0001811530

false

FY

--04-30

2023

Yes

false

0001811530

2022-05-01

2023-04-30

0001811530

2022-10-31

0001811530

2023-09-28

0001811530

2023-04-30

0001811530

2022-04-30

0001811530

2021-05-01

2022-04-30

0001811530

us-gaap:CommonStockMember

2021-04-30

0001811530

us-gaap:NoncontrollingInterestMember

2021-04-30

0001811530

us-gaap:AdditionalPaidInCapital

2021-04-30

0001811530

us-gaap:OtherComprehensiveIncomeMember

2021-04-30

0001811530

us-gaap:RetainedEarningsMember

2021-04-30

0001811530

2021-04-30

0001811530

us-gaap:CommonStockMember

2022-04-30

0001811530

us-gaap:NoncontrollingInterestMember

2022-04-30

0001811530

us-gaap:AdditionalPaidInCapital

2022-04-30

0001811530

us-gaap:OtherComprehensiveIncomeMember

2022-04-30

0001811530

us-gaap:RetainedEarningsMember

2022-04-30

0001811530

us-gaap:CommonStockMember

2021-05-01

2022-04-30

0001811530

us-gaap:NoncontrollingInterestMember

2021-05-01

2022-04-30

0001811530

us-gaap:AdditionalPaidInCapital

2021-05-01

2022-04-30

0001811530

us-gaap:OtherComprehensiveIncomeMember

2021-05-01

2022-04-30

0001811530

us-gaap:RetainedEarningsMember

2021-05-01

2022-04-30

0001811530

2022-04-20

0001811530

us-gaap:CommonStockMember

2022-05-01

2023-04-30

0001811530

us-gaap:NoncontrollingInterestMember

2022-05-01

2023-04-30

0001811530

us-gaap:AdditionalPaidInCapital

2022-05-01

2023-04-30

0001811530

us-gaap:OtherComprehensiveIncomeMember

2022-05-01

2023-04-30

0001811530

us-gaap:RetainedEarningsMember

2022-05-01

2023-04-30

0001811530

us-gaap:CommonStockMember

2023-04-30

0001811530

us-gaap:NoncontrollingInterestMember

2023-04-30

0001811530

us-gaap:AdditionalPaidInCapital

2023-04-30

0001811530

us-gaap:OtherComprehensiveIncomeMember

2023-04-30

0001811530

us-gaap:RetainedEarningsMember

2023-04-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

FOR THE

FISCAL YEAR ENDED April 30, 2023

OR

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 000-56167

NEXT MEATS

HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| |

Nevada |

85-4008709 |

|

| |

(State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

| |

|

|

|

| |

3F 1-16-13 Ebisu Minami Shibuya-ku, Tokyo Japan |

150-0022 |

|

| |

(Address of Principal Executive Offices) |

(Zip Code) |

|

Company Phone Number: 81-90-6002-4978

Securities to be registered under Section 12(b) of

the Act: None

Securities to be registered under Section 12(g) of

the Exchange Act:

| |

Title of each class |

|

Name of each exchange on which

registered |

|

| |

Common Stock, $0.001 |

|

None; Shares are however quoted on the OTC Markets Group Inc’s Pink® Open Market. |

|

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

[X] Yes

[ ] No

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files).

[X] Yes

[ ] No

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to

the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [X] Smaller reporting company [X] Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is

a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

As of October 31, 2022, the last business day of

the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held by

non-affiliates of the registrant was approximately $4,460,762 based on the closing price per share (or $0.75), of the

registrant’s common stock as reported by OTC Markets Group Inc.

The public float has been determined by

multiplying the total non-restricted common shares, issued and outstanding held by non-affiliates as of October 31, 2022, by the

market price of the issuer's common stock at the close of the October 31, 2022 business day.

Indicate the number of shares outstanding of each of the issuer’s

classes of stock, as of the latest practicable date:

502,873,382 shares of common

stock, $0.001 par value, issued and outstanding as of September 28, 2023

0 shares of preferred stock,

$0.001 par value, issued and outstanding as of September 28, 2023.

Table of Contents

TABLE OF CONTENTS

NEXT

MEATS HOLDINGS, INC.

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements and information included in

this Annual Report on Form 10-K for the year ended April 30, 2023 (this “Report”), contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. Forward-looking

statements are not statements of historical facts, but rather reflect our current expectations concerning future events and results. We

generally use the words “may,” “should,” “believe,” “expect,” “intend,” “plan,”

“anticipate,” “likely,” “estimate,” “potential,” “continue,” “will,”

and similar expressions to identify forward-looking statements. Such forward-looking statements, including those concerning our expectations,

involve risks, uncertainties and other factors, some of which are beyond our control, which may cause our actual results, performance,

or achievements, or industry results to be materially different from any future results, performance, or achievements expressed or implied

by such forward-looking statements. Except as required by applicable law, including the securities laws of the United States, we undertake

no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented in this Report.

CERTAIN TERMS USED IN THIS

REPORT

“We,” “us,” “our,”

“the Registrant,” the “Company,” “NXMH”, and “Next Meats Holdings” are synonymous with

Next Meats Holdings, Inc., unless otherwise indicated.

Table of Contents

PART I

Item 1. Business

Corporate History

Next Meats Holdings, Inc., formerly known as Turnkey

Solutions, Inc., was incorporated on April 15, 2020 in the State of Nevada.

On

April 15, 2020, Paul Moody was appointed Chief Executive Officer, Chief Financial Officer, and Director of the Company, at the time known

as “Turnkey Solutions, Inc.”

On

October 1, 2020, the Company, at the time known as “Turnkey Solutions, Inc.” (the “Company” or “Successor”)

announced on Form 8-K plans to participate in a holding company reorganization (“the Reorganization” or “Merger”)

with Intermedia Marketing Solutions, Inc. (“IMMM” or “Predecessor”) and Intermedia Marketing Solutions Merger

Sub, Inc. (“Merger Sub”) collectively (the “Constituent Corporations”) pursuant to NRS 92A.180, NRS A.200, NRS

92A.230 and NRS 92A.250. Immediately prior to the Reorganization, the Company was a direct and wholly owned subsidiary of Intermedia

Marketing Solutions, Inc. and Intermedia Marketing Solutions Merger Sub, Inc. was a direct and wholly owned subsidiary of the Company.

The

effective date and time of the Reorganization was October 28, 2020 at 4PM PST (the “Effective Time”). The entire plan of

Merger is on file with Nevada Secretary of State (“NSOS”) and included in the Articles of Merger pursuant to NRS 92A.200

Nevada Secretary of State (“NSOS”) and attached to and made a part thereof to the Articles of Merger pursuant to NRS 92A.200

filed with NSOS on October 16, 2020. At the Effective Time, Predecessor merged with and into its indirect and wholly owned subsidiary,

Merger Sub with Predecessor as the surviving corporation resulting in Predecessor as a wholly owned subsidiary of the Company.

Concurrently

and after the Effective Time, the Company cancelled all of its stock held in Predecessor resulting in the Company as a stand-alone and

separate entity with no subsidiaries, no assets and negligible liabilities. The assets and liabilities of Predecessor, if any, remained

with Predecessor. The Company abandoned the business plan of its Predecessor and resumed its former business plan of a blank check company

after completion of the Merger.

Full

details pertaining to the Reorganization can be viewed in the Company’s Form 8-K filed on October 29, 2020.

On

November 18, 2020 our now former controlling shareholder, Flint Consulting Services, LLC sold 35,000,000 shares of common stock to Next

Meats Co., Ltd., a Japan Company. Next Meats Co., Ltd. is a Japanese Company that operates in the “alternative meat” industry.

