Filed Pursuant to Rule 424(b)(3)

File No. 333-255312

PROSPECTUS

102,204,552

Shares of Common Stock

This

prospectus relates to the offering and resale by the selling stockholders (the “Selling Stockholders”) identified

herein of up to 102,204,552 shares of the common stock, par value $0.001 (the “common stock”) of Innovative Payment

Solutions, Inc. (“IPSI,” the “Company,” “we,” “our,” or “us”), a Nevada

corporation, which includes: (i) 39,977,779 shares of common stock, consisting of (a) 30,333,334 shares of common stock issued

in a private placement transaction that closed on March 16, 2021 (the “March Private Placement”), (b) 5,066,667 shares

of common stock issued on February 19, 2021 to a Selling Stockholder upon conversion of a 12.5% Original Issue Discount Convertible

Note issued on February 3, 2021 in the aggregate principal amount of $228,000 at a conversion price of $0.05 per share (the “February

3rd Note”) which February 3rd Note was sold in a private placement transaction that closed on February

3, 2021 (the “February 3rd Private Placement”), (c) 4,577,778 shares of common stock issued to a Selling

Stockholder on February 16, 2021, upon the conversion of a 12.5% Original Issue Discount Convertible Note in the aggregate principal

amount of $206,000, at a conversion price of $0.05 per share (the “Second February 16th Note”), which was

sold in a private placement transaction that closed on February 16, 2021 (the “Second February 16th Private Placement”);

(ii) 14,989,333 shares of common stock issuable upon conversion of three 12.5% Original Issue Discount Convertible Notes in the

aggregate principal amount of $2,044,000, plus $204,400.00 of interest to be accrued through the maturity date thereof, with a

conversion price of $0.15 (as adjusted from an original conversion price of $0.23 per share, pursuant to the terms of such note

for subsequent equity sales, the “Initial February 16th Notes”) issued in a private placement transaction

that closed on February 16, 2021 (the “Initial February 16th Private Placement”) (the Initial February

16th Notes, the Second February 16th Note and the February 3rd Note being collectively referred to as the

“Notes”); (iii) 47,237,440 shares of common stock underlying sixteen (16) five-year warrants, which includes (a) 15,166,668

shares of common stock issuable upon the exercise of warrants issued in the March Private Placement having an exercise price of

$0.15 per share (the “March Warrants”), (b) 2,426,667 shares of common stock issuable upon the exercise of warrants

issued to the placement agent in the March Private Placement having an exercise price of $0.1875 per shares (the “Placement

Agent Warrants”), (c) 8,886,958 shares of common stock issuable upon the exercise of warrants issued in the Initial February

16th Private Placement having an exercise price of $0.15 per share (as adjusted from an original exercise price of

$0.23 per share, pursuant to the terms of such warrants for subsequent equity sales the “Initial February 16th

Warrants”), (d) 4,577,778 shares of common stock issuable upon the exercise of warrants issued in the Second February 16th

Private Placement having an exercise price of $0.05 per share (the “Second February 16th Warrants”),

(e) 15,244,446 shares of common stock issuable upon the exercise of warrants issued in the February 3rd Private Placement

having an exercise price of $0.05 per share (the “February 3rd Warrants”), and (f) 934,923 shares of common

stock issuable upon exercise of warrants issued on July 31, 2020, with an exercise price of $0.05 per share (the “July Warrants”),

in a private placement transaction that closed on July 31, 2020 (the “July Private Placement”) (the March Warrants,

the Initial February 16th Warrants, the Second February 16th Warrants, the February 3rd Warrants,

the Placement Agent Warrants and the July Warrants, being collectively referred to as the “Warrants” and such shares

as described in (i)-(iii), being collectively referred to as the “Shares”). We are registering the Shares pursuant

to the registration rights agreements (“Registration Rights Agreements” and each a “Registration Rights Agreement”)

that we entered into with certain of the Selling Stockholders on June 30, 2020, February 3, 2021, February 16, 2021 and March

11, 2021 and the engagement agreement that we entered into with the placement agent for the March Private Placement. See the section

of this prospectus entitled “The Private Placements” for a description of the Private Placements, and the section

of this prospectus entitled “Selling Stockholders” for additional information regarding the Selling Stockholders.

We

are not selling any Shares in this offering. We, therefore, will not receive any proceeds from the sale of the Shares by the Selling

Stockholders. However, we may receive gross proceeds upon the exercise of the Warrants if exercised for cash.

The

Selling Stockholders may sell the Shares described in this prospectus in a number of different ways and at varying prices. The

prices at which the Selling Stockholders may sell the Shares in this offering will be determined by the prevailing market price

for the shares of our common stock or in negotiated transactions. See “Plan of Distribution” for more information

about how the Selling Stockholders may sell the Shares being registered pursuant to this prospectus. The Selling Stockholders

each may be deemed an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended.

The Selling Stockholders have informed us that they do not currently have any agreement or understanding, directly or indirectly,

with any person to distribute the Shares.

We

have agreed to pay the expenses of the registration of the shares of our common stock offered and sold under the registration

statement by the Selling Stockholders. The Selling Stockholders will pay any underwriting discounts, commissions and transfer

taxes applicable to the shares of common stock sold by it.

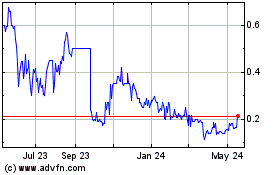

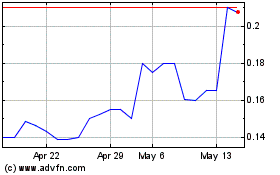

Our

common stock issued is traded on the OTCQB under the symbol “IPSI.” On April 12, 2021, the last reported sale price

of our common stock on the OTCQB was $0.0929.

Investing

in our securities involves various risks. See “Risk Factors” beginning on page 7 of this prospectus for a discussion

of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 26, 2021

Table

of Contents

The

registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information

about us and the common stock offered under this prospectus. The registration statement, including the exhibits, can be read on

our website and the website of the Securities and Exchange Commission. See “Where You Can Find More Information.”

Information

contained in, and that can be accessed through, our web site www.ipsipay.com shall not be deemed to be part of this prospectus

or incorporated herein by reference and should not be relied upon by any prospective investors for the purposes of determining

whether to purchase the Shares offered hereunder.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains, in addition to historical information, certain forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”), that includes information relating to future events,

future financial performance, strategies, expectations, competitive environment, regulation and availability of resources. Such

forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development

and/or otherwise are not statements of historical fact. These forward-looking statements are based on our current expectations

and projections about future events and they are subject to risks and uncertainties known and unknown that could cause actual

results and developments to differ materially from those expressed or implied in such statements.

In

some cases, you can identify forward-looking statements by terminology, such as “may,” “should,” “would,”

“expect,” “intend,” “anticipate,” “believe,” “estimate,” “continue,”

“plan,” “potential” and similar expressions. Accordingly, these statements involve estimates, assumptions

and uncertainties that could cause actual results to differ materially from those expressed in them. Any forward-looking statements

are qualified in their entirety by reference to the factors discussed throughout this prospectus or incorporated herein by reference.

