false

FY

0001753373

0001753373

2022-12-01

2023-11-30

0001753373

2023-11-30

0001753373

2024-04-15

0001753373

2021-12-01

2022-11-30

0001753373

2022-11-30

0001753373

us-gaap:PreferredStockMember

2021-11-30

0001753373

us-gaap:CommonStockMember

2021-11-30

0001753373

us-gaap:TreasuryStockCommonMember

2021-11-30

0001753373

us-gaap:AdditionalPaidInCapitalMember

2021-11-30

0001753373

us-gaap:RetainedEarningsMember

2021-11-30

0001753373

2021-11-30

0001753373

us-gaap:PreferredStockMember

2022-11-30

0001753373

us-gaap:CommonStockMember

2022-11-30

0001753373

us-gaap:TreasuryStockCommonMember

2022-11-30

0001753373

us-gaap:AdditionalPaidInCapitalMember

2022-11-30

0001753373

us-gaap:RetainedEarningsMember

2022-11-30

0001753373

us-gaap:PreferredStockMember

2021-12-01

2022-11-30

0001753373

us-gaap:CommonStockMember

2021-12-01

2022-11-30

0001753373

us-gaap:TreasuryStockCommonMember

2021-12-01

2022-11-30

0001753373

us-gaap:AdditionalPaidInCapitalMember

2021-12-01

2022-11-30

0001753373

us-gaap:RetainedEarningsMember

2021-12-01

2022-11-30

0001753373

us-gaap:PreferredStockMember

2022-12-01

2023-11-30

0001753373

us-gaap:CommonStockMember

2022-12-01

2023-11-30

0001753373

us-gaap:TreasuryStockCommonMember

2022-12-01

2023-11-30

0001753373

us-gaap:AdditionalPaidInCapitalMember

2022-12-01

2023-11-30

0001753373

us-gaap:RetainedEarningsMember

2022-12-01

2023-11-30

0001753373

us-gaap:PreferredStockMember

2023-11-30

0001753373

us-gaap:CommonStockMember

2023-11-30

0001753373

us-gaap:TreasuryStockCommonMember

2023-11-30

0001753373

us-gaap:AdditionalPaidInCapitalMember

2023-11-30

0001753373

us-gaap:RetainedEarningsMember

2023-11-30

0001753373

srt:ChiefExecutiveOfficerMember

2023-05-01

2023-05-31

0001753373

srt:ChiefExecutiveOfficerMember

2023-05-31

0001753373

srt:ChiefFinancialOfficerMember

MTWO:ConsultingAgreementMember

2022-12-01

2023-11-30

0001753373

2023-11-24

2023-11-24

0001753373

2023-11-24

0001753373

srt:ChiefExecutiveOfficerMember

2023-11-30

0001753373

srt:ChiefExecutiveOfficerMember

2022-11-30

0001753373

srt:ChiefFinancialOfficerMember

2023-11-30

0001753373

2023-05-15

0001753373

2023-05-16

0001753373

MTWO:SuperVotingPreferredStockMember

2023-05-16

0001753373

MTWO:SuperVotingPreferredStockMember

2022-12-01

2023-11-30

0001753373

MTWO:SuperVotingPreferredStockMember

2023-11-30

0001753373

us-gaap:CommonStockMember

MTWO:FormerChiefExecutiveOfficerMember

2022-12-01

2023-11-30

0001753373

us-gaap:SubsequentEventMember

2023-12-01

2024-03-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended November 30, 2023

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from __________ to __________

Commission

file number 333-229748

M2I

GLOBAL, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

37-1904036 |

State

or other jurisdiction of

incorporation or organization |

|

(I.R.S.

Employer

Identification No.) |

| 885

Tahoe Blvd., Incline Village, NV |

|

89451 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

Telephone number, including area code: (775) 909-6000

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| None |

|

None |

|

None |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes

☐ No ☒

State

the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s

most recently completed fiscal year: $380,333,691.

State

the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date:464,333,691

common shares issued and outstanding as of April

15, 2024.

TABLE

OF CONTENTS

PART

I

Item

1. Business

Unless

otherwise stated or the context requires otherwise, references in this annual report on Form 10-K to “we,” “us,”

“our,” the “Company,” “M2i,” and “our Company” refer to M2i Global, Inc., a Nevada corporation,

and its subsidiaries.

OUR

BUSINESS

Our

Vision

Our

vision is to develop a world-class portfolio of critical minerals and materials projects. The diversity of our portfolio would provide

an integrated solution to the challenges facing the critical minerals and materials industry.

The

Global Energy Transition

Renewable

energy is expected to overtake coal by 2025 as the world’s largest source of electricity (Source:

“The Clean Energy Future is Arriving Faster Than You Think,” NY Times, August 12, 2023). The growth in renewable energy

is exponential.

In

the U.S., the Secretary of Energy pursuant to authority under the Energy Act of 2020 determines the list of critical minerals and materials.

The final 2022 list of critical minerals includes the following 50 minerals: Aluminum, antimony,

arsenic, barite, beryllium, bismuth, cerium, cesium, chromium, cobalt, dysprosium, erbium, europium, fluorspar, gadolinium, gallium,

germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lithium, lutetium, magnesium, manganese, neodymium, nickel, niobium,

palladium, platinum, praseodymium, rhodium, rubidium, ruthenium, samarium, scandium, tantalum, tellurium, terbium, thulium, tin, titanium,

tungsten, vanadium, ytterbium, yttrium, zinc, and zirconium.

The

vital market for critical minerals and metals is the enabling component of the vital transition

of the energy market. The infrastructure requirement for clean energy is dependent on the availability of the raw materials that these

minerals represent. The future of the nation’s economic security and our national defense industry is reliant on an uninterrupted

supply chain of minerals and metals.

Nickel,

lithium, cobalt, and graphite are used in batteries. Rare-earth minerals such as neodymium and samarium are essential to the magnets

of wind turbines and electric motors. An unstable supply of these minerals threatens the continued growth of renewable energy.

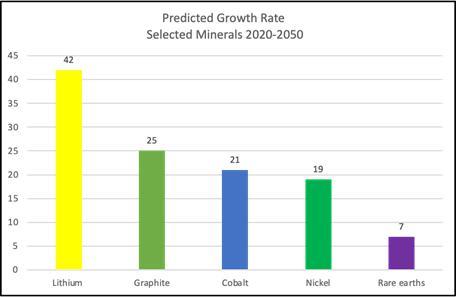

The

chart in figure 1 depicts the projected growth of the demand for specific minerals that provide the base material for the manufacturing

of electrical vehicle and energy storage batteries. The growth rate for projected demand in 2050 is presented using 2020 as the base

of comparison (Source: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions; The

Role of Critical Minerals in Clean Energy Transitions”).

