Hitachi to Take On GE in Power Deal -- WSJ

December 18 2018 - 2:02AM

Dow Jones News

By Takashi Mochizuki

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 18, 2018).

TOKYO -- Hitachi Ltd. agreed to acquire a power-grid unit from

Switzerland-based ABB Ltd. for $6.4 billion, as the Japanese

company beefs up its industrial portfolio against rivals such as

General Electric Co.

The deal, the largest yet for 108-year-old Hitachi, would give

it 80.1% of the ABB unit initially, with an option to take a 100%

stake later. ABB plans to spin off the unit before the deal

closes.

Hitachi, once known as a maker of televisions and other consumer

electronics, has given up most of its consumer lines after heavy

losses a decade ago. It now focuses on big-ticket equipment such as

power plants and train systems. Hitachi executives have been saying

their ambition is to make the company big enough to go toe-to-toe

with GE and Siemens AG.

"Hitachi will become a leader in the global arena and today's

deal is the first specific case I am presenting to you of how we

plan to achieve the goal," said Hitachi Chief Executive Toshiaki

Higashihara.

The deal carries risks including growing competition from lower

cost players in China and the difficulty of managing a large global

workforce from Tokyo. Hitachi said the unit it is buying has about

36,000 employees.

Toshiba Corp. aimed for similar global sway when it bought

nuclear-technology company Westinghouse Electric Co. for $5.4

billion in 2006, only to see Westinghouse file for bankruptcy a

decade later and nearly bring down Toshiba itself.

ABB said Hitachi was the best owner for the maturing business

during rapidly changing market conditions. It said it preferred to

focus on growth areas such as robotics and industrial

automation.

"Today's actions will create a new ABB, a leader focused in

digital industries," said Chief Executive Ulrich Spiesshofer in a

statement.

Hitachi executives acknowledged the business of power

transmission lines and related infrastructure often requires

lengthy construction and negotiations with governments. Mr.

Higashihara said the risk was manageable because of stable demand

for power-grid equipment in comparison to nuclear power, including

in emerging markets such as India, China and Thailand.

Hitachi plans to spend another few billion dollars in the next

five years or so to take the full control of the ABB unit. Mr.

Higashihara said the price was reasonable because Hitachi is buying

a business that is already one of the largest globally.

The ABB unit recorded revenue of more than $10 billion last

year. Hitachi agreed to keep current management and the unit will

keep its headquarters in Switzerland, ABB said.

The deal is set to close by the first half of 2020, the

companies said.

Write to Takashi Mochizuki at takashi.mochizuki@wsj.com

(END) Dow Jones Newswires

December 18, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

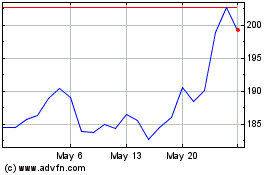

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

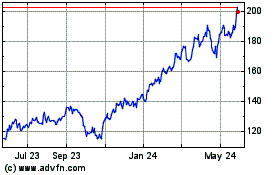

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Jan 2024 to Jan 2025