You

should read this prospectus and the documents we have filed as exhibits to the registration statement, of which this prospectus

is part, completely and with the understanding that our actual future results may be materially different from what we expect.

You should not assume that the information contained in this prospectus or any prospectus supplement is accurate as of any date

other than the date on the front cover of those documents.

Risks,

uncertainties and other factors that may cause our actual results, performance or achievements to be different from those expressed

or implied in our written or oral forward-looking statements may be found in this prospectus under the heading “Risk Factors.”

Forward-looking

statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume

no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors

affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more

forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking

statements.

New

factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess

the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results

to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this

prospectus particularly our forward-looking statements, by these cautionary statements.

INDUSTRY

AND MARKET DATA

This

prospectus contains estimates and other statistical data made by independent parties and by us relating to market size and growth

and other data about our industry. We obtained the industry and market data in this prospectus from our own research as well as

from industry and general publications, surveys and studies conducted by third parties. This data involves a number of assumptions

and limitations and contains projections and estimates of the future performance of the industries in which we operate that are

subject to a high degree of uncertainty, including those discussed in “Risk Factors.” We caution you not to give undue

weight to such projections, assumptions and estimates. Further, industry and general publications, studies and surveys generally

state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness

of such information. While we believe that these publications, studies and surveys are reliable, we have not independently verified

the data contained in them. In addition, while we believe that the results and estimates from our internal research are reliable,

such results and estimates have not been verified by any independent source.

PROSPECTUS

SUMMARY

Company

Overview

We

are a provider of next generation digital payment solutions and services to businesses and consumers. Our business model has substantially

changed during the course of 2020. We have focused on developing a technology driven digital infrastructure via our IPSIPay Platform

and IPSIPay applications and have plans to launch various digital payment cryptocurrency products, including, IPSI Pay, IPSI Stable

Coin, IPSI Wallet and IPSI Payroll, using blockchain technology. We are developing a flexible ecosystem that will enable businesses

and customers to adopt and utilize IPSI Pay prepaid card services, integrated payment service solutions in the U.S. and Mexico,

transfer money to and from the U.S. swiftly and at minimal cost compared to traditional money transfer service providers, utilizing

stable dollar backed digital coins thus allowing small businesses and consumers to have access to various payment routes previously

not available to them. We also intend to use our kiosk payment system and service in the U.S.

Our

initial introduction into virtual payment services was launched in the Mexican market in the third quarter of 2014 where we had

an integrated network of kiosks, terminals and payment channels that enabled consumers to deposit cash, convert it into digital

form and remit the funds to any merchant in our network swiftly and securely. We helped consumers and merchants connect more efficiently

in markets and consumer segments that are largely cash-based and lack convenient alternatives to pay for services in physical,

online or mobile environment.

On

August 5, 2019, we entered into a Stock Purchase Agreement (“Vivi SPA”) with Vivi Holdings to sell to Vivi Holdings,

our Mexican operations for 2,250,000 shares of common stock of Vivi Holdings (the “Stock Sale”), of which nine percent

(9%) was allocated to the following: Gaston Pereira (5%), Andrey Novikov (2.5%), and Joseph Abrams (1.5%). The sale of the Mexican

operations pursuant to the Vivi SPA was closed on December 31, 2019 after the receipt of a final fairness opinion and the approval

of our shareholders. We no longer have any business operations in Mexico and our business is now focused on our U.S. operations

based in Northridge, California.

Our

Strategy

We offer

a simple payment solution for consumers and businesses. We have plans to roll out 50 kiosks in Southern California to provide

digital payments for the unbanked and underbanked using self-service kiosks and an E wallet ecosystem. The kiosks are currently

located in our warehouses in Southern California awaiting re-engineering and installation. Due to measures imposed by the local

governments in areas affected by COVID-19, businesses have been suspended due to quarantine intended to contain this outbreak

and many people have been forced to work from home in those areas. As a result, installation of our network of kiosks, terminals

and payment channels in Southern California has been delayed, which has had an adverse impact on our business and financial

condition and has hampered our ability to generate revenue and access usual sources of liquidity on reasonable terms. During this

delay, we decided to reengineer our kiosks to provide for additional functionality and features.

Our

mission is to leverage our four-years of experience that we had with our Mexican kiosks and build out a U.S. only kiosk network

in Southern California that will allow the majority of the Southern California market to transfer money to Mexico at a lower cost

than their current options and make payments to Mexican vendors as well.

The

launch of the kiosks in Southern California will be directed toward the heavily trafficked Mexican grocery stores, convenience

stores, check cashing businesses, and gas stations. Our goal is to develop a distribution network of kiosks that allow our clients

to enhance their customer experience by combining mobile and hardware interfaces, such as IPSI Wallet, our mobile wallet under

development, coupled with self-service kiosks into a seamless customer centric ecosystem.

Business

Model

Our

primary source of revenue is expected to come from commissions and fees from money transfers. We also expect to derive revenue from a

second screen on the kiosks which will be an ad driven revenue producer. Over the last 4 years we established the model, with over $11,000,000

in revenue 2019 and 2 million Mexican subscribers using the kiosks regularly. This experience and the vending partnerships established

in those machines should facilitate the roll-out of our company owned machines in Southern California. This coupled with U.S. vending

additions such as micro loans, money transmitting opportunities (a $30 Billion business), lotto tickets, and the built- in Mexican vendors,

gives us what we believe to be the total solution for the Mexican consumer population in Southern California. After the launch of 50

kiosks in a small, designated Los Angeles area, we anticipate having a sophisticated distribution network of over 500 kiosks in California,

Texas and Florida. With this initial launch in Southern California, we will own the first 50 machines and the retailer will receive 20%

of the fees as rent. Alternatively, we may sell the kiosks to retailers for a unit price of $6,000 and in return receive 30% of the revenues.

Distribution

Network

We

are developing a distribution network along several verticals; 1) An agent network of independent businesses with high customer

traffic in which our kiosks will be deployed generating additional revenue for them; and 2) Retailers that wish to decongest long

lines and shift service payments to self-service kiosks.

Marketing

We

participate in special local events and exhibitions and provide promo materials to distribute to retailers. We intend to direct

advertisements to the mainly Spanish speaking customers in Southern California, along with our Spanish speaking employees that

can educate and demonstrate services at the kiosks. We expect this will add tremendously to acceptance and word of mouth advertising

in the respective neighborhoods.

Competition

The

payment service business is highly competitive and continued growth depends on our ability to compete effectively. Although we

don’t face direct competition in the form of kiosks, companies like Western Union, Money Gram and Wells Fargo, dominate

the money remittance and wiring business. However, with the E wallet, our customer has the ability to deposit money into the kiosks

and consequently create their own digital wallet bank on our network.

