The FTSE 100 closed higher on Monday as British Airways owner

IAG, Vodafone and Rio Tinto all finished in positive territory.

"European markets have got off to a mixed start to the week with

DAX and FTSE 100 pushing higher, while a sharp rise in Italian

borrowing costs appears to be weighing on the FTSE MIB which is

down heavily for the third day in a row," says Michael Hewson,

chief market analyst at CMC Markets U.K. Elsewhere, Brent prices

reached another new seven-year high after Saudi Arabia increased

prices for Asia customers. Talk over a possible Russian invasion of

Ukraine also continues to underpin prices, he says.

Companies News:

Lok 'N Store Says 1H Performance Was Strong; Occupancy and

Pricing Improved

Lok 'n Store Group PLC said Monday that its performance in the

first half of fiscal 2022 was strong, boosted by significant

improvements in occupancy and pricing, and that self-storage

revenue was up 34% on the previous year.

---

Bodycote CFO Dominique Yates to Retire Once Successor

Appointed

Bodycote PLC said Monday that Chief Financial Officer Dominique

Yates will retire from the company once a successor has been

appointed and an orderly handover of duties has been completed.

---

Pets at Home to Appoint Lyssa McGowan as CEO

Pets at Home Group PLC said Monday that it has appointed Lyssa

McGowan as chief executive officer with effect starting June 1,

after current CEO Peter Pritchard said he will step down from the

role in summer.

---

Zinc Media Group Expects 2H Adj Ebitda to Beat Management

Views

Zinc Media Group PLC said Monday that adjusted earnings before

interest, taxes, depreciation and amortization for the second half

of 2021 are expected to be above management views, and that it has

started 2022 with new-business wins.

---

Lamprell 2H Earnings Hit by Omicron, Adverse Weather

Lamprell PLC on Monday warned that its performance was hurt by

the Covid-19 Omicron variant and adverse weather conditions in the

second half of 2021, and said that it may raise further equity this

year.

---

Vaalco Energy Reports Successful Well Completion at Oil Field

Offshore Gabon

Vaalco Energy Inc. said Monday that it has successfully

completed the Etame 8H-ST oil well in the Etame field offshore

Gabon.

---

Argo Blockchain January Revenue, Bitcoin Mining Slips

Argo Blockchain PLC said Monday that its revenue and the number

of bitcoins it mined in January fell compared to December.

---

Science Group Appoints Jon Brett as Official Finance

Director

Science Group PLC said Wednesday that Jon Brett, who had been

appointed as the acting finance director of the board on Aug. 10,

2021, has now been named group finance director.

---

Filta Group 2021 Revenue Rose, Boosted by North American

Sales

Filta Group Holdings PLC said Monday that revenue rose in 2021

thanks to a stronger performance in the third and fourth quarters

of the year, marked by a significant sales recovery in North

America.

---

Eleco CFO to Step Down Immediately; Interim CFO Appointed

Eleco PLC said Monday that Chief Financial Officer Robert Tearle

is stepping down with immediate effect, and it has appointed Rose

Clark as interim CFO.

---

Oriole Resources Appoints Eileen Carr as Nonexecutive Chair

Oriole Resources PLC said Monday that it has appointed Eileen

Carr as nonexecutive chair.

---

Great Portland Estates New Lettings Set Record High for

Leasings

Great Portland Estates PLC said Monday that it has agreed upon a

number of new lettings since Oct. 1, achieving record leasing rent

for the fiscal year.

---

Nanosynth Appoints Peter Jeremy McNamara COO, Andrew Stedman

CFO

Nanosynth Group PLC said Monday that it has appointed Peter

Jeremy McNamara as chief operating officer and Andrew Stedman as

chief financial officer with immediate effect, and that both

positions will be non board roles.

---

Tufton Oceanic Assets Sells Two Containerships for $21 Mln

Tufton Oceanic Assets Ltd. said Monday that it has agreed to

sell the containerships Candy and Echidna for $21.0 million in

total.

---

Royal London in Initial Takeover Talks With LV= After Bain

Offer's Rejection

Royal London Mutual Insurance Society Ltd. said Monday that it

has had initial discussions with LV= to explore a potential

acquisition of the U.K. insurance company.

---

LV= Appoints Seamus Creedon Interim Chairman

Liverpool Victoria Financial Services Ltd., known as LV=, said

it has appointed Seamus Creedon interim chairman, taking over from

Alan Cook.

---

Prospex Energy Raises GBP2.4 Mln to Fund Selva Project in Italy,

Shares Fall

Shares in Prospex Energy PLC fell Monday after the company said

it has raised 2.4 million pounds ($3.25 million) via a conditional

share placing and subscription to increase its stake in the Selva

field and funds its development.

