding the Availability

of Proxy Materials for the Special Meeting of Stockholders to Be Held on November 6, 2017.

FORTUNE VALLEY TREASURES, INC.

19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan

District,

Shenzhen, 518000, China

Tel: (86) 75586961406

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD NOVEMBER 6, 2017

To the Stockholders of Fortune Valley Treasures,

Inc.

A Special Meeting of

Stockholders (the “Special Meeting”) of Fortune Valley Treasures, Inc., a Nevada corporation (the “Company”),

will be held at 19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan District, Shenzhen, 518000, China. On Monday, November 6, 2017, at

9:30 a.m. for the following purposes:

|

|

1.

|

To approve an amendment to the Articles of Incorporation to increase our authorized capital 75,000,000 common shares to 2,000,000,000 common shares.

|

|

|

|

|

|

|

2.

|

To approve the adjournment

of the Special Meeting, if necessary or appropriate, to solicit additional proxies; and

|

|

|

|

|

|

|

3.

|

To transact such other

business as may properly come before the meeting, or any postponement or adjournment thereof.

|

THE BOARD, INCLUDING THE INDEPENDENT DIRECTORS,

UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THESE PROPOSALS.

You have the right to

receive notice of and to vote at the Special Meeting if you were a stockholder of record at the close of business on October 2,

2017. Whether or not you expect to be present in person at the Special Meeting, please sign the proxy and return it promptly. In

the event there are not sufficient votes for a quorum or to approve any of the foregoing proposals at the time of the Special Meeting,

the Special Meeting may be adjourned in order to permit further solicitation of the proxies by the Company.

By Order of the Board,

|

Lin Yumin

|

|

|

President, Secretary, Treasurer, Director,

Chairman of the Board

|

|

|

October 13, 2017

|

|

Even if you vote your

shares prior to the Special Meeting, you still may attend the Special Meeting and vote your shares in person.

FORTUNE VALLEY TREASURES,

INC.

19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan

District,

Shenzhen, 518000, China

Tel: (86) 75586961406

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

This proxy statement

is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Fortune Valley

Treasures, Inc. a Nevada corporation (the “Company,” “we,” “us” or “our”), for

use at the Company’s 2015 Special Meeting of Stockholders (the “Special Meeting”) to be held on Monday, November

6, 2017, at 9:30 a.m. Shenzhen China Time at 19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan District, Shenzhen, 518000, China and

at any postponements or adjournments thereof. This proxy statement, the accompanying proxy card are being sent to stockholders

on or about October 20, 2017

We encourage you to vote

your shares, either by voting in person at the Special Meeting or by granting a proxy

(i.e.,

authorizing someone to vote

your shares). If you properly sign and date the proxy card, and the Company receives it in time for the Special Meeting, the persons

named as proxies will vote the shares registered directly in your name in the manner that you specified. Please complete and return

the paper proxy card in the pre-addressed, postage-paid envelope provided.

SPECIAL MEETING INFORMATION

Date and Location

We will hold the Special Meeting on November

6, 2017, at 9:30 a.m. Shenzhen, China Time at 19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan District, Shenzhen, 518000, China.

Admission

Only record or beneficial

owners of the Company’s common stock as of the close of business on October 2, 2017 or their proxies may attend the Special

Meeting. Beneficial owners must also provide evidence of stock holdings, such as a recent brokerage account or bank statement.

Purpose of the Special Meeting

At the Special Meeting,

you will be asked to vote on the following proposals:

|

|

1.

|

To approve an amendment to the Articles of Incorporation to increase our authorized capital from 75,000,000 common shares to 2,000,000,000 common shares.

|

|

|

2.

|

To approve the adjournment

of the Annual Meeting, if necessary or appropriate, to solicit additional proxies.

|

VOTING INFORMATION

Record Date and Quorum Required

The record date of the

Special Meeting is the close of business on October 2, 2017 (the “Record Date”). You may cast one vote for each share

of our common stock that you own as of the Record Date.

A quorum of stockholders

must be present at the Special Meeting for any business to be conducted. The presence at the Special Meeting, in person or by proxy,

of stockholders entitled to cast a majority of the votes entitled to be cast as of the Record Date will constitute a quorum. Abstentions

will be treated as shares present for quorum purposes. Broker shares for which the nominee has not received voting instructions

from the record holder and does not have discretionary authority to vote the shares on certain proposals (“Broker Non-Votes”)

will be treated as shares present for quorum purposes. On the Record Date, there were 7,750,000 shares of our common stock outstanding

and entitled to vote. Thus, 3,875,001 shares of our common stock must be represented by stockholders present at the Annual Meeting

or by proxy to have a quorum.