Figure

1: Energy Storage Minerals

Many

of these critical minerals are mined and processed in a small number of countries, as illustrated in the chart in Figure 2 (Source: “The

global fight for critical minerals is costly and damaging,” Nature, July 19, 2023).

Figure

2: Sources of Minerals

The

current dependence on foreign sources for critical materials supply flow and minerals processing must be addressed in the short and mid-term

to create a stable supply chain of these materials to support both the national and economic security of the U.S. The table (Figure

3) depicts the current level of foreign sources for critical minerals by industry (Source: U.S.

Department of the Interior U.S. Geological Survey, MINERAL COMMODITY SUMMARIES 2023).

Figure

3: Critical Minerals List Associated with Key Industries

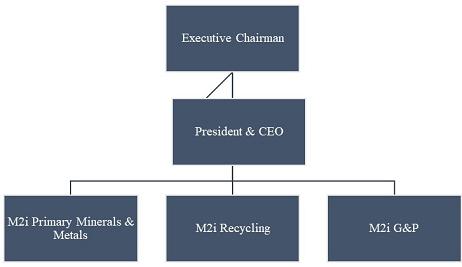

Our

Organizational Chart

It

is currently anticipated that M2i’s structure will be built upon three separate business units with standalone P&Ls to carry

on the Company’s objectives. Each P&L will be led by a vice president, who will work with a management team focused on implementing

and building each effort into a business line, taking advantage of federal and state incentives, and building its own profit and loss

contributions to the overall organization. The vice presidents will report to the president/chief executive officer of the Company. M2i

business development will be a cross-functional discipline whose responsibilities cut across the organization. M2i will establish a finance

department, staffed by a Director of Finance and Controller to ensure the effective and efficient management of funds, and to implement

appropriate accounting controls.

M2i

Primary Minerals & Metals

The

primary business purpose of M2i PMM will be to develop and supply the U.S. sanctioned value chain of critical metals needed by the U.S.

and its free trade partners. M2i PMM will supply the 50 critical minerals and Rare Earth Elements (“REE”) as defined by the

U.S. Geologic Survey 2022. These minerals will be sourced globally from mines adhering to ethical extraction principles and guidelines.

Strategic

Alliances

The

Company expects to enter several strategic alliances (“SAs”) to further its business objectives; namely through multiple

mechanisms including asset acquisition and independent supply contracts. The SAs will likely be with companies that can expand our capability

to extract minerals from existing mines, assist in implementing new mining projects, and develop and place into production new technologies

and processes in extracting and processing minerals. Our efforts, and particularly our JVs, will be focused on delivering guaranteed

access to critical minerals and metals for national defense and economic security.

Currently,

we are in negotiations with Reforme Group (“Reforme”), an Australian mining and recycling company to enter into a strategic

alliance agreement (the “SA Agreement”) wherein Reforme and M2i will create an Australian proprietary limited company (“M2iAust”) to source and trade critical metals and strategic minerals. It is currently anticipated that M2i and Reforme Group will

each be equal shareholders in M2iAust. It is currently anticipated that the SA Agreement will enable us to capitalize on Reforme’s

expertise in critical minerals. Reforme is an innovative Australian mining services, infrastructure, recycling, and renewables company

with specialized expertise in the development of green and brown field mining projects with the demonstrated capability in end-to-end

management of mine operations, processing, logistics and off-take negotiations.

The

SA will play a pivotal role in advancing the critical minerals supply chain and contributing to the global energy transformation. We

expect that the SA will extract critical minerals from existing brownfield mines’ tailings utilizing a novel extraction technology

and process developed by Reforme. Reforme’s technology includes mine remediation methods to return the site to a state that would

satisfy government and community concerns. It is anticipated that Reforme will grant M2iAust a right of first refusal to enter into offtake

agreements with Reforme or its related corporate bodies for any critical metals and strategic minerals extracted from mining tenements

owned or controlled by Reforme. M2i will support the development of strategic resources by Reforme. Together, the companies will refer

any third party off take opportunities in the Asia Pacific region for strategic resources to M2iAust. M2iAust will negotiate offtake

agreements to secure offtake from Reforme and third parties for offtake which will be sold to M2i in subsequent offtake agreements. The

JV has a term of 5 years unless agreed otherwise. By leveraging their combined expertise and resources, the partners intend to establish

a more sustainable and efficient critical minerals ecosystem that fully aligns with the objectives outlined in the United States-Australian

Climate, Critical Minerals, and Clean Energy Transformation Compact.

The Company’s subsidiary,

U.S. Minerals and Metals Corp.,(“USMM”) has assigned its two contracts with Lyons Capital, LLC to the parent Company, M2i

Global, Inc. On February 23, 2023, USMM, and Lyons Capital, LLC (“Lyons”) entered into a business development agreement wherein

Lyons agreed to act as Senior Strategic and Business Development Advisor to USMM for a term of 10 years (the “BDA”). Lyons

received, on January 2, 2024, and on the first business day of each year thereafter 10,000,000 shares of USMM’s common stock in

exchange for a purchase price of $1,000 per year. The BDA may be terminated by either party for any reason effective upon the first business

day of the calendar year following the termination notice provided at least 30 days in advance.

Lyons and USMM also entered into

the Wall Street Conference Business Development Agreement on February 23, 2023 (the “WSCA”), which was also assigned to the

parent Company, M2i Global, Inc. In the WSCA, Lyons agreed, for a term of 5 years, to provide USMM with a yearly event sponsorship, including

a speaking slot at the Wall Street Conference organized by Lyons, and introductions to, among others, personnel for business development

opportunities. In exchange, Lyons will receive $2,000,000 per year in either cash or shares of USMM.’s common stock (if elected,

the issuance of shares will be issued at a purchase price of $200 per year).

Pursuant to the Agreement and

Plan of Merger, dated as of May 12, 2023, and entered into by and among Inky, Inc. and U.S. M and M Acquisition Corp. and U.S. Minerals

and Metals Corp., which is annexed hereto as exhibit 2.01 below, at the time of consummation of the merger, all shares of USMM were simultaneously

converted into shares of M2i Global, Inc.’s common stock, and thus, any shares issued by USMM pursuant to the BDA or WSCA, as referenced

above are now issued from M2i Global, Inc.

M2i

Recycled Minerals &Metals

Critical

metals are of vital importance for the defense sector across the air, sea, and land domains. For instance, tantalum is needed in warheads,

and high-performing alloys used in fuselages of combat aircraft require niobium, vanadium, and molybdenum.

