As filed with the Securities and Exchange Commission on September 15, 2022.

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| GOLDEN STAR ENTERPRISES LTD. |

| (Exact name of registrant as specified in its charter) |

| Delaware | | 7370 | | 52-2132622 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Golden Star Enterprises Ltd.

Suite B, 2803 Philadelphia Pike

Claymont, DE 19703

(888) 680-8033

(Name, Address, including zip code, and telephone and facsimile number, including area code, of registrants’ principal executive offices)

Approximate date of commencement sales to the public: As soon as practicable after the effective date of this Registration Statement and from time to time after this registration statement has become effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement (the “Registration Statement”) on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where an offer or sale is not permitted

SUBJECT TO COMPLETION DATED SEPTEMBER 15, 2022

PRELIMIARY PROSPECTUS

Golden Star Enterprises Ltd.

Selling Shareholders

40,000,000 Shares of Common Stock Pursuant to an Equity Purchase Agreement (MHLFP EPA)

29,000,000 Shares of Common Stock Pursuant to the Exercise of Common Stock Purchase Warrants (MHLFP SPA Warrant Shares and MHLFP EPA Warrant Shares)

37,000,000 Shares of Common Stock Pursuant to a Promissory Note (MHLFP Note Shares)

4,920,000 Shares of Common Stock Pursuant to a Securities Purchase Agreement (MHLFP Commitment Shares)

7,500,000 Shares of Common Stock Pursuant to a Consulting Agreement (Beyond Shares)

118,420,000 Shares of Common Stock

Equity Purchase Agreement

On May 27, 2022, we entered into a Equity Purchase Agreement (“MHLFP EPA”) with Mast Hill Fund, LP (“MHFLP”, or a “Selling Stockholder”), pursuant to which, upon the terms and subject to the conditions thereof, MHFLP is committed to purchase, on an unconditional basis, shares of our common stock (the “Put Shares”) at an aggregate price of up to $5,000,000 (the “Maximum Commitment Amount”) over the course of its term. The term of the Equity Purchase Agreement will end on the earlier of (i) the date on which such Selling Stockholder has purchased Common Stock pursuant to the Equity Purchase Agreement equal to the Maximum Commitment Amount, (ii) two years from the date this Registration Statement is deemed effective, or (iii) written notice of termination by us.

From time to time over the term of the Equity Purchase Agreement, commencing on the date on which a registration statement registering Put Shares becomes effective, we may, in our sole discretion, provide MHFLP with a put notice (each a “Put Notice”) to purchase a specified number of Put Shares (each a “Put Amount Requested”) subject to the limitations discussed below and contained in the Equity Purchase Agreement. Upon delivery of a Put Notice, we must deliver the Put Amount Requested as Deposit Withdrawal at Custodian (DWAC) shares to Selling Stockholder within five trading days.

The actual amount of proceeds we receive pursuant to each Put Notice (each, the “Put Amount”) is determined by multiplying the Put Amount Requested by the applicable purchase price. The purchase price for each of the Put Shares equals 70% of the “Market Price,” which is defined as the lowest closing bid price of the Company’s Common Stock on the Principal Market during the fourteen (14) Trading Days immediately preceding the Put Date of the respective Put Notice, The Valuation Period is the seven (7) trading days immediately following the date MHFLP receives the Put Shares in its brokerage account.

In order to deliver a Put Notice, certain conditions set forth in the Equity Purchase Agreement must be met. In addition, we are prohibited from delivering a Put Notice if: (i) the sale of Put Shares pursuant to such Put Notice would cause us to issue and sell to Selling Stockholder, or the Selling Stockholder to acquire or purchase, a number of shares of our common stock that, when aggregated with all shares of Common Stock purchased by Selling Stockholder pursuant to all prior Put Notices issued under the Equity Purchase Agreement, would exceed the Maximum Commitment Amount; or (ii) the issuance of the Warrant Shares upon exercise of the Warrants would cause us to issue and sell to Selling Stockholder, or the Selling Stockholder to acquire or purchase, an aggregate number of shares of Common Stock that would result in Selling Stockholder beneficially owning more than 4.99% of the issued and outstanding shares of our common stock (the “Beneficial Ownership Limitation’).

If issued presently, the 40,000,000 shares of common stock registered for resale by MHFLP under the MHFLP EPA would represent approximately 37% of our existing issued and outstanding shares of common stock as of September 13, 2022, which totals 107,416,146, and approximately 18% of the fully diluted outstanding share capital, including issuance of the 40,000,000 shares and all other potentially dilutive shares including share purchase warrants and shares underlying convertible notes.

In connection with the execution of the Equity Purchase Agreement, we issued a common stock purchase warrant (the “MHFLP EPA Warrant”) for the purchase of 10,000,000 shares of our Common Stock (the “MHFLP EPA Warrant Shares”) to the Selling Stockholder as a commitment fee. The MHFLP Warrant has a term of five years from the date of issuance and currently has an exercise price (repriced) at $0.04 per share. The exercise of the MHFLP Warrant is subject to the Beneficial Ownership Limitation and is exercisable immediately; upon presentation of an exercise notice, the Company is obligated to issue the corresponding number of shares.

We also entered into a registration rights agreement (the “Registration Rights Agreement”) with MHFLP pursuant to which we agreed to file a Registration Statement to register the resale of the Put Shares, and the resale of shares by MHFLP underlying a Common Stock Purchase Warrant (MHFLP Warrant). Pursuant to the Registration Rights Agreement, we agreed to (i) file the Registration Statement within 120 calendar days from the Closing Date, (ii) use reasonable efforts to cause the Registration Statement to be declared effective under the Securities Act of 1933, as amended, as promptly as possible after the filing thereof, and (iii) use its reasonable efforts to keep such Registration Statement continuously effective under the Securities Act until all of the Put Shares have been sold thereunder or pursuant to Rule 144.

The 40,000,000 shares pursuant to the MHFLP EPA, and the 10,000,000 shares issuable upon exercise of the MHFLP EPA Warrant are being registered under the Registration Statement of which this Prospectus forms a part for resale by MHFLP, which agreed to limiting its ownership to no more than 4.99% of the issued and outstanding shares, at any one time.

