false

0001771706

A1

0001771706

2024-05-31

2024-05-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 31, 2024

GOODNESS

GROWTH HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

British Columbia

(State or other jurisdiction of Incorporation)

| 000-56225 |

|

82-3835655 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

207 South 9th Street

Minneapolis, Minnesota |

|

55402 |

| (Address of principal executive offices) |

|

(Zip Code) |

(612) 999-1606

(Registrant’s telephone number, including

area code)

Not

Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| |

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 5.02. | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers |

Patrick Peters Resignation

(b)

On May 31, 2024, Patrick Peters,

Executive Vice President of Retail of Vireo Health, Inc., a wholly-owned subsidiary of Goodness Growth Holdings, Inc. (the “Company”),

informed the Company of his intention to resign from his position effective June 14, 2024. Mr. Peters’ departure is not based on

any disagreement with the Company on any matter.

Restricted Stock Unit Award

(e)

On

May 31, 2024, the Company granted 121,625 restricted stock units (“RSUs”) representing the Company’s Subordinated

Voting Shares to Joshua Rosen, the Company’s Chief Executive Officer. The RSUs were granted pursuant to a Restricted Stock Unit

Agreement under the Vireo Health International Inc. 2019 Equity Incentive Plan, as amended, effective March 31, 2024 (the “RSU

Award Agreement”), pursuant to the terms of Mr. Rosen’s employment agreement, effective January 1, 2024 (the “Rosen

Employment Agreement”). The RSUs vest upon the first to occur of (a) December 31, 2026 (subject to Mr. Rosen’s

continued employment through that date), (b) termination of Mr. Rosen’s employment other than for Cause (as defined in the Rosen

Employment Agreement) or (c) Mr. Rosen’s resignation from employment for Good Reason

(as defined in the Rosen Employment Agreement).

The RSU Award Agreement has

been filed as Exhibit 10.1 to this Current Report on Form 8-K. The summary description of RSU Award Agreement does not purport to be complete

and is qualified in its entirety by reference to the RSU Award Agreement, which is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GOODNESS GROWTH HOLDINGS, INC. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ Joshua Rosen |

| |

|

Joshua Rosen |

| |

|

Chief Executive Officer and Interim Chief Financial Officer |

Date: June 6, 2024

Exhibit 10.1

GOODNESS GROWTH HOLDINGS, INC.

2019 EQUITY INCENTIVE PLAN

RESTRICTED STOCK UNIT AGREEMENT

(Employee Restricted Stock Unit Award)

I. NOTICE

OF GRANT

| Name

of Participant: | Joshua

Rosen | |

| | | |

| Number

of Restricted Stock Units: | 121,6251 | |

| | | |

| Date

of Grant: | March 31, 20242 | |

| Vesting Schedule: | | Subject to the terms

of this Agreement and the Vireo Health International, Inc. 2019 Equity Incentive Plan (the “Plan”), the

Restricted Stock Units shall vest on the first to occur of (a) December 31, 2026 (subject to Executive’s continued employment

through that date), (b) termination of Executive’s employment by the Company other than for Cause or (c) Executive’s

resignation from employment for Good Reason (as defined below), provided that the Participant is a Service Provider on the applicable

vesting date. |

This is a Restricted Stock Unit Agreement (the

“Agreement”), by and between Goodness Growth Holdings, Inc., a British Columbia corporation formerly known

as Vireo Health International, Inc. and successor to Vireo Health, Inc. (the “Company”), and the participant

identified above (“Participant”), entered into and effective as of the Date of Grant. Any capitalized term that

is not defined in this Agreement shall have the meaning set forth in the Plan as it currently exists or as it is amended in the future.

II. BACKGROUND

| 1. | The Company has adopted and maintains the Plan authorizing the Administrator to, among other things, grant Restricted Stock Units

to certain Employees, Directors, and Consultants. |

| 2. | The Administrator has determined that Participant is eligible to receive an Award under the Plan in the form of Restricted Stock Units,

as further described in this Agreement. |

III.

AGREEMENT. Subject to the Plan, the Company

hereby grants the Restricted Stock Units to Participant under the terms and conditions as follows.

| 1. | Grant of Award. The Company hereby grants to Participant, as of the Date of Grant and subject to the terms and conditions of

this Agreement and the Plan, the number of Restricted Stock Units indicated above (the “Award”). Each Restricted Stock Unit

represents the right to receive one Share (or a cash payment equal to the Fair Market Value of one Share) upon settlement of the Award. |

1

$50,000 divided by closing price of $0.411 on March 31, 2024, results in 121,625 shares.