If a quorum is not present

at the Special Meeting, the stockholders who are represented may adjourn the Special Meeting until a quorum is present. The persons

named as proxies will vote those proxies for such adjournment, unless marked to be voted against any proposal for which an adjournment

is sought, to permit further solicitation of proxies.

Submitting Voting Instructions for Shares

Held Through a Broker

If you hold shares of

common stock through a broker, bank or other nominee, you must follow the voting instructions you receive from your broker, bank

or nominee. If you hold shares of our common stock through a broker, bank or other nominee and you want to vote in person at the

Special Meeting, you must obtain a legal proxy from the record holder of your shares and present it at the meeting. If you do not

submit voting instructions to your broker, bank or other nominee, your broker, bank or other nominee will not be permitted to vote

your shares on any proposal considered at the Special Meeting.

Authorizing a Proxy for Shares Held in Your

Name

If you are a record holder

of shares of our common stock, you may authorize a proxy to vote on your behalf by mail, as described on the enclosed proxy card.

Authorizing a proxy will not limit your right to vote in person at the Special Meeting. A properly completed, executed and submitted

proxy will be voted in accordance with your instructions, unless you subsequently revoke the proxy. If you authorize a proxy without

indicating your voting instructions, the proxyholder will vote your shares according to the Board’s recommendations.

Revoking Your Proxy

If you are a stockholder

of record, you can revoke your proxy by (1) delivering a written revocation notice prior to the Special Meeting to our President

and Secretary, Lin Yumin at 19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan District, Shenzhen, 518000, China.; (2) delivering a later-dated

proxy that we receive no later than the opening of the polls at the Special Meeting; or (3) voting in person at the Special Meeting.

If you hold shares of common stock through a broker, bank or other nominee, you must follow the instructions you receive from your

nominee in order to revoke your voting instructions. Attending the Special Meeting does not revoke your proxy unless you also vote

in person at the Special Meeting.

Vote Required

|

Proposal

|

|

Vote Required

|

|

Broker Discretionary Voting Allowed

|

|

Effect of Absentions and Broker Non-Votes

|

|

Proposal 1 —

To approve

an amendment to the Articles of Incorporation to increase our authorized capital 75,000,000 common shares to 2,000,000,000 common

shares.

|

|

Affirmative vote of the majority of the votes entitled to be cast by the holders of the common stock.

|

|

No

|

|

Abstentions and broker non-votes, if any, will have the same effect of a vote against this proposal.

|

|

Proposal 2 —

To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies.

|

|

Affirmative vote of the holders of a majority of the votes cast at the Annual Meeting.

|

|

No

|

|

Abstentions and broker non-votes, if any, will have the same effect of a vote against this proposal.

|

INFORMATION REGARDING THIS SOLICITATION

Our Board is making this

solicitation and the Company will bear the expense of the solicitation of proxies for the Special Meeting, including the cost of

preparing, printing, and mailing this proxy statement, the accompanying Notice of Special Meeting of Stockholders, and the proxy

card. If brokers, trustees, or fiduciaries and other institutions or nominees holding shares in their names, or in the name of

their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies form, such beneficial

owners, we will reimburse such persons for their reasonable expenses in so doing. In addition, we will indemnify them against any

losses arising out of that firm’s proxy soliciting services on our behalf.

In addition to the solicitation

of proxies by the use of the mail, proxies may be solicited in person and/or by telephone or facsimile transmission by directors,

officers or employees of the Company the Company’s officers are located at 19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan District,

Shenzhen, 518000, China. No additional compensation will be paid to directors, officers or regular employees of the Company for

such services.

If a stockholder wishes

to participate in the Special Meeting, the stockholder may submit the proxy card originally sent with this Proxy Statement or attend

in person.

The SEC has adopted rules

that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports

with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed

to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience

for stockholders and cost savings for companies.

