UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

———————

FORM

10-K

———————

|

S

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For

the fiscal year ended:

December

31, 2007

OR

|

£

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For

the transition period from: _____________ to _____________

Commission

file number:

000-21394

|

|

GelStat

Corporation

|

|

|

|

(Exact

name of registrant as specified in its charter)

|

|

|

Delaware

|

|

90-0075732

|

|

(State

or Other Jurisdiction

|

|

(I.R.S.

Employer

|

|

of

Incorporation or Organization)

|

|

Identification

No.)

|

|

3557

SW Corporate Parkway

Palm

City, Florida

|

|

34990

|

|

(Address

of Principal Executive Office)

|

|

(Zip

Code)

|

|

|

|

|

Registrant’s

telephone number, including area code:

(772) 283-0020

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, $0.01 par value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

£

No

S

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes

£

No

S

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

£

No

S

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12

months (or for such shorter period that the registrant was required to submit and post such

files). Yes

£

No

S

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not

be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form 10-K.

£

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated

filer

|

£

|

Accelerated

filer

|

£

|

|

Non-accelerated filer

|

£

|

Smaller reporting company

|

S

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

£

No

S

The

number of shares outstanding of the registrant’s common stock, as of date of filing this Report, was

127,447,078.

The

aggregate market value of the common stock held by non-affiliates of the registrant on such date, based upon the closing price

of the common stock of $0.03 as reported by the OTC Bulletin Board on June 30, 2012 was $1,970,374.

INDEX

|

|

|

|

|

|

Part I.

|

|

|

|

|

|

|

|

|

|

Item 1.

|

|

Business.

|

3

|

|

Item 1A.

|

|

Risk Factors.

|

8

|

|

Item 1B.

|

|

Unresolved Staff Comments.

|

12

|

|

Item 2.

|

|

Properties.

|

12

|

|

Item 3.

|

|

Legal Proceedings.

|

12

|

|

Item 4.

|

|

Mine Safety Disclosures.

|

12

|

|

|

|

|

|

|

Part II.

|

|

|

|

|

|

|

|

|

|

Item 5.

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

13

|

|

Item 6.

|

|

Selected Financial Data.

|

14

|

|

Item 7.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

14

|

|

Item 7A.

|

|

Quantitative and Qualitative Disclosures About Market Risk.

|

15

|

|

Item 8.

|

|

Financial Statements and Supplementary Data.

|

15

|

|

Item 9.

|

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

|

28

|

|

Item 9A.

|

|

Controls and Procedures.

|

28

|

|

Item 9B.

|

|

Other Information.

|

28

|

|

|

|

|

|

|

Part III.

|

|

|

|

|

|

|

|

|

|

Item 10.

|

|

Directors, Executive Officers and Corporate Governance.

|

29

|

|

Item 11.

|

|

Executive Compensation.

|

30

|

|

Item 12.

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

32

|

|

Item 13.

|

|

Certain Relationships and Related Transactions, and Director Independence.

|

33

|

|

Item 14.

|

|

Principal Accounting Fees and Services.

|

33

|

|

|

|

|

|

|

Part IV.

|

|

|

|

|

|

|

|

|

|

Item 15.

|

|

Exhibits, Financial Statement Schedules.

|

34

|

|

|

|

|

|

|

SIGNATURES

|

|

|

35

|

PART

I

Explanatory

Note.

This Report on Form 10-K for the year ended December 31, 2007 has been compiled from information which is believed to

be true and correct in all material respects. This Report has been prepared in 2012 in order to correct filing delinquencies.

Certain

statements in this Report constitute "forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements that address expectations or projections about the future, including without limitation statements

about product development, market position, expected expenditures and financial results, are forward-looking statements.

Some

of the forward-looking statements may be identified by words such as "expects," "anticipates," "plans,"

"intends," "projects," "indicates," "believes" and similar expressions. Any statements

contained herein that are not statements of historical fact should be deemed to be forward-looking statements. These statements

are not guarantees of future performance and involve a large number of risks, uncertainties and assumptions. Accordingly, actual

results or performance of Gelstat Corporation ("Gelstat" or the “Company”) will most likely differ significantly,

positively or negatively, from forward-looking statements made herein. Unanticipated events and circumstances are likely to occur.

Factors that might cause such differences include, but are not limited to, those discussed under Item 1A, Risk Factors.

These

factors include, but are not limited to, risks that Gelstat products may not perform as expected or may not receive the level

of market acceptance anticipated; anticipated funding may be unavailable; intense market competition may result in lower than

anticipated revenues or higher than anticipated costs; and general economic conditions, such as the rate of employment, inflation,

interest rates and the condition of the capital markets may change in a way that is not favorable to Gelstat. This list of factors

is not exclusive. Gelstat undertakes no obligation to update any forward-looking statements.

The

Company cautions the reader not to place undue reliance on any forward-looking statements.

ITEM

1. DESCRIPTION OF BUSINESS

General

Gelstat

was incorporated on November 13, 1991 in the State of Minnesota under the name Developed Technology Resource, Inc. and reincorporated

in Delaware on October 27, 2010. The Company's principal executive office is located at 3557 SW Corporate Parkway Palm City, FL

(772) 283-0020 and its website is www.Gelstat.com. The information found at the Company's website is not incorporated in or made

a part of this report on Form 10-K.

Effective

April 30, 2003, the Company acquired Gelstat Corp. ("GC") as a wholly-owned subsidiary. GC was organized in June 2002

for the purpose of developing, manufacturing and marketing over-the-counter ("OTC") and other non-prescription consumer

health products related to migraine and sleep. The acquisition was accomplished by merger of GC (a Minnesota corporation) with

our wholly-owned subsidiary, NP Acquisition (a Minnesota corporation). In the merger, the former owners of GC received shares

of our common stock and GC became our wholly-owned subsidiary. No cash consideration was exchanged. The amount of the merger consideration

was negotiated at arm’s length based on the then recent trading price of our common stock and our assessment of the business

prospects of GC. In July 2003, the Company changed its name to Gelstat Corporation. On March 17, 2004, GS Corp. was merged into

its parent company, Gelstat Corporation. References in this Report to the "Company" or "Gelstat" mean Gelstat

Corporation.

In

2004, the Company established a subsidiary called GS Pharma, Inc. On January 5, 2005, GS Pharma assigned all rights in the license

previously granted to it by Gelstat to DTLL, Inc. (OTCBB: DTLI) in exchange for 12.5 million shares of DTLL. On November 14, 2005

the Company sold 12.4 million of its shares in DTLL for $500,000. As a result of the transaction, the Company will no longer be

consolidating DTLL results in the Company’s future financial statements. Because DTLL failed to pay its required payments

to have rights to the pharmaceutical applications, the rights reverted back to Gelstat.

In

late 2005, the Company became insolvent and only marketed its products on a limited basis.

