false

0001493137

0001493137

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): November

12, 2024

LIFELOC TECHNOLOGIES,

INC.

(Exact name of registrant

as specified in its charter)

| Colorado |

|

000-54319 |

|

84-1053680 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

| 12441 West 49th Ave., Unit 4 |

|

|

| Wheat Ridge, CO |

|

80033 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(303) 431-9500

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

LCTC |

N/A |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On November 12, 2024,

Lifeloc Technologies, Inc. (the “Company”) issued a press release announcing its operating results for the period ended

September 30, 2024. This press release was made available on the Company’s website as of November 12, 2024. A copy of

the press release is furnished herewith as Exhibit 99.1.

The information in

this Form 8-K, including the exhibit attached hereto, is being “furnished” and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of

that section, nor shall it be deemed incorporated by reference in any Company filing under the Securities Act of 1933, as amended,

unless expressly set forth by specific reference in such filing that such information is incorporated by reference therein.

| |

Item 9.01 |

Financial Statements and Exhibits. |

| |

|

|

(d) Exhibits.

SIGNATURES

Pursuant to the

requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Date: November 12, 2024 |

LIFELOC TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Vern D. Kornelsen |

| |

|

Chief Financial Officer and Secretary |

Exhibit 99.1

Lifeloc

Reports Third Quarter 2024 Results

WHEAT RIDGE, Colo., November

12, 2024 -- Lifeloc Technologies, Inc. (OTC: LCTC), a global leader in the development and manufacturing of breath alcohol and drug

testing devices, has announced financial results for the quarter ended September 30, 2024.

Third Quarter

Financial Highlights

Lifeloc posted

quarterly net revenue of $2.087 million in the third quarter of 2024, resulting in a quarterly net loss of $(158) thousand,

or $(0.06) per diluted share. These results compare to net revenue of $2.696 million and quarterly net profit of $110

thousand, or $0.04 per diluted share in the third quarter of 2023. Revenue for the quarter decreased 23% versus the third quarter

last year. This decrease year-over-year was caused in part by sales in the third quarter last year benefitting from the relief of supply

constraints, which allowed completion of order backlogs. Nine-month 2024 net revenues of $6.628 million and a net loss of $(740) thousand,

or $(0.30) per diluted share, compared to net revenue of $7.140 million and a net profit of $111 thousand, or $0.05 per diluted share,

for the same nine months of 2023. Total gross margin in the third quarter improved to 43.7% versus 41.5% for the same quarter last year.

For the first nine months of 2024 gross margin was 41.4% versus 43.4% for the same period last year.

The gross margin

improvement in the third quarter was primarily a result of product sales mix. The margin decline for the nine months of 2024 was a result

of general cost inflation which the company is working to address through pricing. The losses for the quarter and year to date were caused

primarily by the high research and development costs with the push to SpinDx commercialization.

We believe our

core alcohol detection product line-up is strong. The L-series LX9 and LT7 units have features and performance that have driven market

penetration by meeting previously unaddressable market needs, such as smart phone pairing, wider temperature use ranges and fast customization

that incorporates local languages. We expect that sales of our newer L-series devices will be incremental to FC-series devices rather

than displacing FC sales. The L-series devices have been certified to meet the requirements of most modern registration standards, such

as SAI’s (Standards Australia International) latest AS 3547:2019 standards for Breath Alcohol Detectors. Our FC-series devices remain

popular with many law enforcement and international organizations. Our Easycal® automated calibration station, the only automated

calibration available for portable breath alcohol testers, builds valuable protection around our brand and contributes to market share

gains by the workplace Phoenix® 6.0 BT and EV 30 devices.