Securities Purchase Agreement

On May 20, 2022, we entered into a Securities Purchase Agreement (“SPA”) and Senior Secured Promissory Note with MHFLP, whereby in consideration of $370,000, less $37,000 discount fee; less $26,640 to J.H. Darbie and Company, pursuant to a finder’s fee agreement, and $5,000 for legal expenses, we issued to MHFLP a convertible promissory note (“MHFLP Note”) in the principal amount of $370,000. Further, in conjunction with the MHFLP Note, the Company agreed to issue a series of five-year warrants for the purchase of a cumulative 19,000,000 shares of our Common Stock (the “MHFLP SPA Warrants”), all exercisable at $0.04 per share (the “MHFLP SPA Warrant Shares”) as a result of the impact an anti-dilution clause whereby if at any time while the warrants are outstanding, the Company shall sell or grant any option to purchase or sell or grant any right to reprice, or otherwise dispose of or issue any common stock or securities priced at less than the exercise price of the warrants, then the Company is obligated to notify the warrant holder and to adjust the warrant exercise price by reducing, at the option of the Holder and only reduced to equal the issuance price or the new issuance such that the number of Warrant Shares issuable shall be increased such that the aggregate Exercise Price payable hereunder, after taking into account the decrease in the Exercise Price, shall be equal to the aggregate Exercise Price prior to such adjustment (for the avoidance of doubt, the aggregate Exercise Price prior to such adjustment is calculated as follows: the total number of Warrant Shares issuable upon exercise of this Warrant immediately prior to such adjustment (without regard to the Beneficial Ownership Limitation) multiplied by the Exercise Price in effect immediately prior to such adjustment). On June 6, 2022, the Company issued shares under a consulting agreement to Beyond priced at $0.04 per share thus triggering a repricing of the share purchase warrants originally issued under the SPA to an exercise price of $0.04 per share.

The principal amount of the MHFLP Note and all interest accrued thereon is payable on May 20, 2023. The MHFLP Note provides for interest at the rate of 12% per annum, payable at maturity, and is convertible into our Common Stock at a price of $0.01 per share, or 37,000,000 common shares (the “MHFLP Note Shares”) subject to equitable adjustments for stock splits, stock dividends or rights offerings by the Borrower relating to the Borrower’s securities or the securities of any subsidiary of the Borrower, combinations, recapitalization, reclassifications, extraordinary distributions and similar events. Holder shall be entitled to deduct $1,750.00 from the conversion amount in each Notice of Conversion to cover Holder’s fees associated with each Notice of Conversion.

We also entered into a registration rights agreement (the “Registration Rights Agreement”) with MHFLP pursuant to which we agreed to file a Registration Statement to register the underlying MHFLP Note Shares, and the MHFLP SPA Warrant Shares. Pursuant to the Registration Rights Agreement, we agreed to (i) file the Registration Statement within 120 calendar days from the Closing Date, (ii) use reasonable efforts to cause the Registration Statement to be declared effective under the Securities Act of 1933, as amended, as promptly as possible after the filing thereof, and (iii) use its reasonable efforts to keep such Registration Statement continuously effective under the Securities Act until all of the Put Shares have been sold thereunder or pursuant to Rule 144.

The 37,000,000 MHFLP Note Shares issuable upon conversion of the MHFLP Note and the 19,000,000 common shares issuable upon exercise of the MHFLP SPA Warrants are being registered under the Registration Statement of which this Prospectus forms a part for resale by MHFLP, which agreed to limiting its ownership to no more than 4.99% of the issued and outstanding shares, at any one time.

Further, the Company is registering 4,920,000 shares of common stock (the MHLFP Commitment Shares), on behalf of the selling shareholder, pursuant to the SPA which shares were issued as a commitment fee to MHLFP.

Finally, the Company is registering 7,500,000 shares of common stock, on behalf of the selling shareholder, Michael Kahiri, pursuant to a consulting agreement between the Company and Beyond Media SEZC a company of which Mr. Kahiri is the sole shareholder.

Use of Proceeds

We intend to use the proceeds from the Equity Line and any cash received upon exercise of the warrants, unless the warrant holder elects to use the cashless exercise provision in which case we will not receive any proceeds for the warrants exercised, for general corporate and working capital purposes and other purposes that the Board of Directors deems to be in the best interest of the Company.

We intend to raise additional capital through equity and debt financings as needed, though there cannot be any assurance that such funds will be available to us on acceptable terms, on an acceptable schedule, or at all.

Our independent registered public accountant has issued an audit opinion for the year ended December 31, 2021, which includes a statement expressing substantial doubt as to our ability to continue as a going concern. Accordingly, any investment in the shares offered hereby involves a high degree of risk and you should only purchase shares if you can afford a loss of your entire investment.

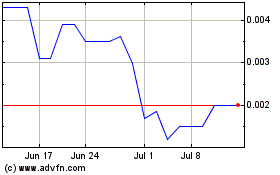

Our common stock is quoted on the OTC Pink Sheets under the symbol “GSPT.” The closing price of our common stock as reported on the OTC Pink Sheets on September 14, 2022, was $0.017 per share.

You should rely only on the information contained in this prospectus. We have not authorized any persons to provide you with information different from that contained in this prospectus. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. We are a smaller reporting company, as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as such we may take advantage of reduced reporting burdens. Investing in our common stock involves risk. Please see “Risk Factors” beginning on page 13.

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ THE ENTIRE PROSPECTUS, INCLUDING THE SECTION ENTITLED “RISK FACTORS” BEGINNING ON PAGE 13 BEFORE BUYING ANY SHARES OF OUR COMMON STOCK.

NEITHEIR THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is September 15, 2022

You should rely only on the information contained or incorporated by reference to this prospectus in deciding whether to purchase our Common Stock. We have not authorized anyone to provide you with information different from that contained in this prospectus. Under no circumstances should the delivery to you of this prospectus or any sale made pursuant to this prospectus create any implication that the information contained in this prospectus is correct as of any time after the date of this prospectus. To the extent that any facts or events arising after the date of this prospectus, individually or in the aggregate, represent a fundamental change in the information presented in this prospectus, the prospectus will be updated to the extent required by law.

TABLE OF CONTENTS

This prospectus is part of a Registration Statement we filed with the Securities and Exchange Commission (the “SEC.”) Under this registration process, the selling stockholders may, from time to time, offer and sell up to 118,420,000 shares of our common stock, as described in this prospectus, in one or more offerings. This prospectus provides you with a general description of the securities the selling stockholders may offer. You should read this prospectus carefully before making an investment decision.

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with additional or different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the shares of our common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances or any jurisdiction in which such offer or solicitation is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus regardless of the time of delivery of this prospectus or any sale of our common stock. The rules of the SEC may require us to update this prospectus in the future.