In

2006 and through 2007 the Company struggled under the burden of significant debt and accounts payable, declining revenues, negative

cash flows from operations and lack of capital.

In

April 2008, WSR Consulting, Inc. (WSR)was engaged in an attempt to turn around the Company. In June 2008 a founder of WSR assumed

the position as interim CEO of the Company. The Company was quickly downsized and refocused to minimize the Company’s monthly

expenses while management attempted to clean up the balance sheet and secure capital.

In

July 2008, the Company’s patent #7,192,614 was forced to auction by a creditor and subsequently, purchased by and assigned

to that creditor. This was a key asset of the Company and seriously impaired its ability to continue as a going concern. Throughout

2008 the Company’s CEO and one of its board members used personal funds to rigorously negotiate with this creditor to retain

rights to the patent.

In

November 2009, the Company’s CEO, Mr. Gerald N. Kieft, one of its board members and a few investors were able repurchase

the patent from the creditor through an entity named High Alpha Partners, Inc. d/b/a Gelstat Direct. In December 2009, the entire

inventory held in Vero Beach, Florida was seized by the owner of the facility due to the Company’s back rent payments. In

July 2010, the Company’s CEO, Mr. Gerald N. Kieft, and a few investors were able to repurchase the inventory from the landlord

through Gelstat Direct.

In

September 2010, Gelstat Direct formally contributed assets it owned relating to Gelstat into a majority-owned subsidiary of High

Alpha Partners, Inc. named GSC Direct, Inc. In September 2011, 100% of the outstanding shares of GSC Direct, Inc. were acquired

by Gelstat in exchange for the issuance of 25,000,000 shares of Gelstat common stock. See Item 13, “Certain Relationships

and Related Transactions, and Director Independence.”

In

September 2011, GSC Direct, Inc. and its assets were merged into Gelstat in a share exchange.

Gelstat

is a consumer health care company dedicated to the cost-effective development and marketing of OTC and other non-prescription

consumer health care products. When development efforts ceased in 2005 due to lack of capital, its efforts had been focused on

proprietary, innovative products that addressed multi-billion dollar global markets.

The

Company's first product is Gelstat® Migraine is a patented homeopathic drug designed to provide acute relief from migraine

and migraine-like headaches. Gelstat Migraine was originally launched through distributors into retailers and wholesalers across

the United States. In 2008, the Company changed its business model to focus on Direct-to-Consumer sales and marketing efforts.

As such, the Company’s products are now sold primarily through its website www.gelstat.com and through a very limited number

of retailers.

Gelstat(TM)

Sleep is presently under final development and is intended to be marketed as a sleep aid. It was introduced to consumers in 2010

on a test basis to obtain data to determine product viability. Gelstat Sleep is expected to be classified as a dietary supplement.

The Company plans to formally launch the product in the fourth quarter of 2012 contingent on raising any required capital.

While

Gelstat expects to continue developing new products and will be opportunistic in regard to unanticipated opportunities within

the OTC health care product field, the two products listed above are expected to account for essentially all of the Company's

activity over the next 12 months.

Overview

of Regulations Regarding the Manufacture and Sale of Homeopathic Drugs and Nutritional Supplements.

This

overview is a brief summary and does not purport to be complete.

In

general, the Company's products are regulated both by the U.S. Food and Drug Administration (the "FDA") and by the U.S.

Federal Trade Commission (the "FTC") as well as States through their “little FTC” laws and rules as well

as other consumer protection laws. Internationally, the Company must comply with the federal and local laws of each country.

The

FDA treats homeopathic drugs, both prescription and OTC, differently than non-homeopathic drugs. Unlike non-homeopathic drugs,

homeopathic drugs are not required to submit to pre-market approval and are not required to be tested for safety and effectiveness.

Homeopathic drugs must meet the standards set forth by the Homeopathic Pharmacopoeia of the United States.

In

general, the FTC and the FDA prohibit fraud in the marketing of homeopathic drugs, monitor OTC versus prescription use of homeopathic

drugs, hold homeopathic drugs to several labeling requirements, and require production incompliance with current good manufacturing

practices (with some minor exceptions).

The

FDA prohibits "health fraud," defined as:

The

deceptive promotion, advertisement, distribution or sale of articles, intended for human or animal use, that are presented as

being effective to diagnose, prevent, cure, treat, or mitigate disease (or other conditions), or provide a beneficial effect on

health, but which have not been scientifically proven safe and effective for such purposes. Such practices may be deliberate,

or done without adequate knowledge or understanding of the article.

Only

those homeopathic drugs that treat "self-limiting" conditions that the average consumer can recognize and diagnose are

allowed to be marketed as OTC drugs. Homeopathic drugs that claim to treat serious diseases and those that require diagnosis by

a physician, such as AIDS or cancer, must be marketed as prescription homeopathic drugs - they cannot be sold as an OTC drug.

The

FDA requires that homeopathic drugs be properly labeled. “A drug or device shall be deemed to be misbranded if its labeling

is false or misleading in any particular fashion.” Furthermore, Section 352 of the Act requires that the name and place

of business of the manufacturer, packer, or distributor be placed on the package. Homeopathic drugs for retail sale must also

bear adequate directions for use that can be interpreted by the average lay person, and their ingredients as well as the dilution

of each active ingredient must be stated (with dilution stated as the number of 1:10 dilutions required to arrive at the final

concentration of active ingredient). The label must also state at least one major indication for the drug, the drug's established

name, and any applicable warnings.

The

FDA requires that homeopathic drugs be manufactured in general conformance with current good manufacturing practice ("cGMP").

However, there are two exceptions to this requirement. First, homeopathic drugs do not require expiration dating. Second, the

FDA does not presently require laboratory determination of the identity and strength of each active ingredient prior to the release

and distribution of the drug on the market. For further information on the FDA's regulation of homeopathic drugs, see the FDA's

Compliance Policy Guide, "Conditions Under Which Homeopathic Drugs May be Marketed," which is available on the FDA's

website, www.fda.gov, are also subject to the U.S. Dietary Supplement Health and Education Act of 1994("DSHEA"). Under

DSHEA a manufacturer must only supply the FDA with information adequate to provide "reasonable assurance that the product

does not present a significant or unreasonable health risk of illness or injury." This information must be supplied at least

75 days before the product is available to consumers. DSHEA permits the labels of dietary supplements to contain truthful and

non-misleading structure/function claims and nutritional support claims that describe the role of the nutrient in supporting wellness.

Nutritional supplements are not allowed to make claims to diagnose, prevent, cure, treat, or mitigate disease.

Products

Gelstat(TM)

Migraine

Gelstat

Migraine is a patented homeopathic drug intended for use in providing acute relief from the pain and associated symptoms of migraine

and migraine-like headaches. It is believed to be more effective if used early in the course of an attack, but may be used at

any time. Gelstat Migraine is administered sublingually (under the tongue), where it is held in place briefly before being swallowed.

