United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

o

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

OR

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ________TO________

COMMISSION FILE NUMBER 0-14278

TERRALENE FUELS CORPORATION

|

DELAWARE

|

|

52-2132622

|

|

(STATE OF INCORPORATION)

|

|

(I.R.S. ID)

|

35 South Ocean Avenue, Patchogue, New York, 11772

1-888-488-6882

Securities registered pursuant to Section 12(b) of the Act:

COMMON STOCK OTC: BB

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $.0001

(Title of Class)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common stock, $.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

o

No

o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

o

Yes

x

No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

o

Yes

x

No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o

Yes

x

No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a smaller reporting company.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o

Yes

x

No

As of March 30, 2012, there were 72,198,691 shares of the issuer's $0.0001 par value common stock issued and outstanding.

Documents incorporated by reference: None

Terralene Fuels Corporation

FORM 10-K

For The Fiscal Year Ended December 31, 2011

INDEX

|

PART I

|

|

|

3

|

|

|

|

|

|

|

|

|

|

ITEM 1.

|

BUSINESS

|

|

|

3

|

|

|

ITEM 1A.

|

RISK FACTORS

|

|

|

7

|

|

|

ITEM 1B.

|

UNRESOLVEDCOMMENTS

|

|

|

7

|

|

|

ITEM 2.

|

PROPERTIES

|

|

|

8

|

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

|

8

|

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

|

8

|

|

|

|

|

|

|

|

|

|

PART II

|

|

|

9

|

|

|

|

|

|

|

|

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

|

9

|

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

|

12

|

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

|

12

|

|

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

|

13

|

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

|

F-1

|

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

|

|

14

|

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES

|

|

|

14

|

|

|

ITEM 9B.

|

OTHER INFORMATION

|

|

|

15

|

|

|

|

|

|

|

|

|

|

PART III

|

|

|

16

|

|

|

|

|

|

|

|

|

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

|

|

16

|

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

|

|

17

|

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

|

|

18

|

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

|

|

18

|

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

|

|

19

|

|

|

|

|

|

|

|

|

|

PART IV

|

|

|

20

|

|

|

|

|

|

|

|

|

|

ITEM 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

|

|

20

|

|

|

|

|

|

|

|

|

SIGNATURES

|

|

|

21

|

|

Note About Forward-Looking Statements

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” (refer to Part I, Item 1A). We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

ITEM 1. BUSINESS

GENERAL

Terralene Fuels Corporation, formerly Golden Spirit Enterprises Ltd., formerly Golden Spirit Gaming Ltd., formerly Golden Spirit Mining Ltd., formerly Golden Spirit Minerals Ltd., formerly 2UOnline.com, Inc., formerly Power Direct, Inc., was incorporated in the State of Delaware on September 13, 1993, and we maintain our principal executive offices at 1288 Alberni Street, Suite 806, Vancouver, British Columbia, Canada V6E 4N5. Our offices in the United States are located at 177 Telegraph Road, Suite 541, Bellingham, Washington 98226.

We changed our name from Power Direct, Inc., to 2UOnline.com, Inc. by filing a Certificate of Amendment to our Certificate of Incorporation on January 31, 2000. We also changed our trading symbol from "PWDR" to "TWOU" in order to reflect our decision to shift our focus from oil and gas production to Internet- related activities. Our symbol was then changed to "TWOUE". On or about April 18, 2000, we were removed from the Over-the-Counter Bulletin Board ("OTCBB") for failure to comply with NASD Rule 6530, which requires any company listed on the OTCBB to be current in its public reporting obligations pursuant to the Securities and Exchange Act of 1934. The Company was re-instated on the OTCBB on October 7, 2002 under the symbol "TWOU". The Company filed a certificate of amendment to its Articles of Incorporation with the State of Delaware on October 1, 2003 to change its name to Golden Spirit Minerals Ltd. The name change reflects management's decision to shift the Company's focus from internet-based business development to mineral exploration. On October 8, 2003, the trading symbol for the Company became "GSPM". On October 19, 2004, the Company changed its name to Golden Spirit Mining Ltd. and the trading symbol was "GSML". On July 18, 2005 the Company changed its name to Golden Spirit Gaming Ltd. and the trading symbol was “GSGL”. On June 30, 2006, the Company changed it’s name to Golden Spirit Enterprises Ltd. and the trading symbol is currently “GSPT”. On November 29, 2011, the Company changed its name to Terralene Fuels Corporation and the trading symbol remains as “GSPT.

On August 17, 2005, the Company incorporated Golden Spirit Poker Company Limited, a British Virgin Islands Corporation. Golden Spirit Gaming Ltd. was issued 10 shares of this Company for consideration of $10.00, representing 100% of the issued capital of Golden Spirit Poker Company Limited.

We were originally incorporated to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of Delaware. We were inactive from September 13, 1993, through November 1998, when we began the process of identifying potential business interests, including, but not necessarily limited to, interests in oil and natural gas producing properties. The Company will be involved in the development, production, financing and packaging of innovative film and television programming. In addition, the Company has signed an agreement with Eneco Industries to participate in a series of Municipal Solid Waste (garbage) fueled Recycling and Resource Recovery Plants.

OUR BUSINESS

Our initial focus was on the development of oil and natural gas properties. In this regard, we purchased interests in two properties; one in the United States and one in Canada. In or around December 1999, we decided to review the focus of our business, primarily the direction we would take with our various oil and gas projects. We decided that maintaining interests in oil and gas producing properties should no longer be our focus. Due to the growth of the Internet, we decided to pursue Internet-related activities. We determined that Internet-related activities would provide a positive revenue stream sooner than oil and gas producing activities. Due to the lack of success with our internet activities we decided to abandon this business and commencing in 2003 instead pursue opportunities in mineral exploration and development

We had limited success with both our internet activities and our mineral exploration and development activities. In mid 2005, management of the Company decided to focus on online gaming and in June 2006. On June 30, 2006, the Company changed its name and focus from gaming to reflect the Company’s plan to expand its operations to include the marketing of other products and venues. The Company was involved in the development, production, financing and packaging of innovative film and television programming. During 2011, we opted out of this business totally. On September 30, 2006, Congress passed the Unlawful Internet Gambling Enforcement Act of 2006. The new proposed legislation prohibits banks, credit card companies, money transmitting businesses, and other third-party payment providers from knowingly processing online gaming transactions. Due to this ruling and the negative impact it would have on the Golden Spirit poker website, management decided to discontinue its online gaming operations in 2006.