The SEC allows us to incorporate by reference information that we file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. You should rely only on the information incorporated by reference or set forth in this prospectus or any prospectus supplement.

DEALER PROSPECTUS DELIVERY OBLIGATION

Until September [ ], 2024, all dealers that effect transactions in these securities, whether or not participating in this Offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the ”Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the ”Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” and “continue” or the negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees of future performance. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. You are cautioned to not place undue reliance on these forward-looking statements, which speak only as of their dates.

We cannot predict all the risks and uncertainties that may impact our business, financial condition or results of operations. Accordingly, the forward-looking statements in this prospectus should not be regarded as representations that the results or conditions described in such statements will occur or that our objectives and plans will be achieved, and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this prospectus and include information concerning possible or projected future results of our operations, including statements about potential acquisition or merger targets, strategies or plans; business strategies; prospects; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results; and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to a variety of factors and risks, including, but not limited to, those set forth under “Risk Factors” starting on page 13 of this prospectus.

You should read these risk factors and the other cautionary statements made in the Company’s filings as being applicable to all related forward-looking statements wherever they appear in this prospectus. We cannot assure you that the forward-looking statements in this prospectus will prove to be accurate and therefore prospective investors are encouraged not to place undue reliance on forward-looking statements. You should read this prospectus completely. Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

We caution investors not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described in this prospectus, as well as others that we may consider immaterial or do not anticipate at this time. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. Our expectations reflected in our forward-looking statements can be affected by inaccurate assumptions that we might make or by known or unknown risks and uncertainties, including those described in this prospectus. These risks and uncertainties are not exclusive and further information concerning us and our business, including factors that potentially could materially affect our financial results or condition, may emerge from time to time.

For more information about the risks and uncertainties the Company faces, see the section “Risk Factors” in this prospectus. Forward-looking statements speak only as of the date they are made. The Company does not undertake and specifically declines any obligation to update any forward-looking statements or to publicly announce the results of any revisions to any statements to reflect new information or future events or developments. We advise investors to consult any further disclosures we may make on related subjects in our annual reports on Form 10-K and other reports that we file with or furnish to the SEC.

MARKET DATA

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. To our knowledge, certain third-party industry data that includes projections for future periods does not take into account the effects of the worldwide coronavirus pandemic. Accordingly, those third-party projections may be overstated and should not be given undue weight. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

ABOUT THIS PROSPECTUS

We have not authorized anyone to provide you with any information or to make any representation other than that contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus prepared we may authorize to be delivered or made available to you. We do not take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More Information” in this prospectus.

For investors outside the United States: Neither we or the selling stockholders have done anything that would permit a public offering of the securities or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside of the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

You should rely only on the information contained in this prospectus. Neither we, the selling stockholder have authorized any dealer, salesperson or other person to provide you with information concerning us, except for the information contained in this prospectus.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate or plan to operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry, and assumptions based on such information and knowledge which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our company’s and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors” beginning on page 13. These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Statement Regarding Forward-Looking Statements” on page 4 above.

PROSPECTUS SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our securities. Before deciding to invest in our securities, you should read this entire prospectus, including the discussion of “Risk Factors” and our consolidated financial statements and the related notes.

Throughout this prospectus, unless otherwise designated or the context suggests otherwise,

| • | all references to the ”Company,” “Golden Star,” ”Enigmai”, the ”registrant,” “we,” “our,” or ”us” in this prospectus mean Golden Star Enterprises Ltd.., a Delaware corporation, and its wholly owned subsidiary, Enigmai Ltd., an Israel corporate entity. |

| | |

| • | “year” or ”fiscal year” means the Company’s fiscal year ending December 31st; and |

| | |

| • | all dollar or $ references refer to United States dollars, unless otherwise indicated |

Our Company

Our History

On September 13, 1993, we were incorporated as Power Direct, Inc. on January 31, 2000, we effected a name change to 2U Online.com, , and further name changes to Golden Spirit Minerals Ltd. on October 8, 2003, Golden Spirit Mining Ltd. on October 19, 2004, Golden Spirit Gaming Ltd. on July 18, 2005, Golden Spirit Enterprises Ltd. on June 30, 2006, Terralene Fuels Corporation on August 29, 2011, and to Golden Star Enterprises Ltd., which is our current name on June 5, 2013. On October 27, 2020, the Company entered into an acquisition agreement with the shareholders of Enigmai Ltd., an enterprise software company established in 2009 which offers clients a workforce management system solution, whereby the Company acquired 100% of the issued and outstanding shares of Enigmai Ltd in exchange for 22,000,000 restricted common shares of the Company, of which 2,000,000 shares were a finder’s fee payment to third parties. The transaction closed effective October 31, 2020, and the Company administratively issued the shares on November 24, 2020, making Enigmai Ltd. a wholly owned subsidiary of the Company.

Overview

We conduct all of the operations currently through Enigmai, our wholly owned subsidiary based in Israel, which was established in early 2009 and has since developed an advanced workforce management system for scheduled environments. Enigmai helps organizations implement their vision, integrating with existing systems and software. Enigmai offers a visible, detailed, aware organizational system, which considers all relevant factors and provides a service appreciated by both managers and employees (the “Enigmai Business Suite”)

The Enigmai Business Suite software is a fixed fee software – every client receives the same version. Customers pay a one-time fee for the Enigmai Business Suite software, and 12% annually for maintenance and support, which maintenance fee may fluctuate dependent on the client, the features requested, the number of seats and the geographical locations . Updates and new versions are included, and we charge a small one time set up fee.

Recent Developments

On January 14, 2022, we entered into a finder’s fee agreement with J.H. Darbie & Company (“Darbie”) whereby Darbie provided introduction services to qualified funders for the Company. In consideration for any closing introductions Darbie would receive a finder’s fee in cash equal to 8% of the gross proceeds of an equity/convertible debt transaction or 3% of the gross proceeds of a non-convertible debt transaction, plus equity in the form of common stock equal to 8% of the amount raised. We issued a total of 701,053 shares of restricted common stock to Darbie on May 20, 2022, and these shares are not a part of this prospectus offering.

