Form 8-K - Current report

November 03 2023 - 3:11PM

Edgar (US Regulatory)

false0001335112

0001335112

2023-11-02

2023-11-02

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 2, 2023

(Exact name of registrant as specified in its charter)

| | |

(State or other jurisdiction of | | |

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: | |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | Name of each exchange on which registered |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Unless otherwise stated or unless the context otherwise requires, the terms “

we

,” “us,” “

our

,” “

Logiq

,” “

DLQ Parent”

and the “

Company

” refer to Logiq, Inc., a Delaware corporation. Furthermore, unless otherwise stated or unless the context otherwise requires, references “

Abri

” refer to ABRI SPAC, Inc., a Delaware corporation, prior to the Closing Date. All references herein to the “

Board

” refer to the board of directors of the Company. All references to “

Collective Audience

”, “

Combined Company

” or “

Surviving Corporation

” refer to “

Collective Audience, Inc

.”, a Delaware corporate, after giving effect to the Business Combination (as defined below).

Terms used in this Current Report on Form 8-K (this “

Report

”) but not defined herein, or for which definitions are not otherwise incorporated by reference herein, shall have the meaning given to such terms in the Proxy Statement (as defined below) in the section entitled “

Frequently Used Terms

” beginning on page 1 thereof, and such definitions are incorporated herein by reference.

This Report incorporates by reference certain information from reports and other documents that were previously filed with the Securities and Exchange Commission (the “

SEC

”), including certain information from the Proxy Statement/Prospectus. To the extent there is a conflict between the information contained in this Report and the information contained in such prior reports and documents and incorporated by reference herein, the information in this Report controls.

| Completion of Acquisition or Disposition of Assets |

As previously announced, on September 12, 2022, Abri SPAC I, Inc., a Delaware corporation (“

Abri

”), Abri Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Abri (“

Merger Sub

”), Logiq, Inc., a Delaware corporation (the “

Company

”) and, DLQ, Inc., a Nevada corporation and wholly owned subsidiary of the Company (“

DLQ

”) entered into a Merger Agreement (the “

Merger Agreement

”), included as an exhibit to this Current Report on Form 8-K as Exhibit 2.1.

As previously reported on the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission (“

SEC

”) on October 25, 2023, the Company held a special meeting of its stockholders (the “

Special Meeting

”), at which holders of

59,902,368 or 56.89%

shares of Company Common Stock ( the “

Company Common Stock

”) were present in person or by proxy, constituting a quorum for the transaction of business. Only stockholders of record as of the close of business on September 25, 2023, the record date (the “

Record Date

”) for the Special Meeting, were entitled to vote at the Special Meeting. As of the Record Date, 105,284,314 shares of Company Common Stock were outstanding and entitled to vote at the Special Meeting.

At the Special Meeting, the Company’s stockholders voted to approve the proposals outlined in the final prospectus and definitive proxy statement filed by the Company with the SEC on October 10, 2023 (the “

Proxy Statement

”), including, among other things, the adoption of the Merger Agreement and approval of the transactions contemplated by the Merger Agreement, including the merger of Merger Sub with and into DLQ, with DLQ continuing as the surviving corporation and as a wholly-owned subsidiary of Collective Audience, and the issuance of Collective Audience securities as consideration thereunder, as described in the section titled “

The Business Combination Proposal (Proposal 1)

” beginning on page 89 of the Proxy Statement/Prospectus (the “

Merger

” and, together with the other transactions contemplated by the Merger Agreement, the “

Business Combination

”).

On November 2, 2023 (the “

Closing Date

”), the Business Combination, including the Merger, was completed (the “

Closing

”).