2

Approved in connection with the Company entering into an executive employment agreement with Mr. Rosen.

| 2. | Vesting and Forfeiture. The Award will vest as to the number of Restricted Stock Units and on the dates specified in the Notice

of Grant above, but only if Participant is a Service Provider on such dates. Except as otherwise expressly provided in this Agreement

or the Plan, if Participant ceases to be a Service Provider, then all Restricted Stock Units subject to this Award that have not yet vested

shall be forfeited. In the event of the Participant’s separation from service (as such term is defined in Section 409A of the

Code and its related regulations (“409A”)) by the Company for Cause, all Restricted Stock Units, whether vested or unvested,

shall be cancelled and forfeited as of the date of such separation from service for no consideration. In the event of the Participant’s

separation from service for any reason other than Cause, all vested Restricted Stock Units will remain outstanding and eligible for settlement

on a Trigger Date. |

| 3. | Nature of Restricted Stock Units. The Restricted Stock Units granted pursuant to this Award are bookkeeping entries only and

do not provide Participant with any dividend, voting or other rights of a shareholder of the Company. The Restricted Stock Units shall

remain forfeitable at all times unless and to the extent the vesting conditions set forth in this Agreement are satisfied. |

| 4. | Settlement of Units. Subject to the provisions of the Plan and this Agreement, the Company shall settle each vested Restricted

Stock Unit by delivering to Participant one Share to which such vested Restricted Stock Unit relates, a cash payment equal to the Fair

Market Value of one such Share, or a combination of both upon the earliest to occur of the following (such earliest date being referred

to herein as the “Trigger Date”): (a) the third (3rd) anniversary of the Date of Grant; (b) the death or permanent

disability (as such term is defined in 409A) of Participant; (c) a Change in Control of the Company; or (d) eighteen (18) months

after the Participant’s separation from service (as such term is defined in 409A) by the Company without Cause or by the Participant

for “Good Reason”. |

For this purpose, “Cause”

and “Good Reason” shall have the meanings ascribed to such terms in any written employment agreement between Participant and

the Company; provided, however, that if no such agreement exists, “Cause” and “Good Reason” shall be defined as

follows:

“Cause” hereunder means:

| (a) | Participant’s material failure to perform his/her job duties competently as reasonably determined by the Company’s board

of directors (the “Board”); |

| (b) | gross misconduct by Participant which the Board reasonably determines is (or will be if continued) demonstrably and materially damaging

to the Company; |

| (c) | fraud, misappropriation, or embezzlement by Participant; |

| (d) | an act or acts of dishonesty by Participant and intended to result in gain or personal enrichment of Participant at the expense of

the Company; |

| (e) | Participant’s conviction of or plea of nolo contendere to a felony regardless of whether involving the Company and whether or

not committed during the course of Participant’s employment by the Company, other than with respect to any criminal penalties related

to the illegality of possessing or using Marijuana under the Controlled Substance Act, 21 U.S.C. Section 812(b); |

| (f) | Participant’s violation of the Company’s code of conduct, employee handbook or other material written policy, as reasonably

determined by the Board; or |

| (g) | the material breach by Participant of any employment agreement or other written agreement between Participant and the Company. |

With respect to (a) and (f), above,

the Company shall first provide Participant with written notice and an opportunity to cure such breach, if curable, in the reasonable

discretion of the Board, and identify with specificity the action needed to cure within fifteen (15) days of Participant’s receipt

of written notice from the Company.

“Good Reason” shall mean the

initial occurrence of any of the following events without Participant’s consent:

| (i) | a material diminution in Participant’s responsibilities, authority, duties or title; |

| (ii) | a material diminution in Participant’s salary or wages, other than a general reduction in base salaries that affects all similarly

situated Company employees in substantially the same proportions; or |

| (iii) | a relocation of Participant’s principal workplace to a location more than fifty (50) miles from Participant’s principal

place of employment on the Date of Grant, as a condition of continued employment of Participant on the same terms; |

provided, however, that “Good Reason”

shall not exist unless Participant has first provided written notice to the Company of the initial occurrence of one or more of the conditions

under clauses (i) through (iii) above within thirty (30) days of the condition’s occurrence, such condition is not fully

remedied by the Company within thirty (30) days after the Company’s receipt of written notice from Participant, and the termination

of this Agreement as a result of such event occurs within ninety (90) days after the initial occurrence of such event.