On May 20, 2022, we entered into a Securities Purchase Agreement (“SPA”) and Senior Secured Promissory Note with MHFLP, whereby in consideration of $370,000, less $37,000 discount fee; less $26,640 to Darbie pursuant to the finder’s fee agreement, and $5,000 for legal expenses, we issued to MHFLP a convertible promissory note (“MHFLP Note”) in the principal amount of $370,000. Further, in conjunction with the MHFLP Note, the Company agreed to issue a series of five-year warrants for the purchase of a cumulative 19,000,000 shares of our Common Stock (the “MHFLP SPA Warrants”), all exercisable at $0.04 per share (the “MHFLP SPA Warrant Shares”) as a result of the impact an anti-dilution clause whereby if at any time while the warrants are outstanding, the Company shall sell or grant any option to purchase or sell or grant any right to reprice, or otherwise dispose of or issue any common stock or securities priced at less than the exercise price of the warrants, then the Company is obligated to notify the warrant holder and to adjust the warrant exercise price by reducing, at the option of the Holder and only reduced to equal the issuance price or the new issuance such that the number of Warrant Shares issuable shall be increased such that the aggregate Exercise Price payable hereunder, after taking into account the decrease in the Exercise Price, shall be equal to the aggregate Exercise Price prior to such adjustment (for the avoidance of doubt, the aggregate Exercise Price prior to such adjustment is calculated as follows: the total number of Warrant Shares issuable upon exercise of this Warrant immediately prior to such adjustment (without regard to the Beneficial Ownership Limitation) multiplied by the Exercise Price in effect immediately prior to such adjustment). On June 6, 2022, the Company issued shares under a consulting agreement to Beyond priced at $0.04 per share thus triggering a repricing of the share purchase warrants originally issued under the SPA to an exercise price of $0.04 per share.

On May 27, 2022, we entered into a Equity Purchase Agreement with Mast Hill Fund, LP (“MHFLP”, or a “Selling Stockholder”), pursuant to which, upon the terms and subject to the conditions thereof, MHFLP is committed to purchase, on an unconditional basis, shares of our common stock (the “Put Shares”) at an aggregate price of up to $5,000,000 (the “Maximum Commitment Amount”) over the course of its term. The term of the Equity Purchase Agreement will end on the earlier of (i) the date on which such Selling Stockholder has purchased Common Stock pursuant to the Equity Purchase Agreement equal to the Maximum Commitment Amount, (ii) two years from the date this Registration Statement is deemed effective, or (iii) written notice of termination by us.

From time to time over the term of the Equity Purchase Agreement, commencing on the date on which a registration statement registering Put Shares becomes effective, we may, in our sole discretion, provide MHFLP with a put notice (each a “Put Notice”) to purchase a specified number of Put Shares (each a “Put Amount Requested”) subject to the limitations discussed below and contained in the Equity Purchase Agreement. Upon delivery of a Put Notice, we must deliver the Put Amount Requested as Deposit Withdrawal at Custodian (DWAC) shares to Selling Stockholder within five trading days.

The actual amount of proceeds we receive pursuant to each Put Notice (each, the “Put Amount”) is determined by multiplying the Put Amount Requested by the applicable purchase price. The purchase price for each of the Put Shares equals 70% of the “Market Price,” which is defined as the average of the two (2) lowest volume weighted average prices of our Common Stock during the Valuation Period. The Valuation Period is the seven (7) trading days immediately following the date MHFLP receives the Put Shares in its brokerage account.

In order to deliver a Put Notice, certain conditions set forth in the Equity Purchase Agreement must be met. In addition, we are prohibited from delivering a Put Notice if: (i) the sale of Put Shares pursuant to such Put Notice would cause us to issue and sell to Selling Stockholder, or the Selling Stockholder to acquire or purchase, a number of shares of our common stock that, when aggregated with all shares of Common Stock purchased by Selling Stockholder pursuant to all prior Put Notices issued under the Equity Purchase Agreement, would exceed the Maximum Commitment Amount; or (ii) the issuance of the Warrant Shares upon exercise of the Warrants would cause us to issue and sell to Selling Stockholder, or the Selling Stockholder to acquire or purchase, an aggregate number of shares of Common Stock that would result in Selling Stockholder beneficially owning more than 4.99% of the issued and outstanding shares of our common stock (the “Beneficial Ownership Limitation’).

In connection with the execution of the Equity Purchase Agreement, we issued a common stock purchase warrant (the “MHFLP EPA Warrant”) for the purchase of 10,000,000 shares of our Common Stock (the “MHFLP EPA Warrant Shares”) to the Selling Stockholder as a commitment fee. The MHFLP EPA Warrant has a term of five years from the date of issuance and has an exercise price of $0.04 per share. On June 6, 2022, the Company issued shares under a consulting agreement to Beyond priced at $0.04 per share thus triggering a repricing of the share purchase warrants originally issued under the SPA to an exercise price of $0.04 per share. The exercise of the MHFLP EPA Warrant is subject to the Beneficial Ownership Limitation and is exercisable immediately; upon presentation of an exercise notice, the Company is obligated to issue the corresponding number of shares.

We also entered into registration rights agreements (the “Registration Rights Agreements”) with MHFLP pursuant to which we agreed to file a Registration Statement to register the resale of the Put Shares, and the resale of shares by MHFLP underlying the MHFLP EPA Warrant, as well as the shares underlying the MHFLP Note, the MHFLP SPA Warrants and 4,920,000 shares of common stock issued to MHFLP as a commitment fee, pursuant to the SPA. Pursuant to the Registration Rights Agreements, we agreed to (i) file the Registration Statement within 120 calendar days from the Closing Date, (ii) use reasonable efforts to cause the Registration Statement to be declared effective under the Securities Act of 1933, as amended, as promptly as possible after the filing thereof, and (iii) use its reasonable efforts to keep such Registration Statement continuously effective under the Securities Act until all of the Put Shares have been sold thereunder or pursuant to Rule 144.

On June 6, 2022, the Company entered into a consulting agreement with Beyond Media SEZC (“Beyond”) whereby Beyond will provide consulting and investor relations service to the Company for a period of 12 months. Beyond directed the Company to issue the shares to its principal Michael Kahiri, who was issued a total of 7,500,000 shares of common stock valued at $0.04 per share ($300,000) under the contract on June 6, 2022.

Corporate Information

Our principal executive offices are located at 2803 Philadelphia Pike, Suite B #565, Claymont, DE 19703. Our telephone number is (888) 680-8033 and our website address is www.goldenstarenterprisesltd.com. The information contained on our website is not part of this prospectus.