Government

and Environmental Regulation and Laws

Currently

our business is not impacted by government regulation. We may in the future be subject to a variety of regulations aimed at preventing

money laundering and financing criminal activity and terrorism, financial services regulations, payment services regulations,

consumer protection laws, currency control regulations, advertising laws and privacy and data protection laws and therefore expect

to experience periodic investigations by various regulatory authorities in connection with the same, which may sometimes result

in monetary or other sanctions being imposed on us. Many of these laws and regulations are constantly evolving and are often unclear

and inconsistent with other applicable laws and regulations, making compliance challenging and increasing our related operating

costs and legal risks. In particular, there has been increased public attention and heightened legislation and regulations regarding

money laundering and terrorist financing. We may have to make significant judgment calls in applying anti-money laundering legislation

and risk being found in non-compliance with such laws.

The

regulatory regime governing blockchain technologies, cryptocurrencies, digital assets, utility tokens, security tokens and offerings

of digital assets is uncertain, and new regulations or policies may materially adversely affect our development and the value.

Regulation of digital assets, like IPSI Stable Coin, cryptocurrencies, blockchain technologies and cryptocurrency exchanges, is

currently undeveloped and likely to rapidly evolve as government agencies take greater interest in them. Regulation also varies

significantly among international, federal, state and local jurisdictions, and is subject to significant uncertainty. Various

legislative and executive bodies in the United States and in other countries may in the future adopt laws, regulations, or guidance,

or take other actions, which may severely impact the permissibility of digital assets generally and the technology behind them

or the means of transaction or in transferring them. In addition, any violations of laws and regulations relating to the safeguarding

of private information in connection with IPSI Stable Coin, IPSI Pay, IPSI Payroll and/or IPSI Wallet could subject us to fines,

penalties or other regulatory actions, as well as to civil actions by affected parties. Any such violations could adversely affect

the ability of the Company to maintain IPSI Stable Coin, IPSI Pay, IPSI Payroll and/or IPSI Wallet, which could have a material

adverse effect on our operations and financial condition. Failure by us to comply with any laws, rules and regulations, some of

which may not exist yet or are subject to interpretation and may be subject to change, could result in a variety of adverse consequences,

including civil penalties and fines.

Human

Capital/Employees

As

of December 31, 2020, Innovative Payment/Solutions had 2 full time employees, which are its chief executive officer

and chief technology officer and 5 consultants. None of our employees is represented by a labor union, and we consider our employee

relations to be good.

The

principal purposes of our 2018 Equity Incentive Plan (the “Plan”) is to attract, retain and motivate selected employees,

consultants and directors through the granting of stock-based compensation awards and cash-based performance bonus awards.

Our

Corporate History and Background

We

were incorporated on September 25, 2013 under the laws of the State of Nevada originally under the name Asiya Pearls, Inc.

On May 27, 2016, Asiya Pearls, Inc. filed a Certificate of Amendment to its Articles of Incorporation to change its name from

Asiya Pearls, Inc. to QPAGOS.

Qpagos

Corporation was incorporated on May 1, 2015 under the laws of Delaware under the name Qpagos Corporation as the holding company

for its two 99.9% owned operating subsidiaries, QPagos, S.A.P.I. de C.V. (“Qpagos Mexico”) and Redpag Electrónicos

S.A.P.I. de C.V. (“Redpag”). Each of these entities were incorporated in November 2013 in Mexico. Qpagos Mexico was

formed to process payment transactions for service providers it contracts with as well as provide electronic payment solutions

to multiple clients in several industry segments, including retail, financial transportation, and government; and Redpag was formed

to deploy and operate kiosks as a distributor of Qpagos Mexico.

On

August 31, 2015, QPAGOS Corporation entered into various agreements with the shareholders of Qpagos Mexico and Redpag

to give effect to a reverse merger transaction (the “Reverse Merger’’). Pursuant to the Reverse Merger, the

majority of the shareholders of Qpagos Mexico and Redpag effectively received shares in Qpagos Corporation, through various consulting

and management agreements entered into with Qpagos Corporation and sold an effective 99.996% and 99.990% of the outstanding shares

in Qpagos Mexico and Redpag, respectively to Qpagos Corporation. The series of transactions closed effective August 31, 2015.

Upon the close of the Reverse Merger, Qpagos Corporation became the parent of Qpagos Mexico and Redpag and assumed the operations

of these two companies as its sole business.

On

May 12, 2016, Qpagos Corporation entered into an Agreement and Plan of Merger (the “Merger Agreement”) with

QPAGOS and QPAGOS Merge, Inc., a Delaware corporation and wholly owned subsidiary of QPAGOS (“Merger Sub”). Pursuant

to the Merger Agreement, on May 12, 2016 Qpagos Corporation and Merger Sub merged (the “Merger”), and Qpagos

Corporation continued as the surviving corporation of the Merger and became a wholly owned subsidiary of QPAGOS. As a result of

the Merger, each outstanding share of Qpagos Corporation common stock was converted into the right to receive two shares of QPAGOS

common stock as set forth in the Merger Agreement. Under the terms of the Merger Agreement, we issued, and Qpagos Corporation

stockholders received in a tax-free exchange, shares of our common stock such that Qpagos Corporation stockholders owned approximately

91% of our company immediately after the Merger. In addition, each outstanding warrant of Qpagos Corporation was assumed by us

and converted into a warrant to acquire a number of shares of our common stock equal to twice the number of shares of common stock

of Qpagos Corporation subject to the warrant immediately before the effective time of the Merger at an exercise price per share

of Company common stock equal to 50% of the warrant exercise price for Qpagos Corporation common stock. There were no options

outstanding in Qpagos Corporation prior to the merger.

On

November 1, 2019, we changed our name from QPAGOS to Innovative Payment Solutions, Inc. On November 1, 2019, we also filed a Certificate

of Change with the Secretary of State of the State of Nevada to effect a reverse split of our common stock at a ratio of 1-for-10

(the “Reverse Stock Split”), effective on November 1, 2019. As a result of the Reverse Stock Split, each ten (10)

pre-split shares of common stock outstanding were automatically combined into one (1) new share of common stock. Unless otherwise

stated, all share and per shares numbers in this prospectus have been adjusted to reflect the Reverse Stock Split.

On

December 31, 2019, we consummated the disposal of Qpagos Corporation, including the two Mexican subsidiaries, Qpagos Mexico and

Redpag, in exchange for 2,250,000 shares of common stock of Vivi Holdings, of which nine percent (9%) was allocated to the following:

Gaston Pereira (5%), Andrey Novikov (2.5%), and Joseph Abrams (1.5%). The Vivi SPA was closed on December 31, 2019 after the satisfaction

of customary conditions, the receipt of a final fairness opinion and the approval of our shareholders. We no longer have any business

operations in Mexico and have retained our U.S. operations based in Northridge, California.

Corporate

Information

Our

principal offices are located at 19355 Business Center Drive, #9, Northridge, CA, 91324, and our telephone number at that

office is (818) 864-8404. Our website address is www.ipsipay.com. Information contained in our website does not form part of this

prospectus and is intended for informational purposes only.

