Should you buy Polestar Stock In 2022?

July 19 2022 - 11:10AM

Finscreener.org

Polestar Automotive

Holding (NASDAQ: PSNY)

is a Sweden-based electric vehicle (EV) company. Established in

1996, the company is actually a joint venture between Volvo

and Geely (OTC:

GELYF) , and most of its vehicle production takes place in the

Chinese region.

Polestar started trading on the Nasdaq by merging with a special

purpose acquisition company, the Gores Guggenheim Group, back in

September 2021. Following that merger, Volvo now holds 49.5% of the

total shares in Polestar. Also, due to the merger, the company’s

enterprise value has exceeded many established EV manufacturers

such as Rivian (NASDAQ: RIVN).

Despite having a bright future, EV makers around the world have

seen a steep decline in share prices in 2022. Despite being the

talk of the town, Polestar stock has lost more than 40% of its

value so far this year. In this inflationary market, interest rates

are moving up, and people are slowly losing out on their purchasing

powers. Will it be a safe decision to put up oneU+02019s money on

this newly growing EV dealer?

Polestar has a lot of potential

The fact that Polestar is linked to the rapidly expanding EV

industry is one of the main arguments in favor of being bullish on

the stock. The demand for EVs has been steadily expanding along

with peopleU+02019s growing environmental awareness due to the

rising levels of global warming.

In Q1 of 2022 of this year, despite all the supply chain

disruptions and chip shortages, the number of electric vehicles has

grown by 76% year-over-year, and as per the latest projections, the

number of people wanting to purchase EVs globally has reached 52%.

The projections also state that EV sales will total $20 billion by

2025 as more customers show interest in purchasing battery-powered

vehicles.

China already has the biggest market for EVs in the world

and intends

to sell around 5 million vehicles by the end of this

year. Further, the EV market in the U.S. follows the Chinese

market in terms of market size, and sales are expected to take a

significant jump (nearly double) by the end of 2022. All this

indicates there is a huge opportunity coming up in the EV

industry.

Polestar has access to these huge markets, and company

management is quite

hopeful and expects to double its sales by this year,

delivering around 65,000 electric vehicles globally. The company

has also planned to produce 290,000 EVs by 2025, which is a

significant increment compared to its present times.

Polestar has to survive a competitive

market

The global EV market has become extremely competitive as legacy

auto manufacturers are entering this sector. As the demand for EVs

increase in the future, these competitive forces are going to

increase even further. Therefore, to survive and succeed in this

market, a business needs to provide the highest quality

services.

Polestar’s products have been quite successful in grabbing the

eyes of the customers. The company has been expecting its two

models: Polestar, the premium hybrid model, and Polestar 2, the

standard sedan, to even compete with giant EV makers like Tesla and

other mid-high range sedans.

Moreover, it intends to launch three new cars by 2024 along with

selling a whole range of new electric vehicles, including luxury

SUVs. So, if its newer launches are able to resonate with the

market in a better fashion, Polestar has a lot of growth

potential.

Polestar stock remains expensive and is valued at 17x trailing

sales. Its projections do not justify the stock to be a must-buy as

of now, as there is not sufficient data to back the company’s

future performance. Its high growth rate and the market potential

of the EV industry, in general, do make the stock an extremely

attractive one yet.

Polestar is a good buy if you can handle higher than average

levels of risk.

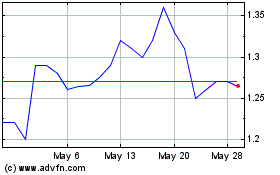

Geely Automobile (PK) (USOTC:GELYF)

Historical Stock Chart

From Feb 2025 to Mar 2025

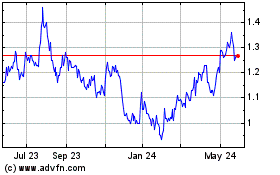

Geely Automobile (PK) (USOTC:GELYF)

Historical Stock Chart

From Mar 2024 to Mar 2025