As filed with the Securities and Exchange

Commission on July 13, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

WORLD TECHNOLOGY CORP.

(Exact name of registrant as specified in

its charter)

|

Nevada

|

|

4899

|

|

46-1204713

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary standard industrial

classification code number)

|

|

(I.R.S. employer

identification number)

|

600 Brickell Ave., Suite 1775

Miami, Florida 33131

(855)467-6500

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Seán McVeigh

Chief Executive Officer

600 Brickell Ave., Suite 1775

Miami, Florida 33131

(855) 467-6500

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

Mitchell S. Nussbaum, Esq.

Angela M. Dowd, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

(212) 407-4000 – Telephone

(212) 407-4990 – Facsimile

|

Ralph De Martino, Esq.

Alec Orudjev, Esq.

Cavas S. Pavri, Esq.

Schiff Hardin LLP

901 K. Street, N.W., Suite 700

Washington D.C. 20001

(202) 778-6400 – Telephone

(202) 778-6460 – Facsimile

|

Approximate date of commencement of proposed

sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered

on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box.

x

If this form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

¨

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

(Do not check if a smaller reporting company)

|

Smaller reporting company

x

|

|

Emerging growth company

x

|

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

¨

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Proposed Maximum

Aggregate Offering Price

(1)

|

|

|

Amount of

Registration Fee

(1)

|

|

|

Common Stock, $0.001 par value

(2)

|

|

$

|

11,500,000

|

|

|

$

|

1,431.75

|

|

|

Warrants to purchase Common Stock

(3)

|

|

|

|

|

|

|

|

|

|

Common Stock issuable upon exercise of the Warrants $0.001 par value

(2)

|

|

|

11,500,000

|

|

|

|

1431.75

|

|

|

Representative’s

Warrants to Purchase Common Stock and Warrants

(3)(4)

|

|

$

|

-

|

|

|

$

|

—

|

|

|

Common Stock underlying Representative’s Warrants, $.001 par value

(2)(5)

|

|

$

|

718,750

|

|

|

|

89.49

|

|

|

Warrants included in Representative’s Warrants

(3)

|

|

|

|

|

|

|

|

|

|

Common Stock issuable upon exercise of Warrants underlying Representative’s Warrant $0.001 par value

(2)(6)

|

|

|

575,000

|

|

|

|

71.59

|

|

|

Total

|

|

$

|

24,293,750

|

|

|

|

3,024.58

|

(7)

|

|

|

(1)

|

Estimated solely for the

purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act. Includes the aggregate offering

price of additional shares that the underwriters have the right to purchase to cover over-allotments, if any.

|

|

|

(2)

|

In accordance with Rule 416(a), the Registrant is also

registering hereunder an indeterminate number of additional shares of common stock that shall be issuable pursuant to Rule 416

to prevent dilution resulting from stock splits, stock dividends or similar transactions.

|

|

|

(3)

|

No fee is payable pursuant to Rule 457(g) under the Securities

Act of 1933, as amended.

|

|

|

(4)

|

We have agreed to issue warrants

exercisable within five years after the effective date of this registration statement representing 5% of the total

number of securities issued in the offering (the “Representative’s Warrants”) to Dawson James Securities,

Inc., the representative of the underwriters (the ”Representative”). The Representative’s Warrants will be exercisable

at a per share price equal to 125% of the common stock public offering price. Resales of the Representative’s Warrants on

a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, are registered hereby. Resales

of shares issuable upon exercise of the Representative’s Warrants are also being similarly registered on a delayed or continuous

basis hereby. See “Underwriting.” In accordance with Rule 457(g) under the Securities Act, because the shares of the

Registrant’s common stock underlying the Representative’s Warrants are registered hereby, no separate registration

fee is required with respect to the warrants registered hereby.

|

|

|

(5)

|

Represents the aggregate

maximum offering price of the number of shares of common stock issuable upon exercise of the Representative’s Warrants.

|

|

|

(6)

|

Represents the aggregate maximum offering price of the

number of shares of common stock issuable upon exercise of the Warrants included in the Representative’s Warrants.

|

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said

Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission

is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in

any state or other jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION, DATED JULY 13, 2018

|

SHARES

of

COMMON

STOCK

and

WARRANTS TO PURCHASE UP TO

SHARES

OF COMMON STOCK

and

SHARES OF COMMON STOCK UNDERLYING

THE WARRANTS

World Technology Corp

.

We are offering an aggregate of shares

of our common stock, $0.001 par value per share, at a public offering price of $ per

share, together with warrants to purchase up to shares of our common stock (the “Warrants”).

Each accompanying Warrant is to purchase one share of common stock. The common stock and Warrants will be separately issued but

will be purchased together in this offering. Each full Warrant will have an exercise price of $ per

share, will be exercisable upon issuance and will expire five years from the date on which such Warrants were issued. We are also

offering the shares of common stock that are issuable from time to time upon exercise of the Warrants.

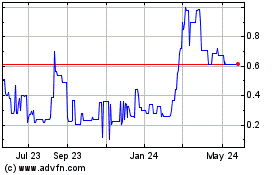

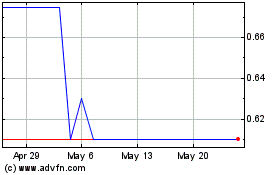

Our common stock is currently quoted on the OTC Pink

Market under the symbol “WCOR”.

On July 13, 2018, the last reported sales

prices of our common stock on the OTC Pink Market was $4.25 per share.

We have applied to list our common stock on the

NASDAQ Capital Market under the symbol “WCOR”. There can be no assurance that our common stock will be approved

for listing on the NASDAQ Capital Market. The closing of this offering is contingent upon the successful listing of our

common stock on The NASDAQ Capital Market. The Warrants will not be listed for trading and no market for the Warrants is

expected to develop. Without an active trading market, the liquidity of the Warrants will be limited.

We are an “emerging growth company” as

defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements

for future filings

World Global Holdings Pte. Ltd. and its affiliates, including

World Global Network Pte. Ltd., currently own approximately 75% of our common stock. Upon the closing of this offering, World Global

Holdings Pte. and its affiliates will continue to own a combined controlling interest in us, and we will meet the definition of

a “controlled company” under the corporate governance standards for NASDAQ listed companies and we will be eligible

to utilize certain exemptions from the corporate governance requirements of the NASDAQ Stock Market.

Investing in our securities involves a high degree of risk.

See “Risk Factors” beginning on page 12 to read about factors you should consider before buying shares of our common

stock and Warrants.

