UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

February

28, 2015

Date

of Report (Date of earliest event reported)

il2m

INTERNATIONAL CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

333-176587 |

|

27-3492854 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

3500

West Olive Avenue

Suite

810

Burbank,

California |

|

91505 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(702)

726-0381

Registrant’s

telephone number, including area code

N/A

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION

3. SECURITIES AND TRADING MATTERS

ITEM

3.02 UNREGISTERED SALES OF EQUITY SECURITIES

During

January and February 2015, the Board of Directors of il2m International Corp., a Nevada corporation (the "Company")

authorized the issuance of an aggregate 84,298,807 shares of restricted common stock as follows:

Conversion

of Convertible Notes

Asia

Capital

During

January and February 2015, the Company issued an aggregate of 20,400,000 shares of its common stock to two entities in connection

with the conversion of debt in the amount of $2,040. The debt is evidenced by that certain 3% convertible promissory note dated

May 17, 2013 in the principal amount of $52,500 (the "Convertible Note") issued by the Company to Asia Capital Markets

Limited LLC ("Asia Capital"). The Convertible Note was subsequently acquired by Gatehouse Financial Limited ("Gatehouse")

from Asia Capital in accordance with the terms and provisions of that certain debt purchase agreement dated November 15, 2013

between Asia Capital and Gatehouse (the "Debt Purchase Agreement") as part of a transaction involving acquisition of

and change in control of the Corporation. Subsequently, in accordance with the terms and provisions of that certain assignment

of convertible note dated January 20, 2014 (the "Assignment"), Gatehouse sold and assigned a portion of its right, title

and interest in and to the Convertible Note to separate assignees, which assignees all paid consideration to Gatehouse for the

purchase of their respective interest. The Company received those certain notices of conversion and the Board of Directors authorized

the issuance of the aggregate 20,400,000 shares of common stock to four of the assignees at a per share price of $0.0001. The

shares were issued to four non-United States residents in reliance on Regulation S promulgated under the Securities Act. The shares

of common stock have not been registered under the Securities Act or under any state securities laws and may not be offered or

sold without registration with the United States Securities and Exchange Commission or an applicable exemption from the registration

requirements. The assignees acknowledged that the securities to be issued have not been registered under the Securities Act, that

they understood the economic risk of an investment in the securities, and that they had the opportunity to ask questions of and

receive answers from our management concerning any and all matters related to acquisition of the securities.

LG

Capital Funding LLC

During

February 2015, the Company issued an aggregate of 15,642,592 shares of its common stock to LG Capital Funding LLC ("LG Capital")

in connection with the conversion of debt in the amount of $805.00 in principal and $39.70 in accrued interest. The debt is evidenced

by that certain 8% convertible promissory note dated June 26, 2014 in the principal amount of $60,000.00 (the "8% Convertible

Note") issued by the Company to LG Capital. The Company received that certain notice of conversion and the Board of Directors

authorized the issuance of the aggregate 15,642,592 shares of common stock to LG Capital at a per share price of $0.000054. The

shares were issued to LG Capital as a United States resident in reliance on Section 4(2) promulgated under the Securities Act.

The shares of common stock have not been registered under the Securities Act or under any state securities laws and may not be

offered or sold without registration with the United States Securities and Exchange Commission or an applicable exemption from

the registration requirements. LG Capital acknowledged that the securities to be issued have not been registered under the Securities

Act, that it understood the economic risk of an investment in the securities, and that it had the opportunity to ask questions

of and receive answers from our management concerning any and all matters related to acquisition of the securities.

KBM

Worldwide Inc.

During

January and February 2015, the Company issued an aggregate of 13,484,654 shares of its common stock to KBM Worldwide Inc. ("KBM

Worldwide") in connection with the conversion of debt in the amount of $10,000.00 and $2,425.00, respective, in principal.

The debt is evidenced by that certain convertible promissory note dated May 2, 2014 in the principal amount of $37,500.00 (the

"KBM Convertible Note") issued by us to KBM Worldwide. The Company received those two certain notices of conversion

and the Board of Directors authorized the issuance of 10,543,478 shares of common stock at a per share price of $0.00023 and 2,941,176

shares of common stock at a per share price of $0.0034, respectively, to KBM Worldwide. The shares were issued to KBM Worldwide

as a United States resident in reliance on Section 4(2) promulgated under the Securities Act. The shares of common stock have

not been registered under the Securities Act or under any state securities laws and may not be offered or sold without registration

with the United States Securities and Exchange Commission or an applicable exemption from the registration requirements. KBM Worldwide

acknowledged that the securities to be issued have not been registered under the Securities Act, that it understood the economic

risk of an investment in the securities, and that it had the opportunity to ask questions of and receive answers from our management

concerning any and all matters related to acquisition of the securities.