Available

Information

We

have included our website address as a factual reference and do not intend it to be an active link to our website. We make available

on our website, www.ipsipay.com., our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form

8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. These reports are

available free of charge through the investor relations page of our internet website as soon as reasonably practicable after those

reports are filed with the SEC.

Summary

Risk Factors

Our

business faces significant risks and uncertainties of which investors should be aware before making a decision to invest in our common

stock. If any of the following risks are realized, our business, financial condition and results of operations could be materially and

adversely affected. The following is a summary of the more significant risks relating to the Company. A more detailed description of

our risk factors set forth under the caption “Risk Factors” in this prospectus.

Risks

Relating to our Company

|

|

●

|

We have

had very limited operations to date with our new business model.

|

|

|

●

|

We may

continue to generate operating losses and experience negative cash flows and it is uncertain whether we will achieve profitability.

|

|

|

●

|

The

COVID-19 pandemic has caused a delay in our roll out plans which has negatively impacted our ability to generate revenue and

operations and our results of operations.

|

|

|

●

|

If we cannot establish profitable operations, we will need to raise additional capital to fully implement our business plan,

which may not be available on commercially reasonable terms, or at all, and which may dilute your investment.

|

|

|

●

|

We have

identified material weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively

remediated or that additional material weaknesses will not occur in the future.

|

|

|

●

|

Servicing

our debt requires a significant amount of cash and certain covenant restrictions under our indebtedness may limit our ability

to operate our business.

|

|

|

●

|

We will

be dependent on technology networks and systems to process, transmit and securely store electronic information and we could

be subject to liability if our technology systems fail to be secure.

|

Risks

Relating to our Kiosk Business

|

|

●

|

The

payment services industry is highly competitive, and many of our competitors are larger and have greater financial and other

resources.

|

|

|

●

|

There

is uncertainty as to market acceptance of our technology and services.

|

|

|

●

|

We rely

on an outside vendor for the supply of key kiosk parts and the partial or complete loss of this supplier could cause customer

supply or production delays and as a result potentially a loss of revenues.

|

|

|

●

|

We are

subject to the economic risk and business cycles of our merchants and agents and the overall level of consumer spending.

|

|

|

●

|

A decline

in the use of cash as a means of payment may result in a decline in the use of our kiosks and terminals.

|

|

|

●

|

Our

business operations are geographically concentrated and could be significantly affected by any adverse change in the regions

in which we operate.

|

|

|

●

|

We are

not currently subject to extensive government regulation; however, we could be subject to extensive government regulation

once we implement our cryptocurrency operations, and there can be no guarantee that new regulations applicable to our business

will not be enacted.

|

Risks

Related to our Plans to Launch Various Digital Payment Cryptocurrency Products

|

|

●

|

There

can be no assurance that we will be successful in developing digital payment cryptocurrency products.

|

|

|

●

|

We will

be dependent upon the growth of the blockchain industry in general, as well as the networks on which we will rely to operate

IPSI Stable Coin and IPSI Wallet, all of which is subject to a high degree of uncertainty.

|

|

|

●

|

The

regulatory regime governing blockchain technologies, cryptocurrencies, digital assets, utility tokens, security tokens and

offerings of digital assets is evolving and uncertain, and new regulations or policies may materially adversely affect our

development.

|

General

Risk Factors

|

|

●

|

The

laws and regulations regarding our industry is constantly evolving and failure to comply may adversely impact our business.

|

|

|

●

|

Our

systems and the systems of our third-party providers may fail due to factors beyond our control, which could interrupt our

service, cause us to lose business and increase our costs.

|

|

|

●

|

Unauthorized

disclosure of data, whether through cybersecurity breaches, computer viruses or otherwise, could expose us to liability, protracted

and costly litigation and damage our reputation.

|

|

|

●

|

We may

not be able to successfully protect the intellectual property we license or own and may be subject to infringement claims.

|

|

|

●

|

Certain

of our officers may have a conflict of interest.

|

Risks

Relating to our Securities

|

|

●

|

There

is currently a limited public trading market for our common stock and an active market may never develop.

|

|

|

●

|

Our

stock price has fluctuated in the past, has recently been volatile and may be volatile in the future, and as a result, investors

in our common stock could incur substantial losses.

|

|

|

●

|

Because

our common stock may be a “penny stock,” it may be more difficult for investors to sell shares of our common stock,

and the market price of our common stock may be adversely affected.

|

|

|

●

|

Our

investors’ ownership may be diluted in the future.

|

THE

OFFERING

|

Issuer:

|

|

Innovative

Payment Solutions, Inc., a Nevada corporation

|

|

|

|

|

|

Securities offered

by the Selling Stockholders

|

|

102,204,552 shares

of our common stock, including (i) 39,977,779 shares of common stock, (ii) 14,989,333 shares of common stock issuable upon

conversion of the Notes, and (iii) 47,237,440 shares of common stock issuable upon exercise of the Warrants.

|

|

|

|

|

|

Total Common

Stock outstanding after this offering

|

|

440,043,533

shares of common stock; assuming all of the Shares offered in this offering are issued including Shares issuable upon conversion of the

Notes and exercise of the Warrants.

|

|

|

|

|

|

Use

of Proceeds

|

|

We will not receive

any proceeds from the sale of the Shares covered by this prospectus. However, we may receive gross proceeds upon the exercise

of the Warrants if exercised for cash. See “Use of Proceeds.”

|

|

|

|

|

|

Risk

Factors

|

|

Investing in our

securities involves a high degree of risk. For a discussion of factors to consider before deciding to invest in our securities,

you should carefully review and consider the “Risk Factors” section of this prospectus beginning on page 7 of

this prospectus.

|

RISK

FACTORS

Investing

in our common stock involves a high degree of risk, and you should be able to bear the complete loss of your investment. You should

carefully consider the risks described below, the other information in this prospectus and the documents incorporated by reference

herein when evaluating our company and our business. If any of the following risks actually occur, our business could be harmed.

In such case, the trading price of our common stock could decline and investors could lose all or a part of the money paid to

buy our common stock

Risks

Relating to our Company

We

have had very limited operations to date with our new business model.

In

December 2019, we sold our Mexican operations and are now focused on operations in the United States. To date, as a result of

COVID-19 business closures, the installation of our network of kiosks, terminals and payment channels in Southern California has

been delayed, and we have not yet installed any kiosks in the United States. As such, we have a very limited operating history.

We have yet to demonstrate our ability to overcome the risks frequently encountered in the payment services industry in the United

States and are still subject to many of the risks common to early stage companies, including the uncertainty as to our ability

to implement our business plan, market acceptance of our proposed business and services, under-capitalization, cash shortages,

limitations with respect to personnel, financing and other resources and uncertainty of our ability to generate revenues. There

is no assurance that our activities will be successful or will result in any revenues or profit, and the likelihood of our success

must be considered in light of the stage of our development. There can be no assurance that we will be able to consummate our

business strategy and plans, or that financial, technological, market, or other limitations may not force us to modify, alter,

significantly delay, or significantly impede the implementation of such plans. We have insufficient results for investors to use

to identify historical trends. Investors should consider our prospects considering the risks, expenses and difficulties we will

encounter as an early-stage company. Our revenue and income potential is unproven and our business model is continually evolving.