Neither the Securities and Exchange Commission nor any other

regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any

representation to the contrary is a criminal offense.

|

|

|

Per Share and Warrant

(2)

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

|

|

|

|

Underwriting discounts and commissions

(1)

|

|

$

|

|

|

|

|

|

|

|

Proceeds to us, before expenses

|

|

$

|

|

|

|

|

|

|

|

|

(1)

|

We have agreed to reimburse

the underwriters for other out-of-pocket expenses relating to this offering up to a maximum of $125,000 for all such expenses.

- See “Underwriting” for a description of the compensation payable to the underwriters.

|

|

|

(2)

|

The public offering price and underwriting discount

correspond to an assumed public offering price per share of common stock of $ and an assumed public offering price per full warrant

of $ .

|

In addition to the underwriting discounts and commissions

described in the section entitled “Underwriting” on page 79 of this prospectus, we have agreed to issue to

Dawson warrants, exercisable commencing 180 days immediately following the date of effectiveness of the

registration statement of which this prospectus forms a part, and exercisable for a period of five years from the date of

effectiveness of the registration statement of which this prospectus forms a part, to purchase shares of common stock and

Warrants equal to 5% of the total number of shares and Warrants sold in this offering at a per share and Warrant price equal

to 125% of the public offering price (the “Representative’s Warrants”). The registration statement of which

this prospectus is a part also covers such Representative’s Warrants and the shares of common stock and Warrants

issuable upon the exercise thereof and the shares of common stock issuable upon the exercise of such Warrants. We have

granted the representative of the underwriters a 45day option to purchase up

to additional

shares of

common

stock

and/or

up

to additional

Warrants, in any combinations thereof, solely to cover over-allotments, if any, at the public offering price less the

underwriting discount. If the underwriters exercise this option in full, the total underwriting discounts

and

commissions

will

be

$ ,

and the additional proceeds to us, before expenses, from the over-allotment

option

exercise

will

be

$ .

The underwriters expect to deliver the shares and Warrants against

payment on or about , 2018.

Prospectus dated ,

2018

Dawson James Securities, Inc.

TABLE OF CONTENTS

We have not authorized anyone to provide

you with any information or to make any representation, other than those contained in this prospectus or any free writing prospectus

we have prepared. We take no responsibility for, and provide no assurance as to the reliability of, any other information that

others may give you. This prospectus is an offer to sell only the shares offered hereby, but only in circumstances and in jurisdictions

where it is lawful to do so. The information contained in this prospectus is accurate only as of its date, regardless of the time

of delivery of this prospectus or of any sale of our securities.

Neither we nor any of the underwriters

have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action

for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions

relating to, this offering and the distribution of this prospectus.

Our logo and some of our trademarks and

tradenames are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property

of other organizations. Solely for convenience, trademarks, tradenames and service marks referred to in this prospectus may appear

without the ®,

TM

and

SM

symbols, but those references are not intended to indicate in any way that we

will not assert to the fullest extent under applicable law our rights or the rights of the applicable licensor to these trademarks,

tradenames and service marks.

We

obtained the statistical data, market data and other industry data and forecasts described in this prospectus from market research,

publicly available information and industry publications. Industry publications generally state that they obtain their information

from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly,

while we believe that the statistical data, industry data and forecasts and market research are reliable, we have not independently

verified the data, and we do not make any representation as to the accuracy of the information. We have not sought the consent

of the sources to refer to their reports appearing or incorporated by reference in this prospectus.

PROSPECTUS SUMMARY

This summary

highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider

in making your investment decision. Before investing in our Securities, you should carefully read this entire prospectus, including

our financial statements and the related notes and the information set forth under the headings “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included

elsewhere in this prospectus. Unless the context otherwise requires, references to “World Technology”, “WCOR”,

“we”, “our”, “us” or similar terminology in this prospectus refer on a historical basis to

“World Technology Corp” on a consolidated basis with its former wholly-owned subsidiary and, since November 3, 2017,

the date on which our wholly-owned subsidiary was dissolved, refer to World Technology Corp. Except as otherwise indicated, market

data and industry statistics used throughout this prospectus are based on independent industry publications and other publicly

available information.

Overview

We are a technology

company that provides wearable devices for use in the quantified-self wellness market. Our wearable devices and related applications

provide our end-users with health related knowledge acquired through self-tracking. Our Life Sensing Technology uses state-of-the-art

sensors, enhanced signal processing and algorithms to collect and process specific data from end-users; and it is embedded into

Helo

, our branded wearable devices that are designed, produced and sold into the wellness market through our exclusive marketing

and distribution partner, World Global Network Pte. Ltd. and its distribution network (which we refer to herein as WGN). WGN is

a direct-to-consumer, multi-level marketing company with operations in countries including the U.S., Singapore, Ireland, Thailand,

India, the Philippines and Japan. WGN is 50% owned by each of Fabio Galdi, who serves as our Chairman of the

Board and Chief Technology Officer, and his brother, Gabriele Galdi. World Global Holdings Pte. Ltd., our largest stockholder,

which we refer to as WGH, is 50% owned by Gabriele Galdi, 28% owned by Alfonso Galdi, the brother of Fabio Galdi and Gabriele Galdi,

and 22% owned by Alessandro Senatore, who serves as a director of our company. Currently, WGH, WGN and their affiliates collectively

own approximately 75% of our outstanding common stock.

Our strategic goal

is to build a growing community of loyal

Helo

users in the wellness market who enjoy meaningful information from the user-friendly

applications on their

Helo.

Since the initial commercial launch of the first

Helo

devices in the second half of 2016,

we have shipped and been paid for over 570,000 units of

Helo

devices. Our

Helo

devices are being worn by end-users

in North America, Asia and Europe.

Helo

is more than just a wearable device that measures steps, heart rate and blood pressure

- what we believe differentiates

Helo

from other available wearable devices in the wellness sector is that our Life Sensing

Technology captures and processes additional user biometric data, populating our databases and enabling novel applications including

a non-invasive sugar trend monitoring and alcohol sensing applications that are currently under development.

Given the launch of our existing products

and our strong sales and marketing relationship with WGN, we believe that we are well positioned to address specific market segments

within the wellness market. We expect to enter the sugar trend wellness monitoring market in the latter part of 2018, following

the launch of

Helo Extense

, a wirelessly connected device that will enable users of

Helo LX

and

Helo LX+

,

an enhanced version of

Helo LX

with additional sensors that was launched in January 2018, to non-invasively monitor their

sugar trends on demand. In 2019, we expect to launch a

Helo

device with continuous alcohol sensing capability by completing

the development and integration of a miniaturized alcohol sensor in partnership with 1A SmartStart, LLC.

