false

--03-31

2025

Q3

0001122020

0001122020

2024-04-01

2024-12-31

0001122020

dei:FormerAddressMember

2024-04-01

2024-12-31

0001122020

2025-02-13

0001122020

2024-12-31

0001122020

2024-03-31

0001122020

2024-10-01

2024-12-31

0001122020

2023-10-01

2023-12-31

0001122020

2023-04-01

2023-12-31

0001122020

us-gaap:CommonStockMember

2023-03-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001122020

us-gaap:RetainedEarningsMember

2023-03-31

0001122020

2023-03-31

0001122020

us-gaap:CommonStockMember

2024-03-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001122020

us-gaap:RetainedEarningsMember

2024-03-31

0001122020

us-gaap:CommonStockMember

2023-09-30

0001122020

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001122020

us-gaap:RetainedEarningsMember

2023-09-30

0001122020

2023-09-30

0001122020

us-gaap:CommonStockMember

2024-09-30

0001122020

us-gaap:AdditionalPaidInCapitalMember

2024-09-30

0001122020

us-gaap:RetainedEarningsMember

2024-09-30

0001122020

2024-09-30

0001122020

us-gaap:CommonStockMember

2023-04-01

2023-12-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-12-31

0001122020

us-gaap:RetainedEarningsMember

2023-04-01

2023-12-31

0001122020

us-gaap:CommonStockMember

2024-04-01

2024-12-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-12-31

0001122020

us-gaap:RetainedEarningsMember

2024-04-01

2024-12-31

0001122020

us-gaap:CommonStockMember

2023-10-01

2023-12-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2023-10-01

2023-12-31

0001122020

us-gaap:RetainedEarningsMember

2023-10-01

2023-12-31

0001122020

us-gaap:CommonStockMember

2024-10-01

2024-12-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2024-10-01

2024-12-31

0001122020

us-gaap:RetainedEarningsMember

2024-10-01

2024-12-31

0001122020

us-gaap:CommonStockMember

2023-12-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001122020

us-gaap:RetainedEarningsMember

2023-12-31

0001122020

2023-12-31

0001122020

us-gaap:CommonStockMember

2024-12-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2024-12-31

0001122020

us-gaap:RetainedEarningsMember

2024-12-31

0001122020

PCSV:ThreeIndividualsMember

2024-04-01

2024-12-31

0001122020

PCSV:ThreeIndividualsMember

2024-12-31

0001122020

2023-04-01

2024-03-31

0001122020

us-gaap:SubsequentEventMember

2025-01-22

2025-01-22

0001122020

us-gaap:SubsequentEventMember

2025-01-22

0001122020

us-gaap:SubsequentEventMember

2025-01-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended December 31, 2024

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from________ to________

Commission

File No. 000-49990

PCS

EDVENTURES!, INC.

(Exact

name of Registrant as specified in its charter)

| Idaho |

|

82-0475383 |

| (State

or Other Jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

941

S. Industry Way

Meridian,

Idaho 83642

(Address

of Principal Executive Offices)

(208)

343-3110

(Registrant’s

telephone number, including area code)

11915

W. Executive Dr., #101

Boise,

ID 83713

(Former

name, former address and former fiscal year,

if

changed since last report)

Indicate

by check mark whether the Registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the Registrant was required

to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a small reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

Non-accelerated

filer ☐ |

Smaller

reporting company ☒ |

| Emerging

growth company ☐ |

|

|

|

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS

Indicate

by check mark whether the Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Not

applicable.

APPLICABLE

ONLY TO CORPORATE ISSUERS

Indicate

the number of shares outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date:

February

13, 2025: 122,189,763 shares of Common Stock

Forward-Looking

Statements

This

Quarterly Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In

some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” “will,” “would”

or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking

statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or

by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the

statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity,

performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in

this Quarterly Report. We cannot assure you that the forward-looking statements in this Quarterly Report will prove to be accurate, and

therefore, prospective investors are encouraged not to place undue reliance on forward-looking statements. You should carefully read

this Quarterly Report completely, and it should be read and considered with all other reports filed by us with the United States Securities

and Exchange Commission (the “SEC”) that are contained in the SEC Edgar Archives, including issues related to “Cybersecurity”

enumerated in “Part I, Item 1C. Cybersecurity,” of our 10-K Annual Report for the fiscal year ended March 31, 2024, filed

with the SEC on June 28, 2024 (the “Annual Report”), which commence on page nine (9), a copy of which is attached hereto

by Hyperlink in Part II-Other Information, in Item 6, Exhibits, hereof, and is incorporated herein by reference. Other than as required

by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the

future.

Documents

Incorporated by Reference

See

Part II, Other Information, Item 6, Exhibits.

(This

space intentionally left blank.)

PCS

EDVENTURES!, INC.

FORM

10-Q

FOR

THE QUARTERLY PERIOD ENDED DECEMBER 31, 2024

INDEX

| |

|

|

Page |

| PART

I – |

FINANCIAL

INFORMATION |

|

3 |

| |

|

|

|

| ITEM

1. |

Condensed

Financial Statements (unaudited) |

|

3 |

| |

|

|

|

| |

Condensed

Balance Sheets as of December 31, 2024 (unaudited), and March 31, 2024 |

|

4 |

| |

Condensed

Statements of Operations for the Three and Nine Months ended December 31, 2024, and 2023 (unaudited) |

|

5 |

| |

Condensed

Statement of Stockholders’ Equity for the Three and Nine Months ended December 31, 2024, and 2023 (unaudited) |

|

6 |

| |

Condensed

Statements of Cash Flows for the Nine Months ended December 31, 2024, and 2023 (unaudited) |

|

7 |

| |

Notes

to Condensed Financial Statements (unaudited) |

|

8 |

| |

|

|

|

| ITEM

2, |

Management’s

Discussion and Analysis of Financial Conditions and Results of Operations |

|

12 |

| |

|

|

|

| ITEM

3. |

Quantitative

and Qualitative Disclosures about Market Risk |

|

16 |

| |

|

|

|

| ITEM

4. |

Controls

and Procedures |

|

16 |

| |

|

|

|

| PART

II - |

OTHER

INFORMATION |

|

17 |

| |

|

|

|

| ITEM

1. |

Legal

Proceedings |

|

17 |

| |

|

|

|

| ITEM

1A. |

Risk

Factors |

|

17 |

| |

|

|

|

| ITEM

2. |

Unregistered

Sales of Equity Securities and Use of Proceeds |

|

17 |

| |

|

|

|

| ITEM

3. |

Defaults

Upon Senior Securities |

|

17 |

| |

|

|

|

| ITEM

4. |

Mine

Safety Disclosures |

|

17 |

| |

|

|

|

| ITEM

5. |

Other

Information |

|

17 |

| |

|

|

|

| ITEM

6. |

EXHIBIT

INDEX |

|

17 |

| |

|

|

|

| SIGNATURES |

|

18 |

PART

I –FINANCIAL INFORMATION

PART

I – FINANCIAL INFORMATION

Item

1. Condensed Financial Statements

The

Condensed Financial Statements of the Registrant required to be filed with this 10-Q Quarterly Report were prepared by management and

commence below, together with related notes. In the opinion of management, the Condensed Financial Statements fairly present the financial

condition of the Registrant.