Such settlement shall occur as soon as

practicable following the Trigger Date (but in no event later than ninety (90) days following the Trigger Date); provided, however,

that if Participant is a Specified Employee

(as defined in 409A) and the Trigger Date is that which is described in subsection (d), above, then, to the extent required to comply

with 409A, the settlement shall occur on the first business day following the earlier of (i) the day that is six (6) months

after the Participant’s separation from service, or (ii) the Participant’s death.

| 5. | Transferability. The Award may not be assigned or transferred by Participant other than by will or the laws of descent and

distribution. The Restricted Stock Units held by any such transferee will continue to be subject to the same terms and conditions that

were applicable to the Restricted Stock Units immediately prior to the transfer. |

| 6. | No Shareholder Rights. Neither Participant nor any permitted transferee of the Award will have any of the rights of a stockholder

of the Company with respect to any Shares subject to this Award unless and until a certificate evidencing such Shares has been issued,

electronic delivery of such Shares has been made to Participant’s designated brokerage account, or an appropriate book entry in

the Company's stock register has been made. No adjustments shall be made for dividends or other rights if the applicable record date occurs

before a stock certificate has been issued, electronic delivery of the Shares has been made to Participant’s designated brokerage

account, or an appropriate book entry in the Company's stock register has been made, except as otherwise described in the Plan. |

| 7. | Restrictive Covenants Agreement. As an inducement to the Company to enter into this Agreement and grant the Award to Participant,

Participant has executed or shall duly execute a Confidential Information, Intellectual Property Rights, Non- Competition and Non-Solicitation

Agreement (the “Restrictive Covenants Agreement”), in a form approved by the Company. Participant acknowledges and

agrees that the Company’s execution of this Agreement and the grant of the Award to Participant are conditioned upon Participant

executing the Restrictive Covenants Agreement. |

| 8. | Securities Law and Other Restrictions. Notwithstanding any other provision of the Plan or this Agreement, the Company shall

not be required to issue, and Participant may not sell, assign, transfer or otherwise dispose of, any Shares, unless (a) there is

in effect with respect to the Shares a registration statement under the Securities Act and any applicable state or foreign securities

laws or an exemption from such registration, and (b) there has been obtained any other consent, approval or permit from any other

regulatory body that the Administrator, in its sole discretion, deems necessary or advisable. The Company may condition such issuance,

sale or transfer upon the receipt of any representations or agreements from the parties involved, and the placement of any legends on

certificates representing the Shares, as may be deemed necessary or advisable by the Company in order to comply with such securities law

or other restrictions. |

| 9. | Tax Withholding. THE COMPANY IS ENTITLED TO (A) WITHHOLD AND DEDUCT FROM FUTURE FEES OR WAGES OF PARTICIPANT (OR FROM

OTHER AMOUNTS THAT MAY BE DUE AND OWING TO PARTICIPANT FROM THE COMPANY), OR MAKE OTHER ARRANGEMENTS FOR THE COLLECTION OF, ALL LEGALLY

REQUIRED AMOUNTS NECESSARY TO SATISFY ANY FEDERAL, STATE OR LOCAL WITHHOLDING AND EMPLOYMENT-RELATED TAX REQUIREMENTS ATTRIBUTABLE TO

THE AWARD, INCLUDING, WITHOUT LIMITATION, THE GRANT OR SETTLEMENT OF THE RESTRICTED STOCK UNITS. IF THE COMPANY IS UNABLE TO WITHHOLD

SUCH AMOUNTS, FOR WHATEVER REASON, PARTICIPANT AGREES TO PAY TO THE COMPANY AN AMOUNT EQUAL TO THE AMOUNT THE COMPANY WOULD OTHERWISE