Gelstat Migraine is provided in single dose dispensers, which are intended to ensure ease of use as well as consistent, accurate

administration of medication.

In

a clinical trial of 30 patients who consistently develop moderate to severe migraine headache pain were treated with Gelstat Migraine

early in the course of an attack, while at the mild pain phase. The primary objective of the study was to assess the efficacy

of Gelstat Migraine in providing acute relief from migraine headache pain and associated symptoms. Results demonstrated that migraine

headache pain two hours after treatment was either mild or none in approximately 83% of patients. Pain-free response was obtained

by 48% of patients, with 34% reporting only mild pain. Moderate pain was reported by 17% and severe pain by 0% (none). Of those

pain-free at two hours, 71% remained pain-free during the 24 hour post-dose period and 85% remained pain-free or had only mild

pain. Moderately painful headache recurred in 14% of patients and severely painful headache in 0%. Migraine associated symptoms

such as photophobia, phonophobia and nausea were eliminated in 53% of those patients initially reporting such symptoms. Side effects

were infrequent and minor.

Initial

clinical trial data suggests that Gelstat Migraine may be more effective than competing OTC migraine relief products, and that

it may not be associated with the side effects common to other OTC products, such as stomach upset, or the development of rebound

headaches and chronic daily headaches. Prescription medications for migraine are generally associated with significant side effects,

none of which have been reported or noted with use of Gelstat Migraine. Further details regarding this initial clinical trial

are available on the Company’s website at

www.gelstat.com

. The information found at the Company's website is not

incorporated in or made a part of this report on Form 10-K.

Gelstat(TM)

Sleep

Gelstat(TM)

Sleep is presently under final development and is intended to be marketed as a sleep aid. It was introduced to consumers in 2010

on a test basis to obtain data to determine product viability. Gelstat Sleep is expected to be marketed as a nutritional supplement

for OTC (non-prescription) sales. The company plans to formally launch the product in the fourth quarter of 2012 contingent on

raising any required capital.

Gelstat

Sleep is provided as an orally dispersible tablet, a form of administration believed to be of particular benefit because of the

rapid onset of absorption and the high percent of active ingredient absorbed. It is believed that Gelstat Sleep may offer consumers

an effective OTC sleep aid without the risks and side effects associated with other OTC and prescription sleep aids.

The

tablets are specifically formulated for effective delivery of active ingredients. Unlike nearly all other non-prescription sleep

aids, Gelstat Sleep does not contain antihistamines. Antihistamines cause drowsiness, but they are often ineffective sleep aids,

and have side effects that create problems for many users.

Gelstat

Sleep is expected to employ a unique combination of active ingredients, each of which has independently been shown in some studies

to be effective in promoting healthy sleep. Those ingredients are combined with proprietary adjuncts as part of the delivery system

intended to provide rapid, effective and safe administration when used as directed. By utilizing an orally dispersible tablet

to deliver the planned combination of ingredients, the Company hopes to offer a product that is substantially advantageous relative

to competing products.

Sales

and Marketing

Domestic

Sales & Marketing

Gelstat

intends to market and distribute its products initially through direct-to-consumer marketing efforts and then through drugstores

and pharmacies, food stores, and mass merchandise retailers once the products have achieved significant brand recognition and

until the Company has the capital to support its marketing efforts. Presently, Gelstat offers Gelstat Migraine for sale through

its website and through a very limited number of retailers.

International

Sales & Marketing

The

global incidence of migraine and other conditions intended to be addressed by the Company's products approximates that found in

the United States. Gelstat is pursuing international opportunities for Gelstat Migraine simultaneous with its current domestic

sales and marketing activities.

Competition

There

are numerous other companies that manufacture and market products that compete with the present and intended products of the Company.

Most of the companies that compete with Gelstat have much greater market exposure, human resources and financial resources than

the Company. Most of the products that compete with the Company's products have greater brand recognition, and have already achieved

a certain amount of consumer acceptance.

The

Company believes that Gelstat Migraine competes primarily with other OTC migraine medications. The OTC migraine market is based

almost entirely on common analgesics, some having been slightly modified for use in the treatment of migraine (e.g. by the addition

of caffeine). Typical competitors include products like Excedrin Migraine(R), Motrin Migraine(R) and Advil Migraine(R).

Non-steroidal

anti-inflammatory drugs (NSAIDs: ibuprofen, aspirin, etc.) have significant harmful side effects. Common side effects of these

OTC analgesics include rebound headaches (both caffeine and NSAIDs have been implicated as a cause of rebound headaches), chronic

daily headache, liver damage, kidney damage, ulcers and, less serious but more frequently encountered stomach upset. The Company

also competes with prescription migraine treatments. Triptans are now recognized as the prescription drug of choice for most migraine

patients, and have largely displaced other prescription medications. The proposed mechanism of action for all Triptans is vasoconstriction

(narrowing of blood vessels) via binding with serotonin receptors on blood vessels leading to relief of migraine pain and associated

symptoms.

Principal

Suppliers

Gelstat

is dependent on vendors, suppliers and strategic partners. The Company must reach and maintain agreements with third-parties to

supply it with the accounting, management, manufacturing, packaging, public relations, advertising, clinical trials, product brokering

and distribution, and other products and services necessary to affect its business plan. The Company believes that at least several

alternative sources exist for each service and component purchased for and used in the manufacture and marketing of its products.

However, Gelstat generally does not have long-term service agreements with those performing services for the Company or long-term

supply agreements with suppliers to provide product at any set price or at all. In addition, Gelstat currently does not have the

physical or human resources to independently manufacture its products or any other products that might be developed. While believing

that alternate vendors could be found, the need to change vendors, should it arise, could have a material adverse effect on the

Company. The Company intends to outsource all of its product manufacturing and packaging operations for the foreseeable future.

Intellectual

Property

The

Company plans to continuously define, expand and defend the intellectual property related to its products and delivery systems.

The Company was issued United States patent number 7,192,614 relating to Gelstat Migraine on March 20, 2007. Intellectual property

protection may be very important to the successful marketing and distribution of its products. Gelstat will therefore continue

to file patent and other intellectual property applications to protect inventions and improvements that are considered important

to the development of its products and business. Gelstat also relies on trade secrets, know how, continuing technological innovation

and licensing opportunities to develop and maintain its competitive position.

Research

and Development

Gelstat

is a marketing driven company presently dedicated to products addressing migraine, and problem sleep. Each of these is a multi-billion

dollar international market. Nonetheless, potential new product opportunities may be evaluated according to their likely competitive

advantage(economic as well as clinical), potential market size, patentability, and suitability for sale as non-prescription products,

likely consumer acceptance and perceived ability of the Company to successfully execute development and launch within the constraints

of present opportunities.

Gelstat

believes that clinical trials are essential to demonstrate efficacy in a manner recognized and accepted by the medical community

as well as the consumer and, accordingly, plans to conduct clinical trials on every product it develops.