Our Technology

Life Sensing Technology is a proprietary

technology that has been developed by our in-house team. It uses state-of-the-art sensors that are selected or customized to our

specifications, and optimally configured for

Helo

devices. These sensors continuously collect specific user biometric data

that is encrypted and securely uploaded to our cloud based storage platform where the data signal is processed using our proprietary

algorithms and artificial intelligence to further refine the collected data. This ongoing data upload populates an ever-expanding

bio-parameter database that we believe will have the potential to develop into a diverse and rich resource that will be highly

sought after for wellness and health-related data mining, and third party software application (or App) development. Currently,

controlled access to our user-anonymized version of this data is available via our Open Application Programming Interface (or OpenAPI)

which delivers selected data to authorized third parties, enabling

Helo

Apps to query our database in real-time and providing

data for research, product evaluation and other purposes. We are responsible for the data we provide and the third parties who

access our data are responsible for interpreting our data and presenting it to end-users.

We believe that our data collection, user-approval

and authorization to use this data is enhanced by the close customer relationship established by WGN and the

Helo

users,

and this proximity enables us to secure permission to collect data on demand and to store, own and optimally analyze this data

for in-house and third-party development. We believe that our access to the user through WGN’s exclusive direct sales model

creates a protected market for our current product offerings and secures a ready market for our future product offerings currently

in development.

Our Relationship with WGN

WGN is a multi-level marketing company

specializing in sales, marketing and distribution of technology products worldwide online. WGN has served as our distribution

partner since 2014. In early 2016, WGN transitioned out of its worldwide mobile business to enter into the wearables market. Today,

our

Helo

line of products is WGN’s primary offering. We believe that sales of

Helo

through the direct selling

channel lends itself to a person-to-person promotion because although

Helo

is a technology product, its Apps provide meaningful

information to the user that is of personal nature and well suited to encourage person to person discussion.

Mr. Fabio Galdi, our Chairman of the Board

and Chief Technology Officer, and his brother Gabriele Galdi, each currently own 50% of WGN. Until May 2017, Fabio Galdi was the

Chief Executive Officer of our company, and currently he serves as the Chief Executive Officer of WGN. Gabriele Galdi is also the

owner of 50% of the outstanding equity of WGH, our largest stockholder and an affiliate of WGN. The remaining 50% of

WGH is owned by Alfonso Galdi, the brother of Fabio Galdi and Gabriele Galdi, who owns 28% of WGH, and Alessandro Senatore, a director

of our company, who owns 22% of WGH. Currently, WGH, WGN and their affiliates collectively own approximately 75% of our outstanding

common stock. Consequently, certain conflicts of interest, which are more fully discussed below, may exist between our

company, on the one hand, and WGN, on the other hand.

Based on our Strategic Partner Master Sales

and Worldwide Distribution Agreement that we entered into with WGN on October 1, 2017, WGN places

Helo

orders with us on

a prepaid basis at an agreed upon mark-up on our cost of manufacture. Once we receive orders from WGN, we authorize our supplier

to fulfill these orders and notify WGN when their orders are ready for pickup or shipment.

We have granted WGN a non-exclusive license

to use our brands (including the marks “

Wor(l)d

” and “

Helo

”), to promote sales of

Helo

devices to end-users in the wellness market worldwide as well as sales of

Helo

Apps to its users. We are in the process

of amending our Strategic Partner Master Sales and Worldwide Distribution Agreement, to provide that in addition to our mark-up

on

Helo

sales, we will receive a 30% net revenue share on all

Helo

App sales by WGN on Google Play Store, Apple’s

App Store or directly downloaded from the

Helo App Store

. Currently, there are some free Apps available for download by

Helo

users, and we expect to generate revenues from user paid

Helo

Apps sales beginning in 2019.

The initial term of the Strategic Partner

Master Sales and Worldwide Distribution Agreement with WGN is five years. After the initial term, the Strategic

Partner Master Sales and Worldwide Distribution Agreement shall renew automatically for an additional two year term and thereafter

for additional one year terms unless either we or WGN provides written notice to the other party on or prior to 180 days before

the expiration of the initial term of any renewal term of its intent to terminate the agreement at the end of the initial term

or renewal term, as applicable. Either party may also terminate the Strategic Partner Master Sales and Worldwide Distribution

Agreement for cause, for non-payment or non-performance by the other party or in the event of the insolvency of the other party.

We believe that our exclusive partnership

with WGN in the wellness market allows us to reach prospective end-users worldwide, and promote the benefits of a growing range

of targeted paid Apps. These Apps have been designed by third party subject matter experts to provide users with specific, relevant

and timely information so they can make appropriate lifestyle choices based on the current status of their continuously measured

bio-parameters. We believe that users will self-select their Apps to meet their information requirements. We believe that this

attribute will help build viral sales, loyalty to, and belief in, the

Helo

devices and will facilitate user endorsements

and recommendations. In addition, WGN’s turnkey online direct sales business model provides users with the instant ability

to make sales referrals for our products.

As WGH, WGN and their affiliates, currently

collectively own approximately 75% of our outstanding common stock, these persons and entities have the ability to control the

outcome of all matters submitted for stockholder action, including the approval of significant corporate transactions, the terms

of, and matters relating to, our Strategic Partner Master Sales and Worldwide Distribution Agreement with WGN, among others. They

also have the ability to exert a controlling influence on our management, direction and policies, including the ability to appoint

and remove our directors and officers. At present, WGH and its affiliates have appointed individuals who are officers,

executives, or directors of WGN and/or WGH as two of our three directors. These directors have fiduciary duties to both us and

WGN and/or WGH and may become subject to conflicts of interest on certain matters where WGN and/or WGH’s interests may not

be aligned with the interests of our minority stockholders. In addition, because WGH and its affiliates (which include

Mr. Gabriele Galdi and WGN) will hold more than 50% of our outstanding common stock following this offering, we meet the definition

of a “controlled company” under the corporate governance rules for NASDAQ-listed companies. Controlled companies

are not required to have a majority of independent directors, nor are they required to have a compensation committee or an independent

nominating function. Although our current intention is to not avail ourselves of the controlled company exemption, we

are eligible to do so and may determine to avail ourselves of these corporate governance exemptions in the future.

The Wearable Devices Market

Our current market is the quantified-self

(i.e. self-knowledge through self-tracking) wellness market. According to The Global Wellness Institute, the global

wellness industry is a $3.7 trillion market and growth is expected to accelerate by 17% in the next five years. In addition, the

worldwide wearables market is set to nearly double by 2021, according to International Data Corporation, with the wearable technology

market expected to reach $51.6 billion by 2022.

