Annual Report (foreign Private Issuer) (40-f)

April 20 2016 - 11:50AM

Edgar (US Regulatory)

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

¨

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended:

December 31, 2015

Commission File Number:

001-31819

GOLD RESERVE INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

|

Alberta, Canada

(Province or other jurisdiction of incorporation or organization)

|

1040

(Primary Standard Industrial Classification Code Number)

|

N/A

(I.R.S. Employer Identification Number)

|

926 West Sprague Avenue, Suite 200, Spokane, Washington 99201 (509) 623-1500

(Address and telephone number of Registrant’s principal executive offices)

Rockne J. Timm,

926 West Sprague Avenue, Suite 200, Spokane, Washington, 99201 (509) 623-1500

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

None

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Class A common shares, no par value per share

Rights to Purchase Class A common shares

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

x

Annual Information Form

x

Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Class A common shares, no par value per share: 76,447,147

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

x

Yes

¨

No

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

Registrant was required to submit and post such files).

x

Yes

¨

No

Explanatory note

Gold Reserve Inc. ("Gold

Reserve", the "Company", "we", "us", or "our")

is a Canadian issuer eligible to file its annual report pursuant to Section 13

of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"),

on Form 40-F. We are a "foreign private issuer" as defined in Rule

3b-4 under the Exchange Act and in Rule 405 under the U.S. Securities Act of

1933, as amended (the "Securities Act"). Our equity securities are

accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the

Exchange Act pursuant to Rule 3a12-3.

CAUTIONARY NOTE REGARDI

NG differences in united states and

canadian reporting practices

We are permitted, under a

multi-jurisdictional disclosure system adopted by the United States and Canada,

to prepare this Annual Report in accordance with Canadian disclosure

requirements, which are different from those of the United States.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

AND INFORMATION

The

information presented or incorporated by reference in this document contains

both historical information and “forward-looking statements” (within the

meaning of Section 27A of the Securities Act and Section 21E of the Exchange

Act) or “forward looking information” (within the meaning of applicable

Canadian securities laws) (collectively referred to herein as “forward-looking

statements”) that may state our intentions, hopes, beliefs, expectations or

predictions for the future.

Forward-looking

statements are necessarily based upon a number of estimates and assumptions

that, while considered reasonable by us at this time, are inherently subject to

significant business, economic and competitive uncertainties and contingencies

that may cause our actual financial results, performance, or achievements to be

materially different from those expressed or implied herein and many of which

are outside our control.

Some

of the material factors or assumptions used to develop forward-looking statements

include, without limitation, the uncertainties associated with: our ability to complete

the transactions contemplated by the Memorandum of Understanding (the “MOU”) we

entered into with the

Bolivarian Republic of Venezuela (“Venezuela”),

on February 24, 2016, with respect to the potential

settlement, including the payment and resolution, of the amounts awarded

(including pre and post award interest and legal costs) (the “Arbitral Award”)

by the International Centre for Settlement of Investment Disputes (“ICSID”),

an

amount yet to be agreed to by the parties in exchange for our contribution to

the Brisas-Cristinas Project

(as defined herein)

of

the technical mining data (the "Mining Data") related to

our previous mining project in Venezuela known as the “Brisas

Project”

and the potential subsequent joint

development and financing of the Brisas-Cristinas Project by us and Venezuela; the

ability of Venezuela to obtain financing on favorable terms, if at all, to fund

the contemplated payments to us pursuant to the Arbitral Award or the other

transactions contemplated by the MOU; risks associated with the concentration

of our potential future operations and assets in Venezuela; the timing of our

enforcement or collection of the Arbitral Award if the transactions

contemplated by the MOU are not concluded; actions and/or responses by the

Venezuelan government in connection with the negotiation of definitive

documentation pursuant to the MOU and/or with respect to our ongoing collection

efforts related to the Arbitral Award; economic and industry conditions

influencing the sale of the equipment related to the Brisas Project; conditions

or events impacting our ability to fund our operations and/or service our debt;

our ability to maintain listing of our Class A common shares on the TSX Venture

Exchange (the "TSXV"); and our long-term plans for identifying and

achieving revenue producing operations.