A number of brokerages

and other institutional holders of record have implemented householding. A single proxy statement will be delivered to multiple

stockholders sharing an address unless contrary instructions have been received from the affected stockholders. If you have received

notice from your broker that it will be householding communications to your address, householding will continue until you are notified

otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer

to receive a separate proxy statement, please notify your broker. Stockholders who currently receive multiple copies of the proxy

statement at their addresses and would like to request information about householding of their communications should contact their

brokers or other intermediary holder of record. You can notify us by sending a written request to: Lin Yumin, President and Secretary,

19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan District, Shenzhen, 518000, China.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets

forth, as of October 2, 2017, the beneficial ownership of each current director, the Company’s executive officers, each person

known to us to beneficially own 5% or more of the outstanding shares of the Company’s common stock, and the executive officers

and directors as a group.

Beneficial ownership

is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”) and includes voting

or investment power with respect to the securities. Common stock subject to options or warrants that are currently exercisable

or exercisable within 60 days of October 2, 2017, are deemed to be outstanding and beneficially owned by the person holding such

options or warrants. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of

any other person. Percentage of ownership is based on 7,750,000 shares of the Company’s common stock outstanding as of October

2, 2017.

Unless otherwise indicated,

to our knowledge, each stockholder listed below has sole voting and investment power with respect to the shares beneficially owned

by the stockholder, except to the extent authority is shared by their spouses under applicable law. Unless otherwise indicated,

the address of all executive officers and directors is c/o President and Secretary, 19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan

District, Shenzhen, 518000, China.

The Company’s directors

are divided into two groups — interested directors and independent directors. Interested directors are “interested

persons” as defined in Section 2(a)(19) of the 1940 Act.

|

IDENTITY OF PERSON

OR GROUP

|

|

CLASS

|

|

TOTAL

SHARES

OWNED

|

|

|

PERCENT OF

SHARES

OWNED

|

|

Lin Yumin

President, Secretary, Treasurer, Director

|

|

Common Stock

|

|

|

0

|

|

|

|

0

|

%

|

Xinlong Shen

Director

|

|

Common Stock

|

|

|

1,090,000*

Direct

|

|

|

|

14.06

|

%

|

|

Directors and Executive Officers as a Group (2 persons)

|

|

Common Stock

|

|

|

1,090,000

|

|

|

|

14.06

|

%

|

|

(1)

|

Beneficial ownership

has been determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended.

|

|

(2)

|

The persons named

above known to be a beneficial owner of 5% or more of the Company’s stock may be deemed to be a “parent” and

“promoter” of the Company, within the meaning of such terms under the Securities Act of 1933, as amended, by virtue

of his direct holdings in the Company.

|

*

The above noted shares were fully

paid for by the owner and were not paid for by means of a loan of any description.

The following table sets

forth as of October 2, 2017, the dollar range of our securities owned by our directors and executive officers.

|

Name

|

|

Dollar Range of Equity

Securities Beneficially Owned

(1)(2)

|

|

|

Interested Director:

|

|

|

|

|

|

Xinlong Shen

|

|

|

over $100,000

|

|

|

|

|

|

|

|

|

Independent Directors:

|

|

|

|

|

|

|

|

|

|

|

|

Lin Yumin

|

|

|

0

|

|

|

Lin Yumin

|

|

|

0

|

|

|

(1)

|

The dollar range of

the equity securities beneficially owned is based on the closing price per share of the Company’s common stock of $1.67 on

October 2, 2017 on the OTCBB.

|

|

(2)

|

The dollar ranges

of equity securities beneficially owned are: none; $1-$10,000; $10,001-$50,000; $50,001-$100,000; and over $100,000.

|

ADDITIONAL INFORMATION

1. Yumin Lin is the

President,

Secretary, Treasurer, Director, Chairman of the Board

of FVTI and he holds no shares of FVTI. Xinlong Shen is the Director

of FVTI and he holds 1,090,000 shares of FVTI. Yumin Lin is the Sole Director of DIGL and he holds 15,000,000 Shares of DIGL. Due

to the position of Yumin Lin as an officer and director on the Board of Fortune Valley Treasures, Inc. and as a shareholder and

the president, secretary, treasurer and sole director of DaXingHuaShang Investment Group Limited (DIGL). The Agreement between

the parties is not at Arms Length.