We

see an opportunity to establish a closed-loop, transparent program for capturing and returning critical metals and minerals in the defense

industrial supply chain. This program would encompass both new production and end-of-life systems, ensuring that these valuable resources

are reused domestically rather than relying on foreign sources.

The

defense supply chain presents a significant volume of critical metals that can be effectively recycled and reused. By tapping into this

resource and establishing M2i as an efficient supplier of this service, we can capture a considerable market share. This opportunity

arises from the fact that no recycling company, to our knowledge, has successfully accomplished this on a large scale thus far.

M2i

Government and Industry Affairs

M2i

Government and Industry Affairs is the business unit established with the goals of aligning U.S. policy in terms of industry requirements

and national interests. The cornerstone of the value proposition of M2i GIA is the creation and management of the Strategic Minerals

Reserve (“SMR”) in collaboration with the federal government to enable an uninterrupted supply of the most critical minerals

and metals to mitigate the current and future vulnerabilities of this vital supply chain. We expect the SMR to augment or enhance the

National Defense Stockpile.

M2i

GIA will focus on two key efforts, the implementation of the SMR and the ongoing liaison with the government at the federal, state, and

local levels. Critical to the success of the SMR will be the continuing dialogue with key congressional members. We have established

congressional support in Nevada and are working to receive both an authorization in the annual National Defense Authorization Act, as

well as, an appropriation of funding to enable the implementation of the SMR. M2i GIA also aims to establish a collaboration with Hawthorne

Army Depot, located in Hawthorne, Nevada, to obtain the storage and administrative space to conduct a pilot demonstration.

The

ongoing liaison with select members of the congressional contingent from Nevada will act to ensure that the SMR pilot retains the focus

of each respective office. We expect that the conclusion of a successful pilot will lead to the establishment of the second phase of

the SMR, which is to build out the SMR to multiple locations, and to stockpile critical minerals that would extend supply beyond the

DOD industry to private sector industry organizations in the event of a disruption to the flow of critical minerals.

Human

Capital

Recruiting

the right people will be critical to our success. We believe that the team of officers, directors and advisors that we have already assembled

will provide a strong foundation for developing our business.

Financing

Sources

We

estimate that our first two years of operation will require $20-30 million. Our aim is to obtain government funding to meet this need.

Competition

The

Company, upon achieving its business objectives, believes it will be one of the only companies that operates across the full spectrum

of the mineral and metals industry.

The

rare earths mining and processing markets are capital intensive and competitive. Outside of the six (6) major rare earth producers in

China, and those consolidated under their production quotas—there are only two other producers operating at scale, MP Materials

and Lynas, which processes its rare earth materials in Malaysia. The Company’s competitors may have greater financial resources,

as well as other strategic advantages to maintain, improve and possibly expand their facilities.

It

is possible that when the Company achieves its anticipated production rates and other planned products, the increased competition could

lead competitors to engage in predatory pricing behavior. Any increase in the amount of rare earth products exported from other nations,

and increased competition, whether legal or illegal, may result in price reductions, reduced margins and loss of potential market share,

any of which could materially adversely affect our profitability.

Additionally,

our potential Chinese competitors have historically been able to produce at relatively low costs due to domestic economic and regulatory

factors, including less stringent environmental regulations. If we are not able to achieve anticipated costs of production, then any

strategic advantages that our competitors may have over us, such as lower labor and production costs, could have a material adverse effect

on our business. As a result of these factors, we may not be able to compete effectively against current and future competitors.

Many

of the Company’s competitors, as well as potential competitors, possess substantially greater financial, marketing, personnel and

other resources than the Company. The Company’s competitors and potential competitors include far larger, more established companies

that have access to capital markets, and to other funding sources that may be unavailable to the Company. There can be no assurance the

Company will be able to compete successfully against current or future competitors or that competitive pressures faced by the Company

will not materially adversely affect its business, operating results, and financial condition.

Compliance

with Government Regulation

Mining

operations and exploration activities are subject to various national, state, and local laws and regulations in United States, as well

as other jurisdictions, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health,

waste disposal, protection of the environment, mine safety, hazardous substances and other matters.

We

believe that we are and will continue to be in compliance in all material respects with applicable statutes and the regulations passed

in the United States. There are no current orders or directions relating to our Company with respect to the foregoing laws and regulations.

Item

1A. Risk Factors

Not

required for smaller reporting companies.

Item

1B. Unresolved Staff Comments

Not

required for smaller reporting companies.

Item

1C. Cybersecurity

Risk

Management and Strategy

We

recognize the critical importance of developing, implementing, and maintaining robust cybersecurity measures to safeguard our information

systems and protect the confidentiality, integrity, and availability of our data.

Managing

Material Risks & Integrated Overall Risk Management

We

have strategically integrated cybersecurity risk management into our broader risk management framework to promote a company-wide culture

of cybersecurity risk management. This integration ensures that cybersecurity considerations are an integral part of our decision-making

processes at every level. Our management team continuously evaluates and addresses cybersecurity

risks in alignment with our business objectives and operational needs.

Oversee

Third-party Risk

Because

we are aware of the risks associated with third-party service providers, we have implemented stringent processes to oversee and manage

these risks. We conduct thorough security assessments of all third-party providers before engagement and maintain ongoing monitoring

to ensure compliance with our cybersecurity standards. The monitoring includes annual assessments of the SOC reports of our providers

and implementing complementary controls. This approach is designed to mitigate risks related to data breaches or other security incidents

originating from third-parties.

Risks

from Cybersecurity Threats

We

have not encountered cybersecurity challenges that have materially impaired our operations or financial standing.

Item

2. Properties

Our

principal executive offices are located at 885 Tahoe Blvd. Incline Village, NV 89451. The Company does not own any property or hold any

leases.

Item

3. Legal Proceedings

We

know of no legal proceedings to which we are a party or to which any of our property is the subject which are pending, threatened, or

contemplated or any unsatisfied judgments against us.

Item

4. Mine Safety Disclosures

Not

applicable.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

MARKET

INFORMATION

Our

Common Stock began trading on the OTC Pink Market under the symbol “INKI.” On June

8, 2023, our stock symbol changed to “MTWO”. You should be aware that over-the-counter market quotations may reflect

inter-dealer prices, without retail mark-up, mark-down or commissions and may not necessarily represent actual transactions.

HOLDERS

As

of April 15, 2024, there were approximately 87 stockholders of record holding 464,333,691 shares of our Common Stock. This number does

not include an indeterminate number of stockholders whose shares are held by brokers in street name. The holders of our Common Stock

are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Holders of our Common Stock

have no preemptive rights and no right to convert their Common Stock into any other securities. Additionally, there are no redemption

or sinking fund provisions applicable to our Common Stock.

