Heineken 1st Half Topped Market Views; Sees Significant Cost Pressures Ahead -- Update

August 01 2022 - 1:51AM

Dow Jones News

By Michael Susin

Heineken NV said Monday that net profit for the first half rose

on the back of action to mitigate inflationary pressures on its

cost base, and that it affirmed its forecast for 2022 and changed

its guidance for 2023.

The Dutch brewer said that it expects significant cost pressures

and ongoing investment to impact the second-half of 2022 and into

2023, noting that the commodities price softening is being offset

by higher natural price levels and availability.

"Our pricing and revenue management actions have effectively

offset these inflationary pressures so far in absolute terms, and

we remain committed to continuing to do so," the company said.

As a result, the company backed its 2022 guidance to achieve a

stable-to-modest sequential improvement in adjusted operating

profit margin.

"We are changing our previous guidance for 2023. We will move

from an operating profit margin objective towards delivering

operating profit (beia) organic growth, in the range of a mid- to

high-single digit," it said.

The brewer said its Evergreen program is on track to achieve 1.7

billion euros ($1.74 billion) in aggregate gross savings by end of

2022.

The company reported net profit for the half year of EUR1.27

billion, compared with EUR1.03 billion a year earlier. Net profit

had been expected to come in at EUR1.11 billion, according to two

analysts' estimates taken from FactSet.

The company said beia net profit--one of the company's preferred

metrics--rose 40% to EUR1.33 billion. Beia stands for before

exceptional items and amortization of acquisition-related

intangible assets.

Net revenue for the period rose to EUR13.49 billion from

EUR10.01 billion, and was also higher than the consensus forecast

of EUR12.85 billion based on five analysts' estimates taken from

FactSet.

The brewer said volume for the Heineken brand rose 13.8%

organically on year.

The board has declared an interim dividend of 50 European cents,

up from 28 European cents a year earlier.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

August 01, 2022 02:36 ET (06:36 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

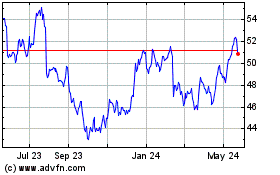

Heineken Nv (QX) (USOTC:HEINY)

Historical Stock Chart

From Dec 2024 to Jan 2025

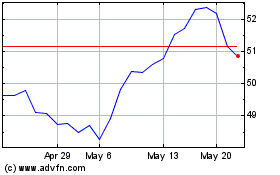

Heineken Nv (QX) (USOTC:HEINY)

Historical Stock Chart

From Jan 2024 to Jan 2025