The Merger Consideration and Treatment of Securities

At Closing, pursuant to the terms of the Merger Agreement and after giving effect to the redemptions of shares of common stock by public stockholders of Abri:

| | The total consideration paid at Closing (the “ Merger Consideration ”) by Abri to DLQ security holders was 11,400,000 shares of the Abri common stock valued at $114 million (the “ Consideration Shares ”); |

| | Each share of DLQ Common Stock, if any, that was owned by Abri, Merger Sub, DLQ or any other affiliate of Abri immediately prior to the effective time of the Merger (the “ Effective Time ”) was automatically cancelled and retired without any conversion or consideration; |

| | each share of Merger Sub common stock, par value $0.0001 per share (“ Merger Sub Common Stock ”), issued and outstanding immediately prior to the Effective Time was converted into one newly issued share of Common Stock of the Surviving Corporation. |

As a result of Closing, DLQ. became a wholly-owned subsidiary of Abri.

Concurrently with Closing, upon issuance of the Consideration Shares, the Company declared a Dividend Distribution of 3,762,000 of the total Consideration Shares (representing 33%) to the Lo

g

iq, Inc. stockholders (the “

Logiq Dividend

”) of record as of October 24, 2023 (the “

Dividend Record Date

”). Certain Company stockholders which are entitled to 1,500,000 of such Logiq Dividend shares agreed to become subject to an Escrow Agreement (the “

Reset Shares

”), which shares may be released to certain institutional investors to cover any reset in the amount of Consideration Shares to cover a $5 million investment in DLQ (the “

DLQ Investment

”) in the form of convertible promissory notes issued by DLQ (the “

DLQ Notes

”). Additionally, As disclosed in that certain Form 8-K filed with the SEC on September 8, 2023, an aggregate of $5,000,000

of DLQ Notes converted into shares of common stock of DLQ representing an aggregate of 14% of DLQ and were exchanged for an aggregate of 1,600,000 Consideration Shares. The remaining 53% of Consideration Shares were issued to the Company and are subject to an 11-month lock-up, as well as a separate escrow account which shall be released once such the DLQ Investors recoup their original investment amounts.

The foregoing description of the Merger and the Merger Agreement and the transactions contemplated thereby does not purport to be complete and is subject to and qualified in its entirety by reference to the full text of (i) the Merger Agreement, incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on September 12, 2022, (ii) the First Amendment to the Merger Agreement filed as Exhibit 2.2 to the Company’s Current Report on Form 8-K filed with the SEC May 2, 2023, (iii) the Second Amendment to the Merger Agreement filed as Exhibit 2.3 to the Company’s Current Report on Form 8-K filed with the SEC on July 25, 2023, (iv) the Third Amendment to the Merger Agreement filed as Exhibit 2.4 to the Company’s Current Report on Form 8-K filed with the SEC on July 25, 2023 and (v) the Fourth Amendment to the Merger Agreement filed as Exhibit 2.5 to the Company’s Current Report on Form 8-K filed with the SEC on September 1, 2023.

In connection with the Closing, on November 2, 2023, the Company declared a Dividend distribution of the 3,762,000 shares of Abri common stock, at a ratio of 0.027 shares of Abri common stock per each 1 share of Company common stock to the Company’s shareholders as of record as of the Dividend Record Date.

The actual date of delivery and receipt of such Abri common stock by holders of record as of Dividend Record Date may be delayed due to administrative matters and will vary on a case-by-case basis depending on how such shares are held by such holders (e.g. as registered holders, street name, etc.).

| | | Financial Statements and Exhibits |

(b)

Pro Forma Financial Information

The Company will file the financial statements required by Item 9.01 of Form 8-K by an amendment to this Current Report on Form 8-K no later than 71 days from the date this Current Report on Form 8-K is required to be filed.

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Cover Page Interactive Data File (embedded within Inline XBRL document) | | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

| | |

| | |

| | |

| | Chief Executive Officer and Executive Chairman |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

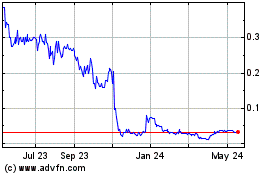

Logiq (PK) (USOTC:LGIQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

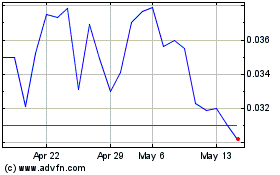

Logiq (PK) (USOTC:LGIQ)

Historical Stock Chart

From Nov 2023 to Nov 2024