It currently offers, and plans to continue to offer, amongst other things, artificial chicken and beef products made from meat substitutes.

As will be described later on, Next Meats Co., Ltd. is now a wholly owned subsidiary of the Company.

On

November 18, 2020, Paul Moody resigned from his position of Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer

and Director.

Simultaneous

to Paul Moody’s resignations, Ryo Shirai was appointed as our Chief Executive Officer and Director, Hideyuki Sasaki as our Chief

Operating Officer and Director, and Koichi Ishizuka as our Chief Financial Officer.

On

January 8, 2021 our now former majority shareholder, Next Meats Co., Ltd., a Japan Company, along with our Board of Directors, took action

to ratify, affirm, and approve a name change of the Company from Turnkey Solutions, Inc., to Next Meats Holdings, Inc. The Company filed

a Certificate of Amendment with the Nevada Secretary of State (“NVSOS”) to enact the name change with an effective date of

January 19, 2021. This was previously disclosed in the Form 8-K we filed on January 25, 2021.

Also

on January 8, 2021, our now former majority shareholder Next Meats Co., Ltd., along with our Board of Directors took action to ratify,

affirm, and approve a change of the Company’s ticker symbol from TKSI to NXMH.

Pursuant

to the above, the Company carried out a FINRA corporate action. As a result of the aforementioned actions the Company’s CUSIP number

was changed from 90043H102 to 65345L 100. The change in CUSIP,

name change, and symbol change were posted on the FINRA daily list on January 25, 2021 with a market effective date of January 26, 2021.

On

January 28, 2021, Next Meats Co., Ltd., along with our Board of Directors, took action to ratify, affirm, and approve the issuance of

452,352,298 shares of restricted common stock to Next Meats Co., Ltd. The shares were issued for services rendered to the Company.

On

June 9, 2021 the Company entered into a “Share Cancellation and Exchange Agreement” (referred to herein as “the Agreement”)

with Next Meats Co., Ltd., a Japan Company. Pursuant to the Share Cancellation and Exchange Agreement, effective on December 16,

2021, Next Meats Holdings, Inc. acquired Next Meats Co., Ltd. as a wholly owned subsidiary. Commensurate with this action, there was

a conversion of the Next Meats Holdings, Inc. percentile share interest in exchange for the Company’s 100% share interest in Next

Meats Co., Ltd. Immediately prior to the effective time, each (now former) shareholder of Next Meats Co., Ltd. cancelled and exchanged

their percentile share interest in Next Meats Co., Ltd. for an equivalent percentile share interest in Next Meats Holdings, Inc. at a

pro rata percentage. As a result of the Share Cancellation and Exchange Agreement, we now own 100% of the issued and outstanding shares

of Next Meats Co., Ltd., which constitutes 1,000 shares of common stock.

We

believe that the aforementioned transaction(s) relating to the Share Cancellation and Exchange Agreement described above constituted

a tax-free organization pursuant to Section 368(a)(1) of the Internal Revenue Code. Full details of the Share Cancellation and Exchange

Agreement are contained within our Form 8-K filed with the Securities and Exchange Commission on December 16, 2021.

Following

the acquisition of Next Meats Co., Ltd. on December 16, 2021, we ceased to be a shell company. Currently, and going forward, we intend

to act as a holding company for our subsidiaries which develop and sell alternative meat products, created from various meat substitutes.

On

December 28, 2021, Ryo Shirai resigned as our Chief Executive Officer and was appointed Chairman

of the Board of Directors.

The

resignation of Mr. Ryo Shirai, as Chief Executive Officer, was not the result of any disagreement with the Company on any matter

relating to its operations, policies, or practices.

On

December 28, 2021, Mr. Koichi Ishizuka was appointed Chief Executive Officer of the Company.

On

December 28, 2021 we filed an amendment to our Articles of Incorporation with the Nevada Secretary of State, resulting in an increase

to our authorized shares of Common Stock from 500,000,000 to 1,000,000,000.

-

1 -

Table of Contents

On

or about December 29, 2021, we sold 270,929 shares of restricted Common Stock to Demic Co., Ltd.., a Japanese Company, at a price of

$2.00 per share of Common Stock. The total subscription amount paid by Demic Co., Ltd. was approximately $541,858. Demic Co., Ltd. is

not considered a related party to the Company.

The

proceeds from the sale of shares went to the Company to be used as working capital.

On

or about December 29, 2021, we sold 882,257 shares of restricted Common Stock to Kiyoshi Kobayashi, a Japanese Citizen, at a price of

$2.00 per share of Common Stock. The total subscription amount paid by Kiyoshi Kobayashi was approximately $1,764,513. Kiyoshi Kobayashi

is not considered a related party to the Company.

The

proceeds from the sale of shares went to the Company to be used as working capital.

On

or about February 4, 2022, we sold 208,855 shares of restricted Common Stock to Daisuke Kuroika, a Japanese Citizen, at a price of $2.10

per share of Common Stock. The total subscription amount paid by Daisuke Kuroika was approximately $438,596. Daisuke Kuroika is not considered

a related party to the Company.

The

proceeds from the sale of shares went to the Company to be used as working capital.

On

or about March 7, 2022, we sold 668,780 shares of restricted Common Stock to Yakuodo Co., Ltd., a Japanese Company, at a price of $1.30

per share of Common Stock. The total subscription amount paid by Yakuodo Co., Ltd. was approximately $869,414. Yakuodo Co., Ltd. is not

considered a related party to the Company.

The

proceeds from the sale of shares went to the Company to be used as working capital.

On

or about March 29, 2022, we sold 133,779 shares of restricted Common Stock to Hidemi Arasaki, a Japanese Citizen, at a price of $1.30

per share of Common Stock. The total subscription amount paid by Hidemi Arasaki was approximately $173,913. Hidemi Arasaki is not a related

party to the Company.

The

proceeds from the sale of shares went to the Company to be used as working capital.

On

or about April 5, 2022, we sold 91,000 shares of restricted Common Stock to Interwoos Co., Ltd., a Japanese Company, at a price of $0.90

per share of Common Stock. The total subscription amount paid by Interwoos Co., Ltd. was approximately $81,900. Interwoos Co., Ltd. is

not a related party to the Company.

The

proceeds from the sale of shares went to the Company to be used as working capital.

The

aforementioned sales of shares detailed above were conducted pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation

S"). The sales of shares were made only to non-U.S. persons/entities (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant

to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective

affiliates, or any person acting on behalf of any of the foregoing.

On

or about July 20, 2021 we had acquired 5,000 shares of Series Z Preferred Stock of Dr. Foods, Inc., a Nevada Company, from CRS Consulting,

LLC, a Wyoming Limited Liability Company (“CRS”).

On

or about July 1, 2022, we sold the 5,000 shares of Series Z Preferred Stock of Dr. Foods, Inc., a Nevada Company (“DRFS”),

to White Knight Co., Ltd., a Japan Company (“WK”), at a price of approximately $147,624 USD (20,000,000 Japanese Yen) (“The

Share Purchase Agreement”). White Knight Co., Ltd. is owned and controlled by our Chief Executive Officer, Koichi Ishizuka. White

Knight Co., Ltd. is deemed to be an accredited investor. The purchase of shares was made for investment purposes. The consummation of

the transaction contemplated by the Share Purchase Agreement resulted in us no longer having an equity position in DRFS and with WK becoming

the largest controlling shareholder of DRFS.

We

intend to use the proceeds from the aforementioned sale for working capital.