We

believe our most important goal and best opportunity remains the convergence of the global need for rapid detection of drugs of abuse

with Lifeloc’s proven capability to build easy-to-use portable testing equipment. We are therefore focusing our research

and development efforts on leveraging the SpinDx™ technology platform, sometimes referred to as

“Lab on a Disk,” to develop a series of devices and tests that can be used at roadside and in emergency rooms, forensic labs

and workplace test sites to achieve a rapid and quantitative measure for a panel of drugs of abuse. The initial product release is projected

to be a device with a disk that allows for detection of delta-9-THC (the major intoxicating component of the cannabis plant) from a test

subject’s saliva, followed by a disk for a panel of other drugs. SpinDx has been demonstrated in our laboratory to effectively detect

for delta-9-THC, cocaine, fentanyl, amphetamine methamphetamine, morphine, MDMA, and benzodiazepines. Testing has validated the SpinDx

measurement technology against the definitive standard liquid chromatography-mass spectroscopy (LCMS) measurement utilizing human samples.

The LCMS data have validated the SpinDx test results on real-world human saliva tests at a limit of detection of approximately 10 ng/ml.

With our research and development work, we continue to improve our technology’s robustness, speed, and convenience of operation.

We are currently performing validation testing of the microfluidic action and full drug assay within the current disk design before this

transitions into production tooling. We plan to start beta testing of our SpinDx saliva testing system utilizing the delta-9-THC disks

later this quarter using prototype readers as shown in the photograph below. Commercial launch of our first SpinDx application is projected

to occur later in 2025. Following initial commercialization, we expect more offerings from this technology platform to include expanded

drug panels and samples collected from blood and breath. Following the release of our SpinDx saliva testing system, we expect to accelerate

development of combining our LX9 breathalyzer with the THC SpinDx detection unit, to produce our roadside marijuana breathalyzer system.

“We believe

we are getting close to validating and launching our device into rapid drug testing,” said Dr. Wayne Willkomm, Lifeloc’s chief

executive officer. “We anticipate continued high research and development expenses in this final push toward commercialization.

With the rising demand for saliva drug testing, the initial release of SpinDx to the market becomes more urgent and valuable.”

In anticipation

of declining cash because of the high research and development investment in SpinDx, the company has sought to strengthen its financial

resources. Early in the third quarter the Company closed on a $750,000 line of credit with Citywide Banks as well as a private placement

of 210,000 shares of the Company’s common stock at $3.80 per share, resulting in a $798,000 capital injection to assist the SpinDx

development in moving forward to testing and commercialization.

“The small

private placement was very efficient,” said Dr. Willkomm, “with no underwriting costs and minimizing shareholder dilution.”

About Lifeloc Technologies

Lifeloc Technologies, Inc. (OTC: LCTC) is a

trusted U.S. manufacturer of evidential breath alcohol testers and related training and supplies for Workplace, Law Enforcement, Corrections

and International customers. Lifeloc stock trades over-the-counter under the symbol LCTC. We are a fully reporting Company with our SEC

filings available on our web site, www.lifeloc.com/investor.

Forward Looking Statements

This press release includes forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, which involve substantial risks and uncertainties

that may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements

expressed or implied in this press release, including statements about our strategies, performance, expectations about new and existing

products, market demand, economic conditions, acceptance of new and existing products, technologies and opportunities, market size and

growth, and return on investments in products and market, are based on information available to us on the date of this document, and we

assume no obligation to update such forward-looking statements. Investors are strongly encouraged to review the section titled “Risk

Factors” in our SEC filings.

Phoenix® and

Easycal® are registered trademarks of Lifeloc Technologies, Inc.

SpinDx™

is a trademark of Sandia Corporation.

Amy Evans

Lifeloc Technologies, Inc.

http://www.lifeloc.com

(303) 431-9500

LIFELOC TECHNOLOGIES,

INC.

