UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: 30 November 2023

Commission File Number: 001-14958

NATIONAL GRID plc

(Translation

of registrant’s name into English)

England and Wales

(Jurisdiction

of Incorporation)

1-3 Strand, London, WC2N 5EH, United Kingdom

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule

101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule

101(b)(7): ☐

Indicate

by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3- 2(b) under the Securities

Exchange Act of 1934. ☐ Yes ☒ No

If

“Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b):

n/a

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

99.1

|

Exhibit

99.1 Announcement sent to the London Stock Exchange on 01

November

2023 — Total Voting Rights

|

|

99.2

|

Exhibit

99.2 Announcement sent to the London Stock Exchange on 08

November

2023 — Director/PDMR Shareholding

|

|

99.3

|

Exhibit

99.3 Announcement sent to the London Stock Exchange on 16

November

2023 — Publication of Supplementary

Prospectus

|

|

99.4

|

Exhibit

99.4 Announcement sent to the London Stock Exchange on 30

November

2023 — Holding(s) in Company

|

|

99.5

|

Exhibit

99.5 Announcement sent to the London Stock Exchange on 30

November

2023 — Holding(s) in Company

|

Exhibit

99.1

1 November 2023

National Grid plc ('National

Grid' or 'Company')

Voting Rights update

National Grid's registered capital as of 31 October 2023 consisted

of 3,935,660,942 ordinary shares, of which, 247,482,870 were

held as treasury shares; leaving a balance of 3,688,178,072 with

voting rights.

The figure of 3,688,178,072 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to

notify their interest in, or a change to their interest in,

National Grid under the FCA's Disclosure Guidance and Transparency

Rules.

Pritti Patel

General Counsel, Corporate and Deputy Company

Secretary

Exhibit

99.2

8 November 2023

National Grid plc ('National

Grid' or 'Company')

Notification of Transactions of Persons Discharging Managerial

Responsibilities ('PDMRs')

This announcement is made in accordance with Article

19 of

the Market Abuse Regulation ('MAR') and relates to the National

Grid Share Incentive Plan ('SIP') monthly purchases on behalf of

PDMRs.

In accordance with MAR the relevant Financial Conduct Authority

('FCA') notifications are set out below.

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Andy

Agg

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

Financial Officer

|

|

b)

|

Initial notification / Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Monthly purchase of securities ("partnership shares") under the

Share Incentive Plan

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP 9.93998

|

15

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.11.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

John

Pettigrew

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

Executive Officer

|

|

b)

|

Initial notification / Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Monthly purchase of securities ("partnership shares") under the

Share Incentive Plan

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP 9.93998

|

15

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.11.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Will

Serle

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

People & Culture Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Monthly purchase of securities ("partnership shares") under the

Share Incentive Plan

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP 9.93998

|

15

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.11.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Ben Wilson

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Strategy and External Affairs Officer

|

|

b)

|

Initial notification / Amendment

|

Initial notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Monthly purchase of securities ("partnership shares") under the

Share Incentive Plan

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP 9.93998

|

15

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.11.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

Exhibit

99.3

16 November 2023

National Grid plc / National Grid Electricity Transmission

plc

Publication of a Supplementary

Prospectus

The following supplementary prospectus has been approved by the

Financial Conduct Authority and is available for

viewing:

The Supplementary Prospectus dated 16

November 2023 (the "Supplementary Prospectus")

supplementing the prospectus dated 27 July 2023 (the

"Prospectus") for the National Grid plc and National Grid

Electricity Transmission plc Euro 20,000,000,000 Euro Medium Term

Note Programme.

The Supplementary Prospectus should be read and construed in

conjunction with the Prospectus.

To view the full Supplementary Prospectus, please paste the

following URL into the address bar of your browser:

http://www.rns-pdf.londonstockexchange.com/rns/7382T_1-2023-11-16.pdf

A copy of the Supplementary Prospectus has been submitted to the

National Storage Mechanism and will shortly be available to the

public for inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

For further information, please contact:

|

Kwok Liu

|

+44 (0) 7900 405 729 (m)

|

|

Deputy Treasurer, Funding & Investment

National Grid plc

|

|

|

|

|

|

Lyndsey Evans

|

+44 (0) 7714 672 052 (m)

|

|

Corporate Communications

National Grid plc

|

|

DISCLAIMER - INTENDED ADDRESSEES

Please note that the information contained in the Prospectus may be

addressed to and/or targeted at persons who are residents of

particular countries (specified in the Prospectus) only and is not

intended for use and should not be relied upon by any person

outside these countries and/or to whom the offer contained in the

Prospectus is not addressed. Prior to relying on the information

contained in the Prospectus you must ascertain from the Prospectus

whether or not you are part of the intended addressees of the

information contained therein.

Your right to access this service is conditional upon complying

with the above requirement.

Exhibit

99.4

30 November

2023

National Grid plc ('National

Grid' or 'Company')

Notification of Major Interest in National Grid Ordinary

Shares

National Grid has received a notification on Form TR-1 from

BlackRock, Inc. that its total interest in National Grid voting

ordinary shares is as shown below.