The

Board of Directors of NXMH, WK, and DRFS unanimously approved the above transaction.

The

aforementioned sale of shares was conducted pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). The

sale of shares was made only to non-U.S. persons/entities (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to

offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective

affiliates, or any person acting on behalf of any of the foregoing.

On

July 12, 2022, Mr. Ryo Shirai resigned as the Company’s Chairman of the Board of Directors and as a Director. Mr. Shirai's resignations

are a result of personal health issues. The resignations of Mr. Ryo Shirai were not the result of any disagreement with the Company on

any matter relating to its operations, policies, or practices.

On

or about November 28, 2022, we sold 306,680 shares of restricted Common Stock to Motohiro Tomiyama, a Japanese Citizen, at a price of

$0.67 per share of Common Stock. The total subscription amount paid by Motohiro Tomiyama was approximately $205,470. Motohiro Tomiyama

is not a related party to the Company.

The

proceeds from this sale are to be used by the Company for working capital.

The

aforementioned sale of shares was conducted pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). The

sale of shares was made only to non-U.S. persons/entities (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to

offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective

affiliates, or any person acting on behalf of any of the foregoing.

On

November 22, 2022, Ryo Shirai sold 8,229,451 shares of restricted Common Stock of the Issuer to White Knight Co., Ltd., a Japanese Company

owned and controlled by Koichi Ishizuka, the Chief Executive Officer, Chief Financial Officer, and Chairman of the Board of Directors

of the Company, at a price of $0.001 per share of Common Stock. The total subscription amount paid by White Knight Co., Ltd. was approximately

$8,229. Ryo Shirai was formerly the Company’s Chief Executive Officer and Chairman of the Board of Directors, until his resignations

on December 28, 2021.

On

November 22, 2022, Ryo Shirai sold 79,521,051 shares of restricted Common Stock of the Issuer to Koichi Ishizuka, a Japanese Citizen,

at a price of $0.001 per share of Common Stock. The total subscription amount paid by Koichi Ishizuka was approximately $79,521.

On

November 22, 2022, Ryo Shirai sold 25,112,780 shares of restricted Common Stock of the Issuer to Hiroki Tajiri, a Japanese Citizen, at

a price of $0.001 per share of Common Stock. The total subscription amount paid by White Knight Co., Ltd. was approximately $25,113.

Hiroki Tajiri is a board member of Next Meats Co., Ltd., a subsidiary of Next Meats Holdings, Inc.

On

November 22, 2022, Hideyuki Sasaki sold 112,863,282 shares of restricted Common Stock of the Issuer to White Knight Co., Ltd., a Japanese

Company owned and controlled by Koichi Ishizuka, at a price of $0.001 per share of Common Stock. The total subscription amount paid by

White Knight Co., Ltd. was approximately $112,863. Hideyuki Sasaki is currently the Chief Operating Officer, and a Director, of the Company.

The

above sales of shares were conducted for investment purposes and were recorded by the Company’s transfer agent on December 16,

2022.

The

aforementioned sale of shares was conducted pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). The

sale of shares was made only to non-U.S. persons/entities (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to

offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective

affiliates, or any person acting on behalf of any of the foregoing.

On

or about June 26, 2023, the company consummated an agreement for the sale of 311,102 shares of restricted Common Stock to Ultimate One

LLC, a Japanese Company, at a price of $0.37 per share of Common Stock. The transaction was completed, and recorded by the Company’s

transfer agent, on June 30, 2023. The total subscription amount paid by Ultimate One LLC was approximately $115,108. Ultimate One LLC

is not a related party to the Company.

The

proceeds from this sale are to be used by the Company for working capital.

The

aforementioned sale of shares was conducted pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). The

sale of shares was made only to non-U.S. persons/entities (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to

offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective

affiliates, or any person acting on behalf of any of the foregoing.

The

Company’s Board of Directors is now only comprised of two members.

Non-Reliance

On Previously Issued Financial Statements Or A Related Audit Report Or Completed Interim Review

On

January 28, 2021, our majority shareholder at the time, Next Meats Co., Ltd., (“the Company”) along with our Board of Directors,

took action to ratify, affirm, and approve the issuance of 452,352,298 shares of the Company's restricted common stock to Next Meats

Co., Ltd. The shares were originally accounted for based on the fair market value closing price per share of common stock based on the

open market at the time. However, the Company has determined that the subject valuation analysis was not credible resulting

in the subject value conclusion to not be meaningful given the issuance should have been accounted for as a common control transaction.

As such, it is the Company’s belief that the open market value of its common shares did not, at that time, reflect the true value

of the shares.

The

share valuation has been adjusted and is, in the Company’s belief, now corrected and accounted for as a common control transaction,

with our now wholly owned subsidiary, at a valuation of $0. The $452,352 increase in the resulting par value of common shares on

the Company's balance sheet has been offset by a corresponding decrease in additional paid in capital in the equity portion

of the Company's balance sheet.

The

Company currently estimates that the adjustments will have the effect of decreasing the net loss by approximately $5.8 billion as a result

of a non-cash expense, and decreasing additional paid-in capital by the same amount, starting at the three months ended January 31, 2021.

The adjustments are expected to impact the Company’s consolidated financial statements for subsequent reporting periods through

year-end April 30, 2023. The adjustments are not expected to impact on the Company’s liquidity or capital resources or compliance

with any material agreements.

Given

the above issuance has now been reclassified as a common control transaction, the Company intends to file amendments to the following

reports to rectify the historical error regarding the aforementioned valuation of shares: the Form 10-Q for the period ended January 31,

2021, the Form 10-K for the year ended April 30, 2021, the Form 10-Q for the period ended July 31, 2021, the Form 10-Q for the period

ended October 31, 2021, the Form 10-Q for the period ended January 31, 2022, the Form 10-K for the year ended April 30, 2022, the Form

10-Q for the period ended July 31, 2022, the Form 10-Q for the period ended October 31, 2022, and the Form 10-Q for the period ended January

31, 2023.

This

Form 10-K for the year ended April 30, 2023, includes the above share issuance adjusted and reclassified as described

above.

Our

Subsidiaries

Currently,

we have four subsidiaries. Each of our subsidiaries furthers our business agenda by acting as regional hubs through which we may operate

in various strategically chosen geographic locations.

On

December 16, 2021, we acquired Next Meats Co., Ltd., a Japan Company.

On

or about February 7, 2022, we incorporated Next Meats USA, Inc., a California Company.

On

or about February 8, 2022, we incorporated Next Meats HK Co. Limited, a Hong Kong Company.

On

or about March 2, 2022, we incorporated Next Meats (S) Pte. Ltd., a Singapore Company.

-

2 -

Table of Contents

Business Information

We share the same business plan as that of our subsidiaries and we

also act as a holding company for our subsidiaries. Through Next Meats Co., Ltd., Next Meats USA, Inc., Next Meats HK Co. Limited, and

Next Meats (S) Pte. Ltd., we develop and sell alternative meat products, with ingredients derived from predominantly, plant based materials.

For the purposes of the foregoing business plan, all references to “Next Meats”, Next Meats Co., Ltd.”,“Next

Meats USA”, “Next Meats HK”, “Next Meats (S) Pte. Ltd.”, or “the Company”, refer collectively

to Next Meats Holdings, Inc., and its subsidiaries, unless otherwise noted.

Our mission, or philosophy, is that “We Won’t Let Earth

End”. Next Meats works to provide a solution to the climate crisis and food insecurity problems by distributing, what we believe

to be, delicious alternative-meat products rooted in Japanese cuisine, worldwide. Next Meats is a food-tech venture founded in Tokyo,

by people passionate about delivering a better future for our children. We strive to create tasty alternatives to your favorite dishes,

without the same environmental impact of using meat. We believe in a more ecologically sustainable future for every person.