SUMMARY OF THE OFFERING

| The Issuer | | Golden Star Enterprises Ltd. |

| | | |

| Number of Shares Currently Outstanding | | 107,416,146 Common Shares |

| | | |

| Securities being offered by selling stockholders | | A Selling Stockholder identified in this prospectus may offer and sell up to 40,000,000 shares of our common stock to be sold by Mast Hill Fund L.P. (MHFLP), a Delaware corporation, pursuant to the Equity Purchase Agreement. Further, the Company is registering 37,000,000 shares of common stock, on behalf of a Selling Stockholder, pursuant to a Securities Purchase Agreement and Promissory Note entered into with MHFLP, for which the Company has received the proceeds, and which MHFLP may sell. Further, the Company is registering 4,920,000 shares of common stock issued to MHFLP as a commitment fee in respect of the aforementioned Securities Purchase Agreement. Mast Hill Fund, L.P., will not hold more than 4.99% of the issued and outstanding shares of our Common Stock at any one time. Finally, the Company is registering 7,500,000 shares of common stock, on behalf of a Selling Stockholder, issued to Michael Kahiri, pursuant to a Consulting Agreement the Company entered into with Beyond Media SEZC. |

| | | |

| Description of Common Stock issuable upon the exercise of Common Stock Purchase Warrants Included in the registration statement by selling stockholders | | The Company is registering a cumulative 29,000,000 shares of common stock on behalf of a Selling Stockholder, pursuant to certain Common Stock Purchase Warrants, which allows for the purchase of common stock upon exercise of the warrants, issued to MHFLP, in conjunction with the Equity Purchase Agreement, and Securities Purchase Agreement, wherein MHFLP may purchase common stock at $0.04 per share. All common stock purchase warrants are exercisable immediately; upon presentation of an exercise notice, the Company is obligated to issue the corresponding number of shares. |

| | | |

| Offering Price | | The Selling Stockholders may sell all or a portion of the shares being offered pursuant to this prospectus following the effectiveness of this Form S-1 Registration Statement, or not at all. |

| | | |

| Public Market | | We are currently traded on the OTCPINK market under the symbol GSPT. We cannot give any assurance that the shares being offered will have a market value, or that they can be resold at the offered price if and when an active secondary market might develop. |

| | | |

| Duration of Offering | | The shares offered pursuant to “Put Notices” are offered for a period of twenty-four months following effectiveness of this Registration Statement, unless extended by our Board of Directors for an additional 90 days. |

| | | |

| Number of Shares Outstanding Before the Offering | | There are 107,416,146 shares of Common Stock issued and outstanding as of the date of this prospectus, 0 Stock Options granted as of the date of this prospectus, and 29,000,000 Warrants issued as of the date of this prospectus. |

| | | |

| Registration Costs | | We estimate our total costs relating to the registration herein to be approximately $50,000. |

| | | |

| Net Proceeds to the Company | | If the Company is successful in issuing all available “Put Notices” to Mast Hill Fund, LP, we will issue an estimated 40,000,000 shares of Common Stock, $0.0001 par value at an offering price equal to 70% of the volume weighted average price of the Company’s Common Stock on the Principal Market on the Trading Day immediately preceding the respective Put Date for the duration of the Offering (the “Offering”) for maximum net proceeds to the Company of $5,000,000 if all the shares are sold. |

| Use of Proceeds | | We will not receive any of the proceeds from the sale of the Common Stock registered hereunder. We will receive proceeds from MHFLP upon “Put Notices” presented to MHFLP by the Company, and pursuant to the Equity Purchase Agreement. We will also receive proceeds upon the exercise of the MHFLP Warrants, assuming they are not exercised on a “cashless” basis. We intend to use such proceeds, if any, for general corporate purposes and working capital requirements. |

| | | |

| Risk Factors | | An investment in our Common Stock involves a high degree of risk. You should carefully consider the risk factors set forth under the “Risk Factors” section herein and the other information contained in this prospectus before making an investment decision regarding our Common Stock. |

Summary Historical Financial Data

The following table summarizes our recent financial data. We have derived the following summary of our statements of operations data for the six months ended June 30, 2022, and 2021 from our unaudited condensed consolidated financial statements appearing elsewhere in this prospectus. We have derived the following summary of our statements of operations data for the fiscal years ended December 31, 2021, and 2020, and the following summary of our balance sheet data as of December 31, 2021 and 2020, from our audited consolidated financial statements appearing elsewhere in this prospectus. The following summary of our financial data set forth below should be read together with our financial statements and the related notes to those statements, as well as the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” appearing elsewhere in this prospectus.

| | | Six Months Ended June 30 | | | Year Ended December 31, | |

| | | (Unaudited) | | | Audited | |

| | | 2022 | | | 2021 | | | 2021 | | | 2020 | |

| Statement of Operations Data: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Revenues | | $ | 22,836 | | | $ | 21,666 | | | $ | 45,075 | | | $ | 52,165 | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Cost of revenue | | | 1,370 | | | | 1,300 | | | | 2,705 | | | | 25,809 | |

| Professional fees | | | 51,272 | | | | 39,156 | | | | 112.172 | | | | 5,894 | |

| Consulting fees | | | 577,501 | | | | 254,519 | | | | 428,021 | | | | 72,272 | |

| Research and development | | | 88,398 | | | | - | | | | - | | | | - | |

| General and Administrative | | | 95,976 | | | | 122,277 | | | | 286,441 | | | | 6,832 | |

| Total operating expenses | | | 814,517 | | | | 417,252 | | | | 829,339 | | | | 110,807 | |

| Operating Loss | | | (791,681 | ) | | | (395,586 | ) | | | (784,264 | ) | | | (58,642 | ) |

| | | | | | | | | | | | | | | | | |

| Other income (expenses): | | | | | | | | | | | | | | | | |

| Loss on debt settlement | | | - | | | | (135,577 | | | | (135,577 | ) | | | - | |

| Interest expense | | | (1,880,808 | ) | | | (441,954 | ) | | | (1,254,863 | ) | | | (488,640 | ) |

| Unrealized gain (loss)on investment | | | (100,240 | ) | | | (468,100 | ) | | | (792,933 | ) | | | 988,684 | |

| Total other income (expense) | | | (1,981,046 | ) | | | (1,045,631 | ) | | | (2,183,373 | ) | | | 500,044 | |

| | | | | | | | | | | | | | | | | |

| Net Income (Loss) | | | (2,772,729 | ) | | | (1,441,217 | ) | | | (2,967,637 | ) | | | 441,402 | |

| | | | | | | | | | | | | | | | | |

| Other Comprehensive Income (Loss) | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | 2,264 | | | | 77 | | | | (1,575 | ) | | | (407 | ) |

| Comprehensive Income (Loss) | | $ | (2,770,4655 | ) | | $ | (1,441,140 | ) | | $ | (2,969,212 | ) | | $ | 440,995 | |

| | | | | | | | | | | | | | | | | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Current assets | | $ | 302,410 | | | | 99,471 | | | $ | 347,445 | | | $ | 1,091,154 | |

| Total Assets | | | 302,410 | | | | 99,794 | | | | 347,445 | | | | 1,091,154 | |

| Total Liabilities | | | 3,946,684 | | | | 1,131,839 | | | | 2,084,054 | | | | 601,572 | |

| Total stockholders’ equity | | | (3,644,274 | ) | | | (1,032,045 | ) | | | (1,736,609 | ) | | | 489,582 | |