The Company has engaged in the development, production, financing and packaging of innovative film and television programming. It continues to look for financing for its films in progress and distribution channels for its acquired films. In addition, the Company has signed an agreement with Eneco Industries to participate in a series of Municipal Solid Waste (garbage) fueled Recycling and Resource Recovery Plants. The Agreement calls for a joint venture utilizing EnEco's expertise and technology to develop a municipal solid waste (garbage) recycling and biomass derived renewable energy facility. Golden Spirit and EnEco will build and operate a series of solid waste recycling and biomass derived renewable energy facility with greenhouse and algae subsystems that will utilize our Thermal Oxidation Process System (TOPS) technology to generate electricity for sale to the local power grid. Further details on the new Terralene Fuels - Eneco project can be viewed on our website

www.goldenspirit.ws

.

In 2010, the Company signed an agreement with Global Terralene Inc .for the acquisition of all assets pertaining to Terralene Fuels. Terralene Fuel is a patented fuel alternative formulation that is the equivalent of 87 octane regular gasoline and utilizes renewable energy sources in 45% of its composition. Terralene’s unique fuel reduces greenhouse gas and other environmental damaging emissions and can be easily integrated into the existing fuel infrastructure. Further details on the new Terralene Fuels project can be viewed on our website

www.terralenefuels.com

.

Our Investment in Available for sale securities – related parties

Organa

The Company owns common shares of Organa Gardens International Inc. (formerly Shotgun Energy Corporation) (“Organa”), a public company with directors and significant shareholders in common that does not represent a position of control of or significant influence over Organa. During 2007 the Company recorded an unrealized loss in the carrying value of its available-for-sale securities totaling $3,775, which was recorded as other comprehensive income (loss). During the year ended December 31, 2008, the Company recorded an unrealized loss in the carrying value of its available-for-sale securities totaling $5,612 which was recorded as other comprehensive income (loss). During the year ended December 31, 2009, the Company sold 50,000 shares resulting in a realized loss of $(780) and recorded an unrealized loss in the carrying value of its available-for-sale securities totaling $5,138, which was recorded as other comprehensive income. During the year ended December 31, 2010, the Company received 700,300 restricted shares of Organa valued to $7,003 pursuant to a debt settlement and sold Nil Organa shares. The Company recorded an unrealized loss in the carrying value of its available-for-sale securities totaling $2,541, which was recorded as other comprehensive income (loss). As a result, the carrying value of the available for sale shares of Organa is $4,504 as at December 31, 2010.

During the year ended December 31, 2011, the Company sold Nil Organa shares and recorded an additional unrealized loss of $ (3,097). As a result, the carrying value of the available for sale shares of Organa is $1,407 as at December 31, 2011. Effective December 31, 2011, the Company recorded a $1,689 write-down of its investment in Organa due to an other-than-temporary decline in the value of the shares.

Legacy

The Company owns common shares of Legacy Wine & Spirits International Ltd. (“Legacy”), a public company with directors and significant shareholders in common, that does not represent a position of control of or significant influence over Legacy. During 2007 the Company recorded an unrealized gain in the carrying value of its available-for-sale securities totaling $590,993. During the year ended December 31, 2008, the Company acquired 23,200 shares valued at $19,532 sold 99,400 shares resulting in a realized gain of $28,645(net of commissions of $2,132) and recorded an unrealized gain in the carrying value of its available-for-sale securities totaling $275,121, which was recorded as other comprehensive income. During the year ended December 31, 2009, the Company sold 301,600 shares resulting in a realized gain of $180,398 and recorded an other-than-temporary loss in the carrying value of its available-for-sale securities totaling $34,001.

During the year ended December 31, 2010, the Company the Company received 1,451,360 restricted shares of Legacy valued to $72,568 pursuant to a debt settlement and sold Nil Legacy shares. The Company recorded an other-than-temporary loss in the carrying value of its available-for-sale securities totaling $47,069. As a result, the carrying value of the available for sale shares of Legacy is $37,535 as at December 31, 2010.

During the year ended December 31, 2011, the Company sold Nil Legacy shares and recorded an additional unrealized loss of $ (33,781). As a result, the carrying value of the available for sale shares of Legacy is $3,754 as at December 30, 2011. Effective December 31, 2011, the Company recorded a $32,843 write-down of its investment in Legacy due to an other-than-temporary decline in the value of the shares.

Available for sale securities – related parties include the following:

|

|

|

December 31 ,

|

|

|

December 31,

|

|

|

|

|

2011

|

|

|

2010

|

|

|

2,345,937 (2010-2,345,937) shares of Legacy Wine & Spirits

|

|

$

|

3,754

|

|

|

$

|

37,535

|

|

|

703,750 (2010- 703,750) shares of Organa Gardens International

|

|

|

1,407

|

|

|

|

4,504

|

|

|

|

|

$

|

5,161

|

|

|

$

|

42,039

|

|

FILM PRODUCTION & DEVELOPMENT SECTOR

Film Production and development costs at December 31, 2011 are made up as follows:

|

|

|

Gross Cost

|

|

|

Accumulated amortization

|

|

|

Writedown of film rights and related costs

|

|

|

Net Cost

December 31, 2011

|

|

|

Net Cost

December31, 2010

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquired films and film rights

|

|

$

|

84,970

|

|

|

$

|

-

|

|

|

|

(84,970

|

)

|

|

$

|

-

|

|

|

$

|

1

|

|

|

Films in progress

|

|

|

5,793

|

|

|

|

-

|

|

|

|

(5,793

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

90,763

|

|

|

$

|

-

|

|

|

$

|

(90,763

|

)