2. Full legal name and business address

of each officer/director of FVTI and DIGL

|

FVTI

|

|

|

|

|

|

Name

|

|

Position

|

|

Address

|

|

|

|

|

|

|

|

Yumin Lin

|

|

President, Secretary, Treasurer, Director, Chairman of the Board

|

|

19F Lianhe Tower, 1069 Nanhai Avenue, Nanshan District, Shenzhen, Guangdong,

China

|

|

|

|

|

|

|

|

Xinlong Shen

|

|

Director

|

|

19F Lianhe Tower, 1069 Nanhai Avenue, Nanshan District, Shenzhen, Guangdong,

China

|

|

DIGL:

|

|

|

|

|

|

Name

|

|

Position

|

|

Address

|

|

|

|

|

|

|

|

Yumin Lin

|

|

President, Secretary, Treasurer, Director,

|

|

19F Lianhe Tower, 1069 Nanhai Avenue, Nanshan District, Shenzhen, Guangdong,

China

|

3. None of the officers or directors of FVTI

have purchased or sold any shares of FVTI within the last two years.

4. No FVTI shares are owned directly or indirectly

by any associate or close family member of the officers or directors of FVTI.

5. None of the officers or directors of FVTI

or DIGL are now or within the past two years have been a party to any contract, arrangement or understanding with any person with

respect to any shares of FVTI, nor does any officer or director of FVTI have any arrangement with any associate or family member

with respect to any future employment by FVTI or DIGL or with respect to any future transactions with FVTI or DIGL.

PROPOSAL 1: APPROVAL OF AN AMENDMENT TO

THE ARTICLES OF INCORPORATION TO AUTHORIZE THE BOARD OF DIRECTORS TO INCREASE THE COMPANY’S AUTHORIZED CAPITAL FROM 75,000,000

TO 2,000,000,000 COMMON SHARES

The Board has adopted,

and recommends that stockholders approve an amendment to the Company’s Articles of Incorporation to increase our authorized

capital from 75,000,000 common shares to 2,000,000,000 common shares. (the “Increase in Authorized Capital Proposal”).

The Increase in Authorized Capital Proposal

The form of the proposed

amendment to the Company’s Articles of Incorporation to affect an increase in Authorized Capital is attached to this Proxy

Statement as Appendix A. Under the terms of the Authorized Capital Proposal, the Board will be given the authority to implement

the proposed amendment.

Reasons for the Proposal

The purpose of the amendment

to our Articles of Incorporation is to reorganize our capital structure, which management believes will better position us to attract

financing and to have share capital available for possible acquisitions in the future. We are currently planning to issue 300 million

shares to acquire 100% of the shares and assets of DaXingHuaShang Investment Group Limited (“DIGL”), a company incorporated

under the laws of the Republic of Seychelles.

DIGL is a Seychelles

company, founded on April 7, 2016. The share capital of the company is 250,000,000 common shares. There are currently three shareholders

of DIGL, they are

Yumin Lin with 15,000,000 shares of DIGL,

Gaosheng Group Co., Ltd.

(Beneficial Owner: Ma Huijun, Address -

Second Floor, Capital City, Independence Avenue,

Victoria, Mahe, Seychelles

, with 107,500,000 shares of DIGL and

China Kaipeng Group

Co., Ltd.

(Beneficial Owner: Luo Naiyong, Address -

Second Floor, Capital City, Independence

Avenue, Victoria, Mahe, Seychelles w

ith 127,500,000 shares of DIGL.

The following table shows

the percentage, date of issuance and cost in US funds of the above noted shares of DIGL.

|

Name

|

|

Number of shares

|

|

|

% of DIGL

Owned

|

|

|

Date of Issue

|

|

|

Cost(USD)

|

|

|

Yumin Lin

|

|

|

15,000,000

|

*

|

|

|

6

|

%

|

|

|

April 7, 2016

|

|

|

$

|

6,000

|

|

China Kaipeng Group Co., Ltd.

Beneficial Owner: Luo Naiyong

|

|

|

127,500,000

|

*

|

|

|

51

|

%

|

|

|

April 7, 2016

|

|

|

$

|

51,000

|

|

Gaosheng Group Co., Ltd.

Beneficial Owner: Ma Huijun

|

|

|

107,500,000

|

*

|

|

|

43

|

%

|

|

|

April 7, 2016

|

|

|

$

|

43,000

|

|

* Upon closing, all the above noted shares

will be transferred to FVTI.

