Icon Media Holdings, Inc. Announces Closing the Asset Purchase of IFX Financial Services Group

December 05 2011 - 7:30AM

Marketwired

Icon Media Holdings, Inc. (PINKSHEETS: ICNM) is pleased to announce

that the Company has closed on the purchase of the assets of IFX

Financial Services Group. The Company also has redesigned and

re-launched the website http://www.ifxltd.com and is executing its

online marketing campaign to sell its merchant processing services

and merchant cash advance products.

The U.S. Commerce Department says online shoppers spent $47.5

billion during the second quarter of 2011, with e-commerce

accounting for 4.6% of all retail sales. Credit card sales account

for at least 40% of these sales. Furthermore, a study by Merchant

Processing Resource estimated the size of the merchant cash advance

market in 2010 was over $524M, and growing at a rapid pace.

"This acquisition allows us to tap into this burgeoning market,

and create a new residual revenue stream," commented Rob Deakin,

CEO of Icon. "We also will be able to lower the overall cost of

processing transactions on the e-commerce sites we own and/or

operate."

The Company expects that IFX should add an additional 15% in

revenue in the first year. IFX will continue to operate under the

IFX brand and will be a wholly owned subsidiary of Icon Media

Holdings.

This acquisition positions Icon for further visibility in the

ever-increasing e-commerce markets and is consistent with Icon's

business model for vertical and horizontal growth through

acquisitions.

About Icon Media Holdings, Inc. (ICNM):

Icon Media Holdings, Inc. is a diversified global e-commerce

company. The Company currently owns and/or operates e-commerce

websites, including www.moviegoods.com, www.puntdogposters.com, and

sells on storefronts such as Amazon, Amazon UK and eBay, among

others. Corporate website: www.iconmediaholdings.com.

About IFX Financial Services Group:

IFX Group affiliates have been providing financial services to

merchants since 1937. The Company sells merchant processing

services as well as merchant funding solutions such as cash

advances, short term loans, acquisition loans and much more.

Forward-Looking Statements & Disclaimers: The information in

this Press Release includes certain "forward-looking" statements

within the meaning of the Safe Harbor provisions of Federal

Securities Laws, as that term is defined in section 27a of the

United States Securities Act of 1933, as amended, and section 21e

of the United States Securities Exchange Act of 1934, as amended.

Statements in this document, which are not purely historical, are

forward-looking statements and include any statements regarding

beliefs, plans, expectations or intentions regarding the future.

Investors are cautioned that such statements are based upon

assumptions that in the future may prove not to have been accurate

and are subject to significant risks and uncertainties, including

the future financial performance of the Company. Although the

Company believes that the expectations reflected in its

forward-looking statements are reasonable, it can give no assurance

that such expectations or any of its forward-looking statements

will prove to be correct. Readers are cautioned not to place undue

reliance on these forward-looking statements that speak only as of

the date of this release, and the Company undertakes no obligation

to update publicly any forward-looking statements to reflect new

information, events, or circumstances after the date of this

release except as required by law.

Contact: Terry Kraemer Phone: 919.237.5700 ext. 203

info@iconmediaholdings.com

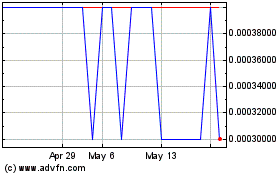

Icon Media (PK) (USOTC:ICNM)

Historical Stock Chart

From Feb 2025 to Mar 2025

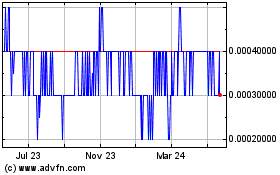

Icon Media (PK) (USOTC:ICNM)

Historical Stock Chart

From Mar 2024 to Mar 2025