Report of Foreign Issuer (6-k)

May 26 2016 - 12:12PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer Pursuant to Rule

13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of May 2016

Commission File Number: 001-31819

Gold Reserve Inc.

(Exact name of registrant as specified in its

charter)

926 W. Sprague Avenue, Suite 200

Spokane, Washington 99201

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under

cover Form 20-F or Form 40-F.

Form 20-F

¨

Form 40-F

x

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as

permitted by

Regulation S-T Rule 101(b)(1):

¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as

permitted by

Regulation S-T Rule 101(b)(7):

¨

Indicate by check mark whether the registrant by

furnishing the information contained in this Form is also thereby furnishing

the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes

¨

No

x

If

“Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b):

This

Report on Form 6-K and the exhibit attached hereto are hereby incorporated by

reference into Gold Reserve Inc.’s (the “

Company

”) current Registration

Statements on Form F-3 on file with the

U.S.

Securities and Exchange Commission (the “

SEC

”)

.

The following exhibit is furnished with this

Form 6-K:

99.1

Material Change Report

Cautionary Statement Regarding Forward-Looking

Statements and information

The information presented or

incorporated by reference in

this report contains both historical information and “forward-looking

statements” (within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or “forward looking information” (within the meaning of

applicable Canadian securities laws) (collectively referred to herein as

“forward looking statements”) that may state our intentions, hopes, beliefs,

expectations or predictions for the future.

Forward-looking statements are necessarily

based upon a number of estimates and assumptions that, while considered

reasonable by us at this time, are inherently subject to significant business,

economic and competitive uncertainties and contingencies that may cause our

actual financial results, performance or achievements to be materially

different from those expressed or implied herein and many of which are outside our

control.

Forward-looking statements involve risks

and uncertainties, as well as assumptions, including those set out herein, that

may never materialize, prove incorrect or materialize other than as currently

contemplated which could cause our results to differ materially from those expressed or implied by

such forward-looking statements. The words “believe,” “anticipate,” “expect,” “intend,”

“estimate,” “plan,” “may,” “could” and other similar expressions that are

predictions of or indicate future events and future trends, which do not relate

to historical matters,

identify forward-looking statements. Any such forward-looking statements are

not intended to provide any assurances as to future results.

Numerous factors could cause

actual results to differ materially from those described in the forward-looking

statements, including without limitation:

-

our ability

to reach agreement on definitive documentation for the transactions

contemplated by the Memorandum of

Understanding (the “MOU”) that the Company entered into with the

Bolivarian Republic of Venezuela

(“Venezuela”)

on February 24, 2016,

with respect to the potential settlement, including the payment and

resolution, of the amounts awarded (including pre and post award interest

and legal costs) (the “Arbitral Award” or “Award”) by the International

Centre for Settlement of Investment Disputes,

an amount yet to be agreed to by

the parties in exchange for

the

Company

’s

contribution of the mining data

related to the Brisas Project (the “Mining Data”) to the Brisas-Cristinas

Project (as defined herein)

and the

potential subsequent joint development and financing of the

Brisas Project and the adjacent

Cristinas gold-copper project

into

one combined project (

“Brisas-Cristinas

Project”

) by the Company and

Venezuela

and consummate such transactions;

-

the ability of Venezuela to obtain financing

on favorable terms, if at all,

to fund the contemplated payments to

the

Company

pursuant to

the Arbitral Award or the other transactions contemplated by the MOU,

including the potential development of the Brisas

-Cristinas Project

;

-

our ability along with Venezuela to obtain the

approval of the National

Executive Branch of the Venezuelan government to create a Special Economic

Zone or otherwise provide tax and other economic benefits for the

activities of the jointly owned entity (which we refer to herein as the “mixed

company”) contemplated by the MOU;

-

our ability

to satisfy the obligations under our outstanding notes

following any payment by Venezuela under the Arbitral Award or with

respect to our contribution of the Mining Data to the mixed company, and

any subsequent distribution of remaining funds to our shareholders (subject in each case to the payment

of outstanding or incurred corporate obligations and/or taxes);

-

the timing of the

consummation of the transactions contemplated by the MOU or our

collection of the Arbitral Award, if at all;

-

the costs associated with the enforcement and

collection of the Arbitral Award, including the costs that we will incur

in connection with the settlement of the Arbitral Award pursuant to the

transactions contemplated by the MOU;

-

the complexity and uncertainty of varied legal

processes in multiple international jurisdictions associated with our ongoing

efforts to collect the Arbitral Award (including the U.S.);

-

concentration of our potential future

operations and assets in Venezuela, including operational, regulatory,

political and economic risks associated with Venezuelan operations;

-

the potential for corruption and uncertain legal enforcement

in Venezuela, including requests for improper payments;

-

the potential that civil unrest, military actions

and crime will impact our potential future operations and assets in

Venezuela;

-

risks associated with exploration and, if

adequate reserves, financing and other resources are available,

development of the Brisas-Cristinas Project (including regulatory and

permitting risks);

-

our ongoing

liquidity and capital resources and access to additional funding in the

future when required;

-

continued servicing or restructuring of our

outstanding notes or other obligations as they come due;

-

our ability

to maintain continued listing of its

Class A common shares on the TSXV;

-

our long-term

plan for identifying and achieving revenue producing operations in the

future;

-

shareholder dilution resulting from

restructuring, refinancing or conversion of our outstanding notes;

-

shareholder dilution resulting from the sale of

additional equity, if required;

-

value realized from the disposition of the

remaining Brisas Project related assets, if any;

-

value realized from the disposition of the Mining

Data, if any, pursuant to the transactions contemplated by the MOU or

otherwise;

-

prospects for the

Company

’s

exploration and development of mining projects,

including the potential joint development of the Brisas-Cristinas Project

by the Company and Venezuela;

-

currency, metal prices and metal production

volatility;

-

adverse U.S. and/or Canadian tax consequences;

-

abilities and continued participation of certain

key employees; and

-

other risks normally incident to the exploration,

development and operation of mining properties.

This list is not exhaustive of

the factors that may affect any of our forward-looking statements. See “Risk

Factors” contained in our Annual Information Form and Annual Report on Form

40-F filed on

www.sedar.com

and www.sec.gov,

respectively for additional risk factors that could cause results to differ

materially from forward-looking statements.

Investors are cautioned not to

put undue reliance on forward-looking statements,

and investors should not

infer that there has been no change in our affairs since the date of this

report that would warrant any modification of any forward-looking statement

made in this document

, other

documents periodically filed with the SEC or other securities regulators or

presented on the Company

’s

website. Forward-looking statements speak only as of the date

made. All subsequent written and oral forward-looking statements attributable

to us or persons acting on our behalf

are

expressly qualified in their entirety by this notice. We disclaim any intent

or obligation to update publicly or otherwise revise any forward-looking

statements or the foregoing list of assumptions or factors, whether as a result

of new information, future events or otherwise, subject to our disclosure

obligations under applicable U.S. and Canadian securities regulations.

Investors are urged to read the

Company

’s

filings with U.S. and Canadian securities regulatory agencies,

which can be viewed online at www.sec.gov and

www.sedar.com

, respectively.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: May 26, 2016

GOLD RESERVE INC.

(Registrant)

By: /s/

Robert A.

McGuinness

Name: Robert A. McGuinness

Title:

Vice President – Finance & CFO

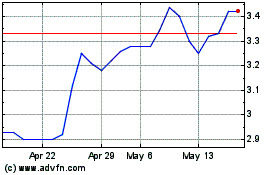

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Feb 2024 to Feb 2025