From a technology perspective, this market

has been revolutionized by Bluetooth wearable devices coupled with smartphones that connect to the cloud which have opened up a

vast array of new products and services. We believe that low power, full Internet of Things (or IoT) connectivity will also yield

another wave of innovation, as users will no longer be tied to their smartphones for connectivity purposes. In addition, the decreasing

costs of chips and other components, combined with miniaturization are also expected to expand the size of this market.

Market education by Fitbit, Apple and others

has encouraged wearable device acceptance. Today, the key drivers of this market include technology improvements and the “self-care

is the new healthcare” attitude phenomenon. We believe that increasing health and fitness awareness, combined with the rising

share of an aging population, increasing incidences of chronic and lifestyle diseases and a focus on prevention rather than cure,

will also increase the demand for quantified-self wellness products.

However, we also believe that the growth

of the wellness market could be inhibited by factors that might have a negative impact on user perception, such as devices that

generate data without giving insights into what that data signifies or devices that fail to correlate generated data with factors

affecting digital health or devices that fail to provide actionable intelligence regarding a digital health outcome. It is our

expectation that privacy and security concerns and evolving regulations in these areas will also have a material impact on the

future of the quantified-self wellness market.

Healthcare/Digital Health Market

As technology matures and as wearables and

sensors are further miniaturized, we believe that more novel applications for healthcare will be developed. We believe that we

will witness integration of medical sensors into consumer electronics that will enable home-based medical data gathering and support

remote care and preventive digital health programs with potential opportunities in areas such as wellness monitoring; safety monitoring;

home rehabilitation; treatment efficacy assessment and early detection of disorders.

Sugar Trend Monitoring

Market

The importance of blood glucose (also known

as blood sugar) monitoring is that it currently serves as the main tool used to check diabetes control. We plan to provide a wearable

device in the wellness sector that is non-invasive, blood free, and is capable of on-demand or continuous self-monitoring of the

user’s sugar trends, and that does not require consumable components (such as lancets or patches that attach to the skin).

If we are successful in introducing this device, we believe this will be a critical feature that will distinguish us from the other

wearable devices that are currently available in the wellness market.

Our Products

Our

Helo

wearable devices have been

designed to satisfy the demand from customers in the quantified-self wellness market. We have built a platform where both our

Helo

users leverage our device to monitor their wellness and where our

Helo

devices serve as a gateway to an automated data collection

capability that we believe opens up the opportunity for the development of a huge range of wellness Apps and data mining opportunities.

Since the fourth quarter of 2016, we have

moved from supplying only a single sensor device for our

Helo Classic

and

Helo LX

models to providing multi-sensors

for our

Helo LX+

model that was launched in the first quarter of 2018.

We have worked to optimize our Life Sensing

Technology and upgrade our

Helo

device from its

Classic

version to the current

Helo LX

, and introduced

Helo

LX+

in 2018 that offers more features to our users in the wellness market. We believe that our

Helo LX

and

Helo LX+

(which was launched at the Consumer Electronics Show 2018 in Las Vegas in January 2018) are designed and are suitable for the worldwide

quantified-self wellness market.

Our Mission and Growth Strategy

We seek to become a leading wellness wearable

device and “big data” provider whereby our

Helo

users would benefit from the availability of new products and

services (initially in the wellness sector and later in the healthcare market segment), developed from sharing their anonymized,

aggregated, multi-ethnic, bio-parameter data in a structured way with authorized third parties.

We intend to grow our business by adopting the following strategies:

|

|

·

|

Increase unit sales to the wellness market by:

|

|

|

o

|

Rolling out new

Helo

models at different price points with functionalities that are tailored to end-users in the different wellness market segments;

|

|

|

o

|

Enhancing

Helo

’s functionality and features by continuing to fund Life Sensing Technology development and building new sensor technology partnerships, so we can introduce more sensors that could capture more data or partner with algorithm experts who help enhance the processing of the data that we already capture so that third parties can develop more creative Apps.

|

|

|

·

|

Supporting the development and sales of

Helo

Apps:

|

|

|

o

|

Based on our existing operating platform and as we continue to collect biometric data from

Helo

users, we believe that the data gathered using our Life Sensing Technology will create significant revenue opportunities for us as more subject matter experts and third-party App developers begin to access our data by the second half of 2018.

|

|

|

o

|

Facilitating the accelerated development of

Helo Apps

by third party developers through the addition of our own development team to streamline and continuously upgrade the OpenAPI so that the process is fully turnkey and self-service. In addition, we plan to regularly promote the leading apps on the

Helo App Store

, at events like the Consumer Electronics Show and via our distributor, WGN.

|

|

|

·

|

Entry into the healthcare market. If and when our

Helo LX Pro

is approved as a medical device by the FDA for the U.S. market (and other appropriate authorities in other international jurisdictions) and we are able to secure a suitable distribution partner, we intend to launch a complementary product line that is specifically designed for the healthcare market, that would provide user-appropriate information to the user and physician-appropriate information to the physician.

|

|

|

·

|

Launch of

HeloPay

. We plan to launch an IoT device (such as

Helo 2

that is scheduled for delivery in 2019) that will have near field communication (NFC) technology, enabling

HeloPay

to work on

Helo

devices, with NFC and where Contactless Visa or MasterCard works, so we could offer instant worldwide payment capability for all

HeloPay

enabled devices.

|

Our Competitive Strengths

We believe that our strength comes from

our understanding of the wellness market, our ability to anticipate end-user’s needs, our ability to further develop, integrate

and monetize our Life Sensing Technology, our OpenAPI that allows third parties to develop novel, user targeted and responsive

Helo

Apps, our exclusive distribution model and the proprietary user database that we are able to build through the sale

of

Helo

wearable devices by our exclusive distributor, WGN. We believe we have a scalable business platform that is conducive

to potential growth in revenue and profitability, and we believe our business model will adapt well to changing market conditions.

Sales and Marketing

We believe that to obtain sales, we do not

need a dedicated and expensive sales and marketing team as our current business model is to sell our

Helo

devices directly

to WGN, who then sells the

Helo

devices to the end-users.

We believe WGN’s consultants and its

peer-to-peer referral process is ideal for the sale of our

Helo

devices in the wellness market. Leveraging its online model,

we believe WGN is capable of promoting our

Helo

devices worldwide efficiently and effectively as its consultants are motivated

by the referral-based commission process to identify and reach out to people who they believe may be interested in our

Helo

wearable device and wish to make a purchase.