DIGL owns Dongguan

City France Vin Tout Co. Ltd (“DCFV”). DCFV is the business arm of DIGL. It includes wholesale and retail sales of

packed food and other consumer products. Additionally, DCFV is engaged in the retail sales and wholesale of a wide spectrum of

wine products in China. Our primary focus will be the introduction and sale of wine products in China. These wine products will

include the sale of wines from France, Spain and Italy as well as wines from California, Australia and Chile. Please see the attached

financials.

The Board will make the

decision once all the information has been completely analyzed. We fully expect the acquisition of the shares and assets of DaXingHuaShang

Investment Group Limited to proceed as planned. The issuance of 300,000,000 shares of FVTI will result in a significant dilution

of the current shareholders’ stock positions and will result in an immediate change of control of FVTI.

Effect of the Increase in Authorized

Capital on Holders of Outstanding Common Stock

If implemented, the Increase

in Authorized Capital will affect all current holders of common stock. The voting rights of FVTI shareholders will not change.

However, due to the dilution of the relative percentage of current shareholder stock, their voting power will be reduced significantly

upon the issuance of 300,000,000 new shares to DIGL. Specifically, current shareholders own a total of 7,750,000 common shares.

The issuance of 300,000,000 new shares to three DIGL owners will reduce the current shareholder’s voting power to 2.5% of

the total voting power after the issuance is completed.

After the effective date

of the Increase in Authorized Capital, we will continue to be subject to the periodic reporting and other requirements of the Securities

Exchange Act of 1934, as amended. The common stock will continue to be listed on the OTCBB under the symbol “FVTI”.

Names and Addresses of New Shareholders

to be Issued 300,000,000 new shares

|

Name of Shareholder

|

|

New Shares FVTI

to be Issued

|

|

|

Address

|

|

LIN, Yumin

|

|

|

18,000,000

|

|

|

19F Lianhe Tower, 1069 Nanhai Avenue, Nanshan District, Shenzhen, Guangdong, China

|

Gaosheng Group Co. Ltd.

Beneficial Owner: Ma Huijun

|

|

|

129,000,000

|

|

|

Second Floor, Capital City, Independence Avenue, Victoria, Mahe, Seychelles

|

China Kaopeng Group Co. Ltd.

Beneficial Owner: Luo Naiyong

|

|

|

153,000,000

|

|

|

Second Floor, Capital City, Independence Avenue, Victoria, Mahe, Seychelles

|

|

TOTAL

|

|

|

300,000,000

|

|

|

|

No Going Private Transaction

The Increase in Authorized

Capital, if implemented, is not intended to be the first step in a “going private transaction” within the meaning of

Rule 13e-3 of the Securities Exchange Act of 1934, as amended.

Federal Income Tax Consequences of the Increase

in Authorized Capital

Whereas the Increase

in Authorized Capital has no effect on individual shareholders share positions, there are no material U.S. federal income tax consequences

of the Increase in Authorized Capital to holders of common stock.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” THE APPROVAL OF THE AMENDMENT TO THE ARTICLES OF INCORPORATION TO AUTHORIZE THE INCREASE IN AUTHORIZED CAPITAL.

PROPOSAL 2: ADJOURNMENT OF THE SPECIAL MEETING

The Company’s stockholders

may be asked to consider and act upon one or more adjournments of the Special Meeting, if necessary or appropriate, to solicit

additional proxies in favor of any or all of the other proposals set forth in this proxy statement.

If a quorum is not present

at the Special Meeting, the Company’s stockholders may be asked to vote on the proposal to adjourn the Special Meeting to

solicit additional proxies. If a quorum is present at the Special Meeting, but there are not sufficient votes at the time of the

Special Meeting to approve one or more of the proposals, the Company’s stockholders may also be asked to vote on the proposal

to approve the adjournment of the Special Meeting to permit further solicitation of proxies in favor of the other proposals. However,

a stockholder vote may be taken on one of the proposals in this proxy statement prior to any such adjournment if there are sufficient

votes for approval on such proposal.

If the adjournment proposal

is submitted for a vote at the Special Meeting, and if the Company’s stockholders vote to approve the adjournment proposal,

the meeting will be adjourned to enable the Board to solicit additional proxies in favor of one or more proposals. If the adjournment

proposal is approved, and the Special Meeting is adjourned, the Board will use the additional time to solicit additional proxies

in favor of any of the proposals to be presented at the Special Meeting, including the solicitation of proxies from stockholders

that have previously voted against the relevant proposal.

