UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2024

|

|

|

|

001-41208 |

|

|

(Commission File Number) |

|

NOVONIX LIMITED

(Translation of registrant’s name into English)

Level 38

71 Eagle Street

Brisbane, QLD 4000 Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20‑F or Form 40‑F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

Exhibit No. Description

Exhibit 99.1 Notice of Extraordinary General Meeting of NOVONIX Limited (including Form of Proxy) dated December 23, 2024

Exhibit 99.2 Appendix 3B (Proposed issue of securities) dated December 23, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

NOVONIX LIMITED By: /s/ Dr. John Christopher Burns Dr. John Christopher Burns Chief Executive Officer |

|

|

|

Date: December 24, 2024

EXHIBIT 99.1

Notice of Extraordinary General Meeting

Notice is given that an Extraordinary General Meeting of shareholders of NOVONIX Limited

(ACN 157 690 830) (the Company) will be held on 22 January 2025 at 11:00am (AEST) in person at the offices of Allens, Level 26, 480 Queen Street, Brisbane (the Meeting).

Important: The resolutions set out in this Notice should be read together with the accompanying Explanatory Memorandum.

Agenda

Resolution 1 – Ratification of issue of Shares under the Institutional Placement

To consider and, if thought fit, to pass the following resolution as an Ordinary Resolution:

That for the purposes of Listing Rule 7.4 and for all other purposes, Shareholders approve and ratify the issue under the Institutional Placement made on 2 December 2024 of 74,064,647 Shares on the terms set out in the Explanatory Memorandum which accompanies this Notice.

Voting exclusion

The Company will disregard any votes cast on this resolution by certain persons. Details of the applicable voting exclusions are set out in the 'Voting exclusions' section of the Notes to this Notice.

Resolution 2 – Approval of issue of Shares to Phillips 66 under the Conditional Placement

To consider and, if thought fit, to pass the following resolution as an Ordinary Resolution:

That for the purposes of Listing Rule 10.11 and for all other purposes, Shareholders approve the proposed issue to Phillips 66 under the Conditional Placement expected to be made on or about 29 January 2025 of 12,771,392 Shares on the terms and conditions set out in the Explanatory Memorandum which accompanies this Notice.

Resolution 3 – Issue of Incentive Options to Andrew Liveris

To consider and, if thought fit, to pass the following resolution as an Ordinary Resolution:

That, for the purposes of Listing Rule 10.11 and for all other purposes, Shareholders approve the issue of 3,000,000 Incentive Options to Andrew Liveris on the terms and conditions set out in the Explanatory Statement.

Voting exclusion

The Company will disregard any votes cast on this resolution by certain persons. Details of the applicable voting exclusions are set out in the 'Voting exclusions' section of the Notes to this Notice.

Resolution 4 – Approval of Performance Rights Plan

To consider and, if thought fit, to pass the following resolution as an Ordinary Resolution:

That, for the purposes of Listing Rule 7.2 exception 13 and all other purposes, the Company's Performance Rights Plan, as set out in Explanatory Memorandum, and the issue of securities under the Company's Performance Rights Plan, be approved.

Voting exclusion

The Company will disregard any votes cast on this resolution by certain persons. Details of the applicable voting exclusions are set out in the 'Voting exclusions' section of the Notes to this Notice.

The attached Explanatory Memorandum is incorporated into and forms part of this Notice. A detailed explanation of the background and reasons for the proposed resolutions are set out in the Explanatory Memorandum.

|

By order of the Board of Directors

|

Suzanne Yeates

Company Secretary |

23 December 2024 |

Dated |

Voting Notes

Eligibility to Vote

Regulation 7.11.37 of the Corporations Regulations 2001 (Cth) permits the Company to specify a time, not more than 48 hours before a general meeting, at which a 'snap-shot' of Shareholders will be taken for the purposes of determining Shareholder entitlements to vote at the Meeting.

The Board has determined that the registered holders of fully paid Shares of the Company at 7:00pm (Sydney time) on 20 January 2025 will be taken to be Shareholders for the purposes of the Meeting and accordingly, will be entitled to attend and vote at the Meeting.

How to Vote

A Shareholder who is entitled to attend and vote at the Meeting may do so:

•by corporate representative (if the Shareholder is a corporation); or

Attendance in Person

The Meeting will also be held in person at the offices of Allens, Level 26, 480 Queen Street, Brisbane QLD.

Voting by Proxy

An eligible Shareholder can vote in person at the Meeting or appoint a proxy or, where a Shareholder is entitled to two or more votes, two proxies. Where two proxies are appointed, a Shareholder may specify the number or proportion of votes to be exercised by each proxy appointed. If no number or proportion of votes is specified, each proxy appointed will be taken to exercise half of that Shareholder’s votes (disregarding fractions).

An appointed proxy need not themselves be a Shareholder.

To be valid, the appointment of a proxy (made using a properly completed and executed Proxy Form) must be received by the Company no later than 48 hours before the commencement of the Meeting (i.e. 11:00am (AEST) on 20 January 2025).

Proxy Forms can be submitted in four ways:

•Online at https://investorcentre.linkgroup.com

•By mail to Link Market Services at the following postal address:

NOVONIX Limited

c/- Link Market Services Limited Locked Bag A14

Sydney South NSW 1235 Australia

•By facsimile to +61 2 9287 0309

Link Market Services Limited Parramatta Square

Level 22, Tower 6

10 Darcy Street

Parramatta NSW 2150

Instructions on how to complete the Proxy Form are on the reverse of the Proxy Form attached to this Notice.

If a Proxy Form is signed by an attorney, a Shareholder must also send in the original or a certified copy of the power of attorney or other authority under which the Proxy Form is signed.

Undirected Proxies

The Chair intends to vote undirected proxy votes in favour of all resolutions (subject to the voting exclusions below).

Voting by Corporate Representative

A Shareholder or proxy which is a corporation and entitled to attend and vote at the Meeting may appoint an individual to act as its corporate representative to vote at the Meeting. The appointment must comply with section 250D of the Corporations Act. The representative should bring to the Meeting evidence of his or her appointment unless it has previously been provided to Link Market Services.

