UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

Report of Foreign Private Issuer

Pursuant to Rule

13a-16

or

15d-16

under the

Securities Exchange Act of 1934

For the month of October 2017

Commission File Number

1-8910

NIPPON TELEGRAPH AND TELEPHONE CORPORATION

(Translation of registrant’s name into English)

OTEMACHI FIRST SQUARE, EAST TOWER

5-1,

OTEMACHI

1-CHOME

CHIYODA-KU,

TOKYO

100-8116

JAPAN

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(7):

NOTICE REGARDING PAYMENT RECEIVED IN RESPECT OF THE ARBITRATION AWARD RELATED TO NTT DOCOMO’S STAKE IN

TATA TELESERVICES LIMITED

On October 31, 2017, the registrant filed with the Tokyo Stock Exchange a notice regarding payment received

in respect of the arbitration award related to NTT DOCOMO’s stake in Tata Teleservices Limited. Attached is an English translation of the notice filed with the Tokyo Stock Exchange.

The information included herein contains forward-looking statements. The registrant desires to qualify for the “safe-harbor”

provisions of the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important factors that could cause the registrant’s actual results to differ materially from those set forth

in the attachment.

The registrant’s forward-looking statements are based on a series of assumptions, projections, estimates,

judgments and beliefs of the management of the registrant in light of information currently available to it regarding the registrant and its subsidiaries and affiliates, the economy and telecommunications industry in Japan and overseas, and other

factors. These projections and estimates may be affected by the future business operations of the registrant and its subsidiaries and affiliates, the state of the economy in Japan and abroad, possible fluctuations in the securities markets, the

pricing of services, the effects of competition, the performance of new products, services and new businesses, changes to laws and regulations affecting the telecommunications industry in Japan and elsewhere, other changes in circumstances that

could cause actual results to differ materially from any future results that may be derived from the forward-looking statements, as well as other risks included in the registrant’s most recent Annual Report on Form

20-F

and other filings and submissions with the United States Securities and Exchange Commission.

No

assurance can be given that the registrant’s actual results will not vary significantly from any expectation of future results that may be derived from the forward-looking statements included herein.

The information on any website referenced herein or in the attached material is not incorporated by reference herein or therein.

The attached material is a translation of the Japanese original. The Japanese original is authoritative.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

NIPPON TELEGRAPH AND TELEPHONE CORPORATION

|

|

|

|

|

By

|

|

/s/ Takashi Ameshima

|

|

|

|

Name:

|

|

Takashi Ameshima

|

|

|

|

Title:

|

|

Vice President

|

|

|

|

|

|

Investor Relations Office

|

Date: October 31, 2017

October 31, 2017

Company Name: Nippon Telegraph and Telephone Corporation

Representative: Hiroo Unoura, President and Chief Executive Officer

(Code No.: 9432, First section of Tokyo Stock Exchange)

Notice regarding Payment Received in respect of the Arbitration Award related to

NTT DOCOMO’s Stake in Tata Teleservices Limited

NTT DOCOMO, INC. (“NTT DOCOMO”), a subsidiary of Nippon Telegraph and Telephone Corporation, announced previously in its Form

6-K

filing with its release entitled, “Notice regarding NTT DOCOMO’s Court Decision regarding its Stake in Tata Teleservices Limited” filed on May 1, 2017. Based on the decision by the High Court

of Delhi regarding the arbitration award related to NTT DOCOMO’s stake in Tata Teleservices Limited, NTT DOCOMO received payment from Tata Sons Limited of the arbitration award on October 31, 2017. For more details, please see the attached

press release by NTT DOCOMO.

|

|

|

|

|

For further inquiries, please contact:

|

|

|

|

Takayuki Kimura or Tatsuya Watanabe

|

|

Investor Relations Office

|

|

Finance and Accounting Department

|

|

Nippon Telegraph and Telephone Corporation

|

|

Phone:

|

|

+81-3-6838-5481

|

|

Fax:

|

|

+81-3-6838-5499

|

NTT DOCOMO, INC.