|

|

$

|

-

|

|

|

$

|

1

|

|

WASTE ENERGY SECTOR

The Thermal Oxidation Process System (TOPS) Greencycle Gasification plants decompose organic matter (with heat and air) and recover non-organics by utilizing specialized equipment and is a proven alternative to landfills. Greencycle uses low heat (500-600 Celsius) to convert all the carbon locked up in unsorted garbage into a form where it produces high quality heat through a second stage gas oxidizer running at around 1,100 Celsius. This process creates energy, enough to make electrical energy and

support district heating / greenhouses. The

Greencycle system provides controlled conditions to utilize Carbon Dioxide (CO2) for accelerated plant growth in greenhouses and algae farms. The other non-carbon materials in garbage, such as aluminum, tin, copper and stainless steel, and can be easily separated after all the carbon has been removed without melting or slagging. Micron sized metals, silica, calcium etc, are also sorted out for re-use by using the Ash Recycling and Recovery Equipment (ARRE) sub-system.

As of December 31, 2011, the Company has not secured any facilities to construct the Gasification Plant, nor has it incurred any other expenditures for the year ended December 31, 2011. (2010 - $Nil)

On August 24, 2010, the Company signed an agreement with Global Terralene Inc. for the acquisition of all assets pertaining to Terralene Fuels. Under the terms of the agreement, the Company will issue 7,000,000 restricted common shares to Global Terralene Inc. in two phases. On November 30, 2010, the Company approved and issued 5,000,000 restricted common shares valued at $125,000 to Global Terralene Inc. The Company will issue a further 2,000,000 restricted common shares valued at $50,000 once certain documents outlined in the agreement are prepared and exchanged by both parties (issued February 2012). Terralene Fuel is a patented fuel alternative formulation that is the equivalent of 87 octane regular gasoline and utilizes renewable energy sources in 45% of its composition. Terralene’s unique fuel reduces greenhouse gas and other environmental damaging emissions and can be easily integrated into the existing fuel infrastructure. During the year ended December 31, 2011, the Company capitalized $6,212 in patent work.

Total Investments in Terralene Fuels costs at December 31, 2011 and 2010 total $131,212 and $125,000 respectively, and include the following assets:

|

Patents, trademarks, copyright

|

|

Formulas, reports, studies

Schematics, proprietary info

Website

Terralene brandname

|

The purchase was completd in 2012 and no preliminary allocation has been completed.

Amortization for intangible assets with definitive useful life purchased from Terralene Fuels, specifically the website, will be recorded over the estimated useful life of the website using the straight-line method for financial statement purposes when the product or service has been delivered or performed and invoiced by the Company and it begins to recognize revenues.

Ownership Interests.

The following chart specifies our stock ownership at December 31, 2011

|

Percent

|

|

|

|

|

|

Ownership

|

|

Entity

|

|

Nature of Ownership

|

|

|

|

|

|

|

|

9.70%

|

|

Legacy Wine & Spirits International Ltd.

|

|

3,934,357 Shares of Common Stock *

|

|

|

|

|

|

|

|

1.70%

|

|

Organa Gardens International Inc.

|

|

703,750 Shares of Common Stock **

|

_______

* 1,451,360 of these shares are restricted common shares

** 700,300 of these shares are restricted common shares.

Employees.

We currently have 2 full-time employee/consultants. None of our employees are subject to any collective bargaining agreements.

Change in Directors

On February 1, 2012, the Registrant accepted the resignation of Sharon Deutsch as Secretary, Treasurer, Director and Chief Financial Officer of the Registrant. The resignation was not motivated by a disagreement with the Registrant on any matter relating to the Registrant's operations, policies or practices.

On February 1, 2012 Matt Kelly, an American businessman, based in New York U.S.A., joined the Board of Directors and was appointed Secretary, Treasurer and Chief Financial Officer of the Registrant.

ITEM 1A. RISK FACTORS

Not applicable to smaller reporting companies

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

ITEM 2. PROPERTIES

Property Held by Us

. As of the dates specified in the following table, we held the following property in the following amounts:

|

Property

|

|

December 31, 2011

|

|

December 31, 2010

|

|

|

|

|

|

|

|

Cash

|

|

US $ 61

|

|

US $824

|

We do not presently own any interests in real estate. We do not presently own any inventory or equipment.

Our Facilities

.

We do not own any real property. As of August 1, 2010, Terralene Fuels Corporation has leased 1250 sq. ft of office space from Holm Investments Ltd. at $2,500 per month for a period of 3 years.

Terralene Fuels Corporation principal corporate offices are located at 35 South Ocean Avenue

Patchogue, NY, 11772 Fax – 1 888 265 0498 Phone – 1 888 488 6882

ITEM 3. LEGAL PROCEEDINGS

None

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

As at December 31, 2011 there were approximately 2,000 holders of the outstanding shares of the Golden Spirit Enterprises Ltd.'s $0.0001 par value common stock. Golden Spirit Enterprises Ltd. participates in the OTC Bulletin Board Electronic Quotation System maintained by the National Association of Securities Dealers, Inc. On or about April 18, 2000, we were removed from the Over-the-Counter Bulletin Board ("OTCBB") for failure to comply with NASD Rule 6530, which requires any company listed on the OTCBB to be current in its public reporting obligations pursuant to the Securities and Exchange Act of 1934. The Company was re-instated on the OTCBB on October 7, 2002 under the symbol "TWOU". Commensurate with the name change and forward stock split, the Company also took the necessary steps to change its symbol and CUSIP Number. Therefore, the Registrant's CUSIP Number has changed from 9021014 20 7 to 3811194 10 9. On October 8, 2003, being 6:30 A.M. EST, the Registrant's symbol changed from TWOU to "GSPM". On October 19, 2004, being 6:30 A.M. EST, the Registrant's symbol changed from GSPM to "GSML".