Condensed Balance Sheets (Unaudited)

| | |

| | |

| |

| ASSETS | |

| | |

| |

| | |

September

30, 2024 | | |

December

31, 2023 | |

| CURRENT

ASSETS: | |

| | | |

| | |

| Cash | |

$ | 841,621 | | |

$ | 1,766,621 | |

| Accounts

receivable, net | |

| 611,439 | | |

| 812,126 | |

| Inventories,

net | |

| 3,160,200 | | |

| 3,024,834 | |

| Federal and

state income taxes receivable | |

| 60,420 | | |

| — | |

| Prepaid

expenses and other | |

| 89,049 | | |

| 105,967 | |

| Total

current assets | |

| 4,762,729 | | |

| 5,709,548 | |

| | |

| | | |

| | |

| PROPERTY

AND EQUIPMENT, at cost: | |

| | | |

| | |

| Land | |

| 317,932 | | |

| 317,932 | |

| Building | |

| 1,928,795 | | |

| 1,928,795 | |

| Real-time

Alcohol Detection And Recognition equipment and software | |

| 569,448 | | |

| 569,448 | |

| Production

equipment, software and space modifications | |

| 1,349,839 | | |

| 1,154,803 | |

| Training

courses | |

| 432,375 | | |

| 432,375 | |

| Office equipment,

software and space modifications | |

| 254,333 | | |

| 216,618 | |

| Sales and

marketing equipment and space modifications | |

| 226,356 | | |

| 226,356 | |

| Research

and development equipment, software and space modifications | |

| 725,556 | | |

| 480,684 | |

| Research

and development equipment, software and space modifications not in service | |

| 147,615 | | |

| — | |

| Less

accumulated depreciation | |

| (3,511,125 | ) | |

| (3,326,837 | ) |

| Total

property and equipment, net | |

| 2,441,124 | | |

| 2,000,174 | |

| | |

| | | |

| | |

| OTHER ASSETS: | |

| | | |

| | |

| Patents,

net | |

| 80,517 | | |

| 64,439 | |

| Deposits

and other | |

| 12,261 | | |

| 111,157 | |

| Deferred

taxes | |

| 1,046,493 | | |

| 806,652 | |

| Total

other assets | |

| 1,139,271 | | |

| 982,248 | |

| Total

assets | |

$ | 8,343,124 | | |

$ | 8,691,970 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| CURRENT

LIABILITIES: | |

| | | |

| | |

| Accounts

payable | |

$ | 328,528 | | |

$ | 402,231 | |

| Term loan

payable, current portion | |

| 52,789 | | |

| 51,588 | |

| Income taxes

payable | |

| — | | |

| 44,952 | |

| Customer

deposits | |

| 28,940 | | |

| 195,719 | |

| Accrued expenses | |

| 270,932 | | |

| 329,311 | |

| Deferred

revenue, current portion | |

| 56,090 | | |

| 79,036 | |

| Reserve

for warranty expense | |

| 46,500 | | |

| 46,500 | |

| Total

current liabilities | |

| 783,779 | | |

| 1,149,337 | |

| | |

| | | |

| | |

| TERM LOAN

PAYABLE, net of current portion and debt issuance

costs | |

| 1,132,066 | | |

| 1,170,243 | |

| | |

| | | |

| | |

| DEFERRED

REVENUE, net of current portion | |

| 8,575 | | |

| 11,565 | |

| Total

liabilities | |

| 1,924,420 | | |

| 2,331,145 | |

| | |

| | | |

| | |

| COMMITMENTS

AND CONTINGENCIES (Note 5) | |

| | | |

| — | |

| | |

| | | |

| | |

| STOCKHOLDERS'

EQUITY: | |

| | | |

| | |

Common

stock, no par value; 50,000,000 shares authorized, 2,664,116 shares

outstanding at September 30, 2024 (2,454,116 outstanding at December 31, 2023) |

|

|

5,466,014 |

|

|

|

4,668,014 |

|

| Retained

earnings | |

| 952,690 | | |

| 1,692,811 | |

| Total

stockholders' equity | |

| 6,418,704 | | |

| 6,360,825 | |

| Total

liabilities and stockholders' equity | |

$ | 8,343,124 | | |

$ | 8,691,970 | |

| |

| | | |

| | |

LIFELOC

TECHNOLOGIES, INC.