At present, our principal focus is on the creation of plant-based

food products to replace traditional animal products, while retaining the taste and texture of the original.

At Next Meats, safety and quality are our top priorities. Many people

imagine chemical additives when they hear the word “alternative meat”, but it is our intent to only use the minimum, necessary

ingredients, and keep additives at a minimum or as a last option. We combine vegetable proteins such as soybeans and peas and mold them

with heat and pressure to create a unique texture and flavor. We produce our products only in certified food factories. To ensure that

our products are safe, we produce them in clean food factories certified by the Japan Food Safety Management Association (JFS), HALAL,

etc., for thorough quality control. We are also exporting more and more of our products overseas as time progresses, and we believe part

of the reason is that our products are highly valued for their quality and “Made in Japan” taste.

Below, pictured on the right, is the active production of one of

several of our product offerings, NEXT Yakiniku, a meat alternative to skirt steak. Pictured on the left is our NEXT Yakiniku once cooked

and prepared for consumption.

While we maintain rigorous safety and cleanliness standards for the

factories that produce Next Meats products, it should be noted that we do not, at this time, directly manufacture any of our products.

As a result of one of our collaborative agreements, the majority of our products are manufactured utilizing the facilities of Mama Foods

Co., Ltd., while in other instances we use, and may continue to utilize, facilities of third party strategic partners to manufacture

certain products (for example, the Next Patty is manufactured by one of these third parties). In the future, we may seek to manufacture

our products internally, but at this time we have no plans to do so. We intend to maintain ongoing relationships and agreements with

local manufacturers for as long as they remain certified by JFS, HALAL, etc. and meet our rigorous safety and cleanliness standards.

From time to time we send out staff members into the facilities that manufacturer our products for ongoing inspections and observation.

- 3 -

Table of Contents

Currently Available Products

The

following list of products is not comprehensive, but it is a showcase of some of our most popular items:

| |

1. |

NEXT Burger 2.1- The NEXT Burger is a meat (plant-based) patty made by combining the proteins of

peas and soybeans. In comparison to regular burgers, we believe the NEXT Burger to be very gentle on the body while retaining the

taste of a traditional burger patty. |

| |

2. |

NEXT Gyudon- Gyudon, also known as a beef bowl, is a Japanese dish traditionally consisting of

a bowl of rice topped with beef and onion simmered in a mildly sweet sauce flavored with dashi, soy sauce and mirin. The NEXT Gyudon

is made from processed soybeans and natural seasonings, without using any animal ingredients and without adding chemical seasonings.

The cholesterol in this product is almost zero and we believe it to be a far healthier option than a typical gyudon, while retaining

all the flavor. |

| |

3. |

NEXT Yakiniku- The world's first plant-based Yakiniku barbecue meats have two types, the Short-rib,

and the Skirt-steak. Both are: |

- Free of artificial additives

- High in protein

- No Cholesterol

- Uses Non-GMO soy

- Low in saturated fat

The textures slightly vary but they both have a non-intrusive,

lightly sweet and savory flavor which makes it extremely versatile. The NEXT Yakinikus are excellent grilled and "topped on rice"

or in a stir fry, or in tacos, and in an endless possibility of dishes.

| |

4. |

NEXT Tuna- The NEXT Tuna is 100% botanical and low in fat cholesterol. It is available in a can

and there is no need to drain oil or water. We believe it is ideal for hand-rolled sushi and pasta, as well as being placed on a

salad or sandwiched with mayonnaise. In addition, since it can be stored at room temperature for a long period of time (2 years after

manufacture date), it can be used as an emergency food, given its long shelf life. |

A list of the majority of our currently available products can be

viewed at: https://www.nextmeats.global/product

The vegetable protein for the Next Yakiniku is formed in a twin-screw

extruder, then dried, boiled, fried, and seasoned. Finally, it is heat sterilized and frozen. The Next Burger and Next Gyudon also use processed soy that comes out the extruder but they are cooked differently afterwards.

The main ingredient for our products is predominantly soybeans.

Different varieties of soybeans and production areas are used for different products to give them varying textures and colors.

The products are all sold frozen with the exception of the canned Next Gyudon, and they are all classified as “processed soy

products”. In some stores, depending on the results of the bacteria count test, the product can be sold in the chilled zone in

the fridge (5℃).

Other than the main ingredient, soybeans, the other part of the product

is the seasoning, such as yakiniku sauce, beef bowl sauce, and herb seasoning.

The below is included to provide a visual of some our current product

offerings detailed above.

Trademarks

We have obtained trademarks within Japan for the names of our existing

products. Any proposed or future products are also trademarked, or will likely be trademarked, within Japan or are pending receipt of

such trademark rights within Japan. In Taiwan we have also trademarked our ‘NEXT Yakiniku’ product. Additionally, our name,

‘Next Meats’ is trademarked in the United States, Japan, China, and Taiwan.

Future Products

Development of new products is ongoing, and in some instances may

not be to the point where we can publicly announce our plans. However, we can state that as of the date of this report we are in active

development of Next Beef and Next Rice, although we cannot state with any level of specificity when development of these future products

will conclude. We continually strive to create and sell new products, and we anticipate our product line will continue to expand and

diversify in fiscal year 2024 and the years to follow as our business expands and grows.

Distribution

At present, we distribute our products through several wholesale

companies, while also selling directly through our website. The USA version of our website can be viewed at the following link: https://www.nextmeatsusa.com/.

We have accounts with Kokubu and NIPPON ACCESS, two of the largest food wholesalers in Japan, and they distribute our products to restaurants

and supermarkets throughout the country.

- 4 -

Table of Contents

We have been, or will be, distributing our products in various countries

through the efforts of our subsidiaries. Namely, Next Meats USA, Inc., Next Meats HK Co. Limited, and Next Meats (S) Pte. Ltd. will continue

to spearhead distribution of our products in the United States, China, and Singapore respectively. These strategically incorporated subsidiaries

will also allow us to create regional hubs in these countries, through which, in the future, we may launch further expansion efforts

into surrounding countries.

As a result of our wholesale and distribution channels mentioned

above, Next Meats products are widely distributed in supermarkets and restaurant chains as an alternative meat brand. Notably, several

of our food products can be found in Wayback Burgers’ Japanese Restaurant locations. These Wayback Burgers locations are owned

and controlled by WB Burgers Asia, Inc. Koichi Ishizuka is the sole officer, director, and controlling shareholder of WB Burgers Asia,

Inc.

Below are some of the various supermarkets and restaurants (this

is not a full list) that our products can be found in.

Pictured below is one of our scientists on staff developing and producing

one of our various alternative meats products using the TVP method described above.

Marketing Strategy

At present, our marketing plan is comprised of daily

posts and releases through various social networking platforms, SNS messaging, and we have also appeared at events throughout Japan,

distributed press releases, and attempted to have our company featured on various news media. Whenever we release a new product, we also

release an official press release and/or we hold a press conference in Japan. We have also created a television commercial, which can

be viewed on our website. The commercial was originally created in Japanese, and has only aired on television in Japan thus far, but

has also been translated into English and Chinese. It was, and is, our belief that creating and running a television commercial would

help to differentiate us from many other startups who do not reach out to the general public through this medium. We have also held various

tasting events to allow potential customers to sample our various products and spread awareness of our brand name. As our operations

progress, our marketing initiatives will remain ongoing and we will continually seek to identify and explore new methods of increasing

consumers’ awareness of our products.