Voting by Attorney

A Shareholder entitled to attend and vote at the Meeting is entitled to appoint an attorney to attend and vote at the Meeting on the Shareholder's behalf. An attorney need not themselves be a Shareholder.

The power of attorney appointing the attorney must be signed and specify the name of each of the Shareholder, the Company and the attorney, and also specify the meeting(s) at which the appointment may be used. The appointment may be a standing one.

To be effective, the power of attorney must also be returned in the same manner, and by the same time, as specified for Proxy Forms.

Voting Exclusions

The Corporations Act and the Listing Rules require that certain persons must not vote in particular ways, and the Company must disregard particular votes cast by or on behalf of certain persons, on each of the Resolutions to be considered at the Meeting. These voting exclusions are described below.

Under Listing Rule 14.11, the Company will disregard any votes cast in favour of a Resolution by or on behalf of:

(a)the below named person or class of persons excluded from voting; or

(b)an associate of that person or those persons:

|

|

Resolution |

Persons excluded from voting |

Resolution 1 – Ratification of issue of Shares under the Institutional Placement |

Any person who participated in the Institutional Placement |

Resolution 2 - Approval of issue of Shares to Phillips 66 under the Conditional Placement |

Phillips 66 and any other a person who is expected to participate in, or who will obtain a material benefit as a result of, the proposed issue of Shares under the Conditional Placement (except a benefit solely by reason of being a holder of Shares) |

Resolution 3 – Issue of Incentive Options to Andrew Liveris |

Andrew Liveris and any other a person who is expected to participate in, or who will obtain a material benefit as a result of, the proposed issue of Incentive Options (except a benefit solely by reason of being a holder of Shares) |

|

|

Resolution |

Persons excluded from voting |

Resolution 4 – Approval of Performance Rights Plan |

Any person who is eligible to participate in the Performance Rights Plan |

However, this does not apply to a vote cast in favour of a Resolution by:

(a)a person as proxy or attorney for a person who is entitled to vote on the Resolution, in accordance with the directions given to the proxy or attorney to vote on the Resolution in that way; or

(b)the Chair as proxy or attorney for a person who is entitled to vote on the Resolution, in accordance with a direction given to the Chair to vote on the Resolution as the Chair decides; or

(c)a holder acting solely as nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met:

(i)the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on the Resolution; and

(ii)the holder votes on the Resolution in accordance with directions given by the beneficiary to the holder to vote in that way.

The Company will also apply these voting exclusions to persons appointed as attorney by a Shareholder to attend and vote at the Extraordinary General Meeting under a power of attorney, as if they were appointed as a proxy.

Resolutions

All items of business involving a vote by Shareholders require Ordinary Resolutions, which means that, to be passed, the item needs the approval of a simple majority of the votes cast by Shareholders entitled to vote on the Resolution.

Explanatory Memorandum

This Explanatory Memorandum forms part of the notice convening the Extraordinary General Meeting of NOVONIX Limited to be held at 10:00am (AEST) on 22 January 2025.

Background to the Extraordinary General Meeting and Resolutions

Purpose

The purpose of the Meeting is to consider and vote on the Resolutions Entire document

Shareholders are encouraged to read this document in its entirety before making a decision on how to vote on the Resolutions being considered at the Meeting. If you have any doubt how to deal with this document, please consult your legal, financial or other professional advisor.

Glossary

Certain terms and abbreviations used in the Explanatory Memorandum and the Notice of Meeting have defined meanings, which are set out in the Glossary of this Explanatory Memorandum.

Resolutions are not interdependent

The Resolutions are not interdependent. In the event that one or more of the Resolutions are not approved by Shareholders, the voting outcome of the balance of the Resolutions will not be affected.

Listing Rules

Broadly speaking, Listing Rule 7.1 limits the number of equity securities a company can issue in a 12 month period to 15% of its issued share capital, except for certain issues, including where first approved by shareholders.

Listing Rule 7.4 provides that an issue made under Listing Rule 7.1 is treated as having been made with Shareholder approval if the issue did not breach Listing Rule 7.1 and Shareholders of the company subsequently approve it.

Listing Rule 10.11 provides that unless one of the exceptions in Listing Rule 10.12 applies, a listed company must not issue or agree to issue equity securities to a related party unless it obtains the approval of its shareholders.

1Resolution 1 – Ratification of issue of Shares under Institutional Placement

On 26 November 2024, the Company announced that it would undertake a capital raising to raise approximately $57.1 million, comprising:

(a)a fully underwritten placement to institutional and sophisticated investors to raise approximately $44.4 million within the Company's Placement Capacity at that time under Listing Rule 7.1 (Institutional Placement), through the issue of 74,064,647 new Shares (Institutional Placement Shares) (representing approximately 15% of the total Shares of the Company prior to the issue);

(b)subject to obtaining Shareholder approval and completion of the Institutional Placement, a further non underwritten placement to Phillips 66 to raise approximately $7.7 million (Conditional Placement) of approximately 12,771,392 new Shares (Conditional Placement Shares); and

(c)a non-underwritten share purchase plan to Eligible Shareholders to raise approximately $5 million (before costs) (SPP) through the issue of up to 8,333,333 Shares (SPP Shares).

The Company has engaged Citigroup Global Markets Australia Pty Ltd (ABN 64 003 114 832 / AFSL 240992) and Jefferies (Australia) Pty Ltd (ABN 76 623 059 898) to act as bookrunners, lead managers

and underwriters of the Institutional Placement and as joint lead managers of the Conditional Placement pursuant to the Underwriting Agreement (Joint Lead Managers). The terms and conditions of the Underwriting Agreement are set out on pages 40 to 42 of the investor presentation released to ASX on 26 November 2024.

On 27 November 2024, the Company announced the successful completion of the Institutional Placement, which raised $44.4 million at an offer price of A$0.60 per new Share. The Institutional Placement Shares were issued on 2 December 2024 to institutional and sophisticated investors who participated in the Institutional Placement.

The issue of the Conditional Placement Shares to raise approximately $7.7 million is subject to Shareholder approval (see Resolution 2), as Phillips 66 falls within Listing Rule 10.11.3 and none of the exceptions under Listing Rule 10.12 applies for the issue of the Conditional Placement Shares.