Effective at the opening on July 18, 2005 the Company’s symbol changed from GSML to “GSGL” and the CUSIP Number became 38119U 10 1.

Effective at the opening on June 30, 2006, the Company’s symbol changed from GSGL to “GSPT” and the CUSIP Number is now 38119N 10 7.

Effective at the opening on November 29, 2011, the Company’s symbol remained as “GSPT” and the CUSIP Number is now 88104B 10 5.

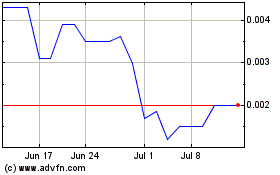

According to quotes provided by quotemedia.com, the Terralene Fuel Corporation’s common stock closed at:

|

Quarter

|

|

High

|

|

|

Low

|

|

|

2009 First Quarter

|

|

$

|

0.10

|

|

|

$

|

0.02

|

|

|

2009 Second Quarter

|

|

$

|

0.09

|

|

|

$

|

0.02

|

|

|

2009 Third Quarter

|

|

$

|

0.09

|

|

|

$

|

0.02

|

|

|

2009 Fourth Quarter

|

|

$

|

0.09

|

|

|

$

|

0.02

|

|

|

2010 First Quarter

|

|

$

|

0.04

|

|

|

$

|

0.02

|

|

|

2010 Second Quarter

|

|

$

|

0.09

|

|

|

$

|

0.02

|

|

|

2010 Third Quarter

|

|

$

|

0.07

|

|

|

$

|

0.03

|

|

|

2010 Fourth Quarter

|

|

$

|

0.05

|

|

|

$

|

0.03

|

|

|

2011 First Quarter

|

|

$

|

0.00

|

|

|

$

|

0.00

|

|

|

2011 Second Quarter

|

|

$

|

0.06

|

|

|

$

|

0.03

|

|

|

2011 Third Quarter

|

|

$

|

0.07

|

|

|

$

|

0.01

|

|

|

2011 Fourth Quarter

|

|

$

|

0.01

|

|

|

$

|

0.00

|

|

The Company traded as 2UOnline.com from January 1, 2003 to October 8, 2003, as Golden Spirit Minerals Ltd. from October 9, 2003 to October 18, 2004, as Golden Spirit Mining Ltd. from October 19, 2004 to July 17, 2005 and Golden Spirit Gaming Ltd. from July 18, 2005 to June 29, 2006 and Golden Spirit Enterprises Ltd. from June 30, 2006 to November 29, 2011 and Terralene Fuels Corporation thereafter to date. Such quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

The public may read and copy any materials filed with the SEC at the SEC's Public Reference Room at 450 Fifth Street NW, Washington, D.C. 20549. The public may also obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is

http://www.sec.gov

.

Common Stock

:

The Company is authorized to issue 500,000,000 shares of common stock, $.0001 par value, each share of common stock having equal rights and preferences, including voting privileges. The shares of $.0001 par value common stock of the Company constitute equity interests in the Company entitling each shareholder to a pro rata share of cash distributions made to shareholders, including dividend payments. The holders of the Company's common stock are entitled to one vote for each share of record on all matters to be voted on by shareholders. There is no cumulative voting with respect to the election of directors of the Company or any other matter, with the result that the holders of more than 50% of the shares voted for the election of those directors can elect all of the Directors. The holders of the Company's common stock are entitled to receive dividends when, as and if declared by the Company's Board of Directors from funds legally available therefore; provided, however, that the cash dividends are at the sole discretion of the Company's Board of Directors. In the event of liquidation, dissolution or winding up of the Company, the holders of common stock are entitled to share ratably in all assets remaining available for distribution to them after payment of liabilities of the Company and after provision has been made for each class of stock, if any, having preference in relation to the Company's common stock. Holders of the shares of Company's common stock have no conversion, preemptive or other subscription rights, and there are no redemption provisions applicable to the Company's common stock. All of the outstanding shares of the Company's common stock are duly authorized, validly issued, fully paid and non-assessable. As of December 31, 2011, 72,198,691 shares of Terralene Fuels Corporation’s common stock were issued and outstanding.

(1)

2011 Stock Transactions

On January 13, 2011, the Company issued 25,000 restricted common shares valued at $750 to a new director for his services and issued 250,000 restricted common shares valued at $7,500 to a consultant for his services in relation to the company’s Terralene Fuels project.

The Company issued a total of 12,000,000 common shares pursuant to the exercise of options under the Company’s 2011 Stock Incentive and Option Plan at prices between $0.03 - $0.035 per share to satisfy debt to related parties in the amount of $171,000 and for consulting services in the amount of $197,250.

During the year ended December 31, 2011, 15,000,000 restricted common shares were issued valued at $30,000 pursuant to deferred compensation contracts with related parties.

(2

)

2010 Stock Transactions

During the year ended December 31, 2010, 515,000 incentive stock options were granted and immediately exercised at $0.04 per share to satisfy debts related parties in the amount of $20,600, 5,610,000 incentive stock options were granted and immediately exercised at $0.02 per share to satisfy debts related parties in the amount of $112,200 and 5,341,667 incentive stock options were granted and immediately exercised at $0.03 per share to satisfy debts related parties in the amount of $160,250 and 3,050,000 for services at $91,500.

During the year ended December 31, 2010, 1,500,000 restricted common shares were issued valued at $60,000 pursuant to deferred compensation contracts with related parties.

During the year ended December 31, 2010, 465,000 restricted common shares were issued valued at $14,950 to four individuals for advisory board and other services.

During the year ended December 31, 2010, 5,000,000 restricted common shares were issued valued at $125,000 pursuant to the acquisition of Terralene Fuels.

(3)

2011 Stock Options

On January 18, 2011, the Company filed a Registration Statement on Form S-8 to cover 12,000,000 shares of common stock to be granted pursuant to the Company’s 2011 Stock Incentive and Option Plan.

On December 23, 2011, the Company filed a Registration Statement on Form S-8 to cover 15,000,000 shares of common stock to be granted pursuant to the Company’s 2012 Stock Incentive and Option Plan.