We are subject to the risks inherent to the operation of a new business enterprise and cannot assure you that we will be able

to successfully address these risks.

We

may continue to generate operating losses and experience negative cash flows and it is uncertain whether we will achieve profitability.

For the years ended December 31, 2020 and 2019,

we incurred a net loss of $5,444,544 and $3,729,106, respectively. We have an accumulated deficit of $27,629,575 through December 31,

2020. We expect to continue to incur operating losses until such time, if ever, as we are able to achieve sufficient levels of revenue

from operations. There can be no assurance that we will ever generate significant sales or achieve profitability. Accordingly, the extent

of future losses and the time required to achieve profitability, if ever, cannot be predicted at this point.

We

also expect to experience negative cash flows for the foreseeable future as we fund our operating losses. Although we believe

our existing cash and cash equivalents will be sufficient for the near term, in the long term we may not generate significant

revenues or raise additional financing in order to achieve and maintain profitability. Our failure to achieve or maintain profitability

would likely negatively impact the value of our securities and financing activities.

The

COVID-19 pandemic has caused a delay in our roll out plans which has negatively impacted our ability to generate revenue and operations

and results of operations.

The

COVID-19 pandemic has required our management to focus their attention primarily on responding to the challenges presented by

the pandemic, including implementing our new business strategy as quickly and efficiently as possible, and adjusting our operations

to address changes in the virtual payments industry. Due to measures imposed by the local governments in areas affected by COVID-19,

businesses have been suspended due to quarantine intended to contain this outbreak and many people have been forced to work from

home in those areas. As a result, installation of our network of kiosks, terminals and payment channels in Southern California

has been delayed, which has had an adverse impact on our business and financial condition and has hampered its ability to generate

revenue and access usual sources of liquidity on reasonable terms.

We

may need additional funding and may be unable to raise capital when needed, which would force us to delay, reduce or eliminate

our product development programs or commercialization efforts.

As

of December 31, 2020, we had cash and cash equivalents of $94,703. Subsequent to December 31, 2020, we raised an additional $4,550,000

from the sale of our securities. We believe that based on our current operating plan, our existing cash and cash equivalents will

be sufficient to enable us to fund our operations for the near term and our debt and other obligations. See “Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” However,

we believe we will need additional funds to fully implement our business plan. Additional equity or debt financing, may not be

available on acceptable terms, if at all, particularly in the current economic environment. If adequate funds are not available,

we may be required to delay, reduce the scope of or eliminate, one or more of our new products in development.

Until

such time, if ever, as we can generate substantial product revenues, we will be required to finance our cash needs through public

or private equity offerings, debt financings and corporate collaboration and licensing arrangements. If we raise additional funds

by issuing equity securities, our stockholders may experience dilution. Debt financing, if available, may involve agreements that

include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital

expenditures or declaring dividends. Any debt financing or additional equity that we may raise may contain terms, such as liquidation

and other preferences, that are not favorable to us or our stockholders. If we raise additional funds through collaboration and

licensing arrangements with third parties, it may be necessary to relinquish valuable rights to our technologies, research programs

or product candidates or grant licenses on terms that may not be favorable to us.

If

we cannot establish profitable operations, we will need to raise additional capital to fully implement our business plan, which

may not be available on commercially reasonable terms, or at all, and which may dilute your investment.

Achieving

and sustaining profitability will require us to increase our revenues and manage our operating and administrative expenses. We

cannot guarantee that we will be successful in achieving profitability. If we are unable to generate sufficient revenues to pay

our expenses and our existing sources of cash and cash flows are otherwise insufficient to fund our activities, we will need to

raise additional funds to continue our operations and in order to fully implement our business plan. If we do not generate such

revenue from operations, we may be forced to limit our expansion. Furthermore, if we issue equity or debt securities to raise

additional funds, our existing stockholders, may experience dilution, and the new equity or debt securities may have rights, preferences

and privileges senior to those of our existing stockholders. If we are unsuccessful in achieving profitability, and we cannot

obtain additional funds on commercially reasonable terms or at all, we may be required to curtail significantly or cease our operations,

which could result in the loss to investors of their investment in our securities.

We

have identified material weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively

remediated or that additional material weaknesses will not occur in the future. If our internal control over financial reporting

or our disclosure controls and procedures are not effective, we may not be able to accurately report our financial results, prevent

fraud, or file our periodic reports in a timely manner, which may cause investors to lose confidence in our reported financial

information and may lead to a decline in our stock price.

Our

management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined

in Rule 13a-15(f) under the Exchange Act. We have identified material weaknesses in our internal controls with respect to our

segregation of duties and our limited resources and our insufficient controls over review of accounting for certain complex transactions

therefore our disclosure controls and procedures are not effective in providing material information required to be included in

our periodic SEC filings on a timely basis and to ensure that information required to be disclosed in our periodic SEC filings

is accumulated and communicated to our management to allow timely decisions regarding required disclosure about our internal control

over financial reporting. Due to limited staffing, we are not always able to detect errors or omissions in financial reporting.

If we fail to comply with the rules under Sarbanes-Oxley related to disclosure controls and procedures in the future, or, if we

continue to have material weaknesses and other deficiencies in our internal control and accounting procedures and disclosure controls

and procedures, our stock price could decline significantly and raising capital could be more difficult. If additional material

weaknesses or significant deficiencies are discovered or if we otherwise fail to address the adequacy of our internal control

and disclosure controls and procedures our business may be harmed. Moreover, effective internal controls are necessary for us

to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial

reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported

financial information, and the trading price of our securities could drop significantly.

To

date we have not successfully generated sufficient revenue to pay our operating expenses and have relied on proceeds from recent

note issuances to pay the deficiency.

As

of December 31, 2020, we had outstanding convertible debt in the principal amount of $903,641, net of unamortized discount of

$980,852, pursuant to the terms of various notes that we issued. Subsequent to December 31, 2020, we issued unsecured convertible

notes in the aggregate principal amounts of $1,788,500. At March 29, 2021, our only remaining debt was convertible debt in the

principal amount of $2,044,000. To date, we have not generated sufficient revenue to pay the balances owed under these notes and

provide sufficient working capital to run our business. The outstanding principal amount of the notes is convertible at any time

and from time to time at the election of the holder after certain periods of time into shares of our common stock at discounts

to the market price of our common stock. In addition, upon the occurrence and during the continuation of an Event of Default (as

defined in the notes), the notes each will become immediately due and payable and we have agreed to pay additional default interest

rates. Upon conversion of these notes, our current shareholders will suffer dilution, which could be significant.