(This

space intentionally left blank.)

PCS

EDVENTURES!, INC.

Condensed

Balance Sheets

| | |

December

31, 2024 | | |

March

31, 2024 | |

| | |

(Unaudited) | | |

| |

| CURRENT ASSETS | |

| | | |

| | |

| Cash | |

$ | 3,590,051 | | |

$ | 1,329,708 | |

| Accounts receivable, net

of allowance for doubtful accounts of $34,204 | |

| 163,759 | | |

| 1,675,859 | |

| Prepaid expenses | |

| 283,611 | | |

| 394,091 | |

| Inventory,

net | |

| 2,036,969 | | |

| 2,025,483 | |

| Total

Current Assets | |

| 6,074,390 | | |

| 5,425,141 | |

| | |

| | | |

| | |

| NONCURRENT ASSETS | |

| | | |

| | |

| Lease Right-of-Use Asset | |

| 1,188,710 | | |

| 273,905 | |

| Deposits | |

| 29,747 | | |

| 6,300 | |

| Property and equipment,

net | |

| 101,462 | | |

| 43,739 | |

| Deferred

tax asset | |

| 2,385,355 | | |

| 2,541,259 | |

| Total

Noncurrent Assets | |

| 3,705,274 | | |

| 2,865,203 | |

| | |

| | | |

| | |

| TOTAL

ASSETS | |

$ | 9,779,664 | | |

$ | 8,290,344 | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 77,661 | | |

$ | 100,853 | |

| Payroll liabilities and

accrued expenses | |

| 109,755 | | |

| 229,970 | |

| Deferred revenue | |

| 22,015 | | |

| 14,549 | |

| Lease

Liability, current portion | |

| 100,729 | | |

| 70,782 | |

| Total

Current Liabilities | |

| 310,160 | | |

| 416,154 | |

| | |

| | | |

| | |

| NONCURRENT LIABILITIES | |

| | | |

| | |

| Lease

Liability, net of current portion | |

| 1,138,093 | | |

| 218,373 | |

| Total

Noncurrent Liabilities | |

| 1,138,093 | | |

| 218,373 | |

| | |

| | | |

| | |

| TOTAL

LIABILITIES | |

$ | 1,448,253 | | |

$ | 634,527 | |

| | |

| | | |

| | |

| STOCKHOLDERS’

EQUITY | |

| | | |

| | |

| Preferred stock, no par

value, 20,000,000 authorized shares, no shares issued and outstanding | |

| - | | |

| - | |

| Common stock, no par value,

150,000,000 authorized shares, 122,958,993 and 124,733,494 shares issued and outstanding | |

| - | | |

| - | |

| Additional Paid-in Capital | |

| 40,180,438 | | |

| 40,570,459 | |

| Accumulated

deficit | |

| (31,849,027 | ) | |

| (32,914,642 | ) |

| TOTAL

STOCKHOLDERS’ EQUITY | |

| 8,331,411 | | |

| 7,655,817 | |

| | |

| | | |

| | |

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 9,779,664 | | |

$ | 8,290,344 | |

The

accompanying notes are an integral part of these unaudited condensed financial statements.

PCS

EDVENTURES!, INC.

Condensed

Statements of Operations

(Unaudited)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

For the Three Months Ended December 31, | | |

For the Nine Months Ended December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| REVENUE | |

$ | 701,147 | | |

$ | 459,087 | | |

$ | 6,128,409 | | |

$ | 6,831,694 | |

| COST OF SALES | |

| 348,660 | | |

| 310,657 | | |

| 2,459,747 | | |

| 2,503,552 | |

| GROSS PROFIT | |

| 352,487 | | |

| 148,430 | | |

| 3,668,662 | | |

| 4,328,142 | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Salaries and wages | |

| 436,150 | | |

| 353,934 | | |

| 1,440,181 | | |

| 1,313,886 | |

| General and administrative expenses | |

| 375,081 | | |

| 231,475 | | |

| 1,091,005 | | |

| 821,116 | |

| Total Operating Expenses | |

| 811,231 | | |

| 585,409 | | |

| 2,531,186 | | |

| 2,135,002 | |

| INCOME (LOSS) FROM OPERATIONS | |

| (458,744 | ) | |

| (436,979 | ) | |

| 1,137,476 | | |

| 2,193,140 | |

| OTHER INCOME | |

| | | |

| | | |

| | | |

| | |

| Tax credit | |

| - | | |

| - | | |

| - | | |

| 31,258 | |

| Net interest income | |

| 24,920 | | |

| 20,183 | | |

| 84,043 | | |

| 30,774 | |

| Gain on lease modification | |

| - | | |

| 2,658 | | |

| - | | |

| 2,658 | |

| Total Other Income | |

| 24,920 | | |

| 22,841 | | |

| 84,043 | | |

| 64,690 | |

| Income tax provision | |

| (210,935 | ) | |

| - | | |

| 155,904 | | |

| - | |

| NET INCOME (LOSS) | |

$ | (222,889 | ) | |

$ | (414,138 | ) | |

$ | 1,065,615 | | |

$ | 2,257,830 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | 0.01 | | |

$ | 0.02 | |

| Diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | 0.01 | | |

$ | 0.02 | |

| Weighted Average Common Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 123,596,176 | | |

| 124,733,494 | | |

| 124,275,328 | | |

| 125,183,945 | |

| Diluted | |

| 123,596,176 | | |

| 124,733,494 | | |

| 124,275,328 | | |

| 125,183,945 | |

The

accompanying notes are an integral part of these condensed financial statements.

PCS

EDVENTURES!, INC.

Condensed

Statement of Stockholders’ Equity

(Unaudited)

| | |

# of Common Shares O/S | | |

Common

Stock | | |

Additional Paid-in Capital | | |

Accumulated

Deficit | | |

Stockholders’ Equity (Deficit) | |

| For the nine (9) months ended December 31, 2023 and 2024 | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at 3/31/2023 | |

| 125,732,479 | | |

| - | | |

$ | 40,635,392 | | |

$ | (37,355,830 | ) | |

$ | 3,279,562 | |

| Net Income | |

| - | | |

| - | | |

| - | | |

| 2,257,830 | | |

| 2,257,830 | |

| Shares Repurchased and cancelled | |

| (998,985 | ) | |

| - | | |

| (64,933 | ) | |

| - | | |

| (64,933 | ) |

| Balance at 12/31/2023 | |

| 124,733,494 | | |

| - | | |

$ | 40,570,459 | | |

$ | (35,098,000 | ) | |

$ | 5,472,459 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at 3/31/2024 | |