The Board believes that,

if the number of shares of the Company’s common stock voting in favor of any of the proposals presented at the Special Meeting

is insufficient to approve the proposal, it is in the best interests of the Company’s stockholders to enable the Board, for

a limited period of time, to continue to seek to obtain a sufficient number of additional votes in favor of the proposal. Any signed

proxies received by the Company in which no voting instructions are provided on such matter will be voted in favor of an adjournment

in these circumstances. The time and place of the adjourned meeting will be announced at the time the adjournment is taken. Any

adjournment of the Special Meeting for the purpose of soliciting additional proxies will allow the Company’s stockholders

who have already sent in their proxies to revoke them at any time prior to their use at the Special Meeting adjourned or postponed.

The Board unanimously recommends a vote “for”

the adjournment of the Special Meeting,

if necessary or appropriate, to solicit additional

proxies.

OTHER BUSINESS

The Board knows of no

other business to be presented for action at the Special Meeting. If any matters do come before the Special Meeting on which action

can properly be taken, it is intended that the proxies shall vote in accordance with the judgment of the person or persons exercising

the authority conferred by the proxy at the Special Meeting. The submission of a proposal does not guarantee its inclusion in the

Company’s proxy statement or presentation at the Special Meeting unless certain securities law requirements are met.

SUBMISSION OF STOCKHOLDER PROPOSALS

The Company expects that

the Special Meeting of Stockholders will be held November 6, 2017. A stockholder who intends to present a proposal at that Special

Meeting pursuant to the SEC’s Rule 14a-8 must submit the proposal in writing to the Company at its address, and the Company

must receive the proposal on or before October 27, 2017, in order for the proposal to be considered for inclusion in the Company’s

proxy statement for that meeting. The submission of a proposal does not guarantee its inclusion in the Company’s proxy statement

or presentation at the meeting.

PRIVACY PRINCIPLES

We are committed to maintaining

the privacy of our stockholders and to safeguarding their nonpublic personal information. The following information is provided

to help you understand what personal information we collect, how we protect that information and why, in certain cases, we may

share information with select other parties.

Generally, we do not

receive any nonpublic personal information relating to our stockholders, although certain nonpublic personal information of our

stockholders may become available to us. We do not disclose any nonpublic personal information about our stockholders or former

stockholders to anyone, except as permitted by law or as is necessary in order to service stockholder accounts (for example, to

a transfer agent or third-party administrator).

We restrict access to

nonpublic personal information about our stockholders to employees of Fortune Valley Treasures, Inc. and its affiliates with a

legitimate business need for the information. We intend to maintain physical, electronic and procedural safeguards designed to

protect the nonpublic personal information of our stockholders.

By Order of the Board

|

/s/ Lin Yumin

|

|

|

President, Secretary, Treasurer, Director

|

|

October 13, 2017

Proxy Card for the Special Meeting of Shareholders

THIS PROXY CARD IS SOLICITED BY THE BOARD

OF DIRECTORS

The undersigned hereby appoints Lin Yumin and

Shen Xinlong or either of them (with full power to act alone), as proxy, of Fortune Valley Treasures, Inc. (the “Corporation”),

having the power to appoint a proxy’s substitute, to represent me and to vote all the shares of the Corporation held of record

or which I am otherwise entitled to vote, at the close of business on October 2, 2017 at the Special Meeting of Shareholders to

be held at the Corporation’s offices at 19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan District, Shenzhen, 518000, China, on

Monday, November 6, 2017 at 09:30 a.m., local time, and at any adjournments thereof, with all the powers the undersigned would

possess if personally present, as indicated herein.

THIS PROXY CARD IS SOLICITED BY THE BOARD

OF DIRECTORS AND WILL BE VOTED AS SPECIFIED AND IN ACCORDANCE WITH THE ACCOMPANYING PROXY STATEMENT. IF NO INSTRUCTION IS INDICATED,

THE SHARES REPRESENTED BY THIS PROXY CARD WILL BE VOTED “FOR” IN ITEM 1, ITEM 2 AND ITEM 3.

(Continued on reverse side)

FOLD AND DETACH HERE

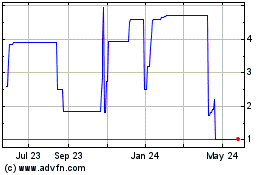

Fortune Valley Treasures (PK) (USOTC:FVTI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Fortune Valley Treasures (PK) (USOTC:FVTI)

Historical Stock Chart

From Nov 2023 to Nov 2024