Servicing

our debt requires a significant amount of cash. Our ability to generate sufficient cash to service our debt depends on many factors

beyond our control.

Our

ability to make payments on and to refinance our debt, to fund planned capital expenditures and to maintain sufficient working

capital depends on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial,

competitive, legislative, regulatory and other factors that are beyond our control. We cannot assure you that our business will

generate sufficient cash flow from operations or from other sources in an amount sufficient to enable us to service our debt or

to fund our other liquidity needs. If our cash flow and capital resources are insufficient to allow us to make scheduled payments

on our debt, we may need to seek additional capital or restructure or refinance all or a portion of our debt on or before the

maturity thereof, any of which could have a material adverse effect on our business, financial condition or results of operations.

We cannot assure you that we will be able to refinance any of our debt on commercially reasonable terms or at all, or that the

terms of that debt will allow any of the above alternative measures or that these measures would satisfy our scheduled debt service

obligations. If we are unable to generate sufficient cash flow to repay or refinance our debt on favorable terms, it could significantly

adversely affect our financial condition and the value of our outstanding debt. Our ability to restructure or refinance our debt

will depend on the condition of the capital markets and our financial condition. Any refinancing of our debt could be at higher

interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations.

There can be no assurance that we will be able to obtain any financing when needed.

Covenant

restrictions under our indebtedness may limit our ability to operate our business.

The

notes contain, and our future indebtedness agreements may contain covenants that restrict our ability to finance future operations

or capital needs or to engage in other business activities. The Notes restrict our ability to:

|

|

●

|

incur,

assume or guarantee or suffer to exist any indebtedness for borrowed money of any kind, including, but not limited to, a guarantee,

on or with respect to any of its property or assets now owned or hereafter acquired or any interest therein or any income

or profits therefrom other than Permitted Indebtedness (as defined in the notes);

|

|

|

●

|

repurchase

capital stock;

|

|

|

●

|

repay

any Indebtedness (as defined in the notes) other than certain secured notes which are no longer outstanding or Permitted Indebtedness

or make other restricted payments including, without limitation, paying dividends and making investments;

|

|

|

●

|

sell

or otherwise dispose of assets; and

|

|

|

●

|

enter

into transactions with affiliates.

|

|

|

●

|

In addition,

the notes contain price protection anti-dilution provisions that will discourage financing at prices below the conversion

price of the notes and will result in a decrease in the conversion price of the notes if we should issue securities below

such price.

|

Our

failure to fulfill all of our registration requirements may cause us to suffer liquidated damages, which may be very costly.

Pursuant

to the terms of certain Registration Rights Agreements that we entered into in connection with the private placements described

elsewhere in this prospectus, and our issuance of common stock, notes and warrants in relation thereto, we are required to file

a registration statement with respect to securities issued to the note and warrant holders within a certain time period, the registration

statement must be declared effective within a certain specified time period and we must maintain the effectiveness of such registration

statement. If we fail to do so we could be required to pay liquidated damages. There can be no assurance as to when this registration

statement will be declared effective or that we will be able to maintain the effectiveness of any registration statement, and

therefore there can be no assurance that we will not incur damages under the various Registration Rights Agreements.

We

will be dependent on technology networks and systems to process, transmit and securely store electronic information and we could

be subject to liability if our technology systems fail to be secure.

We

could be held liable for damages or our reputation could suffer from security breaches or disclosure of confidential information

or personal data. We will be dependent on technology networks and systems to process, transmit and securely store electronic information

and to communicate with our kiosks, with our partners and with our customers. Security breaches of this infrastructure could lead

to shutdowns or disruptions of our systems and potential loss or unauthorized disclosure of confidential information or data,

including personal data. The theft and/or unauthorized use or publication of our, or our customers’, confidential information

or other proprietary business information as a result of such an incident could adversely affect our competitive position and

reduce marketplace acceptance of our services. Any failure in the networks or computer systems used by us or our customers could

result in a claim for substantial damages against us and significant reputational harm, regardless of our responsibility for the

failure. In addition, the Company will have access to or are required to manage, utilize, collect and store sensitive or confidential

customer or employee data, including personal data. As a result, we are subject to numerous U.S. and non-U.S. laws and regulations

designed to protect this information, such as various U.S. federal and state laws governing the protection of personal data. If

any person, including any of our employees, negligently disregards or intentionally breaches controls or procedures with which

we are responsible for complying with respect to such data, or otherwise mismanages or misappropriates that data, or if unauthorized

access to or disclosure of data in our possession or control occurs, we could be subject to liability and penalties in connection

with any violation of applicable privacy laws and/or criminal prosecution, as well as significant liability to our customers or

our customers’ clients’ for breaching contractual confidentiality and security provisions or privacy laws. The loss

or unauthorized disclosure of sensitive or confidential customer or employee data, including personal data, whether through breach

of computer systems, systems failure, employee negligence, fraud or misappropriation, or otherwise, could damage our reputation

and cause us to lose customers. Similarly, unauthorized access to or through our information systems and networks or those we

develop or manage for our customers, whether by our employees or third parties, could result in negative publicity, legal liability

and damage to our reputation, which could in turn harm our business, results of operations, or financial condition.

Risks

Related to our Kiosk Business

The

payment services industry is highly competitive, and many of our competitors are larger and have greater financial and other resources.

The

payment services industry is highly competitive, and the implementation of our new business strategy and growth depends on our

ability to compete effectively with both traditional and non-traditional payment service providers. Although we do not currently

face direct competition from any competitor in exactly the same kiosk-based line of business as ours, we currently expect to face

competition from a variety of financial and non-financial business groups which include retail banks, non-traditional payment

service providers, such as retailers, like 7-Eleven and Walmart which provide mobile top-up services, and mobile network operators,

traditional kiosk and terminal operators and electronic payment system operators, as well as other companies that provide various

forms of payment services, including electronic payment and payment processing services. Competitors in our industry seek to differentiate

themselves by offering features and functionalities such as speed, convenience, network size, accessibility, hours of operation,

reliability and price. A significant number of these competitors have greater financial, technological and marketing resources

than we have, operate robust networks and are highly regarded by consumers.

There

is uncertainty as to market acceptance of our technology and services.

We

have conducted our own research of the markets for our services; however, because we are a new entrant into the market, we cannot

guarantee market acceptance of our services and have somewhat limited information on which to estimate our anticipated level of

sales. Our services require consumers and service providers to adopt our technology. Our industry is susceptible to rapid technological

developments and there can be no assurance that we will be able to match any new technological advances. If we are unable to match

the technological changes in the needs of our customers the demand for our products will be reduced.

We

rely on an outside vendor for the supply of key kiosk parts and the partial or complete loss of this supplier could cause customer

supply or production delays and, as a result, potentially a loss of revenues.

We

currently rely on a vendor to manufacture substantial portions of critical hardware that are used with or included in our kiosks.

Although we do not believe the contract is material to us because there are other vendors that could supply the hardware required

for the kiosks, we do not have a contract with any other vendors and therefore, if our present vendor was to delay or terminate

its performance, our business could be disrupted.