---

Taylor Wimpey's Internal CEO Appointment May Raise Eyebrows --

Analysis

Taylor Wimpey PLC's internal appointment of Jennie Daly as its

new incoming chief executive officer could raise eyebrows, given

activist investor Elliott Management's hard lobbying for new blood

at the top.

Market Talk:

January Power-Generation Data Seen Positive for RWE, Negative

for Enel

1047 GMT - Power-generation data for January suggests a positive

implication for RWE and a negative implication for Enel, Jefferies

says. Strong onshore wind performance in the U.S., above-average

solar levels in the U.S. and Spain, and strong German hydroelectric

production seem to favor German utility RWE, Jefferies says.

Conversely, very low hydroelectric output in Italy and negative

onshore wind performance overall don't bode well for Milan-listed

energy group Enel, the bank says. "2022 kicks off with record

January solar levels in Spain, France and U.K., low hydro output in

Italy, Spain and U.K., very high wind speeds across East/Northern

Europe, low wind in West Europe, and strong U.S. wind speeds,"

Jefferies adds.

--

Mining Stocks Are Still Worth Going Long on Despite Short-Term

Volatility, Jefferies Says

1036 GMT - Risk-off sentiment in the markets could pressure

mining shares in the very near term as the cyclicality of mining is

understandably a concern in the face of a tightening cycle,

Jefferies says. However, a modest slowdown in global growth isn't

enough to stop the commodity freight train, and even a sharp

slowdown would only have a transitory impact, the bank says. In

addition, Jefferies says that "the ESG genie is out of the bottle

now," creating unprecedented positive structural implications for

metals demand and supply. This will lead to higher prices in the

future, as supply growth lags demand, it says. Equity valuations

imply, however, that we are at peak now, Jefferies says.

---

Pets at Home Has Significant Cross-Sell Opportunities and Strong

Support to Its Margins

1004 GMT - Pets at Home Group has significant cross-sell

opportunities and strong support to its already robust margins,

Liberum says. The U.K. pet-care company is at peak earnings but its

overall market growth is still expected to accelerate to around

4.5% a year, with more customers acting like "quasi-subscribers"

and engaged members spending around GBP1,000 a year, Liberum says.

It is estimated that the Covid-19 pandemic has driven an up-to-10%

increase in the U.K.'s pet population, the brokerage says. Liberum

currently forecasts fiscal 2022 pretax profit of GBP142 million,

compared with GBP87.5 million for fiscal 2021. Shares are up 0.5%

at 409.6 pence.

---

Taylor Wimpey's New CEO Improves FTSE Representation

0948 GMT - Taylor Wimpey's appointment of Jennie Daly to chief

executive officer is very positive given the longrunning

under-representation of women managing FTSE companies, AJ Bell's

investment director Russ Mould says. The U.K. house builder's

internal promotion secures Daly's near 30 years' of industry

experience, and she should be a safe pair of hands ensuring it runs

smoothly, AJ Bell says. There are eight FTSE 100 companies with a

female CEO--not including Taylor Wimpey--and research indicates

diverse companies outperform less diverse peers, the brokerage

says. "It's therefore encouraging to see the percentage of FTSE

companies with female leadership start to move up, but there is

clearly a lot more to be done," Mould says. Shares are down 0.6% at

148.5 pence.

---

Pets at Home Edges Higher After CEO Appointment

0937 GMT - Shares in Pets at Home edge 0.4% higher after the

U.K. pet-goods retailer appointed Sky executive Lyssa McGowan as

its new chief executive. The appointment of McGowan, who Pets at

Home said is the outgoing chief consumer officer at Sky UK, is

positive as there are common characteristics between the Pets at

Home and Sky businesses, HSBC says. "There are clear links between

the customer life-time value focus of a business like Sky and the

annuity-like behavior that Pets at Home is trying to build in its

customer base," HSBC analysts say. "Also, a strong digital focus

will be key to reaching Pets at Home's ambitions and Ms McGowan

would seem to bring this from her current experience."

Contact: London NewsPlus, Dow Jones Newswires; Write to Sarka

Halas at sarka.halas@wsj.com

(END) Dow Jones Newswires

February 07, 2022 12:33 ET (17:33 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

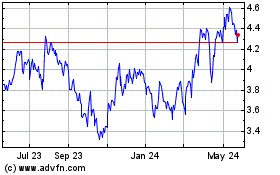

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

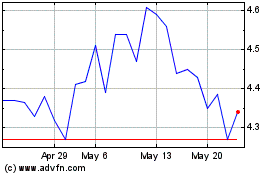

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Dec 2023 to Dec 2024