Yum Brands Sells Slice of China Business Ahead of Spinoff

September 02 2016 - 5:20AM

Dow Jones News

Yum Brands Inc., the owner of KFC and Pizza Hut, has struck a

deal to sell a slice of its China operations to a prominent Chinese

deal maker and the financial affiliate of Chinese internet giant

Alibaba Group Holding Ltd., according to people familiar with the

situation, as it prepares for a spinoff of the China unit.

Primavera Capital, run by former Goldman Sachs Group Inc.

Greater China Chairman Fred Hu, and Ant Financial Services Group

will buy a combined $460 million stake in the Yum China Holdings

Inc. spinoff, according to the people. They will buy the shares at

an 8% discount to the average price at which Yum China's shares

trade between 31 days and 60 days after they are distributed to Yum

shareholders, the people said. The two investors could own between

4% and 6% combined of Yum China, depending on how the shares

trade.

The Chinese backing could spark interest in the spun-off company

among other investors after it separates from Yum Brands and begins

trading separately on the New York Stock Exchange in November. Ant

Financial Services runs China's largest online payments service

Alipay and has investments in the online food-delivery business.

Mr. Hu, a well-respected economist and deal maker, will become Yum

China's chairman, according to the people.

Louisville, Ky.-based Yum has had huge success in building

Kentucky Fried Chicken into China's most popular fast-food chain

since it entered the country in 1987. In recent years, the

franchise stumbled as growing competition and food-safety concerns

hit sales. The KFC brand in China has returned to positive sales

growth over the past year, and Yum China overall generates over a

billion dollars of cash flow annually.

The new investors are betting that Yum China's value will

continue to grow. As part of the agreement, Primavera and Ant

Financial will receive warrants to buy 2% chunks of Yum China

shares twice at valuation thresholds of $12 billion and $15

billion, according to people familiar with the matter. Those

warrants will have a five-year term and could increase the two

investors' ownership to nearly 10% if exercised, they said.

While Yum Brands will no longer own shares in Yum China after

the spinoff, the Chinese operation will continue to pay a 3%

royalty rate to Yum Brands. The Yum China business will be

debt-free after the spinoff and will have the fresh cash from

Primavera and Ant Financial to fund growth plans.

The decision to separate the operations came after Yum Brands

fell under pressure from activist investors', including Corvex

Management LP and Dan Loeb's Third Point LLC, suggesting overhauls.

Corvex's Keith Meister, who has pushed hard for the China spinoff,

received a seat on Yum's board in October and has been instrumental

in negotiations, the people said. Corvex is among Yum Brands' top

holders with a 5.4% stake.

Yum's partnership with Ant Financial, China's most valuable

internet finance company at $60 billion, could help the fast-food

chain navigate China's rapidly changing and highly competitive

food-delivery business. More transactions take place over Alipay at

Yum China's KFC and Pizza Hut chains than at any other fast-food

chain in China.

Chinese e-commerce giant Alibaba, together with its financial

affiliate, has carved out a territory in China's competitive online

food-delivery and booking-services market. Alibaba and Ant

Financial together made a $1.25 billion bet on food-delivery app

Ele.me in April. The two also control online food-services platform

Koubei, which means "word-of-mouth reputation" in Chinese and has

been growing quickly in recent months. Those Alibaba-backed

platforms compete with Meituan-Dianping, China's largest online

provider of movie-ticketing and restaurant bookings, as well as

Chinese search company Baidu Inc.'s Nuomi platform.

Primavera Capital is a China-based private-equity firm founded

by Mr. Hu, who led Goldman's $2.9 billion deal to take a 5% stake

in Industrial & Commercial Bank of China Ltd. ahead of its huge

initial public offering. Mr. Hu has built ties with a range of

China's most important financial figures and earned a Ph.D in

economics from Harvard University.

Primavera was also an investor in Alibaba before its initial

public offering as part of a financing package raised to repurchase

half of Yahoo Inc.'s stake in Alibaba. Mr. Hu's role in that deal

and close relationship with Alibaba Executive Chairman Jack Ma won

Primavera a coveted early investment in Ant Financial last year at

a valuation below its latest $60 billion price tag.

Write to David Benoit at david.benoit@wsj.com, Kane Wu at

Kane.Wu@wsj.com and Rick Carew at rick.carew@wsj.com

(END) Dow Jones Newswires

September 02, 2016 06:05 ET (10:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

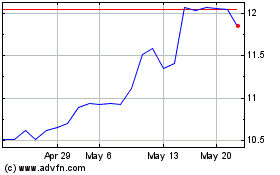

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Feb 2025 to Mar 2025

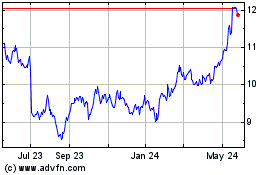

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Mar 2024 to Mar 2025