Kirkland Beats, Gives Outlook - Analyst Blog

March 15 2013 - 10:07AM

Zacks

Kirkland Inc.’s (KIRK) fourth quarter 2012

earnings of 79 cents per share surpassed the Zacks Consensus

Estimate of 74 cents and the year-ago quarter earnings by 6.8%.

Earnings were, however, within the company's guidance range.

Kirkland generated modest earnings on the back of higher sales and

tight expense control.

Quarter in Detail

Kirkland’s net sales climbed 9.2% to $162.9 million from $149.1

million in the year-ago quarter primarily attributable to increase

in items per transactions. Sales were slightly above the Zacks

Consensus Estimate of $162.0 million and were within the company

guidance range of $160 million - $163 million.

Comparable store sales, including e-commerce and excluding the

extra week in the last quarter, declined 2.6% compared with an

increase of 1.4% in the year-ago quarter.

Positive comparative sales results in Florida and Louisiana were

offset by below-average performance in the Southeast and far West.

Strong sales of merchandise like mirrors, fragrance, and seasonals

were offset by a decline in decorative accessories, art, furniture,

frames and impulse.

The company opened 17 stores and closed 2 during the quarter.

Kirkland had a total of 323 stores at the end of 2012.

On a year-over-year basis, gross profit climbed 3.1% to $66.1

million, while gross margin contracted 240 basis points to 40.6% of

sales due to higher merchandise expenses.

Full Year Results

For the full year 2012, Kirkland posted earnings of 77 cents per

share, surpassing the Zacks Consensus Estimate by 10%. Earnings

lagged the year-ago quarter earnings by 18.9%.

Net sales climbed 4.2% to $448.4 million from $430.3 million in

the year-ago quarter, primarily attributable to an increase in the

number of items per transaction. Sales were slightly above the

Zacks Consensus Estimate of $448.0 million.

Balance Sheet

Kirkland exited the quarter with cash and cash equivalents of

$67.8 million compared with $34.3 million in the prior quarter.

Deferred rent and other long-term liabilities stood at $44.2

million compared with $42.1 million in the last quarter.

Guidance

Management expects earnings per share for fiscal 2013 in a range

of 70 cents–85 cents. Kirkland’s expects fiscal 2013 total sales to

increase approximately 5% to 7% compared with fiscal 2012.

Kirkland expects to open 25 to 35 new stores and close

approximately 10 to 15 stores. Store openings will be skewed toward

the second and third quarters of 2013. The company expects capital

expenditure in fiscal 2013 to be in a range of $22 million to $25

million.

The Zacks Consensus Estimates for the first quarter and fiscal

2013 are pegged at 9 cents and 84 cents, respectively.

Kirkland currently holds a Zacks Rank #3 (Hold). Other stocks in

the retail and wholesale sector worth considering include

New York & Company Inc. (NWY), H &

M Hennes & Mauritz AB (HNNMY) and Zumiez

Inc (ZUMZ), all of which carry a Zacks Rank #2 (Buy).

HENNES&MAURIT (HNNMY): Get Free Report

KIRKLANDS INC (KIRK): Free Stock Analysis Report

NEW YORK & CO (NWY): Free Stock Analysis Report

ZUMIEZ INC (ZUMZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

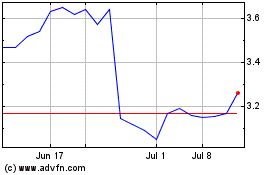

Hennes and Mauritz AB (PK) (USOTC:HNNMY)

Historical Stock Chart

From Jan 2025 to Feb 2025

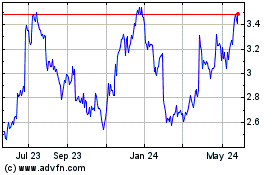

Hennes and Mauritz AB (PK) (USOTC:HNNMY)

Historical Stock Chart

From Feb 2024 to Feb 2025