Current Report Filing (8-k)

December 16 2014 - 1:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): December 15, 2014

_______________________________

Hannover House, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester Street, Springdale,

AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target Development Group,

Inc."

f/k/a "Mindset Interactive Corp."

330 Clematis Street, Suite 217, West

Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 1 — REGISTRANT'S

BUSINESS AND OPERATIONS

| Item 1.01 |

Entry into a Material Definitive Agreement.

a). JSJ Investments - Hannover House, Inc.

(“Company”) has entered into an agreement with JSJ Investments for the purchase of qualifying, aged debts, including

an allocation of revenues for the Fantastic Films, Inc. obligation, and a payment to the National Bank of California to commence

a mutually agreed and beneficial settlement structure. While it was the Company’s preference to defer any such transactions

until after S.E.C. Edgar publication of the Company’s Form 10 Registration, the creditor pressures from the above two beneficiaries

mandated the immediate closing of this transaction. In consideration for the funding of $108,000 by JSJ Investments, the Company

authorized the issuance of 8,974,359 shares of Common stock and a promissory note for $38,000 due in June, 2015.

b). Supplier Studios – Company has

executed distribution / sales agency agreements with two independent video labels / studios. Effective Jan. 1, 2015, new video

releases from Green Apple Entertainment, Inc. (Florida Corporation) and Fever Dreams, Inc. (New Jersey Corporation) will be handled

exclusively under the label venture being managed for Company by V.P. Tom Sims. A schedule of initial new releases titles from

these two supplier labels is included in the Company’s Form 10 Registration, and will be separately promoted through press

releases and other forms of public communication. Initial sales estimates for 2015, based on current releases and sales activities

for these two labels, show an anticipated range of between $3.5-million and $5-million, supplemental to all other revenues of the

Company. |

|

SECTION 5 — CORPORATE GOVERNANCE

AND MANAGEMENT

| |

|

|

| Item 5.02 |

Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

a). Officer Salary – In respect of the enhanced

release activities and anticipated revenues for the Company, effective January 1, 2015, the base, annual salary for Eric Parkinson

will be restored to its original level of one-hundred-eighty-thousand dollars (USD $180,000); for the past two years, Parkinson

had agreed to a reduced salary.

b). Board Membership – Subject to coverage

by a “director’s & officers” liability insurance policy, Tom Sims has agreed to join the Hannover House,

Inc. board of directors, effective upon activation of said D&O insurance. The Company is seeking two (2) additional, qualified

candidates to join the Board of Directors and to bring the total to five (5). |

|

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

a). Annual Shareholder’s Meeting / Annual Report

- Company has amended the Articles of Incorporation, and filed same with the Wyoming Secretary of State, to enable the Board of

Directors to reserve the option of issuing an “annual report” for Shareholders, in lieu of, or in addition to, an Annual

Shareholder’s Meeting. As of the date of this Form 8 filing, the Board has not decided on the date, location or need for

an Annual Shareholder’s Meeting covering the year ending 12/31/2014. Formal meetings / gatherings were held in January in

2011, 2012 and 2013 (covering activities in the prior years), which meetings were conducted in Fayetteville, Arkansas to

limited Shareholder attendance. In response to Shareholder requests, the Annual Shareholder’s Meeting held in February, 2014

(for the year ending 12/31/2013) was held in New York City, which also generated limited attendance while costing the Company

many thousands of dollars more than the prior three meetings. The Company is requesting feedback and suggestions from Shareholders

regarding the issue of an Annual Shareholder’s Meeting vs. an Annual Report, or both; and if a meeting were to be held, suggestions

for location / venue and dates. |

|

SECTION 8 — OTHER EVENTS

| Item 8.01 |

Other Events.

a). Form 10 Registration Filing - Company has

completed all requested revisions and formatting changes to the Form 10 Registration Statement, which is being submitted to MacReportMedia

for filing with the S.E.C. Edgar database. It is Company’s intention to seek uplisting to the OTC “QB” board

upon S.E.C. acceptance of registration. |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: December 15, 2014 |

Hannover House, Inc. |

| |

By |

/s/ Eric F. Parkinson |

| |

|

Name: Eric F. Parkinson

Title: C.E.O. |

INDEX TO EXHIBITS

| Exhibit No. |

|

Description |

| 1 |

|

Not Applicable. |

| |

|

|

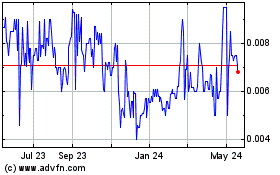

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Feb 2025 to Mar 2025

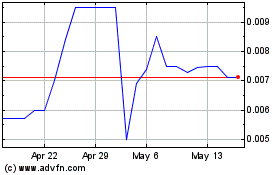

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Mar 2024 to Mar 2025