DIVIDEND

POLICY

We

have never paid any cash dividends on our Common Stock and do not anticipate paying any cash dividends on our Common Stock in the foreseeable

future. We presently intend to retain all earnings to implement our business plan. Any future determination to pay cash dividends will

be at the discretion of our Board and will be dependent upon our financial condition, results of operations, capital requirements and

such other factors as our Board deems relevant. Our ability to pay cash dividends is subject to limitations imposed by state law.

RECENT

SALES OF UNREGISTERED SECURITIES

None.

Issuer

Purchases of Equity Securities

In August of 2023, the Company re-purchased 6,013,334 shares of the Company’s common stock from Ioanna Kallidou

for $435,000 (the “Treasury Stock Repurchase”).

Item

6. [Reserved]

Not

required for smaller reporting companies.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The

information and financial data discussed below is derived from our financial statements for the fiscal years ended November 30,

2023, and 2022. The financial statements of the Company were prepared and presented in accordance with generally accepted accounting

principles in the United States. The information and financial data discussed below is only a summary and was prepared to provide a

historical and narrative discussion of our financial condition and results of operations through the eyes of management and should

be read in conjunction with the historical financial statements and related notes of the Company contained elsewhere in this Form

10-K. The financial statements contained elsewhere in this Form 10-K fully represent the Company’s financial condition and

operations; however, they are not indicative of the Company’s future performance. This discussion contains forward-looking

statements based upon current plans, expectations and beliefs that involve risks and uncertainties. Our actual results and the

timing of certain events could differ materially from those anticipated in or implied by these forward-looking statements as a

result of several factors, including those discussed in the section captioned “Risk Factors” included under Part I, Item

1A and elsewhere in this Form 10-K.

Results

of Operations for the fiscal years ended November 30, 2023 and 2022:

Revenue

During

the fiscal years ended November 30, 2023 and 2022 we generated total revenue of $3,400 and $1,000,

respectively.

Operating

expenses

For

the fiscal year ended November 30, 2023, operating expenses were $1,982,836, compared to $67,442 for the year ended November 30,

2022. Operating expenses consist primarily of general and administrative expenses and legal and professional fees incurred in

connection with the operation of our business. The net increase of $1,915,394 in operating expenses was primarily a result of an

increase in professional fees to implement the change in business as noted in Part I, Item 1 earlier in this document.

Net Loss

Our net loss for the fiscal years

ended November 30, 2023 and 2022 was $1,990,162 and $66,442, respectively.

Liquidity

and Capital Resources and Cash Requirements

As of November 30, 2023, the

Company had cash of $48,197 and $114 as of November 30, 2022. Furthermore, the Company had a working capital deficit of

$1,974,353 and $108,369 as of November 30, 2023 and 2022, respectively.

During the fiscal year ended November

30, 2023, the Company used $1,611,258 of cash in operating activities compared to $13,010 of cash in operating activities during the year

ended November 30, 2022. The increase in cash used in operating activities were the result of increased general and administrative expenses

and legal and professional fees.

During the fiscal year ended

November 30, 2023, the Company had no cash flows from investing activities. During the fiscal year ended November 30, 2022, the

Company used $21,370 cash flows in investing activities related to website development.

During the fiscal year ended

November 30, 2023, the Company generated $1,659,341 cash in financing activities which came from related-party loan of $608,319, a

convertible note of $250,000 and proceeds from sale of common stock of

$1,236,022 offset by repurchase of common stock of $435,000. During the fiscal year ended November 30, 2022, the Company generated $34,380 of cash in financing activities which

came from a related-party loan.

OFF

BALANCE SHEET ARRANGEMENTS

We

have no off-balance sheet arrangements, including arrangements that would affect our liquidity, capital resources, market risk support

and credit risk support or other benefits.

Item

7A. Quantitative and Qualitative Disclosures about Market Risk

Not

required for smaller reporting companies.

Item

8. Financial Statements and Supplementary Data

The

full text of our audited consolidated financial statements begins on page F-1 of this annual report .

Item

9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

On

February 8, 2024, M2i Global, Inc. dismissed Heaton & Company, PLLC dba Pinnacle Accountancy Group of Utah (“Pinnacle”)

as the Company’s independent registered public accounting firm. During the engagement period from December 6, 2019 to February

8, 2024, there were no disagreements between the Company and Pinnacle on any matter of accounting principles or practices, financial

statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of Pinnacle, would have caused Pinnacle

to make reference to the matter in a report on the Company’s financial statements. The decision to replace Pinnacle was approved

by the Board of Directors of the Company.

Effective

February 8, 2024, the Company appointed Turner, Stone & Company, LLP (“Turner Stone”) as the independent registered public

accounting firm to audit the consolidated financial statements of the Company, and the related consolidated statements of operations,

changes in stockholders’ deficit, and cash flows of the Company and the related notes to consolidated financial statements.

Item

9A. Controls and Procedures

The

Company is responsible for establishing and maintaining a system of disclosure controls and procedures (as defined in Rule 13a-15(e)

and 15d-15(e) under the Exchange Act) that is designed to ensure that information required to be disclosed by us in the reports that

we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Commission’s

rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information

required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated

to the issuer’s management, including its principal executive officer or officers and principal financial officer or officers,

or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

An

assessment was conducted with the participation of our principal executive and principal financial officer of the effectiveness of the

design and operation of our disclosure controls and procedures as of November 30, 2023. Based on that evaluation, our management concluded

that our disclosure controls and procedures were not effective as of such date to ensure that information required to be disclosed in

the reports that we file or submit under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified

in SEC rules and forms.

Management’s

Report on Internal Control over Financial Reporting

Management

is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)).

The Company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability

of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally

accepted in the United States of America. Because of its inherent limitations, internal control over financial reporting may not prevent

or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls

may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Under the supervision and with the participation of management, including the Chief Executive Officer and Chief Financial Officer, the

Company conducted an evaluation of the effectiveness of the Company’s internal control over financial reporting as of November

30, 2023, using the criteria established in “Internal Control - Integrated Framework” issued by the Committee of Sponsoring

Organizations of the Treadway Commission (“COSO - 2013”).