Collaborative Efforts

On December 11, 2020, Next Meats Co., Ltd. entered into a Joint Development

Agreement with Euglena Co., Ltd. with the intent to jointly develop artificial meat products containing Euglena. To date, this has resulted

in the creation of “Next Yakiniku Euglena EX” which integrates the microalgae euglena into our Next Yakiniku product. We

are currently working on developing a burger patty alongside Euglena Co., Ltd.

On December 28, 2020, Next Meats Co., Ltd. entered into a Memorandum of

Understanding with Toyota Tsusho Corporation to agree to consider this partnership with the aim of taking measures to make a new food

culture permeate society and contribute to the achievement of SDGs (Sustainable Development Goals), by making use of each companies’

strengths in forming an ecosystem that expands the Japanese and overseas plant meat market and reinforces its value chain. Thus far,

this has resulted in introductions to new retailers, assistance with our exporting plans to China (including introductions to factories

in China), as well as the development of the “Menchikatsu” cutlet product which was released recently.

On May 5, 2021, Next Meats Co., Ltd. entered into a Joint Research Agreement

with Nagaoka University of Technology. The research pertains to regulatory mechanisms of iron-binding protein gene expression in leguminosae

plants. Leguminosae plants possess a gene that encodes iron-binding protein, but this gene is not expressed in the seeds, so plant-based

meat made using seeds from leguminosae plants, like soybean, lack iron-binding proteins when compared to animal meats. One solution to

this problem is the production of cultivars wherein iron-binding protein genes are expressed within the seeds; the elucidation and usage

of epigenetic control mechanisms will be effective in modifying gene expression. Therefore, we will conduct fundamental research on the

development of plant variant that can produce seeds that contain high levels of iron-binding protein through the usage of the plant epigenetics

technology at the Nagaoka University of Technology.

On October 11, 2021, we, through our now wholly owned subsidiary Next

Meats Co., Ltd., entered into and consummated a “Collaboration Agreement” with Dr. Foods Co., Ltd., a Japan company and wholly

owned subsidiary of Dr. Foods, Inc., a Nevada Company, that shares common management with the Company, to co-develop new food products

and subsequently offer them for sale. Dr. Foods Co., Ltd. operates in the “plant-based food” industry. It currently offers,

and plans to continue to offer, amongst other things, artificial foie gras made from meat substitutes, and intends to offer, in the future,

a diverse range of microalgae-based foods.

The Collaboration Agreement with Dr. Foods, Inc. is

for a period of two years, and may be renewed thereafter under the same terms for additional one-year terms unless terminated in writing,

with three months’ notice, by either party. The Collaboration Agreement, amongst other things, details the terms and conditions

by which Next Meats Co., Ltd. and Dr. Foods Co., Ltd. may co-develop, cooperate and contribute towards the development of new products

and technologies. The specific allotment of tasks per project will be determined in writing by each party at the outset of collaborative

efforts. Dr. Foods Co., Ltd. will primarily, although not exclusively, contribute to research and development, and Next Meats Co., Ltd.

will primarily, although not exclusively, contribute to distribution of new products/technologies. Costs pursuant to the collaborative

efforts of the partners, will be the respective responsibility of the party responsible for fulfilling such tasks.

- 5 -

Table of Contents

On March 17, 2022, Next Meats Co., Ltd, a subsidiary

of Next Meats Holdings, Inc. has agreed to conclude a business alliance agreement with Yakuodo Co., a subsidiary of Yakuodo Holdings,

Inc. and as a part of this alliance, Yakuodo has agreed to purchase certain shares of Next Meats Holdings, Inc., to strengthen the relationship

between the two companies. Moving forward, the two companies will consider the following possibilities for collaboration with a particular

focus on utilization of data owned by Yakuodo, product development utilizing Yakuodo’s employee assets, and improvement of logistics

efficiency. All such future plans have not been outlined with any further specificity at this time.

At this time, the majority of Next Meats’ products

are manufactured at facilities owned by Mama Foods Co., Ltd. (“Mama Foods”), a Japan Company. Mama Foods is owned and controlled,

at this time, by White Knight Co., Ltd., which in turn is owned and controlled by our Chief Executive Officer, Koichi Ishizuka.

On April 10, 2023, Next Meats Co., Ltd. and Van Gelder,

a Netherlands Company, signed an exclusive distribution contract which enables them to start importing Next Meats products from Japan,

and selling in European markets starting from April 2023, with Bidfood and Van der Valk Hotel as the first customers. The primary product

of relevance to this agreement is the “Next Short Rib 2.0" also called “Next Kalbi”.

Future Plans

We anticipate that continued development of new products will be an ongoing

process. Simultaneously, we are focused on expanding our sales distribution channels, and issuing pertinent press releases while conducting

media interviews. We are in the process of developing our subsidiaries which includes, in some cases, the preparation of specialized

domestic products (which we are not yet ready to announce). Increasing production, and local distribution via our subsidiaries, will

be a developing process going into the future, and we cannot forecast with any level of specificity, at this time, when such plans will

be realized.

During fiscal year 2024, we intend to begin the process of listing on

the NASDAQ if our financial situation is conducive to such an effort. Further, we intend to increase our mass media exposure and

have tentative plans to begin placing OOH (Out of Home) advertisements in strategic locations throughout Japan. In fiscal year 2024

and beyond we tentatively intend to increase our overseas media and event exposure, with a particular focus on offering Next Kalbi

2.0 in the United States and the Netherlands.

Government Regulations

The below does not extensively detail every law and

regulation to which the Company may be subject to, but rather provides an overview of the kind of food safety standards to which our

product(s) will be held.

The main law that governs food quality and integrity

in Japan is the Food Sanitation Act ("FSA") and the law that comprehensively governs food labeling regulation is the Food Labeling

Act.

The FSA regulates food quality and integrity by:

- Establishing standards and specifications for food,

additives, apparatus, and food containers and packaging;

- Providing for inspection to see whether the established

standards are met;

- Providing for hygiene management in the manufacture

and sale of food; and

- Requiring food businesses to be licensed.

Under the FSA, additives and foods containing additives

must not be sold, or be produced, imported, processed, used, stored, or displayed for marketing purposes unless the Minister of Health,

Labour and Welfare ("MHLW") has declared them as having no risk to human health after seeking the views of the Pharmaceutical

Affairs and Food Sanitation Council ("PAFSC"). In addition, it is not permissible to add any processing aids, vitamins, minerals,

novel foods or nutritive substances to food unless they have been expressly declared by the MHLW as having no risk to human health.

The MHLW may establish specifications for methods

of producing, processing, using, cooking, or preserving food or additives to be served to the public for marketing purposes ("Specifications"),

or may establish standards for food ingredients or additives to be served to the public for marketing purposes ("Standards")

pursuant to the FSA. Accordingly, where substances are allowed to be added to food, they may only be used within the limits expressly

set by the Specifications and Standards.

Our Facilities

At present, Next Meats Co., Ltd. rents a Tokyo office from an unrelated

third party at a price of 426,662 JPY per month.

In May of 2023, we closed our Niigata research lab.

As a result, we moved our research and development, which was previously

conducted at the Niigata research lab, to a new facility in Iwate, Japan. This location is not rented, owned, or leased by Next Meats

Holdings, Inc. or any of its subsidiaries. It should be noted that the research lab in Iwate is being provided rent free to the company

by Mama Foods Co., Ltd., which is owned and controlled by Koichi Ishizuka, our Chief Executive Officer, through White Knight Co., Ltd.,

which is also controlled by Mr. Ishizuka.