Forward-looking statements involve risks and uncertainties,

as well as assumptions that may never materialize, prove incorrect or

materialize other than as currently contemplated which could cause our results

to differ materially from those expressed or implied by such forward-looking

statements. The words “believe,” “anticipate,” “expect,” “intend,” “estimate,”

“plan,” “may,” “could” and other similar expressions that are predictions of or

indicate future events and future trends, which do not relate to historical

matters, identify forward-looking statements. Any such forward-looking

statements are not intended to provide any assurances as to future results.

Numerous

factors could cause actual results to differ materially from those described in

the forward-looking statements, including without limitation:

·

our ability to reach agreement with

Venezuela on definitive documentation for the transactions contemplated by the

MOU and complete such transactions;

·

the timing of the conclusion of the

transactions contemplated by the MOU or our collection of the Arbitral Award,

if at all;

·

the ability of Venezuela to obtain

financing

on favorable terms, if at all, to fund the contemplated

payments pursuant to the Arbitral Award or the other transactions contemplated

by the MOU, including the potential development of the Brisas

-Cristinas Project

;

·

value realized from the disposition of

the Mining Data, if any, pursuant to the transactions contemplated by the MOU

or otherwise;

·

our ability with Venezuela to obtain

the

approval of the National Executive Branch of the Venezuelan

government to create a special economic zone or otherwise provide tax and other

economic benefits for the activities of the jointly owned entity (which we

refer to herein as the “mixed company”) contemplated by the MOU;

·

our ability to repay our outstanding

notes and associated interest in cash, if required, satisfy our obligations

under our outstanding contingent value rights CVRs or make a distribution of any

remaining funds to our shareholders after repaying our then existing

obligations following any payment by Venezuela pursuant to the Arbitral Award

or with respect to our contribution of the Mining Data to the mixed company,;

·

the costs associated with the

enforcement and collection of the Arbitral Award, including the costs that we may

incur in connection with the completion of the MOU;

·

the complexity and uncertainty of

varied legal processes in multiple international jurisdictions associated with

our ongoing efforts to collect the Arbitral Award;

·

concentration of our potential future operations

and assets, if any, in Venezuela;

·

the potential for corruption and

uncertain legal enforcement, civil unrest, military actions and crime in

Venezuela and its impact on our potential future operations in Venezuela;

·

risks associated with future exploration

and development of the Brisas-Cristinas Project;

·

our current liquidity and capital

resources and access to additional funding in the future when required;

·

continued servicing or restructuring of

our outstanding Notes or other obligations as they come due;

·

our ability to maintain continued

listing of our Class A common shares on the TSXV;

·

shareholder dilution resulting from

restructuring, refinancing or conversion of our outstanding Notes or from the

sale of additional equity;

·

value realized from the disposition of

the remaining Brisas Project related assets, if any;

·

prospects for our exploration and

development of Brisas-Cristinas Project and/or the LMS Gold Project, as

described in the attached Annual Information Form Exhibit 99.1 ;

·

currency, metal prices and metal

production volatility;

·

adverse U.S. and/or Canadian tax

consequences;

·

or ability to attract new employees,

if required, and the continued participation of existing employees; and

·

other risks normally incident to the

exploration, development and operation of mining properties.

This list is not exhaustive of the factors that may affect

any of our forward-looking statements. See "

Risk Factors"

in

Management's Discussion and Analysis

for the fiscal year ended December

31, 2015 is included herein as Exhibit 99.3

.

Investors

are cautioned not to put undue reliance on forward-looking statements, whether

in this document, other documents periodically filed with the Securities and

Exchange Commission (the "SEC") or other securities regulators or

presented on our website. Forward-looking statements speak only as of the date

made. All subsequent written and oral forward-looking statements attributable

to us or persons acting on our behalf are expressly qualified in their entirety

by this notice. We disclaim any intent or obligation to update publicly or

otherwise revise any forward-looking statements or the foregoing list of

assumptions or factors, whether as a result of new information, future events

or otherwise, subject to our disclosure obligations under applicable rules

promulgated by the SEC and the Ontario Securities Commission (the "OSC").