A

material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a

reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented

or detected on a timely basis. In its assessment of the effectiveness of internal control over financial reporting as of November 30,

2023, the Company determined that there were control deficiencies that constituted material weaknesses, as described below.

| |

1. |

We

do not have an Audit Committee – While not being legally obligated to have an audit committee, it is the management’s

view that such a committee, including a financial expert member, is an utmost important level control over the Company’s

financial statements. Currently the Board of Directors acts in the capacity of the Audit Committee, and does not include a member

that is considered to be independent of management to provide the necessary oversight over management’s activities. |

| |

|

|

| |

2. |

We

did not maintain appropriate cash controls – As of November 30, 2023, the Company has not maintained sufficient internal controls

over financial reporting for cash, including failure to segregate cash handling and accounting functions, and did not require dual

signatures on the Company’s bank accounts. Alternatively, the effects of poor cash controls were mitigated by the fact that

the Company had limited transactions in its bank accounts. |

| |

|

|

| |

3. |

We

did not implement appropriate information technology controls – As at November 30, 2023, the Company retains copies of all

financial data and material agreements; however, there is no formal procedure or evidence of normal backup of the Company’s

data or off-site storage of data in the event of theft, misplacement, or loss due to unmitigated factors. |

| |

|

|

| |

4. |

The

Company lacks segregation of duties. |

Accordingly,

the Company concluded that these control deficiencies resulted in a reasonable possibility that a material misstatement of the annual

or interim financial statements will not be prevented or detected on a timely basis by the company’s internal controls.

As

a result of the material weaknesses described above, management has concluded that the Company did not maintain effective internal control

over financial reporting as of November 30, 2023 based on criteria established in Internal Control- Integrated Framework issued by COSO.

Changes

in Internal Controls over Financial Reporting

There

have been no changes in our internal controls over financial reporting that occurred during the fiscal year ended November 30, 2023, that

have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

In

our annual report for the fiscal year ended November 30, 2022, we identified the following material weaknesses which are still

applicable:

| |

● |

We

do not have an audit committee |

| |

● |

We

did not implement appropriate information technology controls |

| |

● |

We did not maintain appropriate cash controls |

Management

plans to address these material weaknesses in the coming quarters.

In

our annual report for the fiscal year ended November 30, 2022, we identified the following material weaknesses which are no longer

applicable:

| |

● |

Beginning in May 2023, the Company began to improve internal controls by

hiring additional resources to ensure appropriate review and oversight. |

Item

9B. Other Information.

Rule

10b5-1 Trading Arrangement

During

the fiscal year ended November 30, 2023, no director or officer of the Company adopted or terminated a “Rule 10b5-1 trading arrangement”

or “non-Rule 10b5-1 trading arrangement,” as each term is defined in Item 408(a) of Regulation S-K.

Item

9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections

Not

applicable.

PART

III

Item

10. Directors, Executive Officers and Corporate Governance

Our

executive officer’s and director’s and their respective ages are as follows:

| Name |

|

Age |

|

Positions |

| Doug

Cole |

|

67 |

|

Executive

Chairman, Chief Financial Officer |

| Jeffrey

W. Talley |

|

64 |

|

President

and Chief Executive Officer |

Set

forth below is a brief description of the background and business experience of our executive officers and directors for the past five

years.

Doug

Cole

Doug

Cole, age 67, is Executive Chairman and Chief Financial Officer of the Company. Doug brings over 39 years of experience in sales, marketing,

and leadership roles, having run over 8 companies, both public and private. He has focused all his time on global development of startup

companies and turnarounds. He has been involved with raising millions of dollars for his companies and numerous M&A work. As a private

and public chairman, CEO, and board member, he has expanded every company he has been involved with, leveraging relationships globally.

He has spoken at many major industry conferences throughout his career.

Prior

to M2i, Doug was Chairman and CEO of American Battery Metals Corporation (ABML) from 2017 to 2021, where he orchestrated a successful

turnaround that resulted in a high of a $2 billion market capitalization. Mr. Cole led the transition from a lithium exploration and

development company to a lithium asset and lithium-ion battery metal recycling company and left the company in August of 2021. He was

a Partner overseeing all ongoing deal activities with Objective Equity LLC from 2005 through 2016, a boutique investment bank focused

on the high technology, data analytics and the mining sector.

Since

1977, Mr. Cole has held various executive roles, including Chairman, Executive Vice Chairman, Chief Executive Officer and President of

multiple public corporations. From May 2000 to September 2005, he was also the Director of Lair of the Bear, The University of California

Family Camp located in Pinecrest, California. During the period between 1991 and 1996 he was the CEO of HealthSoft and he also founded

and operated Great Bear Technology, which acquired Sony Image Soft and Starpress, then went public and eventually sold to Graphix Zone.

In 1995, Mr. Cole was honored by New Enterprise Associates, a leading venture capital firm, as CEO of the year.

Since

1982 he has been very active with the University of California, Berkeley where he mentors early-stage technology companies. Mr. Cole

has extensive experience in global M&A and global distributions. He obtained his BA in Social Sciences from UC Berkeley in 1978.

Jeffrey

W. Talley

Lieutenant

General (Ret) Jeffrey W. Talley, age 64, is President and Chief Executive Officer of U.S. Minerals and Metals Corporation. Jeff is an

accomplished senior executive and proven leader with experience in large-scale organizations, public private partnerships, national &

cyber security, environmental & energy sustainability, disaster emergency management, infrastructure resilience, data analytics &

technology, R&D, and higher education. Jeff’s career consists of a portfolio of academic, business, and government experiences.

Prior

to assuming his role, he served as President and CEO of The P3i Group, which he founded in 2020, providing senior management consulting

to clients, with emphasis on the application of P3s to solve complex problems and create new opportunities. Prior to The P3i Group, Jeff

served as Vice President and Global Fellow at IBM from 2017 thru 2020, IBM’s Global Government Industry practice, advising senior

leadership on strategic issues to include emerging markets, business development, and acquisitions.

Jeff’s

board experience includes serving as Chairman of the Board of Directors for BluMetric Environmental, a Canadian environmental consulting

and water cleantech company, from March 2019 until July 2023. Jeff also served as a Member of the Board of Directors of the Environmental

and Energy Study Institute, a 501(c)(3) non-profit organization focused on advancing science-based solutions for climate change, energy,

and environmental challenges, from September 2019 until April 2023.

Jeff’s

military career included duty in the U.S., Korea, Kuwait, and Iraq, culminating in 2012 when he was appointed to the rank of Lieutenant

General and to a four-year term as the Chief of Army Reserve (USAR) & Commanding General of the U.S. Army Reserve Command (USARC).

The USAR and USARC is an organization of over 215,000 Soldiers/civilians, 134 general officers/executives, an annual operating budget

of $9B, and activities in over 30 countries, including all states/territories. He has received numerous medals/awards, including two

Army Distinguished Medals and three Bronze Star Medals. He retired from the military in 2016 and was recognized by the U.S. Senate on

June 28, 2016 with “Tribute to Lieutenant General Jeffrey W. Talley”, as reflected in the congressional record. On April

28, 2023, he was awarded the Gold de Fleury Medal for “inspirational leadership to the Nation and the U.S. Army Engineer Regiment.”

