Current Report Filing (8-k)

December 18 2015 - 12:55PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 15, 2015

GLOBAL HEALTHCARE REIT, INC.

(Exact Name of Registrant as Specified in its Charter)

| | |

Utah | 0-15415 | 87-0340206 |

(State or other jurisdiction of incorporation) | Commission File Number | (I.R.S. Employer Identification number) |

8480 E. Orchard Road, Suite 3600, Greenwood Village, CO 80111

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (303) 449-2100

________3050 Peachtree Road, Suite 355, Atlanta, GA 30305_______

(Former name or former address, if changed since last report)

| |

___ | Written communications pursuant to Rule 425 under the Securities Act |

___ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

___ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

___ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

| |

| |

ITEM 7.01 | REGULATION FD DISCLOSURE |

| |

On December 15, 2015, the Company issued a press release update on recent developments. A copy of the press release is filed herewith.

The information in this Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, and they shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. By filing this Current Report on Form 8-K and furnishing this information pursuant to Item 7.01, The Company makes no admission as to the materiality of any information in this Current Report on Form 8-K, including Exhibit 99.1, that is required to be disclosed solely by Regulation FD.

ITEM 9.01 EXHIBITS

99.1 Press Release dated December 15, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | |

| | Global Healthcare REIT, Inc. (Registrant) |

| | | |

| Dated: December 18, 2015 | | /s/ Lance Baller Lance Baller, Interim CEO and President |

Global Healthcare REIT Provides Update

GREENWOOD VILLAGE, COLORADO — December 15, 2015 — Global Healthcare REIT, Inc. (OTCQB: GBCS), a company that owns healthcare properties and leases them to senior care facility operators, is providing a general update.

Management team

On November 20th the Board appointed Lance Baller, Interim CEO & president and Andrew Sink, Interim COO. Both Messrs. Baller and Sink already serve as members of the Board of Directors. Mr. Baller’s expertise in mergers, acquisitions, refinancing, and capital management will benefit the Company in maximizing its cash flow opportunities. Mr. Sink’s experience in real estate operations will serve to optimize each property’s performance within the Company’s robust real estate portfolio.

South Carolina Acquisition

We previously announced the execution of a Purchase Agreement to acquire a skilled nursing facility located in Ridgeway, South Carolina. That transaction was scheduled to close on October 31, which we extended to November 30, with the right to extend to December 31 with an additional $10,000 earnest money payment. In order to secure the appropriate financing, finalize the lease agreement and ensure a smooth license transfer ,we requested a further extension through January 31, 2016, requiring an additional $10,000 earnest money payment. We are in discussion with several potential sources of financing that would be required to consummate the Ridgeway purchase.

Additional Working Capital

We have reached an agreement with Mr. Neuman, one of our directors, to prepay the Gemini Gaming, LLC promissory note that was given as part of the split-off of the Company’s former gaming properties. This loan repayment is expected to close by the end of December, accounting for 100% of the carried value of the note on the Company’s balance sheet, or approximately $575,000 in working capital for the Company.

We continue to seek sources for additional working capital to fund capital improvement commitments at some of our properties as well as additional acquisitions.

Dividends

In an effort to accretively pursue our growth initiatives, the Company has decided to forgo its cash dividend payment for Q3. These funds can be better allocated to generate multiple returns by completing capital improvements at our vacant Independent Living Facility (ILF) and Assisted Living Facility (ALF) in Tulsa,

1

Oklahoma. The completion of these properties can generate an additional $80,000 in cash flow per month when the assets are handed over to our tenants and the leases become effective. We expect to resume and strengthen our dividend payment after completing the capital improvements. These efforts along with completing the acquisition in South Carolina and refinancing two of our current properties should further enhance our cash flow and strengthen our dividend capability going forward.

Management Commentary

“Our Board has become extremely proactive in addressing all aspects of the Company’s operations and relationships with lenders, tenants and investors. We are optimistic that we are on a path to see significant improvements in the Company’s financial condition and results of operations,” stated Lance Baller. “We will continue to strengthen our operational management team, reduce operational costs, finish our commitments on completing the renovation of the Tulsa ILF and ALF and create a robust business plan for the Company. The Company has plans to revitalize its Lonoke, Arkansas property by negotiating with a new tenant to take over the facility in order to maximize the site’s capacity and improve occupancy. While initially the new lease will yield reduced rent, rents are expected to improve as occupancy of the facility returns to historic levels.”

About Global Healthcare REIT

Global Healthcare REIT acquires real estate properties primarily engaged in the healthcare industry, including skilled nursing homes, medical offices, hospitals and emergency care facilities. The company does not operate its own healthcare facilities, but leases its properties under long term operating leases. It currently owns interest in 11 facilities primarily across the Southeastern U.S. For further information, visit www.gbcsreit.com.

Forward-looking Statements

This press release may contain projection and other forward-looking statements. Any such statement reflects the Company’s current views with respect to future events and financial performance. No assurances can be given, however, that these events will occur and actual results could differ materially from those presented. There can be no assurance that the Company will be able to declare and pay cash dividends to common stockholders in the future, or the frequency or amount of such dividends, if any. A discussion of important factors that could cause actual results to differ from those presented is included in the Company’s periodic reports filed with the Securities and Exchange Commission (at http://www.sec.gov).

Investor Relations Contacts:

J Paul Consulting

303-570-6093

2

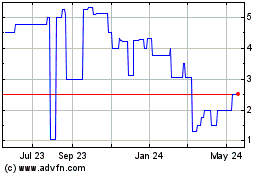

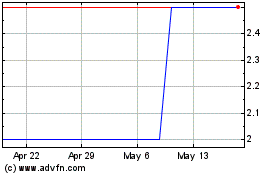

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Jul 2023 to Jul 2024