The issue of the SPP to raise approximately $5 million (before costs) is subject to Shareholder approval, as the proposed issue of Shares under the SPP falls within Listing Rules 7.1 and 10.11.1 and none of the exceptions under Listing Rules 7.2 or 10.12 apply for the issue of the SPP Shares. The Company has obtained a waiver from ASX to enable the SPP to be conducted at the same price as the Institutional Placement and for the SPP Shares to be issued as an exception to the Company's Placement Capacity.

The proposed use of funds from the capital raising, including the Institutional Placement, the Conditional Placement and the SPP, will allow the Company to order, install and commission key equipment that is required to achieve commercial production of 3,000 tonnes per annum (tpa) at the Riverside facility in 2025. For further information, refer to the Company's announcements to ASX on 26 November 2024.

The Institutional Placement Shares were issued by the Company without prior Shareholder approval pursuant to its 15% annual Placement Capacity under Listing Rule 7.1.

Listing Rule 7.1 provides that during any 12 month period, a listed company must not (subject to certain exceptions), issue any equity securities, including securities with rights of conversion to equity, if the number of those securities exceed the Company's Placement Capacity. An issue of equity securities which has been approved by Shareholders under Listing Rule 7.1 does not count towards a company's Placement Capacity. Listing Rule 7.4 provides that an issue made under Listing Rule 7.1 is treated as having been made with Shareholder approval if the issue did not breach Listing Rule 7.1 and Shareholders of the company subsequently approve it.

The Company seeks Shareholder approval under Listing Rule 7.4 and for all other purposes to ratify the issue of the Institutional Placement Shares.

The Company wishes to maintain as much flexibility as possible to issue further equity securities in the future. If Resolution 1 is passed, the Institutional Placement Shares will not count towards the Company's Placement Capacity, effectively reinstating the Company's Placement Capacity by increasing the number of equity securities it can issue without Shareholder approval, which will provide the Company flexibility to issue Shares in the future without obtaining further Shareholder approval as required.

If Resolution 1 is not passed, the Institutional Placement Shares will count towards the Company's Placement Capacity, effectively decreasing the number of equity securities it can issue without Shareholder approval, which will impact on the Company's flexibility for future capital raisings.

1.4Requirements of Listing Rule 7.5

In accordance with Listing Rule 7.5 the following information is provided in relation to Resolution 1:

(a)The allottees of the Institutional Placement Shares were sophisticated and institutional investors who participated in the Institutional Placement, as determined by the Company in agreement with the Joint Lead Managers, in accordance with the objectives of the offer.

(b)The Institutional Placement issue consisted of 74,064,647 Shares.

(c)The Institutional Placement Shares were issued on 2 December 2024.

(d)The issue price per Institutional Placement Share was A$0.60.

(e)The purpose of the Institutional Placement, including the use and intended use of funds, is set out in section 1.2 above.

(f)There were no other material terms under agreements entered into with investors in respect of the issue of the Institutional Placement Shares.

A voting exclusion statement is included in this Notice.

2Resolution 2 – Approval of issue of Shares to Phillips 66 under Conditional Placement

A summary of the Conditional Placement is outlined in section 1.1 above. Phillips 66 is proposing to participate in the Conditional Placement.

The proposed use of funds from the Conditional Placement will allow the Company to order, install and commission key equipment that is required to achieve commercial production of 3,000 tonnes per annum (tpa) at the Riverside facility in 2025. For further information, refer to the Company's announcements . For further information, refer to the Company's announcement to ASX on 26 November 2024.

Listing Rule 10.11 provides that unless one of the exceptions in Listing Rule 10.12 applies, a listed company must not issue or agree to issue equity securities to a related party and certain other parties referred to in Listing Rule 10.11 unless it obtains the approval of its shareholders.

The proposed issue of the Conditional Placement Shares to Phillips 66 falls within Listing Rule 10.11.3 and none of the exceptions under Listing Rule 10.12 applies, therefore requiring Shareholder approval under Listing Rule 10.11.

Resolution 2 seeks Shareholder approval under Listing Rule 10.11 and for all other purposes for the issue of Conditional Placement Shares to Phillips 66.

If Shareholder approval is given under Listing Rule 10.11, Shareholder approval is not required under Listing Rule 7.1, and the issue of the Conditional Placement Shares will not count towards the Company's Placement Capacity.

If Resolution 2 is passed, the Company will be able to issue the Conditional Placement Shares to Phillips 66.

If Resolution 2 is not passed, the Company will not be able to issue the Conditional Placement Shares to Phillips 66 and will need to seek alternative sources of funding.

2.4Requirements of Listing Rule 10.13

In accordance with Listing Rule 10.13, the following information is provided in relation to Resolution 2:

(a)The person participating in the Conditional Placement is Phillips 66.

(b)Phillips 66 is a substantial (10%) holder in the Company and has nominated a director to the board of the Company, and is therefore subject to Listing Rule 10.11.3.

(a)The number of Conditional Placement Shares for which approval is sought is 12,771,392 Shares.

(b)It is intended that the Conditional Placement Shares will be issued on or about 29 January 2025, and in any event within 1 month of the date of this Meeting.

(c)The issue price per Conditional Placement Share will be A$0.60.

(d)The purpose of the Conditional Placement, including the use and intended use of funds, is set out in section 1.2 above.

(e)There were no other material terms under agreements entered into with investors in respect of the issue of the Conditional Placement Shares.

A voting exclusion statement has been included in this Notice.

3Resolution 3 – Issue of Incentive Options to Andrew Liveris

Resolution 3 seeks Shareholder approval to issue Incentive Options to Andew Liveris.

Andrew Liveris was previously a director of the Company, but has now been engaged by the Company as a Strategic Advisor. His son, Mr Nicholas Liveris, is currently a director of the Company.

The proposed issue of the Incentive Options to Andrew Liveris are in recognition of services provided by Andrew as a strategic advisor to the Company.

A summary of Listing Rule 10.11 is outlined in section 2.3 above.

The proposed issue of the Incentive Options to Andrew Liveris falls within Listing Rule 10.11.1 as Andrew Liveris is a related party of a Director of the Company (Nicholas Liveris). As none of the exceptions under Listing Rule 10.12 applies, Shareholder approval under Listing Rule 10.11 is required.