Jeff’s

academic positions held are: Assistant Professor, Associate Professor, Professor, Department Chair, Endowed Chair, Institute Director,

Adjunct Professor, Advanced Leadership Fellow, Scholar-in-Residence, and Professor of the Practice, with appointments at the University

of Notre Dame, Southern Methodist University, The Johns Hopkins University, Harvard University, and University of Southern California.

Jeff

holds a Ph.D. from Carnegie Mellon University, an Executive M.B.A. from the University of Oxford, an M.S.E. from The Johns Hopkins University,

an M.L.A. from Washington University in St. Louis, an M.S.S. from the U.S. Army War College, an M.A. from Assumption College, and a B.S.

from Louisiana State University. He is a registered Professional Engineer (P.E.), a Board-Certified Environmental Engineer (BCEE) in

Sustainability, and a Diplomate, Water Resources Engineer (D.WRE).

Family

Relationships

There

are no family relationships among our executive officers and directors.

Involvement

in Certain Legal Proceedings

During

the past ten years, except as set forth above, none of our directors, executive officers, promoters, control persons, or nominees has

been:

| |

● |

the

subject of any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer

either at the time of the bankruptcy or within two years prior to that time; |

| |

|

|

| |

● |

convicted

in a criminal proceeding or is subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

● |

subject

to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or any

Federal or State authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any

type of business, securities or banking activities; |

| |

|

|

| |

● |

found

by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated

a federal or state securities or commodities law; |

| |

|

|

| |

● |

the

subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently

reversed, suspended or vacated, relating to an alleged violation of (a) any Federal or State securities or commodities law or regulation;

(b) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or

permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order,

or removal or prohibition order; or (c) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business

entity; or |

| |

|

|

| |

● |

the

subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization

(as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29)

of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary

authority over its members or persons associated with a member. |

Committees

of the Board

Due

to the small size of the Company and its Board of Directors, we currently have no audit committee, compensation committee or nominations

and governance committee of our board of directors. We do not have an audit committee financial expert.

Code

of Ethics and Business Conduct

The

Company has adopted a Code of Ethics and Business Conduct (“Code of Ethics”) that applies to all of its directors, officers

and employees. Any waiver of the provisions of the Code of Ethics for executive officers and directors may be made only by the Board

of Directors. Any such waivers will be promptly disclosed to the Company’s shareholders. A copy of our Code of Ethics is attached

as an exhibit to this Form 10-K and will be provided to any person requesting same without charge. To request a copy of our Code of Ethics

please make written request to our Chief Executive Officer c/o M2i Global, Inc. at 885 Tahoe Blvd., Incline Village, NV 89451.

Changes

in Nominating Procedures

None.

Item

11. Executive Compensation

EXECUTIVE

COMPENSATION SUMMARY COMPENSATION TABLE

The

Summary Compensation Table shows certain compensation information for services rendered in all capacities for the fiscal years ended

November 30, 2023 and 2022. Other than as set forth herein, no executive officer’s salary and bonus exceeded $100,000 in any of

the applicable years. The following information includes the dollar value of base salaries, bonus awards, the number of stock options

granted and certain other compensation, if any, whether paid or deferred.

Summary

Compensation

The

particulars of compensation paid to the following persons:

| |

(a) |

our

principal executive officer; |

| |

(b) |

each

of our two most highly compensated executive officers who were serving as executive officers at the end of the fiscal years ended

November 30, 2022 and 2023; and |

| Name and Principal Position | |

Year | | |

Stock

Awards

($) | | |

Option

Awards

($) | | |

All Other

Compensation

($) | | |

Total

($) | |

| Doug Cole | |

2022 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Executive Chairman, Chief Financial Officer, Former Chief Executive Officer(1) | |

2023 | | |

| - | | |

| - | | |

| 305,667 | | |

| - | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Jeffrey W. Talley | |

2022 | | |

| - | | |

| - | | |

| - | | |

| - | |

| President and Chief Executive Officer of U.S. Minerals and Metals, Corporation(2) | |

2023 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Ioanna Kallidou | |

2022 | | |

| - | | |

| - | | |

| 49,000 | | |

| 49,000 | (3) |

| Former President(3) | |

2023 | | |

| - | | |

| - | | |

| 16,500 | | |

| 16,500 |

|

(1)

On December 11, 2023, Mr. Doug Cole resigned from the President and Chief Executive Officer roles of the Company, but still maintains

his roles as Executive Chairman and Chief Financial Officer.

(2)

On December 11, 2023, Mr. Talley, was appointed as President and Chief Executive Officer of the

Company.

(3) Consists of a $35,000 salary and $14,000 bonus.

Agreements

with Named Executive Officers

M2i

and its subsidiaries entered into new agreements or amended existing agreements with its named executive officers. A summary of the compensation

provided under such agreement is as follows:

| |

1. |

On

December 1, 2022, Jeffrey W. Talley and U.S. Minerals & Metals Corporation entered into a consulting agreement where Mr. Talley

agreed to serve as president and chief executive officer of U.S. Minerals & Metals Corporation until the agreement is terminated.

Mr. Talley is entitled to a consulting payment of $41,666.67 per month. His additional bonuses are determined by the Board of Directors. |

| |

|

|

| |

2. |

On

January 23, 2023, Douglas Cole and U.S. Minerals and Metals Corporation entered into a business development agreement where Mr. Cole

agreed to serve as a Senior Strategic and Business Development Advisor for a term of 10 years to U.S. Minerals & Metals Corporation.

For his services, Mr. Cole will receive, on January 2, 2024, and on the first business day of each year thereafter until and including

the first business day of January 2033, 10,000,000 shares of the U.S. Minerals & Metals Corporation’s common stock, par

value $.0001, as they may be adjusted from time to time on account of splits, consolidations, dividends and similar changes in exchange

for a purchase price of $1,000. |

| |

|

|

| |

3. |

Pursuant to the Agreement and

Plan of Merger, dated as of May 12, 2023, and entered into by and among Inky, Inc. and U.S. M and M Acquisition Corp. and U.S. Minerals

and Metals Corp., which is annexed hereto as exhibit 2.01 below, at the time of consummation of the merger, all shares of USMM were simultaneously

converted into shares of M2i Global, Inc.’s common stock, and thus, any shares issued by USMM pursuant to the BDA or WSCA, as referenced

above are now issued from M2i Global, Inc.

|

There

are no arrangements or plans in which we provide pension, retirement or similar benefits for our executive officers, except that our

executive officers may receive stock options at the discretion of our board of directors.