Condensed

Statements of Income (Loss) (Unaudited)

| | |

| | |

| |

| | |

Three

Months Ended September 30, | |

| REVENUES: | |

2024 | | |

2023 | |

| Product

sales | |

$ | 2,075,994 | | |

$ | 2,676,872 | |

| Royalties | |

| 3,016 | | |

| 5,063 | |

| Rental

income | |

| 8,316 | | |

| 13,573 | |

| Total | |

| 2,087,326 | | |

| 2,695,508 | |

| | |

| | | |

| | |

| COST

OF SALES | |

| 1,175,374 | | |

| 1,576,117 | |

| | |

| | | |

| | |

| GROSS

PROFIT | |

| 911,952 | | |

| 1,119,391 | |

| | |

| | | |

| | |

| OPERATING

EXPENSES: | |

| | | |

| | |

| Research

and development | |

| 521,107 | | |

| 516,174 | |

| Sales

and marketing | |

| 329,716 | | |

| 309,898 | |

| General

and administrative | |

| 269,450 | | |

| 269,593 | |

| Total | |

| 1,120,273 | | |

| 1,095,665 | |

| | |

| | | |

| | |

| OPERATING

INCOME (LOSS) | |

| (208,321 | ) | |

| 23,726 | |

| | |

| | | |

| | |

| OTHER

INCOME (EXPENSE): | |

| | | |

| | |

| Interest

income | |

| 9,525 | | |

| 17,678 | |

| Interest

expense | |

| (10,019 | ) | |

| (10,494 | ) |

| Total | |

| (494 | ) | |

| 7,184 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| BENEFIT

FROM FEDERAL AND STATE INCOME TAXES | |

| 50,488 | | |

| 78,693 | |

| | |

| | | |

| | |

| NET

INCOME (LOSS) | |

$ | (158,327 | ) | |

$ | 109,603 | |

| | |

| | | |

| | |

| NET

INCOME (LOSS) PER SHARE, BASIC | |

$ | (0.06 | ) | |

$ | 0.04 | |

| | |

| | | |

| | |

| NET

INCOME (LOSS) PER SHARE, DILUTED | |

$ | (0.06 | ) | |

$ | 0.04 | |

| | |

| | | |

| | |

| WEIGHTED

AVERAGE SHARES, BASIC | |

| 2,611,616 | | |

| 2,454,116 | |

| | |

| | | |

| | |

| WEIGHTED

AVERAGE SHARES, DILUTED | |

| 2,611,616 | | |

| 2,454,116 | |

| | |

| | | |

| | |

=

LIFELOC

TECHNOLOGIES, INC.

Condensed

Statements of Income (Loss) (Unaudited)