Due

to capital constraints, Gelstat has currently suspended all R&D efforts and clinical trials but hopes to resume efforts in

the future once capital is obtained.

Employees

Gelstat

maintains an executive office in Palm City, Florida and a warehouse and distribution facility in Stuart, Florida. As of date of

filing this Report, the Company had no employees.

ITEM

1A. RISK FACTORS

Risks

Related to Our Business

Our

ability to continue as a going concern is in substantial doubt absent obtaining adequate new debt or equity financings.

Our

continued existence is dependent upon us obtaining adequate working capital to fund all of our operations. Working capital limitations

continue to impinge on our day-to-day operations, thus contributing to continued operating losses. Currently, the Company is entirely

dependent on outside investments to support its operations. Thus, if we are unable to raise funds to fund the development, manufacturing

and marketing of our products, we may not be able to continue as a going concern and you will lose your investment.

We

have a limited recent operating history on which to evaluate our potential for future success and to determine if we will be able

to execute our business plan. Therefore, it is difficult to evaluate our future prospects and the risk of success or failure of

our business.

Since

we encountered severe financial problems in 2005, we have had very limited operations. Revenue has been limited to some website

orders since we have lacked the capital for marketing. You must consider our business and prospects in light of the risks and

difficulties we will encounter as an early-stage company. These risks include:

|

|

·

|

our

ability

to

raise

sufficient

working

capital,

|

|

|

·

|

our

ability

to

effectively

and

efficiently

market

and

distribute

our

products,

|

|

|

·

|

our

ability

to

obtain

market

acceptance

of

our

current

products

and

future

products

that

may

be

developed

by

us,

and

|

|

|

·

|

our

ability

to

sell

our

products

at

competitive

prices

which

exceed

our

per

unit

costs.

|

We

may not be able to address these risks and difficulties, which could materially and adversely affect our revenue, operating results

and our ability to continue to operate our business.

The

success of our products is subject to ongoing and additional clinical trials which may not be successful.

The

U.S. Food and Drug Administration (the “FDA”) does not require homeopathic drugs to be submitted to pre-market approval

and are not required to be tested for safety and effectiveness. Our GelStat Migraine product has undergone two clinical trials

and additional trials may be required. In order to test the efficacy of the GelStat Migraine product, we have put it through a

clinical trial and, if we have the necessary funding, anticipate putting the product through additional testing. Although this

product has already undergone two clinical trials with favorable results, we cannot assure you that the results will be favorable

in the future trials. Additionally, some consumers and retailers may defer purchasing the product until such time, if any, that

such additional trials are successfully completed. The results of future clinical trials are expected to strongly affect the economic

viability and perceived value of our products. There can be no assurance as to the outcome of future clinical trials on our current

or future products. If the clinical trial results for any of the Company’s initial products suggest that any of them are

not efficacious, or reveal unexpected problems such as serious side effects, the Company may be unable to successfully market

the products even if we desired to do so. In such event, the Company’s results of operations will be adversely affected

and you may lose your investment.

Because

successful development of our products is uncertain, our results of operations may be materially harmed.

Our

development of current and future products is subject to the risks of failure and delay inherent in the development of non-prescription

consumer health care products, including but not limited to the following:

|

|

•

|

delays

in

product

development,

clinical

testing,

or

manufacturing;

|

|

|

•

|

unplanned

expenditures

in

product

development,

clinical

testing,

or

manufacturing;

|

|

|

•

|

failure

to

receive

regulatory

approvals,

if

required;

|

|

|

•

|

emergence

of

superior

or

equivalent

products;

|

|

|

•

|

inability

to

manufacture

our

products

on

a

commercial

scale

on

our

own,

or

in

collaboration

with

third

parties;

and

|

|

|

•

|

failure

to

achieve

market

acceptance.

|

Because

of these risks, our development efforts may not result in any commercially viable products. If a significant portion of these

development efforts are not successfully completed, required regulatory approvals are not obtained, or any approved products are

not commercialized successfully, our business, financial condition, and results of operations may be materially harmed.

Any

unanticipated problems with product development and commercialization develop or our products are found to be ineffective or unsafe,

our business may fail.

Our

successful development of existing and new products is subject to the risks of failure and delay inherent in the development and

commercialization of products. We may experience unanticipated or otherwise negative research and development results. Existing

or proposed products may be found to be ineffective or unsafe, or may otherwise fail to receive required regulatory clearance

or approval. We may find that existing or proposed products, while effective, are uneconomical to commercialize or market. Existing

or proposed products may not achieve broad market acceptance.

Because

we will need to rely on third parties for the development, manufacture, sales and marketing of our current or future products,

our future success will be dependent on the timeliness and effectiveness of the efforts of these third parties.

We

do not have the capability and resources to manufacture, market or sell our current products or any future product. We intend

to outsource all of our product manufacturing and packaging operations for the foreseeable future. Accordingly, we will seek to

enter, at the appropriate time, into agreements with other companies that can assist us and provide certain capabilities that

we do not possess. Even if we do succeed in securing these alliances, we may not be able to maintain them if, for example, development

results are disappointing or approval of a product (if required) is delayed or sales of a product are below expectations. Furthermore,

any delay in entering into agreements could delay the development and commercialization of our products and reduce their competitiveness

even if they reach the market. Any such delay related to our agreements could adversely affect our business. Further, f

ailure

by such parties to provide the agreed services at an acceptable level could adversely affect our business.

If

our products gain widespread commercial acceptance, we could face potential difficulties in locating sufficient manufacturing

sources.

We

have used third parties to manufacture our products on a limited basis. If we are unable to produce our products in sufficient

quantities at an acceptable cost, we may lose customers and our business could be harmed. Our ability to expand production could

also be hindered by the availability of materials used to manufacture our products or the availability of qualified personnel.

These difficulties could result in reduced quality of our products or reduced sales, which could damage our industry reputation

and hurt our ability to generate revenues.

Because

the consumer healthcare product market is subject to substantial regulation by regulatory agencies, if we do not obtain the requisite

regulatory approvals we need to market our products, we will not be able to commercialize our products.

We

believe that all of our current and planned products will be marketed either as homeopathic products or as dietary supplements,

and that each will therefore be exempt from the new drug approval process required in the United States for prescription pharmaceuticals.

The Company’s products, product development activities and manufacturing processes are nonetheless subject to regulation

by the Food and Drug Administration (“FDA”) and by comparable agencies in foreign countries. In the U.S., the FDA

regulates manufacturing, labeling and record keeping procedures even for non-prescription products. We use qualified third-party

manufacturers to perform these services; however, if these third-parties do not comply with the regulations, we may not be able

to sell our products. Nonetheless, the failure of such third parties to adhere to regulations could have a material adverse affect

on our business.