Auctus

Private Equity Fund LLC

During

February 2015, the Company issued an aggregate of 10,564,000 shares of its common stock to Auctus Private Equity Fund LLC ("Auctus

Private Equity") in connection with the conversion of debt in the amount of $1,901.52 in accrued interest. The debt is evidenced

by that certain convertible promissory note dated June 6, 2014 in the principal amount of $62,750.00 (the "Auctus Convertible

Note") issued by us to Auctus Private Equity. The Company received that certain notice of conversion and the Board of Directors

authorized the issuance of the aggregate 10,564,000 shares of common stock to Auctus Private Equity at a per share price of $0.00018.

The shares were issued to Auctus Private Equity as a United States residents in reliance on Section 4(2) promulgated under the

Securities Act. The shares of common stock have not been registered under the Securities Act or under any state securities laws

and may not be offered or sold without registration with the United States Securities and Exchange Commission or an applicable

exemption from the registration requirements. Auctus Private Equity acknowledged that the securities to be issued have not been

registered under the Securities Act, that it understood the economic risk of an investment in the securities, and that it had

the opportunity to ask questions of and receive answers from our management concerning any and all matters related to acquisition

of the securities.

JMJ

Financial

During

February 2015, the Company issued an aggregate of 10,500,000 shares of its common stock to JMJ Financial ("JMJ Financial")

in connection with the conversion of debt in the amount of $2,520.00 in principal. The debt is evidenced by that certain convertible

note dated July 31, 2014 in the principal amount of $250,000.00 (the "JMJ Convertible Note") issued by us to JMJ Financial.

The Company received that certain notice of conversion and the Board of Directors authorized the issuance of the aggregate 10,500,000

shares of common stock to JMJ Financial at a per share price of $0.000240. The shares were issued to JMJ Financial as a United

States resident in reliance on Section 4(2) promulgated under the Securities Act. The shares of common stock have not been registered

under the Securities Act or under any state securities laws and may not be offered or sold without registration with the United

States Securities and Exchange Commission or an applicable exemption from the registration requirements. JMJ Financial acknowledged

that the securities to be issued have not been registered under the Securities Act, that it understood the economic risk of an

investment in the securities, and that it had the opportunity to ask questions of and receive answers from our management concerning

any and all matters related to acquisition of the securities.

JSJ

Investments

During

January 2015, the Company issued an aggregate of 13,707,561 shares of its common stock to JSJ Investments ("JSJ Investments")

in connection with the conversion of debt in the amount of $15,705.83 in principal. The debt is evidenced by that certain convertible

promissory note dated June 19, 2014 in the principal amount of $100,000.00 (the "JSJ Convertible Note") issued by us

to JSJ Investments. The Company received those two certain notices of conversion and the Board of Directors authorized the issuance

of the aggregate 3,333,333 shares of common stock at a per share price of $0.003 and 10,374,228 shares of common stock at a per

share price of $00055 to JSJ Investments. The shares were issued to JSJ Investments as a United States resident in reliance on

Section 4(2) promulgated under the Securities Act. The shares of common stock have not been registered under the Securities Act

or under any state securities laws and may not be offered or sold without registration with the United States Securities and Exchange

Commission or an applicable exemption from the registration requirements. JSJ Investments acknowledged that the securities to

be issued have not been registered under the Securities Act, that it understood the economic risk of an investment in the securities,

and that it had the opportunity to ask questions of and receive answers from our management concerning any and all matters related

to acquisition of the securities.

SECTION

9 – FINANCIAL STATEMENTS AND EXHIBITS

Item

9.01 Financial Statements and Exhibits

(a)

Financial Statements of Business Acquired.

Not

applicable.

(b)

Pro forma Financial Information.

Not

applicable.

(c)

Shell Company Transaction.

Not

applicable.

(d)

Exhibits.

Not applicable.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

il2m

INTERNATIONAL CORP. |

|

| |

|

|

|

| DATE:

April 20, 2015 |

|

/s/

Sarkis Tsaoussian |

|

| |

|

Sarkis

Tsaoussian |

|

| |

|

President/Chief

Executive Officer |

|

5

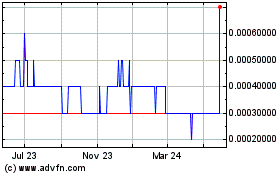

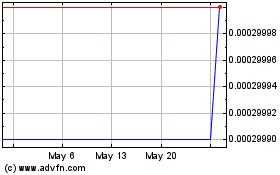

IL2M (PK) (USOTC:ILIM)

Historical Stock Chart

From Jan 2025 to Feb 2025

IL2M (PK) (USOTC:ILIM)

Historical Stock Chart

From Feb 2024 to Feb 2025