During the year ended December 31, 2011, the Company issued a total of 12,000,000 common shares pursuant to the exercise of options under the Company’s 2011 Stock Incentive and Option Plan at prices between $0.03 - $0.035 per share to satisfy debt to related parties in the amount of $171,000 and for consulting services in the amount of $197,250.

The Company’s stock option activity is as follows:

|

|

|

Number

of options

|

|

|

Weighted Average Exercise Price

|

|

Weighted Average Remaining Contractual Life

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2009

|

|

|

3,002,517

|

|

|

$

|

0.20

|

|

2.67 years

|

|

Granted during 2010

|

|

|

14,516,667

|

|

|

|

-

|

|

|

|

Exercised during 2010

|

|

|

(14,516,667

|

)

|

|

|

-

|

|

|

|

Balance, December 31,2010

|

|

|

3,002,517

|

|

|

|

-

|

|

|

|

Granted during 2011

|

|

|

12,000,000

|

|

|

|

0.03

|

|

|

|

Exercised during 2011

|

|

|

(12,000,000

|

)

|

|

|

|

|

|

|

Balance, December 31, 2011

|

|

|

3,002,517

|

|

|

$

|

0.20

|

|

2.67 years

|

(4)

2010 Stock Options

On April 21, 2010, the Company filed a Registration Statement on Form S-8 to cover 10,000,000 shares of common stock to be granted pursuant to the Company’s 2010 Stock Incentive and Option Plan.

During the year ended December 31, 2010, 515,000 incentive stock options were granted and immediately exercised at $0.04 per share to satisfy debts related parties in the amount of $20,600, 5,610,000 incentive stock options were granted and immediately exercised at $0.02 per share to satisfy debts related parties in the amount of $112,200 and 5,341,667 incentive stock options were granted and immediately exercised at $0.03 per share to satisfy debts related parties in the amount of $160,250 and 3,050,000 for services at $91,500.

The Company’s stock option activity is as follows:

|

|

|

Number of options

|

|

|

Weighted Average Exercise Price

|

|

Weighted Average Remaining Contractual Life

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2008

|

|

|

3,002,517

|

|

|

$

|

0.20

|

|

2.67 years

|

|

Granted during 2008

|

|

|

-

|

|

|

|

-

|

|

|

|

Exercised during 2008

|

|

|

-

|

|

|

|

-

|

|

|

|

Granted during 2009

|

|

|

3,900,000

|

|

|

|

-

|

|

|

|

Exercised during 2009

|

|

|

(3,900,000

|

)

|

|

$

|

0.03

|

|

2.67 years

|

|

|

|

|

|

|

|

|

|

|

|

|

Granted during 2010

|

|

|

14,516,667

|

|

|

|

-

|

|

|

|

Exercised during 2010

|

|

|

(14,516,667

|

)

|

|

|

0.03

|

|

|

|

Balance, December 31, 2010

|

|

|

3,002,517

|

|

|

$

|

0.09

|

|

2.67 years

|

ITEM 6. SELECTED FINANCIAL DATA

FINANCIAL HIGHLIGHTS

|

Fiscal Year Ended December 31

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenu1

|

|

$ Nil

|

|

|

$ Nil

|

|

|

$ Nil

|

|

|

$ Nil

|

|

|

$

|

43l

|

|

|

Operating Loss

|

|

|

(359,281

|

)

|

|

|

(352,321

|

)

|

|

|

(181,787

|

)

|

|

|

(274,195

|

)

|

|

|

(454,400

|

)

|

|

Net Loss

|

|

|

(393,813

|

)

|

|

|

(399,390

|

)

|

|

|

(36,170

|

)

|

|

|

(245,550

|

)

|

|

|

(422,958

|

)

|

|

BaBasic and diluted net loss per share

|

|

|

0.01

|

|

|

|

0.01

|

|

|

|

0.01

|

|

|

|

0.01

|

|

|

|

0.03

|

|

|

CaCash dividends declared per share

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Cash, cash equivalents, & short term investments

|

|

|

61

|

|

|

|

824

|

|

|

|

1,223

|

|

|

|

1,556

|

|

|

|

6,282

|

|

|

Total assets

|

|

|

136,434

|

|

|

|

167,863

|

|

|

|

137,827

|

|

|

|

1,015,455

|

|

|

|

740,556

|

|

|

Long-term obligations

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Stockholders’ equity (deficit)

|

|

|

35,389

|

|

|

|

6,413

|

|

|

|

(123,592

|

)

|

|

|

690,820

|

|

|

|

391,502

|

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

THIS FOLLOWING INFORMATION SPECIFIES CERTAIN FORWARD-LOOKING STATEMENTS OF MANAGEMENT OF THE COMPANY. FORWARD-LOOKING STATEMENTS ARE STATEMENTS THAT ESTIMATE THE HAPPENING OF FUTURE EVENTS ARE NOT BASED ON HISTORICAL FACT.FORWARD-LOOKING STATEMENTS MAY BE IDENTIFIED BY THE USE OF FORWARD-LOOKING TERMINOLOGY, SUCH AS "MAY", "SHALL", "WILL", "COULD", "EXPECT", "ESTIMATE", "ANTICIPATE", "PREDICT", "PROBABLE", "POSSIBLE", "SHOULD", "CONTINUE", OR SIMILAR TERMS, VARIATIONS OF THOSE TERMS OR THE NEGATIVE OF THOSE TERMS. THE FORWARD-LOOKING STATEMENTS SPECIFIED IN THE FOLLOWING INFORMATION HAVE BEEN COMPILED BY OUR MANAGEMENT ON THE BASIS OF ASSUMPTIONS MADE BY MANAGEMENT AND CONSIDERED BY MANAGEMENT TO BE REASONABLE. OUR FUTURE OPERATING RESULTS, HOWEVER, ARE IMPOSSIBLE TO PREDICT AND NO REPRESENTATION, GUARANTY, OR WARRANTY IS TO BE INFERRED FROM THOSE FORWARD-LOOKING STATEMENTS.