Our Competition

The wellness market is both evolving and

fiercely competitive with a multitude of participants, including specialized consumer electronics companies, traditional health

and fitness companies, traditional watch companies, broad-based consumer electronics companies and manufacturers of lower-cost

devices. In addition, we compete with a wide range of stand-alone wellness and fitness related mobile apps that can be purchased

or downloaded through mobile app stores.

We are a small company that is relatively

new to the wearable devices market, and we will continue to face significant competition from larger, more established companies.

We believe we could be a niche player because of our exclusive distribution arrangement with WGN and our ability to leverage Life

Sensing Technology (such as our non-invasive sugar trend monitoring technology, which is currently in development) to bring alternative

wellness solutions to our end-users.

Risks Affecting Our Business

Investing in our securities involves significant

risks and uncertainties. You should carefully consider the risks and uncertainties discussed under the section titled “Risk

Factors” elsewhere in this prospectus before making a decision to invest in our securities. Certain of the key risks we face

include, without limitation:

|

|

·

|

We have a limited operating history and have incurred net losses of $6,719,509 since the commencement of operations. Our company is therefore subject to the risks associated with new businesses;

|

|

|

·

|

We will require additional financing to fund our current business plan, even following this offering. The failure to obtain such financing may restrict our ability to grow or may cause our business to fail;

|

|

|

·

|

Due to the nature of our business model, we rely to a very significant extent on WGN as the sole distributor of our products and services. The loss of this relationship would severely harm our business;

|

|

|

·

|

Our products are manufactured by a single contract manufacturer, and the loss of our manufacturing relationship would have a material adverse effect on our business;

|

|

|

·

|

The quantified-self wellness market that we operate in is a highly competitive market. If we do not compete effectively in terms of technology, pricing, functionality and design, our prospects, operating results, and financial condition could be adversely affected;

|

|

|

·

|

Our directors, officers and principal stockholders collectively control a significant amount of our shares, and their interests may not align with the interests of our other stockholders;

|

|

|

·

|

The loss of the services of our key employees, particularly the services rendered by Mr. Seán McVeigh, our Chief Executive Officer, Mr. Anthony S. Chan, our Chief Financial Officer and Mr. Fabio Galdi, our Chief Technology Officer, could harm our business;

|

|

|

·

|

Fabio Galdi, the Chairman of our Board of Directors, is a major stockholder of WGN and therefore may become subject to conflicts of interest that may not be resolved in favor of our common stockholders;

|

|

|

·

|

The lack of public company experience of certain members of our management team could adversely impact our ability to comply with the reporting requirements of U.S. securities laws.

|

|

|

·

|

If we are unable to successfully develop and timely introduce new products and services or enhance existing products and services, our business may be adversely affected;

|

|

|

·

|

The market for quantified-self wellness devices is still in the relatively early stages of growth and if it does not continue to grow, grows more slowly than we expect, or fails to grow as large as we expect, our business and operating results could be harmed;

|

|

|

·

|

Our failure or inability to protect our intellectual property rights, or claims by others that we are infringing upon or unlawfully using their intellectual property could diminish the value of our brand and weaken our competitive position, and adversely affect our business, financial condition, operating results, and prospects;

|

|

|

·

|

Our business is subject to a variety of U.S. and foreign laws and regulations that are continuously evolving, including those related to privacy, data security, and data protection due to our collection, processing, and use of personal information and other user data, such as the E.U. Data Protection Directive which covers the transfer of personal data from the European Union to the United States;

|

|

|

·

|

We do not currently have an active public market for our securities. An active trading market may not develop for our securities, and you may not be able to sell your common stock at or above the offering price per share;

|

|

|

·

|

The market price of our common stock has been and will likely continue to be volatile, and you could lose all or part of your investment; and

|

|

|

·

|

If we are unable to implement and maintain effective internal control over financial reporting in the future, our ability to produce accurate financial statements could be impaired, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our common stock may decline.

|

If any of these or other risks and uncertainties

occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading

price of our common stock would likely decline, and you may lose all or part of your investment.

Emerging Growth Company Under the JOBS Act

As a company with less than $1.07 billion

in revenues during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business

Startups Act of 2012, or the JOBS Act. As an emerging growth company, we have elected to take advantage of reduced reporting requirements

and are relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging

growth company:

|

|

·

|

we may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations;

|

|

|

·

|

we are exempt from the requirement to obtain an attestation and report from our auditors on whether we maintained effective internal control over financial reporting under the Sarbanes-Oxley Act;

|

|

|

·

|

we are permitted to provide less extensive disclosure about our executive compensation arrangements;

|

|

|

·

|

we are permitted to utilize the extended transition period for complying with new or revised accounting standards available to private companies; and

|

|

|

·

|

we are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements.

|

We may take advantage of these provisions

until December 31, 2019 (the last day of the fiscal year following the fifth anniversary of our initial public offering) if we

continue to be an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in

annual revenues, have more than $700 million in market value of our shares held by non-affiliates or issue more than $1.0 billion

of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens.

We have elected to provide two years of audited financial statements. Additionally, we have elected to take advantage of the extended

transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying

with new or revised accounting standards that have different effective dates for public and private companies until the earlier

of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act.

Going Concern

Our independent registered public accounting

firm has included a “going concern” paragraph in their opinion on our consolidated financial statements, expressing

substantial doubt that we can continue as an ongoing business for the next twelve months. Our consolidated financial statements

do not include any adjustments that may result from the outcome of this uncertainty. If we experience any unanticipated delay or

difficulties in the manufacture of our

Helo

wearable devices or if we cannot secure the financing needed to continue as

a viable business, our stockholders may lose some and/or all of their investment in us. We incurred $1,130,747 and $788,204 in

net losses for the years ended December 31, 2017 and 2016, respectively; and $504,147 in net loss for the quarter ended March 31,

2018. As of March 31, 2018, we had an accumulated deficit of $6,719,509.

Our Corporate History and 2017 Reorganization

We were incorporated in the State of Nevada

on October 22, 2010, under the name Halton Universal Brands Inc. Our initial business was acting as a brokerage, consulting and

marketing firm specializing in brand consulting and new product strategy consulting for emerging brands.

Effective October 29, 2014:

|

|

1.

|

Power Clouds Inc. (formerly known as World Assurance Group, Inc., and which we refer to as PWCL) acquired 7,095,000 shares of our common stock, representing 98% of the then issued and outstanding share capital of our company, for cash consideration of $378,000;

|

|

|

2.

|

We discontinued our previously existing brokerage and brand consultancy business; and

|

|

|

3.

|

We acquired a mobile phone business and related assets from PWCL for consideration of $557,898, funded by way of debt from PWCL

|

We accounted for the October 29, 2014 transactions

as a reverse merger of PWCL’s mobile phone business and related assets into the Company.