TR-1: Standard form for notification of major holdings

1. Issuer Details

ISIN

Issuer Name

UK or Non-UK Issuer

2. Reason for Notification

|

An acquisition or disposal of voting rights

|

3. Details of person subject to the notification

obligation

Name

City of registered office (if applicable)

Country of registered office (if applicable)

4. Details of the shareholder

Full name of shareholder(s) if different from the person(s) subject

to the notification obligation, above

City of registered office (if applicable)

Country of registered office (if applicable)

5. Date on which the threshold was crossed or reached

6. Date on which Issuer notified

7. Total positions of person(s) subject to the notification

obligation

|

|

%

of voting rights attached to shares (total of 8.A)

|

%

of voting rights through financial instruments (total of 8.B 1 +

8.B 2)

|

Total

of both in % (8.A + 8.B)

|

Total

number of voting rights held in issuer

|

|

Resulting situation

on the date on which threshold was crossed or reached

|

6.780000

|

0.100000

|

6.880000

|

254134567

|

|

Position of

previous notification (if applicable)

|

4.420000

|

2.460000

|

6.880000

|

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reached

8A. Voting rights attached to shares

|

Class/Type of shares ISIN code(if possible)

|

Number of direct voting rights (DTR5.1)

|

Number of indirect voting rights (DTR5.2.1)

|

% of direct voting rights (DTR5.1)

|

% of indirect voting rights (DTR5.2.1)

|

|

GB00BDR05C01

|

|

250072204

|

|

6.780000

|

|

Sub

Total 8.A

|

250072204

|

6.780000%

|

8B1. Financial Instruments according to (DTR5.3.1R.(1)

(a))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Number of voting rights that may be acquired if the instrument is

exercised/converted

|

% of voting rights

|

|

American Depository

Receipt

|

|

|

2759907

|

0.070000

|

|

Securities

Lending

|

|

|

176088

|

0.000000

|

|

Sub

Total 8.B1

|

|

2935995

|

0.070000%

|

8B2. Financial Instruments with similar economic effect according

to (DTR5.3.1R.(1) (b))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Physical or cash settlement

|

Number of voting rights

|

% of voting rights

|

|

CFD

|

|

|

Cash

|

1126368

|

0.030000

|

|

Sub

Total 8.B2

|

|

1126368

|

0.030000%

|

9. Information in relation to the person subject to the

notification obligation

|

2. Full chain of controlled undertakings through which the voting

rights and/or the financial instruments are effectively held

starting with the ultimate controlling natural person or legal

entities (please add additional rows as necessary)

|

|

Ultimate controlling person

|

Name of controlled undertaking

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock

(Singapore) Holdco Pte. Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock HK Holdco

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Lux Finco

S.a.r.l.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Japan

Holdings GK

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Japan

Co., Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 2)

|

Trident

Merger, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 2)

|

BlackRock

Investment Management, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Cayman 1

LP

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Cayman

West Bay Finco Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Cayman

West Bay IV Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Group

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Finance

Europe Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock

Investment Management (UK) Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock Australia

Holdco Pty. Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock

Investment Management (Australia) Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Cayman 1

LP

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Cayman

West Bay Finco Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Cayman

West Bay IV Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Group

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock

International Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Holdco 4,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Holdco 6,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Delaware

Holdings Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock

Institutional Trust Company, National Association

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Holdco 4,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Holdco 6,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Delaware

Holdings Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Fund

Advisors

|

|

|

|

|

BlackRock, Inc.

(Chain 8)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 8)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock

(Singapore) Holdco Pte. Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock HK Holdco

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock Asset

Management North Asia Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Cayman 1

LP

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Cayman

West Bay Finco Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Cayman

West Bay IV Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Group

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Finance

Europe Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock

(Netherlands) B.V.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Asset

Management Deutschland AG

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Canada

Holdings LP

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Canada

Holdings ULC

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Asset

Management Canada Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 12)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 12)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 12)

|

BlackRock Capital

Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 12)

|

BlackRock Advisors,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Cayman 1

LP

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Cayman

West Bay Finco Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Cayman

West Bay IV Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Group

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Finance

Europe Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Advisors

(UK) Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock

(Singapore) Holdco Pte. Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock

(Singapore) Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

Trident

Merger, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

BlackRock

Investment Management, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

Amethyst

Intermediate, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

Aperio

Holdings, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

Aperio

Group, LLC

|

|

|

|

10. In case of proxy voting

Name of the proxy holder

The number and % of voting rights held

The date until which the voting rights will be held

11. Additional Information

|

BlackRock Regulatory Threshold Reporting TeamJana Blumenstein020

7743 3650

|

12. Date of Completion

13. Place Of Completion

|

12 Throgmorton Avenue, London, EC2N 2DL, U.K.

|

This notice is in compliance with National Grid's obligations under

the Disclosure and Transparency Rules.