Investors are urged to read our filings with U.S. and Canadian securities

regulatory authorities, which can be viewed online at www.sec.gov and

www.sedar.com, respectively.

CURRENCY

Unless otherwise indicated,

all references to "$", U.S. $ or "U.S. dollars" in this

Annual Report refer to U.S. dollars and references to "Cdn$" or "Canadian

dollars" refer to Canadian dollars. The 12 month average rate of exchange

for one Canadian dollar, expressed in U.S. dollars, for each of the last three calendar

years equaled 0.7820, 0.9052 and 0.9709, respectively, and the exchange rate at

the end of each such period equaled 0.7226, 0.8620 and 0.9401, respectively.

PrincipAl Canadian Documents

Annual

Information Form.

Our Annual

Information Form for the fiscal year ended December 31, 2015 is included herein

as Exhibit 99.1.

Audited Annual Financial Statements.

Our audited consolidated financial statements as at December 31, 2015

and 2014 and for the fiscal years ended December 31, 2015, 2014 and 2013,

including the report of the independent auditors with respect thereto, are

included herein as part of Exhibit 99.2.

Management’s

Discussion and Analysis.

Management’s

discussion and analysis for the fiscal year ended December 31, 2015 is included

herein as Exhibit 99.3.

DISCLOSURE CONTROLS

AND PROCEDURES

An evaluation was performed

under the supervision and with the participation of our management, including

the chief executive officer and chief financial officer, of the effectiveness

of the design and operation of our disclosure controls and procedures (as

defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act) as of the end of

the period covered by this Annual Report. Based on that evaluation,

management, including the chief executive officer and chief financial officer,

concluded that our disclosure controls and procedures were effective as of the

end of the period covered by this Annual Report to provide reasonable assurance

that information required to be disclosed by us in the reports that we file or

submit under the Exchange Act is recorded, processed, summarized and reported

within the time period specified in the SEC rules and forms.

MANAGEMENT’S

ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management's Annual Report on

Internal Control over Financial Reporting for the fiscal year ended December

31, 2015 is included herein as part of Exhibit 99.2.

Attestation Report of The Registered Public Accounting Firm

The effectiveness of our

internal control over financial reporting as of December 31, 2015 has been

audited by PricewaterhouseCoopers LLP, independent auditors, as stated in their

report included herein as part of Exhibit 99.2.

CHANGES IN INTERNAL

CONTROL OVER FINANCIAL REPORTING

During the fiscal year ended

December 31, 2015, there were no changes in our internal control over financial

reporting that have materially affected, or are reasonably likely to materially

affect, our internal control over financial reporting (as defined in Rules

13(a)-15(f) and 15d-15(f) under the Exchange Act).

AUDIT COMMITTEE

Our Board of Directors (the "Board")

has a separately-designated standing Audit Committee for the purpose of

overseeing our accounting and financial reporting processes and audits of our

annual financial statements.

As at the date of the Annual Report, the following

individuals comprise the entire membership of our Audit Committee, which has

been established in accordance with Section 3(a)(58)(A) of the Exchange Act:

Patrick

McChesney (Chair) Jean Charles Potvin James P Geyer

Our Audit

Committee’s Charter can be found on our website at www.goldreserveinc.com in

the Investor Relations section under "Governance."

Independence.

The Board has made the affirmative determination that

all members of the Audit Committee are "independent" pursuant to the

criteria outlined by the Canadian National Instrument 52-110 - Audit Committees

and Rule 10A-3 of the Exchange Act.

Audit Committee Financial Expert.

Mr. McChesney, now a business consultant, was most

recently a financial executive for an automotive sales group and has served in

similar positions for a number of other companies. Mr. Potvin is a director

and President of Murchison Minerals Ltd. (formerly Flemish Gold Corp.), has a

MBA-Finance degree and was an investment analyst at Burns Fry Ltd for 13 years.

