Current Report Filing (8-k)

November 21 2018 - 3:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 15, 2018

LIQUIDMETAL TECHNOLOGIES, INC.

(

Exact name of Registrant as Specified in its Charter

)

|

Delaware

|

001-31332

|

33-0264467

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

20321 Valencia Circle

Lake Forest, CA 92630

(Address of Principal Executive Offices; Zip Code)

Registrant’s telephone number, including area code:

(949) 635-2100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Compensatory Arrangements of Certain Officers.

|

Executive Employment Agreements

On November 15, 2018, Liquidmetal Technologies, Inc. (the “Company”) entered into an Employment Agreement with Bruce Bromage, the Company’s Chief Operating Officer (the “Bromage Employment Agreement”). The Bromage Employment Agreement has a term of three years and will continue thereafter on an “at-will” basis until terminated by either the Company or Mr. Bromage upon 30 days’ prior written notice. The Bromage Employment Agreement provides for an annual base salary of $291,000 plus bonuses at the discretion of the Company’s Board of Directors. The agreement provides that the Company can terminate Mr. Bromage’s employment at any time and for any reason, provided that if his employment is terminated without “Cause” (as specifically defined in the agreement), then he will continue to be entitled to his base salary and health and welfare benefits for a period of twelve months after termination, and his unvested equity awards (to the extent they would have vested during the twelve-month period after termination)will immediately vest and become exercisable until the earlier of two years after vesting or the scheduled expiration date of the award. In the event that Mr. Bromage terminates his own employment within two years after a change in control of the Company for various “Good Reason Events” that are defined in the agreement (including a material change in compensation or duties), the Company will also be obligated to pay him the same severance compensation that would be applicable to a termination without “Cause”. The Bromage Employment Agreement provides that Mr. Bromage will not be entitled to any severance compensation if he voluntarily leaves the employment of the Company or is terminated for “Cause”, and severance payments will cease if he violates certain restrictive covenants in the agreement.

Also on November 15, 2018, the Company entered into an Employment Agreement with Bryce Van, the Company’s Vice President of Finance (the “Van Employment Agreement”). The Van Employment Agreement has a term of three years, subject to automatic extension on a month-to-month after the expiration of the initial three-year term. The Van Employment Agreement provides for an annual base salary of $245,000 plus bonuses at the discretion of the Company’s Board of Directors. The agreement provides that the Company can terminate Mr. Van’s employment at any time and for any reason, provided that if his employment is terminated without “Cause” (as specifically defined in the agreement), then he will continue to be entitled to his base salary and health and welfare benefits for a period of twelve months after termination, and his unvested equity awards (to the extent they would have vested during the twelve-month period after termination) will immediately vest and become exercisable until the earlier of two years after vesting or the scheduled expiration date of the award. In the event that Mr. Van terminates his own employment within two years after a change in control of the Company for various “Good Reason Events” that are defined in the agreement (including a material change in compensation or duties), the Company will also be obligated to pay him the same severance compensation that would be applicable to a termination without “Cause”. The Van Employment Agreement provides that Mr. Van will not be entitled to any severance compensation if he voluntarily leaves the employment of the Company or is terminated for “Cause”, and severance payments will cease if he violates certain restrictive covenants in the agreement.

Option Grant to Bruce Bromage

On November 15, 2018, the Board of Directors of the Company made an option grant under the Company’s 2015 Equity Incentive Plan to Mr. Bromage to purchase up to 4,050,000 shares of Company common stock. The option has an exercise price of $0.14 per share and will expire 10 years from the date of grant unless it terminates earlier upon a termination of service. The shares covered by the option will vest 20% on the first year anniversary date of the date of grant, 20% on the second anniversary, and 60% on the third anniversary. The terms of the option are subject to the provisions of the 2015 Equity Incentive Plan.

