Current Report Filing (8-k)

April 12 2021 - 3:30PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 12, 2021 (April 7, 2021)

MJ

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55900

|

|

20-8235905

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

7320

S. Rainbow Blvd., Suite 102-210, Las Vegas, NV 89139

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code:

(702)

879-4440

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.001 par value per share

|

|

MJNE

|

|

OTC

Markets “PINK”

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Forward-looking

Statements

This

Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements can generally be identified by our use

of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,”

“estimate,” “believe,” “continue,” or other similar words. Readers of this report should be

aware that there are various factors that could cause actual results to differ materially from any forward-looking statements

made in this report. Factors that could cause or contribute to such differences include, but are not limited to, changes in general

economic, regulatory and business conditions in Nevada, and or changes in U.S. Federal law. Accordingly, readers are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Item

1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On March 26, 2021 (the “Effective

Date”), MJ Holdings, Inc. (“MJNE”) entered into a Cultivation and Sales Agreement (the “Agreement”)

with Natural Green, LLC (the “Company”). Under the terms of the Agreement, MJNE shall retain the Company to provide

oversight and management of MJNE’s cultivation and sale of products at MJNE’s Amargosa Valley, NV farm. The Agreement

shall commence on the Effective Date, continue for a period of ten (10) years and automatically renew for a period of five (5)

years. The Company shall be responsible for compliance, standard of care, packaging, insurance, labor matters, policies and procedures,

testing, record keeping, security and marketing. The transaction closed on April 7, 2021.

As deposits, security and royalty, the Company shall

pay to MJNE:

|

|

(i)

|

a $500,000 Product Royalty deposit to be applied to the first Product Royalty or Product Royalties;

|

|

|

(ii)

|

a deposit of $20,000 to be applied against the first and last month’s Security and Compliance fee;

|

|

|

(iii)

|

$10,000 on the first of each month for Security and Compliance;

|

|

|

(iv)

|

a royalty of 10% of gross revenue less applicable taxes (hereinafter “Net Sales Revenue”) on all sales of product by the Company; and

|

|

|

(v)

|

the Company shall, after the first two (2) years from execution of the Agreement, be responsible to pay to MJNE a minimum royalty of $50,000.00 per month.

|

As compensation, MJNE shall pay to the Company:

|

|

(i)

|

a Management Fee that is based upon the net sales price (after taxes) and further subject to all contractual expenses.

|

Item

9.01. FINANCIAL STATEMENTS AND EXHIBITS.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

MJ

HOLDINGS, INC.

|

|

|

|

|

Date:

April 12, 2021

|

By:

|

/s/

Roger Bloss

|

|

|

|

Roger

Bloss

|

|

|

|

Interim

Chief Executive Officer

|

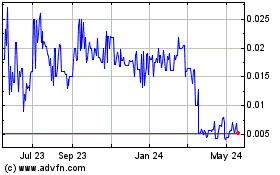

MJ (CE) (USOTC:MJNE)

Historical Stock Chart

From Feb 2025 to Mar 2025

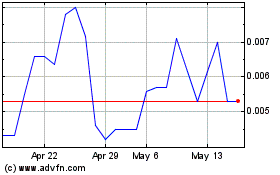

MJ (CE) (USOTC:MJNE)

Historical Stock Chart

From Mar 2024 to Mar 2025