RISK FACTORS

Investing in our shares involves significant risks. Before making an investment decision, you should consider carefully the risks, uncertainties and other factors and information relating to our business, condition and operating results, including those set forth below and those contained elsewhere in this prospectus. If any of the following risks were to occur, our business, affairs, assets, financial condition, results of operations, cash flows, liquidity and prospects could be materially and adversely affected, the trading price of our shares could decline, and you could lose all or part of your investment in our shares. When we say that something could have a material adverse effect on us or on our business, we mean that it could have one or more of these effects.

Risks Relating to Our Business

Our Executive Officers and Directors have additional business activities and as such are not devoting all of their time to us, which may result in periodic interruptions, or business failure.

Although we do not feel there is a conflict of interest, certain of our Directors and Officers operate other business ventures and must balance their time between running the public company and their outside business interests. While there are no set minimum hours that they are obligated to work our Company businesses Mr. Kling spends at least 80 hours a month on our Company business, Mr. Shefsky spends at least 50 hours per month and Ms. Muskal spends at least120 hours per month on our Company business. Our operations may be such that decisions need to occur at times when our directors or officers are unavailable, which may lead to the periodic interruption in the implementation of our business plan. Such delays could have a significant negative effect on the success of the business.

General inflation and increases in the minimum wage and general labor costs, could adversely affect our business, financial condition and results of operations.

Labor is a significant portion of our cost structure, and is subject to many external factors, including minimum wage laws, prevailing wage rates, unemployment levels, health insurance costs and other insurance costs and changes in employment and labor legislation or other workplace regulation. From time to time, legislative proposals are made to increase the minimum wage in Israel, as well as the minimum wage in the United States and Canada, where we may retain staff, and to reform entitlement programs, such as health insurance and paid leave programs. On April 1, 2022, the national minimum wage was increased from 5,300 shekels per month to 5,400 shekels per month in Israel. Despite the fact that we have limited personnel retained as employees and focus predominantly on agreements with independent contractors, we may determine to directly hire employees and this wage increase may also impact on the fees our contractors charge us. This increase will mostly likely contribute to the overall increase in prevailing wage rates and increase in current general levels of inflation. As minimum wage rates increase or related laws and regulations change, we will need to increase not only the wage rates of our minimum wage employees, if any, but also the wages paid to our other hourly or salaried employees. Increases in the cost of our labor could have an adverse effect on our business, financial condition and results of operations, or if we fail to pay such higher wages, we could suffer increased employee turnover. Increases in labor costs generally could force us to increase prices for our customers, which could adversely impact our sales. For some customers with multi-year fixed priced contracts, increases in the minimum wage could decrease our profit margins or result in losses and could have a material adverse effect on our business, financial condition and results of operations.

We have been and could continue to be negatively impacted by the novel coronavirus pandemic (COVID-19) and related governmental actions and orders and market effects.

The coronavirus pandemic (COVID-19) and related economic downturn continues to pose various and interrelated risks to our customers, our employees, our vendors and the communities in which we operate, which have all negatively impacted, and may continue to negatively impact, our business. From March 24, 2020, to current, customers have responded with varying levels of project postponements, particularly in our segment. Our level of customer engagement in licensing our software has varied with the ebb and flow of the initial virus and the subsequent variants and outbreaks. In addition, our business, financial condition and results of operations could be materially adversely affected by future outbreaks of COVID-19 generally or in our facilities. We are also likely to be impacted further by decreased customer demand as a result of a reduction in customer spending or as a result of government-imposed restrictions on businesses. If the pandemic or its recovery continues to reduce customer’s budgets and restrict business operations, the pandemic may have a material adverse effect on our business, results of operations, financial condition and cash flows and adversely impact the trading price of our common stock.

If we are unable to continue to attract new customers and increase market awareness of our company and solutions, our revenue growth could be slower than we expect or could decline.

We believe that our future growth depends in part upon increasing our customer base. Our ability to achieve significant growth in revenue in the future will depend, in part, upon continually attracting new customers and obtaining subscription renewals to our solutions from those customers. Market awareness of our capabilities and solutions is essential to our ability to generate new leads for expanding our business and our continued growth. If we fail to sufficiently invest in our marketing programs or they are unsuccessful in attracting new customers by creating market awareness of our company and solutions, our business may be harmed.

If our existing customers fail to renew their support agreements, or if customers do not license updated products on terms favorable to us, our revenues could be adversely affected.

We intend to derive a significant portion of our overall revenues from maintenance services and software subscriptions, and we depend on our installed customer base for future revenue from maintenance services and software subscriptions and licenses of updated products. Currently we charge our customers monthly recurring fees per seat, an onetime implementation fee, a training fee and any fees related to special developments, as well as monthly maintenance fees. The IT industry generally has been experiencing increasing pricing pressure from customers when purchasing or renewing support agreements. Moreover, the trend towards consolidation in certain industries that we serve, such as financial services, could result in a reduction of the software under agreement and put pressure on our maintenance and support terms with customers who have merged. Given this environment, there can be no assurance that our current customers will renew their maintenance agreements or agree to the same terms when they renew, which could result in our reducing or losing maintenance fees. If our existing customers fail to renew their maintenance agreements, or if we are unable to generate additional maintenance fees through the licensing of updated products to existing or new customers, our business and future operating results could be adversely affected.

Reduced IT or enterprise software spending may adversely impact our business.

Our business depends on the overall demand for IT and enterprise software spend and on the economic health of our current and prospective customers. Any meaningful reduction in IT or enterprise software spending or weakness in the economic health of our current and prospective customers could harm our business in a number of ways, including longer sales cycles and lower prices for our solutions.

Current and future competitors could have a significant impact on our ability to generate future revenues and profits.