| | |

| | |

| |

| | |

Nine Months

Ended September 30, | |

| REVENUES: | |

2024 | | |

2023 | |

| Product

sales | |

$ | 6,580,861 | | |

$ | 7,056,638 | |

| Royalties | |

| 22,776 | | |

| 23,419 | |

| Rental

income | |

| 24,462 | | |

| 60,351 | |

| Total | |

| 6,628,099 | | |

| 7,140,408 | |

| | |

| | | |

| | |

| COST

OF SALES | |

| 3,887,244 | | |

| 4,043,146 | |

| | |

| | | |

| | |

| GROSS

PROFIT | |

| 2,740,855 | | |

| 3,097,262 | |

| | |

| | | |

| | |

| OPERATING

EXPENSES: | |

| | | |

| | |

| Research

and development | |

| 1,738,982 | | |

| 1,308,721 | |

| Sales

and marketing | |

| 1,040,099 | | |

| 897,856 | |

| General

and administrative | |

| 947,384 | | |

| 872,724 | |

| Total | |

| 3,726,465 | | |

| 3,079,301 | |

| | |

| | | |

| | |

| OPERATING

INCOME (LOSS) | |

| (985,610 | ) | |

| 17,961 | |

| | |

| | | |

| | |

| OTHER

INCOME (EXPENSE): | |

| | | |

| | |

| Interest

income | |

| 35,874 | | |

| 46,678 | |

| Interest

expense | |

| (30,226 | ) | |

| (31,319 | ) |

| Total | |

| 5,648 | | |

| 15,359 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| BENEFIT

FROM FEDERAL AND STATE INCOME TAXES | |

| 239,841 | | |

| 77,640 | |

| | |

| | | |

| | |

| NET

INCOME (LOSS) | |

$ | (740,121 | ) | |

$ | 110,960 | |

| | |

| | | |

| | |

| NET

INCOME (LOSS) PER SHARE, BASIC | |

$ | (0.30 | ) | |

$ | 0.05 | |

| | |

| | | |

| | |

| NET

INCOME (LOSS) PER SHARE, DILUTED | |

$ | (0.30 | ) | |

$ | 0.05 | |

| | |

| | | |

| | |

| WEIGHTED

AVERAGE SHARES, BASIC | |

| 2,506,999 | | |

| 2,454,116 | |

| | |

| | | |

| | |

| WEIGHTED

AVERAGE SHARES, DILUTED | |

| 2,506,999 | | |

| 2,454,116 | |

| | |

| | | |

| | |

Lifeloc

Technologies, Inc.

Statements

of Stockholders' Equity (Unaudited)

| | |

| | |

| | |

| | |

| |

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Beginning balances | |

4,668,014 | | |

4,668,014 | | |

4,668,014 | | |

4,668,014 | |

| Beginning balances | |

1,111,017 | | |

1,488,554 | | |

1,692,811 | | |

1,487,197 | |

| Total

stockholders' equity, beginning balances | |

$ | 5,779,031 | | |

$ | 6,156,568 | | |

$ | 6,360,825 | | |

$ | 6,155,211 | |

| | |

| | | |

| | | |

| | | |

| | |

| Common

stock: | |

| | | |

| | | |

| | | |

| | |

| Beginning

balances | |

| 4,668,014 | | |

| 4,668,014 | | |

| 4,668,014 | | |

| 4,668,014 | |

| Issuance

of 210,000 shares at $3.80 per share | |

| 798,000 | | |

| — | | |

| 798,000 | | |

| — | |

| Net

income (loss) | |

| — | | |

| — | | |

| — | | |

| — | |

| Ending

balances | |

| 5,466,014 | | |

| 4,668,014 | | |

| 5,466,014 | | |

| 4,668,014 | |

| | |

| | | |

| | | |

| | | |

| | |

| Retained

earnings: | |

| | | |

| | | |

| | | |

| | |

| Beginning

balances | |

| 1,111,017 | | |

| 1,488,554 | | |

| 1,692,811 | | |

| 1,487,197 | |

| Net

income (loss) | |

| (158,327 | ) | |

| 109,603 | | |

| (740,121 | ) | |

| 110,960 | |

| Ending

balances | |

| 952,690 | | |

| 1,598,157 | | |

| 952,690 | | |

| 1,598,157 | |

| | |

| | | |

| | | |

| | | |

| | |

| Beginning balances | |

| 5,779,031 | | |

| 6,156,568 | | |

| 6,360,825 | | |

| 6,155,211 | |

| Net

income (loss) | |

| (158,327) | | |

| 109,603 | | |

| (740,121) | | |

| 110,960 | |

| Total

stockholders' equity, ending balances | |

$ | 6,418,704 | | |

$ | 6,266,171 | | |

$ | 6,418,704 | | |

$ | 6,266,171 | |

| | |

| | | |

| | | |

| | | |

| | |

LIFELOC TECHNOLOGIES,

INC.