Effective on December 22, 2014 we changed

our name from Halton Universal Brands, Inc. to World Media & Technology Corp.

On March 25, 2015, we issued 12,000,000

shares of our common stock to Mr. Fabio Galdi, our then Chief Executive Officer and majority stockholder and currently our Chairman

of the Board and Chief Technology Officer, at $0.25 per share, for total proceeds of $3,000,000 in cash.

On March 30, 2015, we entered into a Common

Stock Purchase Agreement with PayNovi Ltd., an Irish limited liability company (or PayNovi) and Anch Holdings Ltd., an Irish limited

liability company (or Anch). Pursuant to the terms of the SPA, we purchased 350 shares of PayNovi’s common stock, which represented

35% of PayNovi’s issued and outstanding shares as of the closing date, for a purchase price consisting of 1,361,000 shares

of our common stock, which represented 5% of our then total issued and outstanding shares, and 3,937,005 shares of PWCL’s

common stock, which represented 5% of PWCL’s then total issued and outstanding shares.

In October 2015, PWCL distributed 14,021,122

of the 15,095,000 shares of our common stock held by PWCL to its stockholders. In December 2016, the remaining 1,073,878 shares

of our common stock held by PWCL were transferred to World Global Cash Pte. Ltd., a wholly-owned subsidiary of WGN.

On October 5, 2016, we filed a Form 15 to

suspend our duty to file reports under Sections 13 and 15(d) of the Securities Exchange Act of 1934, as amended. In order to enable

our common stock to continue to trade on the OTC Pink Market after the filing of the Form 15, we have satisfied our obligations

to make adequate current information publicly available within the meaning of Rule 144(c)(2) of the Securities Act of 1933, as

amended, through the filing of Annual and Quarterly Reports and Supplemental Information with OTC Markets. Copies of these reports

are publicly available on the OTC Disclosure and News Service.

On January 6, 2017, we issued 100 shares

of our Series A Super Voting Preferred Stock to Fabio Galdi in exchange for the cancellation of $250,000 of unpaid management service

fees.

On October 1, 2017, we, Fabio Galdi, WGN

and WGN’s wholly owned subsidiary, World Global Assets Pte. Ltd., entered into a Stock Exchange, Debt Forgiveness and Intellectual

Property Assignment Agreement. Pursuant to the terms of that Agreement, we issued 8,000,000 shares of our common stock to WGN.

We also transferred 350 common stock shares of PayNovi to WGN and agreed to forgive the remaining outstanding balance $1,140,506

owed to us by WGN for borrowed money.

In exchange: (i) Fabio Galdi returned to

us for cancellation all 100 shares of our Series A Super Voting Preferred Stock held by Fabio Galdi, (ii) Mr. Galdi forgave the

amounts owed by the Company to him for past services rendered in the aggregate amount of $150,000, (iii) WGN assigned and transferred

to us of all of its right, title and interest in and to certain technology, intellectual property and intellectual property rights,

which rights comprise a key component of our current business, (iv) WGN and Mr. Galdi agreed not to source, promote or enter in

to any agreement for any technology similar to our technology from any supplier other than our company and (v) WGN agreed to terminate

and forego its exclusive relationship with Quality Technology Industrial Co. Ltd. and to purchase

Helo

devices directly

from us upon the terms and subject to the conditions set forth in a Strategic Partner Master Sales and World Wide Distribution

Agreement dated as of October 1, 2017 between us and WGN.

As a result of the October 1, 2017 transactions,

our business model is more akin to a traditional wholesale model whereby our distributor, WGN, places its orders directly with

us on a prepaid basis and, based on such orders, we will instruct our supplier to build and ship the

Helo

devices in accordance

with the specifications furnished by WGN.

On December 4, 2017, we changed our name

to World Technology Corp, with the stock symbol “WCOR” to re-position our company as a technology company.

Corporate Information

Our principal offices are located at 600

Brickell Avenue, Suite 1775, Miami, Florida 33131

,

and our telephone number is (855)-467-6500.

Our website is https://www.worldcorp.com. The website address is intended to provide inactive, textual references only and the

information on or that can be accessed through such website is not part of this prospectus.

THE OFFERING

The following summary contains basic

information about our securities and the offering and is not intended to be complete. It does not contain all the information that

may be important to you. For a more complete understanding of our common stock and Warrants, you should read the section entitled

“Description of Capital Stock” in this prospectus.

|

Common stock offered by us

|

|

shares of common stock

|

|

|

|

|

|

Common stock outstanding before this offering

|

|

shares of common stock

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

shares of common stock ( shares of common stock if the underwriter exercises in full its overallotment option, assuming none of the Warrants issued in this offering are exercised)

|

|

|

|

|

|

Warrants offered by us

|

|

Warrants to purchase an aggregate of shares of common stock. Each Warrant

entitles the holder to purchase one share of common stock at an exercise price of $ per share, will be immediately

exercisable and will expire on the fifth anniversary of the original issuance date, This prospectus also relates to the

offering of the shares of common stock issuable upon exercise of the Warrants. We will not list the Warrants on any securities exchange or other trading market. Without a trading market, the liquidity of the Warrants will be limited.

|

|

|

|

|

|

Overallotment option

|

|

We have granted the underwriter an option to purchase up to shares

of our common stock and/or up to additional Warrants, in any combinations thereof, at the public offering

price, solely to cover over-allotments, if any. This option is exercisable, in whole or in part, for a period of

45days from the date of this prospectus.

|

|

|

|

|

|

Use of proceeds

|

|

We estimate that the net proceeds from this offering will

be approximately $10.0 million, before taking into account the proceeds to be received from any future exercise of

the Warrants issued to investors in this offering and after deducting underwriting discounts and commissions and

offering expenses payable by us. If the underwriter exercises its overallotment option in full, we estimate that the

net proceeds from this offering will be approximately $ million, before taking into account the proceeds to be

received from any future exercise of the Warrants issued to investors in this offering and after deducting

underwriting discounts and commissions and offering expenses payable by us Although we will have broad discretion on

the use of proceeds from this offering, we intend to use the net proceeds from this offering for the

following purposes:

(i) approximately $3.5 million for research and development;

(ii) approximately $1.5 million for talent recruitment and retention;

(iii) approximately $2.0 million for business development; and

(iv) the remainder for working capital and general corporate

purposes and other general and administrative matters.