BE REQUIRED TO WITHHOLD UNDER FEDERAL, STATE OR LOCAL LAW. |

| 10. | Adjustments. Subject to the terms and conditions set forth in the Plan, in the event of any reorganization, merger, consolidation,

recapitalization, liquidation, reclassification, stock dividend, stock split, combination of shares, rights offering, divestiture or extraordinary

dividend (including a spin-off), or any other change in the corporate structure or shares of the Company, the Administrator, in order

to prevent dilution or enlargement of the rights of Participant, shall make appropriate adjustment (which determination shall be conclusive)

as to the number and kind of securities or other property (including cash) subject to the Award. |

| 11. | Subject to Plan. The Award has been granted and issued under, and is subject to the terms of, the Plan. The terms of the Plan

are incorporated by reference in this Agreement in their entirety, and Participant, by execution of this Agreement, acknowledges having

received a copy of the Plan. The provisions of this Agreement shall be interpreted as to be consistent with the Plan, and any ambiguities

in this Agreement shall be interpreted by reference to the Plan. If any provisions of this Agreement are inconsistent with the terms of

the Plan, the terms of the Plan shall prevail. |

| 12. | Shareholder Agreements. Upon the settlement of the Award, Participant shall, at the request of the Company, execute and deliver

such voting, co-sale and other agreements as the Company requests generally of holders of amounts of stock corresponding to that of such

Participant; and if Participant fails to execute and deliver any such agreement, such Participant shall nevertheless hold all stock subject

to, and be bound by, such agreement. |

| 13. | Binding Effect. This Agreement shall be binding upon the heirs, executors, administrators and successors of the parties to

this Agreement. |

| 14. | Governing Law. This Agreement and all rights and obligations under this Agreement shall be construed in accordance with the

Plan and governed by the laws of the Province of British Columbia, without regard to conflicts of laws provisions. |

| 15. | Entire Agreement. This Agreement and the Plan set forth the entire agreement and understanding of the parties to this Agreement

with respect to the grant and settlement of this Award and the administration of the Plan and supersede all prior agreements, arrangements,

plans and understandings relating to the grant and settlement of this Award and the administration of the Plan. |

| 16. | Amendment and Waiver. Other than as provided in the Plan and subject to applicable law, this Agreement may be amended, waived,

modified or canceled only by a written instrument executed by the parties to this Agreement or, in the case of a waiver, by the party

waiving compliance. Notwithstanding the preceding, Participant agrees that the Administrator may amend the Plan or this Agreement, to

take effect retroactively or otherwise, as deemed necessary or advisable for the purpose of conforming the Plan or the Agreement to any

present or future law relating to plans of this or similar nature (including, but not limited to, Section 409A of the Code), and

to the administrative regulations and rulings promulgated thereunder. |

| 17. | Electronic Delivery and Acceptance. The Company may deliver any documents related to this Agreement by electronic means and

request Participant’s acceptance of this Agreement by electronic means. Participant hereby consents to receive all applicable documentation

by electronic delivery and to participate in the Plan through an on-line (and/or voice activated) system established and maintained by

the Company or the Company’s third-party stock plan administrator. |

[Signature Page Follows]

The parties hereto have executed this Agreement effective

as of the Date of Grant.

|

| GOODNESS GROWTH HOLDINGS, INC. |

| |

| | |

| |

| By: | /s/ Joshua Rosen |

| |

| | Joshua Rosen |

| |

| | |

| |

| Its: | Chief

Executive Officer |

| |

| | |

| By

execution of this Agreement, Participant acknowledges having received a copy of the Plan and agrees to all of the terms and conditions

described in this Agreement and in the Plan. |

| PARTICIPANT |

| |

| /s/ Joshua Rosen |

| |

| Name: Joshua Rosen |

Exhibit 10.2

GOODNESS GROWTH HOLDINGS, INC.

2019 EQUITY INCENTIVE PLAN

RESTRICTED STOCK UNIT AGREEMENT

(Employee Restricted Stock Unit Award)

I. NOTICE

OF GRANT

| Name

of Participant: | | |

| | | |

| Number

of Restricted Stock Units: | | |

| | | |

| Date

of Grant: | ______________, 202___ | |

| Vesting Schedule: | | Subject

to the terms of this Agreement and the Vireo Health International, Inc. 2019 Equity

Incentive Plan (the “Plan”), the Restricted Stock Units shall vest

[ratably on each of the first three anniversaries of the date of grant identified above]

(the “Date of Grant”), provided that the Participant is a Service

Provider on the applicable vesting date. |

This is a Restricted Stock Unit Agreement (the

“Agreement”), by and between Goodness Growth Holdings, Inc., a British Columbia corporation formerly known

as Vireo Health International, Inc. and successor to Vireo Health, Inc. (the “Company”), and the participant

identified above (“Participant”), entered into and effective as of the Date of Grant. Any capitalized term that

is not defined in this Agreement shall have the meaning set forth in the Plan as it currently exists or as it is amended in the future.