Although

we may add or change our vendors in the future, our reliance on vendors is expected to continue and involves other risks, including

our limited control over the availability of components, delivery schedules, pricing and product quality. We may also experience

delays, additional expenses and lost sales as a result of our dependency upon outside vendors. If the outside vendors on which

we rely are not able to supply us with needed products or parts, or were to cease or interrupt production, and if other existing

vendors were also unable to supply us in a timely manner, or on comparable terms, our business could be materially adversely impacted.

Our

reliance on outside vendors for our kiosk hardware involves several risks, including the following:

|

|

●

|

there

are a number of reasons our suppliers of required parts may cease or interrupt production or otherwise fail to supply us with

an adequate supply of required parts, including contractual disputes with our supplier or adverse financial developments at

or affecting the supplier;

|

|

|

●

|

we have

reduced control over the pricing of third party-supplied materials, and our suppliers may be unable or unwilling to supply

us with required materials on commercially acceptable terms, or at all;

|

|

|

●

|

we have

reduced control over the timely delivery of third party-supplied materials; and

|

|

|

●

|

our

suppliers may be unable to develop technologically advanced products to support our growth and development of new systems.

|

Disruptions

in international trade and finance or in transportation also may have a material adverse effect on our business, financial

condition and results of operations. Any significant disruption in our operations for any reason, such as regulatory

requirements, scheduling delays, quality control problems, loss of certifications, power interruptions, fires, hurricanes,

war or threats of terrorism, labor strikes or contract disputes could adversely affect our sales and customer relationships.

In addition, in the event of a breach of law by a vendor based outside of the U.S. or a breach of a contractual obligation

that has an adverse effect upon our operations, we may have little or no recourse because all of our vendors’ assets

could be located in a foreign country, such as Russia, Italy, Germany, Canada or the People’s Republic of China, where

it may difficult or impossible to effect service of process and uncertainty exists as to whether the courts in such foreign

jurisdiction would recognize or enforce a judgment of a U.S. court obtained against the vendor.

We

are subject to the economic risk and business cycles of our merchants and agents and the overall level of consumer spending.

The

payment services industry depends heavily on the overall level of consumer spending. We are exposed to general economic conditions

that affect consumer confidence, consumer spending, consumer discretionary income or changes in consumer purchasing habits. Economic

factors such as employment levels, business conditions, energy and fuel costs, interest rates, and inflation rate could reduce

consumer spending or change consumer purchasing habits. A reduction in the amount of consumer spending could result in a decrease

in our revenue and profits. If our merchants make fewer sales of their products and services using our services or consumers spend

less money per transaction, we will have fewer transactions to process at lower amounts, resulting in lower revenue. Weakening

in the economy could have a negative impact on our merchants, as well as consumers who purchase products and services using our

payment processing systems, which could, in turn, negatively impact our business, financial condition and results of operations,

particularly if the recessionary environment disproportionately affects some of the market segments that represent a larger portion

of our payment processing volume. In addition, these factors could force some of our merchants and/or agents to liquidate their

operations or go bankrupt, or could cause our agents to reduce the number of their locations or hours of operation, resulting

in reduced transaction volumes. We also have a certain amount of fixed costs, including salaries and rent, which could limit our

ability to adjust costs and respond quickly to changes affecting the economy and our business.

If

consumer confidence in our business deteriorates, our business, financial condition and results of operations could be adversely

affected.

Our

business is built on consumers’ confidence in our brands, as well as our ability to provide fast, reliable payment services.

As a consumer business, the strength of our brand and reputation are of paramount importance to us. A number of factors could

adversely affect consumer confidence in our brand, many of which are beyond our control, and could have an adverse impact on our

results of operations. These factors include:

|

|

●

|

any

regulatory action or investigation against us;

|

|

|

●

|

any

significant interruption to our systems and operations; and

|

|

|

●

|

any

breach of our security systems or any compromises of consumer data.

|

A

decline in the use of cash as a means of payment may result in a decline in the use of our kiosks and terminals.

We

believe that consumers making cash payments are more likely to use our kiosks and terminals than where alternative payment methods

are available. As a result, we believe that our profitability depends on the use of cash as a means of payment. During the COVID-19

pandemic the use of cash has been discouraged by some local governmental authorities and health experts. There can be no assurance

that over time, the prevalence of cash payments in Southern California will not decline as a greater percentage of the population

adopts credit and debit card payments and electronic banking. The shift from cash payments to credit and debit card payments and

electronic banking could reduce our market share and payment volumes and may have a material adverse effect on our business, financial

condition and results of operations.

Our

business operations are geographically concentrated and could be significantly affected by any adverse change in the regions in

which we operate.

Our

business operations are now solely in the United States, currently southern California. Because to date we plan to derive all

of our total revenues from our operations in United States and expect to continue to derive a significant portion of our revenue

from operations solely in the United States with a focus on southern California for the near future, our business is exposed to

adverse regulatory and competitive changes, economic downturns and changes in political conditions in the United States. Moreover,

due to the concentration of our businesses in the United States, our business is less diversified and, accordingly, is subject

to regional risks.

We

are not currently subject to extensive government regulation; however, we could be subject to extensive government regulation

once we implement our cryptocurrency operations, and there can be no guarantee that new regulations applicable to our business

will not be enacted.

Currently

our business is not impacted by government regulation; however, we may be subject to a variety of regulations aimed at preventing

money laundering and financing criminal activity and terrorism, financial services regulations, payment services regulations,

consumer protection laws, currency control regulations, advertising laws and privacy and data protection laws and therefore experience

periodic investigations by various regulatory authorities in connection with the same, which may sometimes result in monetary

or other sanctions being imposed on us. Many of these laws and regulations are constantly evolving, and are often unclear and

inconsistent with other applicable laws and regulations, making compliance challenging and increasing our related operating costs

and legal risks. In particular, there has been increased public attention and heightened legislation and regulations regarding

money laundering and terrorist financing. We may have to make significant judgment calls in applying anti-money laundering legislation

and risk being found in non-compliance with such laws. The cryptocurrency business may be subject to extensive regulation, see

“Risks Related to our Plans to Launch Various Digital Payment Cryptocurrency Products.” The regulatory regime governing

blockchain technologies, cryptocurrencies, digital assets, utility tokens, security tokens and offerings of digital assets is

evolving and uncertain, and new regulations or policies may materially adversely affect our development.

Risks

Related to our Plans to Launch Various Digital Payment Cryptocurrency Products

There

can be no assurance that we will be successful in developing digital payment cryptocurrency products.

