U.K. Serious Fraud Office Concludes its First Deferred Prosecution Agreement in Standard Bank Case

November 30 2018 - 5:10PM

Dow Jones News

By Mengqi Sun

Standard Bank PLC won't face further prosecution after meeting

the terms of a deferred prosecution agreement, the U.K.'s Serious

Fraud Office said on Friday.

The satisfactory conclusion of the agreement, the first since

the white-collar crime prosecuting agency launched the use of DPAs

in 2014, signals a milestone for the practice and demonstrates the

effectiveness of this type of agreement as a way of altering a

company's culture, the SFO said.

"What we've got is an accomplished outcome," said Lawrence

Cunningham, a professor at George Washington University's law

school with an expertise in corporate governance issues. "I think

it's fair for them to claim this as a victory."

A deferred prosecution agreement allows a prosecutor to suspend

a prosecution for a defined period as long as the organization

completes actions specified in the agreement under the supervision

of a judge. The U.S. Justice Department has a similar practice.

Standard Bank -- now known as ICBC Standard Bank PLC after the

Industrial and Commercial Bank of China Ltd. acquired a majority

stake in the company in February 2015 -- faced an indictment in

November 2015 for its alleged failure to prevent bribery.

The bank's former sister company, Stanbic Bank Tanzania Ltd.,

made a $6 million payment to a local partner in Tanzania in March

2013, the SFO said. The agency said the payment was intended to

influence members of the Tanzanian government to help the banks

secure a contract to raise $600 million in sovereign debt for the

country. The two banks shared $8.4 million in transaction fees

generated from the government-bond deal, the SFO said.

Standard Bank agreed to pay $16.8 million in fines to the U.K.

government and another $7 million in compensation to the Tanzanian

government, and to forgo the $8.4 million in fees from the contract

as part of its agreement with the agency. The bank also agreed to

review and change its internal compliance program and pay for the

agency's costs while cooperating with the investigation, the SFO

said.

The bank worked with an independent reviewer from

PricewaterhouseCoopers LLP to inspect its internal antibribery and

corruption controls. The bank also was required to implement

recommendations from the review, which it completed in August

2017.

"The bank cooperated with the SFO from the outset and has fully

complied with all of the terms of the DPA," Standard Bank said in a

statement on Friday.

Deferred prosecution has become one of the preferred methods in

enforcing laws against corporations, as they give prosecutors more

control over the operations and procedures inside a company to aid

in improving oversight and governance, said George Washington

University's Mr. Cunningham.

"DPAs are a way of holding companies to account without

punishing innocent employees and are an important tool in changing

corporate culture for the better," Lisa Osofsky, director of the

SFO, said Friday in a statement related to the Standard Bank

agreement.

Write to Mengqi Sun at

mengqi.sun@wsj.com<mailto:mengqi.sun@wsj.com>.

(END) Dow Jones Newswires

November 30, 2018 17:55 ET (22:55 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

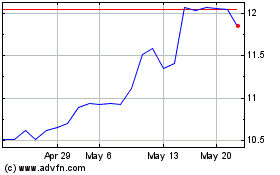

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

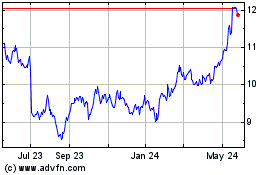

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Dec 2023 to Dec 2024