We had previously developed plans to construct our own NEXT factory

dedicated to alternative protein/product development. It was to include sustainable technologies and DX Systems (HVAC air conditioning

unit). However, we have determined to put such plans on indefinite hiatus given management’s belief that such an endeavor would

result in a large capital expenditure. Management believes it can fulfill its current and anticipated future levels of production with

current manufacturers.

Employees

At present, Next Meats Holdings, Inc. has two employees, solely comprised

of our officers and Directors. Next Meats Co., Ltd. has seven employees, five of which are full time employees and two are part time

employees. Non executive employees of Next Meats Co., Ltd. who are full time employees receive, in addition to their salaries, social

insurance in Japan. Social insurance is comprised of Pension, Health, Unemployment and Worker's Accident Compensation. The remainder

of our subsidiaries do not have employees, with the exception of their officers and directors, and such executive members do not receive

any benefits at this time.

Competition

The alternative meat industry is highly competitive, with a major

market share held by prominent companies, such as Beyond Meat, a Los Angeles-based producer of plant-based meat substitutes. In 2019,

Beyond Meat, which manufactures the plant-based Beyond Burger, went public at a valuation of almost $1.5B. Beyond Meat began offering

direct-to-consumer (D2C) sales in August 2020 and announced partnerships with Yum! Brands and McDonald’s in 2021.

In Japan, there are also several prominent alternative-meat companies

which we consider to be our direct competitors including, but not necessarily limited to, Marukome Co., Ltd., Maisen Fine Foods Co.,

and Kabaya Foods Corporation. Marukome Co., Ltd, one of Japan’s oldest and top miso paste producers, launched their Daizu Labo

(Soybean Laboratories) brand, which features over 30 soy-based substitutes for animal products, eight advertised as ‘meat’

(ready to eat, dried, and frozen). Maisen Fine Foods Co., gradually expanded its business from organic brown rice to rice-based and allergy-friendly

food products. In 2016, they launched a series of gluten-free soybean and rice-based meat products. Kabaya Foods Corporation, a confectionery

company founded in 1946, launched a soy-based jerky in 2018 with the slogan “a new era of snack is coming.”

Despite these, and other, competitors, we believe that we have significant

competitive strengths which poise Next Meats to become a prominent market participant in the alternative food industry going forward.

Item 1A. Risk Factors.

As a smaller reporting company, as defined in Rule

12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We rent office space in Tokyo, Japan from an unrelated third

party. Our Tokyo offices are rented at a rate of 426,662 JPY per month (approximately $3,118).

Previously, we conducted research and development out of a lab

in Nagaoka, Niigata Prefecture, Japan. We no longer rent this space or conduct operations at this facility. We now conduct research

and development at a location provided to us rent free by Mama Foods Co., Ltd., a Japanese Company. Our new location for research

and development is in Hanamaki City, Iwate Prefecture, Japan.

Mama Foods Co., Ltd. is owned and controlled by White

Knight Co., Ltd. White Knight Co., Ltd. is controlled by our Chief Executive Officer, Koichi Ishizuka.

Our subsidiaries may also rent office space on a need be basis

to hold inventory, and perform daily operative tasks.

Item 3. Legal Proceedings.

In May, 2023, a shareholder of Next Meats Holdings,

Inc. (“the Company”) brought an action against Koichi Ishizuka and White Knight Co., Ltd., in the Southern District of New

York for recovery of alleged short swing profits earned under Section 16(b) of the Securities Exchange Act of 1934. Koichi Ishizuka and

White Knight Co., Ltd. are vigorously defending this matter. Although recovery was sought only from Koichi Ishizuka and White Knight

Co., Ltd., the Company was also named as a nominal defendant. The plaintiff seeks no relief against the Company. Next Meats Holdings,

Inc. has no direct exposure in connection with the lawsuit and this action should not be considered material to the Company.

Item 4. Mine Safety Disclosures.

Not applicable.

- 6 -

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

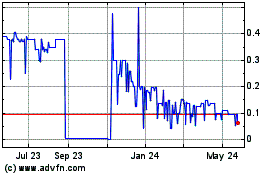

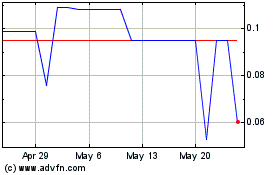

Our common stock was quoted on the over-the-counter

market (the “OTC Markets”) in the Pink Open® Market (the “Pink Market”) under the symbol

“NXMH”. Following the filing of this Annual Report we believe we will be current with our SEC Reporting obligations.

Prior to the filing of this report, due to our delinquent SEC Reporting status, we were demoted by the OTC Markets to the "Expert

Market" tier.

Quotations in Expert Market securities are restricted

from public viewing.

We anticipate that we will resume trading on the Pink

Open® Market now that we are current in our SEC reporting obligations once again, given the filing of this Annual Report.

There is currently a limited trading market in the Company’s

shares of common stock.

Set forth in the below table

are the range of high and low bid closing bid prices for the periods indicated as reported by the OTC Markets Group Inc. The market quotations

reflect inter-dealer prices, without retail mark-up, mark-down, or commissions and may not necessarily represent actual transactions.

The below values are approximate.

| Quarter

Ended |

High

Bid |

Low

Bid |

| April

30, 2023 |

$0.85 |

$0.07 |

| January

31, 2023 |

$0.99 |

$0.21 |

| October

31, 2022 |

$1.30 |

$0.75 |

| July

31, 2022 |

$1.25 |

$0.31 |

| April

30, 2022 |

$1.85 |

$0.76 |

| January

31, 2022 |

$3.57 |

$0.87 |

| October

31, 2021 |

$6.00 |

$2.00 |

| July

31, 2021 |

$8.47 |

$2.30 |

Holders

As

of September 28, 2023, the Company has 502,873,382 shares of common stock, $0.001 par value, issued and outstanding and no shares of

preferred stock issued and outstanding.

As

of September 28, 2023, we have approximately 87 shareholders of record of our common stock. This is inclusive of Cede and Co.,

which is deemed to be one shareholder of record. For further clarification, Cede & Co. is currently defined by the “NASDAQ”,

as “a Nominee name for The Depository Trust Company, a large clearing house that holds shares in its name for banks, brokers and

institutions in order to expedite the sale and transfer of stock.”

Dividends and Share Repurchases

We have not paid any dividends to our shareholders.

There are no restrictions which would limit our ability to pay dividends on common equity or that are likely to do so in the future.

Issuer Purchases of Equity Securities

None.

Equity Compensation Plan Information

Not applicable.

Recent Sales of Unregistered Securities; Uses of

Proceeds from Registered Securities

On January 28, 2021, Next Meats Co., Ltd., along with our Board of Directors,

took action to ratify, affirm, and approve the issuance of 452,352,298 shares of restricted common stock to Next Meats Co., Ltd. The shares

were issued for services rendered to the Company.

On or about December 29, 2021, we sold 270,929 shares of restricted Common

Stock to Demic Co., Ltd.., a Japanese Company, at a price of $2.00 per share of Common Stock. The total subscription amount paid by Demic

Co., Ltd. was approximately $541,858. Demic Co., Ltd. is not considered a related party to the Company.

The proceeds from the sale of shares went to the Company to be used as

working capital.

On or about December 29, 2021, we sold 882,257 shares of restricted Common

Stock to Kiyoshi Kobayashi, a Japanese Citizen, at a price of $2.00 per share of Common Stock. The total subscription amount paid by Kiyoshi

Kobayashi was approximately $1,764,513. Kiyoshi Kobayashi is not considered a related party to the Company.