In

addition, product claims, labels, advertising and other communications with the public are closely monitored by the Federal Trade

Commission (“FTC”) and states under their “Little FTC Acts”. Failure to comply with any of the numerous

regulations which govern our industry could result in regulatory or enforcement actions which would have a material adverse affect

on our business. In addition, we are subject to those risks associated with any highly regulated industry wherein regulations

are subject to change that is both substantial and rapid. Regulatory change may force the Company to expend substantial time and

money becoming compliant, may make the Company’s business more expensive to operate and the products less profitable, or

not profitable at all, and might even prevent the Company from marketing one or more of its products. We are marketing our first

product, GelStat Migraine, as an effective solution in alleviating migraine headaches. Under FDA and FTC rules, we are required

to obtain scientific and/or clinical data to support any health claims we make concerning our products. Although we have neither

provided nor been requested to provide any such data to the regulators in support of this claim, we have in fact obtained supporting

scientific and clinical data. We cannot be certain, however, that the scientific and clinical data we have obtained or will obtain

in the future in support of our claims will be deemed acceptable or sufficient by any regulator. If the FDA or the FTC requests

any supporting information, and we are unable to provide support that is acceptable to the FDA or the FTC, either agency could

force us to stop making the claims in question, which would most likely have a negative impact on sales. Regulatory actions may

materially adversely affect the Company’s business, financial condition and results of operations.

If

any of our products are alleged to have unacceptable adverse effects, we could be subject to liability which would adversely affect

our results of operations.

The

Company faces an inherent business risk of exposure to product liability claims in the event that the use of its products is alleged

to have resulted in adverse effects. Any such claims would likely have an adverse effect on the Company. The Company currently

has product liability insurance for claims against it up to one million dollars,on a per-occurrence basis. However, there can

be no assurance that such coverage would protect the Company in every instance, or that a claim might not substantially exceed

the limit of coverage beyond the Company’s ability to pay. Additionally, there can be no assurance that such insurance will

continue to be available to the Company in the future on commercially reasonable terms, or at all. If the Company is unable to

continue its product liability insurance coverage for any reason, it may have a material impact on the retailer’s willingness

to stock the Company’s products.

If

we lose our Chief Executive Officer, our business may materially suffer.

We

are highly dependent on Mr. Gerald Kieft, Chief Executive Officer, who is our sole officer and provides “as needed”

services. We do not carry “key-man” life insurance on Mr. Kieft. Furthermore, our future success will also depend

in part on our ability to identify, hire, and retain qualified personnel at senior and other management levels. We will experience

intense competition for qualified personnel and may be unable to attract and retain the personnel necessary for the development

of our business. Because of this competition, our compensation costs may increase significantly and our business may suffer.

If

we fail to establish a method to sell, market or distribute our products, our results of operations would be adversely affected.

Because

we have limited experience in the sale, marketing and distribution of consumer products, we intend on selling our products through

the Internet, direct-to-consumer advertising and certain traditional retail outlets. To achieve this, may work with a number of

brokers and distributors currently serving these markets. There can be no assurance that any broker or distributor will be able

to place our product with the aforementioned channels, or that once such initial placement is achieved any retailer or other outlet

will continue to carry our product, or that any broker or distributor will continue working with the Company and our products.

If

we do not obtain protection for our intellectual property rights, our competitors may be able to take advantage of our research

and development efforts to develop competing drugs.

Our

success will depend, in part, on our ability to maintain the confidentiality of our trade secrets and know how, operate without

infringing on the proprietary rights of others and prevent others from infringing our proprietary rights. We have received a United

States patent on our GelStat Migraine product however we cannot assure you that this patent will afford adequate protection to

us. The Company has hired I.P. counsel to assist us with obtaining I.P. protection on our products in international markets. However,

we cannot assure you that we will obtain any such I.P. protection on our products internationally.

Competitors

may successfully challenge our intellectual property rights, produce similar drugs or products that do not infringe our patents,

or produce drugs in countries where we have not applied for patent protection or that do not respect our patents.

If

any of these events occurs, or we otherwise lose protection for our trade secrets or proprietary know-how, the value of this information

may be greatly reduced. Patent protection and other intellectual property protection are important to the success of our business

and prospects, and there is a substantial risk that such protections will prove inadequate.

If

we are subject to intellectual property infringement claims, it could cause us to incur significant expenses, pay substantial

damages and prevent us from selling our products.

In

the drug development business, third parties accumulate large portfolios of patents. Third parties may claim that our patent and/or

products infringe or violate their intellectual property rights. Intellectual property litigation is characterized by unusually

large legal fees, consulting and expert fees and other costs. Any claims that we are violating the intellectual property rights

of another party could cause us to incur significant expenses which may likely exceed our capacity to pay the fees and costs.

If successfully asserted against us, an adverse intellectual property claim is likely to require that we pay substantial damages

in excess of our ability to pay and prevent us from using licensed technology that may be fundamental to our business. Even if

we were to prevail, any litigation regarding intellectual property could be costly and time-consuming and divert our attention

from our business operations. We may also be obligated to indemnify our business partners in any such litigation, which could

further exhaust our resources. Furthermore, as a result of an intellectual property challenge, we may be prevented from selling

our products unless we enter into royalty, license or other agreements. We may not be able to obtain such agreements at all or

on terms acceptable to us, and as a result, we may be precluded from offering some or all of our products.

If

we cannot manage our growth effectively, we may not become profitable.

Businesses,

which grow rapidly often, have difficulty managing their growth. If we grow as rapidly as we anticipate, we will need to expand

our management by recruiting and employing experienced executives and key employees capable of providing the necessary support.

We cannot assure you that our management will be able to manage our growth effectively or successfully. Our failure to meet these

challenges could cause us to lose money, and your investment could be lost.

Among

other things, implementation of our growth strategy would be adversely affected if we were not able to attract sufficient customers

to the products we offer in light of the price and other terms required in order for us to attain the necessary profitability.

Because

of our limited experience in commercializing our products, the market acceptance of the Company’s products is uncertain.

Our

success depends upon the acceptance by retail consumers of our products. Although we believe that our products are efficacious,

and that they will meet with consumer acceptance, we have no assurance of that. There is only limited data by which to gauge consumer

acceptance of the Company’s products. Most of the products that compete with the Company’s products have substantial

brand recognition, and have already achieved a certain amount of consumer acceptance. Those consumers who presently use a competitor’s

product to treat a condition designed to be treated by our products will have to be convinced to switch products, which is often

difficult. We believe that the successful completion of clinical trials demonstrating the efficacy of our products or, in the

case of GelStat Migraine, additional clinical trials, may be essential for the successful marketing of these products, especially

in light of entrenched competition. There can be no assurance that any clinical trials will be completed beyond the initial trials

of GelStat Migraine that have already been completed, or that such additional clinical trials will demonstrate the same degree

of efficacy as these initial trials, or any efficacy at all. Insufficient market acceptance of our products would have a material

adverse effect on our business, financial condition and results of operations.

Although

we plan to diversify our product offering, we may not be successful.