II. BACKGROUND

| 1. | The Company has adopted and maintains the Plan authorizing the Administrator to, among other things, grant Restricted Stock Units

to certain Employees, Directors, and Consultants. |

| 2. | The Administrator has determined that Participant is eligible to receive an Award under the Plan in the form of Restricted Stock Units,

as further described in this Agreement. |

III.

AGREEMENT. Subject to the Plan, the Company

hereby grants the Restricted Stock Units to Participant under the terms and conditions as follows.

| 1. | Grant of Award. The Company hereby grants to Participant, as of the Date of Grant and subject to the terms and conditions of

this Agreement and the Plan, the number of Restricted Stock Units indicated above (the “Award”). Each Restricted Stock Unit

represents the right to receive one Share (or a cash payment equal to the Fair Market Value of one Share) upon settlement of the Award. |

| 2. | Vesting and Forfeiture. The Award will vest as to the number of Restricted Stock Units and on the dates specified in the Notice

of Grant above, but only if Participant is a Service Provider on such dates. Except as otherwise expressly provided in this Agreement

or the Plan, if Participant ceases to be a Service Provider, then all Restricted Stock Units subject to this Award that have not yet vested

shall be forfeited. In the event of the Participant’s separation from service (as such term is defined in Section 409A of the

Code and its related regulations (“409A”)) by the Company for Cause, all Restricted Stock Units, whether vested or unvested,

shall be cancelled and forfeited as of the date of such separation from service for no consideration. In the event of the Participant’s

separation from service for any reason other than Cause, all vested Restricted Stock Units will remain outstanding and eligible for settlement

on a Trigger Date. |

| 3. | Nature of Restricted Stock Units. The Restricted Stock Units granted pursuant to this Award are bookkeeping entries only and

do not provide Participant with any dividend, voting or other rights of a shareholder of the Company. The Restricted Stock Units shall

remain forfeitable at all times unless and to the extent the vesting conditions set forth in this Agreement are satisfied. |

| 4. | Settlement of Units. Subject to the provisions of the Plan and this Agreement, the Company shall settle each vested Restricted

Stock Unit by delivering to Participant one Share to which such vested Restricted Stock Unit relates, a cash payment equal to the Fair

Market Value of one such Share, or a combination of both upon the earliest to occur of the following (such earliest date being referred

to herein as the “Trigger Date”): (a) the third (3rd) anniversary of the Date of Grant; (b) the death or permanent

disability (as such term is defined in 409A) of Participant; (c) a Change in Control of the Company; or (d) eighteen (18) months

after the Participant’s separation from service (as such term is defined in 409A) by the Company without Cause or by the Participant

for “Good Reason”. |

For this purpose, “Cause”

and “Good Reason” shall have the meanings ascribed to such terms in any written employment agreement between Participant and

the Company; provided, however, that if no such agreement exists, “Cause” and “Good Reason” shall be defined as

follows:

“Cause” hereunder means:

| (a) | Participant’s material failure to perform his/her job duties competently as reasonably determined by the Company’s board

of directors (the “Board”); |

| (b) | gross misconduct by Participant which the Board reasonably determines is (or will be if continued) demonstrably and materially damaging

to the Company; |

| (c) | fraud, misappropriation, or embezzlement by Participant; |

| (d) | an act or acts of dishonesty by Participant and intended to result in gain or personal enrichment of Participant at the expense of

the Company; |

| (e) | Participant’s conviction of or plea of nolo contendere to a felony regardless of whether involving the Company and whether or

not committed during the course of Participant’s employment by the Company, other than with respect to any criminal penalties related

to the illegality of possessing or using Marijuana under the Controlled Substance Act, 21 U.S.C. Section 812(b); |

| (f) | Participant’s violation of the Company’s code of conduct, employee handbook or other material written policy, as reasonably

determined by the Board; or |

| (g) | the material breach by Participant of any employment agreement or other written agreement between Participant and the Company. |

With respect to (a) and (f), above,

the Company shall first provide Participant with written notice and an opportunity to cure such breach, if curable, in the reasonable

discretion of the Board, and identify with specificity the action needed to cure within fifteen (15) days of Participant’s receipt

of written notice from the Company.