| 124,733,494 | | |

| - | | |

$ | 40,570,459 | | |

$ | (32,914,642 | ) | |

$ | 7,655,817 | |

| Net Income | |

| - | | |

| - | | |

| - | | |

| 1,065,615 | | |

| 1,065,615 | |

| Shares Repurchased and cancelled | |

| (1,774,501 | ) | |

| - | | |

| (390,021 | ) | |

| - | | |

| (390,021 | ) |

| Balance at 12/31/2024 | |

| 122,958,993 | | |

| - | | |

$ | 40,180,438 | | |

$ | (31,849,027 | ) | |

$ | 8,331,411 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| For the three (3) months ended December 31, 2023 and 2024 | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at 9/30/2023 | |

| 124,733,494 | | |

| - | | |

$ | 40,570,459 | | |

$ | (34,683,862 | ) | |

$ | 5,886,597 | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| (414,138 | ) | |

| (414,138 | ) |

| Balance at 12/31/2023 | |

| 124,733,494 | | |

| - | | |

$ | 40,570,459 | | |

$ | (35,098,000 | ) | |

$ | 5,472,459 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at 9/30/2024 | |

| 124,131,410 | | |

| - | | |

$ | 40,426,646 | | |

$ | (31,626,138 | ) | |

$ | 8,800,508 | |

| Balance | |

| 124,131,410 | | |

| - | | |

$ | 40,426,646 | | |

$ | (31,626,138 | ) | |

$ | 8,800,508 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| (222,889 | ) | |

| (222,889 | ) |

| Net Income (Loss) | |

| - | | |

| - | | |

| - | | |

| (222,889 | ) | |

| (222,889 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares Repurchased and cancelled | |

| (1,172,417 | ) | |

| - | | |

| (246,208 | ) | |

| - | | |

| (246,208 | ) |

| Balance at 12/31/2024 | |

| 122,958,993 | | |

| - | | |

$ | 40,180,438 | | |

$ | (31,849,027 | ) | |

$ | 8,331,411 | |

| Balance | |

| 122,958,993 | | |

| - | | |

$ | 40,180,438 | | |

$ | (31,849,027 | ) | |

$ | 8,331,411 | |

The

accompanying notes are an integral part of these condensed financial statements.

PCS

EDVENTURES!, INC.

Condensed

Statements of Cash Flows

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

Nine Months Ended December 31, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net Income | |

$ | 1,065,615 | | |

$ | 2,257,830 | |

| Provision for income tax | |

| 155,904 | | |

| - | |

| Depreciation and amortization | |

| 19,001 | | |

| 7,863 | |

| Amortization of right of use asset | |

| 108,898 | | |

| 112,063 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| (Increase) decrease in accounts receivable | |

| 1,512,101 | | |

| 214,826 | |

| (Increase) decrease in prepaid expenses | |

| 110,480 | | |

| (518,799 | ) |

| (Increase) decrease in inventories | |

| (11,486 | ) | |

| (556,544 | ) |

| (Increase) decrease in other current assets | |

| - | | |

| (32,058 | ) |

| (Decrease) increase in accounts payable and accrued liabilities | |

| (143,407 | ) | |

| 218,636 | |

| Increase (decrease) in lease liability | |

| (74,038 | ) | |

| (102,927 | ) |

| Increase (decrease) in unearned revenue | |

| 7,467 | | |

| 44,100 | |

| (Increase) decrease in deposits | |

| (23,446 | ) | |

| - | |

| Net Cash Provided by Operating Activities | |

| 2,727,089 | | |

| 1,644,990 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Cash paid for purchase of fixed assets | |

| (76,725 | ) | |

| (16,096 | ) |

| Net Cash Used by Investing Activities | |

| (76,725 | ) | |

| (16,096 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Common stock repurchased and cancelled | |

| (390,021 | ) | |

| (64,933 | ) |

| Net Cash Used by Financing Activities | |

| (390,021 | ) | |

| (64,933 | ) |

| | |

| | | |

| | |

| Net Increase (Decrease) in Cash | |

| 2,260,343 | | |

| 1,563,961 | |

| Cash at Beginning of Period | |

| 1,329,708 | | |

| 442,657 | |

| Cash at End of Period | |

$ | 3,590,051 | | |

$ | 2,006,618 | |

| | |

| | | |

| | |

| Cash Paid for Interest | |

$ | - | | |

$ | 648 | |

| Cash Paid for taxes | |

$ | 131,432 | | |

$ | 41,957 | |

| Non Cash Investing and Financing Transactions: | |

| | | |

| | |

| Right of use assets obtained in exchange for new operating lease liabilities | |

$ | 1,023,703 | | |

$ | 240,281 | |

The

accompanying notes are an integral part of these condensed financial statements.

PCS

EDVENTURES!, INC.

Notes

to the Condensed Financial Statements

December

31, 2024 and 2023

(Unaudited)

NOTE

1 - DESCRIPTION OF BUSINESS AND SIGNIFICANT ACCOUNTING POLICIES

Description

of Business

The

condensed financial statements presented are those of PCS Edventures!, Inc., an Idaho corporation (the “Company,” “PCS,”

“PCSV,” “we,” “our,” “us” or similar words), incorporated in 1994, in the State of Idaho.

PCS specializes in experiential, hands-on, K12 education and drone technology. PCS has extensive experience and intellectual property

(“IP”) that includes drone hardware, product designs, and K-12 curriculum content. PCS continually develops new educational

products based upon market needs that the Company identifies through its sales and customer networks.

Our

products facilitate STEM (“Science, Technology, Engineering, and Math”) education by providing engaging activities that demonstrate

STEM concepts and inspire further STEM studies, with the goal of ultimately leading students to pursue STEM career pathways. Due to our

exceptionally detailed curriculum, our products are easy to teach and do not require a teaching degree or experience to administer.

Our

educational products are developed from both in-house efforts and contracted services. They are marketed through reseller channels, direct

sales efforts, partner networks, and web-based channels.

PCS

has developed and sells a variety of STEM education products into the K12 market which can be categorized as follows:

These

camps are for the informal learning market and are designed to be highly engaging for students while easily administered by the instructor.

The Company offers approximately thirty (30) different enrichment programs and typically develops at least two (2) new programs each

year. Some of the more popular programs include Rockin’ Robots; Build a Better World; Summer Camp Classics; Pirate Camp; Flight

and Aerodynamics; Science of the Human Body; and Claymation.

| |

2. |

Discover

Series Products |

These

products are designed for the makerspace environment and include engaging STEM activities that motivate students to pursue educational

pathways toward STEM careers. The Discover Series includes Discover Engineering; Discover Robotics & Physics; Discover Robotics

& Programming; and Discover STEM.