The

Company proposes as an important part of its business plan to complete development of additional products related to arthritis,

sinusitis and problem sleep. Offering new products is subject to a number of risks including:

|

|

·

|

Acquiring

ownership

or

distribution

rights

to

new

products;

|

|

|

·

|

Having

sufficient

capital

to

acquire

the

rights

to

new

products,

build

inventory

and

market

the

products, and;

|

|

|

·

|

Our

ability

to

generate

effective

marketing

programs.

|

No

assurance can be given that the Company will ever be able to successfully design, develop, and market any such additional new

products.

If

economic conditions in the United States and elsewhere do not materially improve, we may be hampered by our ability to sell our

products.

The

sharp economic downturn in the United States and elsewhere beginning in 2008 and the resulting unemployment has a tendency to

cause consumers to reduce spending except on necessities. While consumer healthcare products may be relatively resistant to this

trend, to the extent that consumers lack disposable money we believe that we will be adversely affected. Unless and until the

economy materially improves, we may be affected by these factors.

Risks

Related to Our Common Stock

Because

the market for our Common Stock is limited, persons who purchase our Common Stock may not be able to resell their shares

at or above the purchase price paid by them.

Our

Common Stock trades on the OTC Markets, which is not a liquid market. There is currently only a limited public market

for our Common Stock. We cannot assure you that an active public market for our Common Stock will develop or be sustained

in the future. If an active market for our Common Stock does not develop or is not sustained, the price may continue

to decline.

Because

we are subject to the “penny stock” rules, brokers cannot generally solicit the purchase of our Common Stock which

adversely affects its liquidity and market price.

The

Securities and Exchange Commission ("SEC") has adopted regulations which generally define “penny stock”

to be an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. The

market price of our Common Stock on the OTC Markets has been substantially less than $5.00 per share and therefore we are currently

considered a “penny stock” according to SEC rules. This designation requires any broker-dealer selling

these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and

determine that the purchaser is reasonably suitable to purchase the securities. These rules limit the ability of broker-dealers

to solicit purchases of our Common Stock and therefore reduce the liquidity of the public market for our shares.

Due

to factors beyond our control, our stock price may be volatile.

Any

of the following factors could affect the market price of our Common Stock:

|

●

|

Our

failure to generate increasing material revenues from our products;

|

|

●

|

Our

failure to become profitable;

|

|

●

|

Our

failure to raise adequate working capital;

|

|

●

|

Our

public disclosure of the terms of any financing which we consummate in the future;

|

|

●

|

Actual

or anticipated variations in our quarterly results of operations;

|

|

●

|

Announcements

by us or our competitors of significant contracts, new products, acquisitions, commercial relationships, joint ventures or

capital commitments;

|

|

●

|

The

loss of significant business relationships;

|

|

●

|

Our

failure to meet financial analysts’ performance expectations;

|

|

●

|

Changes

in earnings estimates and recommendations by financial analysts;

|

|

●

|

Short

selling activities; or

|

|

●

|

Changes

in market valuations of similar companies.

|

In

the past, following periods of volatility in the market price of a company’s securities, securities class action litigation

has often been instituted. A securities class action suit against us could result in substantial costs and divert our

management’s time and attention, which would otherwise be used to benefit our business.

We

may issue preferred stock without the approval of our shareholders, which could make it more difficult for a third party to acquire

us and could depress our stock price.

Our

Board may issue, without a vote of our shareholders, one or more additional series of preferred stock that have more than one

vote per share. This could permit our Board to issue preferred stock to investors who support GelStat and our management

and give effective control of our business to GelStat and our management. Additionally, issuance of preferred stock

could block an acquisition resulting in both a drop in our stock price and a decline in interest of our Common Stock. This

could make it more difficult for shareholders to sell their Common Stock. This could also cause the market price of

our Common Stock shares to drop significantly, even if our business is performing well.

An

investment in GelStat may be diluted in the future as a result of the issuance of additional securities, the exercise of options

or warrants or the conversion of outstanding preferred stock.

In

order to raise additional capital to meet its working capital needs, GelStat expects to issue additional shares of Common Stock

or securities convertible, exchangeable or exercisable into Common Stock from time to time, which could result in substantial

dilution to investors. Investors should anticipate being substantially diluted based upon the current condition of

the capital and credit markets.

Because

we may not be able to attract the attention of major brokerage firms, it could have a material impact upon the price of our Common

Stock.

It

is not likely that securities analysts of major brokerage firms will provide research coverage for our Common Stock since the

firm itself cannot recommend the purchase of our Common Stock under the penny stock rules referenced in an earlier risk factor. The

absence of such coverage limits the likelihood that an active market will develop for our Common Stock. It may also make it more

difficult for us to attract new investors at times when we acquire additional capital.

Since

we intend to retain any earnings for development of our business for the foreseeable future, you will likely not receive any dividends

for the foreseeable future.

We

have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future

earnings to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common

stock in the foreseeable future.

ITEM

1B. UNRESOLVED STAFF COMMENTS

None

ITEM

2. DESCRIPTION OF PROPERTY

Gelstat

presently operates out of an executive office under shared-use arrangement with WSR, a company headed by its Chief Executive Officer,

in Palm City, Florida and leases a warehouse/distribution facility of approximately 2,100 square feet in Stuart, Florida. The

Company believes that its facilities are adequate for its operations for the foreseeable future and that each of such facilities

could be replaced without great difficulty.

ITEM

3. LEGAL PROCEEDINGS

From

time to time, we are involved in litigation in the ordinary course of business. We are not party to any material litigation.

On

January 19, 2006, the Company was served with a Summons and Complaint entitled “Milgaard RE Partnership vs. Gelstat Corporation.”

Milgaard RE Partnership, a promissory note holder, alleged Gelstat owed $76,734 under the note, including interest and fees. On

July 1, 2011, a settlement agreement was reached among parties wherein Milgaard RE Partnership was issued 114,000, $0.03, five

year warrants and $3,600 cash.

In

September 2006, the Company was served with a Summons and Complaint entitled “Dr. Steven Klos vs. Gelstat Corporation.”

Dr. Klos, a promissory note holder, alleged Gelstat owed $100,000 regarding the note. In November 2009 a settlement agreement

was reached among parties whereby Gelstat paid Dr. Klos $25,000.

On

September 10, 2007, the Company was served with a Summons and Complaint entitled “Unicep Packaging, Inc. vs. Gelstat Corporation.”

Unicep Packaging, Inc., a vendor, alleged Gelstat owed $190,340 on an agreement entered into by the parties regarding packaging

of Gelstat’s products. On July 11, 2011, a settlement agreement was reached among parties wherein Unicep was issued 400,000,

$0.03, 5 year warrants and $20,000 cash.