We

are developing and plan to launch various digital payment cryptocurrency products, including, IPSI Pay, IPSI Stable Coin, IPSI

Wallet and IPSI Payroll, using blockchain technology. No assurance can be given that we will be able to successfully launch these

products as and when planned. To date, we have no experience with cryptocurrency products. In addition, the use of cryptocurrencies

to, among other things, buy and sell goods and services and complete transactions, is part of a new and rapidly evolving industry

that employs cryptocurrency assets based upon a computer-generated mathematical and/or cryptographic protocol. Large-scale acceptance

of cryptocurrencies as a means of payment has not, and may never, occur. The growth of this industry in general, and the use of

cryptocurrencies in particular, is subject to a high degree of uncertainty, and the slowing or stopping of the development or

acceptance of developing protocols may occur unpredictably.

There

is uncertainty in the accounting treatment of digital assets and therefore we cannot predict the impact our new digital asset

line of business will have on our financial statements.

There

has been limited precedent set for the financial accounting of digital assets, including accounting for the issuance of any digital

asset related to IPSI Stable Coin, IPSI Wallet. It is unclear how we will be required to account for issuances of our own digital

assets, that we receive as part of expected revenue and any digital assets we could hold on our balance sheet. Furthermore, a

change in regulatory or financial accounting standards could result in the necessity to restate our financial statements. Such

a restatement could negatively impact our business, prospects, financial condition and results of operations. Such circumstances

could have a material adverse effect on our ability to continue as a going concern or to pursue this segment at all, which could

have a material adverse effect on our business, prospects or operations and potentially the value of any cryptocurrencies we hold

or expect to acquire for our own account, including IPSI Stable Coin, to the detriment of our investors.

We

will be dependent upon the growth of the blockchain industry in general, as well as the networks on which we will rely to operate

IPSI Stable Coin and IPSI Wallet, all of which is subject to a high degree of uncertainty.

The

further development and acceptance of blockchain networks, which are part of a new and rapidly changing industry, are subject

to a variety of factors that are difficult to evaluate. The slowing or stopping of the development or acceptance of blockchain

networks and blockchain assets could have a material adverse effect on our business plans and plans for IPSI Stable Coin and IPSI

Wallet, which may have a material adverse effect on us and our stockholders. The growth of the blockchain industry in general,

as well as the networks on which we will rely to operate IPSI Stable Coin and IPSI Wallet, is subject to a high degree of uncertainty.

The cryptocurrency and crypto securities industries as a whole have been characterized by rapid changes and innovations and are

constantly evolving. The slowing or stopping of the development, general acceptance and adoption and usage of blockchain networks

and blockchain assets may materially adversely affect our business plans. For example, given the regulatory complexity with respect

to cryptocurrency and related digital assets, complying with such regulations, which could change in the future or be subject

to new interpretations, could have a material and adverse effect on our ability to develop, launch and continue to operate IPSI

Stable Coin and IPSI Wallet. In addition, the tax and accounting consequences to us related to IPSI Stable Coin and IPSI Wallet

are uncertain, which could lead to incorrect reporting, classification or liabilities. If we successfully pursue our expected

plans related to IPSI Stable Coin and IPSI Wallet the structural foundation of IPSI Stable Coin and IPSI Wallet, and the software

applications and other interfaces or applications upon which IPSI Stable Coin and IPSI Wallet may rely in the future, are and

will be unproven. There can be no assurances that IPSI Stable Coin and IPSI Wallet will be fully secure, which may result in impermissible

transfers, a complete loss of users’ IPSI Stable Coin or amounts held in their IPSI Wallet, or an unwillingness of users

to access, adopt and utilize IPSI Stable Coin and IPSI Wallet, whether through system faults or malicious attacks. Any such faults

or attacks on IPSI Stable Coin or IPSI Wallet may materially and adversely affect our business.

Because

IPSI Stable Coin and IPSI Wallet will likely be a digital asset built and transacted initially on top of existing third-party

blockchain technology, the Company will be reliant on another blockchain network, and users may be subject to the risk of wallet

incompatibility and blockchain protocol risks. Reliance upon another blockchain technology to create the IPSI Stable Coin and

IPSI Wallet subjects us and users to the risk of digital wallet incompatibility, or additional ecosystem malfunction, unintended

function, unexpected functioning of, or attack on, the providers’ blockchain protocol, which may cause IPSI Stable Coin

and/or IPSI Wallet to malfunction or function in an unexpected manner, including, but not limited to, slowdown or complete

cessation in functionality of the network.

The

regulatory regime governing blockchain technologies, cryptocurrencies, digital assets, utility tokens, security tokens and offerings

of digital assets is evolving and uncertain, and new regulations or policies may materially adversely affect our development.

The

regulatory regime governing blockchain technologies, cryptocurrencies, digital assets, utility tokens, security tokens and offerings

of digital assets is uncertain, and new regulations or policies may materially adversely affect the development and the value

of the Company and IPSI Stable Coin. Regulation of digital assets, like IPSI Stable Coin, cryptocurrencies, blockchain technologies

and cryptocurrency exchanges, is currently undeveloped and likely to rapidly evolve as government agencies take greater interest

in them. Regulation also varies significantly among international, federal, state and local jurisdictions and is subject to significant

uncertainty. Various legislative and executive bodies in the United States and in other countries may in the future adopt laws,

regulations, or guidance, or take other actions, which may severely impact the permissibility of tokens generally and the technology

behind them or the means of transaction or in transferring them. In addition, any violations of laws and regulations relating

to the safeguarding of private information in connection with IPSI Stable Coin, IPSI Pay, IPSI Payroll and/or IPSI Wallet could

subject us to fines, penalties or other regulatory actions, as well as to civil actions by affected parties. Any such violations

could adversely affect the ability of the Company to maintain IPSI Stable Coin, IPSI Pay, IPSI Payroll and/or IPSI Wallet, which

could have a material adverse effect on our operations and financial condition. Failure by us to comply with any laws, rules and

regulations, some of which may not exist yet or are subject to interpretation and may be subject to change, could result in a

variety of adverse consequences, including civil penalties and fines.

General

Risk Factors

The

laws and regulations regarding our industry is constantly evolving and failure to comply may adversely impact our business.

Our

business is subject to a wide range and increasing number of laws and regulations. Liabilities or loss of business resulting from

a failure by us, our agents or their subagents to comply with laws and regulations and regulatory or judicial interpretations

thereof, including laws and regulations designed to protect consumers, or detect and prevent money laundering, terrorist financing,

fraud and other illicit activity, and increased costs or loss of business associated with compliance with those laws and regulations

has had, and we expect will continue to have, an adverse effect on our business, financial condition, results of operations, and

cash flows. Our services are subject to increasingly strict legal and regulatory requirements, including those intended to help

detect and prevent money laundering, terrorist financing, fraud, and other illicit activity. The interpretation of those requirements

by judges, regulatory bodies and enforcement agencies may change quickly and with little notice. Additionally, these requirements

or their interpretations in one jurisdiction may conflict with those of another jurisdiction. As United States federal and

state as well as foreign legislative and regulatory scrutiny and enforcement action in these areas increase, we expect that our

costs of complying with these requirements could continue to increase, perhaps substantially, and may make it more difficult or

less desirable for consumers and others to use our services or for us to contract with certain intermediaries, either of which