These

products are designed for the grade school market and use the Company’s proprietary bricks (which are Lego compatible) and curriculum

to engage students to explore, imagine and create within a STEM education framework. The Company offers a variety of grade-specific BrickLAB

products.

| |

4. |

Discover

Drones, Add-on Drone Packages and Ala Carte Drone Items |

These

products are designed around using drones as a platform for STEM education and career exploration. These titles include the Discover

Drones series of Products; Discover Drones Indoor Coding Bundle; Discover Drones Indoor Racing Add-On; Discover Drones Outdoor Practice

Add-on; and all the spare parts and ala carte drone items offered in the Company’s comprehensive drone packages.

| |

5. |

STEAMventures

BUILD Activity Book |

These

series of activity books are designed for the K-3 market and ideal for a distance-learning environment. The series includes twelve (12)

different issues. Instructor guides and/or family engagement guides are included. The Company also provides the necessary bricks for

the builds in the activity books as a separate, but related product.

| |

6. |

Professional

Development Training |

The

Company offers professional development trainings, for a fee, to educators who are implementing the Company’s products in their

classroom.

The

Company intends to continue developing STEM education products that address demand from large markets.

Interim

Financial Information

The

accompanying unaudited condensed financial statements have been prepared in accordance with Generally Accepted Accounting Principles

(“GAAP”) for interim financial information and pursuant to the rules and regulations of the U.S. Securities and Exchange

Commission (“SEC”). Accordingly, the accompanying unaudited condensed financial statements do not include all of the information

and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments and reclassifications considered

necessary in order to make the condensed financial statements not misleading and for a fair and comparable presentation have been included

and are of a normal recurring nature. Operating results for the three (3) months ended December 31, 2024, are not necessarily indicative

of the results that may be expected for the year ending March 31, 2025, or any future periods. The accompanying unaudited condensed financial

statements should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended March 31, 2024, filed

with the SEC on June, 28, 2024 (the “Annual Report”).

Use

of Estimates

The

preparation of these condensed financial statements in conformity with GAAP requires management to make estimates and assumptions that

affect the amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The Company’s significant estimates include reserves related to accounts receivable and inventory, the valuation allowance related

to deferred tax assets, the valuation of equity instruments, and debt discounts.

Revenue

Recognition

The

Company accounts for revenue in accordance with FASB ASC 606, Revenue from Contracts with Customers, which we adopted on April

1, 2018. Revenue amounts presented in our condensed financial statements are recognized net of sales tax, value-added taxes, and other

taxes. Amounts received as prepayment on future products or services are recorded as unearned revenues and recognized as income when

the product is shipped, or service performed.

The

Company had deferred revenue of $22,015 as of December 31, 2024, related to contractual commitments with customers where the performance

obligation will be satisfied within the fiscal year ended March 31, 2025. The revenue associated with these performance obligations is

recognized as the obligation is satisfied. The Company had $14,549 of deferred revenue as of March 31, 2024.

Most

of our contracts with customers contain transaction prices with fixed consideration; however, some contracts may contain variable consideration

in the form of discounts, rebates, refunds, credits, price concessions, incentives, performance bonuses, penalties and other similar

items. When a contract includes variable consideration, we evaluate the estimate of variable consideration to determine whether the estimate

needs to be constrained; therefore, we include the variable consideration in the transaction price only to the extent that it is probable

that a significant reversal of the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable

consideration is subsequently resolved. We recognize revenue when we satisfy a performance obligation by transferring control over a

product or service to a customer. This can result in recognition of revenue over time as we perform services or at a point in time when

the deliverable is transferred to the customer, depending on an evaluation of the criteria for over time recognition in FASB ASC 606.

For certain fixed-fee per transaction contracts, such as delivering training courses or conducting workshops, revenue is recognized during

the period in which services are delivered in accordance with the pricing outlined in the contracts.

Net

Earnings (Loss) Per Share of Common Stock

The

Company calculates net income (loss) per share in accordance with ASC 260, Earnings Per Share (“ASC 260”). Under ASC 260,

basic net income (loss) per common share is calculated by dividing net income (loss) by the weighted-average number of common shares

outstanding during the reporting period. The weighted average number of shares of common stock outstanding includes vested restricted

stock awards. Diluted net income (loss) per share (“EPS”) reflects the potential dilution that could occur assuming exercise

of all dilutive unexercised stock options and warrants. The dilutive effect of these instruments was determined using the treasury stock

method. Under the treasury stock method, the proceeds received from the exercise of stock options and restricted stock awards, the amount

of compensation cost for future service not yet recognized by the Company and the amount of tax benefits that would be recorded as income

tax expense when the stock options become deductible for income tax purposes are all assumed to be used to repurchase shares of the Company’s

common stock.

Common

stock outstanding reflected in the Company’s balance sheets includes restricted stock awards outstanding. Securities that may participate

in undistributed net income with common stock are considered participating securities. The computation of diluted earnings per share

does not assume exercise or conversion of securities that would have an anti-dilutive effect. The following schedules present the calculation

of basic and diluted net income per share:

SCHEDULE

OF BASIC AND DILUTED NET INCOME PER SHARE

| | |

2024 | | |

2023 | |

| | |

For the Three Months ended December 31, | |

| | |

2024 | | |

2023 | |

| Net Loss per common Share: | |

| | | |

| | |

| Basic | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| Diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding Basic | |

| 123,596,176 | | |

| 124,733,494 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding Fully Diluted | |

| 123,596,176 | | |

| 124,733,494 | |

Net

loss for the three (3) months ended December 31, 2024, and 2023 was $(222,889) and $(414,138), respectively.

| | |

2024 | | |

2023 | |

| | |

For the Nine Months ended December 31, | |

| | |

2024 | | |

2023 | |

| Net Income per common Share: | |

| | |

| |

| Basic | |

$ | 0.01 | | |

$ | 0.02 | |

| Diluted | |

$ | 0.01 | | |

$ | 0.02 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding Basic | |

| 124,275,328 | | |

| 125,183,945 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding Fully Diluted | |

| 124,275,328 | | |

| 125,183,945 | |

Net

Income for the nine (9) months ended December 31, 2024, and 2023, was $1,065,615 and $2,257,830, respectively.

Recently

Issued Accounting Pronouncements

The

Company has reviewed recent accounting pronouncements and has determined that they will not significantly impact the Company’s

results of operations or financial position.

NOTE

2 – BUSINESS CONDITION

As

of December 31, 2024, the Company had $3.6 million in cash, $2.0 million in inventory, and $0.2 million in prepaid inventory, with no

debt. Management strongly believes that the Company can sustain its operations over the course of the next twelve (12) months with the

cash it has on hand, and with the revenue and associated profit generated from the sales expected over the course of the next twelve

(12) months, especially given the Company’s large inventory and prepaid inventory balances.

NOTE

3 – ACCOUNTS RECEIVABLE

In

the Company’s normal course of business, the Company provides credit terms to its customers, which generally range from net fifteen

(15) to thirty (30) days. The Company performs ongoing credit evaluations of its customers. The Company established an allowance for

doubtful accounts of $34,204 at December 31, 2024, and March 31, 2024.