Resolution 3 seeks Shareholder approval under Listing Rule 10.11 and for all other purposes for the issue of Incentive Options to Andrew Liveris.

If Shareholder approval is given under Listing Rule 10.11, Shareholder approval is not required under Listing Rule 7.1, and the issue of the Incentive Shares will not count towards the Company's Placement Capacity.

If Resolution 3 is passed, the Company will be able to issue the Incentive Options to Andrew Liveris.

If Resolution 3 is not passed, the Company will not be able to issue the Incentive Options to Andrew Liveris.

Chapter 2E of the Corporations Act prohibits a public company from giving a financial benefit to a related party of the company unless either:

(a)the giving of the financial benefit falls within one of the exceptions (such as reasonable remuneration or arms' length transaction) to the provision; or

(b)prior shareholder approval is obtained for the giving of the financial benefit.

Related party is widely defined under the Corporations Act and includes directors and the children of the directors of a company. An exception to the requirement for shareholder approval is where the proposed

benefit is given in circumstances where the Company and the related party were dealing at arms' length, or on terms that are less favourable to the related party than these terms.

The Directors believe that Shareholder approval is not required under Chapter 2E of the Corporations Act as the Directors (other than Mr Nicholas Liveris) have, after considering all relevant factors, formed the view that the "arms' length" exception applies to the proposed issue of Incentive Options to Mr Andrew Liveris. In reaching this conclusion, the Directors have considered, and satisfied themselves, of the following factors.

•a comparison has been undertaken with comparable transactions on an arm’s length basis;

•the nature and content of the bargaining process undertaken with Andrew Liveris in connection with the proposed issue;

•the impact of the transaction on the Company and non-associated members – in particular, the fact that the proposed issue of securities will not have a negative financial impact on the Company;

•other alternatives were considered;

•expert advice was obtained in structuring the package.

3.4Requirements of Listing Rule 10.13

In accordance with Listing Rule 10.13, the following information is provided in relation to Resolution 3:

(a)The Incentive Options will be issued to Andrew Liveris.

(b)Andrew Liveris is a related party of a Director the Company (Nicholas Liveris), and is therefore subject to Listing Rule 10.11.1.

(c)Approval is sought for 3,000,000 Incentive Options.

(d)The material terms of the Incentive Options are set out in Annexure B.

(e)Subject to shareholder approval being obtained at the Meeting, the Incentive Options will be issued on 22 January 2025 and in any event before the date that is 1 month after the date of the Meeting.

(f)The Company will not receive any consideration for the issue of the Incentive Options. If the Incentive Options are exercised, the Company will receive cash consideration of $0.60 per Incentive Option (being the same price of Shares under the Institutional Placement). Assuming all Incentive Options are exercised, the Company will receive $1,800,000.

(g)The purpose of the Incentive Options is to recognise the services provided by Mr Andrew Liveris in his capacity as strategic advisor to the Company.

(h)There were no other material terms under agreements entered into with investors in respect of the issue of the Incentive Options.

A voting exclusion statement has been included in this Notice.

4Resolution 4 – Approval of Performance Rights Plan

Resolution 4 seeks Shareholder approval of the Performance Rights Plan for the purposes of Listing Rule 7.2, Exception 13.

The Performance Rights Plan was established in 2015 and was subsequently approved by Shareholders at the 2018 and 2021 Annual General Meetings and most recently at the 2022 Annual General Meeting. The plan has been developed to assist the Company to better align the interests of its current and future

Directors and executive management and senior leadership teams with the interests of its Shareholders, by linking part of their remuneration with the financial performance of the Company and therefore, drive the Company's performance.

Under the Performance Rights Plan, NOVONIX intends to grant Performance Rights to participants at no cost. Each Performance Right, once vested, will entitle the participant to acquire one Share, at no cost to the participant.

A summary of Listing Rule 7.1 is outlined in section 1.3 above.

Listing Rule 7.2, Exception 13 provides an exception under which an issuer can issue securities under an employee incentive scheme without utilising the Placement Capacity.

The operation of Exception 13 is two-fold. Firstly, the Company will be permitted to issue securities under the Performance Rights Plan in circumstances where that issue would otherwise cause the Company to exceed the Placement Capacity. Secondly, any Shares issued under the Performance Rights Plan within 12 months of a particular Reference Date will effectively be taken to increase the number of Shares on issue as at that Reference Date for the purposes of determining whether any subsequent issue of securities would exceed the Placement Capacity.

Exception 13 will apply to the Performance Rights Plan if, within three years before the issue date of securities under the Performance Rights Plan, Shareholders have approved the issue of securities under the Performance Rights Plan, as an exception to Listing Rule 7.1.

At the 2022 Annual General Meeting, the Performance Rights Plan was approved by Shareholders for the purposes of Exception 13 on the basis that the maximum number of equity securities proposed to be issued under the Performance Rights Plan for a three year period in reliance of Exception 13 will not exceed 25,000,000. Once this maximum number is exceeded, any issue of securities under the Performance Rights Plan will count towards the Company's Placement Capacity. Since the 2022 Annual General Meeting, the Company has issued 21,860,044 Performance Rights, and further Performance Rights are due to be issued shortly which, if issued, will result in the Company exceeding the maximum number approved by shareholders at the 2022 AGM.

The Company is seeking the approval of Shareholders to essentially increase the maximum number of equity securities proposed to be issued under the Performance Rights Plan over the next 3 years, without counting towards the Company's Placement Capacity (in reliance on Listing Rule 7.2, Exception 13), to 35,000,000 Performance Rights. The terms of the Performance Rights Plan have otherwise not materially changed since it was last approved by shareholders at the 2022 AGM.

The Board is empowered to operate the Performance Rights Plan and grant Performance Rights to eligible participants in accordance with the Listing Rules and on the terms set out in Annexure A of this Explanatory Memorandum.

If Resolution 4 is passed, the Performance Rights Plan will be approved and issues of equity securities under the Performance Rights Plan will not reduce the Company's Placement Capacity (up to the maximum number of equity securities specified in 4.3(c) below).

If Resolution 4 is not passed, the Performance Rights Plan will not be approved. In this case, the Company will still be permitted to issue equity securities under the Performance Rights Plan without needing to obtain shareholder approval (provided that the Company has sufficient Placement Capacity), however such issues will count towards the Company's Placement Capacity.