The markets for our products are intensely competitive and are subject to rapid technological change and other pressures created by changes in our industry. The convergence of many technologies has resulted in unforeseen competitors arising from companies that were traditionally not viewed as threats to our marketplace. We expect competition to increase and intensify in the future as the pace of technological change and adaptation quickens, and as additional companies enter our markets, including those competitors who offer similar products and services to ours, but offer them through a different form of delivery. Numerous releases of competitive products have occurred in recent history and are expected to continue in the future. We may not be able to compete effectively with current competitors and potential entrants into our marketplace. We could lose market share if our current or prospective competitors: (i) introduce new competitive products, (ii) add new functionality to existing products, (iii) acquire competitive products, (iv) reduce prices, or (v) form strategic alliances with other companies. If other businesses were to engage in aggressive pricing policies with respect to competing products, or if the dynamics in our marketplace resulted in increased bargaining power by the consumers of our products and services, we would need to lower the prices we charge for the products we offer. This could result in lower revenues or reduced margins, either of which could materially and adversely affect our business and operating results. Additionally, if prospective consumers choose other methods, different from those that we offer, our business and operating results could also be materially and adversely affected.

Consolidation in the industry, particularly by large, well-capitalized companies, could place pressure on our operating margins which could, in turn, have a material adverse effect on our business.

Acquisitions by large, well-capitalized technology companies have changed the marketplace for our goods and services by replacing competitors that are comparable in size to our company with companies that have more resources at their disposal to compete with us in the marketplace. In addition, other large corporations with considerable financial resources either have products that compete with the products we offer or have the ability to encroach on our competitive position within our marketplace. These companies have considerable financial resources, channel influence, and broad geographic reach; thus, they can engage in competition with our products and services on the basis of sales price, marketing, services, or support. They also have the ability to introduce items that compete with our maturing products and services. The threat posed by larger competitors and their ability to use their better economies of scale to sell competing products and services at a lower cost may materially reduce the profit margins we earn on the goods and services we provide to the marketplace. Any material reduction in our profit margin may have a material adverse effect on the operations or finances of our business, which could hinder our ability to raise capital in the public markets at opportune times for strategic acquisitions or general operational purposes, which may prevent effective strategic growth or improved economies of scale or put us at a disadvantage to our better-capitalized competitors.

We must manage our internal resources during periods of company growth, or our operating results could be adversely affected.

If we are successful with our growth plans, any growth will place significant strains on our administrative and operational resources, and increase demands on our internal systems, procedures and controls. Our administrative infrastructure, systems, procedures and controls may not adequately support our operations. In addition, our management may not be able to achieve a rapid, effective execution of the product and business initiatives necessary to successfully implement our operational and competitive strategy. If we are unable to manage growth effectively, our operating results will likely suffer which may, in turn, adversely affect our business.

Risks Related to Product Development

We need to continue to develop new technologically-advanced products that successfully integrate with the software products and enhancements used by our customers.

Our success depends upon our ability to design, develop, test, market, license, and support new software products and enhancements of current products on a timely basis in response to both competitive threats and marketplace demands. Recent examples of significant trends in the software industry include cloud computing, mobility, social media, networking, browser, and software as a service. In addition, software products and enhancements must remain compatible with standard platforms and file formats. We may be required to integrate software licensed or acquired from third parties with our proprietary software to create or improve our products. If we are unable to achieve a successful integration with third-party software, we may not be successful in developing and marketing our new software products and enhancements. If we are unable to successfully integrate third-party software to develop new software products and enhancements to existing products, or to complete products currently under development which we license or acquire from third parties, our operating results will materially suffer. In addition, if the integrated or new products or enhancements do not achieve acceptance by the marketplace, our operating results will materially suffer. Also, if new industry standards emerge that we do not anticipate or adapt to, our software products could be rendered obsolete and, as a result, our business and operating results, as well as our ability to compete in the marketplace, would be materially harmed.

If our software products and services do not gain market acceptance, our operating results may be negatively affected.

We intend to pursue our strategy of growing the capabilities of our software offerings through our proprietary research and the development of new product offerings. In response to customer demand, it is important to our success that we continue: (i) to enhance our products, and (ii) to seek to set the standard for call center management software in the corporate market. The primary market for our software and services is rapidly evolving, due to the nature of the rapidly changing software industry, which means that the level of acceptance of products and services that have been released recently or that are planned for future release by the marketplace is not certain. If the markets for our products and services fail to develop, develop more slowly than expected or become subject to increased competition, our business may suffer. As a result, we may be unable to: (i) successfully market our current products and services, (ii) develop new software products, services and enhancements to current products and services, (iii) complete customer installations on a timely basis, or (iv) complete products and services currently under development. In addition, increased competition could put significant pricing pressures on our products, which could negatively impact our margins and profitability. If our products and services are not accepted by our customers or by other businesses in the marketplace, our business and operating results will be materially affected.

Our investment in our current research and development efforts may not provide a sufficient, timely return.

The development of our software products is a costly, complex, and time-consuming process, and the investment in software product development often involves a long wait until a return is achieved on such an investment. When cash is available, we make and will continue to make significant investments in software research and development and related product opportunities. Investments in new technology and processes are inherently speculative. Commercial success depends on many factors including the degree of innovation of the products developed through our research and development efforts, sufficient support from our strategic partners, and effective distribution and marketing. Accelerated product introductions and short product life cycles require high levels of expenditures for research and development. These expenditures may adversely affect our operating results if they are not offset by increased revenues. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts in order to maintain our competitive position. However, significant revenues from new product and service investments may not be achieved for a number of years, if at all. Moreover, new products and services may not be profitable, and even if they are profitable, operating margins for new products and businesses may not be as high as the margins we have experienced for our current or historical products and services.

Software development is a long, expensive, and uncertain process, and we may terminate one or more of our development programs.

We may determine that certain software product candidates or programs do not have sufficient potential to warrant the continued allocation of resources. Accordingly, we may elect to terminate one or more of our programs for such product candidates. If we terminate a product in development in which we have invested significant resources, our prospects may suffer, as we will have expended resources on a project that does not provide a return on our investment and we may have missed the opportunity to have allocated those resources to potentially more productive uses, and this may negatively impact our business operating results or financial condition.

Our software products may contain defects that could harm our reputation, be costly to correct, delay revenues, and expose us to litigation.