President and CEO: Kazuhiro Yoshizawa

Tokyo Stock Exchange: 9437

New York

Stock Exchange: DCM

October 31, 2017

Payment Received in Respect of Arbitration Award Regarding Stake in Tata Teleservices

NTT DOCOMO, INC. announced today that on October 31, 2017, it received from Tata Sons Limited (“Tata Sons”) payment of the award amount in

accordance with the High Court of Delhi’s decision regarding DOCOMO’s stake in Tata Teleservices Limited (“TTSL”). DOCOMO previously announced the court’s decision in a Form

6-K

filing

entitled “Court Decision Regarding Stake in Tata Teleservices” filed on May 1, 2017.

1. Amount Received by DOCOMO

¥144.9 billion

*1

2. Transfer of TTSL Shares

Concurrent with the receipt of the

above amount, all shares in TTSL held by DOCOMO have been transferred to Tata Sons and companies designated by Tata Sons.

3. Financial Impact and Partial

Adjustment to Forecasts of Consolidated Financial Results

DOCOMO expects to include the award amount of ¥144.9 billion in other income on its

consolidated financial statements for the three-month period ending December 31, 2017.

Concurrent with the receipt of the above award amount, all

shares in TTSL held by DOCOMO have been transferred to Tata Sons and companies designated by Tata Sons. Upon the transfer of DOCOMO’s shares in TTSL, DOCOMO no longer accounts for investments in TTSL under the equity method. Accordingly, DOCOMO

expects to include a loss on transfer of investments in affiliates of ¥29.8 billion, equal to the reclassification adjustments of foreign currency translation adjustments, in other expense on its consolidated financial statements for the

three-month period ending December 31, 2017.

As a result, net income attributable to NTT DOCOMO, INC. will be adjusted to ¥740 billion and

free cash flow will be adjusted to ¥855 billion in DOCOMO’s forecasts of consolidated financial results for the fiscal year ending March 31, 2018.

|

|

|

|

|

Adjustment to Forecasts of Consolidated Financial Results

|

|

(Billions of yen)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal year ending

March 31, 2018

(Initial forecasts)

|

|

|

Fiscal year ending

March 31, 2018

(Adjusted forecasts)

|

|

|

Changes

|

|

|

Net income attributable to NTT DOCOMO, INC.

|

|

|

655.0

|

|

|

|

740.0

|

|

|

|

85.0

|

|

|

Free cash flow (excluding changes in investments for cash management purposes

*2

)

|

|

|

710.0

|

|

|

|

855.0

|

|

|

|

145.0

|

|

|

*1

|

The amount received includes interest earned and other costs awarded.

|

|

*2

|

Changes in investments for cash management purposes: Changes by purchases, redemption at maturity and disposals of financial instruments held for cash management purposes with original maturities of longer than three

months.

|

Explanation for forecasts of operations:

This filing contains forward-looking statements such as forecasts of results of operations, management strategies, objectives and plans, forecasts of

operational data such as the expected number of subscriptions, and the expected dividend payments. All forward-looking statements that are not historical facts are based on management’s current plans, expectations, assumptions and estimates

based on the information available as of the filing date of this document. Some of the projected numbers in this report were derived using certain assumptions that were indispensable for making such projections in addition to historical facts. These

forward-looking statements are subject to various known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from those contained in or suggested by any forward-looking statement. With regard to

various known and unknown risks, uncertainties and other factors, please see our latest Annual reports on Form

20-F

submitted to the U.S. Securities and Exchange Commission.

For further information, please contact:

Investor

Relations Department

NTT DOCOMO, INC.

Tel:

+81-3-5156-1111

About NTT DOCOMO

NTT DOCOMO, Japan’s leading mobile operator with over 75 million subscriptions, is one of the world’s foremost contributors to 3G, 4G and 5G

mobile network technologies. Beyond core communications services, DOCOMO is challenging new frontiers in collaboration with a growing number of entities (“+d” partners), creating exciting and convenient value-added services that change the

way people live and work. Under a medium-term plan toward 2020 and beyond, DOCOMO is pioneering a leading-edge 5G network to facilitate innovative services that will amaze and inspire customers beyond their expectations. DOCOMO is listed on stock

exchanges in Tokyo (9437) and New York (DCM).

www.nttdocomo.co.jp/english

.

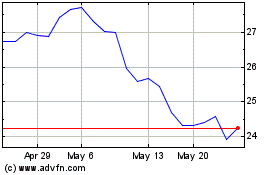

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From Mar 2025 to Apr 2025

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From Apr 2024 to Apr 2025