NOTE

4 - PREPAID EXPENSES

Prepaid

expenses for the periods are as follows:

SCHEDULE OF PREPAID EXPENSES

| | |

December 31, 2024 | | |

March 31, 2024 | |

| Prepaid insurance | |

$ | 19,137 | | |

$ | 10,915 | |

| Prepaid tradeshows | |

| 13,862 | | |

| 25,046 | |

| Prepaid inventory | |

| 172,000 | | |

| 319,977 | |

| Prepaid software | |

| 36,243 | | |

| 17,254 | |

| Prepaid other | |

| 42,369 | | |

| 20,899 | |

| Total Prepaid Expenses | |

$ | 283,611 | | |

$ | 394,091 | |

NOTE

5 - COMMON AND PREFERRED STOCK TRANSACTIONS

The

Company has 150,000,000 authorized shares of common stock, no par value. At December 31, 2024, the total common shares issued and outstanding

was 122,958,993.

During

the nine (9) months ended December 31, 2024, the Company had no option expense.

During

the nine (9) months ended December 31, 2024, the Company did not issue shares of common stock.

During

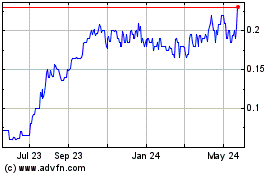

the nine (9) months ended December 31, 2024, the Company repurchased an aggregate amount of 1,774,501 shares common stock, from three

(3) different individuals who each solicited the Company for an offer, at a weighted average price of $0.22 per share for total payments

of $390,020. These shares were then immediately cancelled.

The

Company has 20,000,000 authorized shares of preferred stock. As of December 31, 2024, and March 31, 2024, there were no preferred shares

issued or outstanding.

NOTE

6 – PAYROLL LIABILITIES & ACCRUED EXPENSES

Accrued

expenses for the periods are as follows:

SCHEDULE OF ACCRUED EXPENSES

| | |

December 31, 2024 | | |

March 31, 2024 | |

| Payroll liabilities | |

$ | 95,749 | | |

$ | 165,087 | |

| Sales tax payable | |

| 11,136 | | |

| 9,969 | |

| State income tax payable | |

| (48,660 | ) | |

| 39,929 | |

| Accrued expenses | |

| 51,530 | | |

| 14,985 | |

| Total | |

$ | 109,755 | | |

$ | 229,970 | |

NOTE

7 - RELATED PARTY TRANSACTIONS

The

Company had no related party transactions during the fiscal year ended March 31, 2024, nor during the nine (9) months ended December

31, 2024.

NOTE

8 - SUBSEQUENT EVENTS

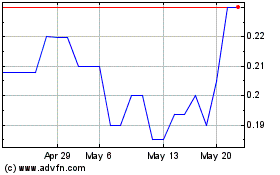

On

January 22, 2025, we purchased 769,230 shares of our no par value common stock from an investor who approached us about this purchase

and who acquired these shares in a private capital raise by the Company in 2016. The price paid per share was $0.205, for an aggregate

purchase price of $157,692.15, which was paid from current cash resources. We will cancel these shares, reducing our current outstanding

shares from 122,958,993 to 122,189,763 shares.

Item 2. Management’s Discussion and Analysis of Financial Condition

and Results of Operations.

Cautionary Statements for Purposes of “Safe Harbor Provisions”

of the Private Securities Litigation Reform Act of 1995:

Except for historical facts, all matters discussed

in this Quarterly Report, which are forward-looking, involve a high degree of risk and uncertainty. Certain statements in this Quarterly

Report set forth management’s intentions, plans, beliefs, expectations, or predictions of the future based on current facts and

analyses. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “intend,”

or similar expressions, we intend to identify forward-looking statements. You should not place undue reliance on these forward-looking

statements. Actual results may differ materially from those indicated in such statements, due to a variety of factors, risks, and uncertainties.

Potential risks and uncertainties include, but are not limited to, competitive pressures from other companies within the Educational Industries,

economic conditions in the Company’s primary markets, exchange rate fluctuation, reduced product demand, increased competition,

inability to produce required capacity, unavailability of financing, government action, weather conditions and other uncertainties, including

those detailed in our SEC filings. We assume no duty to update forward-looking statements to reflect events or circumstances after the

date of such statements.

The following discussion should be read in conjunction

with Item 1, Condensed Financial Statements, in Part I of this Quarterly Report.

Overview

of Current and Planned Operations

PCS

Edventures!, Inc. sells STEM / STEAM products to educational and recreational entities serving youth. At this time, we do not attempt

to align our products to fit in the classroom setting although we are aware that some of our customers use our products to fill enrichment

time blocks in the classroom during formal school time. Classroom curriculum must align with specific state standards to be considered

for use. Each state has their own unique set of standards, making classroom curriculum development a state by-state endeavor.

On

the other hand, out of school programs are not subject to a state governmental standard alignments, although these programs often require

that educational programs align with various sets of state or national educational standards. This difference makes it easier to penetrate

out-of-school programs, as more freedoms exist for curriculum development. We focus our efforts on these out-of-school programs, which

include summer school, summer camps, YMCA programs, Boys and Girls club programs and various other programs offered outside of the classroom,

at all times of the year, that are too numerous to list. Oftentimes, these programs are sponsored, administered and/or supported by local

school districts, and we employ considerable efforts to build relationships with these types of school districts to provide desired programing

for their out-of-school programs. The majority of the time, the out-of-school programs offered are funded with grants; however, some

programs are run on a for- profit basis. The Company sells to all of these types of entities.

We

offer professional development training for instructors using our products; and typically charge a fee for this service, with the fee

primarily covering our expenses. Management does not view this service as a profit center, but rather as a customer service component

of our product that adds to its uniqueness and value in the marketplace, and as a market development endeavor to build out the Company’s

addressable market.

The

nature of our target market produces considerable seasonality for the Company’s revenue. The quarters ended June 30 and September

30 tend to be the peak of this seasonality (with the quarter ended March 31 being close to these quarters), while the quarter ended December

31 tends to be the low point of our seasonality. The Table below reflects this seasonality.

| | | |

Quarterly Revenue $ | |

| Quarter Ended | | |

2021 | | |

2022 | | |

2023 | | |

2024 | |

| | | |

| | | |

| | | |

| | | |

| | |

| March 31 | | |

| 648,743 | | |

| 1,445,594 | | |

| 2,521,470 | | |

| 2,262,772 | |

| June 30 | | |

| 1,062,127 | | |

| 1,391,785 | | |

| 2,605,281 | | |

| 3,159,923 | |

| September 30 | | |

| 993,458 | | |

| 1,243,662 | | |

| 3,767,326 | | |

| 2,267,338 | |

| December 31 | | |

| 566,473 | | |

| 1,847,659 | | |

| 459,087 | | |

| 701,147 | |

The

Company, through winning a competitive Request For Proposal, added the Air Force Junior Reserve Officers’ Training Corp (“AFJROTC”)

as a customer in the second half of calendar year 2022. The Company experienced elevated sales due to the fulfillment of the AFJROTC

orders for the quarters ended December 31, 2022, March 31, 2023, and September 30, 2023. One of the AFJROTC revenue quarters was December