The proceeds from the sale of shares went to the Company to be used as

working capital.

On or about February 4, 2022, we sold 208,855 shares of restricted Common

Stock to Daisuke Kuroika, a Japanese Citizen, at a price of $2.10 per share of Common Stock. The total subscription amount paid by Daisuke

Kuroika was approximately $438,596. Daisuke Kuroika is not considered a related party to the Company.

The proceeds from the sale of shares went to the Company to be used as

working capital.

On or about March 7, 2022, we sold 668,780 shares of restricted Common

Stock to Yakuodo Co., Ltd., a Japanese Company, at a price of $1.30 per share of Common Stock. The total subscription amount paid by Yakuodo

Co., Ltd. was approximately $869,414. Yakuodo Co., Ltd. is not considered a related party to the Company.

The proceeds from the sale of shares went to the Company to be used as

working capital.

On or about March 29, 2022, we sold 133,779 shares of restricted Common

Stock to Hidemi Arasaki, a Japanese Citizen, at a price of $1.30 per share of Common Stock. The total subscription amount paid by Hidemi

Arasaki was approximately $173,913. Hidemi Arasaki is not a related party to the Company.

The proceeds from the sale of shares went to the Company to be used as

working capital.

On or about April 5, 2022, we sold 91,000 shares of restricted Common

Stock to Interwoos Co., Ltd., a Japanese Company, at a price of $0.90 per share of Common Stock. The total subscription amount paid by

Interwoos Co., Ltd. was approximately $81,900. Interwoos Co., Ltd. is not a related party to the Company.

The proceeds from the sale of shares went to the Company to be used as

working capital.

On

or about July 20, 2021 we had acquired 5,000 shares of Series Z Preferred Stock of Dr. Foods, Inc., a Nevada Company, from CRS Consulting,

LLC, a Wyoming Limited Liability Company (“CRS”).

On

or about July 1, 2022, we sold the 5,000 shares of Series Z Preferred Stock of Dr. Foods, Inc., a Nevada Company (“DRFS”),

to White Knight Co., Ltd., a Japan Company (“WK”), at a price of approximately $147,624 USD (20,000,000 Japanese Yen) (“The

Share Purchase Agreement”). White Knight Co., Ltd. is owned and controlled by our Chief Executive Officer, Koichi Ishizuka. White

Knight Co., Ltd. is deemed to be an accredited investor. The purchase of shares was made for investment purposes. The consummation of

the transaction contemplated by the Share Purchase Agreement resulted in us no longer having an equity position in DRFS and with WK becoming

the largest controlling shareholder of DRFS.

We

intend to use the proceeds from the aforementioned sale for working capital.

The

Board of Directors of NXMH, WK, and DRFS unanimously approved the above transaction.

On

or about November 28, 2022, we sold 306,680 shares of restricted Common Stock to Motohiro Tomiyama, a Japanese Citizen, at a price of

$0.67 per share of Common Stock. The total subscription amount paid by Motohiro Tomiyama was approximately $205,470. Motohiro Tomiyama

is not a related party to the Company.

The

proceeds from this sale are to be used by the Company for working capital.

On

or about June 26, 2023, the company consummated an agreement for the sale of 311,102 shares of restricted Common Stock to Ultimate One

LLC, a Japanese Company, at a price of $0.37 per share of Common Stock. The transaction was completed, and recorded by the Company’s

transfer agent, on June 30, 2023. The total subscription amount paid by Ultimate One LLC was approximately $115,108. Ultimate One LLC

is not a related party to the Company.

The

proceeds from this sale are to be used by the Company for working capital.

The aforementioned sales of shares detailed above were conducted

pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). The sales of shares were made only to

non-U.S. persons/entities (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed

selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting

on behalf of any of the foregoing.

- 7 -

Table of Contents

Item 6. Selected Financial

Data.

Not applicable because the Company is a smaller reporting

company.

Item 7. Management’s Discussion

and Analysis of Financial Condition and Results of Operations.

Forward-Looking Statements

Certain statements, other than purely historical information,

including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions

upon which those statements are based, are “forward-looking statements.”

These forward-looking statements generally are identified

by the words “believes,” “project,” “expects,” “anticipates,” “estimates,”

“intends,” “strategy,” “plan,” “may,” “will,” “would,” “will

be,” “will continue,” “will likely result,” and similar expressions.

Forward-looking statements are based on current expectations

and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking

statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which

could have a material adverse effect on our operations and future prospects on a consolidated basis include, but are not limited to:

changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted

accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance

should not be placed on such statements.

Business

We share the same business plan as that of our subsidiaries

and we also act as a holding company for our subsidiaries. Through Next Meats Co., Ltd., Next Meats USA, Inc., Next Meats HK Co. Limited,

and Next Meats (S) Pte. Ltd., we develop and sell alternative meat products, with ingredients derived from predominantly, plant based

materials.

Liquidity and Capital Resources

As of April 30, 2023 and 2022, we had cash and cash

equivalents in the amount of $292,454 and $620,297, respectively. The Company believes that the variance between periods is the result

of decreased revenue during the fiscal year ended April 30, 2023, which resulted in decreased gross profit, and therefore a decreased

amount of cash and cash equivalents.

Currently, our cash balance is not sufficient to

fund our operations and our revenues cannot cover our cost and expenses for any extended period of time. We have primarily relied

upon fundraising activities from the sale of our common stock in order to fund our business activities, and we intend to continue to

relay upon sales of stock to fund operations in the future.

We also intend to use future revenues to fund our

operating activities. However, if our revenue does not increase as we expect, then we may be forced to conduct future fundraising activities,

which may include, but are not limited to, the sale of our common stock, or capital contribution from our officers and directors.

If we need additional cash and cannot raise it, we

will have to adjust our operating strategy accordingly.

As of April 30, 2023, and 2022, we had total assets

of $1,224,683 and $5,728,600, respectively. We attribute the decrease in total assets primarily to a decrease in accounts receivable,

a decrease in advance payments and prepaid expenses, a decrease in land and improvements, and a decrease in inventory. Overall, our activities

and gross profit have decreased during the fiscal year ended April 30, 2023, compared to the year prior.

As of April 30, 2023, and 2022, we had total liabilities

of $1,178,219 and $853,814, respectively. We attribute the increase in total liabilities, to larger loans and advance receipts during

the fiscal year ended April 30, 2023, when compared to the year prior.

- 8 -

Table of Contents

Revenues

For the fiscal years ended April 30, 2023 and 2022,

we generated revenue in the amount of $1,398,133 and $6,950,236, respectively. For the fiscal years ended April 30, 2023 and 2022, our

cost of revenues were $1,326,938 and $5,707,788, respectively. For the fiscal years ended April 30, 2023 and 2022, our gross profit was

$71,195 and $1,242,448, respectively. The decrease in gross profit came about as a result of decreased operations and profitability during

the fiscal year ended April 30, 2023.

We believe the products we offer, and continue to offer, to be a ‘premium’ alternative to traditional food options, which

typically coincides with increased costs. Given the condition of the global economy, we believe there is likely less demand for premium

alternatives to traditional food products, such as those we currently offer. As described in more detail under "Going Concern", we also no longer offer various products which bolstered our balance sheet for the year

prior.

In order to remediate our decreased revenue, profitability,

and activity for the fiscal year ended April 30, 2023, we seek to reach a broader global audience for our products, which we believe

may result in increased customers and therefore revenue. There is no guarantee that we will be successful in this endeavor. We also seek

to continue to develop new products, in an effort to appeal to a wider array of customers.