Pritti Patel

General Counsel, Corporate and Deputy Company

Secretary

Exhibit

99.5

30 November

2023

National Grid plc ('National

Grid' or 'Company')

Notification of Major Interest in National Grid Ordinary

Shares

National Grid has received a notification on Form TR-1 from UBS

Group AG Investment Bank that its total interest in National Grid

voting ordinary shares is as shown below.

TR-1: Standard form for notification of major holdings

1. Issuer Details

ISIN

Issuer Name

UK or Non-UK Issuer

2. Reason for Notification

|

An acquisition or disposal of voting rights; Other

|

Comments

|

UBS trading book holdings in National Grid PLC fell below 5% and

are therefore exempt from reporting.

|

3. Details of person subject to the notification

obligation

Name

|

UBS Group AG Investment Bank

|

City of registered office (if applicable)

Country of registered office (if applicable)

4. Details of the shareholder

Full name of shareholder(s) if different from the person(s) subject

to the notification obligation, above

City of registered office (if applicable)

Country of registered office (if applicable)

5. Date on which the threshold was crossed or reached

6. Date on which Issuer notified

7. Total positions of person(s) subject to the notification

obligation

|

|

%

of voting rights attached to shares (total of 8.A)

|

%

of voting rights through financial instruments (total of 8.B 1 +

8.B 2)

|

Total

of both in % (8.A + 8.B)

|

Total

number of voting rights held in issuer

|

|

Resulting situation

on the date on which threshold was crossed or reached

|

0.000000

|

0.000000

|

0.000000

|

0

|

|

Position of

previous notification (if applicable)

|

5.179408

|

0.019115

|

5.198523

|

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reached

8A. Voting rights attached to shares

|

Class/Type of shares ISIN code(if possible)

|

Number of direct voting rights (DTR5.1)

|

Number of indirect voting rights (DTR5.2.1)

|

% of direct voting rights (DTR5.1)

|

% of indirect voting rights (DTR5.2.1)

|

|

GB00BDR05C01

|

|

0

|

|

0.000000

|

|

Sub

Total 8.A

|

0

|

0.000000%

|

8B1. Financial Instruments according to (DTR5.3.1R.(1)

(a))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Number of voting rights that may be acquired if the instrument is

exercised/converted

|

% of voting rights

|

|

|

|

|

|

|

|

Sub

Total 8.B1

|

|

|

|

8B2. Financial Instruments with similar economic effect according

to (DTR5.3.1R.(1) (b))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Physical or cash settlement

|

Number of voting rights

|

% of voting rights

|

|

|

|

|

|

|

|

|

Sub

Total 8.B2

|

|

|

|

9. Information in relation to the person subject to the

notification obligation

|

2. Full chain of controlled undertakings through which the voting

rights and/or the financial instruments are effectively held

starting with the ultimate controlling natural person or legal

entities (please add additional rows as necessary)

|

|

Ultimate controlling person

|

Name of controlled undertaking

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

UBS

Group AG (Chain 1)

|

|

|

|

|

|

UBS

Group AG (Chain 1)

|

UBS

AG

|

|

|

|

|

UBS

Group AG (Chain 1)

|

UBS AG

London Branch

|

|

|

|

|

UBS

Group AG (Chain 2)

|

|

|

|

|

|

UBS

Group AG (Chain 2)

|

UBS

AG

|

|

|

|

|

UBS

Group AG (Chain 2)

|

UBS

Americas Holding LLC

|

|

|

|

|

UBS

Group AG (Chain 2)

|

UBS

Americas Inc.

|

|

|

|

|

UBS

Group AG (Chain 2)

|

UBS

Securities LLC

|

|

|

|

10. In case of proxy voting

Name of the proxy holder

The number and % of voting rights held

The date until which the voting rights will be held

11. Additional Information

|

UBS trading book holdings in National Grid PLC fell below 5% and

are therefore exempt from reporting.

|

12. Date of Completion

13. Place Of Completion

This notice is in compliance with National Grid's obligations under

the Disclosure and Transparency Rules.

Pritti Patel

General Counsel, Corporate and Deputy Company

Secretary

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly

authorized.

|

|

NATIONAL GRID

plc

|

|

|

|

|

|

|

By:

|

/s/Sally Kenward

_______________________

|

|

|

|

Sally Kenward

Senior Assistant Company Secretary

|

Date:

30 November

2023

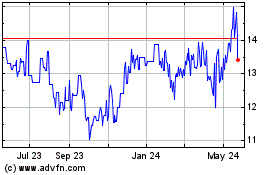

National Grid (PK) (USOTC:NGGTF)

Historical Stock Chart

From Jan 2025 to Feb 2025

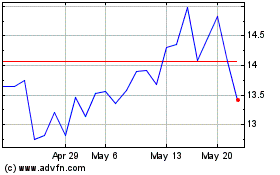

National Grid (PK) (USOTC:NGGTF)

Historical Stock Chart

From Feb 2024 to Feb 2025