THE ASSUMPTIONS USED FOR PURPOSES OF THE FORWARD-LOOKING STATEMENTS SPECIFIED IN THE FOLLOWING INFORMATION REPRESENT ESTIMATES OF FUTURE EVENTS AND ARE SUBJECT TO UNCERTAINTY AS TO POSSIBLE CHANGES IN ECONOMIC, LEGISLATIVE, INDUSTRY, AND OTHER CIRCUMSTANCES. AS A RESULT, THE IDENTIFICATION AND INTERPRETATION OF DATA AND OTHER INFORMATION AND THEIR USE IN DEVELOPING AND SELECTING ASSUMPTIONS FROM AND AMONG REASONABLE ALTERNATIVES REQUIRE THE EXERCISE OF JUDGMENT. TO THE EXTENT THAT THE ASSUMED EVENTS DO NOT OCCUR, THE OUTCOME MAY VARY SUBSTANTIALLY FROM ANTICIPATED OR PROJECTED RESULTS, AND, ACCORDINGLY, NO OPINION IS EXPRESSED ON THE ACHIEVABILITY OF THOSE FORWARD-LOOKING STATEMENTS. NO ASSURANCE CAN BE GIVEN THAT ANY OF THE ASSUMPTIONS RELATING TO THE FORWARD-LOOKING STATEMENTS SPECIFIED IN THE FOLLOWING INFORMATION ARE ACCURATE, AND WE ASSUME NO OBLIGATION TO UPDATE ANY SUCH FORWARD-LOOKING STATEMENTS.

Liquidity and Capital Resources

.

For the year ended December 31, 2011, we had total assets of $136,434, compared to total assets in 2010 of $167,683. This includes a cash balance of $61, compared to $824 in 2010. We have available for sale securities with a fair value of $5,161as at December 31, 2011 and intangible assets of $131,212.

At December 31, 2011, we had current liabilities of $101,045, which was represented by accounts payable and accrued liabilities of $38,439 and $62,606 due to related parties. At December 31, 2010 we had current liabilities of $161,450. The decrease in liabilities was essentially due to a decrease in amounts payable to related parties. At December 31, 2011, we had a working capital deficiency of $(100,984) (2010 - $(160,626)).

Results of Operations

We realized revenue in 2011 of $Nil (2010- $ Nil) and other income of $Nil (2010 - $Nil). In prior years, our revenues from prior businesses totaled $167,449. During the year ended December 31, 2011 our loss was $393,813 (2010 - $399,390). This decrease in loss was due to an increase in consulting fees offset by a decrease in the loss on impairment of securities – related parties, decrease in professional fees and decrease in investor relations fees.

From inception to December 31, 2011, we have incurred cumulative net losses of $18,021,912 resulting primarily from a write-down and equity loss in Organa Gardens International Inc. (a related party) of $1,707,581, a $600,000 property option loss as a recorded value of certain restricted shares issued to Legacy Wine & Spirits International Ltd. (a related party – see our Investment in Available for sale securities (b) Legacy Wine & Spirits International Ltd. above) , a gain on the sale of securities – related parties of ($216,509) , a loss on impairment of securities-related parties of $115,602 and general and administrative expenses of $16,286,173, the majority of which is made up of consulting fees and stock based compensation expense totaling $7,836,741.

The cash and equivalents constitute our present internal sources of liquidity. Because we are not generating any significant revenues, our only external source of liquidity is the sale of our capital stock and any advances from officers, directors or shareholders.

To address the going concern problem discussed in our financial statements, we will require additional working capital. We will also require additional funds to implement our business strategies, including funds for:

payment of increased operating expenses, and further implementation of film industry business strategies,

payment of undetermined expenses relating to the Eneco venture and payment of undetermined expenses relating to the Terralene Fuels venture. No assurance can be given, however, that we will have access to the capital markets in the future, or that financing will be available on acceptable terms to satisfy our cash requirements needed to implement our business strategies. Our inability to access the capital markets or obtain acceptable financing could have a material adverse effect on our results of operations and financial condition and could severely threaten our ability to operate as a going concern. Our forecast of the period of time through which our financial resources will be adequate to support our operations is a forward-looking statement that involves risks and uncertainties, and actual results could vary as a result of a number of factors.

Our Plan of Operation for the Next 12 Months

. We anticipate that we will need to raise additional capital within the next 12 months in order to continue as a going concern. Anticipated revenues for the first quarter of 2009 are not expected to be significant. Therefore, additional capital may be raised through additional public or private financings, as well as borrowings and other resources. To the extent that additional capital is raised through the sale of equity or equity-related securities, the issuance of such securities could result in dilution of our stockholders. There can be no assurance that additional funding will be available on favorable terms, if at all. If adequate funds are not available within the next 12 months, we may be required to curtail our operations significantly or to obtain funds through entering into arrangements with collaborative partners or others that may require us to relinquish rights to certain of our assets that we would not otherwise relinquish.

We do anticipate certain expenditures within the next 12 months for our Investment in Terralene Fuels. We do not anticipate a significant change in the number of our employees within the next 12 months. We are not aware of any material commitment or condition that may affect our liquidity within the next 12 months.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Securities held in our equity and other investments portfolio and equity derivatives are subject to price risk, and generally are not hedged.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Terralene Fuels Corporation

We have audited the accompanying consolidated balance sheets of Terralene Fuels Corporation, (formerly Golden Spirit Enterprises Ltd.) (a development stage company) as of December 31, 2011 and 2010, and the related consolidated statements of operations, stockholders’ equity (deficit), and cash flows for each of the years in the two year period ended December 31, 2011 and for the cumulative period from September 13, 1998 (inception) through December 31, 2011. Terralene Fuels Corporation’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).

Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Terralene Fuels Corporation as of December 31, 2011 and 2010, and the results of its activities and cash flows for each of the years in the two year period ended December 31, 2011 and for the cumulative period from September 13, 1993 (inception) through December 31, 2011 in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company’s current liabilities exceed current assets, has incurred significant losses since inception, all of which raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regards to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

__________________________

/s/ L.L. Bradford & Company, LLC

Las Vegas, Nevada

April 16, 2012

TERRALENE FUELS CORPORATION

(formerly Golden Spirit Enterprises Ltd.)

(A development stage company)

CONSOLIDATED BALANCE SHEETS

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2011

|

|

|

2010

|

|

|

|

|

|

ASSETS

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash

|

|

$

|

61

|

|

|

$

|

824

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS

|

|

|

61

|

|

|

|

824

|

|

|

|

|

|

|

|

|

|

|

|

|

AVAILABLE FOR SALE SECURITIES – related parties

|

|

|

5,161

|

|

|

|

42,039

|

|

|

INVESTMENTS IN INTANGIBLE ASSETS

|

|

|

131,212

|

|

|

|

125,000

|

|

|

FILM PRODUCTION & DEVELOPMENT COSTS

|

|

|

-

|

|

|

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

136,434

|

|

|

$

|

167,863

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

CURRENT LIABILITES

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

38,439

|

|

|

$

|

31,695

|

|

|

Due to related parties

|

|

|

62,606

|

|

|

|

129,755

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES

|

|

|

101,045

|

|

|

|

161,450

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Common stock, $0.0001 par value, 500,000,000 shares authorized

|

|

|

|

|

|

|

|

|

|

Issued and outstanding:

|

|

|

|

|

|

|

|

|

|

72,198,691 (2010 – 44,923,691) common shares

|

|

|

7,220

|

|

|

|

4,492

|

|

|

Additional paid-in capital

|

|

|

18,467,650

|

|

|

|

18,063,878

|

|

|

Deferred compensation

|

|

|

(37,500

|

)

|

|

|

(56,135

|

)

|

|

Deficit accumulated during the development stage

|

|

|

(18,403,880

|

)

|

|

|

(18,010,067

|

)

|

|

Accumulated other comprehensive income (loss)

|

|

|

1,899

|

|

|

|

4,245

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS’ EQUITY

|

|

|

35,389

|

|

|

|

6,413

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDER EQUITY

|

|

$

|

136,434

|

|

|

$

|

167,863

|

|

The accompanying notes are an integral part of these financial statements

TERRALENE FUELS CORPORATION

(formerly Golden Spirit Enterprises Ltd.)

(A development stage company)

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

September 13,

|

|

|

|

|

Year Ended

|

|

|

|

|

|

1993 (inception)

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

to December 31,

|

|

|

|

|

2011

|

|

|

2010

|

|

|

2011

|

|

|

REVENUES

|

|

|

|

|

|

|

|

|

|

|

Processing fees

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

98,425

|

|

|

Gaming Revenue

|

|

|

-

|

|

|

|

-

|

|

|

|

18,596

|

|

|

Sale of oil and gas interest

|

|

|

-

|

|

|

|

-

|

|

|

|

47,501

|

|

|

Interest income

|

|

|

-

|

|

|

|

-

|

|

|

|

2,927

|

|

|

TOTAL REVENUES

|

|

|

-

|

|

|

|

-

|

|

|

|

167,449

|

|

|

COST OF SALES –

Poker royalties and processing fees

|

|

|

-

|

|

|

|

-

|

|

|

|

30,601

|

|

|

GROSS PROFIT (LOSS)

|

|

|

-

|

|

|

|

-

|

|

|

|

136,848

|

|

|

GENERAL AND ADMINISTRATIVE EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advertising and marketing

|

|

|

-

|

|

|

|

-

|

|

|

|

93,895

|

|

|

Consulting fees

|

|

|

232,863

|

|

|

|

183,912

|

|

|

|

7,836,741

|

|

|

Depreciation and amortization

|

|

|

-

|

|

|

|

-

|

|

|

|

132,569

|

|

|

Exploration costs

|

|

|

-

|

|

|

|

-

|

|

|

|

241,754

|

|

|

Investor relations

|

|

|

26,128

|

|

|

|

34,724

|

|

|

|

757,463

|

|

|

Litigation settlement

|

|

|

-

|

|

|

|

-

|

|

|

|

52,169

|

|

|

Loss on settlement of debt

|

|

|

-

|

|

|

|

-

|

|

|

|

302,500

|

|

|

Management fees

|

|

|

-

|

|

|

|

-

|

|

|

|

378,447

|

|

|

Office and general

|

|

|

51,468

|

|

|

|

51,143

|

|

|

|

741,744

|

|

|

Poker Sponsorships

|

|

|

-

|

|

|

|

-

|

|

|

|

52,500

|

|

|

Professional fees

|

|

|

35,060

|

|

|

|

43,051

|

|

|

|

719,418

|

|

|

Travel and accommodation

|

|

|

6,518

|

|

|

|

18,217

|

|

|

|

289,097

|

|

|

Wages and salaries

|

|

|

7,243

|

|

|

|

11,617

|

|

|

|

268,293

|

|

|

Write-off of website development costs

|

|

|

-

|

|

|

|

-

|

|

|

|

425,682

|

|

|

Write-down (recovery) of URL costs

|

|

|

-

|

|

|

|

-

|

|

|

|

1,571,657

|

|

|

Write-down of technology license

|

|

|

-

|

|

|

|

-

|

|

|

|

2,055,938

|

|

|

Write-down of film production and distribution costs

|

|

|

1

|

|

|

|

-

|

|

|

|

90,763

|

|

|

Write-off of other assets

|

|

|

-

|

|

|

|

9,657

|

|

|

|

275,543

|

|

|

TOTAL GENERAL AND ADMINISTRATIVE EXPENSES

|

|

|

359,281

|

|

|

|

352,321

|

|

|

|

16,286,173

|

|

|

OTHER INCOME (EXPENSES)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY LOSS FROM ORGANA GARDENS INTERNATIONAL

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,394,280

|

)