On

December 11, 2007, the Company was served with a Summons and Complaint entitled “Angela Diliddo and Bioinitiate Capital,

LLC. vs. Gelstat Corporation.” Angela Diliddo and Eleanor Kelly (sole principal of Bioninitiate), promissory note holders,

alleged Gelstat owed $120,000 and $60,000, respectively, regarding the notes. On July 1, 2011, a settlement agreement was reached

among parties wherein Angela Diliddo was issued 240,000 $0.03, 5 year warrants and $6,000 cash and Eleanor Kelly was issued 120,000

$0.03, 5 year warrants and $3,000 cash.

On

December 14, 2007, the Company was served with a Summons and Complaint entitled “Stepping Stones Partners, LP and Daniel

D. Hickey vs. Gelstat Corporation.” Stepping Stones Partners, LP/Daniel D. Hickey, a promissory note holder, alleged Gelstat

owed $120,000 regarding the note. On July 1, 2011, a settlement agreement was reached among parties wherein Stepping Stones Partners,

LP/Daniel D. Hickey was issued 120,000 $0.03, 5 year warrants and $16,000 cash.

ITEM

4. MINE SAFETY DISCLOSURES

Not

applicable.

PART

II

ITEM

5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

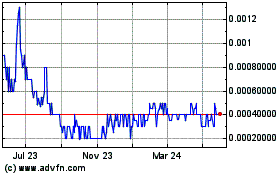

The

Company's $0.01 par value common stock is quoted on the OTC Bulletin Board under the symbol "GSAC." The following table

sets forth the low and the high closing sales prices for each quarter as reported on the OTC Bulletin Board during the years ended

December 31, 2007 and 2006. These quotations reflect inter-dealer prices, without retail mark up, mark down or commissions, and

may not represent actual transactions. We had approximately 255 holders of record of our common stock as of the date of filing

this Report.

|

|

|

Closing Price*

|

|

CALENDAR

2007

|

|

Low

|

|

High

|

|

First Quarter

|

|

$

|

0.07

|

|

|

$

|

0.18

|

|

|

Second Quarter

|

|

$

|

0.07

|

|

|

$

|

0.27

|

|

|

Third Quarter

|

|

$

|

0.12

|

|

|

$

|

0.20

|

|

|

Fourth Quarter

|

|

$

|

0.03

|

|

|

$

|

0.13

|

|

|

|

|

|

|

|

|

|

|

|

|

CALENDAR

2006

|

|

|

Low

|

|

|

|

High

|

|

|

First Quarter

|

|

$

|

0.17

|

|

|

$

|

0.79

|

|

|

Second Quarter

|

|

$

|

0.07

|

|

|

$

|

0.22

|

|

|

Third Quarter

|

|

$

|

0.05

|

|

|

$

|

0.20

|

|

|

Fourth Quarter

|

|

$

|

0.06

|

|

|

$

|

0.18

|

|

Dividends

The

Company has never declared or paid a cash dividend on its common stock and does not anticipate paying any dividends in the foreseeable

future.

Recent

Sales of Unregistered Securities

During

the three months ended December 31, 2007, the Company had no equity transactions.

During

the three months ended September 30, 2007 the Company issued 750,000 options at an exercise price of $.12 per share for services

rendered or to be rendered valued at $90,000.

During

the three months ended September 30, 2007 the Company sold 400,000 shares of common stock and 400,000 warrants with an exercise

price of $.25 for gross proceeds of $40,000.

During

the three months ended June 30, 2007 the Company issued 250,000 warrants at an exercise price of $.10 per share for services rendered

or to be rendered valued at $27,500.

During

the three months ended June 30, 2007, the Company issued 200,000 shares of common stock at $.10 per share for services rendered

or to be rendered valued at $20,000.

During

the three months ended June 30, 2007 the Company sold 700,000 shares of common stock and 700,000 warrants with an exercise price

of $.25 for gross proceeds of $70,000.

During

the three months ended March 31, 2007, the Company issued 400,000 shares of common stock at $.10 per share for services rendered

or to be rendered valued at $40,000.

During

the three months ended December 31, 2006 the Company sold 250,000 shares of common stock and 250,000 warrants with an exercise

price of $.25 for gross proceeds of $25,000.

During

the three months ended December 31, 2006, the Company issued 1,150,000 shares of common stock at prices ranging from $.06 to $0.15

per share for services rendered or to be rendered valued at $136,000.

During

the three months ended December 31, 2006, the Company issued 1,500,000 shares of common stock at $0.08 per share for services

rendered or to be rendered valued at $120,000.

During

the three months ended December 31, 2006, 242,847 five-year options were exercised with a weighted average exercise price of $0.69

on a "cashless" or "net exercise" basis (based on the market price of the Company's common stock the day before

exercise) resulting in the issuance of 2,428 shares of common stock.

During

the three months ended December 31, 2006, the Company issued 120,000 warrants at an exercise price of $.20 per share for services

rendered or to be rendered valued at $8,400.

During

the three months ended December 31, 2006 the Company issued 950,000 options at an exercise price of $.06 per share for services

rendered or to be rendered valued at $95,000.

During

the three months ended September 30, 2006 the Company sold 2,433,888 shares of common stock and 2,433,888 warrants with an exercise

price of $.20 for gross proceeds of $219,050.

During

the three months ended September 30, 2006 the Company issued 197,010 shares of common stock at $.09 per share for services rendered

or to be rendered valued at $17,731.

During

the three months ended September 30, 2006 the Company issued 1,700,000 shares of common stock at $.10 per share for services rendered

or to be rendered valued at $170,000.

During

the three months ended September 30, 2006 the Company issued 3,000,000 warrants at exercise prices ranging from $.25 - $.50 per

share for services rendered or to be rendered valued at $300,000.

During

the three months ended September 30, 2006 the Company issued 760,000 options at exercise prices ranging from $.07 - $.11 per share

for services rendered or to be rendered valued at $57,200.

During

the three months ended June 30, 2006, the Company issued 320,000 shares of common stock at $.12 per share for services rendered

or to be rendered valued at $38,400.

During

the three months ended June 30, 2006, the Company issued 500,000 warrants at an exercise price of $.09 per share for severance

valued at $60,000.

During

the three months ended March 31, 2006 the Company sold 60,000 shares of common stock and 30,000 warrants with an exercise price

of $.70 for gross proceeds of $30,000.

During

the three months ended March 31, 2006, the Company issued 535,000 shares of common stock at prices ranging from $.74 to $.22 per

share for services rendered or to be rendered valued at $241,700.

All

of the sales of the securities above were exempt from registration under Section 4(2) of the Securities Act of 1933 and Rule 506

thereunder on the grounds that the securities were only sold to accredited investors who purchased for investment and legends

were placed on the securities.

ITEM

6. SELECTED FINANCIAL DATA

Not

applicable for smaller reporting companies.

ITEM

7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Please

refer to the consolidated financial statements and related notes thereto which is a part of this report for further information

regarding the results of operations of the Company.