4.3Requirements of Listing Rule 7.2, Exception 13

In accordance with Listing Rule 7.2, Exception 13, the following information is provided in relation to Resolution 4:

(a)A summary of the terms of the Performance Rights Plan is provided in Annexure A to this Explanatory Memorandum.

(b)21,860,044 Performance Rights have been issued under the Performance Rights Plan since it was last approved by Shareholders at the Company's 2022 AGM.

(c)The maximum number of equity securities proposed to be issued under the Performance Rights Plan following approval of Resolution 4 in reliance of Exception 13 shall not exceed 35,000,000.

A voting exclusion statement is included in this Notice.

Directors' recommendations

1Resolution 1 – Ratification of issue of Shares under the Institutional Placement

The Directors believe that Resolution 1 is in the best interests of the Company and unanimously recommend that Shareholders vote in favour of this Resolution.

2Resolution 2 – Approval of issue of Shares to Phillips 66 under the Conditional Placement

The Directors believe that Resolution 2 is in the best interests of the Company and (other than with Mr Suresh Vaidyanathan, who has a special interest in Resolution 2) recommend that Shareholders vote in favour of this Resolution.

3Resolution 3 – Issue of Incentive Options to Andrew Liveris

The Directors (with Mr Nicholas Liveris abstaining) believe that Resolution 3 is in the best interests of the Company and (other than with Mr Nicholas Liveris) recommend that Shareholders vote in favour of this Resolution.

4Resolution 4 – Approval of Performance Rights Plan

The Directors abstain, in the interests of corporate governance, from making a recommendation in relation to Resolution 4.

Glossary

The following terms used in the Notice of Meeting and the Explanatory Memorandum are defined as follows:

$ means Australian dollars.

AEST means Australian Eastern Standard Time.

ASX means the ASX Limited or the securities exchange operated by it (as the case requires).

Board means the board of Directors of the Company from time to time.

Business Day means a day which is not a Saturday, Sunday or a public holiday in Brisbane, Queensland.

Chair means the person appointed Chair of the Meeting.

Company means NOVONIX Limited (ACN 157 690 830).

Conditional Placement has the meaning given to it under the heading 'Background to the Extraordinary General Meeting and Resolutions' in the Explanatory Memorandum.

Conditional Placement Shares has the meaning given to it under the heading 'Background to the Extraordinary General Meeting and Resolutions' in the Explanatory Memorandum.

Corporations Act means the Corporations Act 2001 (Cth) as amended from time to time.

Directors means the directors of the Company from time to time.

Eligible Shareholders means Shareholders who are shown on the Register as at 7:00pm (Sydney time) on 25 November 2025 to have an address in Australia or New Zealand, are outside the United States and are not acting for the account or benefit of a person in the United States.

Explanatory Memorandum means the explanatory memorandum accompanying this Notice.

Incentive Options means an option to be issued a Share on the terms set out in Annexure B to the Explanatory Memorandum.

Institutional Placement has the meaning given to it under the heading 'Background to the Extraordinary General Meeting and Resolutions' in the Explanatory Memorandum.

Institutional Placement Shares has the meaning given to it under the heading 'Background to the Extraordinary General Meeting and Resolutions' in the Explanatory Memorandum.

Joint Lead Managers has the meaning given to it under the heading 'Background to the Extraordinary General Meeting and Resolutions' in the Explanatory Memorandum.

Listing Rules means the official listing rules of the ASX as amended from time to time.

Meeting means the Extraordinary General Meeting of Shareholders to be held on 22 January 2025 as convened by the accompanying Notice.

Notice of Meeting or Notice means the notice of meeting giving notice to Shareholders of the Meeting, accompanying this Explanatory Memorandum.

Ordinary Resolution means a resolution passed by more than 50% of the votes cast by those entitled to vote on the resolution.

Phillips 66 means Phillips 66 Company, a Delaware corporation, of 2331 CityWest Blvd., Houston, Texas 77042, United States.

Placement Capacity means the amount of share capital that can be issued over a 12 month rolling period (generally up to 15% of current issued capital).

Placements means the Institutional Placement and the Conditional Placement.

Proxy Form means the proxy form accompanying the Notice of Meeting.

Performance Right means a performance right issued under the Performance Rights Plan.

Performance Rights Plan means the Company's Performance Rights Plan, summarised in Annexure A.

Register means the register of Shareholders maintained by the Registrar.

Registrar means Link Market Services Limited (ABN 54 083 214 537).

Resolutions means the resolutions set out in the Notice of Meeting.

Shareholder means a registered holder of Shares.

Shares means fully paid ordinary shares in the Company.

SPP has the meaning given to it under the heading 'Background to the Extraordinary General Meeting and Resolutions' in the Explanatory Memorandum.

SPP Shares has the meaning given to it under the heading 'Background to the Extraordinary General Meeting and Resolutions' in the Explanatory Memorandum.

Underwriting Agreement means the underwriting agreement between the Company and the Joint Lead Managers in relation to the Institutional Placement and the Conditional Placement dated 26 November 2024.

Annexure A

|

Summary of the terms of the Performance Rights Plan |

|

|

Term |

Summary of term |

Administration and terms of grant |

A grant of Performance Rights under the Performance Rights Plan is subject to the rules of the Performance Rights Plan and if relevant, the terms of the specific grant. The Board has a wide discretion to determine any vesting conditions, and the terms of, Performance Rights granted under the Performance Rights Plan. |

Eligibility to participate |

The Performance Rights Plan will be open to eligible participants (including Directors, employees and consultants) of the Company or any of its subsidiaries who the Board designates as being eligible. |

Grant of Performance Rights |

Performance Rights will be offered to eligible participants for no consideration under the Performance Rights Plan. The offer must be in writing, dated and specify, amongst other things, the number of Performance Rights for which the participants may accept and the date for acceptance, the date on which the Performance Rights vest and any conditions to be satisfied before vesting, and any other terms attaching to the rights. |

Permitted Nominee |

A participant that receives an offer for the grant of Performance Rights may nominate a body corporate Controlled by that participant, or any other entity to hold the rights on their behalf and the Board has discretion whether or not to accept such a nomination. |