See "Use of Proceeds".

|

|

|

|

|

|

Dividend Policy

|

|

We have never declared or paid dividends on our common stock and currently do not anticipate declaring or paying any cash dividends on our common stock following this offering

|

|

|

|

|

|

Transfer Agent, Warrant Agent and Registrar

|

|

ClearTrust, LLC

|

|

|

|

|

|

Lockup agreements

|

|

See “Underwriting” for more information.

|

|

|

|

|

|

Risk factors

|

|

An investment in our company entails a high degree of risk.

See “Risk Factors” beginning on page 12 of this prospectus and the other information included in this prospectus for a discussion of factors you should carefully consider before investing in our securities.

|

|

|

|

|

|

OTC Pink MKT trading symbol

|

|

WCOR

|

|

|

|

|

|

Proposed NASDAQ symbol and listing

|

|

We have applied to list our common stock on the NASDAQ Capital Market under the symbol "WCOR”. There can be no assurance that our application will be approved. The closing of this offering is contingent upon the successful listing of our common stock on the NASDAQ Capital Market.

|

Unless we indicate otherwise, all information

in this prospectus assumes no exercise by the underwriters of the overallotment option or of the Representative’s Warrants,

and is based on 36,722,244 shares of common stock issued and outstanding as of July 13, 2018, and excludes:

|

|

·

|

7,000,000 shares of common stock that are eligible for future option grants under our 2018 Stock Incentive Plan;

|

|

|

·

|

shares of common stock issuable upon the exercise of the Warrants offered hereby at an exercise price of $

per share; and

|

|

|

·

|

shares of common stock issuable upon the

exercise of the Representative’s Warrants at an exercise price of $ per share, including

shares of common

stock to be issued upon the exercise of Warrants included in the Representative’s Warrants at an exercise price of $

per share.

|

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table

includes (i) summary consolidated statements of operations data for the years ended December 31, 2017 and 2016 and the quarters

ended March 31, 2018 (unaudited) and 2017 (unaudited) and (ii) summary consolidated balance sheet data as of December 31, 2017

and 2016 and March 31, 2018, derived from our audited and unaudited consolidated financial statements and related notes included

elsewhere in this prospectus. Our consolidated financial statements are prepared and presented in accordance with accounting principles

generally accepted in the United States of America. Our historical results are not necessarily indicative of the results that may

be expected in the future. You should read this information together with the sections entitled “Capitalization”, “Management’s

Discussion and Analysis of Financial Condition and Results of Operations”, “Selected Consolidated Financial

Data”, and our consolidated financial statements and related notes included elsewhere in this prospectus.

|

|

|

Years Ended December

31,

|

|

|

Three Months Ended

March 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2018

|

|

|

2017

|

|

|

Statements of Operations Data

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

Total revenues

|

|

$

|

4,110,000

|

|

|

$

|

2,038,171

|

|

|

$

|

2,463,500

|

|

|

$

|

500,000

|

|

|

Total cost of revenues

|

|

|

1,845,000

|

|

|

|

1,516,180

|

|

|

|

1,906,500

|

|

|

|

-

|

|

|

Gross profit

|

|

|

2,265,000

|

|

|

|

521,991

|

|

|

|

557,000

|

|

|

|

500,000

|

|

|

Total operating expenses

|

|

|

3,436,861

|

|

|

|

1,378,116

|

|

|

|

1,061,147

|

|

|

|

597,622

|

|

|

Loss from operations

|

|

|

(1,171,861

|

)

|

|

|

(856,125

|

)

|

|

|

(504,147

|

)

|

|

|

(97,622

|

)

|

|

Total other income

|

|

|

41,114

|

|

|

|

67,921

|

|

|

|

-

|

|

|

|

13,554

|

|

|

Net loss

|

|

$

|

(1,130,747

|

)

|

|

$

|

(788,204

|

)

|

|

$

|

(504,147

|

)

|

|

$

|

(84,068

|

)

|

|

Net loss per share: basic and diluted

|

|

$

|

(0.04

|

)

|

|

$

|

(0.03

|

)

|

|

$

|

(0.01

|

)

|

|

$

|

(0.00

|

)

|

|

Weighted-average number of common shares outstanding: basic and diluted

|

|

|

30,644,436

|

|

|

|

28,581,000

|

|

|

|

36,722,244

|

|

|

|

28,662,994

|

|

|

|

|

December 31,

|

|

|

March

|

|

|

|

|

2017

|

|

|

2016

|

|

|

31, 2018

|

|

|

Balance Sheet Data

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

Total current assets

|

|

$

|

1,992,761

|

|

|

$

|

429,114

|

|

|

$

|

1,601,122

|

|

|

Total assets

|

|

|

2,021,049

|

|

|

|

1,305,939

|

|

|

|

1,627,511

|

|

|

Total current liabilities

|

|

|

1,783,623

|

|

|

|

350,000

|

|

|

|

1,894,232

|

|

|

Total liabilities

|

|

|

1,783,623

|

|

|

|

350,000

|

|

|

|

1,894,232

|

|

|

Total stockholders’ equity (deficit)

|

|

|

237,426

|

|

|

|

955,939

|

|

|

|

(266,721

|

)

|

|

Total liabilities and stockholders’ equity

|

|

$

|

2,021,049

|

|

|

$

|

1,305,939

|

|

|

$

|

1,627,511

|

|

RISK FACTORS

An investment in our securities involves

a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information

in this prospectus in evaluating our company and our business before purchasingour securities. Our business, operating results

and financial condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all

or part of your investment due to any of these risks.

Risks Related To Our Financial Position

We have a limited operating history and have incurred

significant losses since the commencement of operations. Our company is therefore subject to the risks associated with new businesses.

We commenced operations in May 2014 and

have generated limited revenues to date. We incurred $1,130,747 and $788,204 in net losses for the years ended December 31, 2017

and 2016, respectively, and $504,147 in net loss for the quarter ended March 31, 2018. As of March 31, 2018, we had an accumulated

deficit of $6,719,509.

We have a limited operating history upon

which an evaluation of our future success or failure can be made. We have developed new Life Sensing Technology that has generated

limited revenue and carries significant risks generally associated with the development and manufacturing and marketing of any

new product or service. As these products are new in the market, there can be no certainty that customers will ultimately adopt

the products and services we manufacture. Even if we do generate revenues from these new products in the future, these revenues

may not be sufficient to cover our operating costs.

It is too early to predict if we will be

able to generate significant revenues. Therefore, we are, and expect for the foreseeable future to be, subject to all the risks

and uncertainties, inherent in a new business and the development and sale of new wearable devices and related software applications.