Mr. Geyer has a Bachelor of Science in Mining Engineering from the Colorado

School of Mines, has substantial experience in underground and open pit mining

and has held engineering and operations positions with a number of companies

including AMAX and ASARCO and has had previous audit committee experience with

another public company.

The Board has determined that

Mr. McChesney is an "audit committee financial expert" as such term is

defined under Item 8(b) of General Instruction B to Form 40-F.

The SEC has indicated that the designation of Mr. McChesney as an audit

committee financial expert does not make Mr. McChesney an "expert"

for any purpose, impose any duties, obligations or liabilities on Mr. McChesney

that are greater than those imposed on other members of the Audit Committee and

Board who do not carry this designation or affect the duties, obligations or

liability of any other member of the Audit Committee and Board.

CODE OF ETHICS

We have adopted a Code of

Conduct and Ethics (the "Code") that is applicable to all our

directors, officers and employees. The Code contains general guidelines for

conducting our business. The Code was amended and approved by the Board

effective March 24, 2006. No waivers to the provisions of the Code have been

granted since its inception. We intend to disclose future amendments to, or

waivers from, certain provisions of the Code on our website within five

business days following the date of such amendment or waiver. A copy of the

Code can be found on our website at www.goldreserveinc.com in the Investor

Relations section under "Governance." We believe that the Code

constitutes a "code of ethics" as such term is defined by Item 9(b)

of General Instruction B to Form 40-F.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Audit Fees.

The aggregate fees billed for each of the last two fiscal years for professional services rendered by our independent auditors, PricewaterhouseCoopers LLP ("PwC"), for the integrated audit of our annual financial statements for 2015 and 2014 were $100,661 and $124,511, respectively.

Audit-Related Fees.

The aggregate fees billed in each of the last two fiscal years by PwC related to our quarterly reports and services provided in respect of other regulatory-required auditor attest functions associated with government audit reports, registration statements, prospectuses, periodic reports and other documents filed with securities regulatory authorities or other documents issued in connection with securities offerings not otherwise reported under "Audit Fees" above for 2015 and 2014 were $39,069 and $51,579, respectively.

Tax Fees.

The aggregate fees billed in each of the last two fiscal years for professional services rendered by PwC for tax compliance and return preparation services for 2015 and 2014 were $8,829 and $8,311, respectively.

All Other Fees.

None.

Audit Committee Services Pre-Approval Policy

The Audit Committee is responsible for the oversight of our independent auditor’s work and pre-approves all services provided by PwC. Audit Services and Audit-Related Services rendered in connection with the annual financial statements and quarterly reports are presented to and approved by the Audit Committee typically at the beginning of each year. Audit-Related Services other than those rendered in connection with the quarterly reports and Tax services provided by PwC are typically approved individually during the Committee’s periodic meetings or on an as-needed basis. The Audit Committee’s Chair is authorized to approve such services in advance on behalf of the Committee with such approval reported to the full Audit Committee at its next meeting. The Audit Committee sets forth its pre-approval and/or confirmation of services authorized by the Audit Committee Chair in the minutes of its meetings.

OFF-BALANCE SHEET ARRANGEMENTS

We are not a party to any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on our financial performance, financial condition, revenues, expenses, results of operations, liquidity, capital expenditures or capital resources.

CONTRACTUAL OBLIGATIONS

The following table sets forth information on our material contractual obligation payments for the periods indicated as of December 31, 2015. For further details see "Management's Discussion and Analysis" and Note 11 to the audited consolidated financial statements.