Vesting of Performance Rights |

The Performances Rights vest upon satisfaction of any vesting conditions and any other conditions contained in the offer, provided any acquisition of Shares does not breach Corporations Act or the Listing Rules, if applicable. Each vested Performance Right entitles the holder to be issued one Share after the vesting date. |

Cash settlement |

The Board may, in its discretion, substitute the issue of Shares on vesting of Performance Rights by making a cash payment in an amount equivalent in value to the number of Shares to which the holder would otherwise be entitled on vesting of the Performance Rights multiplied by the market value of the Share on the date the Performance Rights vested. |

Lapse |

Unless the Board determines otherwise, unvested Performance Rights shall lapse immediately upon lawful termination or resignation of employment or consultancy arrangement, or if the rights are held by a permitted nominee and the grantee of the rights loses ‘control’ of that nominee, those rights will lapse immediately. |

Rights of participants |

Performance Rights issued under the Performance Rights Plan do not entitle the holder to notice of, or to vote at, or attend shareholders’ meetings, or to receive any dividends declared by the Company. Should the Company undergo a reorganisation or reconstruction of capital or any other such change, the number of Shares over which a Right exists will be adjusted (as appropriate) to the extent necessary to comply with the Listing Rules applying to a reorganisation of capital. |

Quotation |

Performance rights will not be quoted on the ASX. the Company will apply for official quotation of any Shares issued under the Performance Rights Plan in accordance with the Listing Rules and having regard to any disposal restrictions. |

|

|

Term |

Summary of term |

Assignment |

Performance rights are not transferable or assignable without the prior written consent of the Board. |

Termination or amendment |

The Performance Rights Plan may be terminated or suspended at any time by the Board. To the extent permitted by the Corporations Act and the Listing Rules, the Board retains the discretion to vary the terms and conditions of the Performance Rights Plan except where the amendment would have the effect of materially adversely affecting or prejudicing the rights of any participant holding Performance Rights. |

Change of control |

In the event of a change of control event, the Board has discretion to determine whether unvested Performance Rights (or a pro-rata proportion of such rights) will automatically vest. If the Board determines that the rights will not vest, the rights will lapse or the Board may arrange for rights in the bidder to be granted to the holders on terms decided by the Board. If the Board determines that unvested rights will vest, the Board may issue shares to the holders of such rights, or arrange for shares or rights to be issued to holders of Performance Rights by the bidder, or any combination of the foregoing. |

Annexure B

Summary of the material terms of the Incentive Options.

|

|

Date of Offer |

22 January 2025 |

Offeree |

Andrew Liveris |

Number of Options |

On acceptance of the offer, Novonix will issue 3,000,000 options, which are exercisable into Shares. |

Exercise Price |

AUD$0.60 per option (being the same price as Shares under the Institutional Placement) |

Exercise Date |

Provided the Vesting Conditions are met the Options will vest and are exercisable after this Offer is accepted and before the Expiry Date. |

Vesting Conditions |

You must remain a Strategic Advisor to NOVONIX Limited (NOVONIX), or one of its other related bodies corporate in order to exercise the Options. The Options will lapse if you cease to be a Strategic Advisor of NOVONIX or an associated body corporate of Novonix prior to the Expiry Date. Options will vest as follows: 1.1/10th on achievement of sales of 1,000 tonnes of anode material in a financial year. 2.1/10th on achievement of sales of 2,000 tonnes of anode material in a financial year. 3.1/10th on achievement of sales of 3,000 tonnes of anode material in a financial year. 4.1/10th on achievement of sales of 4,000 tonnes of anode material in a financial year. 5.1/10th on achievement of sales of 5,000 tonnes of anode material in a financial year. 6.1/10th on achievement of sales of 6,000 tonnes of anode material in a financial year. 7.1/10th on achievement of sales of 7,000 tonnes of anode material in a financial year. 8.1/10th on achievement of sales of 8,000 tonnes of anode material in a financial year. 9.1/10th on achievement of sales of 9,000 tonnes of anode material in a financial year. 10.1/10th on achievement of sales of 10,000 tonnes of anode material in a financial year. |

Expiry Date |

22 January 2030 |

Disposal Restrictions |

The Options are not transferable or assignable and may be exercised only by the Offeree. |

Change of Control |

All unvested Options will vest automatically and must be exercised within a time period determined by the board of Novonix if there is a change of control transaction in relation to Novonix. A change of control transaction will be that which is determined by the board of Novonix and may include: |

|

|

|

persons acquiring all of the shares in Novonix; or a person acquiring all or substantially all of Novonix’s assets, in which case Novonix will advise you of the time period in which the Options must be exercised or will otherwise lapse. |

NOVONIX Limited ABN 54 157 690 830 LODGE YOUR VOTE ONLINE https://investorcentre.linkgroup.com BY MAIL NOVONIX Limited C/- Link Market Services Limited Locked Bag A14 Sydney South NSW 1235 Australia BY FAX +61 2 9287 0309 BY HAND Link Market Services Limited Parramatta Square, Level 22, Tower 6, 10 Darcy Street, Parramatta NSW 2150 ALL ENQUIRIES TO Telephone: 1300 554 474 Overseas: +61 1300 554 474 PROXY FORM I/We being a member(s) of NOVONIX Limited and entitled to attend and vote hereby appoint: X99999999999 X99999999999 APPOINT A PROXY the Chairman of the Meeting (mark box) OR if you are NOT appointing the Chairman of the Meeting as your proxy, please write the name of the person or body corporate you are appointing as your proxy or failing the person or body corporate named, or if no person or body corporate is named, the Chairman of the Meeting, as my/our proxy to act on my/ our behalf (including to vote in accordance with the following directions or, if no directions have been given and to the extent permitted by the law, as the proxy sees fit) at the Extraordinary General Meeting of the Company to be held at 11:00am (AEST) on Wednesday, 22 January 2025 at the offices of Allens, Level 26, 480 Queen Street, Brisbane QLD (the Meeting) and at any postponement or adjournment of the Meeting. Important for Resolution 4: If the Meeting Chair is your proxy, either by appointment or by default, and you have not indicated your voting intention below, you expressly authorise the Meeting Chair to exercise the proxy in respect of Resolution 4, even though the Resolution is connected directly or indirectly with the remuneration of a member of the Company’s Key Management Personnel (KMP). The Chairman of the Meeting intends to vote undirected proxies in favour of each item of business. VOTING DIRECTIONS Proxies will only be valid and accepted by the Company if they are signed and received no later than 48 hours before the Meeting. Please read the voting instructions overleaf before marking any boxes with an T Resolutions Ratification of issue of Shares under the Institutional Placement Approval of issue of Shares to Phillips 66 under the Conditional Placement Issue of Incentive Options to Andrew Liveris Approval of Performance Rights Plan For Against Abstain If you mark the Abstain box for a particular Item, you are directing your proxy not to vote on your behalf on a poll and your votes will not be counted in computing the required majority on a poll. NVX PRX2501C This form should be signed by the shareholder. If a joint holding, either shareholder may sign. If signed by the shareholder’s attorney, the power of attorney must have been previously noted by the registry or a certified copy attached to this form. If executed by a company, the form must be executed in accordance with the company’s constitution and the Corporations Act 2001 (Cth). Director/Company Secretary (Delete one) Joint Shareholder 3 (Individual) SIGNATURE OF SHAREHOLDERS THIS MUST BE COMPLETED Shareholder 1 (Individual) Joint Shareholder 2 (Individual) Sole Director and Sole Company Secretary Director NVX PRX2501C STEP 3 STEP 2 STEP 1