Net Loss

We recorded a net income/loss of $(4,873,010) and

$(5,795,980) for the years ended April 30, 2023 and 2022, respectively. The decreased net loss for the year ended April 30, 2023, was

the result of a decrease in total operating expenses compared to the year prior.

Cash flows

For the years ended April 30, 2023 and 2022, we had

cash flows from operating activities in the amount of $(1,659,270) and $(8,452,904), respectively. The variance in cash flows is primarily

attributable to decreased operations for the fiscal year ended April 30, 2023.

For the years ended April 30, 2023 and 2022, we had

cash flows from investing activities in the amount of $1,212,042 and $(1,092,511), respectively. The variance in cash flows is attributable

to the disposal of land and improvements for the fiscal year ended April 30, 2023.

For the years ended April 30, 2023 and 2022, we had

net cash provided by financing activities in the amount of $447,202 and $4,084,478, respectively. The variance in cash flows is attributable

to a much larger number of shares sold during the fiscal year ended April 30, 2022, as compared to the fiscal year ended April 30, 2023.

Going Concern

The

Company demonstrates adverse conditions that raise substantial doubt about the Company's ability to continue as a going concern for one

year following the issuance of these financial statements. These adverse conditions are negative financial trends, specifically operating

loss, working capital deficiency, and other adverse key financial ratios.

The

Company has not recorded enough revenue to cover its operating costs and gross revenue for the year ended April 30, 2023 decreased by

$5,551,102 or 79.87% as compared to the year ended April 30, 2023. Management attributes this drop in revenue to global economic challenges,

a restructuring of the Company’s large-scale sales department, changes in product offerings, and discontinued operations in two

subsidiaries.

We

believe the products we offer, and continue to offer, to be a ‘premium’ alternative to traditional food options, which typically

coincides with increased costs. Given the condition of the global economy, we believe there is likely less demand for premium alternatives

to traditional food products, such as those we currently offer. Over the course of the last year, we believe we have been affected by

decreased demand for our products, our decision to no longer wholesale rice, and the decreased price at which we have offered our products,

resulting in less revenue for the year ended April 30, 2023.

Previously,

we also had a wider selection of food options and other facets of our business which we believe drove revenues. Specifically, from time

to time we would engage in the wholesale sale of rice, however we no longer engage in the wholesale sale of rice because our previous

sole supplier is no longer in business. We believe that due to the current downtrend in the global economy, such efforts should not recommence,

if at all, until the global economy recovers to pre-pandemic levels.

At

this time, we also no longer offer “Next Milk” which we believed would gain popularity in the near term. Various components

of the products we offered, or seek to continue to offer, are either not available, or available at price points that are not as attractive.

As a result, at this time, it is difficult for us to produce cost effective products that we believe would rival the cost of generic food

products, and thus bolster our revenues. We believe many consumers are purchasing more cost-effective options. Because of this, we are

exploring means to lessen the cost of our product lineup while maintaining what we believe to be the same quality products, but we cannot

forecast with any level of certainty if such efforts will be successful. Many of these endeavors rely on our ability to source ingredients

at a lower cost, which, at this time, is a challenge.

In

December of 2022, we dissolved NextMeats France, a French Entity. We do not believe there to be a great enough demand for our products

in France and surrounding areas, although we do still intend to offer our products in areas of Europe in the future. We

have also paused efforts to pursue selling products in Hong Kong under our wholly owned subsidiary, Next Meats HK Co. Limited (“Next

Meats HK”), a Hong Kong Company. We do not believe the current market would be conducive to our business objectives in this area

at this point in time. However, we will reassess this decision in the future, although we cannot specifically identity when that may be.

Next Meats HK Co. Limited remains a wholly owned subsidiary of the Company.

We

expect our other wholly owned subsidiaries, Next Meats USA and Next Meats Japan Co. Ltd, to improve their operating income in the next

fiscal year. However, management plans to fund some operating expenses with related party contributions to capital until there is sufficient

revenue to cover all operating expenses. There is no assurance that management's plan will be successful. The financial statements do

not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of

liabilities that might be necessary in the event that the Company cannot continue as a going concern.

Non-Reliance

On Previously Issued Financial Statements Or A Related Audit Report Or Completed Interim Review

On

January 28, 2021, our majority shareholder at the time, Next Meats Co., Ltd., (“the Company”) along with our Board of Directors,

took action to ratify, affirm, and approve the issuance of 452,352,298 shares of the Company's restricted common stock to Next Meats

Co., Ltd. The shares were originally accounted for based on the fair market value closing price per share of common stock based on the

open market at the time. However, the Company has determined that the subject valuation analysis was not credible resulting

in the subject value conclusion to not be meaningful given the issuance should have been accounted for as a common control transaction.

As such, it is the Company’s belief that the open market value of its common shares did not, at that time, reflect the true value

of the shares.

The

share valuation has been adjusted and is, in the Company’s belief, now corrected and accounted for as a common control transaction,

with our now wholly owned subsidiary, at a valuation of $0. The $452,352 increase in the resulting par value of common shares on

the Company's balance sheet has been offset by a corresponding decrease in additional paid in capital in the equity portion

of the Company's balance sheet.

The

Company currently estimates that the adjustments will have the effect of decreasing the net loss by approximately $5.8 billion as a result

of a non-cash expense, and decreasing additional paid-in capital by the same amount, starting at the three months ended January 31, 2021.

The adjustments are expected to impact the Company’s consolidated financial statements for subsequent reporting periods through

year-end April 30, 2023. The adjustments are not expected to impact on the Company’s liquidity or capital resources or compliance

with any material agreements.

Given

the above issuance has now been reclassified as a common control transaction, the Company intends to file amendments to the following

reports to rectify the historical error regarding the aforementioned valuation of shares: the Form 10-Q for the period ended January 31,

2021, the Form 10-K for the year ended April 30, 2021, the Form 10-Q for the period ended July 31, 2021, the Form 10-Q for the period

ended October 31, 2021, the Form 10-Q for the period ended January 31, 2022, the Form 10-K for the year ended April 30, 2022, the Form

10-Q for the period ended July 31, 2022, the Form 10-Q for the period ended October 31, 2022, and the Form 10-Q for the period ended January

31, 2023.

This

Form 10-K for the year ended April 30, 2023, includes the above share issuance adjusted and reclassified as described above.

Item 7A. Quantitative and Qualitative Disclosures

about Market Risk.

As a “smaller reporting company”, we are

not required to provide the information required by this Item.

- 9 -

Table of Contents

Item 8. Financial Statements and Supplementary

Data.

| |

|

Pages |

| |

|

|

| Report

of Independent Registered Public Accounting Firm (PCAOB FIRM ID 5041) |

|

F2 |

| |

|

|

| Condensed

Consolidated Balance Sheets |

|

F3 |

| |

|

|

| Condensed

Consolidated Statements of Operations and Comprehensive Loss |

|

F4 |

| |

|

|

| Condensed

Consolidated Statements of Changes in Stockholders’ Equity (Deficit) |

|

F5 |

| |

|

|

| Condensed Consolidated

Statements of Cash Flows |

|

F6 |

| |

|

|

| Notes to Financial Statements |

|

F7-F10 |

- F1 -

Table of Contents

Report of Independent Registered Public

Accounting Firm

To the shareholders and the board of directors

of Next Meats Holdings, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance

sheets of Next Meats Holdings, Inc. as of April 30, 2023 and 2022, the related statements of operations, stockholders' equity (deficit),

and cash flows for the years then ended, and the related notes (collectively referred to as the "financial statements"). In

our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of April 30,

2023 and 2022, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles