Current Report Filing (8-k)

March 08 2022 - 5:04AM

Edgar (US Regulatory)

0000860543false00008605432022-03-032022-03-03iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 7, 2022 (March 3, 2022)

JACKSAM CORPORATION |

(Exact name of registrant as specified in its charter) |

Commission File Number: 033-33263

Nevada | | 46-3566284 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification Number) |

| | |

3100 Airway Avenue Suite 138 Costa Mesa, CA | | 92626 |

(Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number including area code (800) 605-3580

NA

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share | | JKSM | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On March 3, 2022, Jacksam Corporation (the “Company”) closed its Series B Preferred Stock round of financing. The Company entered into Series B Preferred Stock Purchase Agreement and Common Stock Purchase Warrant (the “Agreement”, or collectively the “Agreements”) with Tysadco Partners, LLC, and Auctus Fund, LLC (each an “Investor”, or collectively the “Investors”).

Under the terms of the Agreements, the Company shall sell to each of the Investors, and each of the Investors shall purchase from the Company, (i) a value of $500,000 of the Company’s Series B Preferred Stocks (the “Series B Preferred Stock”) and (ii) up to an aggregate value of $400,000 of the Company’s warrants (the “Warrants”).

Under the terms of the Series B Preferred Stock Purchase Agreement, each of the Investors shall be issued 1,000,000 shares of the Series B Preferred Stock and the interest rate is 8.0% per annum. The Company granted to the Investors the piggy-back registration rights.

Under the terms of the Common Stock Purchase Warrant, each of the Investors was entitled, at any time during the five-year period following issuance, to purchase up to an aggregate of 2,000,000 shares of the Company’s common stock at an exercise price of $0.20 per share.

Item 2.03 Creation of a Direct Financial Obligation.

The information set forth in Item 1.01 of this report is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this report is incorporated herein by reference.

The offer and sale of the shares by the Company was exempt from registration pursuant to section 4(a)(2) of the Securities Act of 1933, as amended, as a transaction by an issuer not involving any public offering. The Company did not engage in any general solicitation or advertising in connection with the offering or sale of the shares. Each Investor represented that such Investor was an accredited investor as defined in SEC Rule 501(a), has enough knowledge and experience in finance and business matters to be a sophisticated investor who is able to evaluate the risks and merits of the investment, and is able to bear the economic risk of an investment in the Shares. Each Investor further represented that such Investor was purchasing the shares for their own account and not with a view to distribution or resale.

Item 9.01 Financial Statements and Exhibits

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| JACKSAM CORPORATION | |

| | | |

Dated: March 7, 2022 | By: | /s/ Mark Adams | |

| Name: | Mark Adams | |

| Title: | Chief Executive Officer | |

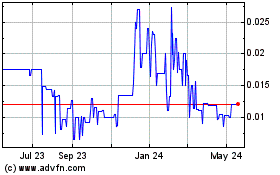

Jacksam (PK) (USOTC:JKSM)

Historical Stock Chart

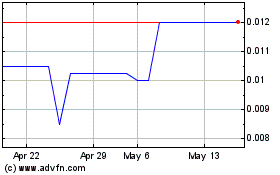

From Jan 2025 to Feb 2025

Jacksam (PK) (USOTC:JKSM)

Historical Stock Chart

From Feb 2024 to Feb 2025