As a result, we may be unable to fully develop, sell and derive material revenues from our products in the timeframes we project,

if at all, and our inability to do so would materially and adversely impact our viability as a company. In addition, we still must

establish certain functions necessary to operate our business, including finalizing our managerial and administrative structure,

continuing product and technology development, implementing financial systems and controls and personnel recruitment.

Accordingly, you should consider our prospects

in light of our limited operating history and the costs, uncertainties, delays and difficulties frequently encountered by companies

in their initial revenue generating stages, particularly those in the wearable device sector. In particular, potential investors

should consider that there is a significant risk that we will not be able to:

|

|

·

|

implement or execute our current business plan, or that our business plan is sound;

|

|

|

·

|

maintain our management team and Board of Directors;

|

|

|

·

|

raise sufficient funds in the capital markets or otherwise to effectuate our business plan; or

|

|

|

·

|

determine that our technologies that we have developed are commercially viable; and/or

|

If we are unable to manage these and similar

risks, we may be unable to achieve sustainable revenues or net profits. If we cannot generate sufficient revenues to operate profitably,

we will not be able to execute our business plan and our business may fail.

Our independent registered public accounting firm has

expressed substantial doubt about our ability to continue as a going concern.

Our auditors have included a “going

concern” paragraph in their opinion on our consolidated financial statements, expressing substantial doubt as to our ability

to continue as an ongoing business for the next twelve months. Our consolidated financial statements do not include any adjustments

that may result from the outcome of this uncertainty. If we experience any unanticipated delay or difficulties in the manufacture

and distribution of our

Helo

wearable devices and if we cannot secure the financing needed to continue as a viable business,

our stockholders may lose some or all of their investment in us.

We will require additional financing to fund our current

business plan, even following this offering. The failure to obtain such financing may restrict our ability to grow or may cause

our business to fail.

We have limited cash, and our working capital

is dependent on the timing and size of the

Helo

orders that our sole exclusive distributor will place with us. Our current

capital is not sufficient to enable us to execute our current business plans, and we will be required to obtain additional financing

to fund our business operations. We may not have funds sufficient for additional investments in our business that we might

want to undertake. We will require additional capital in the near and over the longer term.

We plan to pursue sources of such capital

through various financing transactions and arrangements, including debt financing, equity financing, joint venturing of projects

or other means. We may be unable to locate suitable financing transactions in the time period required or at all, or on terms we

find attractive, and we may not obtain the capital we require by other means. If we do succeed in raising additional capital, the

capital received may not be sufficient to fund our operations going forward without obtaining further additional financing.

Moreover, if we raise additional capital

by issuing equity securities, the percentage ownership of our existing stockholders will be reduced, and accordingly our stockholders

may experience substantial dilution. We may also issue equity securities that provide for rights, preferences and privileges senior

to those of our common stock.

Debt financing, if obtained, may involve

agreements that include liens on our assets, covenants limiting or restricting our ability to take specific actions, such as incurring

additional debt, could increase our expenses and require that our assets be provided as a security for such debt. Debt financing

would also be required to be repaid regardless of our operating results.

Our ability to obtain needed financing may

be impaired by conditions in the capital markets (both generally and in our industry in particular). Some of the contractual arrangements

governing our operations may require us to maintain minimum capital, and we may lose our contract rights if we do not have the

required minimum capital. If the amount of capital we are able to raise from financing activities is insufficient, we may be required

to curtail our business plans or our business may fail, which in either case could result in the loss of your investment.

Risks Related to Our Business and Industry

The loss of the services of our key employees, particularly

the services rendered by Mr. Seán McVeigh, our Chief Executive Officer, Mr. Anthony S. Chan, our Chief Financial Officer

and Mr. Fabio Galdi, our Chairman and Chief Technology Officer, could harm our business.

Our success depends to a significant degree

on the services rendered to us by our key employees. In particular, we are heavily dependent on the continued services of Mr. Seán

McVeigh, our Chief Executive Officer, Mr. Anthony S. Chan, CPA, our Chief Financial Officer and Mr. Fabio Galdi, our Chairman and

Chief Technology Officer. The loss of any key employees, including members of our senior management team, and our inability to

attract highly skilled personnel with sufficient experience in our industry could harm our business. In addition, we do not maintain

any “key-man” insurance policies on Mr. Seán McVeigh, Mr. Anthony S. Chan or any other employees.

If we fail to attract, train and retain

sufficient numbers of qualified people, our prospects, business, financial condition and results of operations will be materially

and adversely affected. In order to continue to provide quality products in our rapidly changing business, we believe it is important

to attract and retain personnel with experience and expertise relevant to our business. Due to the level of technical expertise

necessary to support our existing and new customers, our success will depend upon our ability to attract and retain highly skilled

and seasoned professionals. Competition for highly skilled personnel is intense and there may be only a limited number of persons

with the requisite skills to serve in these positions. Due to the competitive nature of the labor markets in which we operate,

we may be unsuccessful in attracting and retaining these personnel. Our inability to attract and retain key personnel could adversely

affect our ability to develop and manufacture our products.

The lack of public company experience of certain members

of our management team could adversely impact our ability to comply with the reporting requirements of U.S. securities laws.

While our Chief Financial Officer has extensive

public company experience, our Chief Executive Officer and other members of its senior management team only have limited public

company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by the

Sarbanes-Oxley Act of 2002 or responsibilities such as complying with federal securities laws and making required disclosures on

a timely basis. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to

comply with the reporting requirements of the Securities Exchange Act of 1934, as amended, which is necessary to maintain our public

company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy

in which event you could lose your entire investment in our company.

The Chairman of our Board of Directors may become subject

to conflicts of interest that may not be resolved in favor of our common stockholders.

The Chairman of our Board of Directors,

Mr. Fabio Galdi is also a co-founder and the controlling stockholder of WGN. Such association may give rise to potential conflicts

of interest, especially with regard to our key Strategic Partner Master Sales and World Wide Distribution Agreement with WGN.

Pursuant to Nevada law, directors of our

company and controlling stockholders owe fiduciary duties to the company and its stockholders. Directors are required to exercise

the duty of care and the duty of loyalty and to disclose any interest that they may have in any of our projects or opportunities.

We intend to adopt a code of ethics and an audit committee charter, both of which will become effective upon the effectiveness

of the registration statement to which this prospectus is a part. The code of ethics will provide that an interested director needs

to refrain from participating in any discussion among senior officers of our company relating to an interested business and may

not be involved in any proposed transaction with such interested business. Furthermore, the audit committee charter will provide

that most related party transactions must be pre-approved by the audit committee, which will consist of only independent directors.

A majority of directors and certain of our officers live

outside the United States, making it potentially difficult for an investor to enforce liabilities in foreign jurisdictions.

We