UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or

15d-16

of the Securities Exchange Act of 1934

For

the month of November 2024

Commission

File Number: 333-155412

JBS

S.A.

(Exact

Name as Specified in its Charter)

N/A

(Translation

of registrant’s name into English)

Av.

Marginal Direita do Tietê

500,

Bloco I, 3rd Floor

São

Paulo, SP, Brazil

(Address

of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ☒ Form 40-F: ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: November 13, 2024

| |

JBS S.A. |

| |

|

| |

By: |

/s/ Guilherme Perboyre Cavalcanti |

| |

Name: |

Guilherme Perboyre Cavalcanti |

| |

Title: |

Chief Financial and Investment Relations

Officer |

Exhibit 99.1

MATERIAL FACT

GUIDANCE – UPDATE

JBS S.A. (“JBS”

or “Company”) – B3: JBSS3; OTCQX: JBSAY), hereby informs its shareholders and the market, pursuant to article 157, paragraph

4, of Law No. 6,404, of December 15, 1976, as amended (“Brazilian Corporation Law”), and the provisions of the regulations of

the Brazilian Securities and Exchange Commission (“CVM”), in particular CVM Resolution No. 44/21, of August 23, 2021, as amended,

updating the information of the Material Fact dated September 16, 2024, that the Company has adjusted its guidance for net revenues and

Adjusted EBITDA for the 2024 fiscal year as follows:

| | |

Estimate for the fiscal year ending December 31, 2024 |

| | |

R$ millons | |

US$ millions² |

| Net Revenues | |

R$ 411,873 | |

US$ 77,000 |

| EBITDA¹ | |

Between R$ 37,019 and R$ 38,147 | |

Between US$ 6,900 and US$ 7,100 |

| ¹ | EBITDA

adjusted for the following non-recurring items that impacted the nine-month period ended September 30, 2024: (i) R$ 421 million in antitrust

agreements; (ii) R$ 93 million in donations and social programs; (iii) R$ 439 million in restructuring expenses; (iv) R$ 105 million

in Rio Grande do Sul claim; (v) R$ 427 million in fiscal payments– Special Program; and (vi) R$ 91 million in other operating expenses. |

| ² | As the Company’s revenue is mainly recorded

based in the US dollar, the Company considers it useful to disclose the information also

in dollars. Considering an exchange rate of R$4.95 per US$1.00 for the first quarter of 2024,

R$5.22 for US$1.00 for the second quarter of 2024, R$5.55 for US$1.00 for the third quarter

of 2024 and R$5.64 for US$1.00 for the fourth quarter of 2024. |

The above estimates were calculated

based on the Company’s performance and accounting standards, taking into account the following assumptions and methodologies: (i) historical

behavior of the Company’s operations, applied to the Company’s current operating performance; (ii) expected reflections of market conditions

in the locations where JBS operates; (iii) calculation according to historical accounting standards, consistently applied by the Company.

The Reference Form will be resubmitted

for inclusion of the updated information in the guidance and its monitoring and/or updating will be carried out under the terms of the

applicable rules.

The information disclosed

herein constitutes estimates based on the beliefs and substantiated assumptions of JBS Management, as well as on information currently

available. JBS operates globally and, as such, is subject to different market conditions, laws and regulations, as well as changes in

each of these elements in each of these jurisdictions. In addition, the food sector is highly cyclical, volatile, and strongly influenced

by various political, economic, climatic, and environmental factors. All these factors are beyond JBS’s control. These aspects and JBS’s

own operating activity may affect its future performance and lead to results that differ materially from the information indicated above.

Therefore, such estimates are subject to risks and uncertainties and do not constitute a promise of future performance. Because of these

uncertainties, the investor should not make any investment decisions based solely on this information. Any change in perception or in

the factors mentioned above may cause the concrete results to diverge from the projections made and disclosed.

São Paulo, November 13,

2024.

Guilherme Perboyre Cavalcanti

Global CFO and Investor

Relations Officer

Exhibit 99.2

NOTICE TO THE SHAREHOLDERS

DISTRIBUTION OF INTERIM DIVIDENDS

JBS S.A. (“JBS”

– B3: JBSS3, OTCQX: JBSAY) hereby informs its shareholders and the market in general that the JBS’ Board of Directors, held

on the date hereof approved the distribution of Interim Dividends in the total amount of R$ 2,218,116,370.00 (two billion, two hundred

and eighteen million, one hundred and sixteen thousand, three hundred and seventy reais), corresponding to R$1.00 per common share (“Interim

Dividends”), based on the profit reserves determined in the balance sheet dated December, 31, 2023.

In October, the Company had already

distributed R$4.4 billion in dividends.

The amount of dividends per share

is estimated and may vary due to any change in the number of shares held in treasury.

1.

The Interim Dividends will be charged to the mandatory minimum dividends for the fiscal year ending December 31, 2024.

2. The Interim Dividends will be paid

in accordance with the shareholders’ positions existing at the close of the trading session of B3 S.A. - Brasil, Bolsa, Balcão

on November 22, 2024 (base date) and JBS shares will be traded ex-dividend beginning November 25, 2024.

3. There will be no monetary correction

or interests on the value of the Interim Dividends from the date hereof until the date on which the Dividends are effectively paid.

4. The payment of Interim Dividends

will be carried out in national currency, by means of bank credit, and will be on January 15, 2025, at the bank address provided by the

shareholder to Banco Bradesco S.A., JBS’ registrar.

5. For shareholders whose registration

does not contain updated information of CPF/CNPJ or the “Bank/Branch/Account”, the Interim Dividends will only be credited after

the updated of the registration, and within the deadlines determined by Banco Bradesco S.A.

6. The Interim Dividends of shareholders

whose shares are deposited in institutions that provide securities custody services will be credited in accordance with the procedures

adopted by the depositary institutions.

7. As a general rule, the payment

of Interim Dividends will be exempt from Income Tax, in accordance with Article 10 of Law No. 9,249, of 1995.

São Paulo, November 13, 2024.

Guilherme Perboyre Cavalcanti

Global CFO and Investor Relations

Officer

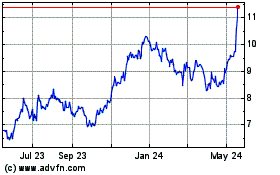

JBS (QX) (USOTC:JBSAY)

Historical Stock Chart

From Feb 2025 to Mar 2025

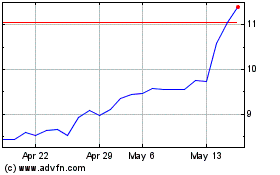

JBS (QX) (USOTC:JBSAY)

Historical Stock Chart

From Mar 2024 to Mar 2025