Condensed Statements

of Cash Flows (Unaudited)

| | |

| | |

| |

| | |

Nine

Months Ended September 30, | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

2024 | | |

2023 | |

| Net

income (loss) | |

$ | (740,121 | ) | |

$ | 110,960 | |

| Adjustments

to reconcile net income (loss) to net cash (used

in) operating activities- | |

| | | |

| | |

| Depreciation

and amortization | |

| 193,096 | | |

| 198,471 | |

| Provision

for doubtful accounts, net change | |

| 1,000 | | |

| — | |

| Provision

for inventory obsolescence, net change | |

| 52,500 | | |

| — | |

| Deferred

taxes, net change | |

| (239,841 | ) | |

| (114,116 | ) |

| Changes

in operating assets and liabilities- | |

| | | |

| | |

| Accounts

receivable | |

| 199,687 | | |

| (81,388 | ) |

| Inventories | |

| (187,866 | ) | |

| (179,943 | ) |

| Federal

and state income taxes receivable | |

| (60,420 | ) | |

| 107,575 | |

| Prepaid

expenses and other | |

| 16,918 | | |

| (207,149 | ) |

| Deposits

and other | |

| 98,896 | | |

| — | |

| Accounts

payable | |

| (73,703 | ) | |

| 87,870 | |

| Income

taxes payable | |

| (44,952 | ) | |

| 36,476 | |

| Customer

deposits | |

| (166,779 | ) | |

| (16,557 | ) |

| Accrued

expenses | |

| (58,379 | ) | |

| (82,738 | ) |

| Deferred

revenue | |

| (25,936 | ) | |

| (13,339 | ) |

| Net

cash (used in) operating activities | |

| (1,035,900 | ) | |

| (153,878 | ) |

| | |

| | | |

| | |

| CASH

FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchases

of property and equipment | |

| (477,623 | ) | |

| (21,611 | ) |

| | |

| | | |

| | |

| Purchases

of research and development equipment, software, and space modifications not in service | |

| (147,615 | ) | |

| — | |

| Patent

filing expense | |

| (21,708 | ) | |

| (1,404 | ) |

| Net

cash (used in) investing activities | |

| (646,946 | ) | |

| (23,015 | ) |

| | |

| | | |

| | |

| CASH

FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Principal

payments made on term loan | |

| (40,154 | ) | |

| (38,988 | ) |

| Proceeds

from issuance of 210,000 shares of common stock at $3.80 per share | |

| 798,000 | | |

| — | |

| Net

cash provided by (used in) financing activities | |

| 757,846 | | |

| (38,988 | ) |

| | |

| | | |

| | |

| NET

(DECREASE) IN CASH | |

| (925,000 | ) | |

| (215,881 | ) |

| | |

| | | |

| | |

| CASH,

BEGINNING OF PERIOD | |

| 1,766,621 | | |

| 2,352,754 | |

| | |

| | | |

| | |

| CASH,

END OF PERIOD | |

$ | 841,621 | | |

$ | 2,136,873 | |

| | |

| | | |

| | |

| SUPPLEMENTAL

INFORMATION: | |

| | | |

| | |

| Cash

paid for interest | |

$ | 27,048 | | |

$ | 28,091 | |

| | |

| | | |

| | |

| Cash

paid for income tax | |

$ | 60,420 | | |

$ | — | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

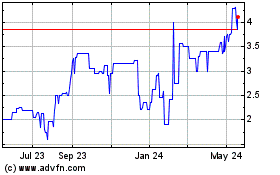

Lifeloc Technologies (PK) (USOTC:LCTC)

Historical Stock Chart

From Mar 2025 to Apr 2025

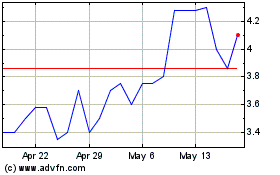

Lifeloc Technologies (PK) (USOTC:LCTC)

Historical Stock Chart

From Apr 2024 to Apr 2025