Less than

More Than

Contractual Obligations Total 1 Year 1-3 Years 4-5 Years 5 Years

Convertible Notes

1

$ 58,099,717 $ - $ 57,057,717 $ - $ 1,042,000

Interest Notes

1

22,679,177 - 22,679,177 - -

Interest 372,515 57,310 114,620 114,620 85,965

Total $ 81,151,409 $ 57,310 $ 79,851,514 $ 114,620 $ 1,127,965

1

Includes $57,057,717 principal amount of 11% due December 31, 2018 (the "2018 Notes") and $1,042,000 principal amount of 5.50% convertible notes due June 15, 2022 (The "2022 Notes" and collectively with the 2018 Notes, the "Convertible Notes"), which consists of convertible notes and interest notes from previous financings and restructurings in 2007, 2012 ,2014 and 2015. Subject to the terms of the Indenture governing the Convertible Notes, the Convertible Notes may be converted into our Class A common shares, redeemed or repurchased. During 2014 we extended the maturity date of approximately $25.3 million of notes from June 29, 2014 to December 31, 2015 and issued approximately $12 million of new notes also maturing December 31, 2015. The interest paid on the extended notes was increased to 11% from 5.5% consistent with the interest paid on the new notes.

During

2015 we extended the maturity date of approximately $43.7 million of notes and related

interest notes (the “Modified Notes”) from December 31, 2015 to December 31,

2018 and issued approximately $13.4 million of additional notes also maturing

December 31, 2018 (the “New Notes and, together with the Modified Notes, the

"2018 Notes") (the "2015 Restructuring"). The amounts shown

above include the principal payments due unless the notes are converted,

redeemed or repurchased prior to their due date (See Note 11 to the audited

consolidated financial statements).

The amount recorded as Convertible

Notes and Interest Notes in the audited consolidated balance sheet as of

December 31, 2015 is comprised of approximately $38.2 million carrying value of

2018 Notes issued pursuant to the 2015 Restructuring, approximately $1.0

million of previously issued 2022 Notes held by note holders who declined to

participate in the note restructuring effected in 2012 and post restructuring

Interest Notes of approximately $0.5 million. The carrying value of Convertible

Notes will be accreted to face value using the effective interest rate method

over the expected life of the notes with the resulting charge recorded as

interest expense.

UNDERTAKING AND

CONSENT TO SERVICE OF PROCESS

We undertake to make

available, in person or by telephone, representatives to respond to inquiries

made by the SEC staff, and to furnish promptly, when requested to do so by the

SEC staff, information relating to: the securities registered pursuant to Form

40-F; the securities in relation to which the obligation to file an annual

report on Form 40-F arises; or transactions in said securities.

We previously

filed an Appointment of Agent for Service of Process and Undertaking on Form

F-X signed by us and our agent for service of process on May 7, 2007 with

respect to the class of securities in relation to which the obligation to file

this Annual Report on Form 40-F arises.

SIGNATURES

Pursuant to the

requirements of the Exchange Act, the Registrant certifies that it meets all of

the requirements for filing on Form 40-F and has duly caused this annual report

to be signed on its behalf by the undersigned, thereto duly authorized.

GOLD RESERVE INC.

By:

/s/ Robert A.

McGuinness

Robert A. McGuinness,

its Vice President of Finance,

Chief Financial

Officer and its Principal Financial and Accounting Officer

April 20, 2016

EXHIBIT INDEX

Exhibit

Number Exhibit

99.1 Annual Information Form for the fiscal year ended

December 31, 2015

99.2 Audited Consolidated Financial Statements as at

December 31, 2015 and 2014 and for the fiscal years ended December 31, 2015,

2014 and 2013

99.3 Management’s Discussion and Analysis for the fiscal

year ended December 31, 2015

99.4 Certification of Gold

Reserve Inc. Chief Executive Officer

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

99.5 Certification of Gold

Reserve Inc. Chief Financial Officer

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

99.6 Certification of Gold

Reserve Inc. Chief Executive Officer

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

99.7 Certification of Gold

Reserve Inc. Chief Financial Officer

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

99.8 Consent of PricewaterhouseCoopers LLP, Independent Auditors

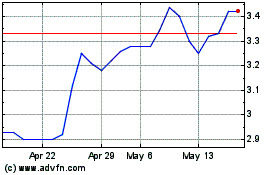

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Feb 2024 to Feb 2025