31, 2022, which corresponds with the lowest seasonal revenue quarter, so the effects of seasonality in 2022 was not as readily apparent

as in other calendar years. The table below removes the AFJROTC revenue to highlight the seasonality that the Company experiences.

| | | |

Quarterly Revenue Less JROTC Revenue $ | |

| Quarter Ended | | |

2021 | | |

2022 | | |

2023 | | |

2024 | |

| | | |

| | | |

| | | |

| | | |

| | |

| March 31 | | |

| 648,743 | | |

| 1,445,594 | | |

| 1,247,835 | | |

| 2,262,772 | |

| June 30 | | |

| 1,062,127 | | |

| 1,391,785 | | |

| 2,605,281 | | |

| 3,159,923 | |

| September 30 | | |

| 993,458 | | |

| 1,243,662 | | |

| 2,501,410 | | |

| 1,822,225 | |

| December 31 | | |

| 566,473 | | |

| 458,239 | | |

| 459,087 | | |

| 701,147 | |

During

the quarter ended December 31, the Company focuses on product development, restocking inventory, and general planning for the next year.

Sales and marketing activities remain fairly constant throughout the year.

Results

of Operations

Revenue

For

the quarter ended December 31, 2024, our revenue was $701,147, which was $242,060 greater than our revenue for the quarter ended December

31, 2023, of $459,087. The difference in revenue was partially due to deferred revenue recognition. For the quarter ended September 30,

2024, we had deferred revenue of $107,336, all of which was recognized as revenue in the quarter ending December 31, 2024. For the quarter

ended September 30, 2023, we had deferred revenue of $4,584, all of which was recognized as revenue in the quarter ending December 31,

2023.

The

difference in revenue was also partially due to increased fulfillment efficiency. We moved into our new warehouse facility in November

of 2024, and have decreased the time between order receipt and order fulfillment significantly. We recognize revenue when the customer

receives the product or service, so less time between order receipt and order fulfillment has the effect of increasing revenue recognized

in any given quarter.

For

the nine (9) months ended December 31, 2024, our revenue was $6,128,409, which was $703,285 less than our revenue for the nine (9) months

ended December 31, 2023, of $6,831,694. The difference in revenue is largely due to the difference between two (2) large customer orders

that we fulfilled in the nine (9) months ended December 31, 2023, amounting to $1,265,916 (Air Force JROTC) and $823,143 (Iowa Scale-Up).

During the nine (9) months ended December 31, 2024, these two (2) customers accounted for $453,113 and $0, respectively. While we added

revenue from other customers during the nine (9) months ended December 31, 2024, we did not overcome the aggregate revenue shortfall

from the two (2) customers described above of $1,635,946 when compared to the nine (9) months ended December 31, 2023.

The

Company has been soliciting larger customers for over two (2) years and has seen some success. The AFJROTC is the Company’s largest

success by a wide margin, producing revenue of $1,265,916 in the nine (9) months ended December 31, 2023, and $1,389,420 in the nine

(9) months ended December 31, 2022.

The

Company has experienced other successes in its campaign to find larger customers. The table below shows customer transactions by size

for the periods indicated.

Number

of Customer Transactions by size

| | |

> $1 million | | |

>$500,000 | | |

> $100,000 | | |

> $50,000 | | |

> $25,000 | | |

> $10,000 | |

| Nine (9) months ended December 31, 2024 | |

| 0 | | |

| 1 | | |

| 14 | | |

| 21 | | |

| 44 | | |

| 90 | |

| Nine (9) months ended December 31, 2023 | |

| 1 | | |

| 2 | | |

| 16 | | |

| 23 | | |

| 34 | | |

| 80 | |

| Nine (9) months ended December 31, 2022 | |

| 1 | | |

| 1 | | |

| 8 | | |

| 18 | | |

| 30 | | |

| 49 | |

| Nine (9) months ended December 31, 2021 | |

| 0 | | |

| 0 | | |

| 5 | | |

| 10 | | |

| 15 | | |

| 38 | |

We

believe that we can continue to successfully solicit larger customers; however, we cannot guarantee success, nor can we provide a

numerical framework to describe the potential success. Risk factors include any developments that negatively impact education

funding in the United States, challenges finding and retaining employees who meet our high standards, and disruptions to our supply

chain of critical components.

Cost

of Sales

We

strive to have a cost of sales that is less than 40% of revenue. We price our products once per year, at the beginning of the calendar

year, and maintain that pricing level throughout the year. During inflationary environments, when the price level of the Company’s

raw materials is increasing, the Company must absorb that negative impact to gross margins until it can reprice its products at the beginning

of the next calendar year. This repricing analysis considers the current pricing level of materials, as well as the likely increase in

those levels in the year ahead. We attempt to incorporate shipping costs into the cost of raw materials, but oftentimes during the course

of the year we are compelled to ship in a more expedient manner, which is more expensive than our baseline assumptions.

For

the quarter ended December 31, 2024, our cost of sales was $348,660, or 49.7% of revenue. For the quarter ended December 31, 2023, our

cost of sales was $310,657, or 67.7% of revenue. For any given quarter, and especially in low revenue quarters, the cost of sales can

vary significantly from our desired 40% or less of revenue. However, for any given year, the calculation is relevant and desired to be

40% or less of revenue. For the nine (9) months ended December 31, 2024, our cost of sales was $2,459,747, or 40.1% of revenue, as compared

to $2,503,552, or 36.7% of revenue for the nine (9) months ended December 31, 2023. Factors affecting cost of sales include:

| Helps

sub 40% cost of sales |

|

Impedes

sub 40% cost of sales |

| Higher

revenue |

|

Higher

inflation |

| Larger

order size |

|

Expedited

shipping |

| Ability

to take advantage of volume discounts |

|

Quality

issues with raw materials |

| Higher

mix of sales from internal efforts |

|

Higher

mix of sales from resellers |

Operating

Expenses

Operating

expenses are divided into two categories – salary + wages, and general + administrative. Salary and wages tend to increase over

time as the Company has been increasing its number of employees and we expect to continue to do so in the future. Also, the Company desires

to retain employees over the long term, which requires periodic increases in compensation as their value to the Company increases.

The

Company also has a discretionary quarterly bonus program based on qualified revenue. Qualified revenue is defined as revenue where there

are no reseller fees or other price adjustments associated with that revenue. Thus, all reseller sales are disqualified from the discretionary

quarterly bonus calculation, as are other miscellaneous transactions where the Company did not receive a full margin. During quarters

with higher revenue, salaries and wages will increase all other things equal.

Salary

and wages were $436,150 for the quarter ended December 31, 2024. For the quarter ended December 31, 2023, salaries and wages were $353,934.

We had twenty-four (24) employees as of December 31, 2024, versus twenty-one (21) employees as of December 31, 2023.

