Asian Shares Broadly Up, Tracking U.S. Gains

December 06 2016 - 12:40AM

Dow Jones News

Asian share markets were broadly higher Tuesday, tracking

overnight gains on Wall Street, as investors globally brushed off

Italian voters' rejection of constitutional changes.

Japan's Nikkei Stock Average was up 0.4%, South Korea's Kospi

rose 1.5%, Australia's S&P/ASX 200 was up 0.5%, and Taiwan's

Taiex gained 1%.

The focus is " back to reflation, and it's back to assessing

2017," said Chris Weston, chief market strategist at IG. While the

issues facing Italy are systemic, they are largely contained for

now, he said. On Sunday, Italian voters rejected a

government-backed plan to overhaul the legislature to make it

easier to pass laws.

Finance stocks in Asia were among the biggest gainers Tuesday,

helped by the calm global reaction to Italy's referendum. In Hong

Kong, banking giant HSBC was up 2.6%, while in Japan, shares of

Nomura Holdings gained 2.7% and Mitsubishi UFJ Financial Group rose

1%.

Investors continue to bet on the "reflation trade" on hopes that

U.S. President-elect Donald Trump will increase fiscal spending,

lower corporate taxes, and boost growth and inflation.

Those expectations were given a boost by encouraging economic

data out of the U.S. and China in recent days, as well as a deal

last week by key oil-producing nations to cut global crude-oil

output, helping lift prices.

Overnight in the U.S., the ISM nonmanufacturing index rose to

57.2 in November from 54.8 in the previous month. The positive

data, along with a largely muted reaction to the Italian results,

helped drive the Dow Jones Industrial Average to close up 0.2% on

Monday, while the tech-heavy Nasdaq added 1%.

In Hong Kong, the Hang Seng Index was up 0.7%, in the second day

of a new trading link between the city's exchange and Shenzhen,

home to China's rising tech firms. The agreement also opens the

door for Chinese investors to buy into some small-cap stocks.

The Shenzhen Composite Index was up 0.3%, outperforming the

Shanghai Composite Index, which was flat.

In Australia, shares were boosted by further gains in oil prices

to hit a fresh one-year high overnight. Prices are up as many

analysts raise hopes that the Organization of the Petroleum

Exporting Countries is more likely to abide by this deal than those

in years past.

"Besides, they only must be on their best behavior for a few

months to get the market into a daily supply deficit," said Phil

Flynn, senior market analyst at the Price Futures Group, in a

note.

Among energy stocks, Oil Search added 0.1%, with their gains

capped as oil prices retreated in Tuesday Asian trade.

Australia's central bank kept its cash rates target at a record

low 1.5% Tuesday. The decision was widely expected by markets.

Traders, meanwhile, are awaiting data on Australia's economy,

due Wednesday. Economists predict a weak economy in the third

quarter as mining investment continues to contract and as wages and

profit growth remain sluggish.

However, signs of weakness in the economy might prove temporary,

given recent stellar gains in prices of commodities such as coal

and iron ore, the country's biggest resource exports, analysts

say.

"There's no need for [Australia's central bank] to cut rates

given...the positives surrounding the commodity sector right now,"

said Hue Lu, senior investment specialist at BNP Investment

Partners.

James Glynn, Kenan Machado and Kosaku Narioka contributed to

this article.

Write to Willa Plank at willa.plank@wsj.com

(END) Dow Jones Newswires

December 06, 2016 01:25 ET (06:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

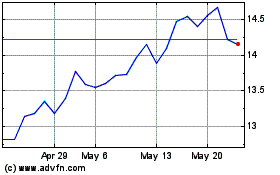

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Jan 2025 to Feb 2025

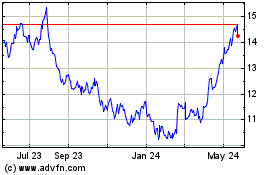

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Feb 2024 to Feb 2025