Grants

of Plan-Based Awards Table

We

did not grant any awards to our named executive officers during our fiscal year ended November 30, 2023.

Compensation

Plans

As

of November 30, 2023, we did not have an equity compensation plan in place.

Outstanding

Equity Awards at Fiscal Year-End

The

following table sets forth for each named executive officer certain information concerning the outstanding equity awards as of November

30, 2023:

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| | |

| OPTION AWARDS | | |

STOCK AWARDS |

| Name | |

| Number of Securities Underlying Unexercised Options

(#)

Exercisable | | |

Number of Securities Underlying Unexercised Options

(#)

Un-exercisable

| | |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options

(#)

| | |

Option Exercise Price

($) | | |

Option Expiration Date | | |

Number of Shares or Units of Stock That Have Not Vested

(#)

| | |

Market Value of Shares or Units of Stock That Have Not Vested

($)

| | |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested

(#)

| | |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested

(#)

|

| Doug Cole | |

| | | |

| - | | |

| - | | |

$ | - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Jeffrey W. Talley | |

| | | |

| - | | |

| - | | |

$ | - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - |

Compensation

of Directors

The

following compensation was provided to the directors of M2i who are not also named executive officers during the fiscal year ended November

30, 2023:

| Name | |

Fees

earned

or paid

in cash

($)

| | |

Stock

Awards

($)

| | |

Option

Awards

($)(1) | | |

Non-

Equity

Incentive

Plan

Compensation

($) | | |

Nonqualified Deferred Compensation Earnings

($) | | |

All Other Compensation($) Total

($) | |

| Doug Cole | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

Item

12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth

information as of November 30, 2023 regarding the beneficial ownership of our Common Stock by (i) those persons who are

known to us to be the beneficial owner(s) of more than 5% of our Common Stock, (ii) each of our directors and named executive officers,

and (iii) all of our directors and executive officers as a group and of our preferred stock. Except as otherwise indicated, the beneficial

owners listed in the tables below possess the sole voting and dispositive power in regard to such shares and have an address of c/o M2i

Global, Inc. 885 Tahoe Blvd. Incline Village, NV 89451. As of November 30, 2023 there were 588,333,691 shares of our Common

Stock outstanding. As of November 30, 2023 there were 100,000 shares of preferred stock issued and outstanding.

Beneficial

ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities.

Shares of our Common Stock subject to options, warrants, notes or other conversion privileges currently exercisable or convertible, or

exercisable within 60 days of the date of this table, are deemed outstanding for computing the percentage of the person holding such

option, warrant, note, or other convertible instrument but are not deemed outstanding for computing the percentage of any other person.

Where more than one person has a beneficial ownership interest in the same shares, the sharing of beneficial ownership of these shares

is designated in the footnotes to this table.

Beneficial

Ownership of Common Stock

| Name

and Address of Beneficial Owner | |

Amount

and Nature of Beneficial Ownership | | |

Percent

of Class | |

| Doug

Cole, Executive Chairman and Chief Financial Officer* | |

| 0 | (1) | |

| * | % |

| Jeffrey

W. Talley, President & Chief Executive Officer of U.S. Minerals and Metals Corporation* | |

| 0 | (2) | |

| * | % |

| Dhruv

Gulati* | |

| 0 | (3) | |

| * | % |

| Alberto

Rosende* | |

| 0 | (4) | |

| * | % |

| Doug

Kunnel* | |

| 1,000,000 | | |

| * | % |

| Directors

and Executive Officers as a Group (6 persons) | |

| 1,000,000 | | |

| * | % |

| * |

Represents

ownership of less than 1% |

| (1) |

This

does not include 70,000,000 shares of Common Stock beneficially owned by The Cole Family Revocable Trust; and 10,000,000 shares of

Common Stock beneficially owned by the Cole Family Trust of 2014 or Mr. Cole’s 100,000 shares of preferred stock. Mr. Cole

does not have any control over the trust, including no voting power and no power to dispose of the shares. |

| (2) |

This

does not include 50,000,000 shares of Common Stock beneficially owned by The Talley Family Revocable Trust. Mr. Talley does not have

any control over the trust, including no voting power and no power to dispose of the shares. |

| (3) |

This

does not include 15,000,000 shares of Common Stock beneficially owned by The Dhruv Gulati 2015 Living Trust. |

| (4) |

This

does not include 4,000,000 shares of Common Stock beneficially owned by Rosende Quattro LLC of which Mr. Rosende is the managing

member. |

Beneficial

Ownership of Preferred Stock

| Name and Address of Beneficial Owner | |

Amount and Nature of Beneficial Ownership of Preferred Stock | | |

Percent of Class | |

| Doug Cole, Executive Chairman and Chief Financial Officer | |

| 100,000 | (1) | |

| 100 | % |

| Directors and Executive Officers as a Group (1 person) | |

| 100,000 | | |

| 100 | % |

| (1) |

Mr.

Cole holds 100,000 shares of preferred stock. This does not include 70,000,000 shares of Common Stock beneficially owned by The Cole

Family Revocable Trust; and 10,000,000 shares of Common Stock beneficially owned by the Cole Family Trust of 2014. Mr. Cole does

not have any control over the trust, including no voting power and no power to dispose of the shares. |

Item

13. Certain Relationships and Related Transactions and Director Independence

Certain

Relationships and Related Transactions

During

May 2023, the Company’s former CEO, Ioanna Kallidou, forgave liabilities totaling $146,593 consisting of accrued payroll and a

related party loan. As a result of the forgiveness, a contribution was recorded to additional paid in capital during May 2023. As of

May 31, 2023, no balances due to Ioanna Kallidou were outstanding.

Director

Independence

We

currently do not have any directors who are “independent” as defined under the NASDAQ Marketplace Rules.

Item

14. Principal Accountant Fees and Services

Turner,

Stone & Company, LLP (“Turner Stone”) served

as the independent registered public accounting firm to audit our books and accounts for the fiscal year ending November 30, 2023 and

Heaton & Company, PLLC dba Pinnacle Accountancy Group of Utah (“Pinnacle”)

served as the independent registered public accounting firm to audit our books and accounts for the fiscal year ending November 30, 2022.