Our software products are highly complex and sophisticated and, from time to time, may contain design defects or software errors that are difficult to detect and correct. Errors may be found in new software products or improvements to existing products after delivery to our customers. If these defects are discovered, we may not be able to successfully correct such defects in a timely manner. In addition, despite the tests we conduct on all of our products, we may not be able to fully simulate the environment in which our products will operate and, as a result, we may be unable to adequately detect the design defects or software errors which may become apparent only after the products are installed in an end-user’s network. The occurrence of errors and failures in our products could result in the delay or the denial of market acceptance of our products and alleviating such errors and failures may require us to make significant expenditure of our resources. The harm to our reputation resulting from product errors and failures may be materially damaging. Our agreements with our strategic partners and end-users typically contain provisions designed to limit our exposure to claims. These agreements regularly contain terms such as the exclusion of all implied warranties and the limitation of the availability of consequential or incidental damages. However, such provisions may not effectively protect us against claims and the attendant liabilities and costs associated with such claims. Accordingly, any such claim could negatively affect our business, operating results or financial condition.

The loss of licenses to use third-party software or the lack of support or enhancement of such software could adversely affect our business.

We currently depend upon a limited number of third-party software products. If such software products were not available, we might experience delays or increased costs in the development of our products. In certain instances, we rely on software products that we license from third parties, including software that is integrated with internally developed software, and which is used in our products to perform key functions. These third-party software licenses may not continue to be available to us on commercially reasonable terms, and the related software may not continue to be appropriately supported, maintained, or enhanced by the licensors. The loss by us of the license to use, or the inability by licensors to support, maintain, and enhance any of such software, could result in increased costs or in delays or reductions in product shipments until equivalent software is developed or licensed and integrated with internally developed software. Such increased costs or delays or reductions in product shipments could adversely affect our business.

Financial Risks

We need to be able to maintain an effective system of internal controls, in order to be able to report our financial results accurately and timely and prevent fraud.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. We outsource our financial reporting through a company that provides that staff, however the work is concentrated in a few individuals. Further, our responsibility to provide the information is concentrated in one or two individuals in our Company. Any future weaknesses in our internal controls and procedures over financial reporting could result in material misstatements in our consolidated financial statements not being prevented or detected. We may experience difficulties or delays in completing remediation or may not be able to successfully remediate material weaknesses at all. Any material weakness or unsuccessful remediation could affect our ability to file periodic reports on a timely basis and investor confidence in the accuracy and completeness of our consolidated financial statements, which in turn could harm our business and have an adverse effect on our stock price and our ability to raise additional funds.

We may not be able to generate sufficient cash to service any indebtedness or contingent transaction consideration that we may incur from time to time, which could force us to sell assets, cease operations, or take other detrimental actions for our business.

Our ability to make scheduled payments on or to refinance any debt or contingent transaction obligations that we have or may incur depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business, and other factors beyond our control. We currently have principal balances on demand loans and convertible notes totaling $1,039,477 accruing interest at between 8 and 12 percent per annum. Our ability to meet our capital needs in the future will depend on many factors, including maintaining and enhancing our operating cash flow, successfully managing the introduction of our new software, successfully retaining and growing our client base in the midst of general economic uncertainty, and managing the continuing effects of the COVID-19 pandemic on our business. We cannot ensure that we will be able to achieve a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on any indebtedness or the contingent transaction consideration.

If our cash flows and capital resources are at any time insufficient to fund our obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital, restructure or refinance our indebtedness, or reduce or cease operations. There can be no assurance that additional capital or debt financing will be available to us at any time. Even if additional capital is available, we may not be able to obtain debt or equity financing on terms favorable to us. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to reduce or curtail our operations.

The terms of our promissory notes will restrict our financing flexibility.

The terms of promissory notes we issued in 2022 contain standard negative covenants customary for transactions of this type. These negative covenants may preclude or restrict our ability to undertake future debt and convertible debt financings without the prior approval of holders of the previous notes and the terms also have anti-dilution provisions that will impact on any financings undertaken. The events of default are also customary for transactions of this type, including default in timely payment of principal or interest, failure to observe or perform any covenant or agreement contained in the convertible note and other transaction documents, the commencement of bankruptcy or insolvency proceedings, and failure to timely file Exchange Act filings.

If our estimates or judgments relating to our critical accounting policies are based on assumptions that change or prove to be incorrect, our operating results could fall below expectations of securities analysts and investors,

resulting in a decline in our stock price.

The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, as provided in “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Critical Accounting Policies and Estimates” in this prospectus, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Our operating results may be adversely affected if our assumptions change or if actual circumstances differ from those in our assumptions, which could cause our operating results to fall below the expectations of securities analysts and investors, resulting in a decline in our stock price. Significant items subject to estimates and assumptions include timing of recognition of revenue on software service renewals and expenses related thereto.

The loss of a major customer or the failure to collect a large account receivable could negatively affect our results of operations and financial condition.

Revenues from a limited number of customers have accounted for a substantial percentage of our total revenues. As we work to complete the release of our updated software offering in SAAS format, we have depended on long term contracts with two key customer accounts in each of fiscal 2022, 2021 and 2020. The loss of one of our clients could materially affect our business and operating results.

A significant downturn in our business may not be immediately reflected in our operating results because of the way we recognize revenue.

We recognize revenue from software subscription agreements ratably over the terms of these agreements. As a result, a significant portion of the revenue we report in each quarter is generated from customer agreements entered into during previous periods, which is reflected as deferred revenue on our balance sheet. Consequently, a decline in new or renewed subscriptions, or a downgrade of renewed subscriptions to less-expensive editions, in any one quarter may not be fully reflected in our revenue in that quarter, and may negatively affect our revenue in future quarters. If contracts having significant value expire and are not renewed or replaced at the beginning of a quarter or are downgraded, our revenue may decline significantly in that quarter and subsequent quarters.

Legal and Regulatory Risks

We will be subject to the reporting requirements of federal securities laws, causing us to make significant compliance-related expenditures that may divert resources from other projects, thus impairing its ability to grow.

We will be subject to the information and reporting requirements of the Exchange Act, and other federal securities laws, including the Sarbanes-Oxley Act. The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the Commission and furnishing audited reports to stockholders will cause our expenses to be higher than most other similarly sized companies that are privately held. As a public company, we expect these rules and regulations to continue to keep our compliance costs high in 2022 and beyond, and to make certain activities more time-consuming and costly. As a public company, we also expect that these rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future, and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers.

The elimination of monetary liability against our directors, officers, agents and employees under Delaware law, and the existence of indemnification rights to such persons, may result in substantial expenditures by us and may discourage lawsuits against our directors, officers, agents and employees.