“Good Reason” shall mean the

initial occurrence of any of the following events without Participant’s consent:

| (i) | a material diminution in Participant’s responsibilities, authority, duties or title; |

| (ii) | a material diminution in Participant’s salary or wages, other than a general reduction in base salaries that affects all similarly

situated Company employees in substantially the same proportions; or |

| (iii) | a relocation of Participant’s principal workplace to a location more than fifty (50) miles from Participant’s principal

place of employment on the Date of Grant, as a condition of continued employment of Participant on the same terms; |

provided, however, that “Good Reason”

shall not exist unless Participant has first provided written notice to the Company of the initial occurrence of one or more of the conditions

under clauses (i) through (iii) above within thirty (30) days of the condition’s occurrence, such condition is not fully

remedied by the Company within thirty (30) days after the Company’s receipt of written notice from Participant, and the termination

of this Agreement as a result of such event occurs within ninety (90) days after the initial occurrence of such event.

Such settlement shall occur as soon as

practicable following the Trigger Date (but in no event later than ninety (90) days following the Trigger Date); provided, however,

that if Participant is a Specified Employee

(as defined in 409A) and the Trigger Date is that which is described in subsection (d), above, then, to the extent required to comply

with 409A, the settlement shall occur on the first business day following the earlier of (i) the day that is six (6) months

after the Participant’s separation from service, or (ii) the Participant’s death.

| 5. | Transferability. The Award may not be assigned or transferred by Participant other than by will or the laws of descent and

distribution. The Restricted Stock Units held by any such transferee will continue to be subject to the same terms and conditions that

were applicable to the Restricted Stock Units immediately prior to the transfer. |

| 6. | No Shareholder Rights. Neither Participant nor any permitted transferee of the Award will have any of the rights of a stockholder

of the Company with respect to any Shares subject to this Award unless and until a certificate evidencing such Shares has been issued,

electronic delivery of such Shares has been made to Participant’s designated brokerage account, or an appropriate book entry in

the Company's stock register has been made. No adjustments shall be made for dividends or other rights if the applicable record date occurs

before a stock certificate has been issued, electronic delivery of the Shares has been made to Participant’s designated brokerage

account, or an appropriate book entry in the Company's stock register has been made, except as otherwise described in the Plan. |

| 7. | Restrictive Covenants Agreement. As an inducement to the Company to enter into this Agreement and grant the Award to Participant,

Participant has executed or shall duly execute a Confidential Information, Intellectual Property Rights, Non- Competition and Non-Solicitation

Agreement (the “Restrictive Covenants Agreement”), in a form approved by the Company. Participant acknowledges and

agrees that the Company’s execution of this Agreement and the grant of the Award to Participant are conditioned upon Participant

executing the Restrictive Covenants Agreement. |

| 8. | Securities Law and Other Restrictions. Notwithstanding any other provision of the Plan or this Agreement, the Company shall

not be required to issue, and Participant may not sell, assign, transfer or otherwise dispose of, any Shares, unless (a) there is

in effect with respect to the Shares a registration statement under the Securities Act and any applicable state or foreign securities

laws or an exemption from such registration, and (b) there has been obtained any other consent, approval or permit from any other

regulatory body that the Administrator, in its sole discretion, deems necessary or advisable. The Company may condition such issuance,

sale or transfer upon the receipt of any representations or agreements from the parties involved, and the placement of any legends on

certificates representing the Shares, as may be deemed necessary or advisable by the Company in order to comply with such securities law

or other restrictions. |

| 9. | Tax Withholding. THE COMPANY IS ENTITLED TO (A) WITHHOLD AND DEDUCT FROM FUTURE FEES OR WAGES OF PARTICIPANT (OR FROM

OTHER AMOUNTS THAT MAY BE DUE AND OWING TO PARTICIPANT FROM THE COMPANY), OR MAKE OTHER ARRANGEMENTS FOR THE COLLECTION OF, ALL LEGALLY

REQUIRED AMOUNTS NECESSARY TO SATISFY ANY FEDERAL, STATE OR LOCAL WITHHOLDING AND EMPLOYMENT-RELATED TAX REQUIREMENTS ATTRIBUTABLE TO

THE AWARD, INCLUDING, WITHOUT LIMITATION, THE GRANT OR SETTLEMENT OF THE RESTRICTED STOCK UNITS. IF THE COMPANY IS UNABLE TO WITHHOLD