Company

Overview

Gelstat

Corporation ("the Company" or "Gelstat") is a consumer health care company dedicated to the cost-effective

development and marketing of over-the-counter (OTC) and other non-prescription consumer health care products. The Company's first

product is "Gelstat® Migraine", a patented OTC homeopathic drug intended for use as a first-line, acute treatment

for migraine and migraine-like headaches. Gelstat Migraine is intended to provide acute (at the time of an attack) relief from

headache pain as well as other symptoms frequently associated with migraine. Gelstat(TM) Sleep is presently under final development

and is intended to be marketed as a sleep aid. It was introduced to consumers in 2010 on a test basis to obtain data to determine

product viability. Gelstat Sleep is expected to be classified as a dietary supplement.

Current

sales and marketing efforts are focused primarily on Gelstat Migraine.

Critical

Accounting Policies

In

response to financial reporting release FR-60, Cautionary Advice Regarding Disclosure About Critical Accounting Policies, from

the SEC, we have selected our more subjective accounting estimation processes for purposes of explaining the methodology

used in calculating the estimate, in addition to the inherent uncertainties pertaining to the estimate and the possible effects

on the our financial condition. The accounting estimates are discussed below and involve certain assumptions that, if incorrect,

could have a material adverse impact on our results of operations and financial condition.

Inventories

We

value our inventory at the lower of the actual cost or the current estimated market value of the inventory. Management reviews

sales, shipped goods and available inventory quantities on a weekly basis and record a provision for excess and obsolete inventory

if considered necessary. Changes in the marketplace or introduction of new products could result in an increase in the amount

of obsolete inventory quantities.

Revenue

Recognition

In

accordance with the Securities Exchange Commission's Staff Accounting Bulletin No. 104 (SAB 104) "Revenue Recognition",

the Company recognizes revenue when persuasive evidence of a customer or distributor arrangement exists or acceptance occurs,

shipment has occurred, the price is fixed or determinable, and the sales revenues are considered collectible. Subject to these

criteria, except with respect to customers that buy products on Pay on Scan terms, we recognize revenue at the time of shipment

of the merchandise.

Stock-Based

Compensation

The

Company accounts for stock-based compensation using the fair value method following the guidance set forth in section 718-10 of

the FASB Accounting Standards Codification for disclosure about Stock-Based Compensation. This section requires a public entity

to measure the cost of employee services received in exchange for an award of equity instruments based on the grant date fair

value of the award (with limited exceptions). That cost will be recognized over the period during which an employee is required

to provide service in exchange for the award – the requisite service period (usually the vesting period). No compensation

cost is recognized for equity instruments for which the employees do not render the requisite service.

The

Company recognizes expenses for the fair value of its outstanding stock warrants and options as they vest, whether held by employees

or others. The fair value of each stock warrant and option at the grant date is evaluated by using the Black-Scholes option pricing

model based upon certain assumptions, including the expected stock price volatility.

Results

of Operations

The

Company had revenues of $18,178 and $233,974 for the years ended December 31, 2007 and 2006, respectively. The decrease in revenues

in 2007 is attributable to the Company marketing on a limited basis only.

Cost

of goods sold were $5,097 and $88,457 for the years ended December 31, 2007 and 2006, respectively. The decrease in cost of goods

sold expense in 2007 is attributable to the corresponding decrease in revenues.

Selling,

general and administrative expenses were $105,689 and $332,235 for the years ended December 31, 2007 and 2006, respectively. The

decrease in 2007 is due to the decrease in professional fees and advertising expense.

The

Company incurred $0 and $38,065 in research and development expense for the years ended December 31, 2007 and 2006 respectively.

The decrease in 2007 is due to the Company discontinuing clinical trials.

The

Company recorded $43,243 and $56,702 of interest expense during the years ended December 31, 2007 and 2006, respectively. The

interest expense relates to a 7% accrual on the outstanding notes payable balance.

Liquidity

and Capital Resources

Cash

flows used in operating activities were $162,132 and $488,056 for the years ended December 31, 2007 and 2006, respectively. Negative

cash flows from operations for the years ended December 31, 2007 were due primarily to the net loss of $1,083,466, partially offset

by amortization of deferred compensation. Negative cash flows from operations for the year ended December 31, 2006 were due primarily

to the net loss of $1,817,827, partially offset by the amortization of deferred compensation.

Cash

flows used in investing activities were $4,000 during the year ended December 31, 2007 consisting of patent application costs

and lease deposits. Comparatively, cash flows of $2,254 used in investing activities during the same period in 2006 were due primarily

to patent application costs offset by lease deposits returned.

Cash

flows provided by financing activities were $158,005 and $274,050 during the year ended December 31, 2007 and 2006, respectively.

Positive cash flows from financing activities during the year ended December 31, 2007 were due to proceeds from issuance of common

stock and short-term notes payable. Positive cash flows from financing activities during the year ended December 31, 2006 were

due solely from proceeds from issuance of common stock.

As

of the date of filing this Report, the Company had approximately $5,000 cash. The Company needs to raise additional capital to

continue operations. There can be no assurance that additional capital will be available on terms acceptable to the Company or

on any terms what so ever. In addition, the Company may evaluate potential acquisitions and alliances, which may require equity

or cash resources. The Company's ability to continue the present operations and successfully implement its development plans is

contingent upon its ability to increase revenues and ultimately attain and sustain profitable operations and/or raise additional

capital.

Cautionary

Note Regarding Forward Looking Statements

This

report includes forward-looking statements including statements regarding liquidity, revenues and cash flows.

The

words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,”

“should,” “plan,” “could,” “target,” “potential,” “is likely,”

“will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking

statements. We have based these forward-looking statements largely on our current expectations and projections about

future events and financial trends that we believe may affect our financial condition, results of operations, business strategy

and financial needs.

The

results anticipated by any or all of these forward-looking statements might not occur. Important factors, uncertainties and risks

that may cause actual results to differ materially from these forward-looking statements are contained in the Risk Factors contained

herein. We undertake no obligation to publicly update or revise any forward-looking statements, whether as the result of new information,

future events or otherwise. For more information regarding some of the ongoing risks and uncertainties of our business, see the

Risk Factors and our other filings with the SEC.

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not

applicable for smaller reporting companies.

ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

GELSTAT

CORPORATION

|

|

BALANCE SHEETS

|

|

AS

OF DECEMBER 31, 2007 AND 2006

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

12/31/2007

|

|

12/31/2006

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

Cash and

cash equivalents

|

|

$

|

1,161

|

|

|

$

|

9,287

|

|

|

Accounts receivable

|

|

|

49,200

|

|

|

|

116,467

|

|

|

Prepaid consulting

|

|

|

5,000

|

|

|

|

—

|

|

|

Other

current assets

|

|

|

20,000

|

|

|

|

20,000

|

|

|

Total Current Assets

|

|

|

75,361

|

|

|

|

145,755

|

|

|

|

|

|

|