HOW TO COMPLETE THIS SHAREHOLDER PROXY FORM YOUR NAME AND ADDRESS This is your name and address as it appears on the Company’s share register. If this information is incorrect, please make the correction on the form. Shareholders sponsored by a broker should advise their broker of any changes. Please note: you cannot change ownership of your shares using this form. APPOINTMENT OF PROXY If you wish to appoint the Chairman of the Meeting as your proxy, mark the box in Step 1. If you wish to appoint someone other than the Chairman of the Meeting as your proxy, please write the name of that individual or body corporate in Step 1. A proxy need not be a shareholder of the Company. DEFAULT TO CHAIRMAN OF THE MEETING Any directed proxies that are not voted on a poll at the Meeting will default to the Chairman of the Meeting, who is required to vote those proxies as directed. Any undirected proxies that default to the Chairman of the Meeting will be voted according to the instructions set out in this Proxy Form, including where the Resolution is connected directly or indirectly with the remuneration of KMP. VOTES ON ITEMS OF BUSINESS PROXY APPOINTMENT You may direct your proxy how to vote by placing a mark in one of the boxes opposite each item of business. All your shares will be voted in accordance with such a direction unless you indicate only a portion of voting rights are to be voted on any item by inserting the percentage or number of shares you wish to vote in the appropriate box or boxes. If you do not mark any of the boxes on the items of business, your proxy may vote as he or she chooses. If you mark more than one box on an item your vote on that item will be invalid. APPOINTMENT OF A SECOND PROXY You are entitled to appoint up to two persons as proxies to attend the Meeting and vote on a poll. If you wish to appoint a second proxy, an additional Proxy Form may be obtained by telephoning the Company’s share registry or you may copy this form and return them both together. To appoint a second proxy you must: on each of the first Proxy Form and the second Proxy Form state the percentage of your voting rights or number of shares applicable to that form. If the appointments do not specify the percentage or number of votes that each proxy may exercise, each proxy may exercise half your votes. Fractions of votes will be disregarded; and return both forms together. SIGNING INSTRUCTIONS You must sign this form as follows in the spaces provided: Individual: where the holding is in one name, the holder must sign. Joint Holding: where the holding is in more than one name, either shareholder may sign. Power of Attorney: to sign under Power of Attorney, you must lodge the Power of Attorney with the registry. If you have not previously lodged this document for notation, please attach a certified photocopy of the Power of Attorney to this form when you return it. Companies: where the company has a Sole Director who is also the Sole Company Secretary, this form must be signed by that person. If the company (pursuant to section 204A of the Corporations Act 2001) does not have a Company Secretary, a Sole Director can also sign alone. Otherwise this form must be signed by a Director jointly with either another Director or a Company Secretary. Please indicate the office held by signing in the appropriate place. LODGEMENT OF A PROXY FORM This Proxy Form (and any Power of Attorney under which it is signed) must be received at an address given below by 11:00am (AEST) on Monday, 20 January 2025, being not later than 48 hours before the commencement of the Meeting. Any Proxy Form received after that time will not be valid for the scheduled Meeting. Proxy Forms may be lodged using the reply paid envelope or: ONLINE https://investorcentre.linkgroup.com Login to the Link website using the holding details as show on the Proxy Form. Select ‘Voting’ and follow the prompts t lodge your vote. To use the online lodgement facility shareholders will need their “Holder Identifier” - Securityholder Reference Number (SRN) or Holder Identification Number (HIN) n o , . BY MOBILE DEVICE Q Our voting website is designed specifically for voting online. You can now lodge your proxy by scanning the QR code adjacent or enter the voting link https://investorcentre.linkgroup.com into your mobile device. Log in using the Holder Identifier and postcode for your shareholding. R Code To scan the code you will need a QR code reader application which can be downloaded for free on your mobile device. BY MAIL NOVONIX Limited C/- Link Market Services Limited Locked Bag A14 Sydney South NSW 1235 Australia BY FAX +61 2 9287 0309 BY HAND delivering it to Link Market Services Limited* Parramatta Square Level 22, Tower 6 10 Darcy Street Parramatta NSW 2150 * During business hours (Monday to Friday, 9:00am–5:00pm) CORPORATE REPRESENTATIVES IMPORTANT INFORMATION Link Group is now known as MUFG Pension & Market Services. Over the coming months, Link Market Services will progressively rebrand to its new name MUFG Corporate Markets, a division of MUFG Pension & Market Services. If a representative of the corporation is to attend the Meeting the appropriate “Certificate of Appointment of Corporate Representative” must be received at registrars@linkmarketservices.com.au prior to admission in accordance with the Notice of Extraordinary General Meeting. A form of the certificate may be obtained from the Company’s share registry or online at www.linkmarketservices.com.au. IF YOU WOULD LIKE TO ATTEND AND VOTE AT THE EXTRAORDINARY GENERAL MEETING, PLEASE BRING THIS FORM WITH YOU. THIS WILL ASSIST IN REGISTERING YOUR ATTENDANCE.