|

|

WRITE-DOWN OF INVESTMENT IN ORGANA GARDENS

|

|

|

-

|

|

|

|

-

|

|

|

|

(313,301

|

)

|

|

GAIN/(LOSS) ON SALE OF SECURITIES-RELATED PARTIES

|

|

|

-

|

|

|

|

-

|

|

|

|

216,509

|

|

|

(LOSS) ON IMPAIRMENT OF SECURITIES-RELATED PARTIES

|

|

|

(34,532

|

)

|

|

|

(47,069

|

)

|

|

|

(115,602

|

)

|

|

DILUTION GAIN – LEGACY WINE&SPIRITS INTERNATIONAL

|

|

|

-

|

|

|

|

-

|

|

|

|

334,087

|

|

|

PROPERTY OPTION LOSS

|

|

|

-

|

|

|

|

-

|

|

|

|

(600,000

|

)

|

|

TOTAL OTHER INCOME (EXPENSES)

|

|

|

(34,532

|

)

|

|

|

(47,069

|

)

|

|

|

(1,872,587

|

)

|

|

Loss before income taxes

|

|

|

(393,813

|

)

|

|

|

(399,390

|

)

|

|

|

(18,021,912

|

)

|

|

Income Tax Provision

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

NET LOSS

|

|

$

|

(393,813

|

)

|

|

$

|

(399,390

|

)

|

|

$

|

(18,021,912

|

)

|

|

NET LOSS ATTRIBUTED TO NONCONTROLLING INTEREST

|

|

|

-

|

|

|

|

-

|

|

|

|

479,978

|

|

|

NET LOSS TO TERRALENE FUELS CORPORATION

|

|

$

|

(393,813

|

)

|

|

$

|

(399,390

|

)

|

|

$

|

(17,541,934

|

)

|

|

BASIC AND DILUTED LOSS PER COMMON SHARE

|

|

$

|

(0.01

|

)

|

|

$

|

(0.01

|

)

|

|

|

|

|

|

BASIC AND DILUTED WEIGHTED AVERAGE COMMON SHARES OUTSTANDING

|

|

|

57,486,554

|

|

|

|

31,352,220

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements

TERRALENE FUELS CORPORATION

(formerly Golden Spirit Enterprises Ltd.)

(A development stage company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ DEFICIT

FOR THE PERIOD FROM SEPTEMBER 13, 1993 (INCEPTION) TO DECEMBER 31, 2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Common Stock

|

|

|

Additional

|

|

|

|

|

|

|

|

|

Other

|

|

|

|

|

|

|

|

Number of Shares

|

|

|

Amount

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Balance, September 13, 1993 (date of inception)

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

September 30, 2003 – common stock issued for cash at $0.01 per share

|

|

|

100,000

|

|

|

|

10

|

|

|

|

990

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

1,000

|

|

|

Net loss for the period ended December 31, 1993

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

(1,000

|

)

|

|

|

0

|

|

|

|

(1,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 1993

|

|

|

100,000

|

|

|

|

10

|

|

|

|

990

|

|

|

|

0

|

|

|

|

(1,000

|

)

|

|

|

0

|

|

|

|

0

|

|

|

Net loss for the years ended December 31, 1994 through 1997

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Net loss for the year ended December 31, 1998

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

(10,797

|

)

|

|

|

0

|

|

|

|

(10,797

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 1998

|

|

|

100,000

|

|

|

|

10

|

|

|

|

990

|

|

|

|

0

|

|

|

|

(11,797

|

)

|

|

|

0

|

|

|

|

(10,797

|

)

|

|

January 6, 1999 – common stock issued for Rising Phoenix

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

finders’ fee at $18.00 per share

|

|

|

13,333

|

|

|

|

1

|

|

|

|

239,999

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

240,000

|

|

|

January 6, 1999 – common stock issued for cash and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

management remuneration at $18.00 per share

|

|

|

10,000

|

|

|

|

1

|

|

|

|

179,999

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

180,000

|

|

|

January 28, 1999 – commons stock issued for services at $21.60 per share

|

|

|

10,000

|

|

|

|

1

|

|

|

|

215,999

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

216,000

|

|

|

February 26, 1999 – common stock issued for services at $21.60 per share

|

|

|

8,333

|

|

|

|

1

|

|

|

|

179,999

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

180,000

|

|

|

April 14, 1999 – common stock issued for cash (net of finance fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of $99,500) at $4.80 to $15.00 per share

|

|

|

118,792

|

|

|

|

12

|

|

|

|

900,488

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

900,500

|

|

|

Less: fair value of warrants issued on financing

|

|

|

0

|

|

|

|

0

|

|

|

|

(764,095

|

)

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

(764,095

|

)

|

|

April 14, 1999 – warrants issued on financing

|

|

|

0

|

|

|

|

0

|

|

|

|

764,095

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

764,095

|

|

|

April 23, 1999 – stock based compensation

|

|

|

0

|

|

|

|

0

|

|

|

|

210,706

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

210,706

|

|

|

April 28, 1999 – common stock issued for technology licence

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

finder’s fee at $18.00 per share

|

|

|

6,667

|

|

|

|

1

|

|

|

|

119,999

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

120,000

|

|

|

June 15, 1999 – common stock issued for technology license at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$18.00 per share

|

|

|

50,000

|

|

|

|

5

|

|

|

|

899,995

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

900,000

|

|

|

June 15, 1999 – common stock issued for services at $15.00 per share share

|

|

|

333

|

|

|

|

0

|

|

|

|

5,000

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

5,000

|

|

|

June 30, 1999 – common stock issued for services at $15.60 per share hare

|

|

|

4,167

|

|

|

|

0

|

|

|

|

65,000

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

65,000

|

|

|

July 15, 1999 – warrants issued for URL purchase

|

|

|

0

|

|

|

|

0

|

|

|

|

328,858

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

328,858

|

|

|

July 20, 1999 – common stock issued for cash on exercise of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

warrants at $18.0 per share

|

|

|

13,333

|

|

|

|

1