The

table below presents the aggregate fees billed for professional services rendered by Turner Stone and Pinnacle for the years ended November

30, 2023 and 2022.

| Fees | |

| 2023 | (1)* | |

| 2022 | (2) |

| Audit Fees | |

$ | [ ] | | |

$ | 9,750 | |

| Audit Related Fees | |

| [ ] | | |

| - | |

| Tax Fees | |

| - | | |

| - | |

| Other Fees | |

| - | | |

| - | |

| Total Fees | |

$ | [ ] | | |

$ | 9,750 | |

*At the time of the filing of this annual report

on Form 10-K, the total fees billed for professional services by Turner Stone have not yet been determined.

| |

(1) |

Represents

aggregate fees charged by Turner Stone for audit of the Company’s financial statements for the fiscal year ended November

30, 2023. |

| |

(2) |

Represents

aggregate fees charged by Pinnacle for audit of the Company’s financial statements for the fiscal year ended November 30,

2022. |

In

the above table, “audit fees” are fees billed for services provided related to the audit of our annual financial statements,

quarterly reviews of our interim financial statements, and services normally provided by the independent accountant in connection with

regulatory filings or engagements for those fiscal periods. “Audit-related fees” are fees not included in audit fees that

are billed by the independent accountant for assurance and related services that are reasonably related to the performance of the audit

or review of our financial statements. These audit-related fees also consist of the review of our registration statements filed with

the SEC and related services normally provided in connection with regulatory filings or engagements. “All other fees” are

fees billed by the independent accountant for products and services not included in the foregoing categories.

PART

IV

Item

15. Exhibits and Financial Statement Schedules

| 1) |

The

consolidated financial statements contained herein are as listed on the “Index to Consolidated Financial Statements”

on page F-1 of this report. |

| 2) |

The

consolidated financial statement schedule contained herein is as listed on the “Index to Consolidated Financial Statements”

on page F-1 of this report. All other schedules have been omitted because they are not applicable, not required, or the information

is included in the consolidated financial statements or notes thereto. |

| Exhibit

Number |

|

Description |

| 2.01 |

|

Agreement and Plan of Merger, dated as of May 12, 2023 and entered into by and among Inky, Inc. and U.S. M and M Acquisition Corp. and U.S. Minerals and Metals Corp. (incorporated by reference to Exhibit 2.01 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.1 |

|

Articles of Incorporation (incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.2 |

|

Certificate of Amendment to the Certificate of Incorporation of Inky Inc. dated May 8, 2023 (incorporated by reference to Exhibit 3.2 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.3 |

|

Articles of Merger dated as of May 18, 2023 (incorporated by reference to Exhibit 3.3 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.4 |

|

Certificate of Amendment to Articles of Incorporation dated June 8, 2023- Name Change (incorporated by reference to Exhibit 3.4 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.5 |

|

Certificate of Designation of Series A Super-Voting Preferred Stock (incorporated by reference to Exhibit 3.5 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.6 |

|

Bylaws (incorporated by reference to Exhibit 3.6 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 10.1 |

|

Consulting Agreement with Jeffrey Talley (incorporated by reference to Exhibit 10.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 10.2 |

|

Business Development Agreement with Lyons Capital LLC dated February 23, 2023 (incorporated by reference to Exhibit 10.2 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 10.3 |

|

Wall Street Conference Business Development Agreement with Lyons Capital LLC dated February 23, 2023 (incorporated by reference to Exhibit 10.3 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 10.4 |

|

Business Development Agreement with Doug Cole dated January 23, 2023 (incorporated by reference to Exhibit 10.4 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 14.1 |

|

Code of Business Conduct and Ethics (incorporated by reference to Exhibit 14.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 21.1 |

|

List of Subsidiaries (incorporated by reference to Exhibit 21.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 31.1* |

|

Certification of Principal Executive Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Securities Exchange Act, as amended. |

| 31.2* |

|

Certification of Principal Financial Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Securities Exchange Act, as amended. |

| 32.1** |

|

Certification of Principal Executive Officer and Principal Financial Officer pursuant to Rules 13a-14(b) or 15d-14(b) of the Securities Exchange Act, as amended, and 18 U.S.C. Section 1350. |

| 101.INS |

|

Inline

XBRL Instance Document. |

| 101.SCH |

|

Inline

XBRL Taxonomy Extension Schema Document. |

| 101.CAL |

|

Inline

XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.DEF |

|

Inline

XBRL Taxonomy Extension Definition Linkbase Document. |

| 101.LAB |

|

Inline

XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE |

|

Inline

XBRL Taxonomy Extension Presentation Linkbase Document. |

| 104 |

|

Cover

Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

| * |

Filed

herewith. |

| |

|

| ** |

Furnished

herewith. |

Item

16. Form 10-K Summary

None.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| M2I

GLOBAL, INC. |

|

|

| |

|

|

| Date:

April 16, 2024 |

By: |

/s/

Jeffrey W. Talley |

| |

|

Jeffrey

W. Talley Chief Executive Officer

|

| |

|

(Principal

Executive Officer) |

In

accordance with the Exchange Act, this Report has been signed below by the following persons on behalf of the registrant and in the capacities

and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Doug Cole |

|

Chief

Financial Officer and Executive Chairman |

|

April 16, 2024 |

| Doug

Cole |

|

(Principal

Financial Officer) |

|

|

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Jeffrey W. Talley |

|

Chief

Executive Officer |

|

April 16, 2024 |

| Jeffrey

W. Talley |

|

(Principal

Executive Officer) |

|

|

M2I

GLOBAL, INC.

FINANCIAL

STATEMENTS

TABLE

OF CONTENTS

Report

of Independent Registered Public Accounting Firm

Board

of Directors and Stockholders

M2i

Global, Inc.

Opinion

on the Financial Statements

We

have audited the accompanying consolidated balance sheet of M2i Global, Inc.(formerly Inky, Inc.) (the “Company”) as of November

30, 2023, and the related consolidated statements of operations, changes in stockholders’ (deficit) equity and cash flows for the

year in the period ended November 30, 2023, and the related notes (collectively referred to as the “financial statements”).

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of November

30, 2023, and the results of its operations and its cash flows for the year in the period ended November 30, 2023, in conformity with

accounting principles generally accepted in the United States of America.

Going

Concern

The

accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note

2 to the financial statements, the Company has limited revenues and incurred recurring losses that raise substantial doubt about its

ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial

statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis

for Opinion

These

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial

statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United

States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities

laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We

conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company

is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit

we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion

on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our

audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or

fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding

the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant

estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides

a reasonable basis for our opinion.

/s/

Turner, Stone & Company, L.L.P.

We

have served as the Company’s auditor since 2024.

Dallas,

Texas

April

16, 2024

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

M2i Global, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheet

of M2i Global, Inc. (the Company) as of November 30, 2022, and the related statements of operations, changes in stockholders’ equity

(deficit), and cash flows for the year then ended, and the related notes (collectively referred to as the financial statements). In our

opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of November 30, 2022,

and the results of its operations and its cash flows for the year then ended, in conformity with accounting principles generally accepted

in the United States of America.

Consideration of the Company’s Ability

to Continue as a Going Concern