|

|

|

Appendix 3B - Proposed issue of securities |

|

|

EXHIBIT 99.2

Announcement Summary

Entity name

NOVONIX LIMITED

Announcement Type

New announcement

Date of this announcement

23/12/2024

The Proposed issue is:

A placement or other type of issue

Total number of +securities proposed to be issued for a placement or other type of issue

|

|

|

|

|

|

|

|

Maximum Number of |

|

|

ASX +security code |

+Security description |

+securities to be issued |

|

|

|

|

|

|

|

NVXAA |

OPTION EXPIRING VARIOUS DATES EX VARIOUS |

3,000,000 |

|

|

|

PRICES |

|

|

|

|

|

|

|

Proposed +issue date

24/1/2025

Refer to next page for full details of the announcement

|

|

|

|

Appendix 3B - Proposed issue of securities |

1 / 5 |

|

|

|

Appendix 3B - Proposed issue of securities |

|

|

Part 1 - Entity and announcement details

1.1 Name of +Entity

NOVONIX LIMITED

We (the entity named above) give ASX the following information about a proposed issue of +securities and, if ASX agrees to +quote any of the +securities (including any rights) on a +deferred settlement basis, we agree to the matters set out in Appendix 3B of the ASX Listing Rules.

If the +securities are being offered under a +disclosure document or +PDS and are intended to be quoted on ASX, we also apply for quotation of all of the +securities that may be issued under the +disclosure document or +PDS on the terms set out in Appendix 2A of the ASX Listing Rules (on the understanding that once the final number of +securities issued under the +disclosure document or +PDS is known, in accordance with Listing Rule 3.10.3C, we will complete and lodge with ASX an Appendix 2A online form notifying ASX of their issue and applying for their quotation).

|

|

|

|

1.2 Registered Number Type |

Registration Number |

|

ACN |

157690830 |

1.3 ASX issuer code

NVX

1.4 The announcement is

New announcement

1.5 Date of this announcement

23/12/2024

1.6 The Proposed issue is:

A placement or other type of issue

|

|

|

|

Appendix 3B - Proposed issue of securities |

2 / 5 |

|

|

|

Appendix 3B - Proposed issue of securities |

|

|

Part 7 - Details of proposed placement or other issue

Part 7A - Conditions

7A.1 Do any external approvals need to be obtained or other conditions satisfied before the placement or other type of issue can proceed on an unconditional basis?

Yes

7A.1a Conditions

|

|

|

|

|

|

|

Approval/Condition +Security holder approval |

|

Date for determination 22/1/2025 |

|

Is the date estimated or actual? Actual |

|

** Approval received/condition met? |

Comments

Part 7B - Issue details

|

|

Is the proposed security a 'New class' (+securities in a class that is not yet quoted or recorded by ASX) or an 'Existing class' (additional securities in a class that is already quoted or recorded by ASX)? Existing class |

Will the proposed issue of this +security include an offer of attaching +securities? No |

Details of +securities proposed to be issued

ASX +security code and description

NVXAA : OPTION EXPIRING VARIOUS DATES EX VARIOUS PRICES

Number of +securities proposed to be issued

3,000,000

Offer price details

Are the +securities proposed to be issued being issued for a cash consideration?

No

Please describe the consideration being provided for the +securities

|

The proposed issue of the Incentive Options to Andrew Liveris are in recognition of services provided by Andrew as a strategic advisor to the Company. |

Please provide an estimate of the AUD equivalent of the consideration being provided for the +securities

0.458000

|

|

|

|

Appendix 3B - Proposed issue of securities |

3 / 5 |

|

|

|

Appendix 3B - Proposed issue of securities |

|

|

Will these +securities rank equally in all respects from their issue date with the existing issued +securities in that class?

Yes

Part 7C - Timetable

7C.1 Proposed +issue date

24/1/2025

Part 7D - Listing Rule requirements

7D.1 Has the entity obtained, or is it obtaining, +security holder approval for the entire issue under listing rule 7.1?

No

7D.1b Are any of the +securities proposed to be issued without +security holder approval using the entity's 15% placement capacity under listing rule 7.1?

No

7D.1c Are any of the +securities proposed to be issued without +security holder approval using the entity's additional 10% placement capacity under listing rule 7.1A (if applicable)?

No

7D.2 Is a party referred to in listing rule 10.11 participating in the proposed issue?

Yes

7D.3 Will any of the +securities to be issued be +restricted securities for the purposes of the listing rules?

No

7D.4 Will any of the +securities to be issued be subject to +voluntary escrow?

No

Part 7E - Fees and expenses

7E.1 Will there be a lead manager or broker to the proposed issue?

No

7E.2 Is the proposed issue to be underwritten?

No

7E.4 Details of any other material fees or costs to be incurred by the entity in connection with the proposed issue

Part 7F - Further Information

7F.01 The purpose(s) for which the entity is issuing the securities

|

The proposed issue of the Incentive Options to Andrew Liveris are in recognition of services provided by Andrew as a strategic advisor to the Company. |

7F.1 Will the entity be changing its dividend/distribution policy if the proposed issue proceeds?

No

|

|

|

|

Appendix 3B - Proposed issue of securities |

4 / 5 |

|

|

|

Appendix 3B - Proposed issue of securities |

|

|

7F.2 Any other information the entity wishes to provide about the proposed issue

|

|

|

|

Appendix 3B - Proposed issue of securities |

5 / 5 |

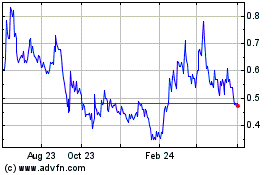

Novonix (PK) (USOTC:NVNXF)

Historical Stock Chart

From Jan 2025 to Feb 2025

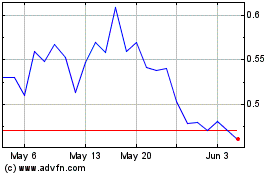

Novonix (PK) (USOTC:NVNXF)

Historical Stock Chart

From Feb 2024 to Feb 2025