Salary

and wages were $1,440,181 for the nine (9) months ended December 31, 2024. For the nine (9) months ended December 31, 2023, salaries

and wages were $1,313,886. As with the case above, we had more employees during the nine (9) months ended December 31, 2024 than the

nine (9) months ended December 31, 2023. We also want to retain our employees which necessitates annual raises to compensate for inflation

and reflect an employee’s increased value to the Company.

General

and administrative expenses include all operating expenses outside of salaries and wages. These include the following categories:

| |

1. |

Advertising

and marketing expenses |

| |

2. |

Trade

show and travel expenses |

| |

3. |

Product

development expenses |

| |

4. |

Finance

charges |

| |

5. |

Contract

labor expenses |

| |

6. |

Lease

expenses |

| |

7. |

Insurance

premiums |

| |

8. |

Workers’

compensation expenses |

| |

9. |

Office

supplies and repairs |

| |

10. |

Professional

expenses |

| |

11. |

Licenses |

| |

12. |

State

sales tax expenses |

| |

13. |

Office

and warehouse infrastructure expenses |

Most

of these expenses are not correlated with changes in revenue, but they tend to increase over time. General and administrative expenses

were $375,081 for the quarter ended December 31, 2024. For the quarter ended December 31, 2023, general and administrative expenses were

$231,475. The increase in general and administrative expenses for the quarter ended December 31, 2024 was largely due to the Company’s

new facilities leases which began in the quarter ending December 31, 2024. Warehouse and Office lease and maintenance expenses were $141,847

for the quarter ending December 31, 2024 compared to $35,071 for the quarter ending December 31, 2023. These expenses included the costs

of upgrading the new facilities, especially the warehouse.

General

and administrative expenses were $1,091,005 for the nine (9) months ended December 31, 2024. For the nine (9) months ended December 31,

2023, general and administrative expenses were $821,116. An increase of warehouse and office lease and maintenance of $109,272 and an

increase of marketing expenses of $30,608 are largely responsible for the increase in general and administrative expenses for the nine

(9) months ended December 31, 2024 over the nine (9) months ended December 31, 2023.

Other

Income and Expenses

Other

income and expenses are those outside of the Company’s ordinary course of business. Interest income and interest expense are disclosed

under other income and expenses. The Company has accumulated cash which is invested in a Vanguard money market fund that invests exclusively

in repurchase agreements and short-term U.S. government securities. The ticker symbol of this fund is VMFXX. The Company’s investments

in this fund produce interest income.

For

the quarter ended December 31, 2024, other income and expenses were $24,920, with net interest income accounting for the entire amount.

For the quarter ended December 31, 2023, other income and expenses were $22,841, with net interest income totaling $20,183 of that amount.

For

the nine (9) months ended December 31, 2024, other income and expenses were $84,043, with net interest income accounting for the entire

amount. For the nine (9) months ended December 31, 2023, other income and expenses were $64,690, with net interest income accounting

for $30,774 of that amount and a tax credit accounting for $31,258 of that amount.

Net

Income (Loss) Before Tax

For

the quarter ended December 31, 2024, net income (loss) before tax was ($433,824) versus ($414,138) for the quarter ended December 31,

2023. Higher revenue and higher costs characterized the net income (loss) before tax for the quarter ended December 31, 2024 compared

to the quarter ended December 31, 2023.

For

the nine (9) months ended December 31, 2024, net income (loss) before tax was $1,221,519 versus $2,257,830 for the nine (9) months ended

December 31, 2023. The nine (9) months ended December 31, 2024 can be characterized as having less revenue and higher costs when compared

to the nine (9) months ended December 31, 2023.

Taxes

The

Company has significant net operating losses which arose due to past losses. At March 31, 2024, the Company had net operating losses

of approximately $9.2 million that may be used to offset against future taxable income.

Prior

to fiscal year 2023, the Company offset its potential tax benefit from the operating loss carry-forwards with a valuation allowance in

the same amount. As it became clear that the Company will more likely than not use its tax loss carry-forward amounts, the valuation

allowance was partially removed for the fiscal year ended March 31, 2023, such that the tax benefit recognized by us in fiscal year 2023

was $1,011,466. The valuation allowance was fully removed as of March 31, 2024, resulting in a tax benefit of $1,529,793 for fiscal year

2024.

While

we do not expect to pay federal income taxes for fiscal year 2025, the deferred tax asset will be adjusted on a quarterly basis to reflect

the amount of taxes it is offsetting for the quarter. The provision for income tax is an unwinding of the tax benefit we recorded in

prior periods when we recognized the value of the deferred tax asset on the income statement.

Liquidity

and Capital Resources

Cash

Flow from Operations

For

the nine (9) months ended December 31, 2024, cash provided by operations was $2,727,088 compared to cash provided by operations of $1,644,990

for the nine (9) months ended December 31, 2023. Cash provided by operations increased significantly, despite the difference in net income

of ($1,192,215) largely due to the difference in the change in accounts receivable. For the nine (9) months ended December 31, 2024,

accounts receivable decreased by $1,512,100 compared to a decrease of $214,826 for the nine (9) months ended December 31, 2023. Other

significant factors causing cash provided by operations to increase in the nine (9) months ended December 31, 2024 versus the nine (9)

months ended December 31, 2023 were an increase in inventories of $11,486 for the December 31, 2024 period versus $556,544 for the December

31, 2023 period, and a decrease in prepaid expenses of $110,480 for the December 31, 2024 period versus and increase in prepaid expenses

of $518,799 for the December 31, 2023 period.

As

of December 31, 2024, total current assets were $6,074,390 and total current liabilities were $310,160, resulting in working capital

of $5,764,230. As of March 31, 2024, total current assets were $5,425,141 and total current liabilities were $416,154, resulting in working

capital of $5,008,987. The Company had a current ratio as of December 31, 2024, of 19.58 compared to a current ratio of 13.04 as of March

31, 2024.

As

of December 31, 2024, we had $3,590,051 in cash and cash equivalents compared to $1,329,708 in cash and cash equivalents as of March

31, 2024. The improvements in working capital, current ratio, and cash on hand this fiscal year-to-date are all due to a significant

decrease in accounts receivable during the nine (9) months ended December 31, 2024.

Cash

Flow from Investing Activities

For

the nine (9) months ended December 31, 2024, cash used by investing activities was $76,725 compared to cash used by investing activities

of $16,096 for the nine (9) months ended December 31, 2023. During the nine (9) months ended December 31, 2024, we purchased warehouse

equipment related to our recent relocation of the warehouse which accounts for the increase in cash used by investing activities.

Cash

Flow from Financing Activities

For

the nine (9) months ended December 31, 2024, cash used by financing activities was $390,020 compared to cash used by financing activities

of $64,933 for the nine (9) months ended December 31, 2023. In both periods, cash used by financing activities was solely due to the

purchase of the Company’s common stock, by the Company, in private transactions with shareholders who solicited the Company for

an offer. For the nine (9) months ended December 31, 2024, the Company purchased 1,774,501 shares of its common stock, and for the nine

(9) months ended December 31, 2023, the Company purchased 998,985 shares of its common stock. In all cases the common stock purchase

by the Company was retired.