SUCH AMOUNTS, FOR WHATEVER REASON, PARTICIPANT AGREES TO PAY TO THE COMPANY AN AMOUNT EQUAL TO THE AMOUNT THE COMPANY WOULD OTHERWISE

BE REQUIRED TO WITHHOLD UNDER FEDERAL, STATE OR LOCAL LAW. |

| 10. | Adjustments. Subject to the terms and conditions set forth in the Plan, in the event of any reorganization, merger, consolidation,

recapitalization, liquidation, reclassification, stock dividend, stock split, combination of shares, rights offering, divestiture or extraordinary

dividend (including a spin-off), or any other change in the corporate structure or shares of the Company, the Administrator, in order

to prevent dilution or enlargement of the rights of Participant, shall make appropriate adjustment (which determination shall be conclusive)

as to the number and kind of securities or other property (including cash) subject to the Award. |

| 11. | Subject to Plan. The Award has been granted and issued under, and is subject to the terms of, the Plan. The terms of the Plan

are incorporated by reference in this Agreement in their entirety, and Participant, by execution of this Agreement, acknowledges having

received a copy of the Plan. The provisions of this Agreement shall be interpreted as to be consistent with the Plan, and any ambiguities

in this Agreement shall be interpreted by reference to the Plan. If any provisions of this Agreement are inconsistent with the terms of

the Plan, the terms of the Plan shall prevail. |

| 12. | Shareholder Agreements. Upon the settlement of the Award, Participant shall, at the request of the Company, execute and deliver

such voting, co-sale and other agreements as the Company requests generally of holders of amounts of stock corresponding to that of such

Participant; and if Participant fails to execute and deliver any such agreement, such Participant shall nevertheless hold all stock subject

to, and be bound by, such agreement. |

| 13. | Binding Effect. This Agreement shall be binding upon the heirs, executors, administrators and successors of the parties to

this Agreement. |

| 14. | Governing Law. This Agreement and all rights and obligations under this Agreement shall be construed in accordance with the

Plan and governed by the laws of the Province of British Columbia, without regard to conflicts of laws provisions. |

| 15. | Entire Agreement. This Agreement and the Plan set forth the entire agreement and understanding of the parties to this Agreement

with respect to the grant and settlement of this Award and the administration of the Plan and supersede all prior agreements, arrangements,

plans and understandings relating to the grant and settlement of this Award and the administration of the Plan. |

| 16. | Amendment and Waiver. Other than as provided in the Plan and subject to applicable law, this Agreement may be amended, waived,

modified or canceled only by a written instrument executed by the parties to this Agreement or, in the case of a waiver, by the party

waiving compliance. Notwithstanding the preceding, Participant agrees that the Administrator may amend the Plan or this Agreement, to

take effect retroactively or otherwise, as deemed necessary or advisable for the purpose of conforming the Plan or the Agreement to any

present or future law relating to plans of this or similar nature (including, but not limited to, Section 409A of the Code), and

to the administrative regulations and rulings promulgated thereunder. |

| 17. | Electronic Delivery and Acceptance. The Company may deliver any documents related to this Agreement by electronic means and

request Participant’s acceptance of this Agreement by electronic means. Participant hereby consents to receive all applicable documentation

by electronic delivery and to participate in the Plan through an on-line (and/or voice activated) system established and maintained by

the Company or the Company’s third-party stock plan administrator. |

[Signature Page Follows]

The parties hereto have executed this Agreement effective

as of the Date of Grant.

|

| GOODNESS GROWTH HOLDINGS, INC. |

| |

| | |

| |

| By: | |

| |

| | |

| |

| Its: | |

| |

| | |

| By

execution of this Agreement, Participant acknowledges having received a copy of the Plan and agrees to all of the terms and conditions

described in this Agreement and in the Plan. |

| PARTICIPANT |

| |

| |

| |

| Name: |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

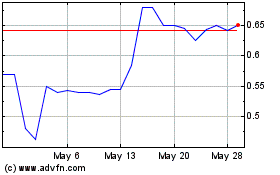

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From May 2024 to Jun 2024

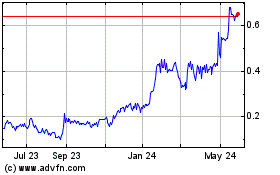

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Jun 2023 to Jun 2024