Option Grants to Non-Employee Directors

On November 15, 2018, the Board of Directors of the Company made an option grant under the Company’s 2015 Equity Incentive Plan to each of the Company’s non-employee directors-- Abdi Mahamedi, Walter Weyler, Vincent Carrubba, and Tony Chung. Each such option gives the grantee the right to purchase up to 240,000 shares of Company common stock at an exercise price of $0.14 per share. The options will expire 10 years from the date of grant unless they terminate earlier upon a termination of service. The shares covered by the option will vest one-third on the first year anniversary of the date of grant, with the remainder vesting ratably on a monthly basis during the 24-month period following the first year anniversary. The terms of the options are subject to the provisions of the 2015 Equity Incentive Plan.

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

On November 15, 2018, the Company held its annual meeting of stockholders (the “Annual Meeting”). At the Annual Meeting, the Company’s stockholders (i) elected six directors to the Company’s board of directors, (ii) granted advisory approval of the compensation of the Company’s named executive officers, (iii) granted advisory approval on a three-year frequency for holding future advisory votes on the compensation of the Company’s named executive officers and (iv) ratified the appointment of SingerLewak LLP as the Company’s independent registered public accounting firm for fiscal year 2018, each as more fully described below.

The final voting results were as follows:

|

Item No. 1:

|

Proposal to elect six directors to the Company’s Board of Directors to serve until the Annual Meeting of Stockholders in 2019.

|

|

Nominee

|

For

|

Withheld

|

Broker Non-

Votes

|

|

Lugee Li

|

459,096,482

|

3,694,991

|

379,790,888

|

|

Abdi Mahamedi

|

451,347,518

|

11,443,955

|

379,790,888

|

|

Walter Weyler

|

451,800,407

|

10,991,066

|

379,790,888

|

|

Vincent Carrubba

|

454,008,310

|

8,783,163

|

379,790,888

|

|

Tony Chung

|

446,907,999

|

15,883,474

|

379,790,888

|

|

Isaac Bresnick

|

452,499,844

|

10,291,629

|

379,790,888

|

|

Item No. 2

|

Proposal to grant advisory approval of the compensation of the Company’s named executive officers.

|

|

For

|

Against

|

Abstain

|

Broker Non-

Votes

|

|

449,852,199

|

10,194,759

|

2,744,515

|

379,790,888

|

|

Item no. 3

|

Proposal to grant advisory approval on the frequency of future advisory votes on executive compensation

|

|

1 Year

|

2 Years

|

3 Years

|

Abstain

|

Broker Non-

Votes

|

|

424,928,167

|

4,398,198

|

32,706,111

|

758,997

|

379,790,888

|

|

Item No. 4

|

Proposal to ratify the appointment of SingerLewak LLP as the Company’s independent registered public accounting firm for fiscal 2018.

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

830,426,874

|

7,827,098

|

4,328,389

|

-

|

Following the Annual Meeting, the Board of Directors considered the voting results on Item No. 3, the non-binding stockholder vote on the frequency of holding future advisory votes on the compensation of the Company’s named executive officers. Based on all of the factors taken into consideration, the Company has decided that it will hold an advisory vote on the compensation of its named executive officers with a frequency of three years.

Item 9.01 Financial Statements and Exhibits.

See the Exhibit Index set forth below for a list of exhibits included in this Form 8-K.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunder duly authorized.

|

|

LIQUIDMETAL TECHNOLOGIES, INC.

|

|

|

|

|

|

By:

|

/s/ Lugee Li

|

|

|

Lugee Li,

|

|

|

Chairman, President, and Chief Executive Officer

|

|

|

|

|

Date: November 21, 2018

|

|

EXHIBIT INDEX

|

*Indicates a management contract or compensatory plan or arrangement.

|

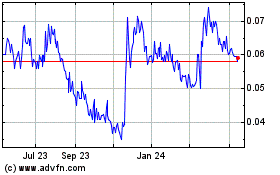

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

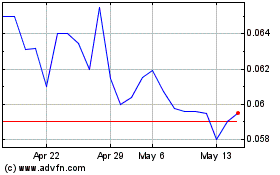

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Dec 2023 to Dec 2024