Off-Balance

Sheet Arrangements

We

had no Off-Balance Sheet arrangements during the three (3) and nine (9) month periods ended December 31, 2024, and 2023.

Item

3. Quantitative and Qualitative Disclosures about Market Risk.

The

Company is a smaller reporting company as defined by Rule 12b-2 of the Exchange Act, and is not required to provide the information required

under this item.

Item

4. Controls and Procedures.

We

maintain disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act that are designed to ensure

that material information relating to us is made known to the officers who certify our financial reports and to other members of senior

management and the Board of Directors. These disclosure controls and procedures are designed to ensure that information required to be

disclosed in our reports that are filed or submitted under the Exchange Act are recorded, processed, summarized, and reported within

the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls

and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under

the Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers,

or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure. Management, with the

participation of our Chief Executive Officer and our President who acts as our Principal Financial Officer have evaluated the effectiveness,

as of December 31, 2024, of our disclosure controls and procedures. Based on that evaluation, our Chief Executive Officer and Principal

Financial Officer concluded that our disclosure controls and procedures were effective as of December 31, 2024, due to the Company engaging

the professional CPA firm of B.A. Harris to assist the Company in preparing our preliminary condensed financial statements and schedules

for our auditor’s review.

Changes

in Internal Control over Financial Reporting

There

have been no changes in our internal control over financial reporting during the quarter ended December 31, 2024, that have materially

affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART

II - OTHER INFORMATION

Item

1. Legal Proceedings.

None.

Item

1A. Risk Factors.

The

Company is a smaller reporting company as defined by Rule 12b-2 of the Exchange Act, and is not required to provide the information required

under this item.

Item

2. Unregistered Sales of Equity Securities and Use of Proceeds.

None.

Item

3. Defaults Upon Senior Securities.

None.

Item

4. Mine Safety Disclosures.

None;

not applicable.

Item

5. Other Information.

No

director or Section 16 officer adopted or terminated a trading arrangement intended to satisfy the affirmative defense conditions of

Rule 10b5-1(c) or a “non-Rule 10b5–1” trading arrangement during the periods reported in this Form 10-Q.

Item

6. Exhibits.

(a)

Index of Exhibits

| Exhibit

No. |

|

Identification

of Exhibit |

|

Location

if other than attached hereto |

| 3.1 |

|

Second Amended and Restated Articles of Incorporation dated October 2, 2006 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.2 |

|

Articles of Amendment dated April 12, 2012 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.3 |

|

Articles of Amendment dated September 25, 2014 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.4 |

|

Articles of Amendment dated September 25, 2015 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.5 |

|

Articles of Amendment dated September 23, 2016 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.6 |

|

Third Amended Bylaws |

|

Attached

to our Form 10 filed October 3, 2023 |

| 31.1 |

|

Certification Pursuant to Section 302 of the Sarbanes-Oxley Act provided by Todd R. Hackett, Chief Executive Officer and Chairman |

|

Attached

hereto |

| 31.2 |

|

Certification Pursuant to Section 302 of the Sarbanes-Oxley Act provided by Michael J. Bledsoe, President, Principal Financial Officer |

|

Attached

hereto |

| 32 |

|

Certification Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 provided by Todd R. Hackett, Chief Executive Officer and Chairman of the Board of Directors, and Mike J. Bledsoe, President and Principal Financial Officer |

|

Attached

hereto |

| 101.INS |

|

Inline XBRL

Instance Document |

|

|

| 101.PRE |

|

Inline XBRL

Taxonomy Extension Presentation Linkbase |

|

|

| 101.LAB |

|

Inline XBRL

Taxonomy Extension Label Linkbase |

|

|

| 101.DEF |

|

Inline

XBRL Taxonomy Extension Definition Linkbase |

|

|

| 101.CAL |

|

Inline XBRL

Taxonomy Extension Calculation Linkbase |

|

|

| 101.SCH |

|

Inline XBRL

Taxonomy Extension Schema |

|

|

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL. |

|

|

10-K Annual Report for the fiscal year ended March 31, 2024, filed with the SEC on June 28, 2024 (the “Annual Report”)

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

PCS

EDVENTURES!, INC. |

| |

|

|

| Dated:

February 14, 2025 |

By: |

/s/

Todd R. Hackett |

| |

|

Todd

R. Hackett |

| |

|

Chief

Executive Officer and |

| |

|

Chairman

of the Board of Directors |

| |

|

|

| Dated:

February 14, 2025 |

By: |

/s/

Michael J. Bledsoe |

| |

|

Michael

J. Bledsoe |

| |

|

President,

Principal Financial Officer and Director |

Exhibit 31.1

CERTIFICATION PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Todd R. Hackett, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q

of PCS Edventures!, Inc.;

2. Based on my knowledge, this report does not contain

any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances

under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the condensed financial

statements, and other financial information included in this report, fairly present in all material respects the financial condition,

results of operations and cash flows of the Registrant as of, and for, the periods presented in this report;

4. The Registrant other certifying officer(s) and

I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and

15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f) and 15d-15(f)) for the Registrant

and have:

| |

a) |

designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

b) |

designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of condensed financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c) |

evaluated the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

d) |

disclosed in this report any change in the Registrant’s internal control over financial reporting that occurred during the Registrant’s most recent fiscal quarter (the Registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting; and |

5. The Registrant’s other certifying officer(s)

and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the Registrant’s auditors

and the audit committee of the Registrant’s board of directors (or persons performing the equivalent functions);

| |

a) |

all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

b) |

any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant’s internal control over financial reporting. |

| Date: |

February 14, 2025 |

|

By: |

/s/

Todd R. Hackett |

| |

|

|

|

Todd R. Hackett, Chief Executive Officer and Chairman |

Exhibit 31.2

CERTIFICATION PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Michael J. Bledsoe, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q

of PCS Edventures!, Inc.;

2. Based on my knowledge, this report does not contain

any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances

under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the condensed financial

statements, and other financial information included in this report, fairly present in all material respects the financial condition,

results of operations and cash flows of the Registrant as of, and for, the periods presented in this report;

4. The Registrant other certifying officer(s) and

I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and

15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f) and 15d-15(f)) for the Registrant

and have:

| |

a) |

designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

b) |

designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of condensed financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c) |

evaluated the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

d) |

disclosed in this report any change in the Registrant’s internal control over financial reporting that occurred during the Registrant’s most recent fiscal quarter (the Registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting; and |

5. The Registrant’s other certifying officer(s)

and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the Registrant’s auditors

and the audit committee of the Registrant’s board of directors (or persons performing the equivalent functions);

| |

a) |

all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

b) |

any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant’s internal control over financial reporting. |

| Date: |

February 14, 2025 |

|

By: |

/s/ Michael J. Bledsoe |

| |

|

|

|

Michael J. Bledsoe, President and Principal Financial Officer |

Exhibit 32

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350

AS ADOPTED PURSUANT TO